What is the applicable latest Post Office Small Saving Schemes Interest rates Oct-Dec 2018? The government announced the interest rate for PPF, Sukanya Samriddhi, NSC, KVP Interest Rates July-Sept 2018. Let us see the changes applicable with effective from 1st October 2018.

Earlier the interest rates used to be announced on yearly once. However, now from 2016-17, the rate of interest will be fixed on a quarterly basis. I already wrote a detailed post on this. I am providing the links to those earlier posts below.

- Post Office Savings Schemes -Changes effective from 1st, April 2016

- Premature closure of PPF account – New Rules 2016

Based on these new changes, now onward interest rate will be declared on a quarterly basis. The earlier quarters (FY 2016-17 and FY 2017-18) interest rate can be viewed in my earlier posts “Interest of PPF KVP NSC SCSS and Sukanya Samriddhi for April-June 2016“, “PPF and Sukanya Samriddhi Scheme interest rate July-Sept 2016“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Oct-Dec 2016”, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Jan-Mar 2017“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates April-June 2017“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates July-Sept 2017“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Oct-Dec 2017?., “Latest Post Office Small Saving Schemes Interest rates Jan-March 2018“, “Latest Post Office Small Saving Schemes Interest rates Apr-June 2018“ and “Latest Post Office Small Saving Schemes Interest rates July-Sept 2018“.

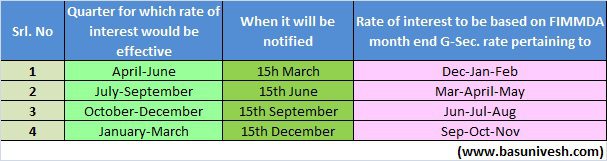

Below is the timetable for change in interest rates for all Post Office Savings Schemes.

As per the schedule, Government announced the interest rate applicable to all Post Office Savings Schemes from 1st July 2018 to 30th Sept 2018.

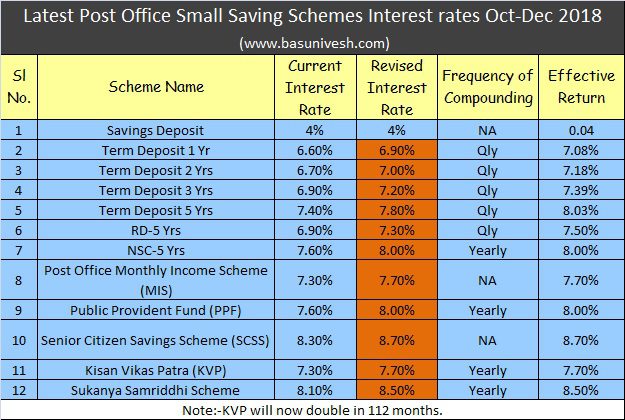

Latest Post Office Small Saving Schemes Interest rates Oct-Dec 2018

Just to quickly recap, last quarter, Government maintained the same interest rate for all Post Office Small Savings Schemes.

However, as it was expected, for this quarter, Government increased the interest rate of few Post Office Small Savings Schemes. Below is the latest Post Office Small Savings Schemes interest rates Oct-Dec 2018.

You notice that there is a sudden rise in interest rates of all small savings schemes (except savings deposit scheme). I marked the same in different colour to highlight the increase.

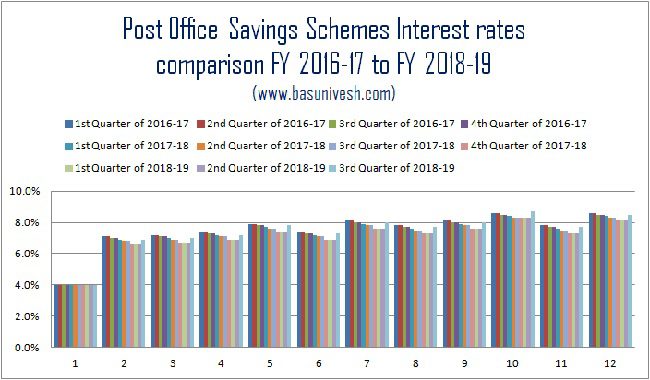

Post Office Small Saving Schemes Interest rates trend FY 2016-17 and 2018-19

Below is the interest rate trend for FY 2016-17 and FY 2018-19.

You notice that after a long gap, there is an increase in interest rate trend of Post Office Savings Schemes.

- All about Public Provident Fund (PPF)

- How to open PPF account online in ICICI and SBI Banks?

- PPF and NSC for NRIs – Amendment Rules 2017

- PPF Account for Minor and Wife – Rules, Tax Benefits and Tricks

- How to encash or withdraw NSC bought from different Post Office?

- NSC-Accrued Interest taxation and way to reduce it

- Post Office Monthly Income Scheme or MIS – A complete guide

- Premature closure of PPF account – New Rules 2016

- PPF withdrawal rules & options after 15 years maturity

- Public Provident Fund -20 unknown facts

- 15 Rules of availing Loan against PPF (Public Provident Fund)

- How to transfer PPF Account from Post Office or Bank to another Post Office or Bank?

- Excel PPF Calculator-Calculate goal, loan or withdrawal amounts

- PPF-Loan and Withdrawal

- PPF-When to contribute to get higher returns?

- All about Kisan Vikas Patra (KVP)-2014

- Sukanya Samriddhi Account -When to invest to earn more returns?

- Sukanya Samriddhi Account-An investment scheme for your girl child

- Post Office Senior Citizen Scheme (SCSS)-Benefits and Interest Rate

- NSC and KVP in e-mode and Passbook mode from 1st July 2016

- How to transfer NSC from one person to another?

- India Post Help Centre and a Toll-Free Number 1924 features

8 Responses

Scss

Pl let me know the increase in int. rate on above made applicable to earlier deposits opened @ 8.3%?

Dear Ramasubramanian,

NO.

Myself & wife both have PMVVY & SCSS & further cannot invest any more in this scheme. Wife is 60 yrs & myself 65 yrs . Let me know for 10,000/- Monthly or 30,000/- quarterly pension which plan is best for me. Also confirm me by Email .

Dear Umesh,

You can use Postal MIS or LIC’s Jeevan Shanti or Jeevan Akshay VI.

Hi Basavaraj Tonagatti, in my UAN account I saw 2 EPF account numbers, I resigned my job June 2018, after 2 months I tried to do final settlement, but query I saw u have 2 accounts please transfer old account to new account. I tried to transfer through my old employer. Then I saw error message u r previous establishment details are not matched with new establishment, so we can’t claim u r request. I checked what is wrong in that, my old establishment exit date 6/6/2018, and my new establishment joining date 26/05/2018. This is the reason I asked my old employer but they are not responding. What I have to do I don’t know, all my KYC updated in my UAN account. Can you suggest without help of employer can we change exit date of my old establishment. ?

Dear Ravi,

Approach the regional EPFO for the same.

I want to know is it possible to deposit any arbitrary amount in PO MIS or it should be multiple of Rs. 100 or Rs.1500?

I want to deposit in PO MIS Rs. 3,89,600/- to get Rs. 2500/- p.m. @ 7.7%. Is it possible? Or I need to deposit Rs. 3,90,000/-?

Dear Ganesh,

It is always in multiples of Rs.1,500. Hence, you are not allowed to invest as you mentioned.