Today Government announced the interest rate for PPF, Sukanya Samriddhi, NSC, KVP Interest Rates April-June 2017. Let us see the changes applicable with effective from 1st April 2017.

Earlier the interest rates used to be announced on yearly once. However, now from 2016-17, the rate of interest will be fixed on a quarterly basis. I already wrote a detailed post on this. I am providing the links to those earlier posts below.

- Post Office Savings Schemes -Changes effective from 1st, April 2016

- Premature closure of PPF account – New Rules 2016

Based on these new changes, now onward interest rate will be declared on a quarterly basis. The earlier quarters (FY 2016-17) interest rate can be viewed in my earlier posts “Interest of PPF KVP NSC SCSS and Sukanya Samriddhi for April-June 2016“, “PPF and Sukanya Samriddhi Scheme interest rate July-Sept 2016“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Oct-Dec 2016”, and “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Jan-Mar 2017“.

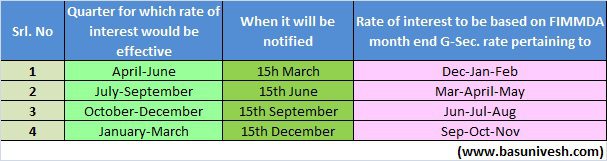

Below is the timetable for change in interest rates for all Post Office Savings Schemes.

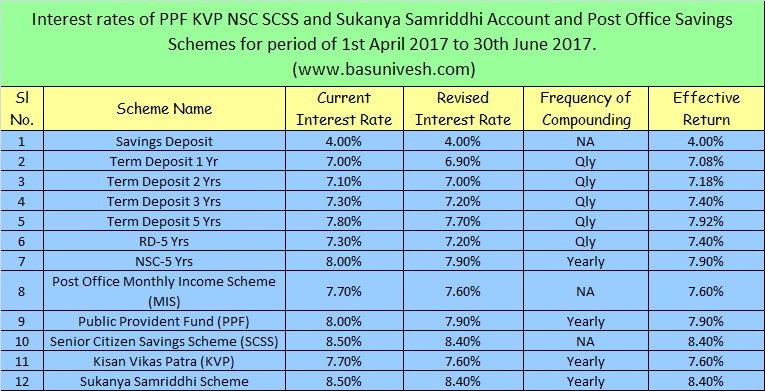

Now as per the schedule, Government announced the interest rate applicable to all Post Office Savings Schemes from 1st April 2017 to 30th June 2017.

PPF, Sukanya Samriddhi, NSC, KVP Interest Rates April-June 2017

Just for a quick recap, last quarter the Government not changed the interest rate and retained the interest rate which was there for September-November 2017.

However, this time Government reduced the interest rate of all products by 0.1% or 10 BPS (100 BPS=1%).

You noticed that for all schemes they reduced 0.1% except Savings Deposit (savings account of the post office).

Except SCSS and Sukanya Samriddhi Scheme, rest of all schemes will be offering you at less than 8% returns.

Note-Earlier Kisan Vikas Patra (KVP) used to double at 112 months but now it will double in 113 months. Just a reduction of 0.1% interest rate in KVP will make you wait for another month to double your money.

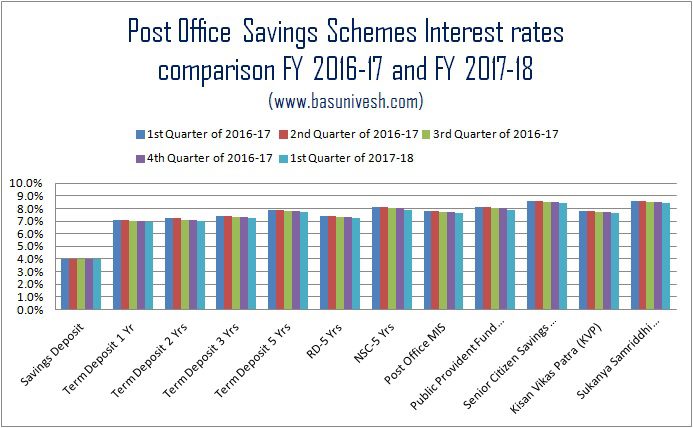

In Below chart, I will try to show you the interest rate movement from the each quarter of FY 2016-17 to the first quarter of FY 2017-18. This will gives you an idea of how the interest rate cycle of Post Office Savings Scheme is moving since a year.

You noticed from above chart that Government did not reduce the savings account rate since FY 2016-17. However, for rest of all schemes of the post office, slowly the interest rate is going down.

This is the trend of PPF, Sukanya Samriddhi, NSC, KVP Interest Rates April-June 2017. Let us hope for better uptrend.

Refer our earlier posts related to Post Office Savings Schemes-

- All about Public Provident Fund (PPF)

- How to encash or withdraw NSC bought from different Post Office?

- NSC-Accrued Interest taxation and way to reduce it

- Post Office Monthly Income Scheme or MIS – A complete guide

- Premature closure of PPF account – New Rules 2016

- PPF withdrawal rules & options after 15 years maturity

- Public Provident Fund -20 unknown facts

- 15 Rules of availing Loan against PPF (Public Provident Fund)

- How to transfer PPF Account from Post Office or Bank to another Post Office or Bank?

- Excel PPF Calculator-Calculate goal, loan or withdrawal amounts

- PPF-Loan and Withdrawal

- PPF-When to contribute to get higher returns?

- All about Kisan Vikas Patra (KVP)-2014

- Sukanya Samriddhi Account -When to invest to earn more returns?

- Sukanya Samriddhi Account-An investment scheme for your girl child

- Post Office Senior Citizen Scheme (SCSS)-Benefits and Interest Rate

- NSC and KVP in e-mode and Passbook mode from 1st July 2016

- How to transfer NSC from one person to another?

- India Post Help Centre and a Toll-Free Number 1924 features

23 Responses

Please advise which is the best to invest one time big amount..for 7-8 years. … anything with tax free returns

Divya-Hard to say BLINDLY. Because reasons don’t know, goal details don’t know but you are investing only for tax free returns?

Hello, As interest for Small Saving Schemes are on decreasing trend, which small saving options would you suggest for better returns and comparitively less market risk based. Are gold etf good for small savings, what are its drawbacks. Please give a detailed explanation and suggestion on small and less risky savings especially for women(housewife/working). Really confused. Would greatly appreciate your help.

Twarita-May I know your expectation from the investment and time horizon?

Short time investment 1-5 years, and may be return better than savings/FD/RD

MY IT RETURN NAME DOES*T MATCH WITH AADHAR CARD ISSUED ,

WHAT SHALL I DO NOW ,

TO WHOM SHALL I APPROACH TO MODIFY EITHER AADHAR OR IT

WHAT IS THE LAST DATE FOR FILING ITR WITHOUT AADHAR

Bunty-Better to modify name in ITR.

Hiii sir,

i have a kid, 2 yrs of age. i m planning for investment . long term (15 yrs) and short term (5 year ). kindly suggest me for long term where i should invest….. mutual fund, sukanya smmurdhi yojana or LIC. and similarly for short term plan ?

Abhijeet-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

thanks sir,

it means u dont support SSY or any LIC plan, neither short term nor long term.

Abhijeet-It is not the outright NO, but we must use the products based on our requirement.

I think you have incorrectly stated that the frequency of compounding interest for NSC is yearly. However, it should be half-yearly.

Krish-Check the recent updates. Now it is yearly compounding.

Hi Basavaraj, I have made some investments and after reading this post I got the idea regarding the interest rates on different investments. This article has helped me in making my choices on investment. Keep posting this type of knowledgeable content.

Thank you

Ankur-Pleasure.

Dear Basu, another great article from you!

I had Google Adsense income, eBay seller income, salary income, FD and NSC income in FY 2016-17. Which form should I use in AY 2017-18?

Raju-Wait for my next post. I am writing on the same.

Sir,

Thanks for the information.

I would like to ask you whether you have any mobile app for your blog?

Thanks

Vinod.

Vinod-As of now NO.

Hi, sir.. Good information. So what is the interest rate of postal life insurance last 3years?

Narayana-You can check that through Post Office.

Thanks.

A side question, I think there is a cap to single MIS investment. Can somebody purchase multiple from the same post office in two different quarters?

Chan-Yes the cap for an individual is Rs.4,50,000. Yes, you can invest multiple time in two different quarters. But at any point of time the all combined MIS investment of an individual must not cross Rs.4,50,000 limit.