What is the applicable latest Post Office Small Saving Schemes Interest rates Jan-March 2018? The government announced the interest rate for PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Jan-March 2018. Let us see the changes applicable with effective from 1st January 2018.

Earlier the interest rates used to be announced on yearly once. However, now from 2016-17, the rate of interest will be fixed on a quarterly basis. I already wrote a detailed post on this. I am providing the links to those earlier posts below.

- Post Office Savings Schemes -Changes effective from 1st, April 2016

- Premature closure of PPF account – New Rules 2016

Based on these new changes, now onward interest rate will be declared on a quarterly basis. The earlier quarters (FY 2016-17 and FY 2017-18) interest rate can be viewed in my earlier posts “Interest of PPF KVP NSC SCSS and Sukanya Samriddhi for April-June 2016“, “PPF and Sukanya Samriddhi Scheme interest rate July-Sept 2016“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Oct-Dec 2016”, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Jan-Mar 2017“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates April-June 2017“, “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates July-Sept 2017“ and “PPF, Sukanya Samriddhi, NSC, KVP Interest Rates Oct-Dec 2017″..

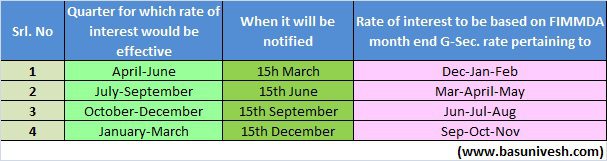

Below is the timetable for change in interest rates for all Post Office Savings Schemes.

As per the schedule, Government announced the interest rate applicable to all Post Office Savings Schemes from 1st January 2018 to 31st March 2018.

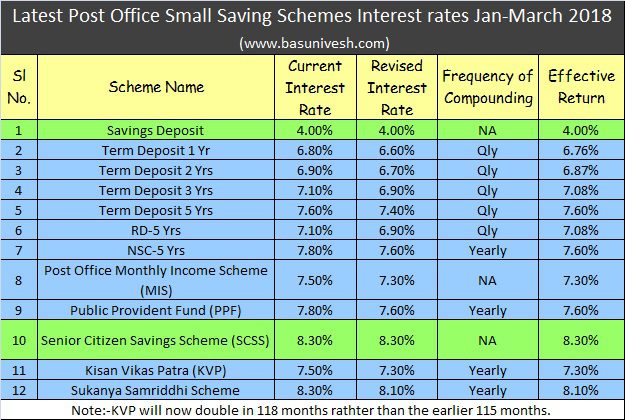

Latest Post Office Small Saving Schemes Interest rates Jan-March 2018

Just to quickly recap, last quarter, Government maintained the same interest rate for all Post Office Small Savings Schemes.

However, this time, Government reduced around 20 BPS or 0.2% for all its schemes (except Savings Account interest rates, SCSS).

Below is the latest Post Office Small Savings Schemes interest rates Jan-March 2018.

I highlighted with green colour wherever there is no change in interest rate.

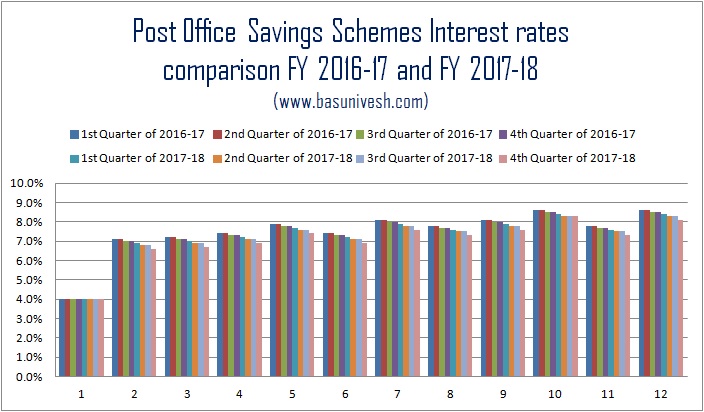

Post Office Small Saving Schemes Interest rates trend FY 2016-17 and 2017-18.

Below is the interest rate trend for FY 2016-17 and FY 2017-18.

You notice that only savings account interest rate is same for almost two years. Rest of all products interest rate slowly reduced.

Refer our earlier posts related to Post Office Savings Schemes-

- All about Public Provident Fund (PPF)

- How to open PPF account online in ICICI and SBI Banks?

- PPF and NSC for NRIs – Amendment Rules 2017

- PPF Account for Minor and Wife – Rules, Tax Benefits and Tricks

- How to encash or withdraw NSC bought from different Post Office?

- NSC-Accrued Interest taxation and way to reduce it

- Post Office Monthly Income Scheme or MIS – A complete guide

- Premature closure of PPF account – New Rules 2016

- PPF withdrawal rules & options after 15 years maturity

- Public Provident Fund -20 unknown facts

- 15 Rules of availing Loan against PPF (Public Provident Fund)

- How to transfer PPF Account from Post Office or Bank to another Post Office or Bank?

- Excel PPF Calculator-Calculate goal, loan or withdrawal amounts

- PPF-Loan and Withdrawal

- PPF-When to contribute to get higher returns?

- All about Kisan Vikas Patra (KVP)-2014

- Sukanya Samriddhi Account -When to invest to earn more returns?

- Sukanya Samriddhi Account-An investment scheme for your girl child

- Post Office Senior Citizen Scheme (SCSS)-Benefits and Interest Rate

- NSC and KVP in e-mode and Passbook mode from 1st July 2016

- How to transfer NSC from one person to another?

- India Post Help Centre and a Toll-Free Number 1924 features

33 Responses

I require TWO clarifications:

1. As the interest rates for SCSS is being revised on quarterly basis, does it mean that the investment will have a fluating rates? To be more specific, if I invest now in this quarter, I will get @ 8.3% pa only for this quarter & for subsequent quarters, the respective announced rates will be applicable-unlike Bank FDs.

2. Can Husband & wife (both having separate PANs) can open individually in both their names each upto Rs.15 lakhs?

Dear Subramanian,

1) It is fixed at the rate when you are booking the SCSS. It works exactly like Bank FDs.

2) Yes, you can do so.

Hi Sir,

Just a have clarification on TDS dedications, I have invested on NSC for 1 lakh. at the time of Maturity will post office will deduct TDS from maturity value and give finally amount ?please clarify if yes can i clam the TDS deducted amount on e-filing?

VSR-Do you think avoiding TDS means avoiding tax?

My NSC matured before 1 year i am not withdrawal not yet can i receive interest frm matured date or can this NSC can converted to another postal scheme frm matured date

pls advise………

Prasanna-You will get the applicable NSC interest rate up to maturity. Post that, the applicable Post Office Savings Account interest rate up to withdrawal.

Thanks sir…

hi i want to deposit a amount of 7 lack in my sons name for 10 years. but i need to guardian please tell me is there is any scheme in which two guardians are allowed. thanks

Sinoj-Not sure, hence you have to check with scheme features personally.

thanks

I want to invest @ 10 lacs as a lumpsum amount for a time horizon of 7-10 years in the name of my 12 years son. What is the best instrument around for good appreciation and safety inclusive.

SKB-Use Equity and Debt Mutual Funds with the allocation of 40:60.

Thanks for your prompt response. Can you suggest some good funds to invest in.

Skb-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Hi I want to invest 7 lakh in post office pls guide me which scheme is best for me in which I get best interest rates .

I went to post office they told me that interest rates are 6. Some percent and the plus point they told me that they don’t cut tds like banks .and when I asked bank employee he said they cut TDS they are lying so I m totally confused pls guide me

Anya-Without knowing your financial goals, it is hard for me to guide.

I just want to get best interest rates on my money in two years or three years

I want to do fd where should I invest in bank or post office

Anya-For the time horizon you specified, there no such huge difference between Bank and Post Office FDs. Hence, choose the one which is comfortable for you to manage.

Anya-Then use Term Deposit of Post Office.

Thanks for replying

Bank FD rates will also be lowered ?

Ankit-As of now for another one quarter, YES.

Out of all these schemes, which one has the maximum limit of deposit? Which one would give quarterly or monthly interest – similar to bank FD?

Kaval-Don’t look at quarterly or monthly interest, but look at an effective annual rate (which I shared in above list). Also, if you are looking for long term, then first identify your NEED or FINANCIAL GOAL, then based on that invest. Don’t invest BLINDLY.

Bank FD rates will also be lowered? 🙁

Budding-May be.

Thanks for the reply!

1)one needs to submit 15H every financial year in post office (for mis/scss etc) (obviously if interest is >10k p.a? Or is it only at time of opening of scheme in post office ?

2)what to do if postmaster REFUSE to give acknowledgement for 15H submitted? (•_•)

P.s read your post on 15H & video. Good work ?

1)I meant if a scheme say scss is for 5 years and applied in post office then do we need to submit 15H every year or only b once at the time of deposit (considering the interest to be same for 5 year period)?

Budding-Submitting Form 15H is every year affair.

Budding-1) You have to submit it yearly.

2) I think they do not give the acknowledgment of the same (because of they still in 1947 model of working).

Even if the TDS deducted, then you can claim it back by filing IT Return.

Yes sir! had experienced this in past. Some of my neighbours are senior citizens. I try to help them with bank matters with that little knowledge I have! Recently I got to know from them that they submitted 15H but bank deducted tds. one uncle has 2lacs FD for which bank deducted tds inspite of submitting 15H.when I went with the uncle to ask manager to reverse the amount, he told he’s unable to do so, as after change of sbm to sbi the software is changed & tds directly being deposited in treasury hence no option to reverse tds. He told he can’t do anything for future deductions also! After few days I got to know this same issue from 4-5 people. They take 15H & refuse to provide acknowledgement & at the time of interest credit, tds is deducted! As my neighbor uncle is illiterate, not techy with no Internet banking it is difficult for him to file returns. Today I was in post office to post something & heard the postmaster shouting on a senior citizen regarding 15H acknowledgedment. That he’ll not give acknowledgement, do whatever bla. Bla. Felt really sorry for that old man. So thought to collect info/rules on this. But sadly RBI doesn’t have a process for such illegitimate tds deductions. At least for old middle class people they should give some option of reversal.

Budding-Usually they do not give acknowledgment. But the sad part is their arrogance and not ready to accept their fault.