LIC Jeevan Shanti is a new single premium guaranteed pension plan which is launching on 12th September 2018. It offers the guaranteed pension with options like an immediate pension or deferred pension.

You may be aware that LIC’s Jeevan Akshay VI also offers the guaranteed pension plan. However, LIC’s Jeevan Akshay is an immediate annuity plan. Maybe for this reason, LIC came with plan LIC Jeevan Shanti. This plan offers both immediate pension and deferred pension plan.

Before proceeding further, first, let us understand few terminologies used in retirement plans.

What is the meaning of annuity?

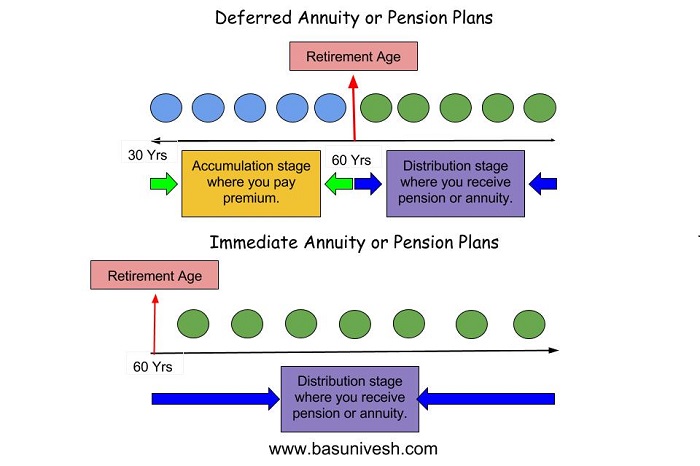

In simple term, you can say it as a Pension, where you will get regular income up to the specified period or conditions. There are two types of annuity.

1) Immediate Annuity-In this case, you invest a lump sum in a product and your pension or annuity starts immediately. Let us say you have around Rs.1 Cr and if you buy immediate annuity plans, then the pension will start immediately from next month.

2) Deferred Annuity-In this case your annuity starts after a certain period. Let us say your current age is 30 years and you are planning to retire at the age of 60 years. If you buy a deferred annuity plan, then you will invest up to your retirement age i.e. up to 60 years of age. After 60 years of retirement, your pension will start.

I tried to explain the same with below illustration as below.

LIC Jeevan Shanti – Single Premium Guaranteed Pension Plan Eligibility

Exceptional cases where Rs.1.5 lakh minimum purchase is exempted-

- If the plan is purchased for the benefit of a handicapped dependent, then the minimum purchase price is Rs.50,000.

- If the plan is purchased by the NPS subscribers.

LIC Jeevan Shanti – Single Premium Guaranteed Pension Plan Annuity Options

Under an immediate annuity plan, you will have options to choose as below.

Do remember that you are not eligible to alter the options at a later stage of the policy period. Hence, choose the options wisely while buying this plan.

LIC Jeevan Shanti – Benefits payable on Survival or on Death

Now let us look into the benefits payable on survival or on death for LIC Jeevan Shanti Plan.

LIC Jeevan Shanti – Guaranteed Addition under deferred annuity plans

Under deferred annuity plans, guaranteed additions will accrue at the end of each policy month, till the end of the deferment period.

The rate of the guaranteed additions during the deferment period will be as below.

Guaranteed Additions per month=(Purchase Price*Annuity Rate per annum payable monthly)/12

Here the annuity rate per annum payable monthly will depend on the age at entry and the deferment period opted.

In case of the death of annuitant during the deferment period, guaranteed additions for the policy year in which the death occurred will accrue till the completed policy month as on the date of death.

LIC Jeevan Shanti – Rebates

- There is an increase in an annuity if your purchase price is above Rs.5 lakh.

- If you purchase this plan online, then there is a 2% discount by way of increasing the annuity.

LIC Jeevan Shanti – Surrender Value

The policy can be surrendered after the completion of 3 months or expiry of the free-look period, whichever is later under the following annuity options.

Under Immediate Annuity Plan-

Option F

Option J

Deferred Annuity Plan-

Option 1

Option 2

LIC Jeevan Shanti – Loan facility

Loan facility is available under this plan after the completion of 1 year. You can avail the loan if you have opted the below options.

Under Immediate Annuity Plan-

Option F

Option J

Deferred Annuity Plan-

Option 1

Option 2

LIC Jeevan Shanti – Review

I think this plan is launched mainly because to cater to the need of the deferred annuity plan seeker. Because LIC is already offering the immediate annuity plan (LIC’s Jeevan Akshay VI).

Annuity inflating yearly at 3% seems to be bit negative side. Our expenses yearly will not increase with meager 3%. At least the 5% to 6% increase is a must to match the expenses.

Even though there is something called GUARANTEED ADDITION attached with this plan, but I am unable to calculate the GA at this juncture as the tabular premium rates are not yet available with me.

By giving some concession to NPS subscribers, I think this plan is launched to garner the NPS subscribers mainly.

Also, LIC is providing this plan to purchase it online with 2% discount. Hence, it is best to go for online rather than going through agents.

I will update the remaining part of review once I will get the complete picture of this plan.

Dear Everybody here ..

You guys may not understand, so let me try to hammer this inside your thick skull.

Basu here, knows everything and is a perfectly honest guy, but he will not explicitly take sides here in his own website.

The two points here are these ..

1. LIC spends crores and crores of money on advertising everywhere. But none of their ads spell out any of their “returns” in % points, unless they can effectively convince you. They will otherwise never fall back on their promise, they will pay you on time.

2. Their returns.. (remember the word “returns”) .. are not really returns. The word “return” is normally applied to financial investment instruments. Like stocks, MFs, FDs, bonds .. etc. What LIC gives you is “insurance”. It is already there in their name, just that you blind and unpadh guys cannot read it. And for that you pay a “premium”. Ideally this premium is not an investment .. it is just a promise from the insurance company, to cover you from an unpredictable loss (of life, of property, of a job, of a car etc). If the loss is predictable … remember.. no insurance company in the world will ever cover it .. because then they will quickly go out of business.

SO do not go to LIC for investing to earn a return.

Go to LIC to cover an accidental loss. And forget about LIC returning your premiums.

Dear SRR,

Thanks for sharing your unbiased views.

My father is 62 yrs old and my mom is 58 years old as of now. He is retired and now wants a regular income to deal with. We are stuck between LIC Jeevan Shanti & Tata AIA’s Guaranteed return Income Plan to invest around 60 Lacs as a single premium. The LIC returns are taxable whereas is it tax-free with TATA AIA’s GRIP under deferred annuity plan? Which should be better product offering out of both or you suggest some other one considering the IRR pre and post IT @ 30% slab. Thanks in advance.

Dear Kamini,

Annuity (whether immediate or deferred) is taxable. Please check properly. Instead, why not he use PMVVY, SCSS or RBI Floating Rate Bonds also?

Sir, is this policy good to take now for investing as bank fds are going down. I want to invest 10lakh

Dear Sreeja,

Don’t compare FDs with this. This is pension plan and FDs are meant for a different purposes.

Hello Basu,

I heard like LIC Jeevan Shanti Plan is getting closed on 26th of August, 2019 . Is it True?

I have another doubt on tax like if Invest 20 Lakh in year 2022 whole amount 20 Lakh is Taxable ?

Please advice

Dear Dinkar,

Yes, it is true. They relaunch the same with lower rates. The whole amount is not taxable. But the annuity you receive is only taxable.

Deferred annuity Jeevan Shanti Plan with following details:-

Period of deferred 10 years

Joint policy under plan J

Both person expired in 11th years

Amount deposited 10 lakhs

Annuity rate 6.65%

How much nominee will get ?

Dear Devinder,

As I have already explained in J Option, the nominee will receive the purchase price.

Dear Tonagatti Jee

Please suffice your Personal Mail id mine is

[email protected]

As need Consultance but not on public platform

Regards

Misra

Dear Misra,

You can reach me at [email protected]

Sir,

Online purchase of 1000000 for deffered annuity how much we need pay including 2?discount.

Dear Jairaj,

There is an online calculator and it depends on your age and other inputs. Hence, do the calculation online.

Sir My daughter is a deaf and dum by birth and her age is 19 years. I would like to invest Rs 600000/- I need pension after 30 years of her age please inform how much I get pension per month

Dear Krishna,

Please calculate on your own by using the LIC website. Regarding the need, if you want the pension after 30 years, then why not invest somewhere else and then buy immediate annuity plans?

Sir,

1) Is annuity earned on PMVVY is subject to TDS?

2) Is the final payment after the term of 10 years (Purchase price+Annuity for last year) is taxable?

If yes, is the whole amount taxable?

If not then under which sec. of I.T. act it is exempt?

Dear Bikas,

1) NO. But do you feel avoiding TDS means avoiding tax?

2) They will not pay but convert into an annuity which is taxable.

Sir,

I am now 60. I want to purchase a joint life deferred (5years) Jeevan Shanti (Plan 850) annuity plan with my wife. My question is 1) if any one of the two dies in the period of deferment can the surviving one continue the plan or surrender it?

2) Can the policy be surrendered at any time after 3 months of purchase. If it is true then whether both the survivors have to sign the surrender form?

3) What is this “SURRENDER VALUE”? Is there any deduction from the original purchase price? OR there are some additions to it?

Dear Bikas,

1) First check JOINT life is possible or not. Because as per me, it is purchased by a single person JOINTLY you can’t buy.

2) and 3) Regarding eligibility of surrender, please refer the above post.

Sir, Is the Jeevan santi lic plan has any benifit of IT rebate under 80cc

Dear Debasis,

YES. But pension is taxable income for you.

Dear, i am a original Indian, we are now British citizen. with OCI(overseas citizen of india) holder. my age 50year,& wife 45 year old. daughter 12 year old. i looking a retire plan invest in india. which policy better for my family.please help me.

Dear Dharmendra,

Stay away from POLICIES create your own corpus rather than depending on policies to accumulate it. However, if you are looking for an immediate annuity plan, then you can check with above plan.

Could your please help us how to create our own corpus. Where to invest and create a corpus?

Dear Joe,

Definitely, but not on such public platform 🙂

Hi

How can i surrened my lic jeevan shanti policy

What is percentage iam going after surrendering the policy

Dear Mahesh,

Approach the home branch of LIC for the same.

Can you please explain tge 2% discount point in jeevan santhi lic plan..

If i invest 2 lakhs with deferred tine if 5 years

Dear M,

They will give you 2% discount on your overall amount you pay at the start of the policy.

can i buy the policy of 1.5 and then increase it later?

Dear Chatterjee,

Yes, you can enhance it at any point of time by buying new one.

Hi Sir,

Very informative and useful

Look forward for such articles

Dear Nagaraj,

Pleasure 🙂

Which is better option for Jeevan Shanti deferred plan ?

3 lacs separate single life for me and my wife?

OR

6 lacs joint life option?

Dear Jatin,

If your retirement is not now, then why to accumulate on own rather than depending on this fund?

Can father be joint life with her own married daughter (30 yrs) by Choosing Option J in Annuity plan Jeeven shanti Policy. Pl reply

Dear NKP,

As per my knowledge, only spouse allowed to be a joint life holder but not kids.

Sir,

You are doing very helpful work. God Bless.

My age is 51, wife age45, We have no issue(Children).Please suggest me suitable insurance Policy jointly to cover each other.

Dear Vijay,

I suggest you ONLY online Term Life Insurance.

ultimately what is the Rate Of Interest in Jevan Shanti . This is a laymn question

Dear Shashidhar,

It is around 6% to 7%.

Dear Sir,

Thanks for the very details of this policy provided.

I am 52 years old and my wife is 47.

I want to invest around 2 lakhs in this policy for the purpose of getting death benefit (to my wife) in case of unfortunate event (with God’s grace should not happen) for her as immediate financial support.

Which option (in deferred) you will recommend?

I want to take the deferred period 8 years and plan to get pension from age 60.

Kindly advice.

Thanks.

Dear Manjunath,

If you are looking for LIFE INSURANCE, then buy the term life insurance. Stay away from such bundled product.

Which is good Term life insurance. Let me know so that I can purchase the same

Dear Nikhil,

Refer my blog post “Top 5 Best Term Insurance Plans in India 2019“.

My parents had bought a policy Under Jeevan Shanti Option J, now, due to a medical emergency, we want to liquidate it. Is it possible ?

Dear Mohithprabhu,

You can surrender it after 3 months completion.

Is it better then Investing in 10 years FD considering only returns?

Dear Kash,

Far better but if your goal is 10 years away, then include equity part also.

very very useful and informative. if we approach a LIC agent he will immediately tries to sell the product without giving sufficient time to think. Thanks a lot for this online information

Dear Ramaiah,

Thanks for your kind words.

Very good and true information by you. Thanks for enlightening on this. Hope people don’t fall on LIC’s miss-selling there policies.

Hi sir I am Manohar my father age 62 I will invest in jeeven shanthi 10laks.will I recvie total amount after 10 yrs

Dear Manohar,

It depends on the option you choose in this plan. Please go through the above post to understand it fully.

Hi Sir,

My father-in-law is 77 yrs old, and looking for pension (immediate annuity). He wants to invest 5 lakhs. Which option would be best for him in Jeevan Shanti.

Thanks,

Harsh

Dear Harsh,

Check Pradhan Mantri Vaya Vanadana also.

Which is best pension plan under government for senior citizens. We have already invested in scss and Pradhan mantri, any other option for pension

Dear Mitra,

It is hard to say without knowing your actual financial life.

Very nicely and correctly explained.

Jeevan Shanti is the best Pension Policy of LIC.

Dear Brij,

Best may be for LIC but check whether this is BEST for you or not.

I want to invest Rs 9 lakh in jean shanti immediate annuity plan. What is my monthly return?

Dear Kunwar,

LIC provided the online calculator, you can use the same or visit the nearest LIC Branch.

If i cancel with in one month, what all the deduction will happens and how much..?? Please replay…

Dear Sundar,

You are not allowed to cancel within a month. However, you can cancel the policy within the free-look-in period od 15 days. Free-look-in period starts from the policy document received date. Hence, if you cancel this during free-look-in period, then you will get the amount by deducting the tax and medical examination cost (if it was done). However, after this period over, you are not eligible to close. If you close, then you have to forget the premium.

Hi Basu,

It seems to me at this point that for immediate annuity option , the interest is marginally better than Jeevan Akhsyay VI. Is my understanding correct?

Subhasis,

Whether you checked for the same annuity option, for same age and tenure?

Hi,

Can you please share actual rate of return in immediate or deferred annuity vis-a-vis the jeevan akhsya 6?

Dear Karan,

Surely I will write on this soon.

Awaiting to hear from you.

Dear Karan,

I will write it. It got delayed as I was stuck up with my Financial Planning tasks.

how the guaranteed addition is calculated,what a person will get after 3 year in option f if he opted for deferment period of 5 year in case of surrender and in case of death. Although a hasy picture came it will be better by giving an example of minimum investment

Dear Bharat,

Please read above post once again. I already shared the GA calculation method. I will update the post once I will get the complete premium chart.

NO clear image in S.alue and Guarented addition

Dear Sonali,

Yes, we have to wait for the premium chart to be disclosed by LIC. Then I will update the post.

Is it worthy spending lumpsum amount say 3-4 lakhs in this plan instead of Mutual Funds, please advise

Dear Ankush,

Is it for your immediate pension or you are looking for accumulating the retirement corpus? If your idea is to accumulate retirement corpus, then better to stay away.

Thanks for the response, what are the best options for accumulating retirement corpus say after 60 years.. I have 20 years to go..

Dear Ankush,

Equity and debt in right proportion and yearly review.

Where can we calculate how much we will get per month for Option F for various one time investment amount?

Send your e-mail pls.

Dear Ajith,

It is [email protected].

Dear Mahalingesh,

Please wait for the launch. After that, they will provide the online calculator.