Do you know the difference between ULIPs Vs Mutual Funds? Well, recently I came across a new knowledge sharing information from HDFC Life. Which I think is completely misguiding the investors.

I stunned myself about how HDFC Life is misguiding openly. Let me share this one by one.

If you need a proof of what I am saying, then visit this HDFC Life’s link of “ULIP and Mutual Fund Comparison”. In this detailed comparison, I found few new comparisons. Which truly defend that between ULIPs Vs Mutual Funds, ULIPs are BEST products.

I will try to explain those points as below.

What is the difference between ULIPs Vs Mutual Funds (as per HDFC Life)?

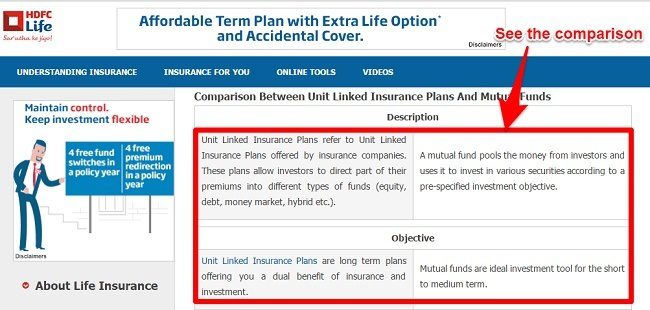

# Description

You notice that in the description, HDFC Life wisely highlighted the types of funds as equity, debt, money market, hybrid etc. This shows that ULIP is the product which invests in various types of funds. However, it wisely skipped to mention the same regarding mutual funds. In relation to mutual funds, HDFC Life just mentioned that mutual funds invest in VARIOUS SECURITIES. But in reality, based on investment objectives, mutual funds also invests in equity, debt, money market, hybrid AND also in a commodity like GOLD.

# Objective

The most surprising aspect of comparison of ULIPs Vs Mutual Fund is related to objective. You notice this in above image. Regarding ULIPs, it is mentioned as “Unit Linked Insurance Plans are long term plans offering you a dual benefit of insurance and investment”. This is true and I completely agree.

But what about mutual funds? It is highlighted as “Mutual funds are ideal investment tool for the short to medium term“. How can mutual funds which also mainly invest in same asset class like ULIPs (equity, debt, money market, hybrid etc.) are turn to be suitable only for SHORT TO MEDIUM TERM but not for LONG TERM?

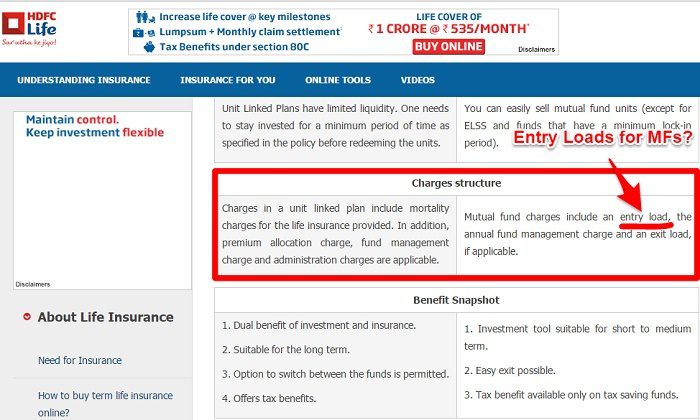

# Charges

In the case of charges, HDFC Life mentioned that Mutual Funds charges include ENTRY LOAD too (along with FMC and exit load). But in reality, in accordance with the requirements specified by the SEBI circular no. SEBI/IMD/CIR No.4/168230/09 dated June 30, 2009, no entry load will be charged for purchase / additional purchase / switch-in accepted by the Fund with effect from August 1, 2009.

Hence, no mutual funds are charging entry load. However, HDFC Life pointing this wrongly. Also, in the case of exit loads for mutual funds, exit load is to make sure that investors must not withdraw or switch to other funds frequently. Hence, for example in the case of equity funds, there will not be any exit loads if you are withdrawing money after a year.

Conclusion-Blind rely or follow is dangerous. Do your own research and if the product suits to you then only go and invest.

53 Responses

Dear Basu sir,

very well written and well explained. i had a few doubts in mind ( regarding ULIPs, not concerned whether HDFC or any other company).

1. all ULIPs invest in the same market in which MFs invest. They invest in the same stocks or funds or AMC, but still ULIP funds returns are less than MF. Why is this difference?

2. Do ULIP funds have any benchmark? ( I haven’t seen any mentioned anywhere any life insurers website). IF yes, which is that?

3. if investment horizon is like 15 to 20 years, than will ULIPs be better than MFs (because maturity amount will be tax free in ULIPs, which is not so in MFs because of expense ratio and Capital gain tax of MF)

i request you to kindly answer my doubts regarding these. Thanks in advance Sir

regards

Dear Rajesh,

1) Generalizing this way is wrong. Their stock picking may be different, entry and exit may be different and % of allocation may be different. More than that, cost is the silent killer in your returns, which many investors ignore.

2) There is no clarity from IRDA in this regard. Hence, few may set or few may not.

3) Check new rules of ULIPs (Budget 2021 – All about the Taxation of ULIPs). They are now taxed like MFs after certain thresohold limit.

Hi Basu can you please share some lights on SBI life Smart Privilege

Dear Shahnawaz,

I usually follow the basics of investment called NEVER COMBINE INVESTMENT WITH INSURANCE.

Hi Basu

Do you any article on ULIP , I mean need to know more about ULIP products, there benifits, Best e.t.c

Thanks

Shahnawaz-I does not support ULIPs. Hence, I have not written on such products.

Even now when ULIP does not have Tax while MF have taxes , Please advise ,

Dear Shahnawaz,

But still ULIPs are not so investors friendly.

Hi,

I need some clarification about HDFC Life pro growth plus policy, is this same like SIP.

Thanks

Santosh

Santosh-SIP is not a product but a way of investment. Your bank RD also can be called as SIP.

Hi

Im investing 2.2 Lakhs in ICICI IPRU Wealth Builder II, Not sure if it is good to continue investment.

Please suggest soem funds for Tax benfit and im ready to take risk.

Thank you,

Ankur-What prompted you to go for this plan? Is your investment criteria is ONLY FOR TAX SAVING or reaching your FINANCIAL GOALS?

Basuji,

I invested in that fund, because it was performing well at that time. But now on some website it is advised to get out of that fund. Its last year return is mere 3%. Then what is point to remain in such fund. I have waited more than one year to perform well; but it is way behind category average. Do you think without considering the return I should carry the SIP?

Pratap-Whether you checked the benchmark return of the fund tracking?

Basuji,

I want to come out of one SIP of a mutual fund, which is non-performing. What is the way of this?

Pratap-Why you invested in those funds and why you now felt to come out?

Dear Sir,

Presently I am a regular reader of your valuable blog. After reading your blog I have little knowledge about Mutual Fund. I have some money in FD, RD & EPF.

1) I want to invest in Mutual Fund (SIP) Rs. 1000/- PM. for 8 – 9 Years for child education purpose, which is best Mutual Fund ?

2) As per your view what is the approximate return from 8 – 9 years ?

They say that they are small and mid cap. I want to start SIP in HDFC mid cap; but i have HDFC balanced. both have same fund manager. That is why I want to avoid hdfc mid cap. Besides, there is 35% over lapping. On some web sites Hdfc mid cap fund is mentioned as small and mid cap. what should I do?

Pratap-If you are confused about which market cap the fund is, check the underlying stocks.

Dear Basuji,

For mid cap SIP which is right choice? Franklin smaller companies or DSP blackrock micro cap? My horizon is minimum 10 yrs.

Pratap-Both are small cap funds but not midcap funds.

Nice post Basu!!!

Investor awareness is paramount.

You can’t just rely on product presentations and brochures.

Risks and unfavorable information is provided in fine print.

So, investor beware.

Deepesh-Thanks for your inputs.

Hi sir I am investing in Axis long term equity fund and DSP Black rock tax saver for tax savings n icici focused blue chip fund for wealth creation since 3 yrs. My view is long term. How is my fund selection?

Basuji,

I have Jeevan Tarang policies for my son and daughter. The policies are going to mature in 2021. I am paying for these policies since 2005. So now what should I do? Is it better to keep paying till 2021 or any ohter way to come out with less loss.

Pratap-Better to continue as it is going to be mature soon.

Your All Points are Valid, Am also a customer who is fed up with the HDFC Life. Just Guide me what to do, Am exhausted with their services.

ISFC-May I know why you exhausted? If they did one mistake means I can’t say HDFC Life is totally BAD. My intention here is to just put some wrong comparison but not to brand HDFC Life as BAD.

You should have highlighted the returns that HDFC Life has generated for its balanced and growth scheme viz a viz similar matching funds of HDFC Mutual Fund and may be one another for various periods like 3, 5, 10 and 15 years. HDFC Life has under performed by a big margin in all of them.

Manoj-Thanks for your inputs. But I wrote this post about how upfront HDFC Life misguiding.

Basu Ji,

What’s your recommendation to buy lumsum in icici prudential value discovery fund.

Please regularly review or recommend good MF /sip

Thanks.

Ketan-Without knowing your financial goals and time horizon, how can I shortlist the fund?

Long term 1o years. Kid education

Ketan-Who suggested this fund to you and where is your debt portfolio for this goal?

Hi Base,

This is Chetan. This is really nice eye opening article.

Thank you very much.

Chetan

Chetan-Pleasure 🙂

Hi Basu,

Nice Article

HDFC Life & HDFC Mutual Fund same organization & opposite view on product.

Objective for HDFC Top 200 Fund

To generate long term capital appreciation from a portfolio of equity and equity-linked instruments primarily drawn from the companies in BSE 200 index.

Entry Load for fund – NIL

http://www.hdfcfund.com/scheme-details/f52bc715-0cfc-4a6a-941b-9a2618e62511

HDFC Life or HDFC Mutual Fund one entity is wrong, everybody knows who is wrong but investor don’t know fact.

Rajendra-Rightly shared and thanks 🙂

Hi Basu , Great. Thanks for sharing.

I shocked Brand like HDFC can do this. ??

Mahesh-Pleasure 🙂

So even the “Pioneer” and “Respected” HDFC group indulges in unfair business practices!!!

Recently I came across one interesting article in ET on 4th September 2016 under the heading ” New Ulip rules deflated life insurer’s profits in 2015-16″ where one major reason enlisted for decline in private life insurer’s profitability was new Ulip rules.

If you get time just go through it and please comment whether it is correct analysis since one of the branch manager of a private life insurance companies (who is my friend) also commented that company does not make much profit from Ulips and hence they are aggressively promoting traditional plans. For that he cited LIC’s example whose profits swelled by 38% in 2015-16 since it focuses on traditional plans.

Ritesh-It is true that there is no margin left in ULIPs and also disclosures are strict. Hence, many insurers (including agents) promoting traditional plans.

So can we assume that New Ulips are more relevant for investors since commissions and other charges have been capped? and insurance companies not making much profits?

Also, many Ulips (depending on type of fund of course) have given healthy returns in the range of 12% -15% over last 5 years. I think we can’t ignore Ulips as an investment tool to generate wealth along with Mutual Funds.

Al least, investor would earn better returns from Ulips instead of traditional plans which are only earning profits for insurance companies at the cost of investor.

Ritesh-What about liquidity issue comparing to MF? Also, it is hard to judge the performance of ULIPs. But in case of MF it is easy. Why I have to risk my money when the same option is available with MF?

one of the major drawback of ulip is..the death benefit is higher of fund value and sum assured.

once your fund value crosses the sum assured …then the isurance part became irrelevant in it.

but still in the name of isurance they deduct the charges unnecesaarilly.

if you are selecting a equity fund.. then in approx seven year time your fund value can easily cross sum assured…

Anurag-Valid point and thanks for sharing.

Thank you sir for highlighting such issues and let the common man know the facts. HDFC should correct itself as it will ruin its image.

Thank You.

Dhruv-Let us see what they do.

Sir

Myself Vasudev

I am a Govt servant with an earning of rs 40000 p/m.. As I am an NPS consumer and I am going to retire in 2043..

My present retiremen savings are like this–

Rs 2000 p/m in reliance retirement fund wealth creation scheme with equity–65% since last two years contd

NPS tier 1 savings since last seven years contd

With these two savings could u please help me whether these two are sufficient or not ? If not then please advise what to do more

Vasudev-Without knowing your financial data, how can I say that this much suffice for your retirement?

Hi sir I am interested in your project

Shardendu-Which project??

Good. Highly appreciate your effort in highlighting misguiding information that too from a big & respected institution like HDFC…am shocked.