The government announced the interest rate for PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Oct-Dec 2017 on 29th September 2017. Let us see the changes applicable with effective from 1st October 2017.

Earlier the interest rates used to be announced on yearly once. However, now from 2016-17, the rate of interest will be fixed on a quarterly basis. I already wrote a detailed post on this. I am providing the links to those earlier posts below.

- Post Office Savings Schemes -Changes effective from 1st, April 2016

- Premature closure of PPF account – New Rules 2016

Based on these new changes, now onward interest rate will be declared on a quarterly basis. The earlier quarters (FY 2016-17 and FY 2017-18) interest rate can be viewed in my earlier posts “Interest of PPF KVP NSC SCSS and Sukanya Samriddhi for April-June 2016“, “PPF and Sukanya Samriddhi Scheme interest rate July-Sept 2016“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Oct-Dec 2016”, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Jan-Mar 2017“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates April-June 2017“ and “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates July-Sept 2017“.

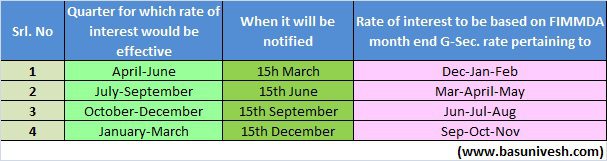

Below is the timetable for change in interest rates for all Post Office Savings Schemes.

As per the schedule, Government announced the interest rate applicable to all Post Office Savings Schemes from 1st October 2017 to 31st December 2017.

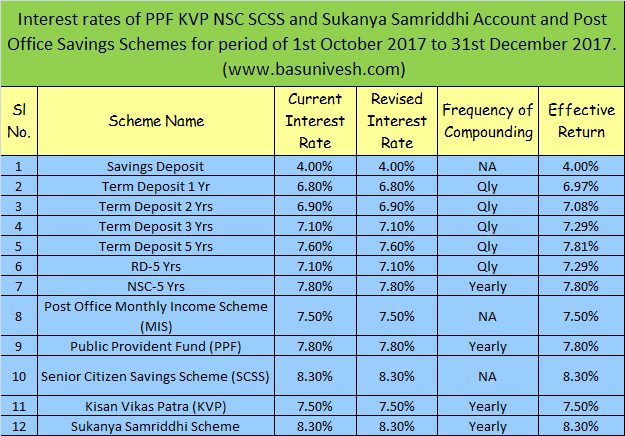

PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Oct-Dec 2017

Just for a quick recap, Government reduced the interest rate of all products by 0.1% or 10 BPS (100 BPS=1%) in the last quarter. However, for this quarter Government retained the same last quarter’s interest rates for all Post Office Savings Schemes. Below is the PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Oct-Dec 2017. Also, I have listed all Post Office Saving Schemes interest rate for Oct-Dec 2017.

Note:-Now the KVP (Kisan Vikas Patra) will take 115 months to double.

If you notice, Sukanya Samriddhi Scheme and SCSS are still fetching you a higher return than any other Post Office Schemes.

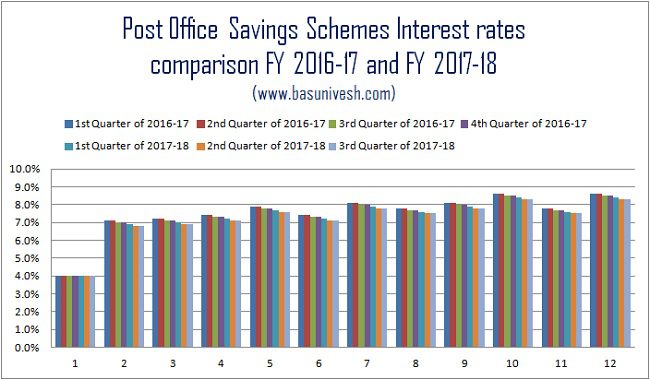

Below is the interest rate trend for FY 2016-17 and FY 2017-18.

You notice that only savings account interest rate is constant since FY 2016-17. For the rest of the schemes, the interest rates are in downward trend.

Refer our earlier posts related to Post Office Savings Schemes-

- All about Public Provident Fund (PPF)

- PPF Account for Minor and Wife – Rules, Tax Benefits and Tricks

- How to encash or withdraw NSC bought from different Post Office?

- NSC-Accrued Interest taxation and way to reduce it

- Post Office Monthly Income Scheme or MIS – A complete guide

- Premature closure of PPF account – New Rules 2016

- PPF withdrawal rules & options after 15 years maturity

- Public Provident Fund -20 unknown facts

- 15 Rules of availing Loan against PPF (Public Provident Fund)

- How to transfer PPF Account from Post Office or Bank to another Post Office or Bank?

- Excel PPF Calculator-Calculate goal, loan or withdrawal amounts

- PPF-Loan and Withdrawal

- PPF-When to contribute to get higher returns?

- All about Kisan Vikas Patra (KVP)-2014

- Sukanya Samriddhi Account -When to invest to earn more returns?

- Sukanya Samriddhi Account-An investment scheme for your girl child

- Post Office Senior Citizen Scheme (SCSS)-Benefits and Interest Rate

- NSC and KVP in e-mode and Passbook mode from 1st July 2016

- How to transfer NSC from one person to another?

- India Post Help Centre and a Toll-Free Number 1924 features

10 Responses

Hi Basu

I have girl child of 1 year old and I want to invest for her. My aims are higher education at around 18 years from now and Marriage at 25 years from now. Now I have three choices

1) MF- Better returns and Liquidity

2) SSY – Fixed guaranteed returns, Liquidity option only after 18 years

3) PPF – Less returns than SSY but liquidity after 15 years and investment can be continued even after 15 years.

Now I am confused, I don’t want tax benefit which is offered by Schemes like PPF and SSY. So, should I just invest in MF and opt for returns over safety ?

Sandeep-Combination of PPF and MF.

Hi Basu,

Great articles to read.

I request your guidance on following query.

I have opened Sunkanya Samridhhi Account for my one old baby-girl. I am investing 9000/month. I am exceeding 80C limit from past 2 years.

I have one more SIP of 3000 in LIC which I can’t close now.

No other investments or EMIes.

So considering very long time period, I want to invest in MF instead of SSA. I have account in ShareKhan as well as CAN from MFUtilities, however I am not able to find best MFs.

Could you please help me with this? Should I invest entire 9000 in one MF or multiple MFs with 2000-3000?

Regards,

Sandeep

Sandeep-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

I do not have PAN card but I opened PPF account submitting FORM-60 and aadhar card. Is the amount I invested in PPF will be eligible for deduction under Sec 80C and maturity interest is tax exempt. So is it EEE (Exempt during investment under Sec.80C-Interest earned during PPF tenure is also exempt-Maturity amount is also tax-free)? Kindly let me know whether I will get tax benefit once my PPF account get matured because I do not have PAN card.

Pooja-How you can claim tax benefits under Sec.80C without PAN? Regarding tax benefits, the rules apply same to all.

Can I claim tax benefits for PPF under Sec. 80C by submitting form 15G?

Pooja-Form 15G applies for TDS but not for claiming Sec.80C.I think someone misguided you.

I have SBI Saving bank account. It has been turned into saving plus account and SBI of their own system is converting some amount into FD. As and when required at the time of withdrawal some part of MOD balance which is always more than Rs. 100,000/ is credited to Clr Bal.

Recently after taking print of saving account passbook, I find that SBI has deducted on 31st August as well on 30th September Rs 59/ on account of MOB SB Debit.

In my opinion it is unjustified since MOD balance throughout the month was more than One lacs.

How should I take with SBI so that undue deduction on account of MOB SB Debit is credited with intrest thereon.

I am a senior citizen and having Senior citizen saving account FD in the same SBI branch.

Awaiting your valuable advice.

Ram-Refer THIS for complain.