Find the complete list of sovereign gold bonds in India from 2015 to 2023 with price history in one place here. The list provides the issue details, issue date, maturity year, and issue price.

Sovereign gold bonds turned out to be most popular among many Indians. Considering the affection for gold, the government of India started this product in 2015. The Bonds shall be issued in the form of Government of India Stock in accordance with section 3 of the Government Securities Act, 2006. The investors will be issued a Holding Certificate (Form C). The Bonds shall be eligible for conversion into de-mat form.

Before you make a decision to buy or invest in Sovereign Gold Bonds (either of old issues or new issues), have a look at all the articles I have written on gold.

- Can we beat inflation by investing in Gold?

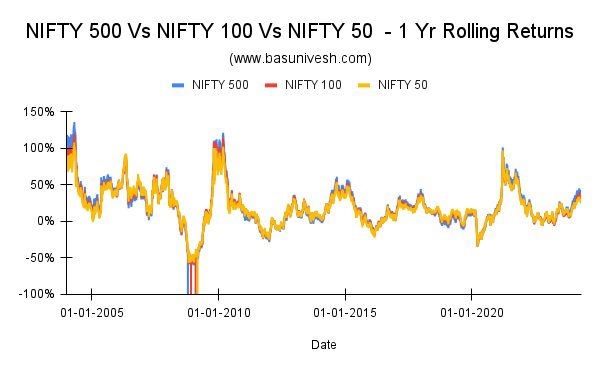

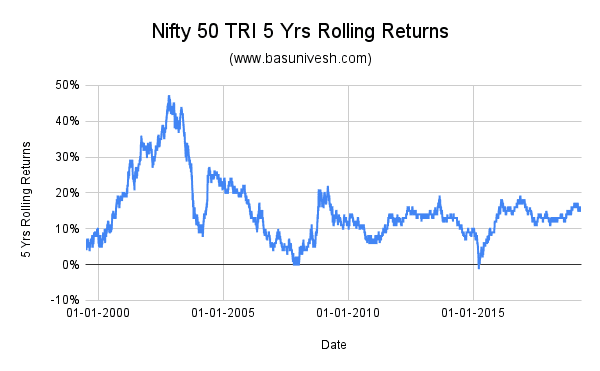

- Nifty 50 Vs Gold – Which is the best investment?

- Yield To Maturity of Sovereign Gold Bond – Misguiding Concept!!

- Sovereign Gold Bond Returns – How much can you expect?

- Gold Volatility – Based on 43 Years of History

- Taxation of Sovereign Gold Bond 2023

- Gold Price of Rs.18.75 in 1925 to Rs.47000 in 2020 – Should you invest?

Features of Sovereign Gold Bond

# Who can invest?

Resident Indian entities including individuals (in his capacity as such individual, or on behalf of a minor child, or jointly with any other individual.), HUFs, Trusts, Universities, and Charitable Institutions can invest in such bonds.

Hence, NRIs are not allowed to participate in the Sovereign Gold Bond Scheme.

# Tenure of the Bond

The tenor of the Bond will be for a period of 8 years with an exit option from the 5th year to be exercised on the interest payment dates.

Hence, after the 5 years onward you can redeem it on the 6th, 7th, or at maturity of the 8th year. Before that, you can’t redeem.

RBI/depository shall inform the investor of the date of maturity of the Bond one month before its maturity.

# Minimum and Maximum investment

You have to purchase a minimum of 1 gram of gold. The maximum amount subscribed by an entity will not be more than 4 kgs per person per fiscal year (April) for individuals and HUF and 20 kg for trusts and similar entities notified by the government from time to time per fiscal year (April – March).

In the case of joint holding, the investment limit of 4 kg will be applied to the first applicant only. The annual ceiling will include bonds subscribed under different tranches during initial issuance by the Government and those purchased from the secondary market.

The ceiling on investment will not include the holdings as collateral by banks and other Financial Institutions.

#Interest Rate

You will receive a fixed interest rate of 2.50% per annum payable semi-annually on the nominal value. Such interest rate is on the value of money you invested initially but not on the bond value as on the date of interest payout.

Interest will be credited directly to your account which you shared while investing.

# Issue Price

The price of SGB will be fixed in Indian Rupees on the basis of a simple average of closing price of gold of 999 purity, published by the India Bullion and Jewellers Association Limited (IBJA) for the last three working days of the week preceding the subscription period. The issue price of the SGBs will be less by Rs.50 per gram for the investors who subscribe online and pay through digital mode.

# Payment Option

Payment shall be accepted in Indian Rupees through cash up to a maximum of Rs.20,000/- or Demand Drafts or Cheque or Electronic banking. Where payment is made through cheque or demand draft, the same shall be drawn in favor of receiving an office.

# Issuance Form

The Gold bonds will be issued as Government of India Stock under the GS Act, 2006. The investors will be issued a Holding Certificate for the same. The Bonds are eligible for conversion into Demat form.

# Where to buy Sovereign Gold Bond?

Bonds will be sold through banks, Stock Holding Corporation of India Limited (SHCIL), designated Post Offices (as may be notified), and recognized stock exchanges viz., National Stock Exchange of India Limited and Bombay Stock Exchange, either directly or through agents.

Click HERE to find out the list of banks to Sovereign Gold Bond Scheme.

# Loan against Bonds

The Bonds may be used as collateral for loans. The Loan to Value ratio will be applicable to ordinary gold loans mandated by the RBI from time to time. The lien on the Bonds shall be marked in the depository by the authorized banks. The loan against SGBs would be subject to the decision of the lending bank/institution, and cannot be inferred as a matter of right by the SGB holder.

# Liquidity of the Bond

As I pointed out above, after the 5th year onwards you can redeem the bond in the 6th or 7th year. However, the bond is available to sell in the secondary market (stock exchange) on a date as notified by the RBI.

Hence, you have two options. You can redeem it in the 6th or 7th year or sell it secondary market after the notification of RBI.

Do remember that the redemption price will be in Indian Rupees based on the previous week’s (Monday-Friday) simple average of the closing price of gold of 999 purity published by IBJA.

# Nomination

You can nominate or change the nominee at any point in time by using Form D and Form E. An individual Non – resident Indian may get the security transferred in his name on account of his being a nominee of a deceased investor provided that:

- The non-resident investor shall need to hold the security till early redemption or till maturity, and

- the interest and maturity proceeds of the investment shall not be repatriable.

# Transferability

The Bonds shall be transferable by execution of an Instrument of transfer as in Form ‘F’, in accordance with the provisions of the Government Securities Act, 2006 (38 of 2006) and the Government Securities Regulations, 2007, published in part 6, Section 4 of the Gazette of India dated December 1, 2007.

# Redemption

As I explained above, you have the option to redeem only on the 6th, 7th, and 8th year (automatic and end of bond tenure). Hence, there are two methods one can redeem Sovereign Gold Bonds. Explaining both below.

a) At the maturity of the 8th year-The investor will be informed one month before maturity regarding the ensuing maturity of the bond. On the completion of the 8th year, both interest and redemption proceeds will be credited to the bank account provided by the customer at the time of buying the bond.

In case there are changes in any details, such as account number, or email IDs, then the investor must inform the bank/SHCIL/PO promptly.

b) Redemption before maturity – If you plan to redeem before maturity i.e. 8th year, then you can exercise this option on the 6th or 7th year.

You have to approach the concerned bank/SHCIL offices/Post Office/agent 30 days before the coupon payment date. Request for premature redemption can only be entertained if the investor approaches the concerned bank/post office at least one day before the coupon payment date. The proceeds will be credited to the customer’s bank account provided at the time of applying for the bond.

# Taxation

There are three aspects of taxation. Let us see one by one.

1) Interest Income-The semi-annual interest income will be taxable income for you. Hence, For someone in the 10%, 20%, or 30% tax bracket, the post-tax return comes to 2.25%, 2%, and 1.75% respectively. This income you have to show under the head of “Income from Other Sources” and have to pay the tax accordingly (exactly like your Bank FDs).

2) Redemption of Bond-As I said above, after the 5th year onward you are eligible to redeem it on the 6th,7th, and 8th year (last year). Let us assume at the time of investment, the bond price is Rs.2,500 and at the time of redemption, the bond price is Rs.3,000. Then you will end up with a profit of Rs.500. Such capital gain arising due to redemption by an individual is exempted from tax.

3) Selling in the secondary market of the Stock Exchange-There is one more taxation that may arise. Let us assume you buy today the Sovereign Gold Bond Scheme 2023-24 Series I and sell it on the stock exchange after a year or so. In such a situation, any profit or loss from such a transaction will be considered as a capital gain.

Hence, if these bonds are sold in the secondary market before maturity, then there are two possibilities.

# Before 3 years-If you sell the bonds within three years and if there is any capital gain, such capital gain will be taxed as per your tax slab.

# After 3 years – If you sell the bonds after 3 years but before maturity, then such capital gain will be taxed at 20% with indexation.

There is no concept of TDS. Hence, it is the responsibility of investors to pay the tax as per the rules mentioned above.

# Whom to approach in case of any issues?

The issuing banks/SHCIL offices/Post Offices/agents through which these securities have been purchased will provide other customer services such as change of address, early redemption, nomination, grievance redressal, transfer applications, etc.

Along with this, a dedicated e-mail has been created by the Reserve Bank of India to receive queries from members of the public on Sovereign Gold Bonds. Investors can mail their queries to this email id. Below is the e-mail id

RBI Email ID in case of Sovereign Gold Bonds-[email protected]

Advantages of the Sovereign Gold Bond Scheme

# After the GST entry, this Sovereign Gold Bond may be advantageous over physical Gold coins or bars. This product will not come under GST taxation. However, in the case of Gold coins and bars, earlier the VAT was at 1% to 1.2%, which is now raised to 3%.

# If you hold it till maturity or redeem it as and when the bonds are eligible, then the gain is tax-free.

# If your main purpose is to invest in gold, then apart from the physical form, investing in ETF or in Gold Funds, seems to be a better option. Because you do not need to worry about physical safekeeping, no fund charges (like ETF or Gold Funds) and the Demat account is not mandatory.

# In Sovereign Gold Bond, the additional benefit apart from the typical physical or paper gold investment is the annual interest payment on the money you invested.

Hence, there are two types of income possibilities. One is interest income from the investment and the second is price appreciation (if we are positive on gold). Hence, along with price appreciation, you will receive interest income also.

But do remember that such interest income is taxable. Also, to avoid tax, you have to redeem it only on the 6th, 7th, or 8th year. If you sell in the secondary market, then such gain or loss will be taxed as per capital tax gain rules.

# There is no TDS from the gain. Hence, you do not need to worry about the TDS part like Bank FDs.

# A sovereign guarantee of the Government of India will make you SAFE.

Disadvantages of the Sovereign Gold Bond Scheme

# If you are planning to invest in your physical usage after 8 years, then simply stay away from this. Because Gold is an asset, which gives you volatility like the stock market but the returns of your debt products like Bank FDs or PPF.

# The key point to understand is also that the interest income of 2.5% is on the initial bond purchase amount but not the yearly bond value. Hence, let us say you invested Rs.2,500, then they pay interest of 2.5% on Rs.2,500 only even though the price of gold moved up and the value of such investment is Rs.3,000.

# Liquidity is the biggest concern. Your money will be locked for 5 years. Also, redemption is available only once a year after 5th year.

In case you want to liquidate in a secondary market, then it is hard to find the right price, and capital gain tax may ruin your investment.

# Sovereign guarantee of the Government of India may feel you secure. However, the redemption amount is purely based on the price movement of the gold. Hence, if there is a fall in the gold price, then you will get that discounted price only. The only guarantee here is a 2.5% return on your invested amount and NO DEFAULT RISK.

List of Sovereign Gold Bonds in India 2015 – 2023

Below is the complete list of Sovereign Gold Bonds in India 2015 – 2023. I have provided the NSE Code, issue details, issue date, maturity date, and issued price.

| List of Sovereign Gold Bonds in India 2015 – 2023 (www.basunivesh.com) | ||||

| NSE Code | Bond Details | Issue Date | Maturity Date | Issued Price |

| SGBSEP31II | Sovereign Gold Bonds 2023-24-Series-II | 20th Sep 2023 | Sep-2031 | 5873 |

| SGBJUN31I | Sovereign Gold Bonds 2023-24-Series-I | 27th Jun 2023 | June-2031 | 5876 |

| SGBMAR31IV | Sovereign Gold Bonds 2022-23-Series-IV | 14th Mar 2023 | Mar-2031 | 5561 |

| SGBDE30III | Sovereign Gold Bonds 2022-23-Series-III | 27th Dec 2022 | Dec-2030 | 5359 |

| SGBAUG30 | Sovereign Gold Bonds 2022-23-Series-II | 30th Aug 2022 | Aug-2030 | 5147 |

| SGBJUN30 | Sovereign Gold Bonds 2022-23-Series-I | 28th Jun 2022 | Jun-2030 | 5041 |

| SGBMAR30X | Sovereign Gold Bonds 2021-22-Series-X | 8th Mar 2022 | Mar-2030 | 5059 |

| SGBJAN30IX | Sovereign Gold Bonds 2021-22-Series-IX | 18th Jan 2022 | Jan-2030 | 4736 |

| SGBD29VIII | Sovereign Gold Bonds 2021-22-Series-VIII | 7th Dec 2021 | Dec-2029 | 4741 |

| SGBNV29VII | Sovereign Gold Bonds 2021-22-Series-VII | 2nd Nov 2021 | Oct-2029 | 4711 |

| SGBSEP29VI | Sovereign Gold Bonds 2021-22-Series-VI | 7th Sep 2021 | Sep-2029 | 4682 |

| SGBAUG29V | Sovereign Gold Bonds 2021-22-Series-V | 17th Aug 2021 | Aug-2029 | 4740 |

| SGBJUL29IV | Sovereign Gold Bonds 2021-22-Series-IV | 20th Jul 2021 | Jul-2029 | 4757 |

| SGBJU29III | Sovereign Gold Bonds 2021-22-Series-III | 8th Jun 2021 | Jun-2029 | 4839 |

| SGBJUN29II | Sovereign Gold Bonds 2021-22-Series-II | 1st Jun 2021 | Jun-2029 | 4792 |

| SGBMAY29I | Sovereign Gold Bonds 2021-22-Series-I | 25th May 2021 | May-2029 | 4727 |

| SGBMR29XII | Sovereign Gold Bonds 2020-21-Series-XII | 9th Mar 2021 | Mar-2029 | 4612 |

| SGBFEB29XI | Sovereign Gold Bonds 2020-21-Series-XI | 9th Feb 2021 | Feb-2029 | 4862 |

| SGBJAN29X | Sovereign Gold Bonds 2020-21-Series-X | 19th Jan 2021 | Jan-2029 | 5054 |

| SGBJAN29IX | Sovereign Gold Bonds 2020-21-Series-IX | 5th Jan 2021 | Jan-2029 | 4950 |

| SGBN28VIII | Sovereign Gold Bonds 2020-21-Series-VIII | 18th Nov 2020 | Nov-2028 | 5127 |

| SGBOC28VII | Sovereign Gold Bonds 2020-21-Series-VII | 20th Oct 2020 | Oct-2028 | 5001 |

| SGBSEP28VI | Sovereign Gold Bonds 2020-21-Series-VI | 8th Sep 2020 | Sep-2028 | 5067 |

| SGBAUG28V | Sovereign Gold Bonds 2020-21-Series-V | 11th Aug 2020 | Aug-2028 | 5284 |

| SGBJUL28IV | Sovereign Gold Bonds 2020-21-Series-IV | 14th Jul 2020 | Jul-2028 | 4802 |

| SGBJUN28 | Sovereign Gold Bonds 2020-21-Series-III | 16th Jun 2020 | Jun-2028 | 4627 |

| SGBMAY28 | Sovereign Gold Bonds 2020-21-Series-II | 22nd May 2020 | May-2028 | 4540 |

| SGBAPR28I | Sovereign Gold Bonds 2020-21-Series-I | 28th Apr 2020 | Apr-2028 | 4589 |

| SGBMAR28X | Sovereign Gold Bonds 2019-20-Series-X | 11th Mar 2020 | Mar-2028 | 4210 |

| SGBFEB28IX | Sovereign Gold Bonds 2019-20-Series-IX | 11th Feb 2020 | Feb-2028 | 4020 |

| SGBJ28VIII | Sovereign Gold Bonds 2019-20-Series-VIII | 21st Jan 2020 | Jan-2028 | 3966 |

| SGBDC27VII | Sovereign Gold Bonds 2019-20-Series-VII | 10th Dec 2019 | Dec-2027 | 3745 |

| SGBOCT27VI | Sovereign Gold Bonds 2019-20-Series-VI | 30th Oct 2019 | Oct-2027 | 3785 |

| SGBOCT27 | Sovereign Gold Bonds 2019-20-Series-V | 15th Oct 2019 | Oct-2027 | 3738 |

| SGBSEP27 | Sovereign Gold Bonds 2019-20-Series-IV | 17th Sep 2019 | Sep-2027 | 3840 |

| SGBAUG27 | Sovereign Gold Bonds 2019-20-Series-III | 14th Aug 2019 | Aug-2027 | 3449 |

| SGBJUL27 | Sovereign Gold Bonds 2019-20-Series-II | 16th Jul 2019 | Jul-2027 | 3393 |

| SGBJUN27 | Sovereign Gold Bonds 2019-20-Series-I | 11th Jun 2019 | Jun-2027 | 3146 |

| SGBFEB27 | Sovereign Gold Bonds 2018-19-Series-VI | 12th Feb 2019 | Feb-2027 | 3276 |

| SGBJAN27 | Sovereign Gold Bonds 2018-19-Series-V | 22nd Jan 2019 | Jan-2027 | 3164 |

| SGBDEC26 | Sovereign Gold Bonds 2018-19-Series-IV | 1st Jan 2019 | Jan-2027 | 3069 |

| SGBNOV26 | Sovereign Gold Bonds 2018-19-Series-III | 13th Nov 2018 | Nov-2026 | 3133 |

| SGBOCT26 | Sovereign Gold Bonds 2018-19-Series-II | 23rd Oct 2018 | Oct-2026 | 3096 |

| SGBMAY26 | Sovereign Gold Bonds 2018-19-Series-I | 4th May 2018 | May-2026 | 3064 |

| SGBJAN26 | Sovereign Gold Bonds 2017-18-Series-XIV | 1st Jan 2018 | Jan-2026 | 2831 |

| SGBDEC2513 | Sovereign Gold Bonds 2017-18-Series-XIII | 26th Dec 2017 | Dec-2025 | 2816 |

| SGBDEC2512 | Sovereign Gold Bonds 2017-18-Series-XII | 18th Dec 2017 | Dec-2025 | 2840 |

| SGBDEC25XI | Sovereign Gold Bonds 2017-18-Series-XI | 11th Dec 2017 | Dec-2025 | 2902 |

| SGBDEC25 | Sovereign Gold Bonds 2017-18-Series-X | 4th Dec 2017 | Dec-2025 | 2911 |

| SGBNOV25IX | Sovereign Gold Bonds 2017-18-Series-IX | 27th Nov 2017 | Nov-2025 | 2914 |

| SGBNOV258 | Sovereign Gold Bonds 2017-18-Series-VIII | 20th Nov 2017 | Nov-2025 | 2911 |

| SGBNOV25 | Sovereign Gold Bonds 2017-18-Series-VII | 13th Nov 2017 | Nov-2025 | 2884 |

| SGBNOV25VI | Sovereign Gold Bonds 2017-18-Series-VI | 6th Nov 2017 | Nov-2025 | 2895 |

| SGBOCT25V | Sovereign Gold Bonds 2017-18-Series-V | 30th Oct 2017 | Oct-2025 | 2921 |

| SGBOCT25IV | Sovereign Gold Bonds 2017-18-Series-IV | 23rd Oct 2017 | Oct-2025 | 2937 |

| SGBOCT25 | Sovereign Gold Bonds 2017-18-Series-III | 16th Oct 2017 | Oct-2025 | 2906 |

| SGBJUL25 | Sovereign Gold Bonds 2017-18-Series-II | 28th Jul 2017 | Jul-2025 | 2780 |

| SGBMAY25 | Sovereign Gold Bonds 2017-18-Series-I | 12th May 2017 | May-2025 | 2901 |

| SGBMAR25 | Sovereign Gold Bonds-2016-17-Series-IV | 17th Mar 2017 | Mar-2025 | 2893 |

| SGBNOV24 | Sovereign Gold Bonds-2016-17-Series-III | 17th Nov 2016 | Nov-2024 | 2957 |

| SGBSEP24 | Sovereign Gold Bonds-2016-17-Series-II | 23rd Sep 2016 | Sep-2024 | 3150 |

| SGBAUG24 | Sovereign Gold Bonds-2016-17-Series-I | 5th Aug 2016 | Aug-2024 | 3119 |

| SGBMAR24 | Sovereign Gold Bonds-2016-Series-II | 29th Mar 2016 | Mar-2024 | 2916 |

| SGBFEB24 | Sovereign Gold Bonds-2016-Series-I | 8th Feb 2016 | Feb-2024 | 2600 |

| SGBNOV23 | Sovereign Gold Bonds-2015-Series-I | 26th Nov 2015 | Nov-2023 | 2684 |

I will add the newly issued sovereign gold bonds as and when they are issued by RBI. I hope this information may be helpful to you.

5 Responses

Dear Basu Sir,

Can you please write a article about how to link Aadhaar with PPF account online? I have a PPF account with HDFC bank.

Thanks.

Dear Rajan,

As per my knowledge, linking of Aadhaar to PPF is required for KYC purpose only. I hope bank have did the KYC before opening the PPF. Please check with HDFC Bank.

Does the interest of 2.5% gets credited to our account as and when or only duirng the maturity? will the interest be credited to my account if i purchase through secondary market?

Dear Aravind,

It will be credited semi-annually to the bank account of the investor and the last interest will be payable on maturity along with the principal (whether you purchase it during offering or from secondary market).

Thanks ji