LIC will be launching one more new plan from 16th May 2017. This plan is called as LIC’s Jeevan Umang (Plan No.845). This is the typical whole life plan.

LIC’s Jeevan Umang (Plan No.845) is a non-linked, with-profits, whole life assurance plan. This plan is the replica of the old closed plan of LIC (Jeevan Tarang Plan No. 178).

Features and Eligibility of LIC’s Jeevan Umang (Plan No.845)

Let us first see the eligibility of LIC’s Jeevan Umang (Plan No.845).

You notice one thing from above image, even though the age of maturity is fixed as 100 years, the maximum for entry in all cases is 70 years. So the assumption from LIC about life expectancy is 70 years.

Date of commencement of risk in LIC’s Jeevan Umang (Plan No.845)

If age of Life Assured is less than 8 years on date of buying the policy, the risk under this plan will start either one day before the completion of 2 years from the date of commencement of the policy or one day before the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier. For Life assured aged 8 or more,

This means, let us say the Life Assured age is 5 years, the life risk will start one day before the completion of 2 years from the date of commencement of the policy (when the life assured is at the age of 7 years) of one day before the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier. But in this case, the risk will commence at the age of 7 years only.

Let us say the Life Assured age is 7 years, in this case, the life risk start immediately following the completion of 8 years of age.

For Life assured aged 8 or more, the risk will commence immediately.

Benefits of LIC’s Jeevan Umang (Plan No.845)

In this plan, you will be eligible for three types of benefits. One is at the time of death, the second type is survival benefit and another one is maturity benefit. Let us discuss one by one.

Death Benefits of LIC’s Jeevan Umang (Plan No.845)

# If death occurs before the commencement of Risk

An amount equal to the total amount of premium/s paid without interest shall be payable

# If death occurs after the commencement of Risk

Death Benefit, defined as the total of “Sum Assured on Death” and bonus and Final Additional Bonus (FAB), if any will be payable.

Meaning of Sum Assured on Death is defined as the highest of

- -10 times of annualized premium or

- – Sum assured on Maturity or

- -Absoluannualizedassured to be paid on death ie Basic Sum Assured

The death benefit will not be less than 105% of all the premiums paid as on date of Death. Premium referred here will not include any taxes, extra premium charged due to underwriting decision and rider premiums.

Survival Benefits of LIC’s Jeevan Umang (Plan No.845)

On the life assured surviving to the end of the premium paying term and all the premiums in policy have been paid, a survival benefit equals to 8% of Basic sum assured (BSA) shall be payable each year.

First survival benefit will be paid at the end of the premium paying term and thereafter on completion of each subsequent year till life assured survives or policy anniversary prior to the date of maturity, whichever is earlier.

Maturity Benefits of LIC’s Jeevan Umang (Plan No.845)

If policy holder survived till the policy term, and have paid all premiums timely, then LIC will pay Sum Assured on Maturity+Bonus+Final Additional Bonus (FAB).

Here, Sum Assured on Maturity is equal to Basic Sum Assured (BSA).

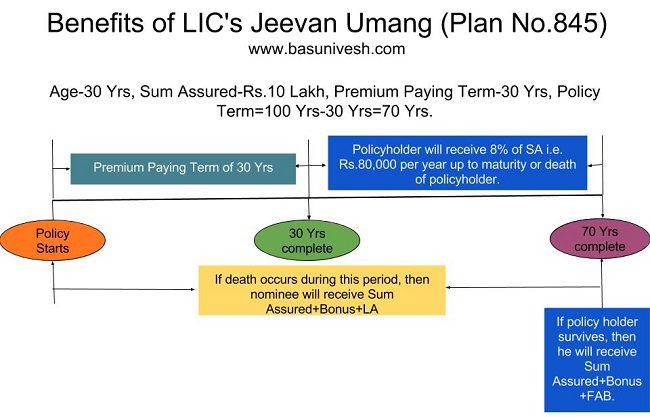

Let me explain the same with the help of below image.

Note below points-

- During premium paying term, you will not receive any benefits. If death occurs during this period, your nominee will receive Sum Assured+Bonus+FAB.

- Once the premium paying term completes, then you will receive 8% of Sum Assured till the maturity period or death of the policy period.

- If policyholder survives till the term of the policy, then again at the end he will receive Sum Assured+Bonus+FAB.

Other Features and benefits of LIC’s Jeevan Umang (Plan No.845)

# Premium paying modes- Yearly, Half-yearly, Quarterly, and Monthly (Monthly mode is only available with SSS and NACH mode).

# Policy can be surrendered during the policy term provided at least 3 full year premiums have been paid.

# Loan Facility-You can avail loan after completion of 3 policy years and up to premium paying term. The maximum loan payable is a) Up to 90% of surrender value in force policies b) Up to 80% of surrender value in paid up policies.

# Free look period-15 days available from the date of receipt of policy bond if the policyholder is not satisfied with the “Terms and Conditions” of the policy.

# Assignment-As per Sec.38 of Insurance Act 1938 allowed. Nomination required as per Sec.39 of Insurance Act 1938.

# Lapse Policy revival-You can revive the policy within 2 years from First unpaid premium (FUP).

How much is the return from LIC’s Jeevan Umang (Plan No.845)?

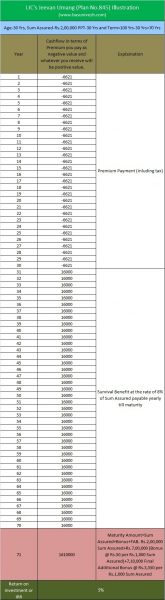

For this purpose, I considered the values as below.

Age of Policy Holder-30 Yrs.

Sum Assured-Rs.2,00,000.

Premium Paying Term (PPT)-30 Yrs.

Policy Term=100 Yrs-30 Yrs=70 Yrs.

Premium-Rs.6,621 (Inclusive of tax).

Bonus Rate-Rs.50 per Rs.1,000 per year. I considered this value as this plan exactly matches the LIC’s old plan Jeevan Tarang.

Final Additional Bonus-Rs.3,550 per Rs.1,000 Sum Assured (Remember that it is the one-time payment, payable at maturity or death).

The results are as below.

You notice that up to 30 years of a term, he will pay Rs.6,621 as premium. From 31 year, he will receive the survival benefit at the rate of 8% till maturity. Again on maturity, he will be eligible to receive the Sum Assured+Bonus+FAB.

I considered as if the policy holder survive until the age of 70 years. However, if we consider that he dies before attaining the age of 70 years, then the returns will be less than what he invested.

Even though it looks too attractive that you have to pay up to 30 years and from 31st year onward to 70 years 8% GUARANTEED return and again if you survive till maturity, then one more time you receive the benefit.

But you calculate using the IRR function of excel sheet (which is the way to calculate your return on investment), it shows just 5.26% returns.

Review of LIC’s Jeevan Umang (Plan No.845)

My take on this plan is SIMPLE and will point down as below.

- This is the combination of whole life plan and money back plan. Hence, premium looks cheaper than the regular endowment or money back plans. But this plan bears its own risk of holding the plan at the long term.

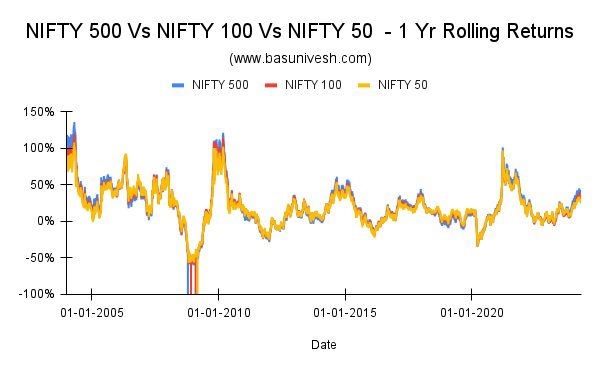

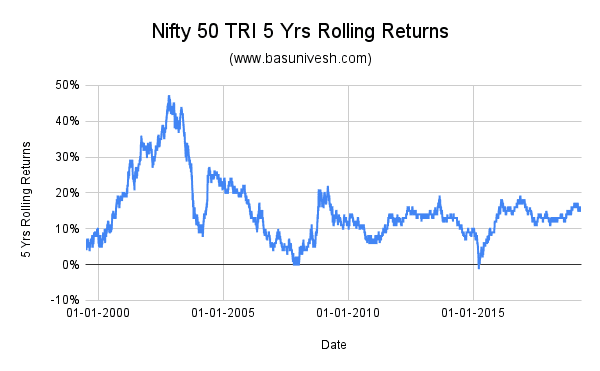

- Returns are pathetic. As I explained from above sheet, the return will hover around 5% to 6%. So do you feel it a great investment?

- This is the not the pure whole life plan. Hence, you will not enjoy the higher bonus rate (for whole life plans LIC offers the bonus rate of Rs.70 per Rs.1,000 Sum Assured). But this is the replica of LIC’s old closed plan Jeevan Tarang, whose bonus rate is not more than Rs.50. Hence, if your agent lures you as if the HIGH bonus policy as this is the whole life plan, then simply ignore that suggestion.

- Buying a term insurance with a simple product like PPF will generate you more return than this plan. Then why to stick to it for so long?

- Taxation is the major motive point for many of us to invest in such products. But do remember that the products I recommended as an alternative to this plan will have same tax benefits as this plan.

- Liquidity is the biggest concern with such plans. Hence, better to stay away.

- If at all your concern is looking for cheapest insurance cover and reliable insurance company, then why not buy the term insurance from LIC itself? NO risk at all for many to buy term insurance with LIC and invest in PPF.

Hope my review will benefit about taking your decision on this plan.

140 Responses

I understood that this old Umang plan (845) is not worth investing and it was withdrawn already.

But could you please cover / suggest the newer Umang plan (945)? Is it still not beneficial?

I’m 30 now & looking for good returns after 15-20 years of rightful investing.

Dear Mani,

The story is the same. No change in my views.

Hello Sir,

This is in reference to the new jeevan umang (945) plan. I am seeing the surrender value (cash value) too high once I have finished the premium paying term from the quote which I got from the agent. But on lic website the surrender value is too low. For eg, on a 15 year policy at my age of 32 for a sum assurred of 25 lakh, I can see that after 20 years, I can get a surrender value of around 48 lakh from agent’s quotation but lic website’s quotation showed me as 22 lakh. So why this is huge difference? and what will be the amount I will be getting after 20 years (that means I have collected 2 lakh per year for 5 years and then want to surrender my policy). Please tell me the correct thing.

Dear Devendra,

Always rely on LIC data than agent’s data.

I have this plan Jeevan umang 845 when the agent approached me he said after three years I can surrender this policy and get the amount I paid for three years …can I surrender and get the amount ?

Dear Jimmy,

Yes, but you get less than what you paid.

So we can’t withdraw the amount at a single time?? From lic plan 845

Dear Akshai,

NO.

Sir,

I took this plan for my mother.She is currently 45 yrs old and paying 3,352rs per month and policy term is 15 years for plan umang 845. I have a doubt and that is, can I withdraw the sum assured ie,5,00,000 after this 15 years of investment at a single time and if so what all benifits will I get with it.I just got an NPS after I took this plan and that is enough for annuity pension ,so I need the full matured money after its policy term..Is it possible to withdraw the whole money at a single time and what all will I get with it??

Plz reply sir

Dear Akshai,

Sadly NO.

Can you please suggest a good investment option. I was thinking of a mutual fund and a term plan but can’t decide which ones to go for? Which are the best mg and term plan options available currently?

Dear Lidwin,

Hard to say BLINDLY.

Sirji,

Now days banks are distributing house loan and they got return@8percent,Then why the bank s don’t invest in mutual funds for more returns.

Dear Santoshkumar,

Lending is ASSURED RETURN but not MUTUAL FUNDS.

Thank you for the article. Looking at the comments, it seems I am late to the party 😉

I ended up reading about this while looking to secure a guaranteed annual income. This plan gives me corpus and risk but for me, like for most people, these are already covered by MF/PPF and term plan+ previous LIC policies, respectively.

Would you suggest any alternative (LIC or otherwise) which helps me to plan for pension more rather than getting other benefits which I have already planned for separately and can expand upon as needed. Essentially, max pension for the amount I will be putting in for next 20-25 years.

Dear CK,

Recommendation depends on analyzing your financial life. The blind recommendation is dangerous to you.

Hi Basavaraj – I really like the content you jot down bcz I was unable to figure out the cons in this policy so it’s good to hear the same. But I did a few calculations from which I was unable to figure out an alternative instrument from where I get ~6.5 – 7% interest after taxation.

Based on the cash sum (surrender amount) quotation I got from a LIC agent I found below no’s (current age – 27yrs):

IRR (at age – 40 yrs) 1.77%

IRR (at age – 50 yrs) 6.81%

IRR (at age – 60 yrs) 7.41%

IRR (at age – 70 yrs) 6.88%

IRR (at age – 80 yrs) 6.09%

URL to my calculations – https://docs.google.com/spreadsheets/d/1rmcm7HX8T1Wv6LBdclNnGuesToO8Qu_JbGIHxDu58Tc/edit#gid=0

I am considering this as a pure investment not life insurance (took Tech Term Plan from LIC for it) but couldn’t figure out an alternative investment instrument to this.

It would be really great if you can please help me with your suggestions bcz I won’t get EEE benefits from PPF above Rs1.5L investments which I can get from this plan.

PS: I earn ~Rs 30L annual income so want to have some safe investment as well apart from MF

Akshit,

Unable to find the safe products? What about PPF or tax free bonds?

Sorry I was referring to risk-free investment instruments. I already invest 1.5L/yr in PPF (don’t invest more as it’ll attract tax on it) & some amounts in T-bills but don’t know about tax-free bonds (EEE) which can make me earn more/equal amount that this scheme (Jeevan Umang)

Dear Akshit,

You are not allowed to invest more than Rs.1.5 lakh in PPF. It is not because it will attract tax but the maximum limit in PPF is that much. LIC policies are illiquid in nature. How you manage your asset allocation with respect to your goal time horizon? How you liquidate and rebalance again? There are many safe ways to look for liquidity and safety. You just have to explore the ideas.

Yeah, I got confused about the PPF thing. Also, I agree that LIC policies are illiquid in nature considering that for the next 20yrs I can’t take out my money otherwise it’s a waste.

Asset allocation:

MF (70%) [majorly long term >5yrs] ; PF/EPF (10%) [tax saving], FDs/T-bills/G-Sec (10%) [liquid asset] ; Bank (10%)

Liquidate & Rebalance: Not done frequently.

Can you please point me to the right policy or financial instrument for better liquidity & safety so I don’t have to take this Jeevan Umang policy and build the same kind of plan myself by investing on my own terms.

Dear Akshit,

Use EPF (even VPF) as debt part of your retirement goal and PPF for other goals debt part. Keep around 10% to 25% in either Liquid or Arbitrage Funds to make sure that asset allocation should be easy. No need of any extra product.

Thanks a lot Basavaraj, VPF is good never thought about it seriously but now read about it & seems like a v good instrument from the retirement perspective.

Also, I’ll figure out liquid & arbitrage funds as you pointed.

Thank you for helping me out in this as now I am convinced that Jeevan Umang doesn’t make sense bcz IRR that I’ll get in it at age of 60 will be the same in EPF/VPF & it’ll be consistent across years so I have option to withdraw it anytime after 5 yrs.

Dear Akshit,

Sure.

Don’t get confused….Here is guarantee for life….It’s a biggest benefit, that gives you peace of mind for life….

Dear Mahesh,

GUARANTEE at what cost??

I want to invest 1,00,000 for 10 to 15 years..after that i want income starting from 11th or 16th year onwards for rest of my life..so tell me which plan is better for me.if lic Jeevan Umang is not better

Dear Mukesh,

Hard to say which is BEST without knowing much about your financial life.

Is this discussion still active in 2019 end? LIC is gonna close Jeevan Umang and other plans (so i’ve heard) and the slab structures will change. Based on this any comments?

Dear Pratham,

LIC closing and re-opening the products to tweak as per IRDA new regulations. Hence, it hardly changes even if they launch newly. I have same opinion.

Dear Mr Basavaraj, greetings,

You do consider the risk cover that the policy provides, life cover till 99 years of age, after the premium paying years are over, the insured gets annual tax free payouts, approx equal to his premium paid every year, till the insured survives, and death benefits to the nominee in case of death of the insured, well, life insurance should never be viewed as an investment product, it should be viewed with respect to its risk cover right ?? To me the policy seems ok, with respect to risk cover and annual payouts, if you consider this bad, WHAT OTHER OPTION DO YOU HAVE IN MIND, if I may ask.

This policy is similar to HDFC LIFE sanchay plus plan, with few differences, but you have ridiculed both of these policies, do you suggest a better plan which could be flawless, please enlighten us !!!

Dear Shantanu,

DO YOU NEED LIFE RISK COVERAGE up to 99 years of your age? Just because of TAX-FREE you are running behind this product, but what about inflation? Anyhow, if it is BEST for you, then please go ahead and god bless you 🙂 For me always a simple strategy-NEVER COMBINE INSURANCE WITH INVESTMENT.

Hello sir

I am an LIC agent, whether its beneficial to me to invest in jeevan umang..

I have explained my clients regarding irr offered by lic and they are interested still.

I want taxfree return for over 8 % yearly investment 3 lakhs

, where to invest

Dear Akhil,

Do think this product gives you more than 6% returns?

sir i think you are totally against of Investment in LIC OF INDIA, MEANS TO BUY LIC POLICIES.Everybody knows in LIC we do not get more than 5 to 6 per cent.but it is for us compulsory savings and family provision.In term insurance we do not get any return and it is only upto 70 years

Dear Dilip,

I am not against LIC. I love certain products like their online term life insurance or their immediate annuity plans. Who said that it is COMPULSORY that LIC is the only way you can do it. Change your mind and you find many many best products than LIC policies.

what if i buy this policy for my say ten years old son,he will start getting two lac for twenty five lakh policy

Dear Dilip,

Do you need INSURANCE for your teenage kid?

It is difficult to understand the LIC pension plan.

Dear Vinod,

In that case better to visit the concerned branch.

I showed this article to lic agent suggesting this plan but he says the bonus rates announced are far higher than expected and would yeild average ?70 * SA (includes survival benefit,SRB,DB and FAB).Please explain this with latest bonus rates announced.(its a very confusing table which they have given).

Dear Sangeetha,

This is where they play the game. Let him show a plan where currently LIC is offering more than Rs.55 bonus rate (except whole life plan). Rest left with you to decide.

But sir this is a whole life plan, if you can help me with illustration?

Dear Sangeetha,

I am saying the whole life Plan No.5, but not this one.

Hi Sir

Please help me How to calculate FAD for Jeevan Umang

Dear Priya,

Refer above post properly. It is simple using the Excel Formula of XIRR.

Basu, thanks a lot for your detailed review of this product. Much appreciated. I’m 41 and with a Sum Assured of 1 Cr, I would pay a premium for 15 years (8 lakhs p.a) and after 15th year I receive 8 lakhs p.a until 70 years and at the end of 70 yrs, I surrender and receive 4.5 Cr. This yields an IRR of 7.4%. Dont you think it would be a better product considering the bank deposit rates at 6.75% currently and this also gives a sort of an assured pension when I reach 56 yrs and offers life cover until 71 or even later (until 99) if i desire to keep the policy unlike a term insurance which gives until 70 yrs. Would you consider this as a good product if the IRR is at 7.4%?

Dear Vishwanath,

I have few questions to you.

1) Do you need LIFE INSURANCE during your retirement?

2) For many of us, TODAY the standard life insurance cover we are looking is Rs.1 Cr. May I know the value of this when you turn 70 years?

3) Now, regarding returns part, I am not sure on what basis you arrived at 7.4% returns. Even if we assume that your calculation is CORRECT, then is it worth to consider 7.4% the BEST return for your 15 years investment?? However, if you are OK with this return (NEGATIVE REAL RETURN), THEN GO AHEAD and INVEST.

I have adopted this policy at the age of 27 for 20 years sum assured is 2500000 and paying premium I know that after the maturity I will receive 8% of the sum assured I receive that amount after the maturity and after sometime I want to discontinue it or are you can say that I want to surrender it at the age of 60 because Who knows that we can live 100 yrs six years also but I am making an assumption in a good way so I am thinking about if I want to surrender this policy at the age of 60 then what will be the surrender value I received at that age

Dear Adv,

Do you feel the sum assured covered under this plan will be sufficient coverage? Also, if you feel the returns of around 5% to 6% are best for you, then go ahead.

Hey

See every want more from his input me also but the point is that I know I won’t be able to live hundred years , if I do so then also I want to surrender the policy at the age of 60 so I just want to confirm After getting 2 Lakha per year at the time of maturity till the age of 57 or 60 yrs of age and then I surrender my policy what will be the total value or approximately will I receive at that time under Jeevan Umang plan.

Dear Arun,

Whether you did a calculation like what is XIRR of your money invested? How long can you sustain with that paltry Rs.2 lakh a year after you turn 60 years?

In the above calculation you need to subtract equivalent term insurance premium and then arrive at IRR then it makes sense. Just putting premium as investment and calculating IRR is completely wrong.

Dear Phani,

Do you think this will differentiate the IRR when the term insurance premiums are at a damn cheap rate? It hardly differentiates even if you consider also. You can try and let me know also 🙂

Hello Sir, I am 42 and bought Jeevan Umang in 2017. Sum assured 7.5L. I paid 2 premiums, 2017 and 2018 so far. What i will get if i surrender after paying another premium in 2019 ?

Dear Ram,

It is hard to say. Better to contact the LIC Branch for the same.

Basu sir,

Can I surrendered it anytime i.e during PPT or during SB period before maturity or death.

Munna-Yes, you can.

Hello Basu,

Thanks for a detailed explanation. I’m 30 years old and I’ve been wanting to purchase an insurance policy and wondering if I should go for a term Or a whole life insurance? Should I go for a pure term or the ones with moneyback guarantee / endowment policies etc? Whats your recommendation ? And, What’s your take on the lic eterm?

Ryan-If you are looking for INSURANCE, then why you are going for a product which combines INSURANCE+INVESTMENT?

Hello Basu,

Thanks for replying. I’m not looking for investment or moneyback etc. I’m looking for a pure term plan. What do you recommended as the best policy in this case?

Ryan-Then buy pure online term plan ONLY.

Can u share calculation for 20 Year Old person for 15 years of premium paying sum assured 25L and life expectancy of 75 years and 45 years Old for 15 years of premium paying term for SA of 50L with life expectancy of 75. Does IRR Change?

Vilas-Refer above calculation and do it in excel. It may slightly change.

How did you arrive at 710000 as FAB in above example. And Is the rate per thousand read as INR 33.50 or INR 3350. ?

Vinod- Refer above post and image properly for the same.

Dear Basavaraj, it’s always a pleasure to read your views on investments and money. Some readers have responded angrily to your posts (regarding LIC). It is OK and it is very good on your part to have replied logically to them. Readers should take a decision based on THEIR understanding and not on anybody else’s recommendation. It is true that what was huge money (50K) for which I had an insurance policy for decades is pittance now. We have to live with our decisions- good and bad.

Keep providing your insights. Thank you.

Shrish-Thanks for your views and accepting mine. But in reality, the anguish individuals are not readers but the agent community.

Dear Basavaraj,

Your explanation is indeed simple and straight forward. Thank you.

I am 40 years and am looking for a GUARANTEED pension programme to start at the age of 50 (max 55). Can you pls suggest few plans from your expertise?

Regards,

Vinay

Vinay-Jeevan Akshay VI.

Thank you very much, Basavaraj. Have gone through details of Akshya 6. Its good for people who wants to start annuity immediately. But me being at 40 years, I want annuity only at 50 or 55. Till then, I can invest on yearly basis. Taking this stand, can you pls tell me which one is the best pension guaranteed plan in India, dear?

Vinay-Sadly NONE such GUARANTEED PLANS neither in India nor across the world. Try to accumulate the same then by doing proper asset allocation between debt and equity for such long term goals through equity mutual funds and PPF or debt products of mutual funds.

Thanks for the help. Cheers and take care.

Sir

If u want to take pension plan then take LIC jeevan akshya vi

Here it’s a single premium plan

It’s a very nice plan

Once u have taken then ur interest rate is fixed and it ‘ll stable for whole life ….

Pradeep-“ur interest rate is fixed and it ‘ll stable for whole life”-In which plan?

Jeevan Akshya 6 pension plan Once taken whatever interest rates is at present that is fix for whole life…

Pradeep-Yes, that I KNOW. But what about the taxation and how it protects the inflation?

It’s taxable according to slab rates and those who had taken earlier version as this is the 6th version they r getting 12-10% till now whereas today the bank rates is quite low, in the long run this plan is beneficial as country develops rates would be further slashed.

Pradeep-They are getting 12%-10% same way who booked FDs during that high-interest rate regime.

Well those customers who had taken jeevan akshya still they are getting the same rate of interest ok

Pradeep-But what about the interest rate and inflation during that period? What if we consider both and arrive at today’s value of money?

well sir in 1990 bank interest rate was 14% at that time lic jeevan akshya interest rate was 12% but still that customer is getting the 12% even today whereas bank interest is fallen down drastically…………ok

Pradeep-Correct!! But how much he invested at that time and whether he is now able to survive NOW when we compare the value of goods and services from 1990s to 2017??

Sir,

Which is the best endowment policy currently being offered by LIC?

Also, Please suggest any Endowment policy from any private bank to look out for.

Yash-Whether you are looking for INSURANCE or INVESTMENT?

A policy which insures me plus gives a good amount of return on maturity

Yash-I need the numbers in case of INSURANCE and GOOD RETURN. Define both of them in terms of numbers of how much you need.

Dear Basu,

My age now is 38 years. I am planning to retire at 50 years. I am planning for a pension of atleast Rs 50k per month. So which specific plans should i opt for. Dont want to have a lot of risk. Right now i have not invested in anything.

thank you.

Sunny-Stay away from any plans which are sold as PENSION or RETIREMENT plans. Accumulate on your using mutual funds and other debt products. If you are unable to do that, then take the help of a planner.

Hello Sir,

This is regarding Jeevan Umang plan.

1. It is guaranteed 8% after 15/20/25/30 investment in LIC

2. What is Maturity amount.

3. In case of happening (death) what will be the return in between Policy term and after the Policy term

Vinod-Please refer above post properly. Your all doubts are already answered.

Hi Basu,

You have mentioned in your post;

“Note below points-

During premium paying term, you will not receive any benefits. If death occurs during this period, your nominee will receive Sum Assured+Bonus+FAB.

Once the premium paying term completes, then you will receive 8% of Sum Assured till the maturity period or death of the policy period.

If policyholder survives till the term of the policy, then again at the end he will receive Sum Assured+Bonus+FAB.”

Que.- If policyholder survives till the term of the policy, then again at the end he will receive Sum Assured+Bonus+FAB.” But, If policy holder will not survive after after completion of premium paying term

In that case, how much their nominee will get??

Thanks in advance.

Death Benefits after commencement of Risk : Sum Assured on death Along with vested simple reversionary bonus & Final Additional bonus if any shall be payable.where sum assured on death defined as highest of

1) 10 times annualized premiums or Sum assured on Maturity

2 absolute amount assured to be death i.e basic Sum Assured

this benefits shall not less than 105% of all premiums paid on date of death.

if Accidentally death occur nominee will received Sum assured + bonuses+final additional bonus+equal to sum assured amount .

Dulal-I already replied in simple term 🙂

Pragn-In that case the Sum Assured+Bonus (accumulated as on date)+FAB (if any).

all good. thank u so much

Hello Mr. Basu,

Thanks for this analysis. It is really useful and as pointed out earlier – your simple ways of explanation is very important for people like me. I had just one doubt in the calculation. While calculating IRR, should we consider the 16 K which the person is receiving from 31st year in your example? Would it have any significant impact on IRR?

Thanks Again

Atul Kulkarni

Atul-I calculated the IRR by considering that survival benefit of 8% guaranteed.

The plan is good.but I searched this type of plan in other insured company.lfound that lic’s jeevan umang is less profitable plan.tbe plan that i searched is giving more benefits like 1.when premium paying term.is over the company will pay the bonus amount of 30 yrs.Rs.@55/1000 i.e 3.30 lacks (sum assured is 2lakbs) afterthat survival benefit will GUARANTED 5%of S.A. PLUS current yr. bonus i.e. 10000+11000(@55/1000–this bonus is variable only) The total survival benefit =Rs.21000 every year. The Maturity Benefit (in 100 yr.=S.A. + Terminal Bonus . In jeevan umang maturity benefit is in 100 yrs.Only exceptional people will alive 100 yrs. So I suggest this plan is not a beneficial plan.

Shailesh-May I know which Life Insurance companies bonus is at least Rs.50 (except LIC)? Have you checked the historical bonus rate of private players? They are very less compare to LIC. I think someone misguided you. For your information, the term of this plan is not 100 years, but 100 years less of your current age. Please read the above post properly.

i am a everyday searcher for a new financial topic..in ur website… i like the way you write in simple language so that even a tenth pass also could understand…

but what i have found is whenever there is a product from Lic or any insurance..i mean endowment or moneyback..u tend to make them look bad.. LIC has been in india for about 75 years or so… i am not any agent or employee of it.. yes people make mistake by investing in insurance.. but who will invest the money in term insurance…. if u say u will die then only ur family will get the money..that too in 25 years only..

myself too investing 13k in mf every month

and still have taken LIC policy for 10lakhs

and icici ismart for 50 lakhs

many of the people arent educated about finance.. and they need guaranteed product.. i remember few years back a mf agent has told about a mutual fund..it was a new fund..asked a person to buy for nav 10rs.. and now.. it hasnt given atleast 6% .. people should cultivate the habit of saving…indians are still in myth that mf and shares are for high class society.. and so they go for recurrung deposits..lic..postal etc where returns are guaranteed.. so rather than badmouthing them..better help people to understand more about the products

Dheeraz-For your information, Term Insurance is NOT AN INVESTMENT. It is risk mitigating product. Hence, no question of RETURN expectation. Hope I replied to your all doubts. Forget about agents or advisers. It is YOUR hard earned money. Hence, the biggest responsibility of KNOWING before investing is WITH YOU. If you not do that homework, then it is your fault. Hence, hoping that someone can educate ME, it is better to take initiative and learn the basics of investing to protect my hard earned money.

I am neither against LIC or it’s product. But bringing in the truth is what I am doing. If someone feel 5% return for an investment of 40 years is GOOD, then I don’t have rights to stop that person. But hiding the real truth is dangerous. This is what I am doing by sharing information about such products. Rest is left with an individual to decide.

i am not trying to educate u sir… but the way u write the article..use the words like pathetic. i am against them.. against an govt organisation.. which is nearly about 75 years old.. and which has helped many families upon..

atleast these endowment and money back policies have atleast more than 98% claim settlement

.. imagine a society where all people close their endowment and money back policies and invest amount in the shares or mfs..is it possible??

Dheeraz-I am not saying that you are educating me. Also, there is nothing wrong if I learn something new from you. I always try to learn from all. Do you remember the old days? What used to be the sum assured of LIC policies? I am not saying anything more than 20-30 years. But just before the year 2000? The sum assured used to be around Rs.25,000 or Rs.50,000. Let us assume one took the policy at that time. Let us say he received the maturity of Rs.50,000 or Rs.1 lakh. Now may I know in what way you can utilize such funds? In no way such maturity amount will help you in funding of any of your goals. All because of inflation.

Hence, what I am pointing is, understand the product. Don’t blindly go ahead with the crowd following that LIC is TRUSTED or GUARANTEED…nothing is guaranteed in this world (including the money you keep in your savings account). Anything can happen with your money. However, try to manage the risk is an art of investment.

HI Basu,

I completely agree with your replies especially the latter one for this specific queries. I wanna share some real life experiences which i faced in my life, my dad is a LIC agent for past 33+years & he made more than 30policies for himself & our family but parallely he invested one fourth of value in shares/mutual funds, the total value what shares are giving/given more or less 85% of gross worth of LIC returns till date, it is just a matter of time the share/mutual fund returns overcome the gross value of mutual LIC returns (not including the agent benifits from LIC Policy). Imagine the vice versa case in the investment.

Based on this experience I started investing 3/4th of my full investement in Mutual funds & 1/4th in Life Insurances, sadly I didnt have term insurance yet.

What I wanna convey here is as Basu said LIC returns wont beat inflation & only advantage is death coverage which you can get it from term insurance as well but at the end its personal choice & their own hardearned money so finally its their decision.

Kiran-Asset allocation for whole your investment is wrong. You have to do asset allocation based on the time horizon of the goal. You did by allocating “3/4th of my full investment in Mutual funds & 1/4th in Life Insurances”. Also, whether you are able to do re-balancing activity by investing in such ILLIQUID products of LIC’s traditional plans??

i agree with you

advice though it may apear biased ,it should be truth

i like the way you put the facts

thanks for guidance

satish

Satish-Pleasure.

Hi Basu sir, good explanation. Tq. After 30yrs of ppt 8% of SA will not meet our expenses. At d time of maturity we might have reached 70 or 80 yrs, by this time we might have finished most of our responsibilities for which matured amount failed to help. After that even we get lumsum it’s not of great help. Bcoz our investments should meet our goals.

Katta-True and the value of that at that time is just meager.

Thank you Sir,

Another great review of new (and pathetic?) product from LIC!!

People in this country do not know concepts of Time Value of Money, Compounding, Internal Rate of Return etc.and simply rely on overstated projections of LIC agents and hence commit mistake of “Investing” in LIC products. Moreover, LIC agents never tell prospect about exit clause (which a policy holder comes to know only after some years when he visits LIC office). I regret to say but this is my personal experience.

Imagine how much of wealth could have been made by people via mutual fund route in last 20 years instead of “Investing” in pathetic LIC products, the wealth destroyer for policy holders.

Thanks again.

Ritesh.

Ritesh-Just look for above example. If you do not sit with a calculator, then this product seems to be like the eighth wonder of the world. However, the reality is something horrible.

i’m A LIC AGENT FROM HYDERABAD , AS PER MY SALES I FEEL JEEVAN LABH AND JEEVAN ANAND, LAKSHYA ARE THE BEST PLAN TO SALE, THIS UMANG SEEMS NOT SO INSTRESTING, OLD PLAN TARANG WAS BETTER THEN THIS ,

Krishna-How the other plans you mentioned are BEST than this plan?

imagine a person paying a premium of 27k for 20years and then, lic returning him 40k annum till his death,and then they will return s.a and bonus and fab, when he die, a person paying 27k now in 2017 and in 2037 he is taking 40k, annum,this amount cannot beat the inflation at all, atleast in tarang old one, they use to get 5.5% with maturity at end of premium paying term, at-least labh and anand and other plans can beat the inflation and also with the security , here i’m giving my opinion kindly tell me if i’m wrong and how ?

Krishna-May I know which other plans of LIC will beat the inflation and give you the REAL returns?

Mr baswaraj etc simply your intention to target me and my lic , I can understand your profession and you , lic plans are very well good to beat your stuff mutual funds , lic gives guarantee and assurance and also lic runs with trust of many people’s , a small example of in our home we wanted to do any puja or anything which is out of our knowledge we take advice from our elders because they know better then us , the same way is lic I mean life insurance of corporations of India , not the mutual funds , mutual funds are subjects to market linked , any thing can happen like Hiroshima and Nagasaki, and mutual Funds is something which can be too good as well too bad , lic is something atleast which some thing scope in tradition way , don’t be so smart ,

Seems your intention is something else , and it’s against lic , please send your product by convincing your customers, I will sell my clients by convincing them , stop blaming lic agents ,

Krishna-I am neither against LIC Agents or LIC. If something truthful hurts such fraternity, then it is YOUR problem but not MINE 🙂

Basu i understand ur problem , when people dont have anything tonearn they always point out others

SK-Thanks 🙂

Krishna-When I targeted YOU and YOUR LIC? Am I get anything by doing this?? In what way LIC Plans BEAT MY STUFF MUTUAL FUNDS? LIC gives a guarantee? So Bonus and FAB are GUARANTEED?? Great comparison of Hiroshima and Nagasaki with Mutual Funds 🙂 Something at least at what COST?? Don’t throw your statements in AIR. Instead prove it with valid points and inputs.

Investment is not an emotional thing. But it needs concrete understanding.

What is the inflation these days ? What is the interest rates offered by Debt Instruments ?Lastly your so called ,mutual funds what returns were given in 2008 ? Its a complex and cyclical share market. So stop criticizing LIC or its plans blindly ?

Nitin-Inflation Rate-Check RBI data. Debt Instruments Interest Rate-In my view, you are pointing other than LIC products. Check individually for the same. If I am looking for investment in MF (as per you mutual funds mean equity…sad but the common misconception), then I never look for a SINGLE year return. I enter into equity if my time horizon is more than 5 years and that also with proper asset allocation. Hope you understood that in the game of investment, managing RISK is the biggest art than selecting the product. By the way, in which category YOUR LIC plan stands in??

I think your assumption of 70 yrs instead of 100 yr leading the rate of investment down and It might happen that insured survive minimum 80 or 85 yrs. or sometime more .

Nitin-The tenure of the policy is 100 Years-Your Current Age. So in the above example, 100 years-30 years=70 years is the tenure of the plan. However, there may be some slight variation in returns if the policyholder dies before this maximum term. But in reality, the return will not cross more than 7% and this is the truth.

My Goal is to have good amount of money in my hand after 12-14 years

No need of money in honad currently

Nikhil-GOOD MONEY means?

Good Money means Good Returns after 10-12 years

Nikhil-Random numbers not works while you are investing. You must have a clear idea of how much you want to expect and when you need that money. Product selection is secondary.

Sir, Currecnlt in FD I am getting less than 7.5% interest . SO any thing giving more than 9 % return is good and The money I will need only after 12 years.

I just want to know in which Mutaul Fund I should iNvest now

Currently I have

BSL Frontline Equity Fund -Grow

BSL Tax Relief 96 Fund-ELSS – Dividend

ICICI Value Discovery Fund – DP Growth

ICICI Balanced Fund – DP – Growth

HDFC Equity Fund-Growth

I have also FD of 10 Lakhs which I want to convert into MF

Nikhil-A single balanced fund like ICICI Balanced fund (growth option) is enough. I am not sure why you opted dividend when you need money after 12 years

Thanks Basu,

I am now going to start SIP for the same as you suggested ICICI Balanced Fund – DP – Growth

Dividend MF was started by my fater approx 5-6 years ago. I am now not going to select any Dividend option now.

Nikhil-Carry on..however for better understanding on MF, read my earlier post “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

Thanks Sir

Is this good one to invest if I want to invest 25000 Annually. My Age is 34 years

Nikhil-If you feel the returns of around 5% to 6% are BEST to you for your 20 years or 25 years of investment, then go ahead. Otherwise, just skip. Never combine insurance with investment.

Ok Thanks, then it better to invest in Mutual Funds

Currently I have investment in following ones

BSL Frontline Equity Fund -Grow

BSL Tax Relief 96 Fund-ELSS – Dividend

ICICI Value Discovery Fund – DP Growth

ICICI Balanced Fund – DP – Growth

HDFC Equity Fund-Growth

I have also FD of 10 Lakhs

Do you let me know where I should transfer this FD in which FUnds

Nikhil-Without knowing much about your goals, it is hard for me to guide.