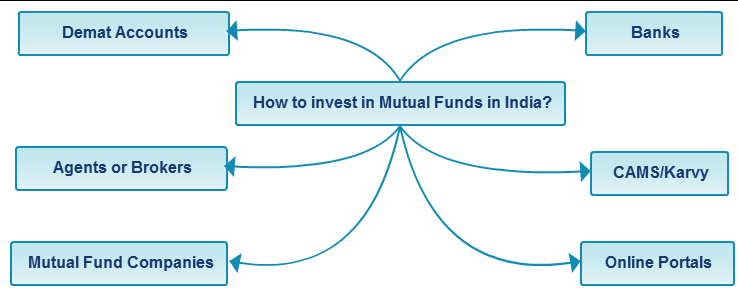

One of the biggest concern of today’s internet savvy investors is that how to invest in Mutual Funds in India online? Currently, we will find many such options. But which one is best suitable to you?

Below I listed them briefly for your understanding and I hope your all queries will get answered about choosing the right mode of investment.

1) Through Agents or Brokers-This is a typical way of investing in India since long. In this option you choose the agent and calling him, he will come to your doorstep and fulfill all necessary formalities like collecting necessary documents for KYC purpose, taking signatures and submitting the forms to respective mutual fund companies. You no need to bother about processing part. He will earn commission directly from mutual fund companies which is adjusted against your NAV. Hence you will not notice the expenditure part in your account statement too. But in reality, if you stay invested for long then he earns more than any insurance agent.

Mutual fund commission is structured in such a way that if you stay long and invested amount grows well then your agent will also earn more. But nothing is free in this world. Hence if your agent is providing service like completing all formalities related to processing, helping you in choosing the right fund based on your requirement and providing you the post-investment service too then I don’t think you can stay away from his/her service, especially new investors who does not know about basics of mutual fund. But the question to be asked is, whether he is capable of providing all service to you or just acting as courier agent who delivers your signed copy of documents to mutual fund companies is question you need to check out before going with any agent or broker. This type investment is completely OFFLINE mode for you.

2) Mutual Fund Companies-All mutual fund companies provide you to invest directly. Here in this mode of investment first you need to download the forms, submit it with filling and submitting the necessary documents (if KYC not done previously). Once the folio (it is like your bank account number and will be unique) generated then you can invest online. Here there are two options for you to choose. One is a normal plan where distribution expenses are adjusted to NAV and another format is Direct Plans where there is no distributor expenses and cheaper to normal plans. The detailed difference is already written by me in my previous posts about Direct Plans and how one can opt for Direct plans. Below are the related posts on this topic in detail.

So in my view, if you are a totally informed investor (it is hard to judge one’s knowledge himself 🙂 ) then it is always a best cheap option to go for DIRECT PLANS. Otherwise, go for normal plans.

3) Through Online Portals-Many have a great misconception that investing through online portals like FundsIndia or Fundsupermart is best and cheapest mode of investment in mutual funds (exactly like buying online term insurance). I agree that they offer you a great convenience of investing Online and you can review all investments at one place. But still, this type of investment is as much as like choosing the broker (who is not charging you any upfront commission directly) or investing through mutual fund companies normal plans.

These online portals even though not charge you anything upfront as cost, but still they collect the commission from mutual fund companies and will be adjusted to your NAV. This option is best to those who are looking for investing online, convenient for tracking their investment and one point of a solution to all your investment quarries irrespective of mutual fund companies. But the cost wise considering, this type option still costlier to DIRECT Plans.

4) Through online Demat Accounts– This type of investing is through your demat accounts where you use this account for your stock trading or holding stocks. These stock brokers such as ICICI Direct, HDFC Securities or Sharekhan offer you investing in mutual funds. But usually, each SIP or investment is charged here directly from your investments and also they receive the commission from respective mutual fund companies. So even though this option seems to be online but costlier than the option of Online Portals.

5) Through CAMS or Karvy-These are like middlemen between you and mutual fund companies for record keeping and processing and will be appointed by mutual fund companies. You can invest through them also exactly like what I mentioned in POINT 2. Currently, they offer online investments only for selected mutual fund companies. But the great convenience of service they provide you is to view your all portfolio at one place and you can request consolidated account statement from them (irrespective of who the service provider) by submitting your request. Visit below links for the same.

Karvy-Requesting Consolidated Account Statements -Karvy/CAMS/FTAMIL/ SBFS

CAMS-Requesting Consolidated Account Statements-CAMS/Karvy/FTAMIL/SBFS

Even CAMS offer you the service of Portfolio creation and maintenance of mutual funds, Listed Equity Shares, Bonds, Savings Schemes, Insurance, Commodities, Real Estate etc.

You can check the details HERE.

6) Banks-Last but not the least in this category are through Banks. Banks usually have access to your account details. So they lure you to invest in mutual funds. Their only motive is SELL and are least bother about analyzing your requirement. Also, you are not sure the current employee who is very much friendly with you now may be there for long in the same bank and branch to guide you in future. Hence it is always best to AVOID investing through Banks.

So there are many ways to invest in India either online or offline according to your comfort. Choosing the right service for investing will actually ease your life. Hope I covered all the options available in India currently.

7) MF Utility–MF Utility actually integrates all stakeholders of the industry like investors, mutual fund companies, and service providers on one online platform. This is an initiative by AMFI (Association of Mutual Funds in India) under the approval of SEBI. The beauty of this platform is, you can do all mutual fund transactions under one roof, irrespective of a Mutual Fund Company or funds. Hence, this platform acts like “Transaction Aggregation Portal”.

This platform provides online access to investors to connect with service providers (like Karvy or CAMS), Banks, Mutual Fund companies, Payment Gateways, and KYC registration agencies (CVL KRA). Therefore, you may say a one-stop solution for investors. This facility will available for 24×7 for access.

This is owned by all mutual fund companies and operated by MF Utilities India Pvt Ltd (MFUI). I wrote a complete post on this. Refer the same at “MF Utilities-Online Investment Platform for Regular and Direct Mutual Funds“.

8) Direct Funds Providing online portals-Now there are few private players who offer you direct plans online. There are many such portals came up. One of them is Inestza. I wrote a complete post on the features of this portal. Refer the same at “Invezta.com: Invest in DIRECT Mutual Fund schemes online at one place“.

sir

does mutual fund houses pay commision to MF utility like other online portals ?

Thanks

Kuldeep-NO.

Hi Basavaraj,

if one is kyc complient, then we can also directly invest like in ICIC in http://www.ICICIpruamc.com,

http://mf.adityabirlacapital.com/Pages/Secured/Individual/OneABC/Login.aspx in birla sunlife after registration .Am i correct? But the problem here is to remember multiple usernames and passwords for each fund house

Krishna-Yes, you are 100% correct.

I created my KYC through online and purchased the mutual fund directly from companies but now i know that i can invest only rs 50000 in a financial year because i created kyc online so how i can i increased my limit beacuse i am investing approx 9000 rs per month through SIP in all schemes

Amit-Complete the regular KYC process and then you can enhance your investment.

Hi, Is MF investment using KARVY, CAMS or MF Utilities India FREE? If not what are the charges or any hidden commission they take?

Jigar-If your concern is COST, then why not invest in DIRECT funds using MF Utility?

If I choose direct option while selecting scheme on mycams portal, than it delivers really direct plan or just fools the investors.

Vineet-You can check the statement later and confirm.

Hi Basavaraj,

Is myuniverse.in is a right platform to invest in mutual funds online?

Please advise.

Thanks

Santosh

Santosh-It may be right for regular funds but not for DIRECT funds.

I WANT TO INVEST LUMPSOME AMOUNT IN DSP MICRO BLACK ROCK FOR 5 YRS..PLS GIVE YOUR SUGGESTION

Anokhi-No equity if your time horizon is less than 5 years.

Sir,

I am new to MFs. I wanted to invest for 5+ years through SIP channel. I have recently started a SIP of ICICI Prudential Long Term Equity Fund (Tax Saving) of 4k per month…..the MF representative told me that it will perform very well and if it doesnt I can stop paying the installment from 3rd month and can withdraw entire amount after an year.

Could you please tell me whether it is good fund to keep in a long run as i can see it is not among the top 6-7 funds currently.

Pls guide

Gaurav-Why you invested and what is your goal?

Sir, I want to get max returns for my investment with moderate risk…I already have ample FD ….Imay want to purchase a house seven to eight years years later for family currently I am 29 years. I want it for down payment…… Currently I am investing only 4k as being naive but as I will gain experience I will invest UpTo 10-15k a month.

Gaurav-Can you define please the meaning of MAX Returns and MODERATE risk?

Dear Sir,

I thank you very much for this awesome article which clearly highlights the pros and cons of various methods for mutual fund investments. I am slightly confused. I hope you can help me out.

1) I am 35 and would like to do long term mutual fund investment for myself, wife and 2 minor children? My wife is a non-salaried housewife. Should I do their investments from my account or create accounts for each of them and do separately? Should I invest everything in my name and keep them as nominees?

2) I would like to do everything myself electronically online. Which utility would be best for me so I can do select mutual funds for all 4 of us and monitor all of them online at one place?

Thank you.

MP-1) You can invest in your name and nominating your family.

2) use MF Utility.

Hello Sir,

My wife passed NISM Exam and got ARN as well.

I tried to contact FundsIndia and NJ. FundsIndia is taking 35% commission from Brokerage as informed to me. Don’t know about NJ.

Any suggestion regarding distributor with which I should tie up?

Ronak-Better NJ (I am also associated with NJ).

Hi Sir,

I am 36 years now and would like to invest in MF. Planning to invest 15000 per month for 10-12 years.

Can you please suggest me a balanced MF plan ?

Also one of my friend suggested me that I should be investing in Equity, Bond and Liquid fund. Is it safe that way, if yes is there any % calculation for that and is it possible/necessary to change the % calculation after 6 years?

Can you please suggest. Sorry for writing lot of queries all together.

Thanks,

J Krishna

Krishna-Funds are listed in “Top 10 Best SIP Mutual Funds to invest in India in 2016“. What your friend told is asset allocation between debt and equity.

Hello Sir,

Recently i have opened a online account with NJ Funds to buy Mutual Funds. Earlier i used to buy directly. I like their services and information they provide me. But i have a fear in my mind whether my investment with NJ Fund will be safe in future. When i applied for online a/c, i received various mails regarding Power of attorney, Bank mandate, auto debit etc etc.. Please advice me whether should i continue with online broker like NJ funds or opt for direct investing with AMC.

Gaurav-It is safe, but track your money on regular basis.

sir which one through i invest in direct plan by online , i want less charges of service

Rakesh-Less charges of service means?

SERVICE COST WHICH IS CHARGE BY MEDIATATOR I.E.BROKERAGE ,COMMISSION ETC.

Rakesh-First understand of whether you are eligible to handle your money on your own.

absolutely sir

Rakesh-Then use DIRECT funds using directly MF AMCs portal or MF UTILITY.

Dear Basavaraj,

I am 32 year old. I have term insurance of 1 crore and house loan running(5 years left).

I wanted to start inventing in MFs through SIP, Rs: 12000/- per month for 20-25 years. I am targeting for my retirement fund and my kid’s education/marriage(20 years from now).

Based on the above blog invest through mutualfund companies with Direct Plans is better.

I am thinking of inventing in 4 funds(3000/- each), is it a better idea ?

Can you please suggest the funds ? or give me some inputs to select a fund ?

I really appreciate your help.

Thanks,

Rajesh B

RAjesh-If you are confident of managing your money on your own, then go for DIRECT. Refer my blog post and read the comments mentioned there. You will get an idea. Refer this “Top 10 Best SIP Mutual Funds to invest in India in 2016“.

Hello Sir,

I am 25 year old, looking for investment of 3000 per month in MFs. I would not like to invest all in one MF instead 3000 in multiple MFs.

If you can please suggest two or more best MFs for tax saving option?

Currently, I’m planning for 3/5 year and will extend/revise the investment option(s).

Thanks in advance.

Vijay-Refer my post “Top 5 Best ELSS or Tax Saving Mutual Funds to invest in 2016“.

Dear sir,

I want to start a SIP in mutual fund for my child education and later for retirement and other things. I am 45 now and I can invest 10-20 k per month with a horizon of 3-5 years or more. as i am financially ok, i believe my risk appetite is moderately high or high.

Request you to suggest me good funds on which I should invest through SIP , online.

rgds

shilp sharma

Shilp-Your goals are long term, but your investment horizon is short term (3-5 years ONLY)?

Dear sir,

I can stretch my investment horizon. request you to suggest me the funds.

Shilp-Stretch to what length? Beyond your goals?

Dear sir,

I Can stretch for 10 years say…as I will need money may be in 10 years or later once my kid grows up. Retirement is still 15 -17 years away. now please suggest me funds.

rgds

Shilp-Refer my earlier posts and go through all comments “Top 10 Best SIP Mutual Funds to invest in India in 2016″.

Thanks..i am following your list of best 2016 fund. Also , i had earlier invested in IDFC Dynamic equity fund -growth as lumpsum. now it is around 3 lac. I feel it is not a good fund and unnecessary i am blocking money there. can u suggest me..shall i continue with this..or switch over to some other funds.

Shilp-What prompted you to invest in that fund? While investing what was your return expectation? Why now you are feeling that the fund is not good?

Dear sir,

It was done by agent as that time i was not so much particular about mutual funds. Now while going through the performance and ranking of the pump in websites , I felt i should come of out of this. In your list of tap ranked funds to invest in 2016 ,also it doesnt figure out.

please advise.

Shilp-Don’t compare others or rankings. Check whether the fund is delivering your expected return or not.

hello Sir,

Firstly, thanks for the very useful information that I was looking for. I am 29years old and currently I want to invest 2.5 lakhs in below MFs:

HDFC Balanced Fund: 75k

TATA Balanced Fund : 75k

Franklin India Prima Plus(Large Cap): 50k

Birla Sunlife Frontline Equity Fund:50k

My investment time frame is for 3 year and I am the first time investor of MFs. I have already covered my tax saving through investing 1.5 lakhs in PPF this year.

Please suggest me which option should I choose to buy above MFs? considering I already have HDFC securities account (I have started trading a bit :)). Should I get HDFC ISA account opened (which will be charged 1000Rs every year). I am not sure how much will they charge on the buying/selling these MFs. I have been informed from the bank there are no other charges. Please advise.

Thanking in anticipation.

Tripti-Who suggested you these funds? Equity is not suitable to your timeframe. Please keep in mind that enter into equity (that too not 100%) only if your time horizon is 5+ years. You are risking your money to a large extent.

Thanks for the reply Sir. I went through various blogs and came to this decision myself. Please suggest me if any better MFs for me. I have other savings also like RD+FD+PPF+tax free Bonds which all are safe investments. So, I thought of jumping into MF from this year. Moreover, I thought Hybrid funds are less risky prepositions.Please suggest.

Tripti-Apart from traditional fixed instruments, I will not suggest anything. Even hybrid funds also have around minimum of 65% equity exposure. Do you know that? Use FDs and some part in Arbitrage Funds. Never believe these start ratings fancy numbers published by so-called experts.

Yes Sir, please consider me well read about these funds. Currently I have more than 5 lakhs in FD. I have these 2 lakhs extra which I want to invest in MFs/any other investment instrument for long term (It can even be more than 5 years, but I see they give best returns in 3 years or so). Please suggest which is the best method to invest (I already have FDs on which I am paying huge TDS :()

Tripti-The problem in your case is data intrepretation. The high returns for 6 months, 1 year or 3 years also be attached with higher standard deviation. Positive return of 30% may turn to negative return of 30% SOON. Hence, it is always best to go for equity only in case your timeframe is more than 5 years and that too with proper asset allocation between Debt:Equity. Let me know specific holding period of your investment to guide you in better way.

Good morning Sir, thanks again for your reply. I want maximum return from my investment of these 2.5 lakhs in MFs. I can hold upto 10 years or more. I am considering to go for direct funds. Please suggest if MFutility is a good option. You can also suggest me some good MFs to create my portfolio.

Time frame – more than 5 years

Amount -2.5 lakhs

Risk Apetite- Moderate to low

Tripti-Good morning. A single equity oriented balanced fund like HDFC or Tata balanced funds are enough (where equity to debt is around 65:35). But strictly for more than 5+ years. If your intention is to go for DIRECT, then you can go ahead with MFU. No issues at all

This brings me back to my initial confusion- should I go for direct plans or invest through online portals. As per your article, direct plans are the way to go. Please suggest.

Tripti-Better DIRECT and start to learn on your own about money. This is the final solution than relying on any agent.

I want to invest in Large cap funds but I am confused in which company should I invest.

Franklin India Opportunities Fund (G)*

55.825, Regular Plan, Growth

*Kotak Select Focus Fund – Regular Plan (G)*

23.014, Regular Plan, Growth

*SBI Blue Chip Fund (G)*

29.313, Regular Plan, Growth

Nilam-Any specific reason for selecting ONLY large cap funds and your timeframe?

Thank you Mr. Tonagatti. No specific reason. Maybe for a longer period though my age is 70 years. I have already invested in the following:

HDFC Top 200 (Reinvested) – 27/11/2009

Franklin India Bluechip Fund (Growth) – 19/05/2010

SBI Gold Fund (Growth) – 02/09/2011

HDFC Gold Fund – 24/04/2012

and my son has invested in the following:

HDFC TaxSaver – 20/04/2012

ICICI Prudential Tax Plan – Dividend – 25/04/2013

TATA Tax Saving Fund – 23/06/2014

Axis Long Term Equity Fund – Dividend – 11/04/2016

Hence please suggest. I am a house wife and want to invest Rs. 5,000/-

Thanking you once again

Nilam

Nilam-I asked the question to identify your need. I found that you and your kid investing simply lump sum whatever you have. Instead, set a particular goal timeframe. Based on that create a portfolio in the proportion of debt:equity. It is wrong of what you both are doing. This is suggestion. Rest is left with you. In your shortlisted fund, I go with SBI.

Thank you for your valuable suggestions. Will do accordingly.

Dear Sir,

Greetings!

I am invested in some MF through Bluechip. I have activated online account of all my MF investments which allow me to track performances periodically. I am also allowed to purchase directly. I want to know can I redeem funds online for purchases made through agent?

Laxman-If you have online access to all mutual funds, then you can do it redemption from respective AMCs portal.

thanks for sharing your knowledge with us. however i would like to know what are the hidden charges if i invest through mfutility for sip in mutual fund. As i am new to this field so please tell me which one will be better for me: fundsindia or mfutility. also please suggest some mutual funds for sip as i am looking into investment for 5-7 years (30000 annually)and 10-15 yrs(50000 annually)

Rishiraj-MFU. Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2016“.

thanks a lot sir.

Sir,

I have just invested in HDFC Small &Midcap fund and ICICI value discovery fund – SIP- 1000/- each, Growth fund 25000/- & Liquid fund 50000/- My age is 47 and i am planning for my two daughter education and marriage. who are 16 and 11 years resp. I am having Bank FD and PPF account also (4 lac FD and lic nearbout 3 lac). I want invest another more in mutual funds from diverting FD to mutual funds. Is it good idea. I am no need of that FD for another 10 years. Or I may get gift from father in form of money. Thanks in advance. I want good portfolio in investment.

Narendra-Your portfolio can’t be generated with mere two lines of your sharing.

Hi Basavaraj,

Need your favour on the below.

I need to invest 50 K for tax savings and i have only 2 days left, kindly assist me on what scheme or fund or where i can invest 50 K pls. Your response is much appreciated.

Sudharkar-I already replied to your mail.

Dear Mr. Basavaraj,

Greetings!

I recently returned from Kuwait and now in Bangalore.

I would like to invest in MF and other tax saving schemes.

Please advise me how to go about it and can you assist me?

Regards,

Sreedhar

Sreedhar-Yes, why not? Drop a mail to [email protected].

Hi Sir,

I am planning to invest through SIP this year( one fund to start with RS 1,000 and later diversify more SIP’s in coming years) for a time of 3-5 years.

Kindly suggest me best time to invest & suggest me ideal factors from fact sheet like ideal Standard Deviation, Beta, Sharpe ratio and any other factors in choosing a good fund.

Is higher or lower NAV value affect my returns?

I was planning for HDFC top 200 direct G / hdfc Index Nifty Dir G / hdfc index fund sensex plan / hdfc premier multi cap d g.

I am interest in HDFC because its AMC is close to my house :).

But currently HDFC is not upto the mark, hence sceptical.

You can sugest me funds from other AMC houses too.

My age is 26 & my salary is within 20k 🙁 & I don’t pay tax

Opting for Direct Growth option (1. Equity 2. ELSS 3. Debt)

Regards,

Nigel

Nigel-NO EQUITY for the time frame you mentioned.

Hi,

I have invested in MF’s, through online portals …. can I convert them to DIRECT mode.

if yes,

will it beneficial?

what is the process?

thanks

Jeevan

Jeevan-Yes, you can convert them to direct. But do remember to convert those units which are free of exit loads and concentrating on taxation part. It is beneficial as the cost of middlemen is zero. However, keep it in mind that you have to manage your fund on your own. If you are capable of doing that, then go ahead.

Hi This is venkat I have Invested in MF initially through broker now I have taken a Demat account from NJ India Invest wealth still partner name showing as broker name

Could you please suggest me what are the changes ? partner changes or brokerage chargers ..Please suggest ?

shall I take it from ICICI bank or sharkhan please suggest.

Venkat-What is your requirement?

Mr.Basu , thanks for this informative article.I am an NRI and is having few mutual fund invetments .After reading this article i signed up in CAMS .There in my profile the NRI status is not mentioned and only my indian home address is listed.I have already updated the KYC with banks .Will there be any issue in future during the redemption of funds .

Vishnu-No issues.

Nice Post !

i like to add this point in to article

Tax benefits. Investments held by investors for a period of 12 months or more qualify for capital gains and will be taxed accordingly. These investments also get the benefit of indexation

HI Basavaraj,

Your articles are superb and helpful to all !! Much appreciated. I planned to invest in SIP from Jan 2016 onwards around 8 K per month for more than 10 to 15 yrs.. so started doing research on that …. i am interested to go for Direct plan….

Have one doubt on that…

I know that we can invest via mutual funds company where we planned to invest.. for example if i plan to invest in axis long term equity then i can invest via axis only…….

but what is the role for CAMS if i opt that… what will be different between investing via mutuals fund company and CAMS? are CAMS will charge any fee?

Kindly advice me so that i can plan accordingly

Sudhakar-CAMS acts as record processing agent for some mutual funds. You can invest through CAMS also. But do remember to mention DIRECT in ARN field and infront of fund name like Axis Long Term Equity Fund-Direct-Growth

Hi Basavaraj,

Thanks for the kind reply…. however i have few clarifications on the below.. kindly help me out…

1. If i invest via CAMS as Direct, will they don’t charge any fee ?

2. If i want to invest in 3 or 4 funds as direct option, shall i apply all through CAMS and can maintain in single portfolia?

Sudhakar-1) NO. 2) CAMS provide DIRECT fund services to those AMCs for whom they are R&T Agents. For rest of the funds you have to chose KARVY.

Hi Basavaraj,

Thank you so much for your kind reply, however not clear on point 2.

Let me ask in other way so that i can be more clear:)

If want to invest in 3 different mutual funds with direct option , suppose say Axis long term equity, reliance tax saver, Fraklin templeton etc…..

so how can i proceed ..

Do i need to reach out to all 3 companies to start investing or will there be any single point of contact such as cams,kavry etc to do…..

Sudhakar-CAMS and KARVY are R&T for these mutual funds. So if your all funds are within a single R&T then you just visit the one. Otherwise, you have to do it both. But recently MF Utility started providing online platform for DIRECT funds too. You no need to visit either R&T or AMCs. Use this platform.

HI Basavaraj,

ur last line says no need to visit.. is that something typo error 🙂 so whom should i visit then pls

Sudhakar-It is not type error. I said, you no need to visit either R&T (CAMS or KARVY) or AMCs. Because MF Utility is an online platform, where you can invest in direct plans ONLINE.

Hi Basavaraj,

Thanks for your kind reply again.

So if i need to invest in axis long term, reliance , Franklin…. should i need to approach all 3 separately to start investing with them and to maintain 3 folios seperately ?

Or via CAMS/Kavry can i invest those 3 funds and maintain single folio?

When u say that no need to visit them and can do it in online….. so how is KYC done… is that also done in online?

Sudhakar-Folios will be different for different fund houses, whether you invest directly with AMCs or use any other platform. However, within a fund house, using a single folio you can invest in multiple funds. Therefore, folio will be unique for respective AMCs. Nowadays eKYC also started. Check with the respective mutual fund companies.

HI Basavaraj,

Thanks for ur kind reply…

i thought of investing in elss around 8 K per month in 4 mutual fund 2k each…

Kindly let me know which 4 will be best to opt from ur point of view..

Axis long term equity,Reliance tax saver,BNP paribas, Franklin tax shield, ICICI pru tax are in my minds 🙂

Sudhakar-Whether you checked the overlap % of investing in four ELSS funds? I suggest you to stick to one fund.

Hi Basava,

Really thanks for a help ! I have invested in Axis long term and Franklin India Tax shield 4 K each SIP via MFU.. Big thanks to you…. Also have few more queries,

1. How is the returns calculated for SIP plans, ex: my first sip was 4th April and NAV for axis long term was 30.354 & units as 131.779

now as on 6th April NAV is 30.060, there is slight drop here… how would it impact here…

2. What is diff in having the holdings in CAN or Demat?

3. In addition i thought of investing 5K on monthly basis within these 3 shares whenever is possible :

DSP-BR Micro Cap Fund – RP (G)

ICICI Pru Exp&Other Services-RP (G)

BNP Paribas Equity Fund (G)

Are those funds are doing goods?

I don’t see the name of these funds as “Direct”. Is that mean there will be brokerage charges if I invest on these ?

Sudhakar-1) NAV changes on daily base. If you are not accustomed to this volatility, then simply stay away. Also, you must invest in equity only for long term perspective. Hence, the two day change in NAV of the drop in NAV price of Rs.0.594 matters you MORE, then simply skip equity investment. It is not meant for you.

2) CAN is the way of investment using MF Utility platform. For Demat holding you need demat account. But for holding MF, demat account not necessary.

3) All funds now offer direct options. Without knowing your timeframe, it is hard for me to say anything. Hence, no comment on your selected funds.

HI Basavaraj,

Thanks for your help !!

i think i failed in explaining my questions to you properly…

1. I am going to invest long term may be around 15 yrs and more… but my question is change in NAV for people investing in SIP how its work …..in order to understand i provided that example of 2 days change in NAV….

2.I am clear now.

3. My investment horizon is more than 10 Yrs only… These funds i was studying for quite some days. so thought of investing on those…

DSP-BR Micro Cap Fund – RP (G)

ICICI Pru Exp&Other Services-RP (G)

BNP Paribas Equity Fund (G)

but my question is , these plans don’t have name Direct so is it mean they have brokerage charges ?

Sudhakar-1) Change in NAV depends on the price movement of underlying asset for that particular day.

3) If your time horizon is 10 years, then include one large cap and small portion into small and mid cap fund. Keep the ratio of 40:60 between debt:equity.

Thank you so much Basavaraj,

Would you help me suggesting the fund name pls..

Sudhakar-I can’t name it directly. But check the short term and ultra short term funds which hold quality papers and also the modified duration is less.

sir thanks for information i want to ask you that suppose i invest in 10 year or 5year plan per month 5000 rupees how i will get after year get complete benefits sir plz reply immediately i have to ask 1 more if i invest 10 lakh rupees for a 1 year plan what will be the benefits plzzzz replyyyy

Ruman-For your information, in Mutual Funds, there are no such plans which we can say 10 years or 5 years plans. How much I will get or how will I get?

Thanks Mr. Basu. It was a good read for me. I am very new to this field and wanted to learn basics. Your articles are really easy to understand and are very helpful. Really appreaciate it.

It would be great if you can suggest me some short term investment plans (six months), where I can invest, save tax and can see my money growing.

As I have future plans and they are not certain so I can’t invest in long term investment schemes. So basically,till date I have been using Bank FDs as a short term investment choice, which was good and was giving me around 7-8% of growth. But now the problem is to save tax, so I am searching for a better option which can give me similar/more growth as well as can save tax.

Please advise me on this query, I would me really thankful to you :).

Thanks in advance for your valuable time.

Ronak-Shor Term and Tax Saving is hard to get. Because except ELSS Mutual Funds (3 years lock-in), all tax saving products will have around 5 years of lock-in.

Hi,

I just opened HDFC ISA account for mutual funds. They are charging me 250/- per quarter as account maintenance. Also, I dont have an option to buy direct plans of mutual funds. When I checked with the HDFC rep, he said there is no difference in regular and direct plan. Its just that Direct plan will have higher NAV and you will sell at higher NAV. I want to open a 10,000 per month SIP (120,000 per year). What will be the difference in my costs if I invest in the growth plan of a fund through HDFC ISA account VERSUS “Direct” growth plan of the same fund directly through the AMC’s website? My understanding is as follows:

HDFC ISA cost:

Rs. 1000 account maintenance + 1.5 to 2% of investment paid by AMC to HDFC + 1.5 to 2% of investment as fund manager’s commission = 1000+ 3600 to 4800 = 4600 to 5800

Direct through AMC portal:

1.5% to 2% of investment as fund manager’s commission = Rs. 1800 to 2400

Is my understanding correct? Is there any reason I should be investing through HDFC ISA account?

ICICI Prudential Long Term Equity Fund (Tax Saving) – Direct Plan – Growth 1000/month from last 5 years

ICICI Prudential Banking and Financial Services Fund – Direct Plan – Growth 3000/month from last 3 months & 1 Lac lumpsum

ICICI Prudential Value Discovery Fund – Direct Plan – Growth 3000/month from last 3 months & 50000 lumpsum

Please guide me.

Murari-What I need to guide?

Sir, I am a biginer in Mutual funds.

I want to invest in Tax saving mutual funds, only for tax saving purpose.

My expected risk category is midium-high. so whether it will be prudennt for me to invest?

whether fundsindia, or fundsupermart is good option ?

Manoj-What is your timeframe?

Hi. Thanks for the informative post!

I have a query.

Sometime back, I purchased a few funds through HDFC Bank Investment Services (my broker) and subsequently Portfolio Numbers were allotted against my PAN by each AMC.

Recently, I checked UTI MF’s website and figured that I can Login with my Portfolio No. and manage my account online. Now here is the doubt.

Can I (or rather should I) use this online portal for new transactions such as direct purchase (new), redeem etc. since the funds in my existing portfolio were originally invested through a Broker?

Of course, I always have the option to transact through my broker but I was thinking of buying a Direct Plan for higher returns.

Please provide your valuable feedback.

Thanks!

Soumava-You can use the all facilities offered by Mutual Fund companies online irrespective of the way you invested. In fact, using the same folio number, you can invest in DIRECT mode of Mutual Funds too.

Hello sir,

Your answers to the comments are reallly informative. So if you can help….. (I am a first time investor and will prefer online mode for any investment)

I live in a small city and when I contacted Karvy and CAMS here they were unaware of MFUtilities or CAN etc. Is there any other way I can register for CAN, like through any AMC or so.

If I first invest through fundsindia (i have a KYC verified account but never invested so far) can I get so called folio numbers for variouis AMC and then can I switch to direct mode online in the same scheme or different schemes.

Lastly, I, for a try, went to Axis online MF and invested (as a new investor) 5000 in one fund. Then when I log into my account and want to check my portfolio, it says that there is no folio number is associated with this account and asking me to map a folio. But I am a new investor. Are they going to provide it online or .. I have already received a mail for confirmation of investment. Have I made a mistake or .. plz suggest.

Thanks in advance

Amit-You have to first check the designated POS for MF Utility. If the concerned Karvy or CAMS not designated then they may not be aware of it. Yes, if you already have KYC done the you can invest through FundsIndia and generate the folios. I am not sure what process Axis MF follow. In my view, once you get login access then you have to register your folio under that login. If you have trouble then you can call the customer care of Axis MF.

Thanks for the reply.

Well i talked to MF utilities and they said that I can send the application directly to their address. And Axis has sent me a folio number.

Bye

Amit,

Log into tour AXIS MF Account..Go to associate folio..They will ask the folio number you got from Account Statement after 1st Invesment..Then type it..They will probably send a verification code at your mobile/email..Type the code..Then your folio will get associated and you will be able to see your transaction and to do as many transaction as you wish in the same folio.

Thanks…really useful info .. I was able to associate Axisbank folio

hi. I want to start investing in MF with portfolio of abt 2 lac pa. 70 pct equity, 30 pct debt. my age is 30 yr. Pls advise best platform among fundsindia, myuniverse, yes bank mf online, hdfc investment service acct.

Girish-FundsIndia (if you feel not to go direct).

Hi

I prefer to invest via BANK, but your column doesnot tell how much charges BANK will deduct. So in terms of cost which one is better and how much is the difference as compared to other online portal.

Advantage of investing via bank is that single account you can manage credit, debit,FD and Mutual funds too

My bank is charging 600Rs per annum for the mutual fund account

Abhishek-Bank act like middlemen and charges of fee may change bank to bank. Apart from that as a regular middlemen, they earn the upfront and trail commission from your investment. Rs.600 is upfront fee and apart from that they earn trail and upfront. It is left with you to decide. If you feel online at one place (mutual funds), then I recommend FundsIndia.

Sir,

Your post was nice and informative, i have some doubts.

1. Is demat account necessary for working with Mutual Funds ?

2. Using Webportals like fundindia safer ?

Santosh-1) Not required. 2) Yes they are safe exactly like investing through an advisers.

Hi Baswaraj,

I am using sharekhan account. Can we have some MF plan where we can invest monthly 1000 rs for 3-4 mutual fund companies And by end of the year , we can get some good return . For example if invest 4000 in 4 companies(1 k each) for 12 month , so much amount we can get ? some guess ? around 60K ?

Vikram-No equity mutual funds if your time horizon is less than 5 years or so.

Hi,

I’m a total naive person when it comes to Finance related to stocks/MFs. Would be able to assist me in getting started.

Goals will be:

Child plan (eductation and any other expenses)

Home loan early repayment: target 10 years 35 Lakhs

Contingency fund if by any chance I have to survive 5 to 6 months with EMI and house hold expenses totaling to 80K (15 K is my car emi due to complete next Nov)

Retirement wealth creation

Abhilash-I can’t plan your whole financial life in commenting 🙂

Hello sir,

Thank you for your informative articles.

I stumbled across your site some months ago while searching for a beginners’ guide to mutual funds in India. One point, however, has eluded me. As a complete beginner, where do I start from?

Also, I do not live in a city and I do not see any mutual fund companies around my place, which is a modest village/ town with 1 bank and 2-3 co-op societies. Is it possible for me to complete KYC formalities and subscribe to my very first mutual fund online? If not, how do I locate nearest branch of a mutual fund company/a reliable broker agency?

Uma-You can use the FundsIndia if you want to invest online. Distance not matters as the initial process of KYC alone is physical. Also, you can invest under an adviser of your choice like ME. These two options are regular mode. Once you are comfort and the folios generated then after few years you can move to DIRECT (IF you feel comfortable in managing your funds on your own).

Thanks for the prompt response, sir. But, suppose, I choose a financial expert (like you?), how do l proceed to the initial process? Do I need to submit the documents at their office or is it possible to forward them by post/email? What will be the initial cost/adviser’s fees for investing? And,if you please, how can one verify the genuineness of the adviser ?

Uma-I usually prefers, my outstation clients to send the forms through post (Because initially clients need to undergo KYC and physical signatures on forms). Also, I not charge any fees for investing. Verifying the genuineness is the toughest task in financial field. So check his knowledge, for how long he is into this business or whether he is a full-time adviser or doing it as part time service and above all his knowledge to guide you.

If I have to invest in SIP for just 4 years, then are equity funds a good choice? If not, will it wise to invest in 2 or 3 equity funds for 4 years , but I will not withdraw the amount for 3 more years to diversify and minimize the risk? If not, is investing with the hybrid funds a better option with the same time horizon?

Raghavendra-No Equity.

What about Hybrid Funds?

RAghavendra-There are many variants of hybrid funds like equity oriented, debt-oriented and even Arbitrage. Which one you are pointing?

Debt oriented conservative and aggressive. Which is better?

Raghavendra-You can use Short Term Debt Funds or Arbitrage Funds.

Thanks for your reply

I have gone through those funds. I have noticed that Arbitrage funds have ‘Minimum balance’. I observed the same in Pharma funds too. What does this ‘minimum balance’ mean?

Raghavendra-When you got this info?

Thanks for replying patiently,

In valueresearchonline.com I have seen that there is a term minimum balance for each fund. For most of the funds it is generally just a hyphen(-).But for some funds its value is 1000/-, 2000/-,5000/- etc.,.

Raghavendra-Check respective mutual fund companies site rather than the site comparison portals.

SIR , I READ YOUR SUGGESTIONS ON YOUR SITE, I AM A BEGINNER TO INVEST IN MUTUAL FUND, SO PL GIVE ME RIGHT SUGGESTION ABOUT MY INVESTMENT MY AGE IS 48YEARS AND I HAVE TO INVEST IN MUTUAL FUND FOR 3TO 4 YEAR TIME HORIZON FOR GETTING BEST RETURN.ADVICE ME

Anurag-If your time horizon is just 3-4 years then better stay away from equity mutual funds. Rather use Bank FDs or Debt Mutual Funds.

Please advise me few best savings plan, as I have no savings until now. The amount invested should be safe. Also enlighten me how to track a mutual fund transaction. one of my friend has invested in MF and wants to see the details online, but unable to. can you guide me on this too. she has opened an ac with NJ trading for demat – but not aware as to how to see the fund growth/diminishing status. pl help us.

Raman-How can I guide you without understanding your financial goals, life and other details? If she invested under adviser like NJ then why can’t she approach them for the same? They provide it to clients.

Hi Basu,

Your yearly suggested funds are always good. Thanks for the help this regard.Now this year I am confused because of volatile market and which always in higher node. I could not make regular monthly SIP investment due to income uncertainty , but in lumsum i can make investment up to 200K per annum for next 2 years and can you explain me what should be portfolio for me my PPF limit of 150K I always mange.

Apart from max PPF now in my folio since last year UTI Equity, UTI Mid Cap,Franklin Higher Growth Companies,ICICI pru value discovery,Franklin Build India,SBI Bluechip and ICICI Pru exports and other services. Due to lumsum mode payment i kept too many fund.

Please suggest my this year folio , I am belive in longterm upto 10-15 years horison.

Vinod-Restrict your PPF to the tune of around 30% of your portfolio. When you say 10-15 years of time horizon then why to select so many funds? One or two funds mentioned in my earlier posts are enough.

Hi Basu,

I am having SBI demat account. I want to invest in MF but I do not have folio number. Is it necessary to have folio number while investing in MF through demat ?

Vaibhav-They issue the Folio number after you invest. It is exactly like your Bank Account number. Before investing they not issue it. This will be helpful for you to track your investment. Also, demat account is not required to invest in mutual funds.

Hi Basu,

I would like to invest upto 70,000 in ELSS funds for tax saving. Could you please clarify the following :

1) I would like the online portal services like FundsIndia or HDFC ISA. Which one is better in terms of charges and any other factors which you think ?

2) In your article , you mentioned that “but still they collect the commission from mutual fund companies and will be adjusted to your NAV” regarding FundsIndia. When the commission is adjusted to our NAV, then what does it mean to say that FundsIndia is a free service ?

3) Would you recommend to opt for FundsIndia platform for ELSS funds ? and what are the charges levied for it if any ?

4) Are there any special charges if i choose SIP ?

5) For starting with ELSS Funds, will i be able to invest directly though online platform like FundsIndia without going to fund company ?

Thanks

Prashanth-In my view FundsIndia is best. Few trading and demat account providers charge you for each fresh investment. Also, few advisers charge you a fee. When you compare to that fee and charges (charged by demat account providers like ICICI Direct) then it is free. But it does not mean that they are doing it for social work.

As I said, FundsIndia earn commission from your investment. Charges depends on funds to fund. In FundsIndia there is no special charges. Yes, you can directly invest in ELSS with FundsIndia.

Thanks for your post.

Regarding investing in banks and mutual fund companies , question is for eg: is investing in Axis Mutual fund equivalent to investing in bank or investing in mutual fund company.

What do you exactly mean when you say bank? Does it mean that AXIS, ICICI, SBI, HDFC etc.,. mutual fund schemes are not mutual fund comapaneis but banks?

Raghavendra-Axis Mutual Fund, HDFC Mutual Fund, ICICI Mutual Fund and SBI Mutual Fund are different from Axis Bank, HDFC Bank, ICICI Bank and SBI Bank. Both are entirely different entities. Banks acts like agents to these mutual fund companies. Hence, it is not direct mode.

Hello Sir,

I am 30 yr old married guy and having 3 Month old daughter. I earn 80k Per month and having below investment

Term Insurance – HDFC Click2Protect Plus of 1 Cr (Taken Last month)

LIC Whole Life Plan -(Taken in 2012) Premium around 24K/yr for 12 yrs to get 40Lac at Age 79.

Health Insurance – ICICI PruLife Health Saver Plan for 5L per Year for Me, Wife and Baby.

PF – Around 45000 per Annum + Equivalent Employer contribution (Since last 1 Yr)

HL – around 4Lac pending. It will be cleared by June 2016.

SIPs investment of total Rs. 8000/- per Month as below (All are planned for long term for around 20yr considering daughter’s education and marriege)

On my name

1) UTI midcap fund (G) Rs. 2000/- (From last 5 yrs)

2) ICICI Tax Plan Regular (G) Rs. 2000/- (from last 2 Month)

3) DSP Black Rock Tax saver fund Reg (G) Rs. 2000/- (from last 2 Month)

On Wife name

1) ICICI Pru value Discovery Reg (G) Rs. 1000/- (From last 4 yrs)

2) HDFC Equity fund (G) Rs. 1000/- (From last 5 yrs)

Please suggest on above investments and what kind of additional investment planning/modification should I do and where ?

Dev-Why two tax saver and small/midcap funds? Retain one fund from each category. I think it is better if you switch from HDFC to any large cap fund mentioned above.

Hi,

Thanks for the response.

Two tax saver considering future requirment of 80C (Total 48K per year).

UTI Mid Cap kept as it have given me good return in last 5 yrs with CAGR of 66.06%

HDFC Equty fund is kept based on advisor suggestion.

What do you think regarding rest policies like TermInsurance & Health insurance, PF ?

Dev-Retain one fund from each category. That’s enough. No issue with term and health, but try to come out of whole life plan.

Sir,

I want 1.5lacs at the end of december 2015 with a monthly investment plan of 12000 per month.kindly suggest the best SIP for my purpose.

Abhimanyi-Use RDs but not BEST SIPs or Mutual funds.

Hi Basavaraj,

I’m new to mutual fund investing.. Can you guide me which one is cheaper, secure and well informed way for investing in Mutual funds? Is it through Funds India or KotakSecureites?

Please help me with this.

Thanks In Advance

-Naresh

Naresh-All are secured, because they just act as middlemen. So don’t worry but check the cost of Kotak Securities. Fundsindia offers it at no extra cost.

Hello Sir,

First of all, i would like to thank you for such a detailed information on ways to do investment in Mutual Fund. Just want to know the credibility of FundsIndia. I checked their website and found very interesting and easy to use. Also, they are not charging anything and have so many deposit options too.

Just want to know whether it is safe to fund through FundsIndia or not. Don’t know whether are reliable or not. I had a talk with one of their senior executive and came to know that if someone invest through SIP, then money first comes in their Account and then they transfer the same to respective stakeholder. Is there any possibility that they can do Fraud or run by taking the money. Is there any security while funding through FundsIndia.

Thanks

Himanshu-FundsIndia is exactly like any adviser. Also the money comes to their account is, I think for trading account. But not related to mutual fund investment. Please clarify with them. To be frank, I personally know the top managment and they are very much reliable.

Thanks Sir. I had a talk with FundsIndia senior executive but i am not able to trust on them. Just want to know that as all the money will send to respective companies then is there a possibility that they can do some fraud or can use our money.

Himanshu-FundsIndia act like any mutual fund adviser and your invested amount not get transferred to fundsindia account. Please clarify the same with fundsindia. If you still doubtful then you can chose an advisers like me.

Hi Basavaraj,

I want to start investing in mutual funds. I have been advised that direct schemes are best because they save the broker/advisor commission.

Although it is said that FundsIndia is free, but they do charge commission from AMCs, whcih can range from 1-2.5%. Is that correct? Which is better, to invest through direct online portals, or through regular plans on FundsIndia?

Pritish-Regarding FundsIndia, it is correct. However, first check yourself whether you are capable of managing your portfolio on your own or not. Otherwise in a run of saving few bucks, you may end up in investing bad products and loosing money.

Hello Basu… I m being more great fan of you.

I was under the impression tha Demat account is the least and cost effective one.

Considering ICICIdemat and agent\broker\middleman, is the demat costly ? can you suggest which to go for ?

Also can you let me know what is that ARN in the mutual funds stand for ? is it for dircet funds ? Thanks ..

Raje-Demat holding will be costlier to you. Because they charge you yearly demat charges and again on each investment. Whereas, adviser or some online portals may not charge anything extra. Hence stay away from demat mode of investment.

Thanks Basu.. I was trying to go in for a DEMAT and continue.. Good i have gone through this and will switch over to the advisor\agency based ones…

Also can you let me know what is that ARN in the mutual funds stand for ? is it for dircet funds ? Thanks..

Raje-Why you stil want to stick to Demat mode? It is costliest investment when it comes to mutual funds. ARN stands for a adviser code. This helps mutual fund company to pay the commission to them.

I was actually going to.. After hearing this, i am now moving out and going through agent. Guess there is a commission in all the types and only the percentage differs and hope through the agent is better.. BTW, any idea about which is the least one ? And thanks for the ARN information.

Raje-Least expensive is DIRECT. But if you don’t want to manage yourself then can opt for FundsIndia (online) or advisers like me.

Hi Basu,

Great work!!!!

I have a query, I am new to stock market and have just started learning the keywords only a few days back. It was great to know about direct and regular plans. Apart from fundsindia and others I also came across scripbox which has minimal options (EMF) for investing. Do you think that is a wise choice with a potential to have good growth?

Regards,

Arin-Whether it is fundsindia or scriptbox, what matters is your regular investment, selection of good funds and stick to them for long term. These platforms are just mediators.

Dear Sir,

Hope you are doing great.

I am looking to invest in ELSS funds. I am new to mutual fund investment.

First:

Can you please suggest me two best ELSS funds to invest ?

Second:

Whether fundsindia is a better option or directly mutual fund companies are better option to invest in MF ?

Three:

I tried for Axis bank long term equity fund, on Axis mutual fund directly. But, Once I select fund to invest, Direct option is disabled automatically & Broker option enabled. It’s asking ARN number too. ( I tried it just for check )

Can you please let me know what could be the problem ?

Thanks

Jalpesh-Why two funds to invest in ELSS? One fund is enough. If you know how to manage the fund and do it on your all service realted issue then go for DIRECT or fundsindia type of middlemen. You have to visit first time directly to AMC to submit your KYC documents and other necessary formalities. Once the folio generated for direct then you can do it online.

Hello Sir,

Thanks for your quick response.

Can you please suggest that one ELSS fund ?

I am planning to invest in SIP of Rs. 1000 per month. Is it fine ?

Thanks.

Jalpesh-You can find my choice in a post “Top 10 Best Mutual Funds to invest in India for 2015“. However, I am unable to answer about whether Rs.1,000 is enough or not. Because it is you to decide on this.

Hello Sir,

Thanks for your support.

One more Ques, I have.

I have one HDFC Life ProGrowth Plus (ULIP) Policy. There, I have invested in Balance Fund & Bluechip Fund.

I am paying installment of Rs. 10,000/- half yearly and paid 2 installments till now.

So almost one year is over.

What is your opinion for this ? Is this good policy ?

guide me if any….

Thanks.

Jalpesh-I am not a big fan of ULIPs. Because they are costly in nature, hard to track the investment, don’t know past history to judge about fund manager and illiquid.

Dear Sir,

Can you please suggest me one or two best short term debt funds ?

Thanks.

Jalpesh-HDFC Short Term Opp Fund. I think this is good fund considering the low expense ratioo, low modified duration and average maturity of underlying debt papers.

Dear Sir,

Currently market is little bit down.

Even all top ELSS funds (Axis LT Equity, Franklin India Tax shield, ICICI Pru Tax saving plan etc..) are going down.

Is it good time to invest in mutual funds or Should I wait for sometimes ?

Jalpesh-You, me and even no expert of this world don’t know whether currently market is actually down or up. Because, what if it further goes down after your investment? Never try to time the market. Instead stick to basics of equity investment. For me, if goal is long term 7+ years then anytime is Good Time.

Hello Sir,

I have PPF account with the post office.

I would like to transfer my PPF account with the Bank (BOB).

Is it possible ?

There are no online facilities with post office PPF account.

Jalpesh-Yes, you can transfer it.

Dear Basavaraj,

I want to invest in Axis long term equity plan as monthly SIP. Can you please provide me the link of the company to invest directly in my email id?

Regards

Dr. Monideep Boruah. Guwahati.

[email protected]

Monideep-Please follow the process explained at Axis Portal.

sir,

I invest online in SBI MF. IThere are 3 options – last broker, direct, other broker.

I had invested 1st time through SBI and after that i choose ‘last broker’ at each investment.

I always reconcile NAV at investment date and at redemption date showing in my Account Statement with actuals showing by various websites for that particular scheme (having NIL exit load).

I had never found any descrepancy there. My query is :-

(i) does it mean that ‘NO BROKERAGE’ is charged from me (since I invest in SBI MF through SBI Bank) or they are deducting brokerage through any other route

(ii) Is it better to choose ‘Direct’ instead of ‘Last broker’.

Rahul-Your ivnestment route is regular one and the adviser expenses are adjusted to NAV. That is the reason you not noticed the expenses. Choosing DIRECT is left with you. If you have expertize and time to manage then go ahead.

Hi Basavaraj,

I have read all your posts and all are really helpful for all. Keep up the good work !!

I have done long study on MF and market trends, so i am confident to proceed my self in selecting the funds and maintaining the portfolio etc…I planned to invest in tax saving elss funds, hence thought of going for direct scheme.. i

But i have few queries which i need ur help…

1.If i want to go for direct mode then how can i fill my KYC pls?

2. If i planned to invest in 2 to 3 funds, i assume KYC is only once required.

Kindly help me to do KYC pls.

Regards,

Sudhakar PR

Sudhakar- No need to worry about these small technical procedural issues. 1) Visit Mutual Fund Company with your required original documents and finish the KYC. They will help you. It is very simple process. 2) Yes, KYC is one-time process.

I came across invest@ease from ICICI Bank. Do you have any inputs regarding their service and ‘costs’ attached to it – in terms of initial and continuing ‘erosion’ in NAV for the investment? Thanks.

Vivek-Let me review it and come out of a post.

Have your reviewed icici invest@ease?

Sanket-It is in my mind. Let me give sometime to do post on this 🙂

Hello Basavraj,

I really appreciate your efforts in writing this article. I have a certain doubt. I am currently visiting some mutual fund offices. I went to once such office of Geojit Paribas (whose address is listed on the official website of Geojit Paribas) wherein the people told me that they sell mutual funds of all companies. They even recommended me some funds after inquiring about my investment horizon etc. Infact they did not suggest any mutual fund of Geojit Paribas.

I am confused whether they are agents or brokers? If I invest via them would it be a bad decision since they will charge me brokerage or may be adjust my NAVs to cover their fees?

Ashutosh-Geojit is not a mutual fund company. But they are the brokers. Hence there is no fund exists which you may call Geojit Paribas Fund 🙂 They act like agents or brokers. They may charge for each investment and along with that they get revenue from mutual fund companies (which is adjusted in your NAV).

Hi Basavaraj, I am looking to invest in MF through direct route and NOT through a broker or demat. Is there a portal where I can do direct investments and choose my MF at one place.

Sanjeev

Sanjeev-You can check recently launched MF Utility (But currently this feature is not available for investors. So wait for some time). Details of this will be available at my earlier post “MF Utilities-Online Investment Platform for Regular and Direct Mutual Funds“. As of now you can visit individual mutual fund companies and start investing.

Dear Basu Sir,

Please help me out in understanding to get KYC . Today I went to Karvy to apply for KYC. In response they said, “you will have to buy mutual funds from here only then you’ll get your KYC. My question is if I get it done from them (Karvy) with MF then they will deduct their commission or not (in case I mention in the form Direct Plan.) I can’t apply only for KYC, why they are forcing to but mutual fund along with this.

Sakshi-Usually while KYC you must submit new application for investment. I don’t think Karvy allow DIRECT funds. Instead I suggest you to use CAMS or directly to respective mutual fund company. Karvy may put their ARN and avoid direct investment.

Dear Basu

Thanks again for spreading the knowledge.

One of my friend’s forced me to invest in SIP -UTI Retirement plan.This is the only SIP mutual fund investment I have.I was not aware of the commision aspect and it is ok with me.Shall I increase SIP from 2k to 4k online?With this SIP reference (KYC) can I invest more in other type of funds in UTI or other fund companies?.

As always awaiting for your advice.

Thanks many.

Saleem-I hope you will get clarity about fund selection by reading my posts “Top 10 Best Mutual Funds to invest in India for 2015” and “Two Mutual Funds-Tax Efficient (Sec. 80C) and Pension Plans in India !!!“.

Thanks for the reply Basu as always.

Hi Basu,

I want to start investing in Mutual funds.

I have read the option which you have mentioned above. which according to you is best.

And let me know the process to complete my KYC.

Hello Sir,

First of all Thanks a lot for the initiative you have taken to spread awareness regarding Investment.

I have read many articles on MF n it’s returns in long term through SIP, though I haven’t started it yet.

I am keen to start with SIP and as a first step,went to my SB kotak for inquiry, they took documents to get my KYC done.

As a next step, can I select the Funds which I prefer based on learning or suggestions from website like yours.

As you have mentioned above in your article going through Banks, they just sell, apart from that for a newbie like me, is it appropriate option or should I go for some other means to start with MF – SIP.

Also on a personal note what mode(Banks/Demat/Broker ..) you prefer.

Thanks for your contribution and awaiting reply.

Thanks,

Ashish

Ashish-Please read my earlier posts “Mutual Fund Direct Plans-Who can move?” and “Online Mutual Fund Investment is really a DIRECT Investment?“.Hope these two will resolve your doubts.

Hello Sir,

I am new investor. I don’t have much knowledge about share and MF. For tax saving purpose, I want to invest 40k (lump sum) in ELSS by my demat account in Share-khan for the present financial year. Since I don’t know much about MF so I want an hassle free investment. Also suggest me the good ELSS option since time is less so please do the favour.

Is it good to invest in ELSS by demat acc in share khan?

Amit-Too many confusion in you. You claim that you don’t know anything about equity. But still preferring equity investment. You claim that you don’t know about mutual funds. But already decided to go with Sharekhan. Finally you did all decisions and declaring that time is too short and asking my opinion whether ELSS is good or what?? What can I say??

As I had mentioned in some of my earlier queries to you, I am a newbie to investment of MF

So, to invest in MF online, one of the first steps is to be KYC compilant, right…

Now, I had a demat account in sharekhan and they also claimed that they will get the KYC done for investors who prefer to invest in MF house directly.

After submitting my docs at the branch and further processing, I can see my KYC status as ‘ KYC REGISTERED WITH CVLKRA’ but I don’t have the acknowledgement for the same as the complete process was done by sharekhan.

Is it also required to submit the KYC acknowledgement to AMC for direct investment? Is it possible to get the acknowledgement online? Thanks

– Sandeep

Sandeep-The status which is showing in CVLKRA is the status that your KYC approved. Yes for all fresh investment you need to submit KYC acknowledgement. You just need to print the status of CVLKRA (You find the tab of print on their site).

Thanks for the information sir.

– Sandeep

dear sir

i want to invest directly to avoid the extra expense to brokerage firms like reliance as i do my own research before investing and i strongly feel they do not add any value .

can you guide me on this as to how i can go abt it. i want to stick to online dealings, i am ready to go once or twice if required. Thanks

Varun-Sticking to online is everyone’s dream. But are you able to review your portfolio yourself? Manage or choose funds yourself? If so then go ahead.

Dear Basu,

I am starting to invest SIP from next month.

I have gathered information regardig some funds.

I want to invest in top equity funds which have given good returns since their startup.

I found following funds which are very good.

(1) HDFC top 200 fund

(2)ICICI prudential top 100 fund – regular plan

(3) ICICI prudential dynamic fund – regular plan

(4) Tata Ethical fund – plan A

(5) Reliance growth plan

My aim is long term retirement planning.

I am planning to invest either of (2) or (3) as well as either of (4) or (5)

Please suggest me which would be right choice for me from above options.

I have read your this article regarding direct fund vs regular fund.

Query: fund (2) and (3) shows “regular fund”. Does this mean even if I directly buy above (2) or (3) from ICICI , they will apply more tax on me?

Expense ration for (2) and (3) is 2.23% and 2.77% respectively.

Thanks and regards,

Dhruv.

Dhruv-HDFC Top 200 and one small and mid cap of your choice is enough. Not required to have so many funds in your kitty. Choosing direct option is not relates to tax, but it is cost effective investing. So all funds these days offers direct funds. Just contact individual mutual funds and invest in direct options if you are confident of investing and managing yourself.

Thanks Basu for valuable information.

I will go ahead with HDFC top 200 fund.

Would you please suggest good fund for mid and small cap?

Thanks in advance.

regards,

dhruv.

Dhruv-You can choose HDFC Midcap Opp Fund.

Hi Basavaraj,

I am Planning to invest in mutual funds which is completely new for me, My investment horizon would be around 15 years and want to invest around 15K per month. After going through various articles i zeroed on following funds can u please suggest whether it is good to go with or anything other these please suggest

Reliance Equity opportunities fund,

ICICI Pru focussed Bluechip equity fund,

Bira sun life frontline equity fund,

HDFC Mid Cap opportunities Fund,

HDFC Prudence Fund

HDFC top 200 Fund

Quantum Long term mutual fund

Would also like to know as a start up investor should i go with Funds india online or through Bank account or through Karvy/Cams account.

Please suggest

Ashok-Invest in ICICI and HDFC Mid Cap Opp Fund. These two are enough.

Thanks Basu for your advice.

just one clarification required for me . Whether investment through HDFC ISA account is better or through Funds India and which give better tracking and hassle free services. Would brokerage commission would be same in both entities

Thanks

Ashok

Ashok-HDFC ISA is just an online platform. Until you opt for DIRECT option it will not add value to your investment and exactly like FundsIndia online platform.

hi sir

First of all thanks a lot for ur initiative .

ur articles are very very helpful for me and to so many who are beginners in MF like me.

I am 28 , I am thinking to start SIP of amount 7000- in MF ( ELSS). I will continue these plans up to 20 years . Important one I didt have any idea about banks or demat account or anything else . I am completely new . so please help me wth these

1.how to invest in SIP via directly or broker or bank , if u guide me some one I am ready to approach them and start , but please suggest me something that is cheap .

2.which are top funds to invest .

3.how to diversify my amount .

4.please create one portfolio for me , I agree to take medium risk and I will increase the sip amount after 2years , and I need one tax saver fund among my portfolio .

I will be happy if reply me on my mail .

really thank u so much in advance .

Regards/Himtejaswi

Himtejaswi-Your doubts are not short one. There are many brokers in your city. Please contact them. Top funds are already listed on this blog. Please do search for the same. Diversification and creating portfolio for is not like writing two lines. It must be personalized on one’s need. So I can’t guide you on that.

Hello,

I have following question

1. Does direct mode is available for ELSS funds. Is there any

2. What is the best option to invest in ELSS, FundsIndia or through AMC. In terms of charge, which one will be cheap.

thanks.

Karthik-1) Yes it is available to all categories of funds. 2) If you know everything to manage then opt for direct plans of AMCs. Otherwise opt FundsIndia.

Dear Basu,

I was trying to check with ICIC bank as to the difference between the invest@ease through the SB account and the demat account. Though I did not get a clear reply I was told that now there are no charges for investing through invest@ease atleast for some of the mutual fund investments. In fact I also tried and investted through this in Birla Sunlife and I can see the folio number and my fund status. If this is fine I wanted to use this instead of demat for investing in mutual fund as otherwise I have to trasfer money from my sb account to the demat linked account as they are separate. I do not want to mix them at this stage also.

Kindly advise if it is fine to invest through this bank account and is the investment safe as done through demat..?

Secondly wanted to invest about some money in FTP or up to 3 year lock in and can you suggest some good fund to park in..

Krishnan-Why demat, instead of why can’t use free service of FundsIndia?

Hello,

Thank you for your informative article.

I have been investing in direct plans through the AMC.

I am finding it very cumbersome. It’s a big process with each AMC to add bank accounts, etc.

Is there any platform to perform aggregated investment into direct plans? I would be willing to pay fees. But I don’t want to pay the trailing commission. FundsIndia etc do not offer direct plan.

I was wondering about the demat option. Can people sell and buy direct units through demat?

Thanks.

Aditya-I don’t think so as it is difficult to add bank accounts. But still each pain you take will give you dividend in long run as it will be less expensive of investing. Please wait for few more days AMFI is about to come up with online platform for direct investors too. Holding in demat format is for your convenience. But investing through broker is still costly. Both have different uses.

Hi, I read your article. I like it really. I got one question. I am going to start SIP plan in MF. But when I been to HDFC bank they told us that to invest online is very easy and there annual charges are Rs. 600 and you will not get any extra charges.

After reading your article I got one doubt that they still going to get commission on my SIP started for whichever mutual fund. Is it possible to go direct plan option while investing online from HDFC bank. So shall I go with HDFC bank or not?

2. Is there any way to know all these options how much commission will get directly from my investment in any MF?

3. To save that commission which directly going to these options is it possible to get in my MF investment amount?

4. Who takes the minimum commission from all these options whom I can choose?

I am little bit confuse on these commission which get invisibly taken away from our MF investment and adjusted towards NAV in MF. Because small percentage also make lot of difference in your total return.

Hope you will answer my question. If you reply on my email that would be appreciated. 🙂

Jitendra- 1) They are offering you Demat Account which I feel costliest way of investing. So stay away.

2) I am unable to understand your query.

3) Yes to save the extra cost you can opt for Direct Funds.

4) If you go direct then such cost saving will be adjusted to your NAV.

But do remember that go direct options only in case you know how to manage funds and track them. Otherwise my suggestion is to opt for online portals like FundsIndia than HDFC.

Thank you sir, for such a quick reply.

But HDFC bank not offering DMAT account and neither I am going for that. I already cleared that.

Its HDFC bank Investment Services Account (ISA) account Rs 600 Per year. I believe this is different. Which they provide to buy / sell / transfer / monitor Mutual funds from Bank portal. So can you guide me on this part. Is it good to go for such kind of ISA service account instead of online portal Or its more cheaper from other online portal.

I believe same way other banks like ICICI , SBI also offers such services to buy or sell MF as an SIP. But, I don’t know about their charges.

I am sorry that you do not get my question.

My 2nd question is whatever these below mode of investments how much commission or percentage or specific amount get adjusted or deducted in our Mutual fund amount from mutual fund companies?

Mode of investment : Demat account, Agency or Brokers or Mutual fund companies or Banks (Here I know that atleast HDFC ISA account charges Rs. 600 P.A.) or CAMS/Karvy or online portals.

Jitendra-No need to review that HDFC product as nothing is free from them 🙂 Even if other banks offers such service then they put their advisory code for the business routed through them. So they earn the commission on that. Regarding the mutual fund commission, please read my earlier post “Life Insurance Vs Mutual Fund Agents-Who earns more?“.

Excellent !!! thanks again for such a nice information.

Moral of the story. Whichever is my mode of your investment to start SIP it will take my money.

Jitendra-Well said Jitendra and using commonsense is enough than being extraordinary expert 🙂

For a dummy (like me) would you say demat account option would be ideal until he got the hang of things?

Bhagwan-For you instead of demat type of investing why can’t you opt FundsIndia which is cheaper than demat option.

I wanted to shift my online mutual fund SIPs from Motilal Oswal demat account to FundsIndia before closing the demat account as I did not need it. I wrote to FundsIndia and got the following reply:

“Dear Sir,

Greetings from Fundsindia!

This is to inform you, Demat account is not required for MF investments here,

Hence, upon your account activation you can transfer your existing funds to us

The documents which you need to submit is , FI application form, Pan Card copy, cancelled cheque leaf with you name pre-printed.

Once you complete the registration,by using our Easy Transfer option the existing offline investments can be transferred to our platform to have a consolidated view and online access over your investment.

Please follow the below given instructions to generate the Easy Transfer request

Login to your account -> Click on Mutual Fund -> Easy Transfer -> Transfer folios -> Continue -> Select the AMC -> Search -> Select the Scheme -> Enter the folio number

Based upon the above steps Easy Transfer letters will be generated, the same needs to be

signed and send it to our mailing address along with your FundsIndia application forms. On receipt of the documents we will do the needful.

Please note that these outside folios must not have an active SIP running and should be offline (not through another online channel) folios.”

Does this mean that my folios cannot be transferred? In that case, what is the solution? Must I redeem them (I opened them only 20 days back)? After transferring or redeeming the folios, there will be nothing left in my demat account. How do I get it closed?

Thanks

Bhagwan-No..the same folios will get transferred.

Dear Basu,

First of all, thanks a lot for this great initiative.

This is really helpful.

I am working professional.

I want to start investing in MFs.

I am eying long term investment and my goal is around 20% returns over a period of 15 years.

I am totally new in mutual funds but during some research on internet I have found following investment.

(1) Reliance growth fund

(2) HDFC equity fund

(3) Franklin India prima plus fund