How often you check bank statements? Many of us never given importance or habit to check bank statements regularly. But nowadays banks never remain bankable. Hence, we must always be suspicious.

Those who follow me on Facebook and in BasuNivesh FB Page may be aware of this incident which happened to me. Because I shared this in social media. However, I felt it is better to share in a blog post for all to caution about such incidents.

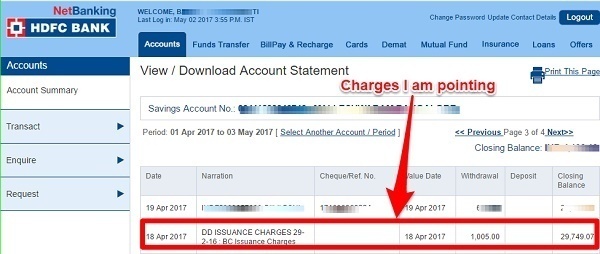

A few days back, when I was randomly checking my account statement, I found this below expenses deducted from my bank account. The explanation was “DD Issuance Charges 29-2-16”. I cross checked my bank statement for that date and found that I took DD from HDFC Bank. Also, HDFC Bank issued DD at free of cost.

However, I found it surprising that how can a bank now after 1 year and 2 months of DD issued can charge and deduct the money from my account.

Hence, I immediately contacted the concerned relationship manager. He explained to me that it may be wrong. But the branch which deducted the charges will be in better position to explain me. Hence, he requested me to raise the complaint.

I used the [email protected] email and wrote as below.

After few days, I received a call from the Branch Manager of the branch from where I took the DD. He was in no mood to listen my points. Instead, he was proving that Bank is correct. I asked below two questions to him, for which he never answered me.

- The DD was issued one year and 2 months bank. Why not the charges deducted during the issuing of the DD? Even if you missed to deduct the charges, then you might have deducted the same within same FY, but here you are deducting in the next FY.

- What if I closed my account during this one year and two months period? How might you collect this charges from me?

Finally, he told me that this is the final decision, if I want to knock at a higher level then I am free. Then I took this issue as a challenge. I warned him that it is not the matter of Rs.1,005, even if it is the matter of Rs.10, now I will not keep silence and I will get back whatever the mistake you did.

Then I took social media help by posting this issue in Change.org and also shared the same on my Facebook, Twitter and Google+ Profiles.

In the meantime, I received the email from HDFC as if a patch up work and it is as below.

Dear Mr. Tonagatti,

What did I learn from this experience?

# Banks are never bankable-Earlier we used to believe on banks blindly as if they take care of our money. However, this is fastly changing. The reason is they also come up with a business module called selling. Hence, for their survival, they do anything.

# Check bank statements-Whether you use your bank account regularly or once in a while, it is always best to keep any on all time. Check your statement once in a week if the transactions are more. Otherwise, check the transactions once in a month. If you found any suspicious transactions or charges, then immediately raise the issue.

# Keep one or two banks accounts-Never keep more than 1-2 accounts. If you found the bank accounts idle for a while, then instead of keeping them idle, better to inform the bank and close it. By keeping a minimum number of bank accounts, it makes your life easy to track your money and on such charges.

# You must know whom to contact-Be informed about whom and how to knock when such incident happens. Usually, all banks nowadays display the information on their websites or in their branches. Hence, knocking the right person is the best method than delaying.

# It is not the matter of Rs.1,005 or which bank did it-I am sharing this experience of mine as a live example. It does not mean that HDFC Bank is bad or all other banks are good. Also, it is not the matter of Rs.1,005 or Rs.1. But they must be open and clear with their policies.

Hence, no matter which bank you deal or the quantum of money involved, it is always best to fight for your rights when you notice such unnecessary charges.

Let me know if you too have faced any such experience. Share it in the comment section so that it may benefit to other readers.

Related Posts-

- What is Banking Ombudsman and how to approach?

- Why Bank FDs show Annualised Yield instead of CAGR?

- How much safe is your Co-Operative Bank?

- Banking Service-Twenty unknown facts

- Bank FDs-Is your Bank have Deposit Insurance and Credit Guarantee (DICGC)?

- Banks as Insurance Brokers in India-Stay away !!!

- Bank Fixed Deposit (FD)-What happens if you not renew or withdraw it?

- Savings Bank Account minimum balance-You know how bank cheating you?

- How to check Bank Balance freely using missed call banking facility?

this is with reference to the item ” How often you check bank statements?”, I faced the same goof up of Banks. Actually, last year, I enrolled my name for one nationalized bank`s insurance account, and subsequently, come to know that , the concerned Bank is acting only as an intermediary,and the lethargic attitudes of our insurance companies, are in no way their concern. hence, wanted to discontinue and wrote a letter , as per their norms, to the Bank not to deduct any more insurance premium for the FY17-18

But to my utter dismay, they have arbitrarily , deducted an amount of Rs.16400-00, and gave no explanation to my letter to their customer service department. This prompted me to write to National Consumer Redressal Forum, who have written to the General Manager of the Hyderabad based Nationalized Bank and forced them to re credit the insurance premium of Rs.16400-00 to my account .

Raghavan-Great to know about your success story. Thanks for sharing such horrible experience with us.

Respected sir – My mother passed away one months ago. She was a bihar govt. employee in health deptt. There is a savings a/c in allahabad bank in the name of my mother. Nominee is my father. It has been 10 yrs since my father passed away & his death certificate was searched but nowhere to be found. So, considering my mother’s death certificate, can i withdraw money from her a/c ? I’m the only child(son) & my age is 17 yrs.

Gaurav-You can claim by producing the death certificate of your mother and your legal heir certificate.

You are a ROCKSTAR Mr. Basu.

Your blogs are so informative and useful.

Thanks for your efforts…and I wish you all the good fortunes in future…

Arun-Thanks a lot 🙂

Dear Basu,

A very timely article in these days of uncertainties. As you put it rightly they are not bankable these days.

I am an NRI and regularly remitting to my NRE a/c in ICICI bank. On March 30 I got a call from BM requesting to remit some cash for FY closing. I did remitted 10 lac same day. But after that no courtesy call or any news but they deducted from my a/c some money which I never noticed. But after that all subsequent remittances had deduction in ICICI but not in Syndicate bank. I sent a mail asking for clarification to NRI cell of the bank. In few hours BM sent me a mail and asked me to call back. When I called he said he will look in to it, but since almost a month now he is not answering mails and phones and NRI cell too silent. I am planning to move all my funds to Syndicate bank.

Plz.advice !!

Ravindra-Syndicate Bank is one of the worst customer service providing Bank in India. Instead of listening to their irresponsive behavior, raise the voice.

Dear Mr Basavaraj Tonagatti, it was really an eye opener and a wake up call. though i have not faced a problem till now but its an advice worth followin, thanks.

Mr. Basavaraj- Thanks for sharing such information. HDFC bank is regular in debiting its customers for such wrong charges . Happens to me on regular intervals . For e.g , recently bank charged me for cheque return charges for the cheques not even deposited by me on the mentioned dates and also the cheque no. Mentioned was wrong . They debited my account twice on the same date for such wrong charges. However, being their imperia client I report this matter to my BM and within a period of 2 days i got reversal of such charges . Be cautious while dealing with HDFC bank.

Thanks

Shrey

Shrey-Thanks for sharing your experience.

Basu, keep up this good work. Just remember that there are many passive readers of your website (It’s a quality work, that’s for sure). One of those is me. Regards. Danish

Danish-Thanks for your encouraging words 🙂

HDFC Banm does this with everyone without fail.This is not the case with some other banks.I would suggest you change from hdfc bank to a better govt bank.You wl not face this nonsense.

JHDFC Banks’ best days are also behind them/.How much time,energy and effort you have spent on the harassment they have melted out to you for no fault of yrs.In the meantime you could have been so much more productive.

Suketu-Here I am not pointing ONLY HDFC. It may happen with any bank. Hence, caution you all.

Mr. Basavaraj – Thanks for sharing your experience with HDFC Bank, which is notorious for its ‘innovative’ charging practices. I had a Savings A/c with them for many years, which I got closed last FY, as it was mostly a dormant a/c. Had observed that whenever any new charges are levied by Banks, HDFC is foremost in this regard, and often deducts usurious charges on frivolous grounds (once deducted Rs 250 from me for not having transacted for a prolonged period). There was also a recent case of HDFC Bank (again !) charging for some service on an opt-out basis, i.e. customer had to inform Bank if not interested in availing the particular service. This was a gross violation of trust between a Bank and its customer. Unsurprisingly, RBI kept mum throughout this episode.

Due to some past experiences like yours, I have been maintaining my Bank transactions in Excel on my home PC, which I keep updated every month. Seems a good way to track one’s Bank A/c, in these ‘unbankable’ times, as you rightly put.

Ramesh

Ramesh-Thanks for sharing your experience.

Faced similar issue with HDFC. I was told that NEFT/RTGS charges have been waived off being a HDFC’s Corporate Salary A/C holder. However charges were getting deducted. Branch Manager/Corporate Salary Relationship Manager did not listen and also did not reply to emails. Then I wrote to Banking Ombudsman in detail, after which HDFC bowed down and refunded the amount.

HDFC is also infamous for inconsistent, arbitrary, unjustified charges for any type of loan. In one case, my colleague was charged for a loan where he did not even apply.

Pushkar-Thanks for sharing your experience.

Sir

I took home loan from bank of india at Dec.2014 as flexible interest rate.when i took this loan rates are 10.20 per annum.As RBI change his policies the intrest rates start to decrease.My intrest rate decrease to 9.55 from 10.20.But after that it remains same till to last month.When I ask the reason of it the branch manager says that it is due to Policy Of RBI as intrests are depending on MCLER not to base rate.

Is it compulsory to everyone?

Where can I got information or where can I complement about my loss due to this policy of bank.

How can I know about the intrest rates of home loan from December 2014to till last month

Please guide me about this.

Guruprasad-Refer my post about MCLR “All about MCLR lending rates in layman terms” and then take a decision.