Recently few readers of the blog started to inquire about Top 10 Best SIP Mutual Funds to invest in India in 2016. I just ignored the suggestion as 2016 was more than 3-4 months away. Now I felt it was necessary to review the old recommendations and suggest the new funds for 2016.

Note-

- Refer our latest post related to Top 10 Best SIP Mutual Funds to invest in India in 2017 at “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

- We disabled commenting feature for this particular post. If you have any doubts based on this post, you can raise the same in our blog forum of BasuNivesh Forum.

Before proceeding further, let us first discuss on the last year’s fund returns and how they performed.

Let us go forward and discuss on Top 10 Best SIP Mutual Funds to invest in India in 2016.

How I am selecting the funds?

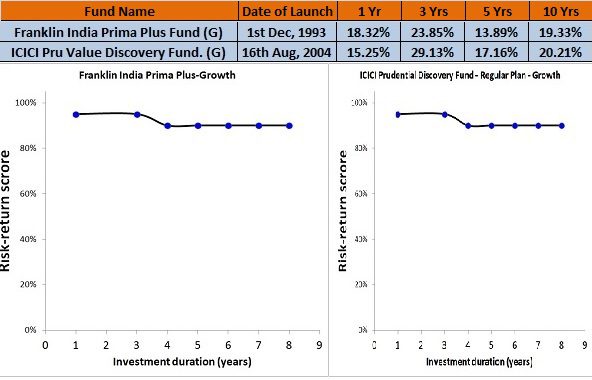

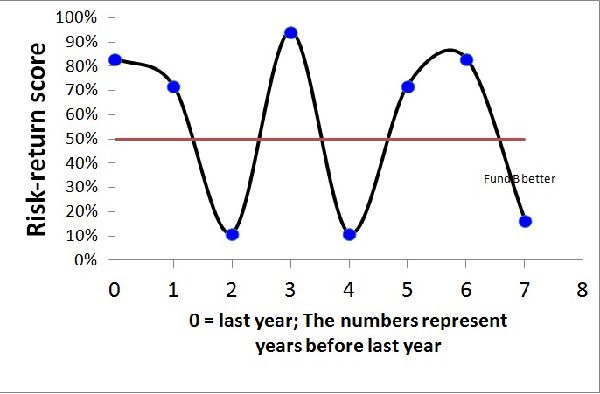

This time, I have been using more advanced criteria to arrive at my fund selection. I know, many just follow the return aspect of funds to arrive at the decision to fund. But in my case, I first screened the top 15 funds in each category based on their returns to benchmark since inception. The funds who consistently beaten the benchmark are listed in that 15. Once I have the list in my hand, then I selected the funds based on Risk-Return Analyzer. It is eye catching to select the funds which will give you good returns. However, at what cost it is giving you a better return? To what extent it protects my investment during a downturn is what differentiate from good fund to bad fund.

Again, I am not saying that these 1o funds alone be considered as “Top 10 Best SIP Mutual Funds to invest in India in 2016”. There may be fewer funds, which are good to compete with these funds. However, I may be biased towards few Mutual Fund Companies (purely on their size and how long they are in MF business in India). Below are the metrics I used to arrive at finally selecting the funds.

If the fund cleared all these tests and given me around a minimum of 80% score since inception, will be added to my list.

- Beta-Volatility measure and tell how much the fund changes for a given change in the Index. Lower the beta, lower the volatility. Hence, your fund must have lower beta.

- Standard deviation-It tells us how for a given set of returns, how much do fund returns deviate from the average. Lower the standard deviation, lower the volatility. Hence, your fund must have lower beta.

- Alpha-It is the risk-adjusted measure. By taking risks, how much the fund manager generated the return over the benchmark. Higher the alpha, higher the outperformance of the fund.

- Sharpe Ratio-It is the risk-adjusted measure. Higher the Sharpe ratio, better is the performance.

- Sortino Ratio-It is the risk-adjusted measure. Higher the Sortino ratio, better is the performance.

- Treynor Ratio-It is also be known as reward ratio. Higher the Treynor ratio, better is the performance.

- Information Ratio-This is calculated by average excess return obtained compared to a benchmark and divides it by the standard deviation of excess returns. Higher the information ratio, higher the consistency in beating benchmark.

- Omega Ratio- It is a risk-return performance measure of an investment asset.

- Downside deviation-This is also be called as BAD RISK.

- Upside potential-This is exactly the opposite of Downside deviation.

- R-squared- It is a measure of how correlated the fund’s NAV movement is with its index.

- SIP Returns-For how many times the fund’s returns are above the index when we invest in SIP.

- Lump Sum Returns-For how many times the fund’s returns are above the index when we invest in a lump sum.

Why I selected two funds in each category?

I think one fund from each category is enough to create a best equity portfolio (even a debt portfolio by using equity-oriented balanced funds). Hence, I stick to the fund selection of maximum two in each category.

Owning many funds is not a great diversification strategy and at the same time, few feel to diversify their investment among AMCs. That, I think not at all a good idea.

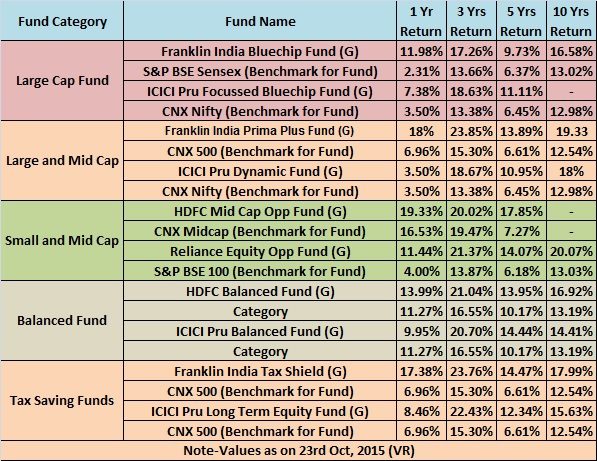

Best two Large Cap Funds to Invest in India in 2016

In this category, I stuck to my last year’s funds. No change in this. Because both funds are performing well. I found Birla Sunlife Frontline Equity Fund best instead of ICICI Bluechip. However, I still stick to ICICI than Birla.

You notice that Risk-Return score for both funds is above 80%.

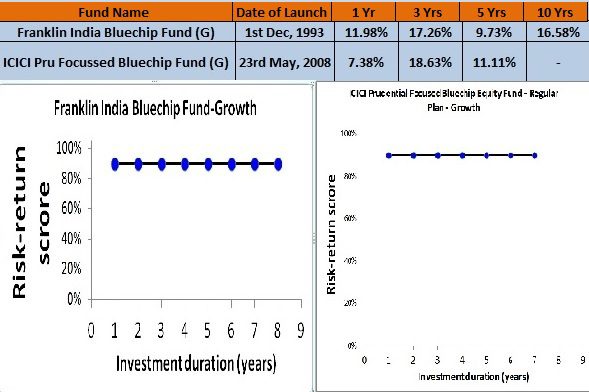

Best two Large and Mid Cap Funds to Invest in India in 2016

This year I added ICICI Pru Discovery Fund and removed ICICI Pru Dynamic Fund. The reason is below chart. Here Fund A represents ICICI Value Discovery and Fund B ICICI Pru Dynamic Fund. ICICI Pru Discovery outperformed the ICICI Pru Dynamic Fund many a time. Hence, switching, but within the same fund house.

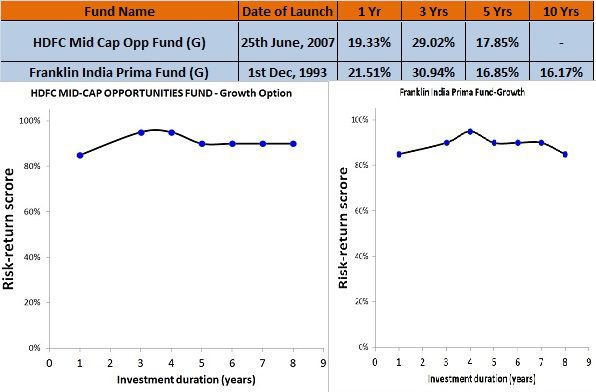

Best two Mid and Small Cap Funds to Invest in India in 2016

In this category, I retained HDFC Mid-Cap Opportunities Fund and switched from earlier Reliance Equity Opp Fund to Franklin India Prima Fund. You can also have in mind about the funds like UTI or SBI Magnum Mid Cap Funds.

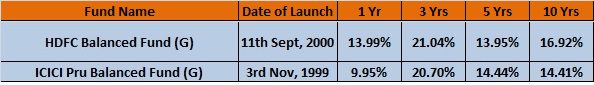

Best two Equity Oriented Balanced Funds to Invest in India in 2016

I retained HDFC Balanced Fund and ICICI Balanced Fund. I suggest to think of Tata Balanced Fund too.

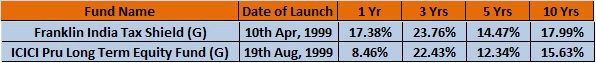

Best two Tax Saving Mutual Funds (ELSS) to Invest in India in 2015

I retained both Franklin India Tax Shield and ICICI Pru Tax Plan.

I noticed that ICICI Fund is a little bit under performing this year. But let us give some time to it. If it continues its low performance, then we can think of switching.

Read my latest post on Top 5 ELSS or Tax Saving Mutual Funds to invest in 2016

Note-We disabled commenting feature for this particular post. If you have any doubts based on this post, you can raise the same in our blog forum of BasuNivesh Forum.

1,007 Responses

Hi Srikanth,

Currently i am investing Rs 12,500 monthly in the below funds since 2013 and i am getting good returns overall 16% .

1. ICICI pru focussed Blue chip fund -direct [ Rs 5000 ]

2.Reliance Equity opportunities fund -direct [ Rs 5000 ]

3. UTI Opportunities -direct [ Rs 2500 ]

Now I want to invest another 2.5K /month after salary increment , I am a long term investor(over 20 yrs) and have decided to add 1 more fund.

4) Birla Sunlife Frontline Equity Fund 2.5k/month

OR

5) ICICI pru value discovery fund 2.5k/month

Please suggest if these picks are fine and also suggest if I need to make any changes in the existing portfolio.

Nishanta-ICICI Bluechip is large cap fund and UTI is also currently in large cap then why one more large cap of Birla? You retain ICICI Bluechip, invest in ICICI Discovery and try to come out of Reliance. Instead, go for HDFC Midcap or Franklin Prima. Where is your debt portfolio?

Hi Basavaraj ,

I am investing sukanya samriddhi [ 5k/month ] & LIC Jeevan Anand [ 5k/month ] into debt portfolios .

I am planning to modify my portfolio , please suggest if its fine .

1. ICICI pru focussed Blue chip fund -direct [ Rs 5000 ]

2. Reliance Equity opportunities fund -direct [ Rs 1500 ]

3. UTI Opportunities -direct [ Rs 2500 ]

4. ICICI pru value discovery fund [ Rs 5000 ]

Nishanta-One large cap is fine like ICICI and along with that Reliance and ICICI Discovery fund.

Sir, As per your advice i have taken icici long term equity fund(tax saving) in 2014 with sip of 4000. Is it wise to continue the sip as the fund is under currently underperforming or do u suggest any other ElSS fund for the the same SIP

Ajit-What prompted you to believe that the fund is underperforming?

Dear basu sir,

hi sir , my name syed i am 30 year old and my son 1 year old

i want to invest money in SIP with 2 fund policy for 20 years long term yearly 12 thousand and monthly 1k .i have 2.5 lack in my hand please suggest how to invest and where which fund / policy to choose …

how to manage 2.5 lack .is STP method good ?

Syed-You can start with the large cap mentioned above.

Hi Basu,

First of all I am sorry for asking you off topic question , I couldnt able to register in forum so couldnt ask question over there, So I am asking you below.

In Below mentioned forum link, you mentioned “not to go for any product which claims to special in retirement”. Any specific reason for the same. Because I am investing SIP 4k/month in UTI retirement Benifit pension plan for past 2 years & as Franklin templeton pension fund is performing well comparitively so I am thinking to divide the investment equally now .

These SIP investments I am planning to continue for more than 25years.

http://www.basunivesh.com/forum/question/where-to-invest-for-retirement/

Any suggestion from your side on this investment. My intention is for retirement corpus purpose.

My Equity:debt investment ratio is 80:20 as of today (I am 30years old) & the above mentioned investment which i am doing is for retirement corpus which is around 18% of my equity investment.

Please provide your valuable suggestion.

Just repeating the queries below again.

1) Why not to go for any product which claims to special in retirement?

2) To invest for a longer period of 25years, how to shortlist or select the MFs.

Kiran-Can you please share your difficulty of nor registering with Forum to my mail [email protected]. I will reply to your question as below.

1) Illiquid, no control over investment and taxation at withdrawal stage.

2) I already mentioned the procedure above.

Hi Basu,

I have sent you the mail over the issue i am facing while registering the forum.

Regarding the query , can you please elaborate in few sentences.

Below is my understanding , please correct me if needed.

Illiquid ? – a concern of exit load or lack of investors

no control over investment? -> I believe MF AMC should take care of this issue…

Taxation ????

Kiran-Yes, there are certain issues with forum. Please wait for a day or two. Illiquid in the sense, you are not able to come out easily. Yes, MF have mandate to invest. So it is based on that. Hence, control over your portfolio. Taxation is different ball game for ULIPs and equity funds. Frankly speaking, equity mutual funds are tax efficient.

Hi Basu,

Do u suggest me to exit from the UTI Retirement benifit pension fund plan ( or any other retirement benifit MFs) asap??? Because as i mentioned earlier it is around 18% of my investments.

Kiran-Better to do that. Because such retirement products are not so liquid in nature than the typical well diversified funds.

Thanks.

Dear Sir,

Below are my current portfolio:

1.Franklin India Blue chip (g)-1000

2.Franklin India Tax Shield-1000

3.HDFC Prudence-1000

4.Franklin India Prima Plus-1000

5.PPF-4000/Month

Along with above I am planning to start a small-mid cap fund with a monthly SIP of Rs1000. Kindly suggest one.

Also suggest if the above portfolio is ok or need changes.

Regards,

Praveen

Praveen-Without knowing your time horizon, it is hard for me to guide.

Sir,

Except tax shield all are for more than 15 years.

I want to add Small -Mid cap too for 15 years or more.

Praveen-That small and mid cap fund is listed above.

Thanks.

1.Should I choose Franklin Prima Fund for small mid cap as I am already having plan from the same fund house?

2.Should I continue with HDFC Prudence or change to HDFC Balanced or some other fund?

Regards,

Praveen

Praveen-1) What matters you more, a fund or fund house?

2) You can switch to HDFC Balanced or Tata balanced.

Hello Basavaraj,

I am completely new to this mutual fund domain. However i got a vague knowledge about what SIP is.. Now i did a declaration in my company stating 12,000INR p.a. as mutual fund and 12,000p.a. as ELSS.. Don’t really understand the difference yet.

1. Now, I would like to have a SIP done for this financial year for 3 years which gives me a decent return. Could you suggest me one? I guess Balanced MF is good for me, still seek your advice.

2. How do i start with ELSS investment? Any suggestion?

3. Among the above two i.e. ELSS and MF , which one has tax exemption under 80c to the maximum limit of 1.5 Lakhs.

Your clarification for the above queries will be highly appreciated and will enlighten me in this area for future.

Thanks..

Ajit-1) No equity investments if your tenure is just 3 years.

2) It is exactly like any other investments in mutual funds.

3) All ELSS funds ONLY will comes under benefit for Sec.80C.

Hi Basu,

Without Knowledge of Mutual funds, but my goal is to invest long term so i am paying 1000/ each in the below mentioned SIP`s

with your valuable suggestions.

1) HDFC mid Cap -direct growth

2) HDFC Balanced fund -direct

3) ICICI pru focussed Blue chip fund -direct

Here my question is .

I am paying SIP amount in “DIRECT” MODE So Shall i pay money through agent to get some +Ve returns?

Please suggest me.

Thank you in advance.

Karthik-What guarantee that your agent will provide you +ve returns than direct funds?

Thanks Basu,

Shall I continue the same direct funds?

Karthik-Yes.

Hi Basu,

I am paying 1000/ each in the below mentioned SIP`s for long term(more than 10 years)

1) HDFC mid Cap -direct growth

2) HDFC Balanced fund -direct

3) ICICI pru focussed Blue chip fund -direct

Please suggest me good fund(Kindly specify name in HDFC or ICICI) for short term goal <=5 years.

Thank you in advance.

Karthik-For short term, I will not suggest any equity oriented funds.

Thanks Basu for reply.

Where can I invest money for short term goal(around 5 years), Please suggest

Karthik-You can use short term or ultra short term debt funds.

Thank you Basu,

Can you please tell me any specific short term or ultra short term debt funds in HDFC or ICICI

Thank you Basu,

i want to invest 1000/- per month in each HDFC and ICICI for short term goal <5 years.

Can you please tell me any specific short term or ultra short term debt funds names in HDFC and ICICI?

Karthik-Why only HDFC or ICICI?

Thanks Basu,

Actually i am investing 1000/- each in HDFC mid cap and HDFC Balanced fund.

and 1000/- in ICICI pru focussed blue chip…

SO i want to invest in HDFC or ICICI.. or else where can i invest , plz suggest.

Karthik-There three funds are enough for your investment. Even for your fresh investments too, you can consider these three funds ONLY.

Thanks Basu for your suggestion.

What about short term goals?

Karthik-Why only HDFC or ICICI?

Sir, my age is 35 & i have started following investments with time period of 15-20 years+

HDFC Top 200- 3500

Birla MNC fund- 3000

ICICI Pru Focused Blue Chip- 3000

ICICI Pru Value Discovery Fund- 3000

Pls advice on fund selection. I am also planning to invest 3000 in TATA Balance fund.

Nagra-Where is your debt portfolio?

Basu, I have LIC Plan (premium- 72k /per annum & HDFC pension plan (premium- 35k/per annum) & also EPF along with mentioned sip investments. Not sure whether i am on right track.. pls advice.

Shall i add TATA balance fund in my portfolio.

Also advice on HDFC top 200, shall i continue as performance is not good in last couple of years.

Nagra-Whether your LIC plan and HDFC pension plan easy to liquidate? For you, ICICI Bluechip, Discovery Fund and Tata balanced funds are enough.

LIC policy have 10 year lock-in period(currently 7th year) & HDFC pension plan have no liquidate option till completion of 20 year.

Idea of having HDFC top 20 & birla sun life for 15 year for daughter education & value discovery, focused bluechip for retirement. Planning to invest 4000 for 20 years for daughter marriage. Kindly advice.

Basu Ji,

I again seek your advise, this time on SIP.

I want to invest 26,500/- per month with the following future goals:

A) 1 Cr after 15 years

B) 5 Cr for retirement (after 30 years)

I have selected the following investment plan:

– GOAL ‘A’ monthly investment (15 yrs)

ICICI Pru Focused Bluechip Fund (G) : 3,675/-

HDFC Mid Cap Opp Fund (G) : 8,575/-

– GOAL ‘B’ monthly investment (30 yrs)

ICICI Pru Focused Bluechip Fund (G) : 4,725/-

HDFC Mid Cap Opp Fund (G) : 2,025/-

Total = 19,000/-.

Balance (7,500) I want to invest in Debt Fund.

Can you please advice:

1.) Is my Equity fund selection correct?

2.) Which debt Fund should I invest in?

3.) Will my returns on above (equity and debt) be taxable?

Regards,

Praveen

Praveen-Perfect. Go ahead. You can consider PPF, the best debt product. No, returns from equity for long term will be tax free. Hence, they not taxed.

Hello Sir,

My aim is to achieve the following.

1. 10 Lacs after 7 years

2. 10 Lacs after 10 years

3. 20 lacs after 15 years

I have started one SIP of 5K per month for Franklin India Prime plus growth. Please suggest ho many funds I shoud take more and what should be SIP and type of funds.

Khan-Each goal must be treated separate for asset allocation. Funds may be same. But equity to debt must vary as per goal tenure. If you already selected Franklin fund, then include one large cap and one small and mid cap fund from above list.

Sir, thanks for your reply.

Please suggest if the below combination is OK.

Franklin prima plus growth – 5k

SBI Magnum equity direct- 3500

ICICI prudential term plan growth-1500

Mirae emerging blue chip- 3500

Tata dynamic bond -regular plan-1500

Thanks,

Khan-ICICI Pru term plan GROWTH? Also, for debt portfolio, don’t use dynamic bond funds. Instead, restrict yourself to short-term or ultra short term funds.

Hi Basavaraj Tonagatti

I came across your blog and must say its of great help. I am presently 24, earning 86,000 per month. This is my first job. Could you help me how do I go about my investments? I have an educational loan of 15lakhs. I am looking to invest in PPF and few SIPs.

Shrutika-Don’t jump into investment. This is your first job. Try to create fundamentals first. Buy online term insurance for around 15-20 times of your yearly income, buy health insurance (for you and family even if employer provide you), buy an accidental insurance and create an emergency fund of at least 6-12 months of your committed expenses. Once, these are in place, then go for long term sure goals like retirement or your marriage plans. Along with that whatever surplus you have try to pre-pay the educational loan at the earliest.

First of all I would like to take the opportunity to thanks you to educate the investors.

I would like to invest around 30to 40k in SIP further. I hv already invested following

SIP

– AXIS Long Term Equity funds – 20k

– ICICI Prod Value Discovery funds (G) – 2k

– Kotak Select Focus funds (G) – 2k

Lumpsum

– Axis Hybrid Funds – 400k

– Axis Equity Saver funds (G) – 200k

PPF / RD – 20k p.m.

Kindly suggest good SIP. Also suggest whether the above funds are ok or I should discontinue. My time horizon is 12 to 15 years and need to build a corpus of around 5 crores in 15 years.

Kindly also advise Is there any options available to switch over from one MF to another. If yes, what to do for the same.

Regards

Bhatt

Bhatt-You had two multi cap funds (ICICI and Kotak). Retain one. Include one large cap fund and also a small and mid cap fund. Also try to make sure that 30:70 debt:equity ratio. For debt you can use PPF. To switch, you have to redeem from existing fund and invest lump and register new SIP in new fund.

So only tax savings funds are eligible as for 80 C? or I can buy any of the funds in SIP and can claim for tax savings

Lokesh-No, only tax saving funds or ELSS funds are eligible for tax saving but not all funds.

Hi Sir,

My monthly current running SIPs in below equity fund as follows…

Franklin India smaller cos. fund ?1000/- regular growth, goal period >15years, for Kids education

Franklin India prima plus fund ?1000/- regular growth, goal period >22years, for retirement

Tata balance fund ?1000/- regular growth, goal period >20years, for Kids marriage.

I also invested in death fund of Birla SL MIP II wealth 25 ?1000/-regular growth, goal period 15years. Please suggest one good fund..

Abhishek-Your strategy is completely wrong. For each goal you must have debt:equity ratio properly. Again in this equity, you must include all market capital funds like large cap, small and mid cap or multi cap. But you selected one fund for one goal. It is not a right way to do.

For debt portion, what is better, ppf or short term debt fund? How much is the tax one pay for income on debt fund? Is it RD good for debt portion?

I am 30 year old Male working in a MNC in Delhi with monthly salary of 1 Lakh/month

I am married and 1 year daughter with no loans.

I want to invest INR 25 Lakh with moderate risk profile (around 15% return per annum)

I am looking for long term horizon (5-10 years)

I have this lumsum money please advice a investment strategy for me

I am considering two options

I park this money in liquid fund temporally and do SIP in Mutual funds.

I buy real estate and also take some loan as I have surplus of 50 thousand/ month

Please advice

Sameer-Some misconception about you are as below. Please give me your reply to proceed further.

1) 15% return is not moderate, but to me aggressive. I expect 10% return from my aggressive portfolio.

2) If your time horizon is 5 years, then don’t enter into equity. First specify the time limit.

3) If your investment is for long term, then why deposit into liquid fund?

Dear Basuji,

What is the difference between large-small cap fund and multi cap fund? And what is diversified fund? On many websites one fund is mentioned as diversified, on another multicap and on another large-small cap fund. It is very confusing when creating portfolio. Plz. clear.

Pratap-It is the underlying stocks market cap, based on that the fund named. Don’t confuse, visit AMC portals and verify them.

I am starting investment in MF for the first time and I have decided to invest 7000 per month following funds (for 5+ years. Please advise me if it’s good portfolio or not.

ICICI Prudential Focused Blue Chip Equity Fund – Growth – Rs. 2000

Mirae Asset Emerging BlueChip Fund – Regular Growth – Rs. 1500

Axis Long Term Equity Fund – Growth – Rs. 2000

Birla Sun Life Dynamic Bond Fund – Retail Plan – Growth – Rs. 1500

Thank you.

Satish-Define first the 5+ years.

Hi sir,

I have the following SIPs running currently:

Birla SL Frontline Equity – 5000

UTI Opportunities – 2000

ICICI Pru Dynamic – 3000

IDFC Premier Equity – 3000

ICICI Pru Value Discovery – 2000

Birla SL Dynamic Bond – 1500

Total Investment/month: 16500/-

Time Horizon : 20 years

I feel I have too many funds in my portfolio but am not able to decide on which ones to move out of and which to continue. Can you recommend changes please? Also should I just stop further SIPs in the funds I move out of or should I move the current accumulated corpus also?

Thanks

Princy-Three funds enough like large cap fund, small and mid cap and a multi cap fund. Where is your debt portfolio?

Thanks! So for equity, does the following look ok?

Birla SL Frontline Equity – 7000

ICICI Pru Value Discovery – 5000

IDFC Premier Equity – 3000

Debt: Birla SL Dynamic Bond was my debt part of the portfolio – since the time horizon was 20+ years, I thought 10% debt is enough. Please suggest changes if required in this.

Princy-Include 30% debt and rest in equity. I suggest short term debt fund rather than income funds.

Thanks a lot for the recommendation! Will modify equity debt ratio as suggested.

However, I see Birla SL Dynamic Bond listed as a short term debt fund here: http://www.moneycontrol.com/mutual-funds/nav/birla-sun-life-dynamic-bond-fund-retail-plan/MBS071

But I guess you are saying this is an income fund. I really do not understand the difference between all these. Which short term debt fund would you recommend, in place of this?

Also, what do you suggest for existing investments in funds I plan to stop SIPs in now (ICICI dynamic, UTI Opportunities)? Should I redeem those also and re-invest the amount in the selected 3 funds (Birla SL FE, ICICI Value Discovery, IDFC Premier Equity)?

Princy-Don’t refer these portals. Instead go for mutual fund company portal to know about the fund. I suggest funds like Franklin India low duration fund or HDFC Banking and PSU Debt fund. As I suggested, retain the one and redeem and invest in the existing funds.

Thanks a lot Basavaraj for taking the time to answer my queries! Appreciate the advice.

Dear Mr Basu,

I started my sip in januray 2016. I will invest at least 10 years from now.

1) franklin india prima plus fund – Rs1000

2) icici prudential focused bluechip equity retail growth fund- Rs 1000

3) kotak emerging equity scheme – Rs 1000

4) HDFC mid-cap opportunities fund-growth option- Rs 1000

5) BSL frontline equity-a – RS 1000

I want to invest rs 5000 more in sips. Should i invest in above old sips or choose another new 5 no’s funds?

i have lump sum rs 500000. please suggest some debt funds to invest for at least 5 years.

i have bank fd for 5 lakhs for 8.5 yr, KVP for 2.5 lakhs for 8.5 yr and ppf 1.50 lakhs/yr.

please reply soon.

Sujan-How you selected these funds? Why two funds within same category?

Hi Basavaraj,

Kindly help me to find suitable SIP for Rs. 10,000 to 20,000/- per month for Long Term Investment. I don’t have any SIP/mutual fund investment as of now. I have PPF ,PF ,RD account.

Please suggest me the SIP plan where i can get better returns in long term investment(more than 10 years).

I heard alot about Franklin returns. Please tell me which Plan is better in Franklin. Also in other Banks.

Also I want to invest 10,000 in 3/3/4 ratio with different different Banks.

Regards,

Shaleen

Regards

Shaleen-For your 10 years goal, use debt (FD or RD but best is short term debt fund) and equity in ratio of 50:50. Funds are already listed above.

gdmrng sir…m very fond of ur blog n ur valuable pieces of advice…

I have the timeframe of 15 years.and did my investment for 15 yr.my funds are following:-

Franklin India blue chip fund-direct-2500/month

sbi magnum midcap fund-2000/month

ppf-3000/month.

sir please suggest as per my 15 yr timeline,my fund selection is right?(I also tried to maintain equity:debt ratio 60:40)

Rajeev-Go ahead.

Sir I am a regular reader of your articles. I found these very useful. My age is 27. I want to build a corpus of 30 lakhs after 20 years. I have invested in SIP at Franklin india blueship fund & Frankin india prima fund Rs 500 each. I have a ppf ac where i invest Rs 1000 pm. Now how much extra I have to invest in SIP to achieve my goal. Please reply. I have term insurance also.

Bikash-Currently I am out of city. Hence, can’t calculate. But you can use online calculators to arrive at required investment. Consider equity:debt in ratio of 70:30 and return around 10%.

Sir Thanks a lot for your reply.

I am NRI,My portfolio :

1)3 ULIP policy of ICICI Pru(10 years n term going to be complete next year) – 70000 rs year

2)1 Birla Sun life Dream Endowment plan – 60000 rs year

3)Sukanya Samridhi – 1.5 lakh per year

4)Bank FD – 10 lakh @ 8.5 for 5 years

5)Post office – RD – 5000 rs per month

6)NSC – 5 lakhs

7)Post office FD – 6 lakh @ 8.4 for 5 years

8) Jeevan Surbhi – Money Back 16000 rs year

I dnt have any car n house loan.Now i want to invest in mutual fund and i am new to mutual fund.I want to invest 25000 rs per month in mutual fund.How should i invest 25000 rs to mutual fund like Debt fund,Balanced fund.

My invest time frame is 10-15 years. Suppose If i want to invest in Debt fund then how to chose which debt fund and what basis we have to select particular fund like SBI magnum fund or ICICI Pru Long Term Plan.

Rameshwar-You can use either PPF or short term debt funds.

Hi,

Am not having more knowledge in MF / shares / markets, but am looking to plan for my future like retirement (my current age 34) & child education (current age is 31/2). my investment listed below

1) ICICI Prudential Long Term Equity Fund (Tax Saving) – Growth – one time Rs.36000 on March 2016

2) Axis long term Equity (G) – Rs.25000 one time on March 2013 (lock in period completed but not planned to close yet)

3) Axis long term Equity (D) -Rs.30000 one time on March 2014

4) PPF monthly Rs.1500/m started on August 2015 (planning to go for Rs.2000/m from April 2016)

I would like to go for 5K to 7.5K / month in SIP for long term at least 15 – 20 years, which should be eligible for 80c and good returns.

Kindly advice me to choose a better scheme.

Thank you in advance.

With Regards,

RMR

RMR-Continue same funds but with growth option and debt:equity in the ratio based on goal.

Thanks for your response.

I’ve started SIP in

Axis long term Equity (G) , ICICI Prudential Value Discovery Fund (G) & ICICI Prudential Long Term Equity Fund (Tax Saving) – Growth – 2k /month as SIP.

How about this ICICI Prudential Child Care Plan – Gift Plan? will it be fruitful for my child education / welfare?

Kindly suggest if anything in good returns.

With Regards,

RMR

RMR-Sta away.

Hi sir,

I want to invest 5K in SIP for log term(10yr +) , i am very new for SIP.

Please suggess me 2plan in which i can invest 2 * 2.5K and get good return.

Thanks

Vinay

Vinay-Why you two plans ONLY?

Hi,

Thank you for the information that is being shared here. appreciate it. Hope you get time to address my concern!

I’m 25 years old and would like to start investing in SIP. Firstly I would like to start with investing 5K to 6K monthly and I’ve rounded on these funds after looking at your list and some other sites and came to the below conclusion. Also currently I earn around 25K and have no commitments whatsoever. So will 5k-6K be a safe play or should I invest more

Franklin Tax shield 1K monthly

Franklin Smaller Companies 1K

ICICI Pru value Discovery 1K

ICICI Pru balance advantage 1K

Mirae Assets Emerging Blue chip 1K

I want to know if this is a better idea to have 5 mutual funds. Else what would be the better option,

Thanks in advance.

Siva-How much to invest depends on you. Where is debt portfolio?

Thank you for your time. Right now I’m planning to invest 5-6k.

I do not have any idea on which debt fund to choose. Im investing 1k in iwish RD, instead of that would you be able to suggest one debt fund to proceed with.

Siva-Chose short term debt fund.

Hello sir,

I’m 45 years old , working as a Doctor

Please review and provide your valuable suggestions

My investment horizon would be 10-12 years

Corpus would be around 5-8 cr

I’m very new in investments

I started recently in SIP ie IDFC -20k

5 k for 3 kids in RD s

PPF 1.5 yearly

Sukanya smridhi 30k once

Kindly suggest more SIP for me

Regards!

Sadhana-If we assume 10% return from equity investment, then to achieve Rs.5 Cr in 12 years, you need monthly investment of Rs.1.80,000 approximately. Let me know whether it is possible for you? Also how you selected the IDFC fund and which fund it ise?

80k is enough for me per month

My friend suggested me , it’s a IDFC premier equity and IDFC sterling

Should I discontinue this?

Sadhana-One fund is not enough for goal achievement. You have to create a portfolio also you must include debt asset.

Dear Basu,

I’m 29 yrs.. working in MNC having a daughter also expecting 2 more babies by August or September. Already SSA started for daughter 1.5 lac per year. A part, I save about 5000 month looking for SIP’s. Spoke to my friends and they suggested for HDFC top 200.

I dint find any interest in investing into that fund. I would like to invest into two funds 2500*2=5000/m.

Please suggest me good returns funds for 5 Yrs.

I saw couples of replies below where you talk debt and equity which is totally bouncing for me.

Please provide the names of funds.

Thanks

AB

Akash-If your timeframe is 5 years, then don’t enter into any equity funds.

Please tell then how many years should I invest under which fund. 2500 per month in two funds.

Amit-How can I say of how many years or how much? It purely depends on your financial goals.

Dear Basu,

Thanks for all your efforts in educating people like us who keep struggling to get some genuine unbiased investment advise. Request you to please look at my portfolio and suggest changes as appropriate. I am 40 years old and the below equity portfolio is for my retirement and I intend to accumulate 5 cr over a period of 15 years. I started my SIPs in Oct 2015. All are direct growth monthly SIPs.

i. SBI Blue Chip Fund- Rs 10,000

ii. ICICI Pru Value Discovery – Rs 5000

iii. Franklin Small Cos Fund – Rs 5000

iv. Canara Robecco Emerging Equities Fund – Rs 5000

v. DSP BR Micro Cap Fund – Rs 5000

Please suggest if this is fine to build my retirement corpus.

Moreover, I also have lumpsum investments in debt funds:

i. Birla Dynamic Bond: Rs 1,00,000

ii. ICICI Equity Arbitrage Fund: Rs 2,00,000

iii. SBI Magnum Gilt Long Term Fund: Rs 1,00,000

iv. ICICI Pru Long term Fund: Rs 2,00,000

v. HDFC Liquid Fund: Rs 2,00,000

I have Rs 10 lacs as cash which I want to deploy in long term debt funds to generate wealth. Kindly advise

Many Thanks

Nischal-Where is your debt portfolio?

this is debt portfolio, isnt it?

i. Birla Dynamic Bond: Rs 1,00,000

ii. ICICI Equity Arbitrage Fund: Rs 2,00,000

iii. SBI Magnum Gilt Long Term Fund: Rs 1,00,000

iv. ICICI Pru Long term Fund: Rs 2,00,000

v. HDFC Liquid Fund: Rs 2,00,000

Nischal-Don’t go beyond short-term debt fund. The funds you hold are volatile in nature like Dynamic Bond funds, Gilt Funds or Long Term Funds. Why you invested in liquid funds? I said the overall portfolio ratio of equity and debt. Whether that is currently there?

Thanks Basu.

No equity to debt is not there. Should I maintain it?

Please can you explain why should I only focus on short term fund? I am ok investing in them.

Also, I invested in other debt funds to earn more than bank FD. Is this a wrong approach? is it ok to invest lumpsum in equity funds at this point?

My overall objective is to generate wealth.

Nishchal-To mitigate the risk, you must include debt portfolio. It is a must for all equity investors. Beyond short-term debt funds means volatility. You already have enough volatility in equity, so why more?

Dear Basavaraj,

Let me first appreciate your efforts to run blog for people to make financially literate.

I and my wife are planning to invest in SIP of two SIPs of 5000 per month for long term may be for time period of 10-15 years which will take care of all our future needs like retirement and children’s education etc. Please suggest two best growth oriented SIPs. for this goal.

We have not yet bought house and planning to buy may be in text 1-2 years time but till that time we have more spare cash like 30K per month apart from above SIP plan, so please suggest best way to invest which would give us good return as well as we should be able to liquidate, this spare 30K cash every month for short period of time around 1-2 years time frame.

we are around 35 year olds with one kid and double income.

Narendra-For your long term goals, I suggest to keep 40:60 in debt:equity. For debt you can use PPF. For equity, select one large cap and one small and mid cap fund from above list. For short term, use Bank RD.

Dear Basavaraj,

Kindly review my portfolio and suggest any changes that I need to make. I am 35 years old and have bought an apartment(EMI is running)

My portfolio:

Debt:

1) Pf+VPF = 15K per month

2) PPF = ~5k per month

3) FD/RD = ~10k per month

Equity:

1) Reliance Equity opportunities fund — NO SIP, invested 50K 6months back

2) HDFC mid cap opportunities Fund– 5k/month

3)ICICI Pru Dynamic — 5k/month

Now I want to invest another 5K /month. I am a long term investor(over 15yrs) and have decided to make below changes.

4) ICICI Pru value discovery fund –5 k/month instead of ICICI Pru dynamic fund

5) HDFC Balance Fund — 5K/month New SIP.

Please suggest if these picks are fine and also suggest if I need to make any changes in the portfolio.

Regards

Raghu

Raghu-Include one large cap fund from above list. Continue HDFC Midcap Opp and Balanced Funds. Switch to ICICI Discovery from Dynamic. Don’t invest further in Reliance fund. Keep debt to equity ratio in range of 30:70.

Dear Basavaraj,

Thanks for the quick reply.. Will maintain the folios as suggested.

Regards

Raghu

Hi Basavaraj ,

I am going to invest for the first time .I heard equity funds are best If I plan to invest for the long time.I want to invest monthly 2000-3000 Rs for a period of 3 years.Can you suggest me which plan should I choose.I have no concern for tax saving etc.

Thanks

Anshul-3 years long term? You enter into equity only if you have timeframe of 5+ years.

What kind of fund do you suggest for my kind of investment? will it be better to go for 5+ years in equity ? this sum of 2000 Rs some how gets spend every month anyway so I think I should add it up for future where i can fetch it up in a lump sum.

with the rising inflation I think the money blocked in FD is actually depreciating so I want to choose an option where it can actually grow.

Anshul-Set your financial goals at first. Then it is easy for you to chose the product.

Hello Basu,

I am Gulf based NRI with 14 year daughter. I want to accumulate a corpus of 10 lac in next 8+ years for her marriage. I do not want to take risk, so is it good for me to make SIP in Balanced fund HDFC and ICICI 5-6k in each fund monthly?

Sir, I have 15 lac cash in NRE saving a/c, planning to buy property, if I put in FD it will be locked for one year advise me to park this in short term 7-8 months with good and safe returns(tax??)

Ravinder-If you start to invest around Rs.8,000 in an short term debt fund which fetch you around 7% return, then you can achieve Rs.10,00,000 target after 8 years. It is no risk product. In one way you claim to be non-risk taker and in another way you ask of equity funds. If your intention is accumulate this through equity, then I suggest not to invest more than 40% into equity and rest 60% in safe debt product like short-term debt funds. No need to go for equity oriented balanced funds as they invest around 65% or more into equity, which is not suitable to your timeframe.

Regarding Rs.15,00,000, I suggest you to go for a deposit. When you liquidate then there may be some penalty. That’s OK, but best option.

Dear Basu,

Thanks for the kind advice. Kindly advice Short term funds. Should it be one fund or split and put in two funds?

NRI deposits for one year minimum, premature closure will not fetch any interest at all, so it has to be local FD,sure I do accept your valuable advice.

I am regular reader of your blogs, what I understood from your answers to many queries is, invest in equity 10+ years, my timeframe is 8 years, thought balanced fund would be better for me as mentioned in article both HDFC and ICICI fetching good returns in 5 years. May be I misunderstood.

As interest rates are softening will that affect debt fund returns too ?? kindly clarify

Plz.name two short term debt funds.

Many thanks

Ravinder-Invest in single short term or ultra short term fund. One fund is enough. Considering your time frame, I feel 35% debt and 65% equity is risky. Hence, I suggested to avoid balanced fund. Yes, debt funds will effect to interest rate movement. But in inverse ratio. It is like if interest rate cycle goes down, then the price will go up. When you go for short term or ultra short term funds, then the risk of volatility due to interest rate cycle change is less as they hold short term maturity bonds.

Great sir! Appreciate your kind advice. These short and ultra short funds are ok to invest for 8 years horizon with SIP? When I googled for these funds Pandora’s box opened and more confusing!! Kindly name one fund each from category as you didn’t include this category in your top 10 list.

Many thanks again

RAvinder-You did search, I suggest you go more deep and select the one which have good quality bonds in their portfolio and also the modified duration low.

Thanks Basu,

But my search seems to be a waste, kindly name one fund, for that matter few funds. I can select one among them, b’coz you will never wants to promote or seems to promote any fund as you are always unbiased and give fair advice.

Thanks again

Ravinder-Sorry to say. But your understanding is correct 🙂

Thanks Basu,

Never mind!! :-, I will wait for the opportunity. I follow your advice religiously.

I am new to SIP and I need to invest 10000 monthly in 3 to 4 SIPs. I already have Monthly 15000 in recurring account.

Please advice me which SIP I should invest and how much in each?

Sachin-Your timeframe?

Hi Basavaraj avre Vijay here.

Please provide your contact no. here to talk to you regarding investments in mutual funds.

Or else please mail me at [email protected] /call me on 8875004286

Regards

Vijay Rajashekarappa

Vijay-You can contact me at [email protected].

Hey Sir

I want to invested Sum of Rs.25,000 in Mutual Fund for Long Term ,As one of my friend suggested me One Fund Called SBI magnum Mid cap Equity Regular Fund ,is it good to invest as i cant able to make out whether it good fund or not.Please Suggest & if this fund is not good tell me some Good Long term fund to invest ?And I Also want to Start SIP for Long Term suggest Any Good SIP Mutual Fund.

Regards

Mahesh

Mahesh-My selection is listed above. Also, invest in equity only if your time horizon is 5+ years with proper asset allocation to debt and equity.

kindly suggest me the fund for sip of rs 1000/ month for 5 years, as i am seeking to invest in SIP.

Amit-You mean equity mutual fund? Not suitable for your timeframe. Stay away.

Thanks for valuable information.

I’m new to SIP and finalised few funds, could you please review? My time frame vary with the goals.

Age : 33

Goal:

1: Need 50 lac in next 5-10 years for flat in delhi

2: Need 15 lac in next 15 years for child education.

3: Need 1-2 cr in next 20 years for retirement.

Emergency money available = 2 lac as of now

Medical: 7 lac(no life insurance)

Debt fund= 4 lac available in ppf + epf as of now and (7 k/ monthly premium)

land worth= 24lac in tier 3 city(planing to build home in next 15 years, so most probably will not sell it)

Since, I’m new to SIP, I don’t want to put more money but will increase gradually once i get the knowledge and get comfortable with it.

As of now, i’ve decided below funds.

Franklin india prima plus (G) Large cap 2000/

Franklin india high growth Multi cap 1000/

DSP BR Micro cap fund mid and small 1000/

ICICI pru value discovery fund Diversified 1000/

Kindly review and let me know if these funds are okay in longer terms, I can spend 10 K max.

Thanks in advance

Hem-I can’t plan your life financial planning in commenting.

Ok thanks but could you please tell me if the above funds are good for long terms(5+ yrs)

Thanks in advance!

Hem-Above funds means? My listed?

Franklin india prima plus (G) Large cap 2000/

Franklin india high growth Multi cap 1000/

DSP BR Micro cap fund mid and small 1000/

ICICI pru value discovery fund Diversified 1000/

Hem-For 5+ years one large cap fund is enough and don’t invest more than 60% into equity fund.

Sir,

please suggest short term funds for investing more than a year, being a non tax payer i thought better to invest in them instead of FD’s to avoid 15-G submission hassles every year.

Regards,

NISHIKANT

Nishikant-Avoiding TDS means tax free?

Sir,

Good Morning, Please suggest best ultra short funds and share taxation on them.

Regards,

Nishikant

Nishikant-What is your requirement from this investment? Read my latest post of taxation at “Mutual Fund Taxation – Capital Gain Tax Rates for FY 2016-17“.

Hi Basu,

Currently I have below investment (6000/-). I would like to add 4000/- more in my portfolio

1. HDFC Mid- cap Opportunities fund(G) – 2000

2. ICICI Pru Focussed BlueChip Eq Fund(G) – 2000

3. UTI Opportunities Fund(G) – 2000

Can you suggest me which one I should further add. My target is for more than 10-12 years. I am 34 year old and I have 4 year daughter.

I was thinking for below :

Franklin India Smaller Companies Fund – 2000

Franklin(I) High Growth Cos fund – 2000

Daya-UTI is currently in large cap category. Hence, retain ICICI and come out of UTI. Both new franklin funds are find. However, where is your debt portfolio?

Thanks for your reply. I have not taken Debt portfolio. I have invested 2.5 lacs in NSC and rotating every month for tax deduciton. Also I have house loan so 80 C is getting covered by both including my kids school fee.

Which MF I should take in place of UTI?. Total 3 MF I would like to add worth 6000. Please suggest. Also If I am looking for more than 10-12 years so Shall I also include debt fund in my portfolio and if yes then which one I should take.

ICICI Prudential Value discovery fund

HDFC Balanced

Franklin India Smaller Companies Fund

Franklin(I) High Growth Cos fund

Thank you very much for your time and suggestion.

Daya-Funds are now fine. But you must include debt portfolio.

Hi Basu,

Which Debt portfolio you would like to suggest?

Daya-Short Term or Ultra Short Term Debt Funds or even PPF (if goal matches the maturity).

Thanks. I was investing through Funds India and now I want to switch with direct fund so is it wise to switch from distributor and invest directly or shall I close that fund and invest again directly?

Daya-If you feel FundsIndia service not add value to your investment, then you can opt for DIRECT.

Hi Sir,

I am a Girl of 23 working in a MNC , currently earning 25K/PM.

I have come to know that if you start investing early you will have more benefits.

Now first of all these mid cap large cap small cap n balanced cap plans are something I don’t understand

As per you what should I do If i seek for investing Rs. 5000 for a period of 3 years and 1000 for a period of 5 years.

I am unable to understand the high terminology of commerce and investment.

Kindly keep it simple.

Shalini-If your time period is 3-5 years, then simply use RDs. Equity investment is for those who are ready to invest for long term like 5-7+ years.

Hi Sir,

Just started my investments in Mutual funds. I have picked up the following and done a SIP last week before i got to see your page.

DSP Blackrock Micro Cap,

Franklin India Oppurtunities,

SBI blue chip fund,

L & T prudence fund All Growth options.

Pls advise if i need to change any of the above and also advise what other funds i can add to my portfolio. Thanks.

Sreedhar-What is your timeframe?

Hi

I have selected below 5 funds to be invested for long time [say 15-20 years].

All are Direct Growth with 1k each.

1. SBI Bluechip

2. ICICI Pru Value Discovery

3. Mirae Asset Emerging Bluechip

4. Franklin Ind Smaller Companies

5. DSP BR Microcap

Please express your views……

Rahul-Why two small cap funds (DSPBR and Franklin)? I suggest Franklin to retain. Also, where is your debt portfolio?

I have 5000 pm RD in bank as debt part.

If I have change DSP BR Microcap, what fund to replace with…

Rahul-I already said that. It is Franklin existing fund.

Hi…

I am 30 years old. And I want to invest long term in sip [say 20 yrars]….

Want to invest 5k monthly in 5 different funds 1k each….

Mostly in small/mid cap.

Please suggest 5 finds.

Gautam-Why 5 funds and why small/mid cap?

Small and Mid cap gives higher returns…can take 2 multicap too…

But want 5 funds…. its 1k each….

Gautam-I completely agree that small and mid cap can give you high returns. But may ruin you highly in case of market downfall.

Ya… I know…. So please advice 5 fund that will make balance…

Gautam-It’s your wish and the funds are listed above. Because at the end of day, it is your MONEY right 🙂

Hi Basu Sir,

I keep following you blog and post from last couple of months. i am 32 yrs of age:

Below are my investments and request you to review:

1. Axis Long term equity – ELSS – SIP 2500 Rs from Oct 2015 (20 yrs)

2. UTI Mid cap fund – SIP 2000 Rs from Dec 2015 (15 yrs)

New funds I have selected for my Son (1 year old) future (12-15 yrs):

3. ICICI pru value discovery – want to start SIP 1500 Rs

4. Tata Balanced Fund – want to start SIP 1500 Rs

Queries:

A. Should I continue to UTI mid cap. Do you see any issue with this fund.

B. 1 and 3 are multi cap funds. Fund overlap <12%. Selection of ICICI valure discovery is appropriate or not.

c. Larger cap fund do I need to consider intead of 3.

D. In balanced fund I am little confused between Tata and HDFC. If you suggest both are okey then I will go for Tata.

Request you to review queries.

Mukul-You can continue the UTI Fund. Missing part is large cap fund. Also make sure that for each goal you must have equity:debt ratio in 70:30 (I am recommending this based on your timeframe of goals). You can continue Axis, ICICI and Tata. No issues.

Hi,

I have started investing in MF from 2016 . I invest every month in a new MF based upon the ranking. I am planning to go for purchase of other MF also in subsequent months.

Already invested

DSP BLACKROCK MICRO CAP FUND – REGULAR PLAN – GROWTH – 2K – 3 yrs

SBI PHARMA FUND – REGULAR PLAN – GROWTH – 2K – 3 yrs

Axis Long Term Equity-G – 2K – 3yrs

Planning to invest:

Franklin India Smaller Companies Fund GROWTH – 2K- 3yrs

SBI BLUE CHIP FUND – REGULAR PLAN – GROWTH – 2K – 5 yrs

Mirae Emerging Bluechip Fund (G) – 2K -3yrs

Reliance Small Cap Fund (G) – 2K – 3yrs

I have already a backup of Rs. 10L in FD. and 3L in RD. Can you suggest me, if my planning is good to go ahead or i need to change the time frame or invest in mutual fund.

My obejective is to get every month a sum of Rs. 2-3 L after 3 years.

Rakesh-Invest every month based on ranking? What if the next month the ranking change? Will you switch over to another fund? Three funds are enough to create a best portfolio. Why so many funds to confuse on your own?

Thank you Basu 🙂

Can you guide me which mutual fund to purchase and for how many years.

Rakesh-They are listed above. How many years depends on your goal.

Dear Basavaraj,

Which Mutual Fund cap suits for investor ?

If one would like to built the better mutual fund portfolio across the various market cap funds based on his financial goals with its time-frame then what will be the approach?

Anup-It depends on the timeframe of goal and how he structured his debt and equity portfolio. Hard to say any generic answer.

Hello Sir,

When you say 70:30 or 60: 40 in equity to debt ratio. Can Bank FD also considered as an Debt option . or it has to be in a mutual fund which invests 70 % in equity and balance in debt funds

Regards,

Shankar

Shankar-You can use bank FDs too.

Hi Basavaraj,

I am currently 37 years old and have 7 years old daughter. I want to invest for my daughter’s higher education which is about 10-11 years from now, her marriage which is about 15-16 years from now, my retirement which is about 23 years from now. I have been investing in PPF (putting in Sukanya Samruddhi Yojana this year onwards), somewhat in FDs and RDs. But if I have to invest in SIPs, which category funds (equity, debt, etc. and Large cap / mid-cap / multi-cap etc.) are good for my portfolio. Also, if you can name a few companies (of course you have listed above, but which are best of best?) considering my requirements.

—

Br, Ravi A.

Hi Basavaraj, One more question: which platform is best to invest, whether online sites such as Funds India or Scripbox (if so, which one of these two?) or whether one should invest directly with AMC? thanks.

—

Br, Ravi A.

RAvi-If you are cabpale of reviewing and monitoring on your own, then use direct platforms like MF Utility or Investza.

RAvi-You have to go for combination of debt (PPF and Sukanya Samriddhi Account) and Equity Funds. You can include one large cap , one small and mid cap and one large and mid cap. Funds are listed above.

Thanks a lot, Basu Ji :-)! You have been very helpful. One question still :-)…. What are the pros and cons of investing in each category of funds, i.e. Large Cap, Large and Mid Cap, Small and Mid Cap etc. I mean, what are the advantages or disadvantages of investing in each of these? You may also point me to an article giving details / explanation of each of these category of funds. Thanks.

—

Ravi A.

RAvi-Your money will get diversified among all sectors and all cap stocks. I may say a better diversification leads you a less risky.

Hi Basavaraj, Nice article and good to see you helping others to increase their money.

I too have a query for you… am 44 years of age now – doing job with an MNC. Considering two goals – Corpus for my son’s professional education after 6 years (Target 15 lacs), and similarly daughter’s professional education after 14 years (Target 30 lacs?), please suggest best funds for wealth creation.

Currently I have ~10 lacs to invest now, and then can invest total ~30K / month SIP further. Please suggest best funds to invest. Presently all my current investments are mostly in debt instruments, and the targets/ investments that I have mentioned above are for equity investments only.

Thanks in advance for your valuable inputs.

Rakshak-For a goal of 6 years, I suggest to use debt in ratio of 70% and equity in ratio of 30%. For the 14 years goal the reverse will be fine. I mean 30% in debt and 70% in equity. Regarding debt, you can use short term debt funds or ultra short term debt funds. Regarding equity, I already mentioned my choices.

Hi basavaraj, good to read your article and advice. I have been thinking of investing 20-30k in sips for a 10-15 year duration. We don’t have a stable job or house in Delhi, and also thinking of buying a house.

Keeping that things in mind can you kindly suggest a portfolio for investing in sip.

Thanking u in advance

Karsing-First decide whether it is 10 years or 15 years.

Dear Basuji,

First off all thank you very much for my first question about SIP portfolio. I have some more little queries. I am having SIP in reliance growth and reliance opportunities from 5-6 yrs. Now i want to redeem major chunk from those SIPs. Because after reading in your blog i dont want to remain in this fund any more. But, both are SIP INSURE. They say that if you redeem some portion, you will loose your insurance cover. Is that true? Now I am nearing age of 50. And want to marry my daughter in 5-6 yrs. Also want to invest for retirement. Plz. suggest me right SIP formation. And good funds also. Is HDFC Balanced fund appropriate for debt portion?

Pratap-If your daughter’s marriage is just 5-6 years away, then you have to come out from these equity funds (keep around 30% only in equity and rest in debt). When your concern is investment, then why you are bothering about insurance? Regarding fresh investment, considering your retirement age as 60 years, I suggest equity to debt in ratio of 60% to 40%. Funds are listed above.

since 2014 oct.i have investing in following mf hdfc top 200,hdfc prudence,dsp blackrock microcap SIP rs.1000 each/month.is it good investment or add another fund in place of hdfc top 200.pls. suggest. thnx

Kailas-Why you felt HDFC Top 200 to replace with new fund?

Hello Sir,

My name’s Apoorv and I am 22 y.o . I just got my first job and heard about SIP from many people.I am not such Business/Finance savvy so I really don’t understand what you explained in the above list however i really want to invest 1000 rs per month for as long as 3 years of time period.Can you please suggest me if I should invest in SIP or not,if yes then in which type of fund should I invest from the above list.Please guide me through this.Thank you.

Regards,

Apoorv

Apporv-If your timeframe is 3 years, then don’t enter into equity mutual fund.

Dear Basavraji,

My SIP portfolio is as follows :

Reliance Growth Fund : Rs. 1000

Reliance Opportunites Fund : Rs. 2000

Icici Discovery Fund : Rs. 1000

Axis Long Term : Rs. 4000

Franklin High Growth : Rs. 1000

Hdfc Balanced : Rs. 1000

Is it ok. or some changes shoule be made. Plz. guide

Pratap-One large cap, one multi cap, one small and mid cap enough. Even I am find with single balanced fund.

sir I am 30 yr old. (I HV my debt part covered in ppf and post office FD).

i want to sip of 2500 per month for 15 years,as my equity part..

so please suggest me in which category should I invest(I mean large cap/mid/small cap equity MF)???

Rajesh-One large cap and another small and mid cap fund from above list.

sir,

Kindly help me to find suitable mutual fund for Rs. 3,000/- per month for long term horizon 10 to 15 years . I don’t have any mutual fund investment as of now. .

Regards

Rohit-They are already listed above.

Hi ,

My age is 30 yrs and I am new to SIP. I can invest 5000/month for 10 / 15 yrs. Please if you can suggest be some best options please. I am looking to have good amount by the time I retire at the age of 60 yrs.

Regards

Munmun-First understand when you need money EXACTLY. There is a gap of long 5 years between 10/15 years. The funds are listed above. Please go through the above post.

Sir,

I am planning to invest in HDFC Equity Fund-G , keeping in mind portfolio overlap.

I have SIP’s running of 2K each in three funds currently in Franklin India Prima fund and Franklin India high growth cos fund and HDFC Balanced Fund all growth options with time frame of 7 to 9 years. Are the existing funds okay .

thanks and regards,

NISHIKANT

Nishikant-What about your debt portfolio? You must manage around 40% in debt and rest 60% ONLY in equity.

Hello Sir,

I am 34 year old and having been investing in the below funds.

Birla Sunlife Top 100 fund

Franklin Opportunities Fund

HDFC Top 200

L&T Equity Fund

Reliance Equity Opportunities Fund

DSP MicroCAp FUnd- Regular Plan

IDFC Dynamic Bond Fund

I am looking at Systematic Investment for a period of 20 Years. Is the above portfolio a good one to continue investing. Or should i look at making some changes.

Novy-Why so many funds? Also, where is your debt portfolio?

I do have my Debt portfolio covered by EPF, PPF & the IDFC Debt fund. The no. of funds in my portfolio increased over a period of time. Is it advisable to consolidate all the investment into fewer funds, or should i stay invested in these funds and just ensure that future investments are consolidated.

Novy-Consolidate and make sure to have maximum 3-4 funds.

i m new in SIP mutul fund system.i want to invest 2000rs per mnth for 5 yr..which mutual fund is best,,pl suggest me ..

thnks

Vimal-Use 50% in Bank RDs and 50% in short term debt funds.

Hello Sir,

I am investing in Reliance Top 200 Growth (Retail) mutual fund. My sip is Rs. 1000/- PM.

Should i continue with this Mutual fund?

Ajay-It is a multi cap fund and I am not sure about it’s performance than the above said two large and mid cap funds. Also, I am not sure about your tenure. So hard to guide you.

Dear Sir

i want to invest rs 15000/- per month what is best sip or mutual fund for 15 year.please suggest some best fund name.my age is 30 years.

Regards

Ashok

Ashok-They are already listed above.

Hello Sir,

I am currently investing in following funds.

1.UTI Retirement Benefit Pension Fund -2k/permonth

2.HDFC Balanced Fund – Direct Plan (G)-2k/permonth

3.PPF-2k/permonth

4. Reliance My Gold Plan – 2k/Per Month

Please review and provide your valuable suggestions. If I want to increase my sip amount another 2k,should I have to go for other funds or in which of the above funds I can increase SIP.

Also, i had invested around 48 K on KOTAK World GOLD FUND Direct Growth 4 Months back and sold them recently and got around 60K in return.

Could you please advice or show direction on where i can invest that 60K.

Thanks in advance.

Regards,

Praveen

Praveen-How you selected these funds? Any specific reasons?

Hello Sir,

1.UTI Retirement Benefit Pension Fund -2k/permonth

Was advised one of my relatives and have been insvesting 2k/Permonth since 6 Years. If it can be invested in others funds i would take your advise.

2.HDFC Balanced Fund – Direct Plan (G)-2k/permonth

Started investing in this fund since Feb’2016 after reading your post on TOP SIP to invest in 2016.

3.PPF-2k/permonth

Again was an advise of a friend. Investing 2k/per month since 1 year.

4. Reliance My Gold Plan – 2k/Per Month

I have a daughter of 4years, so thought of investing in GOLD from now on rather than buying large amounts later.

Also, i have doing an RD of 5K/per month for covering school fees every year.

I was monitoring Gold funds since 1 year and 6 months back the NAV became very low so took a risk and invested 48K in them. Now i recently sold them and got around 60K.

Your advise in this regard will be greatly appreciated.

Thanks & regards

Praveen

Praveen-First of all remove gold investments completely (Maximum I suggest around 10% of your overall investment). Define goals for each investment. Your friend will not be there when you actually need a cash for funding your goals. Whether your each investments attached with specific goals? I smell they are not.

Hi Basu,

I am investing money as follows ..Can you please suggest me some other investment plans also for saving money and get good returns

1000/- in HDFCmid cap.

1000/- in HDFC Balanced fund.

1000/- in ICICI bluechip.

2000/ in Sukanya sumrudhi.

(60000/- per annum) in HDFC/LIC insurance.

1000 in SBH RD.

1) Will U suggest me to invest 1000/- monthly in PPF Or Instead of PPF, Can i invest in some other mutual fund for 15 years?

2) Can i take any other insurance plan?

Karthik-I don’t know your financial goals. Then how can I guide you?

Please suggest some better schemes for the SIP for 5 – 10 years.

Abhishek-First be clear with your investment. There is a huge gap of 5 years between 5-10 yrs.

5 years.

Abhishek-No equity for your goal. Stay away.

Dear sir

I have recently invested in two SIPs. Rs 5000/- PM in SBI blue chip fund reg plan(G) and Rs 5000/- Pm in SBI Magnum Global fund -regular(G). My present inv plan is for more than 5 years. Pl enlighten on the followings:-

Whether both these funds are purely equity linked or otherwise.

Whether these are large cap, mid cap / short cap equity funds or balanced or debt fund

Have I selected good funds

Should I extend the periodicity of my inv plan for better returns.

What is a liquidity fund.

Further If my son aged 28 yrs intends to invest Rs 40000/- pm for a long term of min 10 yrs, what can be the four good funds for him including one for Tax savings.

Regards

NK Mittal

Narendra-How you blindly invested without knowing much about these funds? Also, be specific about your time frame to guide me in better way.

Hi,

I am a beginner in the MF world and planning to start SIP in the following funds for 15 years.

Birla Sunlife Frontline Equity Fund – 2K

HDFC Midcap Opportunity Fund- 1K

Please suggest.

Thanks

Bhaskar

Bhaskar-Where is your debt portion? Don’t invest all money in equity.

Hi Basavaraj,

Could you please suggest me a debt fund and also suggest if I it is good go with one chunk of the below amount in Birla Sunlife Frontline Equity Fund.

1. My age is 31.

2. Planning to invest 4000 per month.

3. Time Horizon is 15 years.

Thanks

Bhaskar

Bhaskar-You can opt for PPF or short term debt fund for your debt category of investment. Birla fund is good but along with that add one small and mid cap fund from above list.

Hi,

I am 24 now and thinking to invest 1000 each in below mentioned schemes as SIP for (5 years). Please suggest some better schemes apart from the below mentioned ones for (5 years duration).

1. Axis Long term Equity Fund

2. Franklin India Smaller Cos Fund

3. HDFC Balanced fund

4. HDFC Medium Term Opportunities Fund (G)

5. JPMorgan India Banking And PSU Debt Fund – Regular Plan (G)

6. L&T Short Term Opportunities Fund (G)

Abhishek-I not recommend any product if your timeframe is 5 years.

Hey,

I want to invest a sum of Rs 5000/-per month for a period of 25-30 years. Please suggest me in which SIP plans I will go for (Small Cap/Mid Cap or Large Cap).

Please provide the MF names.

Many Thanks

Dear Basu,

currently I am investing in below MF (SIP Rs. 2000 per month), please suggest if it is advisable to switch to other schemes. My time horizon is 5-7 years.

DSP BlackRock Small and Mid Cap Fund-Growth

DSP BlackRock Top 100 Equity-Growth

Franklin India High Growth Companies Fund GROWTH

HDFC TOP 200 FUND – DIVIDEND REINVESTMENT

ICICI Pru Focused Bluechip Equity Fund Reg Plan Growth

ICICI Prudential Value Discovery Fund Reg Plan – Growth

RELIANCE REGULAR SAVINGS EQUITY FUND – GROWTH OPTION

Devendra-One large cap like ICICI Bluechip Fund for around 40% and rest 60% in debt fund is enough. Your time horizon is short. So don’t over expose towards equity.

I wish to deposit 2000/- per month for one year in SIP and I need maximum earnings from it .

Can you please suggest the best one. I have very less knowledge in this.

Ranjini-SIP in Bank RD of one year. The BEST.

Thank you sir

Hi Basavaraj,

I have been investing monthly 2000/- in HDFC mid cap opportunity from past 1 year. Till now I have invested 23,000/- but the value now is 20,190.

It is showing some loss, So I want to stop this SIP.

Can u suggest me to stop this SIP?

Karthik-Whether you invested in this fund only for a one year time frame in mind? If YES, then please come out of equity at the earliest. This where we commit mistake.

Hi Basavaraj,

I want to invest money with the time frame of 7-8 years, Then it will be ok to continue in this HDFC mid cap fund?

Karthik-No small and mid cap for your timeframe.

Sir I have started Flexi SIP in the Mutual fund with least amount i.e. 1000 SIP / Month in few selected funds.

1. The reason I started with such low amount is to ensure I keep on paying the SIP monthly even if I do have financial crisis or other commitments in that particular month.

2. Flexi SIP, so that even If I fail to buy MF in any particular month no issues and my Fund continues.

3. When ever I want I can inject more amount in particular MF and Buy in the same portfolio number

Kindly advice weather such approach is good and am I loosing any extra amount or charges because of such approach.

Sachin-When it comes to investment, I love the forced systematic approach of investment than FLEXI.

Agreed ,Thanks

Hi,

I have few general questions?

Suppose, I’m investing 10k every month thro SIP equally divided in all categories

1) Is it prudent to change funds within the category every year because i found another better performing fund?

2) If i don’t want to sell the discontinued funds, then is it OK to have such large number of mutual funds in my portfolio. Are i have to sell those?

3) For eg. i am having HDFC Top 200 sip and i want to stop that and start Franklin Bluechip or ICICI Pru focussed. By changing funds frequently am i diminishing the wealth accumulation through compounding?

Gayathri-1) Not required and not possible too. The fund you invest now may not be badly ranked by rating portals. Also, no one can be in a position that the fund he/she invested MUST always remain 5 star rated. However, if the fund not performing consistently and under performing to it’s benchmark, then you have to take a call. But strictly not within a year or two.

2) It is purely your call to sell or hold. There are many ways to complicate life. But simple solution always leads to success.

3) Not at all. Because you are redeeming from one fund and investing in another. However, I still fan of HDFC Top 200.

Hi BasavaraJ,

I want to invest 10K per month in SIP. My investment plan is 15 years. Could you please suggest me a best Fund?

Regards,

Amar

Amar-They are already listed above.

Hi Basavaraj,

Yes, thanks for filtering out the top funds and for your quick response. The doubt that I have is, under non tax savers, which Fund category we have to choose? For example, if I wish to invest in Franklin, should I go for Large cap Fund or Large and Mid cap fund?

Appreciate your help and suggestion

Regards,

Amar

Amar-Your investment not all matters your taxation. You have to include one large cap and one small and mid cap. If possible add one large and mid cap. But make sure that equity:debt portion based on your timeframe.

Thank you Basavaraj. One more last question 🙂 – What is your view on Franklin India High Growth Companies Fund?

Amar-It is good multi cap fund as of now. But I suggest only when the fund go through all cycles of a market.

Hi Basu,

I started investing last year in SIP with below funds when NAV was @ this price. Each fund SIP of 2000 is investing monthly.

My Asset Allocation with NAVs purchasing time value:

Franklin India PRIMA PLUS GROWTH 450.719800

Franklin India Smaller Companies Fund – Growth 39.881900

HDFC BALANCED FUND – GROWTH 110.447000

UTI EQUITY FUND GROWTH 104.165600

UTI – MID CAP FUND -GROWTH 82.577500

My time horizon is minimum 8-10 years now all my funds are giving -ve returns should i switch/stop Or change the Asset/funds completely?

I want to reach 1 Crore how many i should wait with these funds to reach?

Your suggestion is very valuable to take my LIFE financial decision.

Best Regards

Manju-You just started investing and you claim to be investor of 8+ years, then why you are concentrating a year negative return?

Hello Basavraj,

I am sorry if it sounds stupid out of me to ask this kind of question.

Can one consider having Tax Savings Fund in the portfolio like any other pure MFs? Or should consider it as a separate entity? If separate, then for what goals it can be attributed to (say long-term goals), apart from just being a tax saving option, and what % returns one can expect vs. pure MFs?

Mahesh-You can consider tax saving funds for consideration while investing into equity. But keep in mind that such funds comes with lock-in of 3 years and also if your goal is long-term, then you can consider it. Many fail to understand that tax saving products are for long term. Also, they not align this investment with their long term goals.

Thank You Basavaraj.

As you have rightly pointed out, I wanted to be clear about its utility in my long-term goals, apart from just being a tax-saving component.

So, essentially it means that one can bet on this component while creating a portfolio for any of the long-term goals (say 10+ years), right? How much returns can be expected?

Mahesh-Yes, your understanding is correct. I assume around 10% to 12% return from equity investment if your time horizon is more than 10+ years.

Thanks a lot Basavaraj for the clarification.

Hi,

Iam 27 year old, currently Iam doing below mentioned investments:

1. Birla Sun Life Tax Relief 96 (G) – SIP – 2k

2. IDFC Tax Advantage (ELSS) Fund – Regular Plan (G) – SIP – 1k

3.Reliance Tax Saver (ELSS) Fund (D) – SIP- 2k

4. SBI Magnum Midcap Fund (G) – SIP – 1k

5. Franklin India High Growth Companies Fund (G) – SIP- 1K

6. LIC Rs. 52,500 pa

I have started investing since year only and my goal is to get good returns in 5-7 years. Please suggest me whether my current plan is correct and also suggest where else i can invest Rs. 2 K per month. I have to fulfill my 80 c criteria also.

regards

Bhardwaj

Bhardwaj-Why so many tax saving funds? Retain one. Also, if your investment period is 5-7 yeas, then don’t go beyond 50% of your total investable surplus towards equity. I am not sure about LIC. For me insurance means pure term plan.

Which fund should I buy

Axis Long Term Equity Fund or ICICI Pru Tax Plan

Wants to start an SIP

Please suggest best one

Vishal-Go through my earlier post “Top 5 Best ELSS or Tax Saving Mutual Funds to invest in 2016“.

I have SIP’s running of 2K each in three funds currently in Franklin India Prima fund and Franklin India high growth cos fund and HDFC Balanced Fund all growth options with time frame of 7 to 9 years. Are the existing funds okay and is it okay if I add a debt fund to these again with the same investment and time frame?

I have selected diversified Franklin funds keeping in mind portfolio overlap, that is around 28%.

Regards,

Manoj Tiwari

Manoj-Considering your timeframe, I suggest more to consider about large cap fund. Also restrict your equity to the maximum of 60%.

Hi,

I am 32 years old and planning to invest 10K per month in following funds for 15 years around.

Large Cap SBI Blue Chip 2k

Large And Mid Franklin INdia Prima Plus 2k

Small And Mid SBI Magnum Mid Cap Fund 2k

Balance Fund SBI Magnum Balance Fund 4k

I have sum LIC policy for family member where I am investing 100K per year. Please suggest me whether above funds combination is ok or not. And what would be the average returns for long term (15-20 years) if someone select the funds from each category as you mentioned. I know it’s hard to say but just a rough idea will be good.

Sarvesh-Funds are fine. But try to manage around 70:30 in equity:debt. Come out of those LIC products. They are low yielding products. You can expect around 10% to 12% return.

What do you think about sukanya samriddhi yojana? Is it worth to open my daughter’s (6 years old)account in this scheme. Gov is giving around 9.2% (current financial) ROI. Should I invest 50% of my debt here and rest in other debt.?

Sarvesh-It is politically motivated product. We don’t know the faith once the current Govt changes. Hence, I prefer PPF over this scheme.

thanks for answering..

does long term(10-15 years) investment in mutual funds comes under taxation or not?

Sarvesh-For debt fund long capital gain will be 20% with indexation (long term means 3 years or more). For equity mutual funds long-term capital gain is NIL (long term means more than a year).

above you mentioned to keep 70 -30 equity:debt ratio. Could you please suggest some debt funds?

Sarvesh-There is no specific fund. You can use PPF (if goal matches to it’s tenure), short term debt funds for managing it.

Hi Basu:

I have SIP 2500 Rs in UTI Mid cap fund Direct Growth from Nov 15. Should I continue this fund or not as fund manager has changed. I checked it on Value Research. If you advice to exit then please suggest other plan

Axis long Term Equity Fund Dirct Growth – Sip 2500 Rs.

Suggest one balanced fund for long term for wealth creation.

Mukul-Continue UTI and Axis. Balanced funds are listed above. Check it.

Sir,

Please share your views about current noise.

Regards,

NISHIKANT

Nishikant-You accepted it is NOISE right? 🙂 I say stay away from NOISE. Look at long term view.

Sir I want to invest in sip of sbi mutual funds from my pocket money .I invest 1000 per month plz suggest better scheme of sbi mutual funds

Pradeep-Without knowing your exact goal and timeframe, how can I guide you?

Time frame 25 to 30 years high risk means can digest capital loss in medium term to get 14 CAGR over the given time frame

Dear sir

I have SIP in following funds for past 6 months

Franklin high growth companies -2000

Franklin smaller companies -1500

Mirae emerging bluechip fluid-1500

All are regular plans with growth option.I also Have a one time investment of 140000(L&t Business cycle fund made in August 2014 at NFO and Mirae Tax saver fund 104000 made in December 2015 at NFO)

I want to know If any changes are to be made to my portfolio.Also weather shall i continue the lump sum investments in the above said plans.I am 30 years old and can take high risk for returns.

Regrads

Arun