Is It Wise for Young Long-Term Investors to Put 100% in Equity? Whether we always generate the best and highest returns by investing in equity for the long term?

In a bull market, we tend to embrace risk, while in a bear market, we shy away from it. Relying solely on past returns during these market phases is a common error. When returns are impressive, we may mistakenly believe they will persist in the future. Conversely, if returns are disappointing, we may prematurely conclude that equity investments are not suitable for us. However, the reality of equity investing tells a different story!

Is It Wise for Young Long-Term Investors to Put 100% in Equity?

I would like to share Jason Zweig’s commentary from Benjamin Graham’s book, “The Intelligent Investor.”

Listen carefully to the feedback. If someone truly exhibits these qualities, not just in your mind but in reality, then you can confidently invest 100% in equity.

# Emergency Fund – Only a small number of individuals may possess an emergency fund. However, a large portion of the population is unaware of the consequences if they were to lose their jobs and remain unemployed for a year or even two years.

# Long-Term Investing – Youngsters lack this eligibility. Indeed, the interpretation of the term “long-term” varies among individuals. Some may consider it to span 2-3 years, while others may extend it to 10-15 years. However, when venturing into the equity market, it is advisable to adopt a mindset that encompasses decades, rather than a shorter timeframe.

# Experience of a bear market – Numerous young individuals may have observed the COVID downtrend and assumed that a bear market does not last for more than a few months. However, upon examining historical data, one would realize that the average duration to recover from the beginning of a bear market is approximately 3 years. It is crucial to bear this in mind initially. Another significant factor is how one conducts themselves during such a downtrend, which holds great importance. Do not perceive Covid as a short-term bear market lasting only a few months or a year. Instead, ready yourself to confront and determine how to act during an extended downtrend.

# GUTS to buy than sell during a bear market – During times of market turmoil, only a select few possess the courage to purchase rather than sell. Your actions during the previous market crash classify you as a seasoned investor.

# Behavior matters a lot – In chapter 8 of “The Intelligent Investor,” it is emphasized that your behavior holds greater significance than your current unwavering trust in equity.

Does the long-term always lead to the BEST and HIGHEST returns?

Assuming you possess all the aforementioned qualities, it is still necessary to consider the probabilities of the equity market. Therefore, let us once again examine the historical performance of the Nifty 50 and endeavor to comprehend the potential returns. Let me share with you some history of Nifty 50 TRI. Then it will give you more clarity.

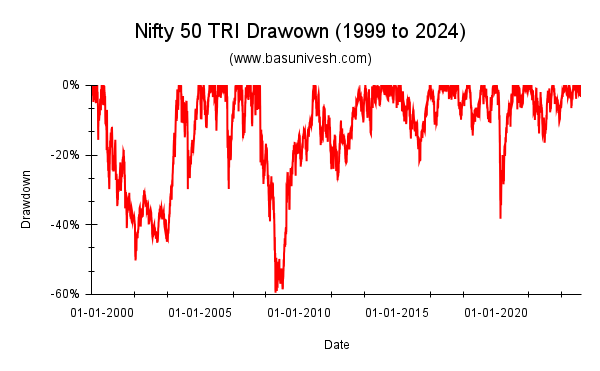

I have taken Nifty 50 TRI data from 1999 to 2024 (the maximum data available). We have around 6,100+ daily data points.

Let us see how the drawdown chart looks.

Drawdown is the percentage of decline in the value of an investment from its highest point to its lowest point over a specific period. It is worth noting that the drawdown was approximately 60% during the 2008 market crash and around 40% during the Covid period. Can you endure such a significant decline in your investments?

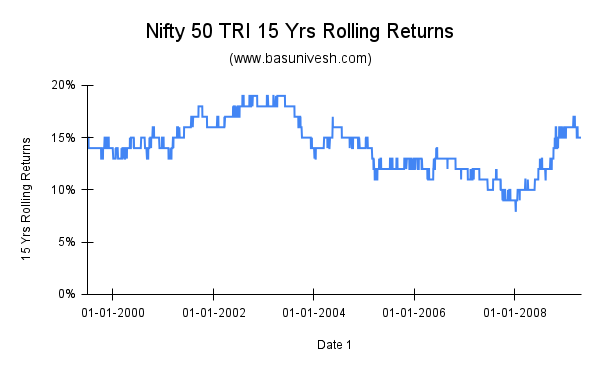

Let us now look into the probability of returns for 5 years, 10 years, or 15 years holding periods through the concept of rolling returns.

# Nifty 50 TRI – 5 Yrs Rolling Returns

Look at the return possibilities, the maximum return is 47% and the minimum is -1%.

# Nifty 50 TRI – 10 Yrs Rolling Returns

If you were to invest in Nifty 50 TRI and maintain the investment for over a decade between 1999 and 2024, you would have experienced a maximum return of 22% and a minimum return of 5%.

# Nifty 50 TRI – 15 Yrs Rolling Returns

In case of a 15-year holding period between 1999 to 2024, the maximum returns generated was 19% and the minimum returns generated was 8%!!

For the past few years, the equity market has been performing exceptionally well. However, if you had invested during the market fall in 2019 caused by the Covid pandemic, when the market level reached around 8,500+ points, and you have been holding onto that investment until now, expecting the same returns for decades to come, you are exposing yourself to significant financial risk.

We are uncertain about which asset class will outperform or underperform and for how long. In such circumstances, it is crucial to have a well-defined asset allocation strategy, even if you are a long-term investor. Always keep in mind that the purpose of investing is to achieve your financial goals and fund your financial goals, rather than solely focusing on generating the highest possible returns.

Hi Basu,

Thanks for detailed post on holding 100% in equity. On similar topic I have question. Does holding for longer duration guarantee greater return? I have following scenario and I am confused why older fund is yielding lower return than newer fund:

I have two funds in my portfolio (apart from other funds):

– UTI Nifty 50 Index Fund

– HDFC Index S&P BSE Sensex Fund

Here are the details of both funds, their start and end date of the SIP, Status of SIP and XIRR:

Fund Name Start Date of SIP End Date of SIP SIP State XIRR

UTI Nifty 50 Index Fund – Direct 07-Nov-22 — Active 22.52%

HDFC Index Fund – S&P BSE

SENSEX Plan — Direct 16-Apr-20 12-Oct-22 Stopped 18.93%

I am surprised to see that HDFC Index fund is yielding lower return compared to UTI Index fund, though HDFC fund was started way before UTI Fund and Sensex was at ~33K at start time and ~60K when SIP was stopped and currently sensex at ~74K. If I do a similar comparison with the UTI fund, when the first SIP was done sensex was at 60K. Note that no money has been withdrawn from both funds. And SIP amounts were different for both funds (I hope the amount should not matter for XIRR). I understand that both funds are slightly different (one tracks Nifty and another Sensex) but the difference of more than 2.5% return yearly is big. So what happened to compounding here?

Dear Meru,

You have to compare the fund returns by considering the same dates (from and to). If you compare two funds returns when the investment dates are different then obiviously they create different returns.