Many of us are now investing in NPS. But are we aware NPS returns for the year 2016? Who is the best NPS Fund Manager according to the performance report? Let us understand this in detail.

Note-I have updated the latest NPS Returns for 2017 in my blog post “NPS Returns for 2017 – Who is best NPS Fund Manager?“.

What is Scheme Preference in NPS Account

In NPS, there are two types of options available to create your portfolio. They are as below. Remember this scheme preference is not available for Government Employees Tier 1 Account Type. However, they have the freedom to choose scheme preference in their Tier 2 account. For rest of all investors, you have an option to choose scheme preference.

# Active choice – You will decide on the asset classes in which the contributed funds are to be invested and their percentages (Asset class E-Maximum of 50%, Asset Class C, and Asset Class G ).

# Auto choice – Lifecycle Fund– This is the default option under NPS and wherein the management of investment of funds is done automatically based on the age profile of the subscriber. At the age of 18 years, the auto choice will invest 50% of pension wealth in E Class, 30% in C Class and 20% in G-Class. These ratios of investment will remain fixed for all contributions until the participant reaches the age of 36 yrs. From age 36 yrs onwards, the weight in E and C asset class will decrease annually and the weight in G class will increase annually till it reaches 10% in E, 10% in C and 80% in G class at age 55 yrs.

At the age of 18 years, the auto choice will invest 50% of pension wealth in E Class, 30% in C Class and 20% in G-Class. These ratios of investment will remain fixed for all contributions until the participant reaches the age of 36 yrs. From age 36 yrs onwards, the weight in E and C asset class will decrease annually and the weight in G class will increase annually till it reaches 10% in E, 10% in C and 80% in G class at age 55 yrs.

Such changes will be done on the birth date of the subscriber. Such changes can be done once in a financial year.

What are the types of funds available in NPS?

There are three types of NPS funds available. They are as below.

- Asset class E : Invest in equity market instruments. This is the riskier asset class among all three.

- Asset class G : Invest in fixed income instruments. The best example of this is central government bond. This is the secured among all three.

- Asset class C : Invest in fixed income instruments. Examples of these are bonds issued by firms or companies. this neither risky like Asset Class E nor safe like Asset Class G.

What are the NPS returns for 2016?

Now let us see what are the returns of NPS for the year 2016. I am updating this information as of 31st August, 2016. I will change it for the next part of the year as and when PFRDA publish it.

NPS Tier 1 Scheme E Returns for 2016

Below is the chart of the same.

You notice that for 3 years returns, UTI (19.78%), ICICI (19.72%) and Kotak (19.41%) performed well. Whereas SBI (19.35%), HDFC (19.12%), Reliance (18.70%) and LIC (15.26%) are laggers. Among all these UTI is best and LIC is the worst performer.

You notice that for 5 years returns, ICICI (14.15%), SBI (14.11%), UTI (14.06%) are performed well. Whereas Kotak (13.92%) and Reliance (13.53%) are lagging behind. LIC and HDFC launched in 2013. Hence, we don’t have 5 years performance data.

NPS Tier 1 Scheme C Returns for 2016

Below is the chart of the same.

You notice that for 3 years returns ICICI (13.37%), Kotak (13.10%) and SBI (12.93%) were performed well. Whereas Reliance (12.81%) UTI (12.71%), HDFC (12.59%) and LIC (12.52%) are lagging behind.

You notice that for 5 years returns leaders are ICICI (11.98%), Kotak (11.78%) and SBI (11.60%). Whereas Reliance (11.51%) and UTI (10%) are lagging behind. LIC and HDFC launched in 2013. Hence, we don’t have 5 years performance data.

NPS Tier 1 Scheme G Returns for 2016

Below is the chart of the same.

You notice that for 3 years returns, SBI (14.66%), Reliance (14.53%) and ICICI (14.37%) are leading performers. Whereas LIC (14.24%), Kotak (14.23%), UTI (14.21%) and HDFC (13.86%) are lagging performers.

You notice that for 5 years returns leaders are ICICI (11.27%), Reliance (11.12%) and Kotak (11.05%). Whereas SBI (10.92%) and UTI (10.73%) are lagging performers. LIC and HDFC launched in 2013. Hence, we don’t have 5 years performance data.

NPS Tier 2 Scheme E Returns for 2016

Below is the chart of the same.

You notice that for 3 years returns, UTI (20.21%), ICICI (19.62%) and SBI (19.44%) are the leading performers. Whereas Kotak (19.08%), Reliance (18.77%), HDFC (12.43%) and LIC (8.52%) are lagging performers.

You notice that for 5 years returns, SBI (14%), Kotak (13.9%) and ICICI (13.87%) are the leading performers. Whereas UTI (13.82%) and Reliance (13.55%) are lagging performers. LIC and HDFC launched in 2013. Hence, we don’t have 5 years performance data.

NPS Tier 2 Scheme C Returns for 2016

Below is the chart of the same.

You notice that for 3 years returns, ICICI (13.16%), SBI (12.86%), Reliance (12.71%) and UTI (12.7%) are best performers. Whereas Kotak (12.66%), LIC (10.79%) and HDFC (10.34%) are lagging performers.

You notice that for 5 years returns, ICICI (11.65%), Kotak (11.03%) and UTI (11%) are best performers. Whereas SBI (10.86%) and Reliance (10.76%) are lagging performers. LIC and HDFC launched in 2013. Hence, we don’t have 5 years performance data.

NPS Tier 2 Scheme G Returns for 2016

Below is the chart of the same.

You notice that for 3 years returns, SBI (14.56%), Reliance (14.51%), UTI (14.39%) and ICICI (14.38%) are the leading performers. Whereas LIC (14.26%), Kotak (14.13%) and HDFC (14.04%) are lagging performers.

You notice that for 5 years returns, ICICI (11.43%%), Reliance (11.23%) and Kotak (10.88%) are best performers. Whereas SBI (10.86%) and UTI (10.71%) are lagging performers. LIC and HDFC launched in 2013. Hence, we don’t have 5 years performance data.

Who is the best NPS Fund Manager?

In above charts we the NPS returns for the year 2016 (as on 31st August, 2016). Now based on those performance returns, who is the best NPS Fund Manager? To identify the best NPS fund manager, I considered last 3 years returns of each scheme. I purposely avoided 5 years returns as two funds not yet completed 5 years.

Also, to arrive at the decision of who is best NPS fund manager, I calculated the standard deviation of 3 years values of each fund manager. The lowest standard deviation provider in my view is best. Standard deviation is a tool to calculate the volatility in returns. Lower the volatility means lower the standard deviation. I prefer the lower standard deviation product compromising on returns part.

Best NPS Fund Manager in Tier 1 Scheme E

Below is the chart of the same.

Notice that LIC’s last 3 years returns is lowest among all. However, look at the standard deviation of LIC. It is just 4.42. Less volatile in nature compare to other fund managers. However, ICICI’s standard deviation is 6.24. But compare to the volatility it has not given the highest return. The highest return provider is UTI but not the ICICI.

So my first choice of best NPS Fund Manager in the case of Tier 1 Scheme E goes to UTI. Reason is it provided the highest average returns for last 3 years with lower deviation compare to other peers (except LIC). I avoided LIC, because even though the standard deviation is low but returns also low. However, UTI looks slightly volatile but delivered the highest average return.

Best NPS Fund Manager in Tier 1 Scheme C

Below is the chart of the same.

In this category, I go with Reliance Fund Manger. The returns are quite good compared to others with lowest standard deviation.

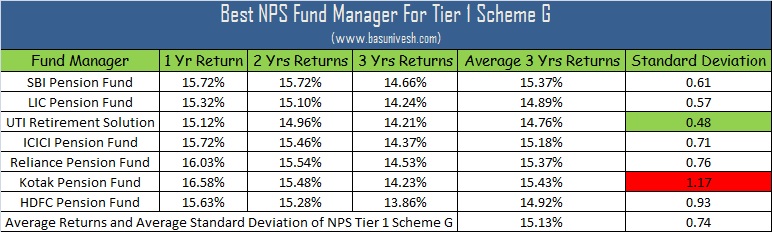

Best NPS Fund Manager in Tier 1 Scheme G

Below is the chart of the same.

Looking at returns and standard deviation, I prefer either UTI or LIC rather than anyone else in this category.

Have you noticed one thing? What I said is Scheme E is highest volatile and then comes Scheme C lesser than Scheme E. Lowest volatile is Scheme G. However, when you look at the returns, Scheme G provided the highest returns. It is all because of these funds holding long term maturity bonds and falling interest rate cycle.

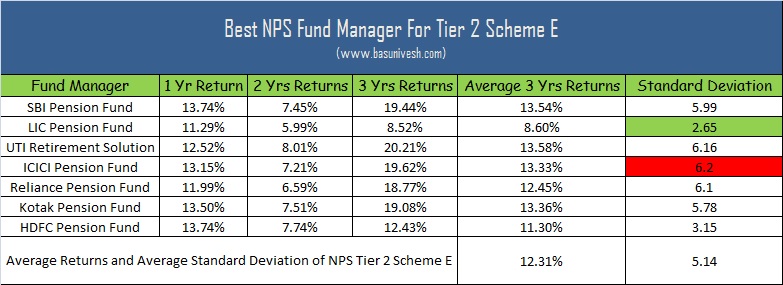

Best NPS Fund Manager in Tier 2 Scheme E

Below is the chart of the same.

Even though LIC’s standard deviation is low (2.65), I will not go with it because the returns are pathetic compared to other funds. Hence, my choice is HDFC with 3 years returns of 12.43%.

Best NPS Fund Manager in Tier 2 Scheme C

Below is the chart of the same.

Obviously, my choice is Kotak as the standard deviation is low with best returns of 3 years as 12.66%.

Best NPS Fund Manager in Tier 2 Scheme G

Below is the chart of the same.

In this category, my choice is UTI with moderate risk and best performance.

Conclusion-You can’t generalize and say which is best NPS Fund Manger. Because there are two variants called Tier 1 and Tier 2. Within these variants, you have three types of funds based on asset class. Hence, choose the pension fund manager based on the asset you opted rather than generalizing.

Hi Basavaraj,

Its great article. Thanks for un-biased articles.

I’ve a query regarding NPS FMC.

How to choose different Fund manager for each asset class (E, C, G, A ). In eNPS portal, I could see option to change FMC only once and it is by default applied for all asset class.

Can you please explain the same?

Dear Reddy, I think to apply for changing Fund Manager, you have to do so physically submitting the same in PFRDA POS.

I’m a Central Govt employee, salary 70 K and 9K per month NPS deduction this per month deduction amount shall increase atleast 6 to 7% per year. Is it enough for post retirement stable life or shall I invest somewhere else. If so, then plz suggest some investment destinations. I have HBL with 21 K EMI for 13 Years.

Regards,

My age is 28 and I already have accumulated Rs.720000 in my NPS A/c. Financial requirement after retirement:- live a status quo life style…

Sourav-Whether this much is enough or not depends on many many many things. These things I don’t know about you. Hence, it is hard for me to say anything blindly.

HI, Thanks for your work. I am a State Govt Employee and I am already investing via CPS. I have a PPF account and investing Rs: 48000 per year. Now I am planning to open a NPS account to invest Rs: 12000 per year.

1. Is It good to invest in NPS?

2. Which fund manager should I select?

3. If you suggest me to invest somewhere else, where would it be?

Sorry I did not say my age. I am 33 years old

Chaithanya-Why you want to start NPS?

Hi, Thanks for a quick reply.

1. I am thinking to save some tax. As this comes under Section 80CCD.

2. As this is a auto debit scheme from my savings account, I can restrict my self to save Rs: 6000 per year

3. If this gives good returns, it will be useful after my retirement.

I am totally unaware of money saving methods. One of my friend suggested me this NPS.

Chaitanya-Do your main purpose of investing is for achieving your financial goals or saving tax? Do you know NPS not provide you pension but you to buy it from Life Insurance companies? Do you know such pension is taxable income when you are in retirement? Think and decide.

Hello sir

I am 30+ , I invest in ppf account 1.5lakh for tax saving . Also 824 rs invest monthly in APY , I want save tax upto rs 2lakh, 8c or 80ccd(1).Is thos full fill .

Still I want 20k invest somewhere , what is your guidance . I am working in a private firm .

Hitesh-Without knowing much about your financial goals, it is hard for me to guide.

Very informative and straight forwards.

Thanks for the post. Looking for more.

Hi Basu,

Thanks for the informative article. As is evident, it is helpful to so many people. Few points of contention though:

1. Suggest that we use the term “relative laggers” instead of “laggers” for funds returning 19.xx% and 18.xx%. Not bad numbers per se.

2. I don’t fully understand why Standard deviation takes precedence over returns. Yes, stability of returns is important, but is it more important than returns ?

3. In fact, why go for 3 year returns in the first place – just to accommodate HDFC and LIC! That doesn’t look right to me. In fact, performance of less than 5 years should be ignored, and hence only other funds should have been considered, since we are talking about contributions into equity also.

4. Lastly, on the taxation of NPS. While it is true that the corpus is going to be taxed (as per today’s situation), it is important not to miss that the contributions are not taxed. So, for a person in 30.9% tax bracket, out of 50k, 16.5k is already in hand, thereby making the effective “spend” only 33.5k. When viewed this way, the returns look far better than the pure XIRR’s that we compute. This is also true for EPF, but the numbers are bigger here.

Vasudevan-1) Difference of 1% does not matter?

2) Standard deviation not criteria but only returns?? What if the product offers you HIGH RETURN at the cost of HIGH DEVIATION, then is it BEST for you?

3) I agree. But just for the performance, I showed it.

4) Rs.16,500 saved and in HAND. But what if the same saved is not invested? EPF offers tax benefit while investing and also taxation is not like NPS while withdrawing. Hence, don’t compare both. NPS is a terrible product.

1. It is not about the difference. But a fund returning 18.xx% is more a relative lagger, not exactly a laggard.

2. Haven’t said that SD is not a criterion, but just that returns are the key here. The primary criterion should be returns closely followed by consistency (SD). Consistency without performance is nothing.

4.If the Rs.16500 saved is not invested or utilized properly, then its not NPS’s fault! It just leaves a higher amount at the hands of the investor initially. The annuity returns are poor and taxable, but the kicker it gives to retirement savings for 20 years or so should leave it in good stead vs plain EPF.

Vasudevan-1) But still 1% is to me lagger and the difference over long term gives huge gap.

2) We use consistency when there is performance.

4) The fault of not NPS, but the fault of definitely those investors who invest in NPS only for the sake of TAX SAVING. Kicker of taxation will kick us to have less corpus available for retirement.

Hello Mr. Basu,

I came to know that NPS ratio now got changed we can invest up to 80% in Equity Portion now.

Is this Correct?

Regards

Paritosh-May I know the source?

I read a article in value research mutual fund magazine. Which says that now we can actively invest in equity upto 80%.

I will share the page shortly.

Basu, below is the notification.

http://www.pfrda.org.in/WriteReadData/Links/LC%2075%20and%20LC%2025d78e41ac-0f61-47e0-9a21-3663cbfc8c75.pdf

Sreekanth-Thanks for sharing this.

That increased equity exposure you mentioned is available only to government subscribers.

Really this is a unfair act by nps authorities.

Parithosh – PFRDA gave a guidance to make it applicable to all subscribers. But it is the POPs who didn’t make it ready even now. Once the POPs are ready, it would be available to private subscribers too. I’m not aware any POP that’s accommodating this new category as of now.

Sreekanth-Thanks for the updates.

Hi Basav,

I started NPS [ICICI ] last year to claim the Tax exemption under 80 CCD , and I think it is mandatory to invest atleast 6000 every year. Going forward, what do you suggest.

1. Just pay the minimum to continue in the plan and invest remaining in equity MFs. [ I already have few Mfs]

2. Continue with NPS to claim the max tax benefits and view it as only retirement corpus.

Thanks,

Naresh

Naresh-I am not fond of NPS or the idea of investing to save tax.

Excellent article, clears the air by driving the point statistically.

Thanks for this analysis.

I am in tax slab of 20%, already 80C limit is reached,

should i invest in NPS or suggest other alternatives to save TAX and with returns,

Thanks,

Hanmant Kattimani,

Hanmant-For you saving tax is important or reaching your financial goals?

hi, iam in my early forties and a self employed professional. I am planning to invest in NPS with the aim of building a retirement fund by the time i am 60. Which would be best option to invest? tier 1 or tier 2.

Do you think it would be wise to invest upto 50k/pa in tier 1 to get 80CCC benifit and rest in tier2?

Satish-Do you think NPS a great retirement product?

which according to you is the best product/group of products?. I can invest upto 30k per month towards building retirement fund. Tax saving is not a concern. I am looking over 16-18 yrs period.

Satish-Equity and Debt Mutual Funds.

Hi Basu,

I am 33 years old and working in IT company. If I opt this plan I have to be stick on NPS till my age is 60 (27 years). Do you think this plan can generate a good amount for my retirement or better can invest the same amount in mutual funds.

I am salary is 10 lacs p.a. Could you please advise to me on this.

Thanks in advance.

Vinod-I personally avoid product which comes with lock-in and no control over my money.

Hi, I’m investing in NPS for 2yrs now and I’m employee of a corporate company. After reading the article I’m able to understand how this works and where my money is invested. Very Informative, thanks. Can you help me out which fund manager I should change to in 2017. Mine is Auto choice and invested all funds on HDFC Pension Funds.

Nagaraj-There is hardly major difference in fund manager performance (if you see above data). However, you are free to choose the fund manager based on above data.

Hi Basavaraj,

I am curious about how you have calculated the standard deviation for the schemes. Also, we have to consider how the market is behaving. Do you think beta is an important parameter ? I am just firing in the dark here.

Ankit-Calculating STD is not a big deal. You have enough online tools available and also formula to do that. Here my concentration is on STD only just to show the BEST. If you dig deep then there are many more judging tools which makes you MAD.

Hi Basu,

I have started reading your articles few months back and they are very informative. You are really doing a great job 🙂

I just wanted to ask one question. Is it advisable to invest in NPS? I am investing little little in equities in every month and I already have PPF account for my wife and Sukanya account for my daughter.

Regards,

Ashish Jindal

Ashish-Stay away.

As always great post Basu

Thanks

Ravindra-Thanks 🙂

Dear Basav,

Great article,retrieving the NPS returns from public forum is quite difficult. Great work.

As per above article NPS Tier 1 Scheme E Returns for 2016

“You notice that for 3 years returns, UTI (19.78%), ICICI (19.72%) and Reliance (18.70%) performed well. Whereas Kotak (19.41%), SBI (19.35%), HDFC (19.12%) and LIC (15.26%) are laggers. Among all these UTI is best and LIC is the worst performer.”

In above Kotak,SBI and HDFC has given much better results than Reliance then why they are termed laggers.Is there any criteria which decides the same.

Nagamohan-Sorry for this type error. I corrected it. But view the results by comparing the deviation, which I explained at the later stage of the post.

Good work basu as always.but if a guys like me who are in mid thirty can invest 2 tenure of 15 years each in PPF as a debt portfolio & continue mutual fund way to invest in equity can generate more corpus than NPS at retirement age assuming average return from both. If you can provide the analysis of comparison in your analytic way will be great.because NPS retirement kitty is taxable

Vinod-I understand your inputs. But here my point is just to give the returns and show who is the best fund manager of NPS. Anyhow I will do that analysis in my upcoming post. NPS kills your tax at the time of retirement, which only a few like you understand. Also, the biggest concern is liquidity.

Dear Basav

Awesome analytical patience u shown in this post.

Shivani-Thanks for your patience in appreciating my good work 🙂

Excellent analysis. Also, the article gives meaningful conclusion who may use it as a starting point.

Sreekanth-Your first appreciation 🙂 It values me more than anything. Thanks once again.