15 Yrs Of Expert Guidance, Fixed Fee-Only Financial Planning Service, No Product Selling

Navigate Financial Challenges Confidently. We believe in putting our clients at the heart of everything we do. Your success is our success, and we are committed to delivering exceptional service tailored to your unique needs.

Why Choose Us

Investing isn’t just about chasing returns; it’s about managing risk and behavior. While you dedicate hours to earning money, it’s crucial to allocate time to optimize its use. Let us help you with expert financial planning and guidance.

Fiduciary

We uphold fiduciary responsibility in accordance with SEBI RIA Regulations, ensuring that our clients’ interests always take precedence. Trust, ethics, and integrity form the bedrock of our client engagement approach, guiding every aspect of our business practices.

Approach

We prioritize building a robust financial foundation by aligning savings and investments with your goals. Our focus is on ensuring accessible funds when needed, minimizing mistakes, and promoting ease and convenience. We emphasize strategic decision-making over chasing return

No Affiliation

We maintain complete independence, with no affiliations, direct or indirect, to Mutual Fund Companies, Insurance Companies, or brokers for product sales. Our practice is rooted in the fixed fee-only financial planning module, where our approach revolves around you.

Why We Need Financial Planning?

It is evident that investing is a process of controlling your behavior and managing the risk than chasing the returns. Every day, you spend around 8 to 10 hours to earn money. Do you spend even 1% of the same time trying to find the best way to utilize this? While it is important to spend time trying to earn more money, it is also important for you to spend time to figure out the right way your money is invested with a proper financial planning.

Philosophy We Follow

At BasuNivesh, our primary source of revenue is derived solely from the fees we charge our clients for the services we provide. We do not involve ourselves in product sales, and therefore, we do not receive any form of compensation or commissions from the products we recommend.

Life, as well as the investment world, is filled with uncertainty. Therefore, a well-structured financial plan must be able to sustain such unpredictability. In investments, we only have control over two aspects: the amount we invest and how long we hold. Returns or outcomes, however, lie beyond our control. Unfortunately, many people have a misguided belief that they can influence returns, when in reality, predicting future outcomes is impossible. The best course of action is to prepare for the worst while hoping for the best.

As financial planners, our responsibility is to guide clients towards adopting simple, proven principles and processes. By adhering to these strategies, investors can strive to achieve their goals while minimizing the occurrence of investment mistakes. We firmly believe that financial planning involves preparing for unforeseen circumstances and achieving financial objectives securely, rather than relying on predicting favorable outcomes.

We have a strong belief in empowering our clients to take charge of their own financial management. Therefore, we emphasize a Do It Yourself approach to financial planning instead of keeping them as our clients indefinitely.

Discover Your Financial Journey

We believe in simplifying the financial planning process for our clients so our approach focuses on delivering straightforward and cost-effective solutions that yield long-term benefits.Through our guidance, you’ll gain insights into low-cost index investments and uncomplicated strategies that outperform complex alternatives. We prioritize passive investing, with a significant emphasis on Index Funds for equity, to mitigate risks, avoid common investment pitfalls, and achieve financial freedom effortlessly.

Basic Financial Plan

Tailored for individuals with limited income or net worth (below Rs.1 Cr) , this module provides essential financial planning guidance at an affordable fee.

Advanced Financial Plan

Designed for clients with greater financial resources (above Rs.1 Cr) , this module offers comprehensive planning solutions to meet long-term goals

DIY (Do It Yourself) Plan

Ideal for those aspiring to manage their finances independently, this empowers clients with the tools to become their own financial planners.

Financial Wellness Session

Our Financial Wellness Sessions offer tailored guidance on equity investments and informed decision-making for diverse audiences.

Insights & Interviews

Podcasts

Upgrade Your Personal Finance Knowledge With Us

Stay informed with our blog for the latest financial strategies, news, and changes. Our expert insights and practical tips will help you make smarter investment decisions and effectively manage your money, empowering you to achieve your financial goals and navigate economic changes with confidence.

Gold and Silver ETF NAV Trap: Why You Just Lost 24% in 1 Day!

Parag Parikh Large Cap Fund: An Index Fund with a Brain?

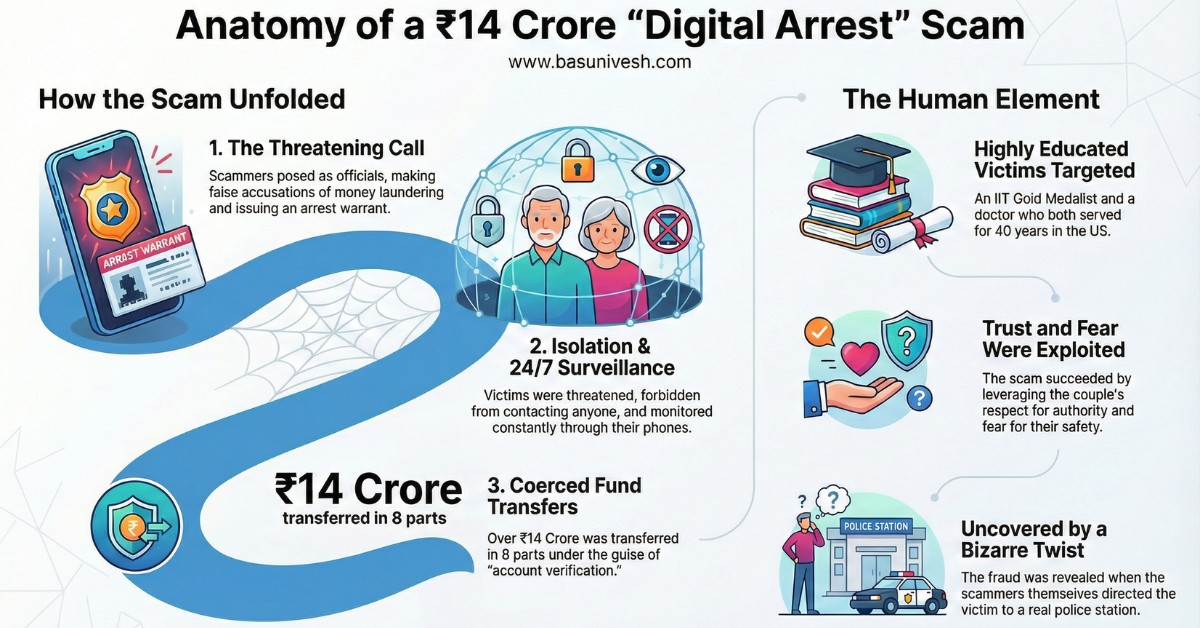

IIT Topper & Doctor Trapped in Rs.14.3 Crore Digital Arrest Scam

Are your Gold and Silver ETFs a ticking time bomb? Why ETFs crashed 24% while silver fell only 6%. Don’t

BasuNivesh

Is Parag Parikh Large Cap Fund a hidden goldmine or just hype? Discover the 5 “smart hacks” this fund uses

BasuNivesh

An IIT topper and his doctor wife were duped of Rs.14.35 crore in Delhi’s biggest “digital arrest” scam. Learn how