Are you looking for the best short-term investment options for 2024 in India? With numerous choices available, finding the ideal one can be challenging.

Before we begin discussing the best short-term investment options for 2024, it is important to first ensure that we have a thorough understanding of the concept. Let us now proceed to delve into the topic.

a) What do you mean by short-term?

To begin the search for the best short-term investment options for 2024, it is essential to first define what we mean by “short-term.” From my point of view, short-term refers to a period of 3-5 years, within which the funds may be needed. However, it is important to recognize that this definition can differ from person to person.

b) Safety of principal

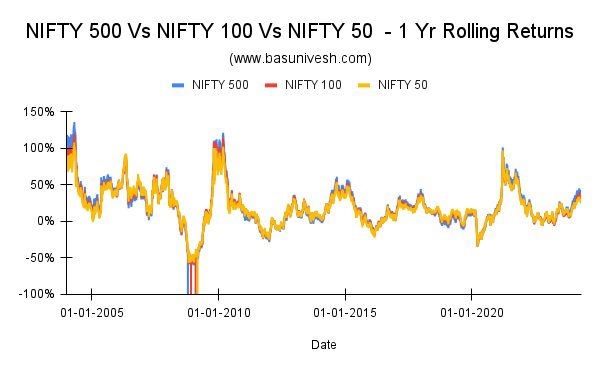

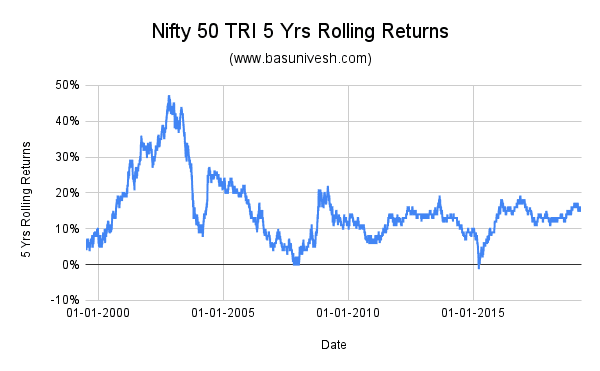

Prioritizing the safety of the principal is crucial when you are investing for your short-term goals, rather than focusing solely on achieving the highest returns. Investing in equity assets for the short term may pose significant risks.

Many investors are well aware of the potential risk and volatility associated with investing in equity. As a result, some may choose to avoid taking risks with equity investments altogether. However, it is important to note that blindly investing in debt mutual funds can lead to even higher levels of risk. This misconception arises from the belief that equity is inherently risky while debt is considered safe.

I have always emphasized that if one lacks the knowledge to select appropriate debt funds, they may inadvertently expose themselves to greater risk than they would with equity investments. Investing in equity exposes you to a unique set of risks, whereas opting for debt mutual funds presents a different set of risks. It is incorrect to assume that there is no risk involved in debt funds. To address this misconception, I have written a series of articles covering the basics of debt mutual funds. You can find all of them under the category “Debt Mutual Funds Basics“.

c) Tye of a goal

Decide if the objective belongs to the category of NEED or WANT-based goals. A prime example of a need-based goal would be a child’s education goal. Such goals cannot be postponed or canceled. Hence, if you are allocating funds towards these vital goals, it is crucial to be extremely careful to minimize any possible risks.

If you have WANT-based goals, such as purchasing a car or traveling, you may consider including 10% to 20% of equity exposure. However, keep in mind that this is not a standard formula. It solely depends on your familiarity with the volatility and risk associated with equity.

d) What about INFLATION?

The financial industry constantly reminds us that our investments should outperform inflation. However, if we prioritize safety in this situation, we may fall behind in our quest to beat inflation. So, what should we do in such a scenario?

It is important to keep in mind that there are two strategies for achieving your financial goals. The first strategy involves taking risks and aiming to beat inflation. On the other hand, the second strategy involves avoiding risks, especially if you are not familiar with the intricacies of risk and volatility or if your goal is short-term. In these cases, you have to compensate for the absence of risk by investing more to ensure reaching your financial goals. Remember that when it comes to short-term goals, investing more as compensation towards the risk is a wise idea.

I have written a detailed post in this regard. You can refer to the same at “Beat The INFLATION – LIES Financial Industry Teaches You!!“.

What are the Best Short-Term Investment Options for 2024?

Now, let’s explore the various choices and discover the best short-term investment options for 2024.

1) Fixed Deposits and Recurring Deposits (RDs)

If you have a lump sum to deposit, consider opting for FDs. On the other hand, if you prefer to accumulate your savings over time through monthly investments, RDs are the way to go. It’s advisable to choose banks that are categorized as “too big to fail” banks. According to the latest list released by RBI on 28th December 2023, this includes SBI, HDFC Bank, and ICICI Bank.

You have an alternative to think about: Post Office Term Deposits or RD (5 years) depending on your specific objective. The advantage of Post Office products is that they offer a 100% sovereign guarantee. However, it’s worth mentioning that they may not be as user-friendly as other choices. Ultimately, the decision is yours and should be determined by your preferences.

Many banks now offer attractive rates and allow penalty-free premature withdrawals. Choose the bank that suits your needs and can use this opportunity. However, avoid NBFCs, Company Deposits, or Co-Operative Banks.

You can stick to these simple products as effective from 1st April 2023 (Debt Mutual Funds Taxation From 1st April 2023), there is no tax advantage of investing in debt mutual funds. However, the only hurdle is the TDS associated with Bank FDs.

2) Liquid Funds

The disadvantage of parking your money in Bank FDs and RDs is that if you are unsure of when you exactly need the money, then you may end up where your FD may mature before you need or you are forced to withdraw before maturity (in this case, you are forced to pay a premature penalty).

The second disadvantage is the TDS concept of FDs. This gains importance if you are investing for more than a year or two. Yearly TDS will reduce the money available for the next year’s earnings.

Hence, if you are unaware of when you exactly need the money and worry about TDS, then you can look for Liquid Funds. However, don’t assume that they are completely safe. You have to look for underlying securities the fund is holding and can take a call. Otherwise, you may end up with a situation like what happened earlier with one Liquid Fund “Is Liquid Fund Safe And Alternative To Savings Account?“.

Choose the fund that has a stable portfolio with clear disclosure of where it will invest.

3) Ultra Short Term Debt Funds

They are riskier than Liquid Funds but less risky than other categories of debt funds (in terms of interest rate volatility). According to SEBI guidelines, the duration of the fund category is defined, but there are no specific guidelines on where the fund manager should invest. This means that if the fund manager chooses to invest in low-rated securities, the risk level increases significantly. Therefore, it is crucial to carefully analyze the portfolio and consider the fund’s track record before making any investment decisions.

4) Money Market Funds

Money Market Fund Invest in Money Market instruments having a maturity of up to 1 Year. This option is ideal for individuals seeking slightly higher returns compared to a liquid fund. Generally, the credit risk and interest risk associated with this investment are relatively low.

Money Market Funds invest in Certificate of Deposits, Commercial Paper, Treasury Bills, Repurchase Agreements or Bank Deposits maturing within a year.

5) Target Maturity Funds or Passive Debt Funds

Target maturity funds function similarly to traditional Bank FDs in terms of maturity features. These funds have a predetermined maturity date, upon which they will return the invested amount. However, unlike Bank FDs, target maturity funds offer the flexibility to invest or withdraw funds at any point before maturity. This allows you to utilize these funds according to your specific financial requirements. Hence, if you know when you need the money, then you can use these funds.

Currently, these funds exclusively invest in Central Government Bonds (Gilt), State Government Bonds (SDL), and PSU bonds. While the risk of default or credit is minimal, it is important to note that interest rate volatility cannot be avoided. Long-term bonds tend to have higher volatility, whereas short-term bonds have lower volatility.

I have listed these in my earlier post and you can refer to the same “List Of Index Funds In India 2024 – Download Excel“.

What about Arbitrage funds as they have equity-like tax treatment?

Arbitrage funds are not risk-free investments despite their similarity in taxation to equity. They allocate a significant portion of their portfolio to derivative and arbitrage instruments linked to the stock and bond markets. While their volatility may resemble that of ultra-short-term debt funds, it’s important to note that approximately 65% of the funds are invested in equity and equity-related instruments, with the remaining 35% allocated to the debt. The investment decisions for this 35% are at the discretion of the fund manager, which could potentially impact short-term goals through credit or interest rate risk. Additionally, the returns of arbitrage funds are dependent on the demand and supply in the derivatives market, meaning that if the volatility declines, the returns will also decrease. This feature also introduces the possibility of negative returns in the short term. Hence, better to avoid arbitrage funds.

Conclusion- As mentioned earlier, it is important to prioritize safety, liquidity, and to some extent, returns similar to those provided by Bank FDs when allocating funds for short-term goals like. It is advisable to avoid higher-risk options as they do not always ensure higher returns.