Recently PFRDA opened a new portal called eNPS. Using this portal, you can open and invest in NPS account online. This is the big relief to many NPS subscribers. Let us see it’s features.

What is National Pension Scheme (NPS)?

This is the retirement product also called as Defined Contributory product. There is no defined benefit. You contribute to this product (in case of Govt. employees, your employer too). Your retirement corpus depends on the amount you contribute and the income generated from this contribution.

Such accumulated retirement corpus can be withdrawn once you retire and can be utilized to buy an annuity (pension product). You are allowed to withdraw part of it before you can buy an annuity. We can explain the same as below.

This is regulated by Government body called as Pension Fund Regulatory Development Authority (PFRDA). PFRDA appointed fund managers, who manage your fund. There are various options of investment to choose based on your risk appetite.

An individual with the age limit of minimum 18 years and maximum 60 years of age can join NPS. Now, NRIs are also allowed to open NPS account.

Once you open NPS account, then you will be allowed a PRAN (Permanent Retirement Account Number), a 12 digit unique number. A minimum of Rs.1,000 can be invested and there is no maximum limit. But minimum single contribution is Rs.500 for Tier 1 and for Tier 2 it is Rs.250.

Note-As per recent PFRDA circular dated 8th August, 2016, the minimum contribution in Tier 1 Account is now reduced to Rs.1,000 a year. There will be no minimum investment limit for Tier 2 account (Earlier, it was Rs.250). Also you no need to maintain the minimum balance in Tier 2 account (Earlier, it was Rs.2,ooo).

As of now there are 7 fund managers, who managing the overall NPS amount. They are as below.

- HDFC Pension Management Company

- LIC Pension Fund

- ICICI Prudential Pension Fund

- Kotak Mahindra Pension Fund

- Reliance Pension Fund

- SBI Pension Fund

- UTI Retirement Solutions

As of now there are 7 insurance companies, who provides you pension products for NPS. They are as below.

- Life Insurance Corporation of India (LIC)

- SBI Life Insurance

- ICICI Prudential Life Insurance

- Bajaj Allianz Life Insurance

- Star-Daichi Life Insurance

- Reliance Life Insurance

- HDFC Standard Life Insurance

There are mainly two types of NPS accounts. One is called Tier 1 and another is Tier 2. You can read the full details about these two accounts in my earlier post “Difference between Tier 1 and Tier 2 Account in NPS“.

What are the tax benefits of investing in NPS?

# Employees of Self Employed Contribution-Employees (Up to 10% of Basic+DA) and for self-employed, up to 10% of gross income will be eligible for deduction under Sec.80CCD (1). This Sec.80CCD (1) is part of Sec.80C limit. Hence, the maximum tax benefit you can avail is Rs.1,50,000.

# Employers contribution-Employers deductions will be claimed by employees under Sec.80CCD (2). The limit for such deduction is lowest of the below three conditions.

- Amount contributed by an employer.

- 10% of Salary (Basic+DA).

- Gross Total Income.

# Additional Rs.50,000 Benefit-Along with above two tax benefits, you can claim additional Rs.50,000 tax benefit under Sec.80CCD (1B). This is over and above Sec.80C limit.

Taxation at maturity-From Budget 2016, 40% of NPS corpus withdrawn at the time of retirement is tax-free. Rest of the amount taxable to you as per the applicable tax slab for that particular year. The annuity you receive from rest of the corpus will be taxable income as per your tax slab.

What are the withdrawal options for NPS?

Refer my latest post on the same “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

This is all about the brief introduction about NPS product. Now let us concentrate on our main purpose of this post.

How to open and invest in NPS account online?

PFRDA recently started eNPS portal. Using this portal, you can open a new account and invest or contribute to NPS account online. Using the eNPS portal, you can generate PRAN and start investing online.

Note-Now NRIs are also allowed to open NPS account online using eNPS. (As per Ministry of Finance Notification).

Some features of eNPS portal are as below.

- You must have either Aadhaar or PAN card to open this account.

- If you try to open an account using Aadhaar, then the OTP (One Time Password) will be sent to your registered mobile number.

- The details like your photo, address, contact details will be fetched from the Aadhaar database.

- if you try to open an account using PAN, then your verification will be done by using the KYC details you provided to your bank.

- You can open both Tier 1 and Tier 2 accounts also. However, those who want to open Tier 2 account only then PAN card and bank details are mandatory.

- The process is not fully ONLINE. Because, once you submit the application online, then you have to take the registration form printout. You have to paste the photograph, affix the signature and send it to below address.

Central Recordkeeping Agency (eNPS)

NSDL e-Governance Infrastructure Limited 1st Floor,

Times Tower, Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013.

- You have to contribute the minimum single investment amount while opening the account (Rs.500 for Tier 1 and Rs.1,000 for Tier 2.)

- You can invest NPS account either through net banking or using debit/credit card.

- You will get the PRAN immediately. You will receive the PRAN to your registered phone and email instantly. You will receive the PRAN card later through post.

- The contributions will be credited to your NPS account within two days of successful remittance of the amount.

- Subscribers who open the new NPS account using eNPS can contribute online. Along with that, members who are NPS accounts holders can create a login and start investing online. Government employees, who are members of NPS account, can create their account online and start investing in their Tier 1 account on their own.

- If you have any doubts, then you can email to [email protected].

How to open and invest in NPS account online ?

Let us first try to understand how a new investor can open an account online by using eNPS.

Below are the steps you have to follow for opening the NPS account online.

# Visit Home Page of eNPS

Click on the options among three. The first one is for opening a new account and registration. The second option is for contribution and the third option is for activation of Tier 2 account of NPS. The screen looks like below. First, click on “Registration” tab.

# New Registration Window-

From below screen you chose the option “New Registration” if you are activating the account first time. Choose “Complete Pending Registration”, if you already did part of registration and saved but not fully completed. Choose “Print Completed Registration Form”, if you completed the process of registration and trying to print the hard copy of the same.

Next is to choose whether you are an individual subscriber or Corporate subscriber (this is meant for your employer). Next, you have to specify your residential status. Then, you have to choose either Aadhaar option or PAN option for registration.

You have to choose which account type of NPS you want to open. Better to opt the first one (Tier I and Tier II). Then finally enter your Aadhaar number and request for OTP. They will send the password to your registered mobile number. The complete screen looks like below.

# eNPS Registration Process–

Once you enter OTP, then you will be redirected to registration window. This window looks like below.

Please note that fields marked with “*” are mandatory. Click on “Save & Proceed” button in short intervals to avoid data loss due to session expiry. Click on “Reset” button to clear the unsaved data.

If you try to create an account with PAN number, then details will be validated online with the Income Tax dept. If PAN records matches with the information provided during NPS registration, you will get PAN Details confirmation message.

Majority of data will be automatically fetched from Aadhaar database or PAN details. You have to specify Bank details (not mandatory), nomination details, investment fund option and you have to upload the signature image. Once, everything over, then you have to confirm.

Finally, you have to go for payment tab and pay the minimum amount of Rs.500 (for Tier 1) and Rs.1,000 (for Tier 2). Once you do the payment, then you will receive the PRAN to your email and mobile number. The PRAN kit containing a PRAN card, IPIN/TPIN, subscribed master report, scheme information booklet along with a welcome letter will be sent to your registered address.

# eNPS Registration Form–

Once the process is over, then you have to take the printout of the registration form, paste your photograph and sign on it. Send this form to below said address within 90 days from the PRAN activation date.

Central Record keeping Agency (eNPS)

NSDL e-Governance Infrastructure Limited,

1st Floor, Times Tower,

Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013.

How to invest in National Pension Scheme (NPS) account online?

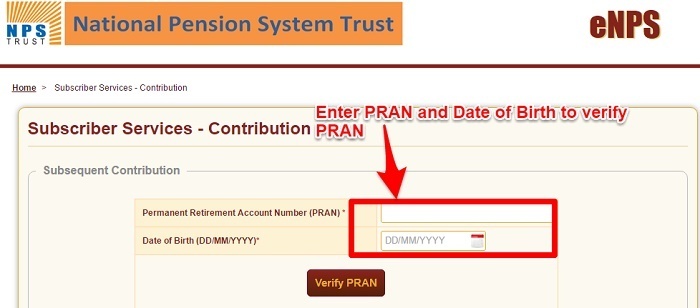

If you already have PRAN, then you can invest online. For this purpose, you have to click on “Contribution” tab. Then enter your PRAN and date of birth to validate and proceed for online payment option. The screen looks like below.

You can invest online by using SBI ePay. This option provides you to pay by any of 40 associated banks. You can pay through net banking or using credit/debit card option.

There are other options to open or invest in NPS account online. But they are points of presence or middlemen. However, the above eNPS portal is from PFRDA. So it’s like directly operating with PFRDA. Hope I cleared the majoring of process and doubts of how to open or invest in NPS account online.

Do you have any problem in open or invest in NPS account online? Please share the same by commenting. Let me and other readers may know and it will benefit to other fresh account opening individuals or investors of eNPS platform.

What are the benefits to open and invest in NPS account online?

You are completely avoiding the middlemen or POP (Point of Presence) using this eNPS platform. Hence, you can save Rs.125 of initial subscription charges. Also, while investing online, you can save the 0.25% of charges which will be charged by POP at the time of investment.

However, rest of the charges like annual maintenance charges or AMC charges will not be avoidable.

eNPS New Updates effective from 1st June 2017-

# Hindi version of eNPS module

Now Hindi is also added in eNPS. The Subscriber shall have the option to choose the desired language option (either English or Hindi) for Registration and/or Contribution through eNPS.

# eSign for Aadhaar based Registration

In case of registration through Aadhaar, it was mandatory for Subscriber to submit physical Application Form within 90 days of completion of registration under eNPS. eSign facility (Aadhaar e-KYC services) has been integrated with eNPS platform to enable the Subscriber to sign his/her PRAN Application electronically. This process has eliminated the requirement of submission of physical documents to CRA.

# New Payment Gateway – Bill Desk

In eNPS, along with SBI ePay, Bill Desk has been integrated as the second Payment Gateway Service Provider. This will help the Subscriber to make payment through any service provider as per his/her choice by selecting the available payment options. An addition of Billdesk as new payment gateway has ensured participation of new banks which were not part of SBl e-Payment gateway especially AXIS Bank and HDFC Bank.

Dear Sir,

This is Srikanta from Bhubneswar, Odisha. I want to contribute and take facilities of NPS. I am a private sector employee. I have no PRAN Number.

Can I open a NPS account ?

What is the difference between Tire-I and Tire-II ?

Please guide me how to open and contribute in NPS.

Dear Srikanta,

Yes, you can open online also. Visit the NSDL website.

I have opened NPS account online recently and everything went smooth. I have even downloaded the PRAN card. However the physical PRAN card that they sent went back undelivered. Do I need physical PRAN card or Downloaded one is good enough?.

Dear Krish,

You can download the softcopy and retain.

Hi Basavaraj,

I have done the payment of Rs 1000 with recently received PRAN number , the transaction status went in pending state which I have seen from pop-up after the deducting 1000 from account.

when I check from site: https://cra-nsdl.com/, there were no history of recently contribution.

Also check the PRAN registration status which was showing ‘PRAN is invalid’.

I’m not sure how/where to check or get regrading the amount deducted from my account but not showing in NPS contribution.

Any help will really appreciate.

Dear Deepak,

Raise an issue with NSDL.

I have opened NPS account through NPS.KARVY.CRA. for every contribution I have to bear ?20 + ?4 GST.

Hence I want to Shift CRA from Karvy to NSDL.

Pl advise.

Dear Shivanand,

Check at first before shifting whether NSDL not charge GST.

NSDL CRA customer care is not reachable by any means. waiting number between 10-20 and call gets automatically disconnected during waiting time itself. Whether anybody else is feeling the same difficulty ?? I’m afraid that after putting my hard earned money in it, if I face any difficulty before or during withdrawl, how would we get any help ??

Dear Ashish,

Whether you dropped an email? If not then contact the nearest Point Of Service of NPS and resolve your issues.

I have recently opened e-nps account, received PRAN and downloaded the final registration form which is to be sent to NSDL within 90 days. This form has a column to be filled by pop-sp. In case of e-nps, who is pop-sp ? I’m unable to understand.

Dear Ashish,

Not required.

thank u sir for nice info. i have tier -1 account then how can i open tier 2 account online

Dear Neela,

Using their app you can open the account.

Dear sir,

As per your article,,, advantage of opening NPS online on eNPS over POP is

Quote

”Also, while investing online, you can save the 0.25% of charges which will be charged by POP at the time of investment.”

Unquote

does it mean every time we are making a contribution , we are paying 0.25% to bank who is acting as POP,,,,,, OR this 0.25% deduction is for only very first contribution.

Dear Ash,

It is every time.

Hi Basavaraj,

I recently registered for NPS and would like to make a monthly contribution. Is there a way I can setup an SIP for NPS?

Dear Gaurav,

Yes, you have to submit the mandate for the same.

I would like to ask a query related to paying the amount. Just take an example I have opened an account, minimum 500 per month. But I like to pay more than 500 rupees for some months. Is it possible or Only we can able to pay 500 rupees.

Dear Marshal,

Yes, that is possible.

You said that NPS is part of 80c and one can avail maximum of 1.5 Lakh under, but i read in some other blogs that NPS is over the 80C and not included in it.

can you please confirm.

Dear Linus,

Refer my post in this regard “NPS Tax Benefits – Sec. 80CCD(1), 80CCD(2) and 80CCD(1B)“.

I have opened NPS account online through enps. I have contributed some amount also. I have received PRAN also. I have digitally verified my signature. In the official website of enps it is mentioned that I need not send the print of my application form as it is electronically verified. Please suggest me.

Vishwanath-Please follow the process which they explained.

Sir, we have submit a crossed of cheque for Rs 1000 /-, for Tier 2 eNPS activation. Apart from that, I payed Rs 1000 /- online as my first contribution. The first contribution got reflected with my Tier-2 account immediately after it’s activation after two days. But what about crossed cheque for Rs 1000 /-. My physical documents submitted after Tier-2 activation has been accepted by CRA Yesterday, after filling a Grievance couple days back.

Durai-Physical cheque may be required to register your NACH.

Hi Sir,

First of all I would like to thank you for your valuable inputs about NPS.

I opened NPS through online mode, and have made a contribution of Rs.1000 each to Tier-I and II accounts. My PRAN no. was generated and I digitally signed the PRAN application form.

But, since then I am unable to log in via my PRAN no. at https://cra-nsdl.com/CRA/.

It is showing as ‘Unauthorized user’ or invalid PRAN.

Does it take some time to get activated? Kindly help me in this regard.

Thanks,

Deb

Deb-May be but not sure. If the error still persists, then better to knock PFRDA.

Hi Deb,

I too facing the same issue as “Unauthorized User” while trying the set the i-pin. Please assist me if your issue is resolved.

Thanks,

Bibin

Bibin-Better to be in touch with POS of PFRDA.

Hi, how did you solve the problem. I am also facing same issue. Kindly help.

please go and reset your password

How many days it took for activation? I am facing same problem. Kindly help.

Rahul, wait for 3-4 working days, it will work 🙂

Thanks Deb. I am able to login with my PRAN now. But my contribution to tier 1 is still not reflecting in my CRA statement. Does it also take some days to do so?

TIA.

Rahul-As per me NO. Hence, better to contact NPS POS.

Yes, don’t worry, it will reflect 🙂

Thanks deb. It did reflect today 🙂

Sir, i have 4 years old tier 1 account and about 2 lakhs deposited now i want to register in tier 2 account then what amount will be available in tier 2 account. Indirectly i want to ask that will all amount if tier 1 is tranferred to tier 2 account . I mean after activate the tier 2 account . Will there 2 lakhs deposit.

Aayush-You are not allowed to transfer the money from Tier 1 to Tier 2. But the reverse is possible.

I opened tier 2 account through on line registration and get a printed S10 form, so where I have to send this form with crossed cheque and copy of pan card,though my tier2 account is shown “active “on cra Nsdl website and I made initial contribution to it.

Prashant-To the nearest POS.

Dear sir,

I have opened NPS Tier-1 NRI account online. Now I wish to open Tier-2 account (NRI status), but since I had opened Tier-1 account online, my POP is shown as ‘eNPS-online’. Other POP like ICICI and HDFC Bank are saying that since Tier-1 is not opened by them, they can’t open Tier-2 account.

Also NRI customers are not allowed to open Tier-2 online on NSDL website.

Request you to kindly advise how NRI can open Tier-2 account online or otherwise.

Regards,

Rohit

Rohit-There is no such special rules to open Tier 2 account than you must have Tier 1 account. I suggest you use offline mode and submit the request to NPS Pos.

Dear Basavaraj,

First of all thanks for a clear and concise article.

1. I am a Central Govt employee with pensionable service.

2. I was advised by a friend to invest Rs 50000 on 31 Mar 17 in NPS, since it would give additional tax benefit.

3. I took his advice and did the same without adequate research due paucity of time.

4. I would like to contribute to NPS through an SIP, is that possible? If so can you please guide me?

5. Now when i came across your article, in one of the comments you have advised against NPS, so I am a little confused!!!.

6. Could you kindly guide me.

Thanks for the effort

Cheers and blue skies!!

Badhrish-Yes, you can contribute like SIP. You have to give ECS mandate to PFRDA for the same. Be in touch with PFRDA POS for the same. Many invest in this scheme with the intention to save tax. But they forget the taxation at the time of retirement. Illiquidity and no control over your investment are some other negatives.

I have registered online using the Aadhar option but by mistake I have selected both Tier 1 and Tier 2 option. How do I change my registration to Tier 1 alone. It is not allowing me to proceed with online payment for Tier 1 a/c unless I make contribution to Tier 2 also.

Shailaja-Contact POS of PFRDA and request for cancellation of Tier 2 account.

Hi Basa,

Thanks for all the information on NPS. I have learned a lot about it. However i need your suggestion on whether to invest in it or not.

You see, i did my own financial planning according to various goals – short, medium & long term.

Short term – Savings A/c, Liquid Funds.

Medium term – Dynamic Bond Funds.

Long Term – EPF, PPF, ELSS MFs & direct Stocks.

I have considered ELSS & stocks as my defacto Retirement Fund.

However i’m not comfortable investing in NPS for the following reasons :

1) Little control – No information on portfolio of respective pension funds.

2) Lack of liquidity – ELSS has lock-in of 3 years only.

3) Customer Care – As NPS is owned by government, i doubt how they will effectively solve issues. PSU banks are worst in terms of customer care.

4) Charges – Charges on everything including the online payment transactions also. Why can’t NPS be cost effective like Mutual Funds.

Because of all these reasons, i’m not sure about investing in NPS. Please advise.

Thanks & Regards,

Sumeet Sasmal

Sumeet-You are on right track 🙂 Avoid NPS.

Dear Basa,

Thanks for your valuable advice. Now i can divert extra funds to ELSS & create retirement fund.

I’m investing in following ELSS :

1) Axis Long Term Equity (Growth – Direct)

2) Birla Sunlife Tax Relief’96 (Growth – Direct)

I did lot of research on Value Research for selecting these two funds. Just wanted your expert advice on the same. Please advice.

Thanks & Regards,

Sumeet Sasmal

What are the annual maintenance charges, if an account is opened and maintained through online.

Pavan-There is no such cost involved for online account.

Hi,

Yesterday i had opened tier 1 eNPS account through online.

Digital signature verified successfully, PRAN number generated, and initial amount contributed successfully

Today on contributing, some amount, i am seeing invalid PRAN account number.

Please let me know whether we need to wait some time for authoring.

Pavan-You have to contact PFRDA. I think some technical error.

Can you please send me the contact details of PFRDA, whom to contact and how to contact.

Pavan-You have to be in touch with POP-SPs. The list is available in this link of POP-SPs of PFRDA. You can be in touch with them who are nearest to you.

Thank you Sir,

Is there any place where we can see the accumulated amount of eNPS account through online.

Suppose, if I am a subscriber for NPS from 5 years, what is the total amount added for me.

Thanks

Pavan Kumar

Pavan-You can check the same in this app.

I am a Central Govt.employee having Old Pension Scheme facility under which i am saving Rs.150000 for the purpose of tax benefit in GPF.

How can i save more tax?

If i am opening an account in NPS (Tier 2) and depositing Rs.50000 annually, can I get Tax benefit or NOT.

What the is difference between NPS Tier 1 and 2?

Why we opt Tier 1?

Why should v opt Tier 2?

Please clarify at the earliest, so i can open the account this month only to save the tax.

Yadav-Refer my post “Difference between Tier 1 and Tier 2 Account in NPS“.

Hi,

I am planning to open new NPS account online, what is the maximum amount we can deposit in a year.

Can we invest more than Rs50,000/- in a calendar year .

Please reply

Pavan-There is no maximum limit for NPS investment.

I have completed the online application, and downloaded it as well.

While downloading it already has my photo and signature, which was uploaded earlier.

When sending the hard copy, do I have to paste my photo over the already existing photo and sign over the photo (since the box allotted for signature is already having my signature).

Please suggest

Pulkit-Not required.

Thanks Basavaraj.. So, I need to just send the downloaded copy, nothing else… right..? No need to paste any photo or signature..

Pulkit-Yes, as photo and signature already showing on application (but better self attest the same and send it).

hi.

i have opened an eNPS account through Adhaar. my photograph was autopopulated from adhaar and i uploaded the signature online. after that i took a printout of payment receipt. But i couldnt find the form to be sent to Mumbai with photograph and signature. Please guide me if i still have to send that form and where can i find one? as i have to show it as a proof for tax saving this financial year. I need 2 things as documents 1.Photocopy of receipt issued by the Insurance Company and 2.Section 80CCD(1B) should be mentioned on the pension policy document. where and how can i find them?

Nikita-You can download the statement using eNPS or check with NPS POS. Statements will not mention about IT Acts. You have to show while filing IT return on your own.

So..once my PRAN will be activated and i’ll receive this kit with IPiN and all..i can see my statement and uplaod the same as proof for tax exemption. That will be all i need or something else also need to be attached alongwith?

Nikita-Yes, that’s enough.

NRI is supposed to contribute through NRE Or NRO .

If NRO is selected ( non repatriable basis) and then if the NRI status changes to Resident Indian say after few yrs, is the account to be Closed or will it continue like a normal resident India ?

NOTE:

While account opening in e-nps ( as NRI) a declaration is done that the contribution will be met by subscriber from his NRE /NRO account only.

UR-Once you cahnge from NRI to resident Indian, then your NRE or NRO accounts MUST be closed. Accordingly, you have to update the same with NPS regarding the change in your residential status.

Thanks for the reply.

NRE will be closed but NRO account will be converted back to Normal savings account on return and I should be able to contribute with that since the same is mapped with the NPS account.

However at one place on NSDL website it is mentioned that the account needs to be closed.

I had written a mail as well to nsdl for this but there is no response.

UR-You no need to close NPS. Just you have to update the bank details.

I have become a NPS subscriber through HDFC Securities. I intend to make the NPS contribution through ECS mode. I am not having any account with the HDFC Bank and I am having my SB account with SBI. Please guide me to remit the contribution through ECS mode.

Rajaraman-Why can’t you use eNPS?

Hi Basavaraj,

Thanks for your article. I have opened account on eNPS portal and did my first payment(contribution). Now, I want it to happen monthly like SIP. How can I avail ECS facility? Or money will deduct automatically from account?

Ankit-Money will not deduct automatically. You have to give NACH mandate.

Basavaraj – Can you please explain the NACH process for eNPS?

Ankit-You have to check with their POS. But I explained the NACH process at my earlier post. Refer the same at “All about NACH (National Automated Clearing House)“.

Basavaraj- I called eNPS Helpline and they said that there is no ECS/NACH facility currently available. Customers have to do manual contribution every time (Monthly/Yearly) until ECS/NACH facility is implemented. I would request you to please verify and update above article with “Modes of payments” topic with these details. Thanks allot for your help.

Ankit-It is disgusting to know.

Dear Basavaraj,

I am at 47 now and would like to join eNPS. I have 2 questions please reply.

1) Is it beneficial for me to join eNPS

2) If i would like to get an amount 40000 per month at the age of 60 then how much

should i invest per month.

Regards

Unnikrishnan Punnakkal.

Unnikrishnan-I am not a fan of NPS due to it’s taxation at retirement and the liquidity issue. Hence, I will not recommend this to you. Calculation is lengthy and I can’t do it without other information.

Dear Basu,

So you don’t recomnend this Pension Plan as a good plan coz there are best pension plans available. What more information is required for pension calculation. I am an nre so i dont need to pay tax so which is the best plan for me at this age.

Unnikrishnan-As of now there are no such pension plans which we can say BEST. You are NRI so you no need to pay tax??

Dear Basavji,

Is this pension plan is good for me at this age. I am planning to join with a monthly

EMI of 5000/= per month. What will be the approx pension per month at the age of 60.

Regards,

Unnikrishnan Punnakkal

Unnikrishnan-I pointed my views, rest is left with you to decide. I can’t calculate to all individuals personally on this platform. But you can expect around 9-10% of returns (pre-tax).

Thanks a lot. I appreciate if comments of financial analysts can be an answer to the subject rather diplomatic answers.

Regards.

Hello, I want to know if now I only open Tire 1 account then in future can I open Tire 2 account

Divya-YES.

Dear Basra,

I have just started a Tier one with an initial investment of Rs:500. Now I would like to change the EMI

to 5000 per month. How can I do this?

Also I have typed a wrong contact number by mistake, which I would like to change. To get the OTP in my

mobile first I should correct the mobile number. How can I do this? Please reply.

Unnikrishnan-You have to request the bank to cancel the NACH mandate. Register the new one. Update your number in Aadhaar.

Hello Sir

I have opened a Tier -1 account through online with adhaar card.

I’m a NRI.

After the generation of online form , should I directly send it to Central Record keeping Agency (eNPS).

Bcuz in the form generated there is portion where my POP bank has to sign and verify.

How this is done? Or should i send the form directly.

Thanks in Advance

Azar-Better to send to POS.

Hi Mr: Basra,

I have registered for the Pension scheme and got the PRAN number. I have the following doubts, please clarify.

1) Is it necessary to post the filled form to the address mentioned?

2) When and where should I decide my monthly EMI.

3) Is the EMI can be monthly, half yearly or yearly.

4) Is the EMI will be automatically deducted from the account.

5) Or I must give ECS approval to bank.

6) I choose the Tier 1 ( what is the difference between 1 and 2)

7) How can I edit some fields like contact number.

Please send me the reply.

Unnikrishnan-1) Yes. 2) It’s your choice. 3) It’s your choice. 4) It’s your choice. 5) Yes. 6) Refer my post “Difference between Tier 1 and Tier 2 Account in NPS“. 7) There is an option. Please check it to edit profile.

I am looking for a pension plan for my father who will be retiring after 11 years. Will NPS be a good policy for him to invest ?

I am 25 years old and currently working in IT sector. Can you let me know the best pension plan which i should get.

Thanks in Advance

Anurag-Defenitely NPS not a best option. Try to accumulate it through investing in mutual funds.

I am working in mpmkvvcl( mp govt. Undertaking) for last 2 years.10% of my basic+grade pay+DA is getting deducted every month by my employer and the same is contributed by my employer.But my nps account has not opened yet by employer.Can I open it using eNPS portal and how can I transfer my deducted amount to this nps account??

RAvi-First check with employer about why the account is not yet opened.

Hi, very informative article.

I am 28 years old and I am searching for good investment options. I just came to know about peer to peer lending as an emerging platform in India and wanted your views on that.

Rajat-I am not an expert in that.

I AM ATTAINING 60 years of age ON 02/01/ 1957 . IS IT at all BENEFICIAL TO JOIN NPS AT THIS AGE?

Anjan-Stay away.

Hi,

I currently i am holding NPS tier 1 account. My previous company detected NPS amount from my salary and they paid for me.Now i am resigned that company and cuurently working in another company where NPS option is not implemented yet. I am planning to contribute the NPS with same Tire 1 account.is still possibe??

yes mean please tell how can i pay my NPS amount??

Thanks for your feedback

Balakumar-Yes, you can contribute. Use above online option to pay.

In NPS , is it necessary to have a same fund manager for tier-I and Tier-II account?

Sud-It can be.

Thanks Basavaraj Tonagatti, very good information. It is very helpful. Also some tips you have mentioned are valuable.

Archan-Pleasure.

Inspired by your NPS tutorial. I have already open a NPS account through online enps. i have also open a tier II a/c .

Now i want to know, withdrawal procedures from tier II a/c……..through online……???????

Is it possible through eNPS, give the online instruction for withdraw money from TIER II a/c. ……money goes to directly his savings ????????

Arjit-It is not yet clear whether they provide that facility or not. But by login, you can check out. I personally not invest in NPS. So, it is hard for me to check and explain you.

Sir , you have said that you are not personally invest in NPS…. So, What is the best Retirement plan ? as per your point of view…..pls Explain in detail.

Arijit-Creating your own corpus by investing in debt and equity.

So, you are actually indicate that get away from so called Retirement Plan available in the Market and just go for direct mutual fund debt or equity. Pls clarify if I am wrong.

Arijit-Yes. I don’t my money be locked and also at the time of retirmeent it be taxed heavily.

hi basu,

can you please do an article on debt schemes of tier 2 account. My query is exclusively regarding debt scheme of tier 2.I have recently read an online article which says the debt scheme of tier 2 can be an excellent substitute for fixed deposit. Since its tier 2,it can be withdrawn any time. What are the tax implications? I am aware that there is no tax exemption like tier1, but is the tax treatment similar to debt funds of mutual funds(with indexation benefit after three years)? The returns of both govt securities& corporate bonds of NPS are quite good,coupled with a low maintainence charges makes it attractive.

Sreekumar-For debt fund of Tier 2, taxation will be same as that of debt products (like mutual funds). But do remember that debt funds also comes with volatility. Longer the maturity period of holding bonds, higher the volatility risk. So don’t think that they are SAFE.

Thanks for the speedy reply

Regarding investments made under section 80CCD(1B):

Do I have to invest 1.5 lac in NPS first to avail the extra benefit of 50k under section 80CCD(1B) ?

Or I can only invest 50k for this financial year and claim deduction u/s 80CCD(1B) ?

NOTE: I have already exhausted my 80C limit of 1.5 lac using PPF, EPF, ELSS and Term Insurance.

Anand-There is no such restriction that one must claim benefit under Sec.80CCD (1B) only after the exhaust of Sec.80C. You are free to show it.

Hello Sir, Can a NRI from US open this account? I am asking this because I don’t see United States listed in the registration page. Could you please research and tell us? It would be helpful for people like who wants to return back. As always, thanks for all what you do in educating common man like me to the world of finances.

Dev-As per the latest notification of Government, NRIs can also open NPS using eNPS account (There is no country specific restrictions). However, this is the latest notification, for which they might have not changed the eNPS portal. Please wait and watch.

Okay, thanks for your quick reply.

Hi Basavaraj,

Your post has given me much clarity which is appreciated a lot, how ever i still have below doubts, could you please clarify them ?

i am a Pvt company employee, already had EPFO account which is exhausting the total amount of 80C limit of 1. 5 lakh , so i have no chance to claim any other provision under 80C bracket , am i eligible to get 48000 deduction under 80CCD(1B) if i plan to invest around 4000 per month in Tier1 account ? or 10 percent of my Basic and DA will has to be shown up under 80C and remaining amount out of 48000 will be deducted under 80CCD(1B) ?

is there any max cap for tax limit, if employer deducts NPS under 80CCD(2) ?

is it sure the amount we invest in Tier2 account can’t be claimed for tax deduction if i have supporting Tier1 account with a min amount of 6000 per annum ?

I remember one LIC super annutation fund by my previous organisation used to give additional 50 thousand or 1 lakh tax deduction(This wont be shown up in earnings at all ) but my current employer do not have this option at all , can you throw any light on this if it is possible to go for it ?

Mahesh-You are eligible to invest in Tier 1 to claim deductions under Sec.80CCD(1B). There is no such restriction that over and above the 10% of Basic+DA must ONLY be shown in this Sec.80CCD(1B). Yes, the maximum cap is there for Sec.80CCD(2). I explained the same in above post. Please check it. Yes, the amount you invest in Tier 2 will not have any tax benefit. Superannuation plans must be a feature provided by employer, but you can’t alone go for that.

But do you think NPS a great product and tax saving is so serious that you invest in wrong product? Think and decide.

Thanks alot for the swift response and concern basavaraj. It is really appreciated once again 🙂

I think supper annutation was giving returns lesser than or close to EPFO returns as per my knowledge goes and i believe NPS depending up on the fund house, i mean if one chooses the equity class is giving a little more than or equal to EPFO . i heard ICICI fund has given around 10-11 percent of return on an average in the last 3 to 5 years.

https://www.valueresearchonline.com/NPS/

One good point about NPS is, it is a hybrid or moderate mutual fund by lowering the risk when compared to 100 percent equity based mutual funds and on top of it we have 15000 flat tax benefit for people who are in 30 percent slab for the 80CCD(1B) and i guess additional 15000 rebate for employer contribution under 80CCD(2) for most of the people who will be in 30 percent slab.

It is giving 40 percent or 20 percent tax rebate while withdrawing NPS fund depending up on on or before 60 years, where as mutual fund returns are 100 percent taxable !

Mahesh-Mutual Fund returns 100% taxable?? Tax rebate on NPS while withdrawing?

i hve opened NPS account thru POP. is it possible to switch NPS account to online, without interacting with POP for any further changes for my tier 1 account, like change of address, reissue of ipin.

Mahesh-Yes, using PRAN number you can use the services of eNPS (But as of now, only contribution is possible).

While investing online. pls select netbanking….as it is almost free..(negligible fee)

investing through debit and credit card has heavy charges.. as below..pls note that for net banking it is Rs 0.6..and not %..so its almost free..

Payment Gateway Charges

Net Banking: ?0.60 per transaction + service tax @ 15%

Debit Card: 0.80% of the transaction amount + service tax @ 15%

Credit Card: 0.90% of the transaction amount + service tax @ 15%

B-Thanks for sharing this information.

dear sir

mai. pv.t.. ltd. compony m karta hu mai jo componyme kam karta tha us se clearence lakar 5 mahina suru ho gaya par mera pf abhi tak nahi Aaya h sir ye mera no. 9633500549 h kab tak Aayega to bataenge

Ganesh-Contact regional EPFO.

Gud evening sir

sir i want subscribe for eNPS as an individual resident indian..

i want to ask that if i become a govt employee in future then what will happen to my nps account…?

whether the same nps account could be used then as a govt employee or what will happen…?

sir please clear my doubt….

thanku in advance…

p.s. the email id of nps u provided in the artical is not working …pls look into this

Umrav-You can provide the PRAN to them and it will continue regularly. What error you are getting regarding the email address?

thanku sir…

one more thing …i am a big fan of ur blog..very educating

u r doing a great job…

thank u very much….

Umrav-Pleasure 🙂

Hi Basavaraj,

I am a regular reader of your blog site and basing on the inputs that i have received from your site and additional Homework that has been done, I have started SIPs and ELSS also and have started saving accordingly.

I have a doubt – As I have already started the above, Do u think its relevant to start NPS also? Also considering the %s and also the 40% criteria, How do i proceed? Will I haev any additional benefits? Kindly indicate. Thanks in advance. Sai

Sai-I am not FAN of NPS. Stay away.

Basavaraj,

will you suggest to go with NPS if the EEE comes for NPS in the future budgets?

Rama-STILL NO. Because of it’s hard stance on liquidity.

Dear Sir,

Thank you for the informative article. Recently i opened the NPS account. What is the procedure for first time login?.

Raj-For contribution, you have to click on Contribution tab for future investment in eNPS portal.

Thank you Sir. For login, i came to know that the user id is my PRAN but what about Password?

Yet to receive my PIN numbers.

Thanking you

Raj-Then wait for that.

Excellent article.Thanks a lot for en lighting us with all the minute details.Only thing I want to draw ur attention towards the para taxation at maturity.In union budget,2016, 40% of the total corpus has been made tax free.Please have a look

Priyajit-Oh..my error. Thanks. I will update the same soon 🙂

Thanks Sir for immediate information.

I am reading your articles from long time.

I do not have any option to invest until now because of my liabilities and EMI’s.

Now I am planning to invest at minimal level say 1000/- per month for my kid of 1.5 year old.

Can you guide me with the materials to be read links to start with.

Prasanth

Prasanth-Go to old Articles section and start reading the posts which attract you 🙂

Hi Basu,

Will it be possible for you to provide the performance of NPS till now. As there are different fund managers handling NPS , it would be great to see whats the performance over the years. Although there is lot of discussions on whether NPS is better retirement scheme than EPF considering % of returns, overall tax benefits, changing policies etc there are many opting for NPS. It will be good to see the figures of current performances. I cannot see those details being discussed anywhere.

Vidya-Thanks for tip. I will do a post on this. Yes, the future is NPS slowly.

Thank You Basa for guiding how to open NPS directly without taking help from POP.

I have one query while selecting aadhar card for direct opening of NPS.

My home town is in other state and I am currently working in Hyderabad. Therefore my Aadhar card contain address of this state. When I have opened the account, the site fetch the permanent and current address directly from the card.

Later when I go back to my home town after 15 years, is there any impact on maturity at 60 years (due to change in address from one state to other).

Please help me to understand.

Ashok-It will not impact. Also, changing the address in Aadhaar is online process. Hence, no issues at all.

Thnx alot sir for wonderful information. Really helpful. I wish one day u post about child future management,will save more parent’s hard earn money as mostly investing as insurance /investment, just a humble request /feedback.thnx and have a relax weekend

Anand-Thanks for your feedback.