Finally the wait is over for those who are very much interested to buy term insurance with LIC and especially ONLINE. Today LIC launched it’s first online term plan to all. So let us see it’s feature. This is the second online plan from LIC after the launch of pension plan Jeevan Akshay VI.

Below are the few features of this plan.

- You will buy this plan only through online mode.

- There are two categories in this plan.

- One is called Aggregate lives. Here you can buy whether you are smoker or non smoker. So there is no such difference in this.

- Second is called Non-Smoker lives.

- For Sum Assured upto Rs.49,00,000 only aggregate premium will be applicable.

- From Rs.50,00,000 onward you have option to choose whether you are smoker or non smoker. If you are smoker then aggregate category only. But if non smoker then you need to mention it and accordingly premium will vary.

- Proposal on own life will only be considered. So you can’t propose for your wife’s life.

- Death benefit will be equal to Sum Assured opted.

- There is no maturity benefit under this plan,

- Minimum Sum Assured for Aggregate category is fixed Rs.25,00,000.

- For non smoker it is Rs.50,00,000.

- There is no maximum limit.

- Minimum Age at entry is 18 Yrs.

- Maximum Age will be 60 Yrs.

- Maximum cover you can opt upto 75 Yrs.

- Minimum Policy Term is 10 Yrs.

- Maximum Policy Term is 35 Yrs.

- You have to pay premium only on annual base.

- Grace period of 30 days will be available for premium payment.

- You can pay the subsequent premiums online either through net-banking/credit card/debit card.

- You need to disclose all the existing policies while buying this plan (irrespective of company).

- Medical Test requirement will be based on individual.

- For further details about this plan, you can contact [email protected] or call to toll free number 1800-22-7717.

Whether NRI’s can buy this plan?

As of now there is no information available on LIC site about eligibility of NRIs. But good feature is, once you are covered under this plan and if afterward you moved to other countries due to your job then too the cover will continue irrespective of your stay across globe. So it is best whoever planning to move can buy this plan and move.

How to buy this plan online?

For detailed video tutor on how you can buy, visit my latest post “Video Tutor on how to buy online term plan of LIC’s e-Term“.

1) Visit LIC Online Plans Page by clicking LIC DIRECT. You will get below screen and rest of the process is displayed in below images.

2) Select your residential status by clicking as below and click on the tab called Confirm & Proceed. Here you have two options too. One is for new customer and another is for those who calculated previously, for them need to enter Access ID (10 digit number which will be sent to your provided mobile number and to mail id).

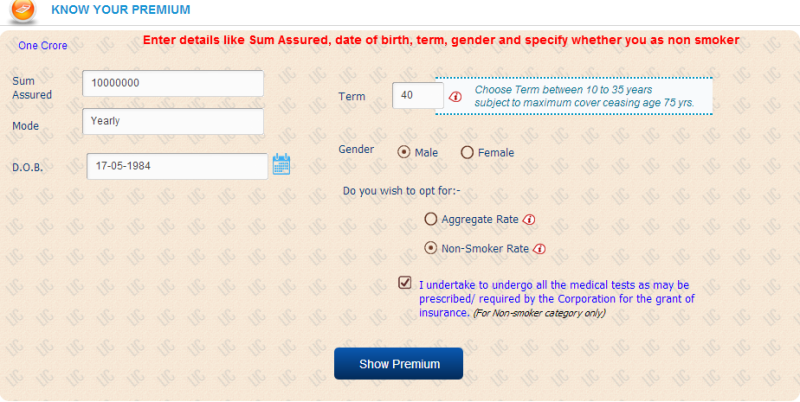

3) Calculate your premium in next step. Enter details like Sum Assured, Date of Birth, Term and whether you are smoker or not.

4) Premium will be displayed as below and you can either recalculate or proceed further.

5) Proceed to fill your personal details in below step. Please remember that this online purchase is set for cities only. So if you not belong to any of cities mentioned in drop down then select city which is nearest to you.

6) Access ID will be generated and which will be sent to your mobile number and email id. Now below are some instruction to proceed and complete the process of buying online.

- You must be in India while buying a plan as you need to undergo the health check up.

- PAN Number is must.

- Form 16 or ITR of last three years is must.

- Details of all your existing insurance (irrespective of insurance company.

- Details of family members.

- Details of medical history.

- Details of Bank like Account number and MICR code etc.

Click on Proceed tab and which asks for 10 Digit Access ID. Provide the same and click on proceed.

7) Provide Personal details, Correspondence details, Identity details, employment details, employment details, lifestyle details, nominee details and finally add family members details. Now add your previous policy details, medical details, provide bank details, personal financial quarries and confirm finally that you understood all the policy details.

Finally view the proposal form in PDF format. If you found any incorrect data then modify once again. Otherwise proceed for buying it through net-banking/credit card/debit card.

Hope above information will be useful for you all.

How much cheaper it is?

In below chart I tried to compare LIC’s online plan with offline plan of Amulya Jeevan, HDFC Click2Protect and ICICI iCare II. You notice that price difference between this new plan to offline plan of LIC is very much. It is around 37% !!!. But if we compare with private insurers online term plans, then still this looks costlier. But not that much. So if you are very much interested to go with LIC brand name then definitely this is best buy.

Even whoever already own Amulya Jeevan then they can plan to switch to this plan. But do remember that cancel your plan once your proposal approved by LIC and also compare the price difference for your individual age.

So whoever planning to buy online term plan may definitely consider this plan as it is from LIC with highest claim settlement ratio in industry.

Interesting points to note before proceeding

- Compare to existing offline term plans of LIC, this looks cheaper.

- Maximum age is 75 Yrs.

- No accidental benefit rider.

- No additional riders attached to it. So it is plan vanilla product.

- You must undergo medical test.

- It is too early how LIC will give service as currently it is heavily depending on agents force.

Sir, I purchased 2 crore tech term plan. after multiple medical tests in 2 months, now they replied ” without commitment postpone for six months”.

What does it mean and what steps should i take now ?

I am a kidney transplant recipient.

thanks and regards

Dear Sampat,

Better to interact with the LIC in this regard. Because they may be in a better position to provide the clarifications and reasons.

Sir,Thanks for Lic officials,I got tech term policy By adding premium of rs.38000 after medical as Lic says extra premium on the basis of medical reports ,I transfered it and got policy number, and policy documents on my email id…but I WANT MEDICAL REPORTS(RECORDS) (COPY) WHICH TPA HAS BEEN SHARED WITH DIGITAL LIC ON EMAIL..AND TPA HAS BEEN UPLOADAED ON LIC PORTAL…I WANT THOSE MEDICAL REPORT COPY. HOW CAN I GET IT? IS IT MY RIGHT ,TO GET COPIES OF MEDICAL REPORT WHICH DONE WHILE BUYING TERM PLAN….KINDLY GUIDE ,I NEED THOSE REPORTS FOR TAKING PREVENTIVE ACTIONS IN MY LIFE..SO KINDLY GUIDE PLEASE. THANKS FOR LIC AND YOU IN ADVANCE.

Dear Rajesh,

You can write to them to get the medical reports.

I say just avoid it. The website is crap. I have made payment twice while purchasing policy. Medical will happen immediately since it’s automated. But no one is contacting me now. All numbers given are either out of order/busy. No response to emails for refund of excess amount. My 17k stuck with them, with no idea when I will get insurance/refund. Avoid Tech Term online plan. Better go with pvt. insurers.

Dear Ashutosh,

Sad to hear your bad experience with this mammoth insurance company of India.

Good luck to anyone looking to purchase LIC Tech term policy. I applied for this policy six months ago. In those six months, I was asked to undergo medical tests twice as my sum insured was greater than 2 Crore. The response from both LIC and the medical team has been extremely poor and lacking. Both of these teams wasted a lot of time. Finally, as per LIC policy, my insurance proposal was rejected as it had been more than 180 days since the proposal was submitted.

I would strongly recommend against purchasing LIC Tech Term. Their website for collecting documents is poorly designed and absolutely not user-friendly. They are extremely slow. There is almost no internal coordination between their departments. If this is how they handle applications for first-time customers, I can only imagine what may happen in the event of a claim file.

Dear Nikhil,

Thanks for sharing your horrific experience with LIC. I completely agree that LIC still have to develop a customer-friendly approach rather than 1947 attitude towards customers.

Hi Basavaraj, I am 24 years and single working in private concern and my current annual income is 2,16,000 also I am doing agriculture and earning nearly 2.5 to 3 lakhs annually…I have not paid any income tax yet as my salary not falling under that category…I am thinking for policy sum of 10000000…as I checked in lic found I am eligible for that with total of my salary and agriculture income for 400000 per annum…but I have only salary slip for annual income of 216000…agriculture income not deposited in Bank account…can apply for this sum amount…i need to know that my application will be accepted by lic as I am only submitting my salary slip of last 3months which have income of 18000. Please help me to know. Thank you.

Sujin- Your income is determined only based on IT return. Also, accordingly insurance companies consider your income.

Mr Basu – Greetings of the season!! I have recently purchased this e Term Plan for myself . I am a 32 year old professional working in the corporate sector. Interested in buying standalone CI and Disability Insurance, solicit your opinion.

Virat-Refer my post “Best Critical illness policy in India – Comparison Table“.

Mr.Basavaraj i am a govt servant aged 44.My annual income was around 4.5 lakhs.i want to take eterm policy for Rs,10000000.but whenever i apply online it always shows that” for the declared income you are not eligible for the sum assured(even i have tried sum assured upto 40 Lakhs)”.how could i know the maximum eligible cover for me.and whom should i contact since its a online policy.

I am also contact lic through email.But they giving some unconvincing and general reply to me to try again.

thaks in advance .

Damodharan-Your eligibility depends on your age, health and income. Hence, you have to try and modify your requirement to proceed for purchase.

Can be possible address and nominee change in lic policy in anywhere in india?

Ajay-Anywhere in India not possible as they have not yet centralized the system. You have to update it to a home branch of LIC.

Hello sir,

Regarding e term plan of LIC –

(1) What is the process of claim settlement for e term plan ? Since it has been brought online, whom to contact during claim?

(2) Is process of claim settlement for online purchased term isurance plans differs from that of offline mode purchased?

(3) Whats is difference between online and offline term insurance plan with respect to ease of claim settlement ?

Thanks,

Vinay

Vinay-1) You can approach the branch which will be informed to you during the process of issuance.

2) BOTH ARE SAME. But Agents spread this misleading news that ONLINE purchased products are least bothered by LIC.

3) BOTH ARE SAME to LIC. But for agents perspective it is ENTIRELY DIFFERENT 🙂

I paid premium online and on the same day received call for medical test. Within 2 days i completed medical tests (14th Aug, 2017) but till date there is no further communication from LIC. Despite repeated calls and emails the process has not moved forward. The LIC representation told me first that the agency conducting medical test has not yet submitted report and next said that the people responsible are new to this process and hence taking time. It is hard to understand what is new in this process and why are they taking more than a month to take this forward. I selected this plan based on trust in LIC but this delay is making me think.

If they do not process in next 15-20 days then i shall ask them for a refund and will take some private policy.

Ajit-It is hard to say of what went wrong. But no option but to wait.

Hi Basavaraj ,

I am a 37 year old salaried professional in IT (with more than 12 years professional exp). I wanted to take SBI Life – eShield (Term Policy) for 50L. My salary is in the 7 Digits. Now i had sent my “Employer certificate” to the SBI underwriter, but they still insist of last 3 Salary Slips. I am not comfortable in handing them my salary slip since it contains data on my PF , UAN & Salary account and what not… The Employer certificate should be sufficient to let them know about my employment. Wouldn’t it be termed as an attempt to breach my financial privacy, since this kind of data about an individual can easily get into wrong hands!. Why are they so desperate to know my salary components via pay slips only? Is there any other instrument i can use to let them know my salary only ? Is there any other safe process here ?

Also they can check my details in C-KYC. Will that help?

Thanks & Regards

Harishanker-I can understand your concerns. But they need the salary slip or IT return. If you have such concern then you can send them the last 3 years IT returns. Using CKYC, then can’t check your income.

I am in middle of e-Term plan purchase. I have paid the premium for Non-smoker category as I neither consume alcohol nor do smoking. Undergone medical examication. After 10 days I received an email stated that you are not eligible for Non-smoker category but eligible for aggregate rate. Hence you need to pay 6000 rs more to get policy.

I am damn sure that my blood and urine test must be normal & must not reflect any kind of alcohol or nicotine.

Then why LIC is asking for Agreegate rate? how can I proove my self Non-Smoker? Is there any way to proove myself?

Ritesh-I am not sure what went wrong with your medical report. However, being a customer, you have all rights to ask for the reasons for considering you as an aggregate category than the normal (but you can’t question their hiked premium). Hence, communicate with them and get the answer.

Sir, I undergone retest for Urine Cotinine and got it negative. so after a month of proposal, finally i got my policy without change in premium or compromising proposed term and amount.

Must say, Bombay office personal are very cooperative. Whenever you mail on [email protected], they always reply very quickly ( all the time i got reply within 15 mins, which never happened with any service provider).

I am happy much happy with the LIC online term plan service.

Thanks again for your valuable suggestion.

Regards,

Ritesh Oza

Ritesh-Great to know this wonderful experience and also thanks for sharing this.

I have bought online LIC e-term plan. After 24 hours of the submission of the online form, I noticed that I made some error while filling the form. Now I have to update the data before proceding it but not getting any response from the LIC customer care and can’t update it online also.

Can you please suggest what should I do?

Anima-You contact them through email. Let them reply and then proceed for further steps.

I have already sent an email to them yesterday but didnt get any response so far.

Anima-Let us wait.

Dear Sir,

I have already purchased Amulya Jeevan-II from LIC in 2015, but now after launching Online eTerm I want to switch to it. Is it possible to do so. Because I have previously purchased policy of Sum Assured Rs. 25,00,000 Only and now I want to take of Rs. 1,00,00,000/- which will be more better than that of previous. Hence, you are requested to guide me and how to do this as well.

Kishor-You can’t switch. But you have to buy new plan online. Once the new policy is issued, then close the existing old.

(1) But Sir, If I am going to buy a new policy then I would have to declare the previously sum assured amount and due to which may be my eligibility to apply for a higher amount will decrease (I don’t know please guide in this sentence). But here (In new policy) I want a lump sum amount of 1,00,00,000/- (One Crore) then what should do to get this cover bcz I am in urgent need.

(2) Second question: I am already purchased an Income Protection Plan from AEGON you know well that how it works i.e (Annual Salary Vs Sum Assured) then what should be mentioned in new upcoming policy’s Previous Policy Details column where Sum Assured is required by the new Insurer. Please guide in this regard.

(1) Further, I have purchased ICICI Pru i Protect (All-in-one) and want to convert it into Only Life Option Plan. Is it possible?

(2) If again I apply afresh for ICICI Pur Life Option plan then what is the possibility to accept by the under writing decision. Is it possible?

My annul salary is 7.58 Lacs only (Post tax) and Rs. 7.58 (Pre Tax). Please guide.

Finally, I want to buy – (i) LIC eTerm for Sum Assured Rs. 1,00,00,000/- (ii) I want to convert ICICI iProtect into Life Option only.

Kishor-How much insurance coverage you get depends on many things. Hence, I can’t decide or say you the perfect numbers.

Kishor-1) In my view NO. But still, it is better to check with the insurer.

2) NONE can answer it except ICICI Life.

Kishor-1) If you are sure of buying new and dumping the old one, then let you not disclose the existing policy. Otherwise, you can let the old policy to lapse and buy new one. But the risk in this act is that you will be out of cover until they issue new policy on new.

2) The existing cover of the Aegon policy.

The insured with 3 kids, has nominated his spouse as nominee, If the Insured dies then nominee will get the death benefit of the Insurance and after one year if that nominee dies then who will be next nominee if monthly 1% of sum assured is fixed for more 100 months after the death of the Insured?

Kishor-It is the legal heirs of that deceased person.

Sir,

It’s stated that ITR of 3 years is a must. But while filing online form there is no option regarding ITR. So please explain when those ITR documents are required and also if is it possible to buy e term for those who do not have either ITR or Form 16.

Thanks.

Anil-While providing documents, then you have to give it.

Hi Sir,

My age is 24 and I am working from last 1.6 years. Hence, I have only 1 ITR with me.

So, Is there a way to get any of the LIC term plans : e-term or Amulya Jeevan?

Abhi-eTerm.

I am a Lecturer in Sr. College, My annual income s abt 7Lks. I have only last year form no.16.

Can I got term plan for 50lks. Pls provide me contact number to fill online term policy form.

Mahajan-Yes you can by providing last year returns and also your salary proof.

If a BSF or Army person who has policy got died due to war or terrorist attack. than in that condition is death claim cover or not ?

Das-If the insured declared his profession while proposing and then insurer issued the policy knowing the profession of insured, then claim will be accepted.

generally lic agent fill the application, he tells me just to sign in the application after giving the related xerox document. in the profession column he fills only government servant though I am a para- military force personal . I think I should change my policy detail ?

Das-YOU MUST.

Hi,

I submitted the e-term proposal and made a online premium payment through net banking but payment confirmation is not generated but amount is deducted from my account. How to get the status and to whom query needs to be raised?

Can i get a customer care number who can share the status of my proposal?

Sudeep-You can use below mentioned ways to contact them.

[email protected]

Contact Nos.-022-67819282/84 022-26127303/04/05

Hi Basavaraj, what are your views on “HDFC Life Group Term Insurance” being offered to Jet Privilege members? It is surprisingly cheap with no documentation and no medicals! Please, need your advise before considering it. Thanks.

Teja-It is group insurance and hence individual not allowed to buy this plan.

Hi Basu, but I’m a Jet Privilege member and I got invitation from jet, asking to join this program. So, are there any cons with this type of group term policy (being offered with HDFC)? Please advise. Thanks.

Teja-I am not sure, better check with respective insurers.

sir, what kind of deaths are excluded in e-term plan?

Vids-In my view suicide within 12 months is the main exclusion.

Hi

I had undergone angioplasty 1.5 years ago after a mild heart attack and I am looking for any (Online/Offline) term insurance policies.

In the last week couple of on line term policies were rejected/declined due to my health condition (I am in a good health now).

Is there any insurance company offering online / offline term insurance for the above condition?

Thanks in Advance

Saran-It is hard for me to say the insurance companies decisions. You have to know the companies.

Hi..sir

I passed out PG in 2015. I started working from July 2016. I am getting pay slips every month. I haven’t filed IT returns till now. Am I eligible to get lic e term policy. Please tell me

Srikanth-It is hard.

Hi ,

Thank you for the effort in clarifying questions/doubts. I have couple of queries

Query 1:

I am planning to buy LIC E- Term policy Insurance, I have been outside india on a ON and OFF between 2012 and 2014 with stay close to 6 months twice in 3 years.

There a question , if my work involes travel outside the country, Do I need to mark as “Yes” because I travel was only for an assignment and this is not something I do every year.

Query 2:

What is the overall time frame for the policy to get issue after submitting the medical records.

Regards,

Krishna

Ganesh-1) YES, 2) From a month to 3-4 months based on the cases.

hi sir.. i have following queries below

1. last 3 years itr foms or last 3 months pay slips are enough to take lic-e term. is it true .

2. is around 3 lakh per annum package necessary to take e term for 50 lakh and above.

Srikanth-1) YES. 2) Necessary or not depends on your requirement. I don’t think Rs.50 lakh insurance is an issue.

Hello,

I have paid LIC eterm policy online (Rs. 8900) for 50 Lakh policy amount. I have no health related problem and to my surprise after medical test, LIC comeback and say to pay more Rs9000 totaling my premium to some Rs 18000. I wouldnt like to take the policy with such huge premium. Can I ask LIC to pay back my earlier paid premium ie, Rs8900, because I am no more willing to go for the policy. Does this fall under free look up period. Understand generally it is considered 15-30 days after I get the policy document. As now they ask me pay extra premium and I am not willing to proceed with the policy, is LIC liable to pay back my premium paid?

Pratap-Your policy is not yet issued. Hence, it will not comes under the free look-in period. Either you have to pay the additional premium to issue policy or else inform them that you don’t want to pay the additional premium. Hence, request them to return the premium. They will pay you the paid premium (excluding taxes and medical examination cost).

i want amulya jeevan 2 policy. my salary is above 1.5 laks to 2 laks from bank fd , home rent and agri business.

but i dont have ITR . lic agent told me that ITR is must like this. how i get term insurance policy. please guide me.

thank u

Mani-Your agent is correct.

ok thanks., and another one policy is anmol jeevan 2 is eligible or not eligible for me?

sir i want term insurance for 15,00,000/- fifteen laks only.

but some body is saying anmol jeevan 2 policy provide insurance will give up to 10,00,000/- without ITR

person like this.

is it possible?

or where i get S.A.15,00,000/- policy for me? term insurance.

thank u

Mani-It is purely underwriter decision to give or not. Don’t rely on anyone (including me). Fill the proposal form, submit to LIC and wait for their answer.

Hi,

I am a female, school teacher age around 35 years, working in a private school. My current gross salary is 23,000 per month. Till now I have not received any Form 16 nor filed any ITR. I can get my salary certificate form the authorized signatory. Can I go for e-term plan for 2500000?

Regards

Sabitrimanjari-Yes, you can get it. But I surprised how can your employer not provided you the Form 16? Check with your employer. Because income proof is must to buy term insurance (either from LIC or others).

My weight is 115 kg and BMI IS 33 with no other health issues. Will LIC charge higher premium from me just on the basis of BMI.

Shila-In my view YES.

Hello Sir,

I want to buy Term plan, please suggest me which plan i Should buy?

Shall I go for LIC? or any other pvt companies?

I want my family shouldn’t face any problems while claiming for summered?

Which is the company which is good, easy & helpful for claiming process?

Planning for 1cr. term insurance, Age 29.

please suggest.

Vrushal-Refer my earlier post “Top 10 Best SIP Mutual Funds to invest in India in 2016“.

Dear sir,

I gone through lic e term n like other companies they don’t have definition for smoker. I used to make 6 yrs back n all private companies are treating me as non smoker but in lic e term the question is ” do u use ot ever used tobacco in any form “? If I click yes then I’ll be smoker and can’t go for high sum assured.. Kindly suggest me should I proceed as smoker or non smoker for lic e term.

Thanks

Abhijit-If you quit your habit 6 years back and you are determined that in future you will not smoke, then opt for non-smoker category.

Dear Mr. Basavaraj Tonagatti,

I have completed 31 years . My DOB is 11-8-84. Mumbai resident.

My concerns regarding term plan are below:

1. I wish to take 2 term plans (LIC E-Term & HDFC Click-to-protect Plus) for 1 CR each respectively. The reason is HDFC offers additional riders and LIC does not. Can I opt for both the policies at a time?

2. If yes then, is it mandatory for me to inform both the companies that about both the plans while applying?

3. I am not a smoker. But I drink occasionally. In that case, will there be any extra premium load for me?

Onkar-1) Try to buy critical or accidental covers separately from general insurers. Avoid riders. Also, go with any one insurer.

2) I replied.

3) Yes, based on underwriter’s decision of respective company’s.

Sir,

Thanks for your quick suggestion.

Related to above point no. 3, while applying LIC E-Term plan there is no provision to declare drinking habits. It is a pure online application, in such case, how can I declare my drinking habit???

Omkar-You have to mention whether you have that habit or not. So mention accordingly.

thanks sir, i really appreciate ur promptness

Hi Basu,

Thanks for your valuable information.

I want to buy lic e-term but I have confusion about income proof. I have filed ITR this month for first time.

Can I apply with single ITR or salary slip?

Please reply

Thanks

Rajesh-I don’t think they issue with one year ITR.

OK and Thank U once again for Ur prompt reply. Now I have no confusion in this regard, and will follow ur suggestion in future.

Hello sir, I jst want to know that can I change the nominee detail after marriage in lic e-term policy? if possible, how to do that?

Thanking You

Srikanta-Yes, you can change nominee details as many times as you wish. You have to do it by sending a letter to assigned service branch.

Its nice to see someone answering so promptly to every qsn arises from various parts of the country. Thank You Mr. Basavaraj.

In this context I too have query regarding choosing between Lic e-term and icici prudential I protect smart policy. This product from icici provides not only term insurance bt provides medical support up to 10lk, with disability, rider, double accidental coverage at a very cheap rate!!! That’s where my confusion began, and I am asking U to please reply me in this matter which one to buy. I am in doubtful mind for 6month or so. Is icici insurance a trustee one?

Srikanta-Don’t buy riders. Go for plain plan. BUy accidental insurance seperately.

Hi,

I am 25 years old and planning on buying a 1 crore cover. I completed my MBA in April 2016 and started working at a reputed firm from June 6, 2016 with a salary of 15 lakhs. Since I was not earning prior to this and do not have previous income, will my proposal get rejected?

Please help since I do not want to delay buying a Term plan and consider it very important. Thanks inadvance!

Mohit-Yes, IT return proof required to show your income.

SIR

MY EMPLOYER DOESN’T PROVIDE ME FOR 16, BUT THEY PROVIDE ME SALARY CERTIFICATE IN COMPANY LETTER HEAD AND EVEN I FILED MY INCOME TAX FIRST TIME FOR YEAR 2013-2014.

KINDLY LET ME KNOW CAN I BUY ONLINE ETERM POLICY OF LIC OR HDFC.MY ANNUAL INCOME IS 3 LAKH. MAY I DESERVED FOR VALUE OF 50 LAKH ETERM POLICY

KINDLY REPLY

Santosh-You can provide the IT return slips as income. Eligibility for Rs.50 lakh depends on LIC underwriter (based on your data). I can’t say on that.

thank you very much for prompt reply.

can i buy with single return slip of one year as as i filed for one year for 2013-2014 only.

kindly let me know.

Santosh-I don’t think it is possible. Check with LIC officials.

Thank you very much for your reply

Dear Sir,

The information that you have provided and your replies to the questions posted by various people has been of immense help.

I wish to apply for LIC e-term (online Term Insurance policy) for my life coverage.

It would be of much help if you can clarify these for me?

1.I already have Amulya Jeevan policy with a coverage of about 25 lakhs . Do I need to surrender this policy before applying for LIC e-term ? If so, can you please provide me the steps to surrender the policy ?

2. Can I increase the coverage amount or period of term in e-Term at a later date, if needed ? If so what are the steps ?

3.Should I bear the medical expenses for any tests required or will the expenses be borne by LIC ?

4. Will the premium at the time of applying be fixed or will it be changed after the medical tests ?

5. Will I get access to the medical reports or will it go directly to LIC?

6. In case of rejection based on results from medical tests what would happen to the payment made online already? Can I get an option for coverage with increased premium

7. After few years, can I increase the term or coverage amount if needed?

8. How long will it take for the whole process to be completed ?

Thanks,

Dileep-1) It is not required. But is purely your wish to continue or discontinue. Surrendering term plan is easier. You just need to stop paying the premium.

2) You can’t increase coverage or tenure in middle. If you desire to buy additional cover, then you must apply for NEW one.

3) If the policy is accepted by you and LIC, then the cost of medical examination will be beared by LIC. If it got rejected or you not accepted the terms they put on you, and proposal cancelled means, you have to bear the cost.

4) It will be fixed.

5) NO.

6) If you accept then policy be issued. Otherwise, they refund it. Yes, you can opt initially.

7) I already replied to in your point No. 2.

8) It depends on case to case. We can’t generelize and say so.

Thank you very much for your reply. Some more additional queries.

If I retain Amulya Jeevan, then can the dependents of the insured will be able to claim against Amulya Jeevan Coverage and also e-Term for life coverage?

Do I need to mention about Medical Insurance policies while applying online ?

Dileep-Yes, your dependents can claim from both offline and online term plans. Mentioning medical insruance is not required while buying life insurance.

Thank you very much

What will happen if term plan is cancelled by LIC due to any reason. will they refund all first paid premium amount

Dear Jeetendra,

It is a contract between you and the insurance company. They have to honor it as long as you pay the premium. Hence, they can’t close the plan for the existing buyers. However, they can stop offering to new customers.

Hi Basvaraj,

It is a nice initiative and you are doing a great job answering all the queries promptly. I am facing certain issues while applying for this plan. Please find the details below.

Sum Assured: 1 Cr, Premium: 15k pa, Salary: 7 lpa

There are 2 fields in “PERSONAL FINANCIAL QUESTIONNAIRE (ANNEXURE-I)”

1. Latest Year

2. Prior Year

My first job was from Oct 2011 to Jun 2014. I did full time post graduation from Aug 2014 to Feb 2016. I joined my current organization from April 2016. I entered my current salary in “Latest Year” textbox and kept the “Prior Year” text box as blank since I was a student in last year.

When I clicked on Submit, I got following error:

“* Income cannot be blank”.

So, I tried submitting my application without filling the Annexure. But I got this error:

“* As per your declared income you are not eligible for chosen insurance cover. However, you can modify income details if you have proof of any additional income”

As a result, I am not able to buy e-term policy. Can you please suggest me, how I can go ahead with this? Does it mean that one has to wait for at least 2 years to buy term insurance so that he can produce income proof of past 2 years?

Regards,

Mohit

Mohit-The problem here is your last year income ZERO.

Hi

I opted LIC eterm policy for 1 Crore policy for a term of 35 years.

when i tried to complete the application, i got an error”* As per your declared income you are not eligible for chosen insurance cover. However, you can modify income details if you have proof of any additional income”

what should be the income to opt for the above Policy.

Please let me know how we can calculate.

Regards,

RamPrasad

Ram-What is your income and how much you proposed? Usually, they offer you around 20-25 times of your yearly income.

Hi,

While submitting LIC E-Term insurance questionnaires online, I got an error message as follows: “* As per your declared income you are not eligible for chosen insurance cover. However, you can modify income details if you have proof of any additional income.”

I am 39, Male, Annual income 6.98 Lakh CTC. I wish to know, how much CTC is needed for eligibility.

Rajat-How much insurance cover you opted?

Hi,

I opted for 1 crore coverage. I had a email communication with LIC-Direct personnel. Based on their response, I have reduced the coverage from 1 Crore to 70 Lakh & problem resolved.

Rajat-Great to know this 🙂

Hi.

I have a doubt –

I have an existing LIC term policy for 25l.

I want to take another policy for 25 l with LIC. However, now I have got sugar and my hb% is 8.6% and if I take with LIC, I am afraid if they will raise any issues .

Should I now take it with another insurer…like SBI Life…can you please help

Bala-Whether other insurers will not raise? They also raise but may not be to the extent like LIC. Chose insurer based on your comfort.

Thank you, Sir –

Will LIC reject my proposal and will they make any problem of my existing policy with them. I am very much concerned on that

I would prefer LIC but I am afraid that if they reject, I cannot get insured again.

Or should I wait till I reach my hb1% less than 8 and then approach LIC again

Please help me

Bala-Existing policy can’t be cancelled. But yes the new proposal may be get accepted or rejected.

Hi,

I have a couple of queries on this LIC eterm insurance

– Is critical illness covered in this scheme? any premium waiver?

– Is death by Natural disasters (ACT OF GOD) is covered?

Biswaroop-1) NO. 2) YES.

Thanks for the detailed information.

Looking at details, it seems LIC eTerm is better choice. I do have one doubt, after insured person’s death what is the claim procedure for this plan? How it will be compared to settlement by an insurance agent?

Buying an insurance by considering the claim settlement is very important as our dependents have to do this.

It will be great if you could provide some information on this.

Mahesh-This is an online plan. So, there will be no agent to help you. However, you no need to worry also. Your nominee must visit the concerned branch with death certificate, their bank details, and original policy document. LIC officials will help you.

Thanks for swift response. This is was I thought of.

The only followup question is, can we select the LIC branch when we enroll the policy? If not, can we claim from any of the LIC branch?

Sorry for bothering you a lot 🙂

Mahesh-Selecting branch is not possible. But you can approach any nearest branch. As this is online term plan, the data will be available across Indian branches.

Hi Sir,

Why term plans are only for working or business persons. Can a normal person who is not working, take insurance ? please let me know if there is any such opportunity.

Hemanth-If you are not working then there will not be financial dependence on you. In that case insurance is not required to such person.

I want purchase team plan 50 Lac,any return at the time of maturity,please confirm….

Prince-In term plans at maturity there will not be any return of money.

Thanks for your valuable support

hi,

I purchased LIC E-term plan on 13.04.2016 and completed my medical test on 16.04.2016. My date of birth is 01.05.1987,

Is there any chance to increase my premium due to my age factor, if my policy commencement date on or after 01.05.2016.Please clarify this.

Varathan-Even after 1st May, your age will not change. Because they consider nearest birthday for calculation.

hi,

i purchased LIC e-term for 75 lakhs for premium of Rs 11679 /- on 13.04.2016, first medical test conducted on 16.04.2015, i mentioned in my proposal kidney stone in 2013. After the second medical test on 10.05.2016, the revised premium is 27137 /-. i want close the proposal. Please tell me the procedure.

Varathan-You have to mail them or call to their customer care and inform about cancellation. They refund the amount.

Thanks for the information

Pl tell, How much disocunt i’ll get in annual premium every year, i want to buy Endowment policy table no 814,

Regards

Sagar J

Sagar-LIC offers only two online plans. One is eTerm and another is Jeevan Akshay VI. You have to buy all rest of the plans through agents mode ONLY.

If i go with Online LIC & not to buy policy through LIC Agent .. then can i get discount every year.

Regards,

Sagar J

Sagraj-YES.

Hi,

My age is 46. After entering all my the details, I run PDF report and verified. When I click on Pay button to make payment, the premium amount is displaying as Zero (0). Due to this, I am not able to make payment?

In the proposal document, it is asking to paste my photo graph and many signatures in many pages..

Ravi-I think it is some process error. Try once again. Yes, you have to take the printout of proposal form, paste photo and sign on it. You have to give it while going for medical examination.

Hi,

I want to get insured with critical illness and accidental disability.

Please suggest me one good company where i can get it.

I tried searching but ups and downs are there in term and conditions.

Dattatray-Can you let me know those ups and downs, this helps me to give you better suggestion.

Let me put it this way.

1. My concern is dependent shouldn’t face any troublesome for claiming the sum insured?

my LIC policy (15L) got lapsed. when i checked to pay the amount LIC office which is in my native from were the policy had been taken informed my agent that i need to get the medical certificate done.

now in bangalore i do not know were i can get this done. please guide. i need at indiranagar reagion

Vidhya-You can check out at nearby LIC authorized medical examination centers and complete the process. You can get it by visiting your nearest LIC office or your agent may guide on this.

I am planning to buy HDFC I protect and LIC E term policies. Do I need to inform them individually ? If I miss to mentioned previous term policy details , will it cause any issues when actual claim settlement time. Kindly confirm.

Ravikumar-Why with two insurer and why not with one? Yes, if you miss vital data like existing insurance coverage, it may create problem.

Reason, I choose is that one is Semi GOVT and other one Private.. I have plan for take 1 cr. So split into 2 term policies. If any insurer rejct claim other can approve. Just for safer side.. Is that good choice?

RAvikumar-When you apply for second insurance, you have to share the first insurance details. When claim arises, do you feel the second company not communicate regarding this claim? They always look for ways to find fault. Let us say company B not found fault and they are about to accept claim, but due to the information you provided about earlier insurance, they may communicate and what if company A rejected? Also, wait for few years, all database will be centralized. No cheating from anyone.

Thank You Basavaraj for detailed information.

Hi its Dattatray,

I am 28 now.Annual income is 6 lac.

I want to buy term plan.I was thinking like buy 50 lac eterm plan from Lic for 30 yrs and 50 lac from icici for 30 yrs with riders .

1.Is there any hidden reason appears at the time of claim rejection?

2. Claim procedure will be the same for both policies?

3.pls provide 1 or 2 name of general insurance companies with riders?

Dattatrau-1) There will not be any hidden reasons. Because if they reject on their own, then they have to answer to IRDA.

2) Yes.

3) General Insurance Companies with Riders? Unable to understand your requirement.

Is it good thing to buy 50 lac cover from Lic e-term and 50 Lac from Icici with riders?

3. Do you know any insurance that comes with options of riders like accedent benefits,critical illnesse,terminal illnesses etc?

Dattatray-What purpose it serves of splitting your insurance? Nothing…Buy separately from General Insurance companies the products like accidental and critical insurance products.

Dear Sir,

These days insurers ask for history of previous and other current life insurance policies, if any?

Sir, what impact does it have if someone does not discloses the number of life insurance policies he/she has?

I am asking this because life insurance is different from general insurance and the Principle of Indemnity does not apply on life insurance…this is what I know so am requesting a clarification.

By the way, I was unable to purchase the LIC’s online eterm policy bcoz I’m in my first year of job and cannot give the annual income for previous year.

Thank you.

Sushil-They ask existing LIFE insurance policies ONLY. They not ask for general health insurance details. This question makes them of how much actually is your human life value. So hiding this vital information is wrong and it can trouble in future.

Hi,

I am planning to buy a 50Lac cover in LIC e-term. I would like to know whether death here means whatever way it is or do they cover only natural death? i couldn’t find any terms and conditions for this policy. Also i would like to know even if i stay abroad for quite a while and during that if anything happens, will they honor the claim?

Krish-Death covers both natural and accidental. If you stay abroad, then it does not end the contract. It will be treated as regular.

Hello Sir,

I plan to purchase the LIC e-term policy for sum assured of atleast 50L and I’m a non-smoker.

My query is what is the medical test procedure after I purchase the e-term policy?

Will LIC tell me which laboratory to go and the city too, OR can I ask for the choice of city and date?

I am asking all this bcoz currently am posted in a village far away from city, so can i ask LIC for date and city as my choice for medical tests?

Thank you.

Sushil-Your medical examination will be before they issue the policy. Yes, based on your location, they suggest you the laboratory which is near to you and authorized by LIC. They will inform of what documents you have to carry, timing and the name of laboratory.

Dear Basu,

In LIC e-Term policy, after entered Basic information like this statement appeared above the family details “….. There cannot be multiple entries/no entry for Father/Mother “. There onwards no progress and confirm and proceed option also not responding. Kindly give me suggestion for further steps

Madhu-It is there. Watch my video. It may be due to some internet problem or site issue.

I am also getting the same issue. which video i have to watch

Dear Pawan,

Video which I shared.

Dear Basu,

Thank you, I successfully submitted LIC e-Term policy after watching your video . I have one more clarification, They sent list of (8) medical tests. Will they conduct these tests or we need to go for private labs? And all required documents and Proposal form send in Offline / Online mode ?

Thanks n regards

Madhu

Hi Basavaraj ,

While Opting LIC e-Term Plan , if we add only one nominee (Ex: Wife) and any unforeseen risk happened for Nominee (Wife in this case) and Insured(Husband) at the same time then who are eligible to receive the SA amount in case if they have children and parents .

Here the question is the SA amount will be handover to only Nominee or any other dependant in the family of insured in the demise of nominee .

Venkat-In that is case, the death claim will be handed over to legal heir of insured.

Sir, I have applied for 1 cr. e-term policy online for non-smoker. But after medical check-ups LIC has reply me to pay Rs.6000 more as my test results are of Smokers category. I had never smoke or drink in my life, please advice what should i do?

Thanks!

Arjun-It purely their decision. Check with other insurers.

Hi,

I wanted to know:

(1) Does online term insurance policies cover permanent disability at par with death? Specifically for LIC e-term plan.

(2) which term insurance policy covers the largest types of deaths like terror atack etc.

Ankit-1) Permanent disability is not equal to death of person. Hence, it is not considered for claim.

2) It depends on the company feature. Hard to list all of them.

Hi Basavaraj,

Really nice write up with all details and comparison.

I have a monthly income (take home) of 70,000/- rupees and I wish to take a cover for 1 CR. I felt LIC plan is bit costly with a premium of Rs.17000/- per year with no riders.

. I somehow liked ICIC iProtect smart which gives 1 CR cover + waiver of premium for PD & Rs, 20 lakhs critical illness rider for a yearly premium of Rs.17500/-

Do you think this is a good move to go ahead with mixed options which gives cover + riders?

PLease help.

Thanks,

Vivek

Vivek-You can go ahead with ICICI but stay away from riders. Instead buy those critical illness and accidental insurance product separately from general insurance companies.

Hi, everyone suggests to buy accidental insurance products separately and not as a rider. Why? Please explain.

Indraneel-Because in rider the features are restrictive along with sum assured, which is not with standalone accidental insurance.

Can you please explain what you exactly mean by “features are restrictive along with sum assured” and how “standalone accidental insurance” differs from a rider?

I am a newbie to this field. So have some doubts which might sound plain to you. Please help.

Indraneel-The whole comparison can’t be explained in this comment section. If you need proof, then consider the rider feature of term insurance which you want to buy and then compare the same with ANY of the accidental insurance features. You find the difference 🙂

OK. I will do that.

Just one query, Can you please compare between the premium amounts of term rider and a separate accidental disability policy.

Or

Please suggest some website where this comparison can be made.

Thank you for your quick replies. I really appreciate your help.

Indraneel-You do that comparison also, you will find riders costly in comparison.

OK. Thanks. Will do.

Any suitable website if you can suggest? LIC’s own website is inappropriately managed and difficult to interpret.

Indraneel-LIC’s online term insurance not offers any rider, then why you check riders on their site?

Hi,

My name in Passport is full but in 10th class and PAN is in abbreviations.

Please suggest which one should I use when buying insurance.

Thanks in Advance.

Satish

Satish-I don’t think it creates problem. You can use anyone.

Hi Basavaraj,

I applied for LIC E-term on 1 Nov 2015 online. And successfully submitted all the necessary documents before 10 Nov 2015. They said there is no need of medical checkup. After completing all the documentation, still they didn’t processed my application yet.

I’m continuously chasing to LIC office. I have submitted my documents again and again as they requested many times. Every time they say, it will be processed in 2-3 days. I’m not sure why it is getting late. And today almost 50 days passed.

Should this take generally 50 days ?

What should I do now ?

Is there any grievance cell ?

Surendra-It depends on proposal. It may take time sometime. You have to wait.

Hi sir,

I am confused to choose term plan between LIC (e-term) and HDFC (click to protect).

as per my age LIC amount is more than HDFC plan please suggest me…

May I know LIC cover which type of death please?

Like HDFC cover Terrorist attach,natural calamity,suicide,critical decease death & of course Accident.

Ranjan-There is no such huge difference between LIC and HDFC term plans. Hence, I suggest you to go for HDFC.

Hello Basu,

I am interested to buy. LIC Amulya Jeevan term plan.

Can we buy it directly from LIC office instead of going through any agent or should i go for e-term.

Regards,

Giriraj

Giriraj-Why offline and why not online? Online is cheaper than offline.

Dear Basavaraj ,

In LIC E-Term policy covers Accidental death and Critical Illness ? or I can able to add those additional coverage in LIC policy ?

pls tell me best e-term policy with above mentioned benefits

Thanks

Krishna

Krishna-No, this plan not offers any riders. I suggest you not to combine life with accidental and critical riders. Instead, buy them separately from general insurance companies.

Sir,

I am 36yrs old , married, 3 yrs old son. My annual income is 4 lakhs.

I am Type 2 diabetics and non-smoker.

Can i prefer HDFC Click2Protect or Some other Life term policy.

I need policy with Accident death cover, and

I wish that, there should be no PROBLEM WHILE CLAIMING because of DIABETICS.

Please guide me.

Thanks in advance

Raam Kumar, Coimbatore

Raam-You can go ahead with HDFC. I suggest you not to combine life with accidental and critical riders. Instead, buy them separately from general insurance companies.

Thanks for your immediate replay. I found this site very useful.

sir , i applied e term plan , and iam completed with all procedure including special bio meteric test for Diabetic , 20 days over , approched the concern they are telling it is kept under writter approval , what can i do next

Kathir-You have to wait, it usually takes time.

Hi Basavaraj

I really appreciate your valuable guidance for investments. I applied for a eterm policy of 60L from LIC and they revised my premium to almost double after the medical reports. Is it possible to know the calculation of their logic for increasing premium. Is it possible to reduce the risk coverage age

Regards

Sanjiv

Sanjiv-It is purely their decision. We can’t question. However, you can ask them to reduce the risk coverage.

HI ,

My mother is a TTD (trust) employee. its follows all rules(salary etc..) like a govt employee norms. and she is 51 years old.

my queries are .she wanted to do term policy for her doughter and her take home is 18ooo PM.

1. Will she eligible for LIC e-term policy? because her yearly income does not cross 3 lacs. But she get pension as well. if it includes it may cross 3 lacs. & .she is diabetic and she does not have any other policies(do not know if ttd is giving any govt polocies.)

2.As she did is not fallen under income brackets she did not file any IT return. she get payslips everymonth. Is pay slip enough for applying the policy? or she need to collect her for 16’s.

3. she belongs to non smoker category, on what amount(SA) she can apply.

4.Do you suggest that if she consult any LIC office will be better?

Regards,

Venkat

Venkat-Please let me know whether she need term insurance or she intended to buy a term insurance for your sister (because you mentioned that she wanted to do term policy for her daughter).

She need take term insurance and nominee will be my sister.

HI ,

I recently contacted the LIC for this term insurance. they are telling since she is 49 years we can not provide the term insuarnace instead they are forcing us to take endowment or jeevan anand.

My mother is a govt employee and she can pay premium why they are rejecting while discussion it self.

I spoke in LIC people only not agents.

Regards

Venkat

Venkat-It is completely wrong. Don’t contact them. Instead, use the online facility and complete the proposal process. Let them process and give the reason for rejection.

sir,

I want to know is family medical history mater at the time of buying LIC e term plan.

Parvinder-YES, very much.

My age 32 i am willing to take term plan from LIC of Sumassured of 25 lakh so kindly advice which plan is best is it pure term plan or Refund of premium i am confuse in between these two . I compare all term plan i find LIC is best in all sence except premium because premium is high as compare to others. But still i can manage it but which one is best term plan or term plan with refund of premium.

Nitin-LIC is best and go ahead if the premium is affordable for you. LIC not offers any premium back term policies.

Hi,

I need to put multiple nominees(Parents & spouce) for my LIC online term plan for 50L. Kindly let me know how to opt for multiple nominees for LIC online term plan.

Jyothi-Even if you nominate parents, the first legal heir will be your wife and it goes to her ONLY but not to your parents. Hence, I suggest to stick one nominee as WIFE.

Thankyou, who will be the best nominee , minor child or wife,

Basu-In my view wife.

While filling LIC online term plan, After entering nominee details it’s shows error as “We are not in a position to process your request. kindly try later or contact ….”..

Please clarify

Jyothi-I am not sure of what wrong is with that particular message. Please try after some time. If error persists, then contact LIC.

Hi Basavaraj,

Can you please explain the basic difference between (apart from the premium amount) Amulya Jeevan and e-Term Policy of LIC? Is there any difference in claim process for the e-Term policy? Why should one go for the e-Term policy instead of Amulya Jeevan? Also, is it LIC look out for arranging the medical test if I am buying e-policy?

Thanks in advance!

Vineet-Apart from premium and ease of buying of e-Term, there is no DIFFERENCE between both (even in claim process). Cost effective is the major force to go for e-Term. For both plans, LIC manages the expenses of medical test. However, if the proposal rejected then in both the plans, they deduct the premium equal to the cost of medical test and return the premium.

Thanks for your reply.

And, the premium is low with e term as compared to any offline policy, is due to no agent commission involved. Is that right? Also, does LIC provide the hard copy of policy or will it be the soft copy only because of online policy?

Vineet-Yes, due to no middlemen the cost will be lower in online term plans. No, they provide hardcopy of policy document exactly like offline plans.

Thanks for all the detailed information. At last, I have given the proposal for LIC e-Term policy. Waiting for the next steps whatever communicated from LIC. Fingers crossed.

Thanks again for your help.

Plz let me know that if their is natural death, accidental death and medical insurance corvered in term policy or not and how the claims are taken do let me know in details

Thanks in advance

Balbir singh-What do you mean by “medical insurance corvered in term policy or not”?

Hi Basavaraj,

I register this policy on 12th Oct and went for medical test on 20th Oct, now since then the eterm team in LIC saying that the proposal is with underwriter for the decision. But that thing is still pending since last 25 days. E term customer care are not responding as well. How to escalate this matter and to whom? Please advise if you are aware of such situation.

Thanks

Vineet-Better to wait few more days. Because if they have some concern then it takes time.

Hi Basu,

Your information are very useful to all readers. I have some doubts about LIC E-term policy. Please clarify the same.

1. LIC E-term policy includes the accidental death benefits?

2. While applying on-line, in the family details which are the details to be entered. Myself, My wife and son are living away from my native place. My parents alone are living in native place. My two brothers are living separately along with their families. Should i include my parents and brothers also in my family details while applying online policy.

Expecting your valuable reply….

Mahi-1) This plan not offers any riders like accidental. Hence, no additional benefit in case of accidental death. Nominee receive only the sum assured.

2) Yes, include parents.

I am willing to go for LIC E-term policy, and have few queries as below. Can you please help me to clarify the doubts?

1) Can I take 2 different policies of 30L each and put my wife as a nominee in one and my father in another policy?

2) What is the maximum amount for which I can opt for the Term insurance?

Girish-1) Yes, you can do so. But it cost slightly higher. Second, even if you nominate your father, the first legal heir will be your WIFE ONLY. Hence, she can claim from your father.

2) It depends on your income, age, health and other issues which underwriter consider while issuing a policy. Usually, they allow insurance of around 20 times of your yearly income.

Thanks a lot for your reply Basu,

Does that mean there is no other way in which I can ensure that some amount should definitely be received by my father only?

Girish-Legally NO.

Thanks a lot for your guidance Basu. You clarified most of my doubts!

Hi,

I had purchased E term online. after medical i got an email as below. What should I do?

Dear Sir/Madam,

The following is the decision of the underwriters

[DECISION] : WITHOUT COMMITMENT POSTPONE FOR 3 MONTH FOR PROPOSALS : 5247

We thank you for your proposal No 5247 for assurance but regret to inform you that it is not possible to accept this proposal at present. The consideration of your proposal is postponed .

Kindly let us have your consent for the postponement of the said proposal, as above, or you could also request for refund of the deposit amount (subject to deduction of cost of medical examination/special reports fees), if you so desire.

Regards

Admn.Officer, LIC Direct

Pounacha-Who take care the risk of the period until they get GYAN and issue the policy? Strange and worst decision from LIC. Just come out or let them specifically mention for what reason they are postponed and when they issue. If they are not specific then it is wrong to wait. Move with private players.

Hi Basu,

I’m unable to decide between taking Amulya Jeevan II or LIC e-term.

For a sum assured of 50 L, the difference in premium is roughly 40%. The term is 35 years (I’m 31 year, and 6 months now).

The 3 main queries I have are:

1) The LIC agent who is helping me with Amulya Jeevan II clearly mentioned that in that plan, I’m assured till end of life, EVEN AFTER the tenure ends i.e. even after I stop paying premium 35 years from now. Is this accurate? How does this compare the LIC E-term policy? The information online doesn’t really clarify this clause.

2) Can you confirm that neither Amulya Jeevan 2, nor LIC E-term have any “disability”, “disease”, or “unemployment” benefits? Does the LIC E-term policy also cover Suicide?

3) Is there a way of skipping the medical test while signing up for the LIC E-term policy (by way of changing the sum assured, or tenure, or specifics about my health). I’m a healthy non smoker, non drinker and am not excited about being poked with needles.

Thanks for your assistance.

Best,

Icarus

Icarus-1) The biggest mis-selling and the cheater is your AGENT. Amulya Jeevan II works exactly like LIC eTerm. In both the plans life risk ends if your death occurs, at maturity or if you stop premium payment. Now decide yourself how much you have to believe your AGENT and his service for the rest of years.

2) Both plans not support any disability riders or unemployement benefit. Both the plans covers suicide only after a year of policy start.

3) If you skip the medical test then they may have more reasons to reject the claim. If you don’t want to go for medical test, then simple solution is to STAY AWAY FROM TERM INSURANCE.

OR TAKE THE ADVISE OF YOUR AGENT WHO IS CLAIMING ALL FALSE INFORMATION TO LURE YOU.

Basu,

Thanks for your prompt response, and for clarifying my doubts.

Can I assume you recommend that I book the LIC E-term policy online directly? Is there any benefit at all in signing up for the more expensive Amulya Jeevan II ?

I noticed some comments around the claim to payment ration being unknown for the E-term, and that it could be risky to buy it?

Regards,

Icarus

Icarus-There is no special benefit to you in buying Amulya Jeevan II. But yes, your agent have good benefit in terms of commission. Hence, he may build up lot of theories. For your information, claim settlement of Amulya Jeevan II are also not known. Becuase it is a raw data which not classify whether the settled claim is of term insurance, endowment or ULIPs. Hence, don’t worry and go ahead with online term plan.

Hi Basavaraj,

Thank you for the information in the article. I have one doubt which I would request you to please help clarifying it.

I was a smoker and quit smoking about 3 years back. So last 3 years I am not smoking.

Last year I purchased a LIC e-Term plan for 50 lakhs. While applying I got confused whether I should apply as a non-smoker or smoker. I e-mailed them and asked this question. They asked me to apply in non-smoker category. I applied in non-smoker category and finished medical checkup and got the policy as well.

Now my doubt is,

There was a question – Are you a smoker or have you ever smoked. I answered “No” to this question.

I answered “NO” to that question because I was applying as a non-smoker.

1. Will that make my policy invalid because I was a smoker previously?

2. Can I cancel this policy and apply for a new policy declaring that I was a smoker before?

Waiting for your valuable help.

I think I committed a mistake by purchasing a policy without consulting an insurance expert. 🙁

Augustine

Augustine-You have a proof of their communication regarding this issue. Just keep the printout of the same along with policy document. No need to worry.

Thank you Basavaraj for answering my Query.

My annual income is 15L. So I was planning to buy another term plan also for 50L from HDFC (or any other provider). To avoid this confusion, I am planning to declare as ‘smoker’ in the new term policy. If I declare as ‘smoker’ in the new term policy will that create any problem? Because I declared as ‘non-smoker’ in the LIC policy and declare as ‘smoker’ in the HDFC policy? When applying for HDFC policy I have tell them that I have a LIC policy also right?

Thanks in Advance.

Augustine

Augustine-If you quit smoking since 3 years and you no longer continue that habit in future, then I don’t think it is required to mention about this habit with HDFC too. Yes, while applying for HDFC, you have to mention about the existing LIC policy details.

Hi Basavaraj,

Let me appreciate you for providing your valuable suggestions to many people who have doubts on insurance policies.

On Aug 27th 2015 I have applied for 25Laks LIC e-term policy, paid the amount on the same day. Still LIC not issued the policy number. Current status is praposal with LIC underwriter.

On 01-Sep-2015 I have applied for 25 laks AEGON Religare iTerm Insurance Plan, today I got policy number via SMS and awaiting for soft and hard copies.

When I was applied for LIC e-term I was not having AEGON Religare policy, When I was applied for AEGON I was not ( still not ) having LIC e-term policy numbers. So I was not able to declare these details.

Does this impact on claim ?

Please advise.

Regards

Aditya

Adityakumar-If LIC accepts your proposal at later date than that of Aegon then you have to inform to LIC. However, if policy period start date is prior to Aegon, then you have to inform to Aegon. Informing either of insurers based on the policy commencement date of LIC will relieve you.

Thank you Basu sir for your timely reply.

I have one more doubt. Please clarify. You say that the acceptance of my application for term insurance will be based on my income, health issues and current insurance. I have already told my income level. I am a Non-smoker category and am maintaining good health. As I already said, I have to pay around Rs.8000/- per annum for Jeevan mithra upto the year 2020 and Rs.4400/- per annum for Anmol Jeevan upto the year 2025.

1. Please advise me whether I should close these policies before taking term insurance of Rs.1.5 crore for 30 years from any one of the companies so as to get the eligibility for the desired amount and term period of insurance.

Yours

06.09.2015

Madurai Suresh Kanna

Suresh-That you have to decide. Because I don’t know for what purpose you bought these policies. But the reality is, endowment plans provide you returns of around 5% and offline term plan is costlier. My suggestion is to apply for term plan without mentioning both these policies. Once you get the term insurance policy issued, then go ahead and cancel these policies immediately.

Dear Basu,

I am 45 years old. Central Govt officer. My wife housewife. I have two daughters at the age of 14 and 7 respectively. I draw anuual GROSS income of Rs.7.25 lakh at present. You know that this income is to be revised around Rs.9.25 lakh (minimum) from next year due to recommendation of pay commission w.e.f. 1.1.2016. I have read your various blogs. I bought 10 years ago one LIC Jeevan mithra – 1 lakh policy (triple coverage policy) covering upto the age of 50 (Rs.7892/- per annum) and I bought 5 years ago LIC Anmol jeevan for Rs.10 lakh covering upto the age of 55 paying Rs.4400/- per annum. Now I want to buy term insurance for a sum of Rs.1 crore to Rs.1.5 crore and for a period of 20 years to 30 years i.e., upto the age of 75. The premium amount of LIC e-term, HDFC click 2 protect, ICICI prutential I protect, MAX Life, AVIVA and Kotak e preferred for Rs.1 crore and Rs.1.5 crore in respect of term period of 20 years, 25 years and 30 years are given below for your ready reference. Please advise me, after analyzing the tables and my opinions in order to come into conclusion and to take the right decision.

20 years 25 years 30 years

1 Cr. 1.5 cr. 1 Cr. 1.5 cr. 1 Cr. 1.5 cr.

LIC e-term 38988 58482 46170 69255 54378 81567

HDFC click 2 protect 24443 36665 28878 43318 36252 54378

ICICI i protect 29526 44289 34086 51129 NA NA

MAX Life 19200 28800 21200 31800 NA NA

AVIVA 24169 36254 24792 37188 NA NA

Kotak e -preferred 21119 30296 22430 32234 24567 35397

My opinions are:

1. As per your advice, the risk coverage period need not go beyond the retirement age or some more years based on our financial commitments like children studies, marriages etc., i.e., not beyond 65 at any cost because thereafter it would be a burden to us. But what I feel that if I am covered upto the age of 75, the chances of receiving the sum assured are much more to our nominee / children and that I ask why it should not be considered as one of our additional investments made to our children like House, Land , jewels, FD etc.,

2. You frequently say that the amount of coverage should be reviewed at the interval of every 5 years because we will earn more in future and the value of coverage might be considered lesser at that time. In this regard, what I feel that though the amount of coverage of 1 crore is considered enough at present it would not be definitely suffice in future. If I increase the coverage amount by separate policy at that time , I will have to pay higher premium and above all there would be possibility of rejection of my application due to medical reason, if any. So I want to increase my coverage upto Rs.1.5 cr. Moreover, I feel that it would not be a burden to me because I pay nearly Rs.3000/- pm now and after a period of 15 years i.e., in post retirement the value of Rs.3000/- would be definitely drastically diminished due to inflation. Hence, it would not be such a heavy burden to me even though I will be getting pension only.

3. You say that all these pvt companies are much reliable like LIC since they are all have good solvency ratio with IRDA regulations. Moreover, when we do not have the claim settlement ratio of these companies including LIC e-term with regard to term insurance, why I should not go with Kotak for Rs.1.5 crore for 30 years If am not able to go with LIC e-term for 30 years for a sum of Rs.1.5 crore.

4. All these are only my opionions based on your argument. Please inform me whether my thinking is right and any omission is there in arriving at my conclusion or any hidden clause is there in kotak for their such lowest premium when comparing to others.

5. I came to know that Kotak e-preferred started only 1.1. 2015.

Expecting your valuableand timely reply,

Date: 05.09.2015

Madurai Suresh kanna.

Madurai-1) Yes, the possibility to get RETURN from Term insurance is more when you turn around 70 years. But what about the value of this sum assured when you turn to 70 years??

2) First check whether they issue the policy of Rs.1 Cr or Rs.1.5 Cr. It depends on your income, health issues and current insurance. If they issue then go ahead.

3) No issue, you can go ahead.

4) I already shared my experience.

5) So what?

Hi, Can someone help me ? I have recently finished my MBA and joined a company. I didnt file my IT return for the last 2 yrs. Will I be able to get LIC e-term Insurance ?

Note: I have 3 years IT return filed before I started my MBA. But dont have IT return for last 2 years.

Nanda-You can submit your Form 16 or income proof of employment and buy it.

Dear Basu,

I have applied for HDFC Click to protect life insurance. After medical tests they came back saying wanted to postpone “Elevated blood sugar levels , liver enzymes levels and MER findings” they are not going to share the medical reports me and would like to refund the full money.

I immediately planned go with LIC though its costly compared to HDFC.

Do I need to disclose postponement of the policy with HDFC and its reasons while applying with LIC?

Regards,

Mahesh

Mahesh-Not required.

There was section in the policy online form it says

“I further agree that if after the date of submission of the proposal but before the issue of First premium Receipt”

“if a proposal for assurance or any application for revival for a policy on my life made to any office of the Corporation or any other insurer has been withdrawn or dropped, deferred or accepted at an increased premium or subject to lien or on terms other than as proposed i shall forthwith intimate the same to the corporation in writing to reconsider the terms of acceptance of assurance”

this should be fine right ?

-Mahesh

Mahesh-The first sentence of what you shared is about start of risk. Insurance companies not provide any claim if death occurs during the submission of proposal and issue of first premium. I don’t think the second point create any issue. Because they again suggest you to go for medical examination, where they surely find this issue.

Dear Basu,

I am 34 yrs old and would like to buy a Term insurance. What is the Policy Term or Tenure in Term insurance policy? and on what basis we should select the Policy Terms (Ex. 20 yrs term, 30 yrs and 35 yrs term). Could u please explain?

Thanks,

Sharad

Sharad-Policy term means the period for which they take your life risk. It must be equal to your retirement age.

Hi Basavaraj,

1. Can we buy more than one insurance policy?

2. Is it ok to declare the previous insurance details to second insurance provider if he ask for, or we can hide

3. If we hide, is there any effect while claiming from both the insurance providers.

4. If answer the q.1 is ‘Yes’, then how claim process works, if I am submitting all my document to 1 insurance provider, then how to claim from second insurance provider.

Thanks,

Vishal

Vishal-1) Yes. 2) It is a MUST to declare. If you hide then they can reject the claim. 3) They may easily reject the claim. 4) You have to follow the same procedure with other insurers also.

Hi Basavaraj,

Thanks a lot!! for you your valuable reply.

I more thing i wanted to know is that, all the insurance policy by default cover the accidental death also or only when we buy out for Accidental Death Benefit rider.

Regards,

Vishal

Vishal-All insurance policies cover accidental death. But when you need additional sum assured be payable if death occurs due to accident, then you have to buy a rider.

Hi,

I am 26 years old,smoker and wishing to go for 1Crore sum for 34 Years.

I was applying for LIC e-Term insurance. At initial stage I came across below the question,

Do you wish to opt for:- 1. Aggregate Rate(For sum assured upto 49lacs, ONLY for aggreagate rate is applicable)

2. Non-Smoker Rate(For sum assured 50 lacs and above proposer can opt for non-smoker rates subject to findings of urinary continine test )

I guess i should select option 2, right?

But I didn’t get the meaning of the terms inside the brackets, for both the cases.

please elaborate what does it means? If i am choosing sum to be 1 crore then what the bracket sums are saying.

it will be much helpful.

Kedar-Yes, you have to opt 2nd one.

Thanks Basu.

But I am confused with the description provided inside the brackets as in below.

2. Non-Smoker Rate(For sum assured 50 lacs and above proposer can opt for non-smoker rates subject to findings of urinary continine test )

Can you please elaborate von it.

Kedar-They are saying that you have to opt non-smoker rate and if later on they found any proof of your smoking habit during test then they consider you as a smoker.

Hi Basu,

First off all I would like to appreciate you for your service which is valuable.

I am planning to opt for LIC e-term plan. I am just curious about below simple doubts/queries regarding e-plans,

1. As currently I am unmarried, I am putting my parents as nominee. But they are illiterate/unfamilier about internet or anything online. Is it necessary that the nominee be should able to claim online?

2. If No, Then can they claim offline by contacting LIC peoples.

K2S-1) Claim procedure is not ONLINE. Only buying is online. 2) Yes.

Thanks Basu.

Hello Basavaraj,

Thanks for sharing all the above questionnaires.

Could you please clarify one of my question regarding State of Health in Family History.

I am planning to take LIC e-term policy. In the online form one has to fill the “State of health” of all the family members.

There are only 2 options “Good” and “Not Good”.

My Father is healthy person. But he has diabetes. I am confused how to highlight this point in the online form.

In this case should I mention Fathers State of health as “Good” ?

In that case can I manually write regarding his Diabetes using a pen on the application form (where Family History Details are mentioned) before submitting to the TPA ?

Regards,

Praveen

Praveen-Better to mention as Not Good. If they ask reasons then you can mention it.

Hi Basavaraj,

I want to buy a term plan with S.A 1cr.I need rides as well with term plan.SO as such i have a plan to purchase two term plan as below.

LIC(50L)-no rider

SBI(50L)-rider available(50L).

1.is it ok to take two term plan instead of taking one single term plan?what are the disadvantage of taking two term plan?

2.taking two term plan will create any problem in case of claim scenario?

2.SBI is having accidental death rider, but what if there is no loss of life and ocurred permanant disability due to any accident?