There is a huge push for Tata AIA Life Guaranteed Return Insurance Plan. Is it worth investing in this product especially due to the falling interest rates?

In India, if someone wishes to sell a financial product, then they must come with two taglines. One is TAX BENEFIT and the second one is GUARANTEED return. Then no matter whatever may be the GUARANTEED, we flock to such products. Life Insurance companies are wisely using these tricks to garner their business.

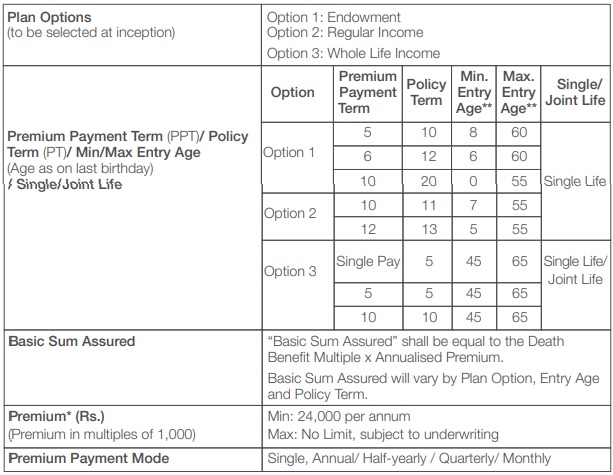

Tata AIA Life Guaranteed Return Insurance Plan Eligibility

Let us see the eligibility for Tata AIA Life Guaranteed Return Insurance Plan.

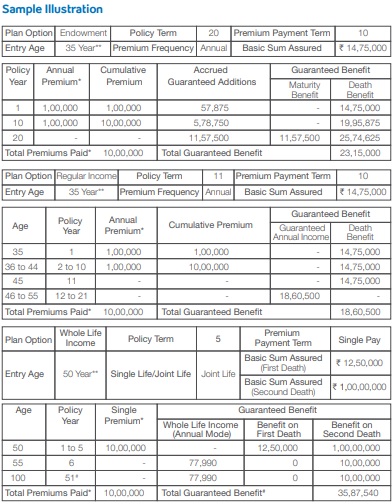

Tata AIA Life Guaranteed Return Insurance Plan illustration

Let me share with you the illustration explained in thier brochure.

Tata AIA Life Guaranteed Return Insurance Plan – Should you buy?

This is a typical endowment kind of a plan. It is exactly like how HDFC Life launched it’s product few days back (HDFC Life Sanchay Plus – A GUARANTEED TRAP!!).

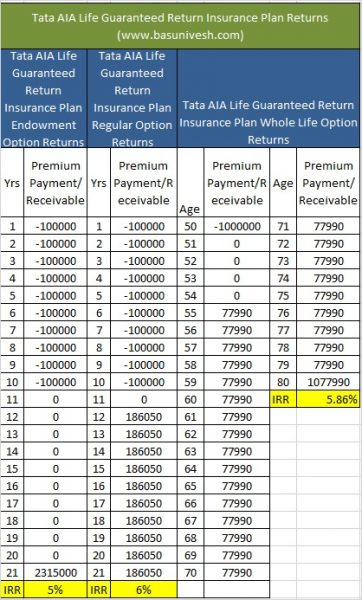

Let us see the returns from this product as per the illustration given above.

You noticed that for all the options, the returns are not more than 6%. Note:-For whole life plan, I expected the life expectancy of an individual up to 80 years. The returns may vary slightly based on the age of the buyer and his life expectancy.

Few points before you jump into buying this product:-

# As it is a typical endowment kind of product, your money will get locked and even though you have a surrender option, in many cases the value may be less than what you will get at maturity.

# Considering the current interest rate trend, this product may looks fantastic. However, rethink twice to lock in such long term product.

# Instead, I suggest you to opt for PMVVY or SCSS Schemes far better than this product.

# If you still feel 5% tax free (without bothering about liquidity), then you can consider this product.

# However, I feel compare to this, LIC’s Jeevan Shanti looks attractive to me.

Conclusion:-It looks attractive now with 5% guaranteed return and that also tax free. However, look at your actual requirement and act accordingly. Compared to this product, I feel PMVVY, SCSS or LIC’s Jeevan Shanti looks attractive (even though returns are taxable from these).

Recent posts:-

- NPS Tier 2 Vs Mutual Funds – Which is better to invest?

- How to start investing in Index Funds in India?

- Should you continue Sukanya Samriddhi Yojana after becoming NRI?

- What happens to unclaimed Bank Savings Accounts and Deposits?

- SIP Vs SWP Mutual Funds – Which is better in India?

- Post Office Small Savings Scheme Interest Rate Oct – Dec 2024

Sir thanks for the analysis. In the end you wrote that LIC Jeevan Shanti is better, could you please share why you think so….

Dear Nikhil,

Jeevan Shanti offers better options than this plan.

Dear Basu

Dear Basu

I always make it a point to read your blog and as far as possible I follow your advise and try to implement them.

Please write a blog differentiating between MEDICLAIM POLICY and HEALTH INSURANCE POLICY; which is better?

Thanks.

RK Bhuwalka

Dear Bhuwalka,

Sure.