Effective from 10th January 2018, the Government of India replaced 8% Government of India Savings Bonds with new 7.75% Government of India Savings Bonds. Let us see the features, benefits, and taxation of these bonds.

There was a huge unrest among many that Government stopped this bonds. However, Mr.Subhash Chandra Garg, Secretary, Department of Economic Affairs, Ministry of Finance, Government of India, clarified tweeting that they are replacing the old 8% Government of India Savings Bonds with new 7.75% Government of India Savings Bonds.

Based on his tweet, I am writing this post considering the fact that all features of 7.75% Government of India Savings Bonds will remain same as that of 8% Government of India Savings Bonds.

Who can invest in 7.75% Government of India Savings Bonds?

The 7.75% Government of India Savings Bonds may be held by –

(1) an individual, not being a Non-Resident Indian

(a) in his or her individual capacity, or

(b) in an ndividual capacity on joint basis, or

(c) in individual capacity on any one or survivor basis, or

(d) on behalf of a minor as father/mother/legal guardian.

(2) a Hindu Undivided Family (HUF).

In case of applications made in the joint names of more than 2 persons, the bond/s interest warrants and Payment Order/s will be issued in the name of the first applicant.

Limits of investment in 7.75% Government of India Savings Bonds

1) Minimum of Rs.1,000 can be invested and in multiples of Rs.1,000.

2) There is no maximum limit set.

Hence, the Face Value of the 7.75% Government of India Savings Bonds will be Rs.1,000.

What are the returns in 7.75% Government of India Savings Bonds?

The Bonds will bear interest at the rate of 7.75% per annum. Interest on non-cumulative Bonds will be payable at half-yearly intervals from the date of issue (The date of issue of the Bonds in the form of Bonds Ledger Account, will be opened (issued) from the date of tender of cash or the date of realisation of draft/cheque.) or interest on cumulative Bonds will be compounded with half-yearly rests and will be payable on maturity along with the principal.

In the cumulative Bonds, the maturity value of the Bonds shall be Rs.1,703 for every Rs.1,000 face value of the bond.

Interest to the holders opting for non-cumulative Bonds will be paid from the date of issue up to 31st July OR 31st January as the case may be, and thereafter half-yearly for a period ending 31st July and 31st January on 1st August and 1st February.

Interest on Bonds in the form of “Bonds Ledger Account” will be paid, by electronically by credit to bank account of the holder as per the option exercised by the investor/holder.

An advice of payment of interest will be issued to the investor one month in advance from the due date. Maturity intimation advice will be issued one month before the due date of the bond.

Facility for payment of interest and principal by ‘demand draft free of cost or at par cheques’ for up country customers is available. The facility of the intra-bank branch and interbank branch transfer of the bonds is available.

Do remember that you can’t change the bond option in middle from Non-Cumulative to Cumulative and vice versa.

Note:-You have to receive the redemption procedure at maturity or as and when the interest is payable. The government will not pay any interest on such interest income which is not claimed or any principal amount that also not claimed by investors.

Tenure of the 7.75% Government of India Savings Bonds

The bond tenure is 7 years from the date of issue. However, you can opt for premature redemption as per the Govt. Notification dated July 29, 2013, and subsequent amendment vide Notification dated August 16, 2013. It is discussed as below.

Premature encashment in respect of the Bonds shall be allowed for individual investors in the age group of 60 years and above, subject to submission of document relating to date of birth of the an investor in support of age to the satisfaction of the issuing bank, after minimum lock-in period from the date of issue as indicated below-

(a) Lock in period for investors in the age bracket of 60 to 70 years shall be 6 years from the date of issue.

(b) Lock in period for investors in the age bracket of 70 to 80 years shall be 5 years from the date of issue.

(c) Lock in period for investors in the age of 80 years and above shall be 4 years from the date of issue.

In case of joint holders or more than two holders of the Bond, the above lock-in period will be applicable even if any one of the holders fulfills the above conditions of eligibility.

After aforesaid minimum lock-in period from the date of issue, an eligible investor can surrender the bonds at any time after the 12th, 10th and 8th half year corresponding to the respective lock-in period but redemption payment will be made on the following interest payment due date.

Thus, the effective date of premature encashment for eligible investors will be 1st August and 1st February every year. However, 50% of interest due and payable for the last six months of the holding period will be recovered in such cases, both in respect of Cumulative and Non-cumulative bonds.

The Bonds are not transferable. The Bonds are not tradeable in the Secondary market and are not eligible as collateral for loans from banking institutions, non-banking financial companies or financial institutions.

An earlier version of the bond period was 6 years.

Where to buy 7.75% Government of India Savings Bonds?

You can buy 7.75% Government of India Savings Bonds from designated branches of SBI and Associate banks,18 Nationalised banks, 3 Private Sector banks (like HDFC and ICICI Banks) and Stock Holding Corporation of India Ltd. I have listed them as below.

# State Bank Of India

# Allahabad Bank

# Bank of Baroda

# Bank Of India

# Bank Of Maharashtra

# Canara Bank

# Central Bank Of India

# Dena Bank

# Indian Bank

# Indian Overseas Bank

# Punjab National Bank

# Syndicate Bank

# UCO Bank

# Union Bank of India

# United Bank Of India

# Corporation Bank

# Oriental Bank Of Commerce

# Vijaya Bank

# IDBI Bank

# ICICI Bank Ltd.

# HDFC Bank Ltd.

# Axis Bank Ltd.

# Stock Holding Corporation of India Ltd.

Nomination facility under 7.75% Government of India Savings Bonds

The sole Holder or all the joint holders may nominate one or more persons as a nominee. Non-Resident Indians (NRIs) can also be nominated. However, remittance of the interest/maturity proceeds will be subject to the foreign Exchange regulations prevailing at the time of remittance.

If the nomination has been made in favour of two or more nominees and either or any of them dies before such payment becomes due, the title to the Bonds shall vest in the surviving nominee or nominees and the amount being due thereon shall be paid accordingly.

In the event of the nominee or nominees predeceasing the holder, the holder may make a fresh nomination. You can make a separate nomination for each investment.

The nomination is not allowed where the bonds are held in the name of the minor. A nomination made by a holder of a Bond can be changed by a fresh nomination in Form B, or as near thereto as may be, or may be canceled by giving notice in writing to the Receiving Office in Form C,

If the nominee is a minor, the holder of Bonds may appoint any person to receive the Bonds/amount due in the event of his / her / their death during the period the nominee is a minor.

You can change the nomination as and when you need.

Taxation of 7.75% Government of India Savings Bonds

Interest income from 7.75% Government of India Savings Bonds will be taxable. However, there is no wealth tax you have to pay. Tax will be deducted at source (TDS) while interest is paid.

The Bonds will be exempt from wealth-tax under the Wealth Tax Act, 1957.

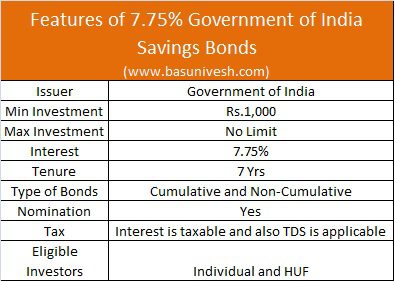

I explained basic features in below image for your easy understanding.

How to hold the 7.75% Government of India Savings Bonds?

The Bonds will be issued in a Bond Ledger Account.

Where to complain in case of 7.75% Government of India Savings Bonds?

If you have any issue with Bank regarding this bond, then you can contact RBI directly using below details.

THE REGIONAL DIRECTOR,

RESERVE BANK OF INDIA,

CUSTOMER SERVICE DEPARTMENT/

BANKING OMBUDSMAN

(LOCATION)

Otherwise, you can also use the below address.

THE CHIEF GENERAL MANAGER IN-CHARGE

DEPARTMENT OF GOVERNMENT AND BANK ACCOUNTS

CENTRAL OFFICE

BYCULLA, OPP. BOMBAY CENTRAL RAILWAY STATION

MUMBAI- 400 008, MAHARASHTRA

7.75% Government of India Savings Bonds -Should you invest?

Let us now discuss about who should consider this bond.

# SOVERIGN GUARANTEE

The biggest positive point is that SECURITY of Government of India. No question of default risk in such bond. Hence, you can invest blindly without any doubt.

# INTEREST RATE

If you look at SBI FD Rate for 5 Yrs to 10 Yrs deposit, it is at 6%. Also, the current Post Office 5 Yrs FD rate is at 7.60%. Hence, I think this bond is definitely the BEST option who are looking for SAFETY and also the GUARANTEED return.

# GOAL-BASED INVESTMENT

I compared the interest of similar tenure products. Hence, do remember that invest in such bond only if your goal is 5 years or so. Also, if you are looking for some constant stream of income, then also you can look at such bond.

But never invest for the sake GUARANTEE and RETURN.

If your goal is more than 5 years or so, then use the products like LIC’s Jeevan Akshay VI or Pradhan Mantri Vaya Vandana Yojana. If you are a senior citizen, then you can opt for Post Office SCSS Scheme, which now offering you the interest rate of 8.3%.

# TAXATION

Whatever the return you will receive from this bond is taxable and also TDS is applicable. Hence, don’t rely on 7.75% return. But try to consider the post-tax return.

Suppose your income is less than Rs.2,50,000 then the effective return will be 7.75%.

Suppose your income tax slab is at 10%, then the effective return will be 6.975%

Suppose your income tax slab is at 20%, then the effective return will be 6.2%

Suppose your income tax slab is at 30%, then the effective return will be at 5.425%

#INTEREST RATE RISK

Even though there is no default risk, there is always an interest rate risk. We don’t know the applicable interest rate after 7 years of maturity. Hence, this interest rate risk is always there.

However, considering the past trend, I am not sure that the Government will close the subscription within 4-5 years.

Go ahead to buy these bonds based on the above points. Blindly for the sake of GUARANTEE and RISK-FREE return always not works.

70 Responses

Dear Sir,

I have invested one crore in GOI 7.75 percent bonds with cumulative option in Feb 2020. Unlike bank FDs wherein there is a TDS on accrued interest, here in this case no TDS was made. After seven years in 2027 when the bonds mature, I will fall in the income tax bracket of 1 crore and a 10% surcharge over my gross income will apply.

This will result in substantial loss by the way of taxes.

Is there a solution to this problem?

Can we convert the bonds from cumulative to non cumulative so that the interest income is spread over the next 5 years and reduce the tax impact at maturity

Please advise

Thanks in advance

Dear Ravo,

I have replied to your email.

This blog is very helpful – breaks down the info so novice people like us can understand. Thanks.

Now on to my question — Does one need to have a Demat account to purchase these bonds. I only have a savings account in ICICI – would this be a sufficient criteria?

Dear Diwakar,

Not required.

Respected Sir,

I am a senior citizens. Can I give 15h while investing in RBI BONDS 7.75 % and not have TDS ?

REGARDS

Dear Upadhye,

Do you think avoiding TDS means avoiding Tax?

Sir, I invested in the 7.75% Government of India Savings Bonds in Feb 2019. From the next financial year, my residential status is set to change. Will this impact my investment since it states “only for Resident Indians”. Also, please clarify on tax treatment in such a case.

Dear John,

Yes, NRIs can’t invest in such savings bonds. However, there is no clarity on whether those resident individuals who turned NRIs can continue or not. Hence, I suggest you approach the R&T Agents of these bonds and update them about your change in residential status.

Like many readers have pointed out, I am keen on Cumulative option of 7.75% bond but looking at an option of considering yearly interests on accrual mode as part of my yearly IT return. In which case, there should be a mechanism to ensure that NO tax is deducted during final payment of cumulative bond . How to ensure the same ? Kindly clarify.

Also, for yearly interest , can we get an Interest Certificate from the bank thru which cumulative bond investment is done

Dear Jeyaram,

Avoiding TDS mean avoiding TAX?

No, If I take care of accrued interests in my tax return every year , then during the final year during maturity payment there should not be a TDS deducted for the whole period interest . Because , I would have already considered yearly interests accumulation in my previous years tax return. How to ensure TDS is not deducted for the first 6 years interests when maturity payment is done ?

Dear Jeyaram,

I am still asking you the same question, how avoiding TDS will benefit you?

Dear Basavaraj : In the scenario I have explained , I would have paid taxes for every year based on the yearly interests calculated for the cumulative bonds. If TDS for the whole period is interest is deducted at the end of 7th year during maturity payment, it would amount to taxing again.

Dear Jeyaram,

Refer my answer.

Dear Basavaraj :

Its not avoiding TDS in the 7th year end during maturity; If I compute the taxes on accrual basis every year and pay them as part of every year IT return for the first 6 years, TDS on 7th year end during maturity should be restricted to only 7th year interest. What is the mechanism available to ensure the same?

Dear Jeyaram,

There is no such hard rule. You can either claim it on prevailing years or on an accrual basis.

I do not get the advice of interest credit.

Can I enhance the amount from 3.5 l to 5l in the same no. If so will the total be consolidated ?

Dear Mukundan,

If you not get the interest, then approach the concerned. Regarding enhancing, is up to you.

Thank you for such helpful website. My question is regarding the CUMULATIVE option for these taxable GOI bonds. I understand that TDS for cumulative option will be deducted all together at maturity, i.e. after 7 years. Is it acceptable to show the entire interest on the tax return and pay tax on this income only at maturity? OR I am REQUIRED to show the interest income under Other Sources every year while filing the IT returns? If acceptable, I would prefer to show the entire interest on the tax return when I receive it, i.e. at the time of maturity. Please advise.

Dear karakoram,

Both is possible and as per your comfort, you can claim.

Hi ,

If I invest in Govt saving bond on my wife name which is housewife and no source of income then still TDS will get deduct on maturity of Govt. saving bond

Hemant-YES.

Can u review hdfc life sanchay as a tool for investment option as it giving 220%maturity addition on sum assured for the benefit of blog members

Rahul-Surely 🙂

Dear Basu is it safe to invest in Srei ncd bonds as it offers attractive lucrative interest rate of 9.5% if we have idle money in bank

Rahul-What about credit quality? Do you searched why they offering such high return?

Hi,

I have a question related to cumulative option, as per earlier conversations i came to know that there wont be any TDS for cumulative options during the entire tenure. Here are my questions :

– Since there wont be any TDS for the first 6 years, is it investor responsibility to show interest income from other sources while filing the IT returns ?

– at the time of maturity (7th year) will there be TDS for the entire interest accumulated for the entire duration ? if yes, then already i paid tax for the first six years though there is no TDS ? Kindly clarify.

Regards,

Divakar

Divakar-Forget about TDS. Now to show the interest income, you have two options. One to declare on yearly or at end (exactly like Bank FDs). It is left with you to choose the option.

Found the discussion useful. Have a couple of follow-up questions. For cumulative option bonds, if one decides to declare interest yearly, how does one calculate interest?

If at end of bond period, TDS or Form 26AS shows interest earned for all 6 years. Can one show only last year’s interest in that years’ tax return?

Thanks.

Dear Dani,

“Can one show only last year’s interest in that years’ tax return?”-YES.

Hi,

If Bond is purchased through a cheque, whom should the cheque be written to?

Is it the name of Bank like HDFC Bank or ICICI Bank or cheque should be in favour of Reserve Bank of India??

Lks-Please check with the bank.

Hi,

Please let me know which branches are authorized to sell these bonds? Only the banks are mentioned.

I want to know the branches in Chennai especially Canara Bank, HDFC Bank, State Bank , IDBI Bank.

Want to know the branch contact numbers directly. None is aware of these bonds when I call the customer care. They say they have not received any circular on this. Pls advise

Lks-It is hard for me to list all the branches of all eligible banks list. You have to knock customer care of respective bank.

what is the criteria for giving 15g form (so that no TDS deduction at the time of maturity – cumulative option)?

and at what stage, at the time of applying for bond itself? can we give 15g in the beginning, calculate the interest income

every year, file return, pls explain.

Jai-If your total income for FY is less than basic exemption limit, then you are eligible for submission of Form 15G/H. You have to submit it on yearly basis (if you are receiving the interest during the FY).

Thank you sir for your reply. Cheers.

sir, i read others questions also to ensure that i am not repeating the same question. For cumulative bond option, TDS will be deducted at the time of maturity payment (i.e after 7years). In this case, how will i file return on yearly basis (to consider the total interest amount for 7 years divided by 7). putting it simply, how will i file return for the cumulative bond option and recover TDS amount after 7 years, if i am eligible for (as tax slab, tax rules may change during every assessment year). sorry for the trouble, as i am not finance person.

Jai-In case of cumulative bonds, if Govt deducts TDS on accrued interest on a yearly basis, you have to show it in IT return exactly like how you show the cumulative FDs.

ok sir, thank you very much.

Other than these bonds in my own name can I buy these bonds exclusively in the name of my wife and adult (studying) daughter? If yes then tax implications whatsoever would be borne by my wife & daughter respectively? I am a senior citizen while wife will be one in July this year.

Gurmeet-Due to clubbing provisions, the income of your wife will be the income of your’s (if the source of investment is from your end). However, in case of your daughter who is major, such clubbing provisions will not come into the picture. Hence, the income from this bond in your daughter case will be her income. However, for safety purpose, make sure that you have a gift agreement (with wife and daughter in a plain paper) to show in future there are some questions about the source of investment by IT Dept.

Sir we will get tds certificate every year in cumulative bond option

Gaurav-TDS will be deducted while paying interest. In case of the cumulative bond, such question not arises and no question of TDS during bond tenure.

what is the best investment options for 50yrold?

Jeff-Hard to say based on mere age sharing.

Sir individual can invest both in scss & RBI 7.75% bonds and also investor is not a tax assessee and have pan no.

Venu-Yes, you can invest in both.

a quick quesiton sir, does thr ROI remains fixed at 7.75% per annum or GOI changes it each year?

Krala-It is FIXED.

Sir..

What is NMDC Offer For Sale. OFS.

It’s too much hyped on media.

Is it wise to Investment in it.

What’s Special about it.

Plz reply.

Ammy-I can’t explain all that topic through commenting. Better you google it to know more about OFS.

Sir what is the last date for invest in this gov bonds

Jayantibhai-There is no such last date notified.

Sir how is ifko tokio wealthplus ulip because of low charges it is advisable to buy or not

Raj-I always suggests to stay away from the product which COMBINES both insurances with investment.

thanks for your inputs regards the safety and guarantee, that is what I was looking for, since instead of investing in property, I plan to keep my corpus locked in such bonds, since property rates may fall or remain stable for quite some time. please do adivse whether my thinking is in the right direction

Naveen-Pleasure 🙂 I am not sure why you want to invest in property. Hence, hard for me to comment.

On how much interest TDS will cut? is it same like bank FD?

Please clarify how much one should invest to avoid TDS?

Harsh-Yes, it is exactly like Bank FDs. Do you think avoiding TDS means avoiding tax?

Sir I have a question for noncumulative mode of investment in goi bond when the interest will be credited

That means the six month from the date of investment or on a fixed date.

Dear Arpit,

It is on the fixed date.

Basu, demat account is not required. The bonds are already in Bond Ledger Account (BLA) form.

Kapil-Sir my bad 🙂 I correct it.

What will be the tax treatment if I submit Form-15H?

Neelam-Tax treatment will not change if you submit Form 15H. Avoiding TDS does not mean avoiding tax. It is just you avoid TDS, but it is still taxable income for you and you have to pay the tax as per your income tax slab.

Thanks a quick reply. I do agree for applicable tax based on my income. For Senior citizens, I feel the better option is Senior Citizen Saving Scheme or any equity oriented balanced mutual fund with dividend of Rs. 0.3/unit. What is your opinion?

Neelam-For senior citizens, you can look for products like SCSS, Pradhan Mantri Vaya Vandana (limitations in investment) or Jeevan Akshay VI.

Thank you so much for sharing such kind of information. Please keep writting.

Jitendra-Pleasure 🙂