LIC declared it’s bonus rate on 6th September 2013. So let us see some big movers and changers this year. Surprising factor this year is the Jeevan Saral. I updated the comparision from my old post to till this declaration. I also highlighted with red colour wherever I found some changes in rates.

Note-LIC declared bonus rates for 2014-15. You can view the details in my recent post “LIC’s Bonus rates for 2014-15 and Comparison“.

You notice from above table that bonus rates are kept as it is for most plans. But major changes are for plan Jeevan Anand, Jeevan Tarang, Jeevan Shree 1 and Jeevan Pramukh. Hope policy holder will rejoice 🙂

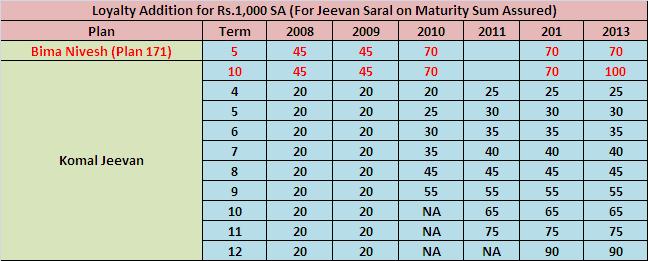

Below is the LA table for Bima Nivesh and Komal Jeevan.

Now the surprising part about LA declaration will be about Jeevan Saral. Last year LA was declared based on the term of the policy. But this year LIC classified LA rate based on term and premium payment slab also. Below is the table showing the same change.

Hope I furnished the full details about the same.

i am having a jeevan saral with yearly premium of 72000. policy term 12 years.

what will be maturity amount approx?

Abhijit-Refer my earlier post “LIC’s Jeevan Saral-Why so much confusion?“.

sir myself having a jeevan saral plan for 15,years my yearly premium is 12254/- at the age of 26 in the year 2013

my question is to u that can u give me an idea that how much I will get after maturity period

Prosenjit-Around 5%.

Hi,

I am having a JEEVAN SARAL policy from LIC. I invested Rs 42035/- per year and 20 years plan.

Can you please confirm that how much amount i will get after mature.

Or

As per current market i can get max if i was invested 20 years back.

Thanks,

Raj

Raj-Go through my earlier post “LIC’s Jeevan Saral-Why so much confusion?“.

I have Lapsed Policy (Lapsed since 11/2011) from LIC (Jeevan Saral) 165-25-25 with assured sum of rs 5,00,000/-.

LIC has recently sent a revival plan (Of course with a certain Late Fee).

Is it advisable to revive the Policy?

Do You Need any other information to answer this query?

Avinash-Better to surrender (if policy completed minimum years).

sir, I have 3 LIC POLICY. DETAILSS ARE GIVEN BELOW :

POLICY NO. & NAME SUM ASSURED STARTING DATE COMPLETION DATE

1. 551480396- endowment 25000 28 oct-2001 yly 28.03.2016

2.556840352 samridih plus 25000 20.4.11 yly 20.4.15

3.556841254 -do- 25000 10.5.11 10.5.15

though the policy no 2&3, maturity date is 20.4.21 & 10.5.21, The RANCHI AGENT TOLD ME THAT IT CAN BE TAKEN THE MONEY AFTER 5 YEARS PAYING.

NOW THIS IS MT REQUEST TO YOU ABOUT HOW MUCH I CAN GET MONEY FROM THESE AFTER MATURING, A LUMP SUM WILL BE SUFFICE.

NOW MY SON IS WORKING IN BANGALORE, TCS. I DESIRE TO DO FOR HER PENSION AFTER 60 YRS. HE IS NOW 29 AND EARNING A PACKAGE OF 8LAKHS PER ANNUM.

PLEASE LET ME KNOW, THE ABOVE. PARTICULARLY, HOW I CAN DO ANY PENSION POLICY FOR MY SON, WHAT WIJJ BE THE YRLY PREMIUM AND HOW MUCH HE CAN GET AFTER 60. I NEED ABOUT 70 TO 1 CRORRE AFTER HIS RETIREMENT. THANKING YOU..

YOURS – ARUN KUMAR SENGUPTA

Arun-Don’t run behind any pension policy.

Why not the pension policies….??

Anoop-Taxability and illiquid options are the negatives of pension policies.

Hi Basavaraj,

I need your help regarding my investment of close to Rs 49000 /yr for 20 yrs sum assured 10lacs back in 2008 in ING product, now known as “Exide Life Creating Life Child” . Frankly, I was quite novice while opting for it as I thought of saving some money for future of our kids. Is it still a good policy and advisable to continue as I am still not sure due to ambiguity and continuously changing the policy name and market conditions.

Thanks in advance for your help and time.

Regards,

Prashant

Prashan-I strictly against any product which combines Insurance+Investment. I don’t know exactly the fine prints of this product. Hence, I can not comment more.

Only single premium bobb

Only single premium rendowment table no 48

I have ULIPs Yungstar Champion, Progrowth Super 2 and Wealth Multiplier by HDFC and Exide Prime Life. I have appx 5 years pending till maturity. Should i continue these?

Mahesh-Before that check the current valuation of these ULIPs and how they performed. Then go ahead for either continue or discontinue.

Thnx for ur kind reply. If i compare with FD returns @ 10%, then i am at loss for last 5 years or u can say since commencement. I am not getting desired returns, and if i surrender, then they will deduct Surrender Chares as well. So, i want an advise on this. Thnx

Arun-Better you wait for days when your ULIPs are at 0% surrender charges. But waiting is not worth if it is not adding any returns to your investment.

I did get call for Plan 814 The callers Mahi Sharma and Mayank Jaiswal say they are from LIC connugt place . Numbers called from 919711654717. They are aslo saying a person from LIC office Pune Shivajai nagar branch MR Prakash witll come for the document collection. And we can verify the ID .The Juicy offer is the Agent commision amount is being credited to policy holders account. 20% in the Ist year, 10% for the remaining years. Can LIC confirm this is true and correct, It sounds correct but I have my own doughts. How do you verify the Valid ID card.

Raj-Stay away, it seems a spam call. If you want to go with them then let them present in concerned branch and you submit all documents in front of Branch Manager of that branch.

Hi,

I have jeevan shree policy since 2000 and have been paid all yearly premiums. Can i withdraw money after surrendering teme in 2016 or will i have to keep is as a floater till next 9 yrs.

Nitin-Surrendering means withdrawing money.

Yes, precisely. I was told that one can withdraw money post 16 yrs (after paying premiums) and surrender this scheme or else can keep it as a floater for next 9 years and take some extra amount after 25 years. So my query is

1) can i withdraw the money and surrender this policy. Leading to a closure

2) If yes, what money will be there lump sum (16 yrs)

3) If no, than what would be the total amount payable after 25 years

Premium being paid by me was 24423.

Nitin-First check for surrender and paid up of policy values. Then dedice. In my view if it is near to maturity then don’t surrender, instead make it to paid up.

I have Jeevan Shree (T No 112) taken in 2001 for Rs. 500,000. Term 25 (premium paying 16)

Can you please share the approx amount that I will get after 25 years?

Bhupinder-What was your expectation while buying or what your agent told to you while selling?

sir, in 2008 i have taken jeevan anand(958/- monthly) and jeevan mithra(814/- monthly) policies for 250000/- each at the age of 29years. now i am planning to surrender the above policies and the same amount invest in mutual funds.i had 35,00000/- term policy, 50,00000/- accidental policy and 300000/- family health policy. so i need only returns.so please advice how much amount i will get whether surrender above endowment policies. suggest will i continue or surrender.

thank you

Harnandha-Please contact LIC branch.

I have a Jeevn Shree (T. No. 162). Sum assured is 5,00,000. Policy Term is 20 and payment term is 12. My premium is 36490. The policy started on 2007 and as of today I have paid 8 years premium. But my vested bonus is showing just 47000 in lic portal. I think it is wrong. Can you please help.

Augustine-Please check up to what year bonus they showed on LIC portal?

Thanks Basavaraj for response. We dont have an option to see it that way. My understanding till day was it should display the vested bonus accumulated till day. Since I have paid already for 7 years, I guess it should be more than just 47 K.

Also adding to above. The benefit of the policy says there will be bonus based on the rate (for every thousand of sum assured). Also for this policy there is some bonus based on LIC performance. Not sure whether these things had any impact in less vested bonus.

Also I paid my second installment for this FY just today. Not sure how exactly their site works. May be they will do the calculation only after full payment for current FY

Augustine-They update once in a year for all policies. Also the above declared bonus rates not yet updated.

Hi Baswaraj,

I have two (one for myself and the other for my wife) LIC Jeevan shree-1 TA162 policies, started in the year 2009 with 25,000 premium each (sum assured is 5 lakhs). We have paid 5 yearly premiums so far. I decided to invest in mutual funds rather than LIC policies to face the inflation and take term plan for insurance purpose. one LIC premium replaced with term plan and other premium with mutual funds.

I am planning for paid up of these two policies. Is it a good idea ?? (OR)

take a loan on these policies and invest the same in mutual funds ??

I know that surrendering policies will give only 30% of amount back.

Please let me know your suggestion.

Srinivas-You said that started these in 2009. First check out both surrender or paid up. Then think which is feasible to you based on your financial situation. Otherwise share the two values here again to discuss further.

Hi Basavaraj,

Hope you are doing well.

I am taking New Endowment policy (814) of LIC. Plan details is

Yearly premium 61150 yearly (including S.T.)

Terms: 30 years

My Age: 26 years

As per the LIC executives and one financial adviser the return which I will get is more than 70lakh. Is this really I am going to get OR this amount is just to make me impress?

Your advice will be well appreciated.

Thanks,

Ankur-What is the sum assured? In all probability they considered higher bonus rate. Please check with them how they arrived at this value and share the same with me.

Hi Basavaraj,

Thanks for replying.

Sum assured is : 2000000

Rev Bonus rate is 48/1000

FAB taken is 1150

Kindly let me know will I really get this amount. If I get can 60+ lakh on maturity than also I am happy with this plan.. But will I get ?

Please advice.

Thanks,

Ankur-Great to know that you are very much satisfied with even Rs.60,00,000 too. Do you know the return? It is around 6% to 7%. So with kind of inflation of around 7%, do you feel you can sustain financially in long run? I feel the FAB is exaggerated a bit. But even if we consider that correct, the return on investment is not at all worth to invest for so long and expect 7% return. It is your money and you decide 🙂

Hi Basavaraj,

I agree with you. I am actually not aware of the inflation rate which is going to come. I wanted to take a policy in which i can secure my life after retirement.I know it is a very long planning but I am looking for some policy/investment in whch i can get good return plus guranteed return (atleast 80% guranteed).

If you could suggest me any policy or investment which can fulfill my requurements that would be a great help from you.

Also i wanted to ask is it good to invest in PF account which is linked with my salary. If I increase my part of share in PF, will it be a good idea as there the interest rate is 8.75% plus it is secured n guranteed too.

Kindly guide.

Thanks for continuos reply.

Ankur-I already replied to your comment. Please check it.

Hi Basavaraj,

Can you please tell me any other plan which can give be better returns and guranteed returns( atleast 80% guranteed). I can invest for 20+ years tenure.

Also is it good to invest in EPF account. As it provide 8.75% of interest.

Thanks,

Ankur-When you are investing for long term then you must understand the meaning of inflation to your investment. So EPF or PPF are good. But parking all your money into such debt products is not wise. Instead, if your time horizon is 20 years then select 1-2 mutual funds (equity oriented) and start investing. Then see the magic of equity and compounding at 20 years.

Alrighty Sir… As you suggested, I am not taking any of the LIC policies for investment purpose (taking term plan for risk cover purpose only).

As per your suggestion along with EPF/PPF I will also invest in mutual funds (equity oriented).

For that case my last query is.. Can you please help me in providing any of the good policies for investing in Mutual funds which can give good returns and a bit guaranteed too. 😛

Thanks a lot ,

Ankur Mathur

e good policies, I mean to say nane of few of the good policies so that i can i can put my efforts in r&d of only nice policies provided by you.

Thanks Sir…Byprovidingfewoft

Anku-Policies for what?

Ankur-The list is available in my old post “Top 10 Best Mutual Funds to invest in India for 2015“.

Name : BIDHAN DAS

Hi Basvaraj,

I have bought Jeevan Saral and here are the details:

Age : 34

Policy : Jivan Saral (165)

Commencement Date: Jan 2012

Terms : 35 Years

Mode : Yearly 60000/-

If I wish to continue upto 3 years, how much i will get (all total)?

If I wish to continue upto 10 years, how much i will get (all total)?

If I wish to continue upto 25 years, how much i will get (all total)?

Also, is it beneficial to stick to the plan?

Your help will be grateful

Regards/Gaurav

Gaurav-You get all your answers at my earlier post “LIC’s Jeevan Saral-Why so much confusion?“.

I took a LIC Endowment policy (with profit) in 2013 at the age of 25 with half yearly prem. of Rs.31820 for 15 years, maturity will be after 20 years of which no prem has to be paid for last five years. I was told it would fetch me about 25 lakh on maturity. Could you please confirm it?

regards,

Chandan

Chandan-You have not provided the sum assured. Also no need to expect more than 6% from this plan.

Sir, I own an old Jeevan anand plan in 2010 at the age of 32 ( 22550 / year for SA 4 lac in 20yrs ) .

1. Is editing possible in my plan, can i reduce the term period to 16 years by changing premium amount. ?

2. Is this is an good idea?

Thanks,

Dr. KRK Rao

Rama Koteswara Rao-First think whether this investment is good or not?

I HAVE JEEVAN SHREE-162 SA-800000 FOR 20YRS,PPT-12 IN 2012,CAN YOU TELL ME MATURITY AMOUNT ?DOES ANY OPTION TO INCREASE PPT FROM 12 TO 15 FOR REDUCE MY QUARTLY PREMIUM?

Ram-Return will be around 5% to 6%.

sir, i have taken new jeevan anand for 17 years of s.a 400000 on yearly premium rs.30366.plz reply how much i get on maturity

Rajesh-Go through below comments. You get answer.

Hello Basavaraj Tonagatti,

I request you to please help me regarding a couple of policies and their maturity:

1) BIMA GOLD

(PREMIUM: 81,870/-, TENURE: 20 YEARS, SUM ASSURED: 25,00,000/-, DATE OF COMMENCEMENT: 28/03/2006)

I am told that there is LOYALTY ADDITION at the end of the tenure. How do I calculate the Loyalty Addition?

2) CHILD FUTURE PLAN

(PREMIUM: 50,038/-, PREMIUM PAYING TENURE: 18 YEARS, SUM ASSURED: 10,00,000/-, DATE OF COMMENCEMENT: 28/08/2008)

FINAL MATURITY IS ON 28/02/2031.

I am told there is a FINAL ADDITIONAL BONUS at the end of the tenure. How do I calculate the Final Additional Bonus?

Different people give me different views and opinions. Kindly help me to know an estimated figure and if possible please direct me to a link for absolute certain clarification.

Varun-FAB is one time payment. They pay you either at claim time or maturity time. It is usually per Rs.1,000 Sum Assured. Suppose you have Rs.1,00,000 Sum Assured policy and LIC declared FAB of Rs.200 then you will receive Rs.20,000 as FAB (one time).

i purachased a jeevan anand…sum assured 13,0000 for 15 years…annual premium is close to 1,00000.

already paid 2 premiums.How much money will i get after 15 years ??

Chandu-Read below comments. You will get answer.

Hello,

I have read this blog as well as the comments on this blog.

I have a question regarding Jeevan Anand just like all others.

I have a LIC Jeevan Anand for the sum assured 10L, for which I have been paying premium of Rs. 4ok every year, and 4 premiums paid.

I have gone through your blog as well a few others like JaagoInvestor and understood that its not good to mix investment and insurance, and that is very clear to me now. And I have almost decided to come out of it. I have a question –

Lets consider this scenario,where think of this Jeevan Anand just as investment (since I had already paid some premiums).

As per the agent and a few sites on the internet, after 25 years (20 yrs from now), I will get around 24 L as maturity amount, and cover of 10L still continues.

Now, lets say I come out of it, I had already paid 1.6L and I will only get 80k.

Now, lets say I put this 80k in the PPF as starting balance, and keep putting the same 40k per year also to the PPF, considering the 8.7% interest rate, it will become approx 25L after 20 years.

So, don’t you see not-much difference between the two?

Or 24L claim by agent etc is not at all true?

I know the maturity values depends on bonus and FAB, but still is it far away from actual maturity value?

Please resolve my final concern.

Thanks

Deepak

Deepak-Currently Jeevan Anand bonus rate is Rs.48 and if we consider the same then bonus accumulation from this policy will be Rs.12,00,000. So in all probability you will receive around 23,00,000 (SA+Bonus+LA if any). So it is close to what your agent claimed. Now coming to your point. Difference you forgot is, in the beginning itself you are less investing to PPF than Jeevan Anand. This loss of Rs.80,000 will be compensated for you with the cost of actual return. Even though you feel neck to neck compare, but I still feel that it is not worth to get around 8.7% also for long term investment like 21 years. Even if you opt a balanced fund, your return will be anywhere between 10% to 12%. Why to stick to debt when your investment horizon is so long??

Hi,

Thanks for the reply.

Let me make my query a little more clear.

I have this policy bought 4 year back, 4 premium paid, and at this point of time, I am thinking whether I should continue or come out of it ??

Secondly, PPF comparison was done to check whether the same money can make more or less?

So, starting from 4 years back —>

If continue with policy – around 23L (investment is 10L) – profit is 13L

Discontinue policy – PPF gives me 25L (considering the same amount to be invested every year, and 80 k (1.6L paid – 80k return now) as initial investment) – profit is 15L

So, this is only thinking about investing the same money somewhere else or continue the policy?

For the non-debt investment I am going to plan separately.

Still good idea to discontinue the policy?

Thanks

Deepak

Deepak-I feel if you have exposure towards equity investment then why to stick to this product?

Ok, thanks, got it.

Thanks again.

I purchased a HDFC LIFE SAMPOORN SAMRIDHI POLICY ON SEPT-2013.

Tenure: 11 years

SA:24 lacs

Consider policy was in force till its last premium and I

opted for ” Enhanced Cash “” option on maturity.

Pl. tell me how much i will get after maturity.

Asim-It is typical traditional plan. So I don’t feel it will give more than 6% return.

Dear Mr. Bsavaraj Tonagatti,

I understand your comment.But request to little elaborate by calculation as i opted for enhanced cash option at the end of maturity.Already Revisionary bonus is declared at3% guranteed till 2021.I await your valuable reply.

Asim-My answer is already predicted by the declared guaranteed revisionary bonus. Hard part for you that you already committed a mistake. If you need elaborate calculation from my end then can you share me the historical bonus values of this plan? Doing research before buying is wise than after buying it.

I purchased two policies in 2011 and both are Jeevan Saral (165). 1st policy with annual premium of 25000 and second one with annual premium of 36000.

I wanted to know whether i can club these two polocies. If yes, what should i do? The reason why i’m asking this question is , the bonus rates and loyalty additions are calculated based on this premium amounts.

I observed in the bonus declaration chart , if the premium ammount is greater than 50000 then the loyalty addition per 1000 MSA is more.

Could anyone comment on this?

Raam-For your information, Jeevan Saral not provides you Bonus, but only LA on MSA. Also you can’t club two policies to gain more LA.

Any idea on the loyalty addition declared for Jeevan Saral policy? Mine is a 16 year policy started in 13/05/2004 (at age of 26) and paid quarterly. I have completed 10 years. Premium paid 24500 per year

I want to know the total amount i can get if I cancel this policy now.

Amal-Latest updates available in this article “LIC’s Bonus rates for 2014-15 and Comparison“.

Hello,

Could you please guide about Jeevan Pramukh policy? I was enrolled in that policy in 2010 for 175000 annual payment for 5 years. Policy matures after 25 years. I have paid all 5 installments now. After reading the post it seems that I will get less money than if I have made a fixed deposit. If I want to withdraw from a plan, what amount I will get back? Could you please elaborate more about the plan? Is the plan is for business personnel and not suitable for ordinary people like me?

I would like to thank you in advance.

Krishna-This plan is currently not available. You can view details of a plan on LIC site.

I have a 20 year money-back policy with profits and acc. benefits started in 1999 and my wife has a Jeevan Surabhi (25 years) with profit. I received phone calls supposedly from IRDA executives on 9th and 10th October saying we are eligible for loyalty additions on these two policies and that it is due on 21 Dec 2014. But they say we have to keep a security deposit of Rs. 30,000/- and this has to be in the form of a policy from Reliance Insurance Co. How can I find out if this is a spurious call or not? These people knew our land phone and also the details of our policy. They say our money was invested in Reliance and as we are not registered with Reliance we have to go through this procedure. Can you please throw some light on this? And are all policies eligible for loyalty additions?

Raghuveer-At first instant it is pure spam call. Because no one from IRDA will call you or insist you to buy. So just neglect it and if person insists you again and again then simply complain with police by providing the received number.

Dear Sir,

Thank you very much for your prompt reply confirming my doubts. But just one question – does LIC give loyalty additions on only certain policies or on all plans?

Best regards,

Raghuveer

Raghuveer-LA will not be applicable to all policies. It depends on policy you buy.

Dear Sir,

I purchased policy Jeevan Anand (T. No. 149) sum assured 15 lacs tenure 25 years @ age of 22.

Currently i am paying anual premium of INR 58358.

Please advise at the maturity what amount shall i get including all bonus or benefit (if any).

Further please advise whether to carry with this plan or can i surrender it and shall take term plan. (VESTED BONUS on this policy is 142500 for 3 years whether i will get anything in case i surrender the policy, if yes what will be the amount i.e. surrender value???). Have paid premium for 3 years (58358*3) INR 175074…

Appreciate if you can alsoo give reply on my personal mail ID [email protected]

Sumit-It is already discussed in below comments. Please go through them for better understanding.

Hello i am 34 yrs old planning to get endowment policy LIC 814. My premium is 144,000 per year for 16years. What will be the return on the policy? how much will i get approximately after 16 years. Is this a good plan? My agent is offering me 15% discount on first year premium. Is this a good discount? In the past I’ve received as high as 35% discount.

Please advice.

Many thanks

Garry

Gaurav-First ask yourself why your agent luring you by offering 35% or 15% of commission payback? Also what he is doing is illegal. So if knowing this he is doing means he is trying to push a dummy product. Rest is left with you.

Mr Basavaraj Tonagatti, I seen all the above comments given by you, All the comments given by you are negative. How can you compare a Banana with an Apple, There is no comparison. LIC Gives insurance but in PPF there is no insurance.

If a person bought LIC’s traditional plan, He pays only Approx Rs 5000 for 1 Lac Sum Assured. If Any thing Goes wrong, the LIC Would Pay him Rs 1Lac in Natural Death and 2 Lacs in Accidental Death. Then Return would be 2000% in Natural Death Case and 4000 % in Accidental Death case.

In second year Returns would be 1000% in Natural Death Case and 2000 % in Accidental Death case.

In Third Yr year Returns would be 666% in Natural Death Case and 1333 % in Accidental Death case.

In Fourth year Returns would be 500% in Natural Death Case and 1000 % in Accidental Death case.

…..

….

….

If nothing goes wrong. then 7% on maturity.

If a person is taking LIC for 20 yrs, Then LIC is Better then any other Investment for 19 yrs 11 months and 29 Days.

But in PPF returns are 8% in First yr and also 8% in Last year.

Pankaj-How about PPF with 8.7% and Term Insurance where you will get the same % of benefits in case of deaths?? Please exaggerate the things to benefit for yourself. What do you mean by 2000%, 1000%, 666% or 500%? First understand the basics of insurance and try not to mix the benefits. At end you are claiming returns will be 7%…do you know the effect of real return??

Hi Basavaraj

Do you know about the ATM plan (table 165) and whether its worth the return?

It was recommended by an agent for younger adults as it provides insurance as well as a good return. Can you provide some representative returns on a 4000/month plan over 10/20 years?

Thanks

Jain-This plan is currently not available. You can view my opinion on this page “LIC’s Jeevan Saral-Why so much confusion?“.

Sir,

I will like to take Lic New Jeevan Anand plan for 26 years term.Sum Assured=10,00,000. Now my age is 27years,

What will be maturity amount after 26 years.

Please let me know.

Regards

Sonu

sir

your maturity amount after 26 years =2500000

Sir ,please let me know ,what will be the maturity amount of 10 lakh investment in lic New jeevan Anand policy for 26 years.Candidate age is 27.

Regards

Sonu Oswal

Sonu-Whether you are asking me as an agent or buyer?

After 26 years, your maturity are 3000000.

Rampreet-May I know how you arrived at this amount?

Dear Sir

i m kuldeep singh lic agent from Delhi ,which lic plan do u suggest ,if anyone invest in lic

i don,t want to make people foolish,please suggest which plan gives us good return

please please

Kuldeep-Only Term Plans.

Sir,

I am interested in Jeevan sugam policy which is newly introduced plan by LIC. Please suggest is it good decision to invest in this plan.

Vicky-Good or bad depends on your financial goals and how much you are expecting. So how can I say that this is good or bad for you??

please provide me your contact number

Anil-You can use Contact Us page of this blog for further communication.

Dear Sir,

I hold Jeevan Saral policy from last 4 years.

Age while enrolling policy:26

Premium : 36030 per annum

MSA: ~ 13,28,000.

Term: 30 years.

I am interested to know the matured amount when the policy term is completed (i.e. 30 years). As per my knowledge I am expecting the below amount assuming I pay all the premiums, correct me if I am wrong??

Maturity amount has 4 components :

1.MSA

2. LA

3. Final Additional Bonus (FAB)

4.Bonus (if any)

Maturity Amount = MSA + LA + Final Additional Bonus (FAB)+Bonus (if any).

Component 1: MSA ==>13,28,000

Component 2:LA ==> 1328 * 35 * 30 = 13,94,400 (where did I get the number 35 and why I am multiplying it with 30 ?? For 10 years jeevan saral policy LA is 350 for my premium amount i.e for year I am assuming it as 35 and multiplying it with my term period.)

Component 3: Final Additional Bonus ==> As per the chart given in this link http://www.jagoinvestor.com/2011/08/lic-policies.html under FAB section.

750 per 1000 of MSA.

so FAB = 750 * 1328 = 9,96,000

Component 4: Bonus (if any ) = 0 (ZERO).

so Maturity Amount = 13,28,000 + 13,94,400 + 9,96,000 + 0 = 37,18,400

This maturity amount 37,18,400 is approximately 7% return on my investment. Right??

Is this policy applicable for FAB??Please correct me If I am wrong in my calculations??

Best Regards,

Badri

Badri-LA changes as term of policy changes. So it is wrong to consider 10 year LA for 30 years policy. Also each plan is unique and there is no guarantee that it must contain LA, Bonus and FAB. So first understand the basics of Jeevan Saral.

Thanks a lot for your quick response.

Q1)Does Jeevan Saral policy provides Final Additional Bonus or not??I am under the assumption it provides FAB.

Q2)Regarding LA , can’t I expect its value to be at-least 1000 for term of 30 years??

Q3)In case FAB is also zero.What is the expected maturity amount?

Maturity Amount = MSA + LA = 13,28,000 + 1328*1000 = 2656000 which is 5.5% return.

Best Regards,

Badri

Badri-For your information this plan does not offer any FAB. Also FAB is not a great game changer. Even if you expect Rs.1,000 LA then do you feel it is worth to continue? Now your calculation seems to be correct. If you satisfied with 5.5% of return then continue.

I have a Jeevan Shree Policy taken in the year 2001. It was a 20 year term with 12 year premium payment. I have paid all due premium for the 12 years. My question is how much I will get back, taking into account the guaranteed payment, loyalty addition. How much likely would be the loyalty addition (based on the previous year’s declaration by LIC). Whether FAB – final additional bonus is payable for this policy, if so how much is payable to me.

Vishwanath-In all probability return will be around 6%.

Hi Sir,

What are the risks that are covered for term insurance of LIC being high premium comparatively of other private insurers. Please send elobrately to my mail id if possible?

Regards

Subbarao

Subbarao-High premium is not because they are covering any additional coverage. But it is purely actuaries decision who design the plan.

Hi,

I am 33 years.

I had taken a Money back Endowment plan in December 2010 forthe premium is 45,000 per annum.

Start Date Sum Ass Yly Prem Maturity Pol Yrs Ttl Prem

Dec-10 1,15,000 4,464 Dec-35 25 1,11,600

Dec-10 5,15,000 19,992 Dec-35 25 4,99,800

Dec-10 6,70,000 21,687 Dec-40 30 6,50,610

The above is without Annual Bonus and Final Bonus.

Question 1

Should I continue with the above.

I also started Jeevan Anand in September 2010- actually I had asked my agent to give me a Pension Plan broken into 2-3 policies with premium payable for 25 years on all the 3 policiesbut he gave me 18 policies with first maturity on 2037 and 1 policy maturing every year thereafter.

The premium annually on Jeevan is Rs.1,50,000. I was told that I would have to pay premium upto 25 years and from then on for another 18 years till age of 75 years, the premium would be serviced from my Pension Receivable. As it turns out now, there is no pension and its actually like 18 Endowment policies. The Date of Last Payemnt of Premium on the policies maturing after September 2038 is September 2039 through September 2054.

Start Date Sum Ass Yly Prem Maturity Pol Yrs Total Prem If Prem Ends at 25 Yrs

Sep-13 3,10,000 13,182 Sep-38 25 3,29,550 3,29,550

Sep-13 3,00,000 12,146 Sep-39 26 3,15,796 3,03,650

Sep-13 2,95,000 11,695 Sep-40 27 3,15,765 2,92,375

Sep-13 2,85,000 10,801 Sep-41 28 3,02,428 2,70,025

Sep-13 2,80,000 10,163 Sep-42 29 2,94,727 2,54,075

Sep-13 2,75,000 9,581 Sep-43 30 2,87,430 2,39,525

Sep-13 2,65,000 8,873 Sep-44 31 2,75,063 2,21,825

Sep-13 2,55,000 8,204 Sep-45 32 2,62,528 2,05,100

Sep-13 2,45,000 7,599 Sep-46 33 2,50,767 1,89,975

Sep-13 2,45,000 7,324 Sep-47 34 2,49,016 1,83,100

Sep-13 2,45,000 7,075 Sep-48 35 2,47,625 1,76,875

Sep-13 2,40,000 6,697 Sep-49 36 2,41,092 1,67,425

Sep-13 2,35,000 6,341 Sep-50 37 2,34,617 1,58,525

Sep-13 2,35,000 6,148 Sep-51 38 2,33,624 1,53,700

Sep-13 2,30,000 5,838 Sep-52 39 2,27,682 1,45,950

Sep-13 2,30,000 5,697 Sep-53 40 2,27,880 1,42,425

Sep-13 2,40,000 6,006 Sep-54 41 2,46,246 1,50,150

Sep-13 2,45,000 5,989 Sep-55 42 2,51,538 1,49,725

Total 46,55,000 1,49,359 47,93,374 37,33,975

Question 2

In the above actual scenario now wher I have been given Jeevan Anand policies istead of a Pension Policy, will I have to actually have to pay the premium til September 2054? If that is the case, my total premium(second last column) is actually higher than the Sum Assured (without considering the yearly Bonus and Final Bonus)?

I feel that I have been cheated by agent and thinking of not paying the premiums.

Question 3:

Can I convert this to a single Endowment policy and continue the premiums so that I dont lose my first year’s premium

Question 4:

Should I forgo the first year’s premium on The Jeevan Anand policy?

-Marzban

Marzban-Do you still feel insurance policies mentioned above or the plans you are expecting will actually worth to invest for long run? What is your expectation from such LIC plans?

sir, I have a jeevan shree policy started sept 1996 with HLY premium Rs. 12941/- paid for 16 yrs. now policy is running with out paying premium for next 9 yrs. pls suggest , what will by my total benefits at maturity.

regards

jk Dhaka

Jitendra-Please contact your nearest LIC branch.

hai sir my policy is jeevan saral completed 5 years if there is any bonus amount comes sir

Sindhu-This policy not eligible for bonus. But LA. Please contact your nearest LIC branch. They guide you.

Sir

I have following policies from LIC as on date

JEEVAN MITRA ( Triple Cover) Table no 133. Policy Term 25 years..Premium Paying terms 25 years.Maturity Value 5,00,000

My Question… Assuming Present Bonus of Rs 50/-.. to be continued, will I get on Maturity, on this policy a total bonus of ( 5000 X 50 X 25) = Rs 6,25,000/- Kindly Confirm

JEEVAN SHREE ( OLD) Table no 112. Policy Value Rs 6,00,000/- Premium Term 25 years, Premium Payment Terms 16 years. I was told that this POLICY earns a minimum Bonus of Rs 50/- per thousand per year. So on Maturity should I get a minimum bonus of Rs ( 600 X 50 X 25) = Rs 7,50,000/- ?

Please clarify me, I will be grateful

Debasis-Yes your calculations are right and also along with bonus you receive the sum assured also. But do you feel this much return worth for such long term investment??

Thanks for yr prompt reply. Yes I do Value yr point.. Return is in adequate. In fact one cant expect a decent return from Insurance Policies.

Could you kindly make a plan for me under which I can earn Rs 50,000 /- per month, with +/- 10% variance per month.

Please note am 55 years , want to take early retirement, no I wont get any VRS benefit

Hi Sir

Hope you are fine

I have taken Jeevan Anand Policy in 2012 April for 15,00,000 (149) for 20 years.

I want to know

1/ What was the Annual Bonus declared in 2013 & 2014

2/ What was the FAB declared last year

3/ I have heard that after maturity , and after withdrawing my money (Sum insured + Bonus) my life cover will still be continue. And if i want I can discontinue the life cover and encash the money at discounted price. Is it true. If yes what is the rate of discount.

Thanks for your help in advance..

Regds

Suraj K

Suraj- Please go through above information regarding bonus values for 2013-14. FAB is one time payment which will be payable at end. Also it will not be in big sum which you can expect 🙂 Regarding point 3-Yes it is true, but sadly NONE from LIC know like how much one can get after maturity. If you want to cross check then you can do it with your concerned LIC agents or officials.

Hello Sir,

I contacted the LIC and they are telling it would be around 3 to 3.1 lakhs. I have already invested 4.5 lakhs till now.

I read some where if you pay upto 12 premiums you would get back all the premiums paid till now.

is it true? I have already paid 10 premiums so far. Do you want me to continue or take the money and invest it somewhere. That way I will atleast save 4.5 laks minimum(the next 10 premiums+ premiums for another 10 yrs as each policy matures one after another after 10 yrs ). Please let me know u r thoughts.

Thanks

Satya

Satya-I don’t from where you got the information that if you pay 12 premiums then you get all paid. Please share the same with me. In my view it is better to discontinue. But the decision is left with you.

Sir,

How much do you think I would be getting if surrender now?

Satya-Please first contact your nearest LIC branch for the same. Share the same with me so that we can discuss further.

Dear Sir,

I have 10 1 lakh Jeevan Anand(table 149) policy maturing for about 10 years(1 policy each year) starting from 2024.

I had bought them in 2004. The agent at that point of time had advised me to do this way. My annual premium is around 45000. I was thinking of either surrending or reducing the tenure to 16 yrs or 21 yrs(so that I will get the money at once).

When I contacted the agent to check whether I can reduce the tenure, he says I have to pay the extra amount not only from now but also for all the 10 years plus some fine. I’m totally confused. I have already spent around 4.5 lakh

and if I reduce the tenure to 16 ( I have to pay double the premium + 2 lakh for the last 10 yrs)

and if I reduce the tenure to 21(the premium is not double but increased + 1 lakh for the last 10 yrs).

He says at the end of 16 yrs, I will be getting around 18 lakhs and 25 lakhs if it is 21 years. The reason I have chosen 16 or 21 is because he told me I would get FAB only after 15 yrs. when I checked online I see a vested bonus of 47100 for each policy. Can you please advise what should I be doing? and how much would I get if I surrender now?

Thanks

Satya-The best advice is to come out as soon as possible.

Sir i have a request to you that kindly take into account the lost accured bonus before giving any advice as a advice without through investogation can cause someone huge losses.

Vishwas-Please suggest with example so that we can discuss further. Do you feel the bonus is so high that it can beat the simple product PPF too????

My personel advice is to continue with the policy as the policy is good . Also you will lose about 500000 + charges as accured bonuses . So my advice is continue these policies as it will be lose making to fiscontinue at this point of time. But never ever get trapped in such a way and buy a pure term plan instead.

Vishwas-Please elaborate more about how the closing will not benefit and also your STRONG recommendation about not buying term plan.

DEAR SIR,

I HAVE PURCHASED THE LIC JEEVEN SAREL PLAN OF RS. 1125000/-, TERMS OF 26 YEARS AND I HAVE TO PAY YEARLY PREMIUM OF RS. 54045/-. AT MATRUITY I WILL RECEIVED MSA OF RS. 1700340/- PLUS LOYALTY ADDITION (L.A.) PLEASE SUGGEST ME THAT I HAVE A GOOD INVEST AT FUTURE OR NOT AND IF I WILL BE CLOSED THIS PLAN AFTER FIVE YEARS THEN THIS IS A GOOD OPTION FOR ME OR NOT. AND IF I HAVE CLOSED THIS AFTER FIVE YEARS THEN I WILL BE GOING TO LOSS. PLEASE TELL ME ABOUT WHAT CAN I DO FOR JEEVEN SAREL PLAN.

REGARDS,

MOHIT

Mohit-Please read below all comments. You will get answer.

DEAR SIR,

I HAVE BOUGHT JEEVAN ANAND POLICY FOR 16 YEARS. I HAVE STARTED ON NOVEMBER 2013.I AM PAYING 50,000 PER YEAR. CAN YOU PLEASE TELL ME HOW MUCH SHALL I GET AFTER 16 YEARS?

Sonalika-This being traditional endowment type plan, return from this will be around 5%.

DEAR SIR,

CAN YOU PLEASE EXPLAIN WHAT DO YOU MEAN BY TRADITIONAL ENDOWMENT?

MY AGENT SAYS IT WILL BE AROUND 22 LAKHS.

IF AFTER SOME TIME I WANT TO STOP WHICH AMOUNT OF MONEY I SHALL GET BACK?

IS IT A SECURE POLICY FOR MY LIFE?

THANKS A TON…

Sonalika-There are various types of product in insurance. But basically are divided as traditional endowment plans (Insurance+Investment)-These are low yielding products due to nature of expenses and investment style of companies, ULIPs-Insurance+Investment, these are typically invested in equity market and term plans. If your agent is quoting Rs.22 lakh then let him do his calculation and do share the same with me for further discussion.

Hi ,

Sir, i have a rs 330000 money back policy. I am paying yearly rs 20722. How much bonus I will get after maturity? Policy term is 20 years. Is it better than provident fund investment?

Santu-Are you satisfied with return of around 5% to 6%? If yes then we can discuss further. But yes, definitely it give less than PPF.

Sir, I’ve taken an endowment policy in LIC for 10 years on august 2004. The sum assured is Rs.75000 and I’ve availed loan for Rs.48000 on march 2012 and did not pay interest. If I surrender now as 2 months before of maturity date how much amount I can get sir. Kindly reply sir.

Kumar-Please visit your nearest LIC branch.

Sir, excuse me, Please reply this one time alone. If I did not avail any loan and no surrender what would be the matured amount.

Kumar-Return will be around 6%. Will you satisfy with kind of return??

Hi Basu,

May I know how to get loyalty addition information of Jeevan Saral? And is maturity = Guaranteed + LA ?

For Example:

For Anual Premium of 4704, Guaranteed Amount for 10 Years = 43360.

As per LA give on this page for 10 years, Maturity = 43360+250*98 = 67860 (98=((4704/12)*250)/1000).

Is my understanding is correct as above example?

Regards,

Murali

Srinivas-I hope my post on Jeevan Saral will benefit you. Please read this post “LIC’s Jeevan Saral-Why so much confusion?“

Thanks Basu,

I got it. My example is corect.

Regards,

Murali

Dear Sir,

I would like to know about that the Jeveen Sarel Plan is better than to Other L.I.C Plan for Endorsement Purpose of Long Term Period product. Could this Plan has been covered the Accident Benefits, if my age is currently 27 years old and I have buy this plan previous year of Rs. 10,00,000/- and yearly premium paid of Rs. 48040/- Then this plan has been covered the Accident Benefits, if yes so please tell me about.

Thank and regards,

Rohit

Rohit-This plan is same like any other typical traditional plan. So return will be around 6%. Hence in my view for long term investment, it is not a good choice. Why you are so bothering about accidental benefit? Do you know accidental insurance of Rs.10,00,000 in market available at as cheap as at Rs.700-Rs.800 per year?

DEAR SIR,

BUT MY QUESTION IS THAT THIS POLICY HAS COVERED THE ACCIDENTAL BENEFITS, IF I HAVE PAID THE YEARLY PREMIUM OF RS. 48040/- AROUND TO 26 YEARS FOR THE POLICY OF RS. 10,00,000/- AND HOW WILL I GET THE MATURITY OF THE VERY PERIOD. IF ANY OTHER PLANS OF LIC WHICH YOU SHARE WITH US THAT THERE HAVE MAX. BENEFITS FOR LONG TERM PURPOSE SO PLEASE TELL ME ABOUT. I AM VERY GRATEFUL TO YOU.

WITH BEST REGARDS,

ROHIT

Rohit-First understand that the policy you having is itself a worst product. Rest of the products are of equally dangerous.

SO SIR, WHICH POLICY HAVE MAXIMUM BENEFITS PROVIDED ? AND WHERE I WILL BE INVESTING FOR THE PURPOSE OF FUTURE PLANNING ? KINDLY GIVE ME ADVICE THE POLICIES OF LONG TERM AND SHORT TERM ALONGWITH THE TERM PLANS.

THANK AND REGARDS,

ROHIT

Rohit-Never ever combine your investments with insurance. So in my view no policy is good for providing your maximum benefits. When you are eager to buy term plans then why you are going for a traditional or ULIP plans??

SIR, ABOVE THE SAID COMMENTS THAT THE LIC SELL THE TERMS PLAN AND IF I GOING FOR TRADITIONAL OR ULIP PLANS WHICH IS CALLED THE NAME OF. PLEASE EXPLAIN THIS AND SUGGEST WHICH PLAN I HAVE PUCHASED AND HOW LONG TIME I AM HAVING IT.

THANKS

Rohit-Can be clear in your commenting. I am unable to understand what you are actually trying to say.

SIR, I AM TRYING TO SAY THAT WHICH TYPE OF PLAN BELONGS TO LIC, I HAVE BUY IT THIS YEAR. COULD I INVEST AT TRADITIONAL OR ULIP PLAN AND HOW LONG TIME I HAVE KEPT IT TO CONTINUE THE VERY POLICY.

THANKS

Rohit-Neither traditional nor ULIP. Instead buy LIC’s online term plan eTerm.

THANK YOU VERY MUCH SIR.

I have a small querry As per jeevan saral plan the LA is to be declared after 10 years. Now as the plan is launched in 2004 it is due in sept 14/oct.14. How they have declared LA for 10 years, 11years,12 years as no ane has completed 10 years

Kailas-It is the profit they feel to declare.

Thanks dear Basavaraj for quick reply.

But it means for jeen saral which is completing 10 years in Sept/oct 14 they have declared LA in advance and similarly for 11th and 12th year in advance?

Kailas-Yes you are right.

sir

lic has declared L.A. for jeevan saral i.e. rs 350 for 10 yrs, rs 375 for 11 yrs and rs 400 for 12 yrs ( for yrly prem of 20000 to 50000). now is that means that each years L.A (after 10th yr) separately added on or only the last year’s L.A will be calculated for a 12 or 15 yrs policy?

Soumya-LA is one time payment. So suppose you have plan of 15 years term then during maturity they will check the LA for 15 yrs policy. They multiply with SA (in case Jeevan Saral it is with MSA) and will pay you the same. So it is not like bonus, which will go on add every year.

Sir,

Recently I have taken a total of 8 New Jeevan Anand Policies for a SA of 2 lacs each (Total SA = 16 lacs) with the policy term from 15 yrs to 22 yrs. I paid a premium of around 108000/- p.a for these policies. I have a son, who is 3 yrs old now and basically I took these policies for my child’s education, since the 1st policy matures at 15 yrs when my son would be 18 yrs old. The agent told me that I have to pay only for 15 yrs but in the bonds the premium payment term is 22 yrs (After 15 yrs, with reduced premium each year). As per the agent the total maturity returns from these policies is around 40 lacs + 20 lacs life time risk cover, but as per my calculation it is around 3020800 (48/- for every 1000/- SA) + 20 lacs lifetime risk cover. I recieved my policy bond last week so I have 1 more week to decide before the free-look period is over. I have couple of queries for you

1) Does New Jeevan Anand policy has good returns and better suited for my child’s education? what exactly would be my returns after maturity (from 15 yrs to 22 yrs)?

2) Does this policy has any terminal/Persistency bonus? If yes what is the interest calculated?

3) There is a new product from Exide life insurance (Previously ING life Insurance) called New Creating Life Plus. How is this product compared to New Jeevan Anand? and whether I should cancel LIC Policy and take this new Creating Life Plus plan for better returns??

Eagerly waiting for your reply

Thanks

Sameena- 1) Jeevan Anand is a typical traditional plan. You can expect around 6% to 7% of return. So considering the education inflation (which is around 8% to 10%), how you be able to provide enough cash to your kid’s future education??

2) There is no interest. But they declare interest yearly (it is simple but not compounding).

3) In my view the best option is to buy term insurance and rest even if you invest in simple and secure product called PP, then you earn more than these typical traditional plans.

Now the choice is your’s.

Could the Jeevan Saral is bad plan in lieu of other plans for a long term investment.

Rohit-What is the meaning of “in lieu of other plans” can you elaborate me?

Sir,

I have 2 policies on my name , jeevan anand and a money back policy, and one on my sons name on which I am am paying the premium. (sum assured 100000 each)

The thing is that received call from Mumbai LIC office saying that I have I have got LIC loyalty additional benefit on all the policies (on my name + sons name + wife ) and they have provided me with some figures that I will receive.

They also say that the agent has informed them to cancel the bonus and that the 40% will be given to agent if I agree to cancel the Royalty addition bonus .

and that the LIC has tied up with HDFC and that I should be holding policies in both this companies if I want to get the royalty benefit. and that I should take a HDFC policy of 26,000. to avail this benefit.

Now my question is id this true that the lic pays Royalty additional benefit any time .or this call is fake just to get the HDFC policy. no written communication in this regards only telephonic conversation do help me as the other guy is rushing and says that he cannot hold my file for long .

can you please give me your mob. no. to have a conversation. URGENT

Bhuvnesh-A typical spam call to sell you HDFC product. Never ever take any action. If you once again receive the same call then just inform that guy that you are going to complain with local police as well as with IRDA.

Hi,

I also received a similar call from Mumbai office and they were not selling any product to me. They just told me the same story of Agent trying to claim 40% of the loyalty benefit. They told me a date and that I would receive the cheque for those amount. I don’t know whether its a spam call or not..

Does ever LIC declare loyalty benefits to its consumers?

Thanks

Nathan

Hello,

I have Jeevan Saral policy termed for 30 years and I started this policy in 2009 (Paid Premium) with yearly premium of 60050. I am looking forward to surrender this policy. Could you please tell me how much I will get back. I am not in India so I could check at LIC office. This policy is still active with all premium paid.

Sushil Diwan

Sushil-I can’t tell the amount. Either you contact directly to servicing branch or let your relative.

Sir,

I have Jeevan Saral Policy with Policy Details-

Start Date – 05/03/2012

Term- 35 Years

Monthly Premium – Rs 8,167/-

As of now, I am not investing anything in ANY other instruments (besides an RD). I have HDFC term plan and TATA AIG Health Insurance.

Considering this background, is Jeevan Saral a proper plan for future needs of child education & marriage ?

Mukul

Mukul-This is worst investment, I can say as you are investing because of your child education and marriage. Return from this plan will be around 7%. So if you are comfortable with kind of return then go ahead. If no, then better to come out after 5 years.

Hi,

I was mulling the option to reduce the premium amount from Rs 8,167/- to somewhere close to Rs 4,000/-.

I would remain invested for at least 10 years and invest remaining amount in SIP/RD. Does this make sense now to reduce the premium amount?

Mukul

Mukul-But will your existing insurance policy allow such changes?

I have checked with LIC branch and they have confirmed that it can be done.

Mukul-OK…but what purpose of reducing premium will serve you? Is there any guarantee that this plan will generate anything good in long run?

Hi, Yes that’s absolutely correct point and I have drawn the same conclusion that it will be better to get out of this policy. I think I should separate Insurance and Long term investments. I would do following-

1) Exit from Jeevan Saral

2) Invest half amount of existing premium -in equity SIP

3) Invest remaining amount in PPF for long term

4) I already have Term Insurance of sizable amount from SBI e-shield.

I think it makes sense… what say?

Mukul

Mukul-Sensible dicision 🙂

Thank you for your advise….

Hi,

I bought a single premium Jeevan Tarang policy in 2008 (15 years), about Rs 3,17,000. Now, I would like to surrender the policy. What amount will I get back on surrendering the policy now? Will I receive the bonus amounts when I surrender now?

Thanks!

Aaroosha-Please contact your nearest or servicing LIC branch for the same.

My Jeevan shree plan (D.o.c:28.11.2001, Table-112, Sum Assured =5Lacs, Term.25yrs/16yrs) All the dues were paid without any default.

Qn;Whether this policy is eligible to get Final Additional Bonus at the time of maturity or not?

pl.advise me.

Thanks,

Natarajamani.A

Natarajamani-I already replied on Google+.

Thanks.

sir,

you are not sure about FAB in this policy(old jeevan shree- Table-112, year-2001-Term.25yrs)?You may know details from the recent maturity claim policy holders. please sir,…

Natarajamani-I am not aware about that.

Dear Sir

how does lic calculate bonus

Yogesh-It is based on the income they generate from the collected fund of insured. That is the reason it changes every year. Usually they declare like Rs.50 per Rs.1,000 Sum Assured per year. So if you have policy of Rs.10,00,000 then for that year bonus will be Rs.50,000. But do remember that this bonus you will get either at maturity or death of insured. They will not add any further interest on this earning. It will be simply kept in your account.

Hi Basu…..

Thanks for this great information that you have shared with us…

I have invested in LIC’s 20 year money back policy with SA of Rs. 5,00,000 and paying a premium of Rs. 31,195 yearly. I have alreday paid my 5th premium in May 14 and my first money back will be due next year i.e 20% of SA.

Currently my vested bonus is showing as Rs. 58,500. Can you please help me in knowing what amounts I will be getting on maturity of my plan and whether there is any thing else that will be received other than bonus….

Thanks…

Chandan-This being typical tradition plan, return from this plan will be around 6%.

Thanks for the info. Should i go for surrender of this policy after the money back next year and invest in mutual funds or should i continue with the same policy… whether the bonus received will be tax free at maturity/surrender ????

Chandan-Better to come out at the earliest. For taxation, read my post “Tax Benefits of Life Insurance“

Hi Basu

Can you please help me in clarifying my doubt below.

I am 39 years old and have a LIC Endowment policy (Table 14) taken in 2009. Policy details are as below

Yearly premium = Rs 1,15,873

Tenure = 27 years

Sum Assured = Rs 30,00,000

So far, I have made five premium payments (Rs 5,79,365). Am yet to pay this years premium. After reading through the blog, I see that I would be at loss if I go ahead with this scheme.

I had a discussion with My LIC agent and he was assuring me the following returns on maturity.

Bonus : (27 * 3,000 * 75) = 60,75,000

Sum assured : 30,00,000

Guaranteed addition : 750 * 3,000 = 22,50,000

In Total, am supposed to get Rs 1,13,25,000 on maturity.

I don’t believe these returns. Can you please clarify whether this can be correct.

Am planning to close the policy and put the money that am going to get back to other investment opportunities that is going to get me better returns.

Thanks

Binu

Binu-How and who gave your agent the bonus amount of Rs.75? None I am saying it once again…None of LIC plans will be currently giving any such high bonus rate. So first ask him on what guarantee that he is claiming Rs.75 a bonus rate. Again Table No.14 not involves any of Guaranteed Addition. That again a false statement by your agent. In reality the return will be around 6%. Please cross check with your agent or if possible contact the nearest LIC office (without your agent).

Thanks for your inputs Basu.

I Went to LIC Office and checked. They are also NOT in agreement with 75 as bonus rate.

Am planning to close the account.

Basanth-Better to act immediately.

Hi,

Thanks for all the info. I have a Jeevan Shree Policy (Table 112).

I pay ~25K every year. PPT is 16 years & maturity on 25th year. My SA is INR 5 Lacs.

I am confused with a lot of conflicting data.

Can you mail me with exactky what is it that I will get after 25 years.

thanks

Ankit

Ankit-Return from this policy not be more than 6%.

How do I know if mine is the old Jeevan Shree or new……I seem to have not have the plicy document. The premium slip only say 112…..thanks

Ankit-When you started? If your policy start date is prior to 1st September 2003 then it is old otherwise new one.

My premium payment copy says DOC 1/1/.2002….?

So what are the details for the old one?

Ankit-Then it was old one and which have GA of Rs.75 per Rs.1,000 Sum Assured per year. You get the information of the same on policy document. Please go through in detail.

Is there any loyalty addition as well?

Ankit-Sorry for my earlier updation. This plan involve Rs.50 of guaranteed addition for the first 5 years only. After that bonus will be as per LIC declaration. There is no LA attached with this plan. So what I predicted is correct and return will be around 6%.

So you mean to say there is no difference in old Jeevan Shree & new Jeevan shree?

thanks

Ankit

Ankit-Old Jeevan Shree was little bit profitable as GA was Rs.75 for whole tenure of policy but in new Jeevan Shree GA is Rs.50 that too only for first five years.

Sir there is a policy of lic Endowment Assurence Policy(T.No 14) from 13-4-11 at age of 46yr.

The Sum Assured id 2,00,000 and no of premiums is 6 with yearly premium 35283.

Sir want to know what is the sum i got at maturity . and Please tell me how to find this.? Thanks

Gaurav-May I know the term of plan. It is not clear from your above comment.

Sum Assured 2,00,000

No of terms 6

yearly premium 35283 Sir.

Guarav-What is your doubt??

Sir i want to know what is the total amount i got on maturity of policy.

and please tell me how to find out this?

Gaurav-Contact your servicing LIC branch.

Hello Sir,

I have Jeevan Saral Policy. I would like you to help me to know current IRR attached to this policy, my amount total maturity amount and relevant details attached to it like MSA, LA etc based on below information. Please help.

Age : 27

Policy : Jivan Saral (165)

Terms : 35 Years

Mode : Semi Annual 36,390

Session Start : 2012 Sep

Also, what does LIC Jeevan Saral Chart shows INR 2, 20,26,510 (assuming 10% IRR)? And how this amount is calculated?

Pankaj-It shows indicative return. To make familiar about product they set minimum return and maximum return. But agents only showing you only maximum indicative return to fool you that return from the policy is 10%. It is not the case. Return from the typical traditional plans like your’s Jeevan Saral will not be more than 6%.

Pankaj-In whatever way you calculate, IRR will not cross more than 6%. Let me know what you expected while buying this plan.

Thanks for help. However, what would be maturity sum based on 6% IRR for me?

Pankaj-You can do it on your own from excel.

I have Jeevan Saral (T. No. 165) for 30 years with annual premium of 60050 and my agent promised me of total sum at the end would be One crore 12 lakhs some some amount. Is that true? thanks…!!

Sushil-No it is completely false. Maximum return you can expect is around 6% to 7%.

Dear Sir,

In Jeevan anand policy, i need a clarification on bonus.

Whether LIC pays interest to the bonus that is getting accumulated every year?

Thanks & Regards,

T.S.N.SYAMALA RAO

I mean compound/simple interest to the bonus that is getting added in my policy.

Syamalarao-It is simple not compounding. Suppose if they declare the bonus of Rs.50 per Rs.1,000 Sum Assured per year then this year bonus will remain same till your maturity. That is the reason these products are low yielding in nature.

Hi Basavaraj,

Its great to see how your explaining to all the query’s which we are posting, I am also the person who is confused about the LIC policies, After reading most of the replies , I have a small question: Which one is the best money back policy for short period.

Regards,

Dinesh

Dinesh-Money Back Plan itself is a bad product. So there is no question of best money back plan. Also there products are meant for long term investors but for short period.

Thanks Raj,

So can you please guide me in which Policy i have to invest( this is for my kids future).

Please suggest me in which i have to invest.

Regards,

Dinesh

Dinesh-Don’t run behind products. First buy a term plan, accidental insurance, health insurance for family, create emergency fund of around 6 months household expenses then start investing on your goals. For long term goals better to go for equity mutual funds rather than such low yielding products.

Thanks Raj…

Hi Basu,

My agye is 25 yr, in 2013 i hav taken a 20yr money back plan with a SA 7.5 lakh and paying anual premium 47,786,

in which i w will get 20% on completion of 5, 10 ,15 yrs,

My question is how much i will get after competiom of my maturity of 20yrs. Plz teel me in exact figures, exclude the amount what i will get after 5, 10, 15 yrs.

Harish-You will receive around 6% return from overall investment.

he Basu,

But my agent told me that i will be getting 15 lack on the maturity after 20yr. If u r correct then its better to surrender the policy after 3 yr, what is your opinion..? How much i will get if i surrender aftet 3yr.

Harish-Let him illustrate about the return expectation what he arrived at. To be frank you may receive less than 6%. So better to surrender. Regarding surrender values, you need to visit nearest or servicing LIC branch. They will guide you in a better way.

I take jeevan aanad policy with profits and accident benifits.for 20 year sum assured 100000.

exactly how much amount I got when I dead in accedent.

How much I got after maturity.

pls Inform friends I am worried.

Ramesh-If your death occurs due to death during policy period then your nominee will receive Rs.2,00,000. On maturity you will receive around 6% of return.

I Have Jeevan Surbhi 15yrs the sum assured is 240000 and Quarterly payment is 6182. I have take this policy in the month of may i have paid app 24100. when will be bonus added to my policy and how much. is it fare to continue the policy as per the policy voucher it say you will be getting sum Assured of 240000 with in 12 years and all the bonus collected will be given at the 15th year. Is this policy is really value worth to continue in feature…….

Ajinkya-This is typical traditional moneyback plan with only difference is your life risk will increase to 0.5 times of SA for every 5 years of completion. Bonus will be added after first year completion and they will intimate the same to you. This being typical traditional plan and return you can expect is around 6%. Now decide yourself whether you will be satisfied with the kind of insurance coverage and return or not then take your own call.

This being typical traditional plan and return you can expect is around 6%. Means 6% on the SA every year or after completion of policy.For example i would be getting approx 14,400 per year or after 15 year i will get only 14,400

Ajinkya-Return on investment always be calculated on how much you invested rather than how much sum assure they are offering you. So my calculation is on your investment but not on sum assured.

Can you Illustration the 6% return by taking

Sum Assured : Rs. 2,40,000

Premium Paying Term : 12 Years

Policy Term : 15 Years

Annual Premium : Rs. 24728

Ajinkya-Forget about sum assured, because you are investing not buying insurance 🙂 So if we consider the 6% return then the future value will be Rs.4,17,159.

I am holder of Rs. 1 Lacs endowment polict for last 25 years. The policy matures in 2014. Can you please let me know thw approximate maturity value I should be expecting.

Thanks

Sanjeev

Sanjeev-Return will be around 6%. But to get the exact amount you can visit your nearest branch or servicing branch.

Dear Basavaraj,

I accidentally stumbled upon this Blog and am using the opportunity to clarify on a policy maturity benefit, for which I have never got a clear answer

I have a Jeevan Shree (T no. 112), bought in 2001, with policy maturity of 15 years and policy payment term of 10 years. I paid Roughly 51000/- per annum as the policy premium. There is seemingly no bonus on the policy and I am not clear as to what should I expect as the maturity amount.

Would u be able to clarify

Ajay-Your’s is a old Jeevan Shree which instead of offering bonus will provide you guaranteed bonus of Rs.75 per Rs.1,000 SA per year. Now you can calculate yourself by multiplying with sum assured you opted along with number of years.

Hi,

I am jeevan anand policy for 5lacs since 2005 for 21years. I paid almost 9 premiums around 25464/- per annum.

I am also holding Jeevan Kishore for my daughter t.no 102 for 9lacs with single premium paid for 4.05lac in 2010 for a period of 25years.

I am also holding Child future plan for my daughter t.no185 for 8lacs first premium paid in2010 for 79662 paid upto 4 premiums and 2 more to go.

Please kindly suggest are these policies are good to continue or not, if not how much amount will get in return so that I can for some kind FD or some thing else.

Regards,

Anil.

Anil-All the existing plans are typical traditional plans. So you can expect around 6-7% returns. So now it is your turn to decide whether these plans are relevant with the kind of education inflation around 10% these days.

Dear Sir,

My self amit kumar Singh. i have jeevan saral policy which premium is 24260 per yrs of sum insured Rs 5 lac. my agent told me that i got 16 lac after 20 yrs. and i have already paid 3 premium. so plz tell me realy i will got this amt or not. if not how much gaurented amt will i get after 20 yrs.

in return chart shown that u will got 10% bonus of ur sum assured. plus loylty bonus after 10 yrs.

plz suggest me this policy is good or not for long peroid.

Thanks & regards,

Amit Kr Singh

Amit-First thing is, in this plan apart from MSA (printed on your bond paper) nothing is guaranteed (LA). But from the current trends of LA rate we can presume that you will receive around 6% return. Agent showed indicative return of 10% which is actually meant for showing the plan feature but it does not mean that this plan will generate 10% return. In my view this is bad policy. Hence once it completes 5 years then come out of this plan.

hi

my query is for benefit calculation of Komal jeevan

Sum Insured 300000

Age of child at entry 0 yrs

Policy start date 22/04/2007

annual premium 22114

premium paid 8 terms

how does LIC calculate Bonus and Loyality additions.what will be maturity benefit for above Sum Insured

regards

Jatinder Singh

Jatinder-Komal Jeevan offers Guaranteed Bonus of Rs.75 per Rs.1,000 SA per year. So you no need to worry about how LIC calculate it. I totally neglect LA part as it amounts to few thousands at end.

thanx

Hi Basavaraj,

I bought LIC Jeevan Anand policy in Oct 2012 with a term of 21 years & min. sum assured of Rs. 25,00000. Annual premium amount is Rs 128448 (Rs 32112 quarterly).If i consider a conservative figure of 45 per 1000, the total shall come out to be 25,00000 + 2362500 = 4862500. Right?

Secondly, will there be any additional final bonus added to it after maturity? If yes, How much could that be? I know its totally dependent on LIC’s annual performance, but as per previous trends taking a conservative figure, will there be any additional amount on top of the above mentioned amount?

Please guide.

And by the way thanks a lot, you are doing a great job & I am sure each one of us here on the blog have already started appreciating your work. 🙂

And i was told by my adviser that if i don’t intend to go for medical coverage after completion of policy tenure of 21 years, I can get 60% of the sum assured as cash (60/100*25,00000 = 15,00000) & close my medical coverage. Is that possible too??

Mankaran-There is no medical coverage in this plan. So no question of any discount or anything. This is completely a false statement by your agent. Check once again with your agent and let me know exactly what he is claiming to be.

That was actually the life cover that he was talking about. The life cover after maturity can be broken & i can get 60% of sum assured in return. That is what he said.

I don’t know if this is called as surrender value after maturity…

Please confirm if this is right?

Mankaran-Yes you are right. But how much LIC will give you option to encash is still not known to anybody. Even LIC not set any rules regarding the same.

Mankaran-Thanks for your kind words. Yes, your calculation is correct. With normal bonus you may also get Final Additional Bonus, which is one time payment at end. I don’t think this will make any big changes in your return part. Hence better to neglect this (even if you think you will get it at end).

i agree with you mr.basavraj. But it surely makes adiffrence if your premium term is more than 30 years and above as FAB rates are very attractive for longer terms.

Milind

Milind-Still the returns will not be more than 8%.

Hi Babu,

I took a policy New Bima Kiran on 2002. The SA is 500000, Premuim is 5500 PA and policy term is 20 years. Can you tell me how much i will get approximatey at maturity. Shall i continue the policy or surrender? . Kindly advice.

Thanks,

Senthil

Senthil-Return will be around 6%. Better you discontinue if it completed more than 3 years.

Hi,

I am a novice here trying to understand the policy matters. I have a policy in my name (Pardon as I don’t know which plan it is but the policy letter says endowment assurance T No. 14) for 5 years with monthly premium of 10810 and sum assured of 6 lacs. Considering the vested bonus that I suppose is 34/1000. My approximate final in hand amount would be around 6+20*5=7lacs.

Is it all or would LIC give any other bonus too?

Amit-First of all buying the product without even knowing the name product name is disaster. Because it is your money and you must take care of in a well manner. Anyhow you already bought it. To guide you in better way. Suppose bonus for your policy is Rs.48 per Rs.1,000 Sum Assured per year for 20 years policy (I assume you bought a plan of 20 years as you have not mentioned about term) then your bonus for whole period is [(Rs.48*Rs.6,00,000)/Rs.1,000]*20 Years=Rs.5,76,000+SA Rs.6,00,000=Rs.11,76,000 (You may also get Final Additional Bonus which I don’t think will create much difference).

I mentioned the term as 5 years. Then is my calculation OK. As i can see bonus rate is 34/1000 since last many years so presuming it to be 34/1000 for next 5 years too. I guess the bonus is =34/1000*600000*5=102000

SA=600000

so in hand=6lacs+1.02=7 lacs

P.S.= I am getting smarter now 😛

Amit-Do you share the policy term? Also let me know what you decided with this policy, whether to continue or not?

Dear Mr. Tonagatti,

First, thank you for the wonderful work you are doing! I bought a 18 year Jeevan Saral Policy in 2004 (when i was 42) with an annual premium of 1,20,000 and Sum Assured 25,00,000. What will be the bonus for this? I tried to calculate from the table you have given but it does not cover 18 year term.

Thanks in advance for your help!

– Anu

Anubhav-Currently LIC declared LA for 10th, 11th and 12th year policies. So based on this (differentiating each year from above table), you can easily calculate the LA rate for 18 years policy. But in all probability return from this policy will be around 6%-7%. One more thing in Jeevan Saral LA will not be calculated on SA instead it is on Maturity Sum Assured and LA is one time payment (not like bonus which will be added on yearly base).

That was amazingly prompt! Thank you!

Can one extrapolate the table?

For example: (Term, LA) = (10, 375), (11, 400), (12, 425), . . . (18, 575).

Giving LA = 575 * MSA /1000

Thanks again,

– Anu

Anubhav-Your understanding is correct. But do remember the difference between SA and MSA in this plan.

Hi Basavaraj,

I have a Jeevan Saral policy of premium Rs. 49000 per annum and sum assured Rs. 1000000 for 35 years.

Can you tell me how much total amount I will get after policy maturity?

Thanks,

Prabhakar

Prabhakar-In all probability return from this policy will not cross 8%. But based on provided information I am unable to calculate it as I need your age while buying plan also.

Hello I am Abhishek Gupta

I am 29 years of age and have a LIC Jeevan Saral Policy.

Premium Amount Paid Annualy-Rs 1,15,296.

I paid my 1st premium in March 2011 and will be paying my 4th premium in couple of days.

Date of Last premium payment is 15/03/2026 and Date of maturity is 15/03/2027.

In policy bond document Maturity sum assured is Rs 20,25,600.

I have a doubt.

After paying 15 annual premiums of Rs (15*1,15,296)=17,29,440, will I get only Rs 20,25,600 at the end of 15 years?

What should be Maturity amount if i withdraw after paying 10 premiums?

Abhishek-My post on this issue will give you a better idea “LIC’s Jeevan Saral-Why so much confusion?“.

After reading your article and all your replies now I have planned to surrender my LIC Jeevan Saral after completing 5 premiums.One more premium in March 2015 and then in March 2016 surrender this policy. Continuing this policy for 10 years would not give me expected returns.

Would I get any LA after surrendering my 5 premiums?

Abhishek-It is good to surrender. LA will be payable but how much is known to LIC only. So discuss with them and finally go ahead.

Thanks Basavaraj for all your help

I have taken jeevan tarang policy for 500000 in 2006 with policy term 20 years..I am paying 6128 Rs quarterly. Could you please explain the amount I will get after the policy term? Will I get the loyalty bonus along with vested bonus? If I surrender the policy after 20 years , will I get the sum assured plus vested bonus plus loyalty bonus?

Vinu-On maturity you will receive SA Rs.5,00,000+ Bonus Rs.4,90,000 (@ Rs.49 per year per Rs.1,000 SA). After one year completion of the maturity you will receive yearly 5.5% of Rs.5,00,000 i.e Rs.27,500 will be payable till your death.

A bit confused here… Will I get the sum assured at the end of 20 year policy term.. This is the first time I am checking the policy details..I feel the policy is really not worth investing more..really feel trapped… Checking for surrender values..

Vinu-You are 100% right. These are low yielding policies. Hence better to come out of this plan. Contact your nearest LIC branch or servicing branch for exact surrender value.

Thank you for the valuable comments Basavaraj..

Hi,

I have Jeevan Anand (table 149) Policy (With Profit With Accident benefit). Details Below:

Commencement: 28 July 2006

1st Prem: 28 Jul 2006 Half Yearly

Last Prem: 28 Jan 2027

SA: 800000

So far completed 8 years (paid 16 premiums). Annual Premium works out to be 19853*2 = 39706 per year. Still 13 Years to go. Do you think its wise to surrender this policy and invest somewhere like PPF/Bank FD. How much amount will I get if I surrender now. Is it 30% of Premium-1st yr Premium + Vested Bonus ??. Kindly advice Is it wise to surrender after 8 years. I understand that I could have surrendered much early, but now thats gone 🙂 will I benefit if I surrender now and invest in some safe deposits? Thanks in advance

Valli

Valli-If you are satisfied with return of around 7% in future from this policy then you can go ahead. Otherwise better to surrender it and start investing in PPF or RD based on your financial goals. Surrender value will be calculated based on the accumulated bonus, term and SA, which you can get it by visiting your nearest LIC branch. In my view it is best to close this policy as soon as possible and continue based on your goals.

Sir

I’ve got a Jeevan anand 149 plan. Request your inputs on the below clarification

1. Will interim reversionary bonus declared every year be accumulated to my policy? So, if the policy term is for 30 years, will i be right in telling that there is no guarantee that LIC will have to necessarily declare bonus (or atleast same amount).

2. Will the final additional bonus be accumulated every year or it just depends on the FAB declared during the year of maturity?

Suresh-There is no compulsion the LIC need to declare bonus every year. But it declares every year since long. So it changes based on the profitability of LIC. Final Additional Bonus is one time payment at the end of policy term. So no question of accumulation.

hi,

i have invest 50000/ year policy of jivan saral for 25 year so ,ple return detail

Mahesh-Whether you already invested or about to invest? If you are planning to invest then currently this plan is not available in LIC.

Hi my husband is 45 years of age and we have taken jeevan aanand policy on his name for 15 years of term. Sum assured is 5 lacs. We are paying 40000 rupees p.a so following are my questions

1. What will be the amount we will receive after 15 years