EPFO recently launched “New EPF Withdrawal Forms”, which are called as Form 19 UAN, Form 10C UAN and Form 31 UAN. Now, employees can withdraw EPF without the employer signature.

Important Notice-Now EPFO recently (February, 2017) launched a single form for EPF Withdrawal. Refer the post for the same at “EPF Composite Claim Form -Single form to withdraw EPF without employer“. A Single form is enough for EPF/EPS withdrawal.

Note–

- EPF Grievance Cell -Lodge EPF related complaints online

- How to combine or consolidate multiple EPF Accounts online?

- 4 EPF withdrawal changes effective from Feb 2016

Earlier if you plan to withdraw your EPF balance, the process was too lengthy. However, now the employees, who have their UAN and activated it, may withdraw it by directly submitting to regional EPFO.

What are the conditions to avail this facility?

- You must have UAN number activated.

- You must linked your Aadhaar number with UAN.

- You must provided your Bank details with UAN.

- You KYC have been verified by your employer using digital signatures.

If you are meeting above four conditions, then you can withdraw EPF without the signature of your employer.

What are the facilities provided?

Using “New EPF Withdrawal Forms”, you can do the following activity.

- Withdraw your EPF or apply for final settlement.

- Withdraw your EPS benefit.

- Make partial withdrawal, loan, or advance.

This “New EPF Withdrawal Forms” are easy to fill, as they require your basic data. You have to fill it and submit the same in regional EPFO Office directly. You don’t need your employer signature for the same.

New Form 19 (UAN)

Use this form to withdraw EPF amount when you quit your job due to retirement, resignation, disablement, termination, marriage, or permanent settlement abroad. The few conditions for submitting this form are as below.

- If you are discharged from the service on receiving the compensation under the Industrial Dispute Act, 1947 or resigned from the job, but not employed in a company where EPFO not applicable, then you have to apply for EPF withdrawal only after two months of waiting period. Along with that, you have to declare about non-employment under any organization where you are having another EPF Account.

- If you are employed again in a new company where the employer falls under EPFO act, then you have to submit for TRANSFER only.

You notice that filling this form is so simple. You have to provide the below details.

- Your mobile number, which is linked with UAN.

- UAN number.

- Your name as it appears in UAN.

- Date of leaving the job.

- Provide reasons for leaving the job (Options are already available in the form).

- PAN Number (Only when your service is less than 5 years).

- Check your eligibility for submitting Form 15G or Form 15H (Only when your service is less than 5 years). Do remember that you are eligible to submit Form 15G or Form 15H only when your income is less than the basic exemption limit (For current year it is Rs.2, 50,000). Read my earlier post on the same “EPF Withdrawal Taxation-New TDS (Tax Deducted at Source) Rules“

- If you are eligible for submitting Form 15G or Form 15H, then submit it in two copies.

- Provide your full address details.

- Finally, sign in the space provided for.

- Submit this duly filled form to regional EPFO (Also, attach one cancelled cheque, which contains your name, bank account number, and IFSC code).

- Based on few cases, you have to submit doctor certificate if you are resigning due to permanent and total incapacity due to bodily or mental infirmity, copy of Visa, Passport Journey Ticket if you are migrating from India for permanent settlement abroad and offer of appointment letter and copy of Visa, Passport Journey Ticket in case of taking up employment abroad.

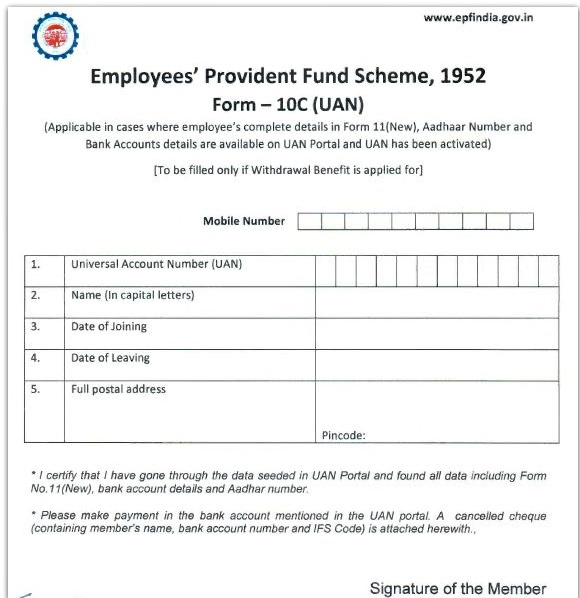

New Form 10C (UAN)

Use this form to claim the EPS amount (Employee Pension Scheme) along with Form 19 (UAN). However, there are certain conditions to use this form and are explained below.

- If you left the job before the completion of 10 years of service;

- If you have attained the age of 58 years before completion of 10 years of service whether in service or left the service.

- If you have completed 10 years of service on the date of leaving your job, but not attained the age of 50 years on the date of filling this form.

- If you attained the age of 50 years, but not 58 years and not willing to go for reduced pension.

- Family member/nominee or legal heir of the employee who died after 58 years age, but had not completed 10 years of eligible service.

No more headaches to fill this form. You have to provide the following details.

- Your mobile number, which is linked with UAN.

- Your UAN number.

- Your name as it appears in UAN.

- Date of joining the current organization.

- Date of leaving the current organization.

- Full postal address of your residence.

- Finally, sign in the space provided for.

- Submit this duly filled form to regional EPFO (Also, attach one cancelled cheque which contains your name, bank account number and IFSC code).

You can read more about the Employee Pension Scheme or EPS in my earlier post “The complete guide to Employee Pension Scheme (EPS) 1995“.

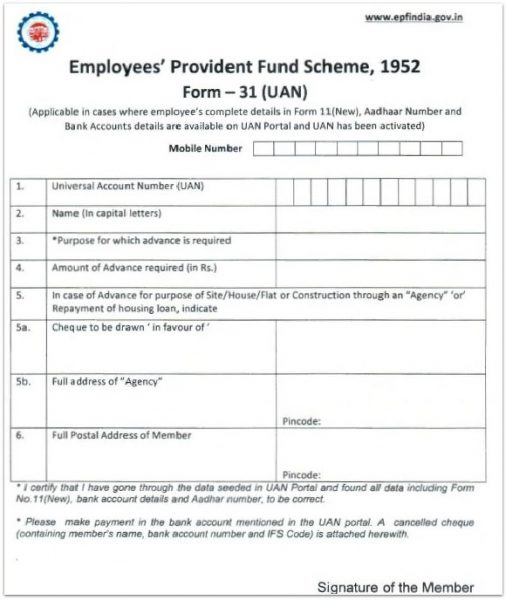

New Form 31 (UAN)

Use this form to avail advances or withdrawal. You can the detailed conditions and eligibility of advance and withdrawal from EPFO in my earlier post “All about EPF (Employee Provident Fund) advance withdrawal“.

Note-Henceforth, employer attestation is not required on Form 31(UAN) (EPFO Circular dated 4th August, 2016).

This is again a simple format and you have to provide details as below.

- Your mobile number which is linked with UAN.

- Your UAN number.

- Your complete name as it appears in UAN.

- Reasons for availing advance or withdrawal.

- Mention the advance or withdrawal amount required.

- In case advance or withdrawal is for the purpose of Site/House/Flat or Construction through a home loan, then the name of the bank to whom you want to pay this advance or withdrawal and full address of a branch.

- Provide your full postal address.

- Finally, sign in the space provided for.

- Submit this duly filled form to regional EPFO (Also, attach one cancelled cheque which contains your name, bank account number and IFSC code). Provide cancelled cheque only the reason is NOT for the purpose of Site/House/Flat or Construction through a home loan.

Please remember that these “New EPF Withdrawal Forms” must be used only when you have UAN and above few conditions met.

What if your Aadhaar and Bank not linked, and your KYC was not verified by an employer?

Nothing to worry, you have to fill the regular Form 19, Form 10C or Form 31 and submit it to regional EPFO. However, in case of withdrawal if your last employer not co-operating with you for withdrawal, then you can follow the below process.

- Fill Form 19 (EPF withdrawal) and Form 10C (EPS Withdrawal). Don’t use these “New EPF Withdrawal Forms”.

- Get attested by anyone of-Manager of a bank (PSU preferred or where you have a savings account), By any gazetted officer or Magistrate / Post / Sub Post Master / Notary.

- Write a letter to regional EPFO stating the reason for not getting attestation from an employer.

- Send the filled form to regional EPFO along with cancelled cheque.

Hope this information will be helpful for all. The complete new instruction is available in “EPFO Circular“

Sir,

My Account number is showing wrong in EPFO i have updated my KYC even though it has not been updated what to do and what is the process of updating the account number in EPFO

Dear Priya,

Do the same through employer.

Hi Sir,

I left my company in 2019. prior to that i worked in 2 companies. Please suggest how to withdrawl all money including PF amount and pension amount both.

Dear Nidhi,

Apply separately for each EPF account.

My employer are refusing to upload the digital signature and change date of exit since I have put case against them for requesting gratuity. I am under medical rest undergone open surgery for ovary. After requesting so many times they are refusing to do. Kindly help me in this regard how to settle my final pf amount.

Dear Sharada,

Approach the EPFO or take a legal route.

Hi , I want withdraw my EPF amount, but I am not able withdraw, I am getting error, account my not updated in my PF account, i am try updating my account, I am getting error not your account not verification failed, kindly help me out

Dear Bala,

Raise an issue with EPFO Grievance Cell Online.

Sir

I worked in a company between 1998 and2004 and could not transfer the PF.

Now I am retired and how to withdraw the money? I worked in And hr a for a Bombay based company. Pl suggest

Dear Venkata,

Approach the regional EPFO.

Hi

I worked in a reputed company but my company was totally closed in ( Maharashtra and Hyderabad ) I worked in Hyderabad ( one branch in Hyderabad ) no employer there my kyc not approved what can I do. How to claim my final settlement. & my Bank account was change ? What can I do with change my Bank account ? Final settlement.

Thanking you

Dear Ramesh,

Approach the regional EPFO.

Dear Sir,

I need a urgent favour of yours. As I have a EPF Member I’d registered in my UAN and belongs to my past organization. And if I am raising the claim it showing previous employer does not have Authorized digital signatory. Hence claim not to be processed. Sir in this case what should I do and please let me know how I can raise my claim. Please do the needful.

Dear Shrikant,

Better to raise an issue with regional EPFO.

HI Basavraj,

I was working in Wipro Technologies from 5th March 2007 to 14 Octoer 2013, That time there was no UAN Number

I only have PF No. which is from wipro PF trust

I want to withdraw my PF , CUrrently working in another company,

can I withdraw my PF from wipro ?

THanks

Shabbir Pathan

Dear Shabbir,

Yes, you can.

Hello,

I am working since last five yrs in MNC company and now i am married so i want to update my details like adhaar card pan card kyc doc and even bank details in company as well in EPFO poratl

i had initiated mail to my company but anyhow my details are not been updated yet

Due to some issue i am leaving job So i have query that can i withdraw my PF even after leaving this company only with UAN number??? such that company is having my previous document and after marriage i have updated my adhar card and pan card with new surname but same is not yet updated in EPFO portal

Dear Varsha,

Yes, you can.

Dear Sir

iam EPF Account Holder in 1997 to 2001, presently my previous is closed

Please let me Know what is the procedure to get UAN Number and claim for my EPFO Amount

During this tenure i worked in Delhi

Thanking You

Best Rergards

JSS

Dear Jayant,

Approach the regional EPFO of Delhi.

Dear sir,

After joinig second company I continued EPF with the same UAN, second PF account created under same UAN, but second employer only created a account but not paid a single month payment. Now company is closed 2 years ago. No one to contact. My PF is not transferred because minimum one payment is required to do in Online portal, and also unable to withdraw the 1st PF account which is 4 years savings. If I ask 1st employer EPF office they say new member is showing in their MIS report and it’s in different EPF offfice. Here they say zero amount is showing for withdrawal. And also bank details update is are not completed by second employer error is showing.

Sir, EPF officers say I have to take bank manager sign on manual claim form. But they are not saying which form no. I have to take signature. Please tell what are all the form no. I have to take signature.

1. Bank details upadate verification pending

2. Transfer is not done

3. I want to claim full amount

4. Can I take signature of other bank manager signature where my savings account is not there.

I hope you can understand my situation. I am struggling from two and half years for withdrawal my money. No proper response from PF office, help desk

Dear Ajay,

On the claim form, you take the Bank Manager’s signature.

Hi Basavaraj,

I worked in a company(say A) for 4.5 years and moved to another company(say B) and worked there for 4 months ,due to personal reasons I left that job.

Presently I am working in a company ,but this new company doesn’t support EPF.

I want to withdraw my EPF from both of my previous companies but in EPFO portal there is no option to choose to withdraw from my first company, only option available is to withdraw form my second company(B) only.

I can view both of my EPF/EPS contributions in EPFO passbook.

Could you please guide me on what to do.

Thanks

Sravan

Dear Sravan,

You have to apply separately.

Dear Sravan

You have to transfer your pf from company 1 to company 2. Ensure your pan aadhar are linked to the Uan.Please note name on Pan ,Aadhar,Uan should be same.

You have total service of 4 years 9 months .If your total amount is less than 50000 no tax else 10% tax.

Sir I worked for 13 years in a Pvt. Company ,at Mumbai. ,thereafter I left the job and started own business at bilaspur,c.g. as per record I had pf amounts more than 6 lakh .I had valid uan no. ,varified by addhar and linked with bank account. How can I withdraw my PF amount or transfer the amount to bilaspur regional epfo office,if possible.thanks sunil

Dear Sunil,

If you have UAN, then using unified portal, you can withdraw.

HI

My claim has been rejected due to the following reason.

1) CONTRIBUTION RECEIVED UPTO 02/2015 HENCE MEMBER SUBMIT THE CLARIFICAION OF DOL 2) CERTIFICATE A/B/C/D/E/F NOT ENCLOSED / SIGNED

I was in Indian till Jan 2015, and then went onsite, so it makes sense that my last PF contribution was on Feb 2015.

I resigned when I was onsite, last year October 2019. How do I prove these guys or explain them that is why the date of leaving and last PF date doesnt match. I have reached out to my employer for any ideas and also submitted an online greival form.

Any guidance is much appreciated.

Thanks

Gopi

Dear Gopi,

Better to raise an issue with EPFO Grievance Cell Online.

Hi,

i was worked with 2 different companies and i want withdrew my pf full and final settlement kindly give me suggestion bcz i have a lot of confusion .

Dear Mohd,

What confusion?

Hi,

My online claim has been rejected stating that due to : 1) UCD CLAIM-SUBMIT DELAY SUBMISSION LETTER,FORM-15G, PANCOPY & CHEQUE LEAF WITH NAME FOR GENUINENESS 2) CERTIFICATE ENCLOSED IS IMPROPER

May I know what I am missing here. My PAN, Aadhar and Bank CHEQUE are not validated in the portal.

Do I need to upload the Form 15G along with the application

Sorry I mentioned it wrong. I have my PAN, Aadhar and Bank CHEQUE are validated in the portal

Dear Ramesh,

Yes.

My company not updating DOE for eps can I submit claim offe

Dear Shilpa,

Yes.

Sir i lost my phone and forget UAN number password so please kindly advise me how to change my phone number in epf as i am not able to login.

Dear Surya,

Why not you apply for duplicate SIM?

Sir, there is an overlap of date of joining in my new company and date of exit from previous company. I am unable to transfer pf. This overlap is because I didn’t serve the notice period of my previous company. What can be done to claim or transfer pf amount from my previous pf?

Dear Harry,

No option but to edit the dates by your employer.

Dear Sir,

I have left the job on 15th April, 2019 and now i can claim the EPF. My Joining date in 15th Oct, 2012 and now total duration is more then 5 years and TDS not to be deducted on withdrawal but still in online claim page there is a option indicating to upload Form 15G. so please confirm that whether i need to submit the Form 15G or ignore the option.

further w.e.f. April, 2017 interest in passbook is not shown, please confirm whether i will get my total interest on withdrawal ?

My UAN is completely seeded with KYC (Aadhaar, PAN, Bank Account No.)

Awaiting your reply.

i have written mail to EPFO authorities but no response.

With Regards,

Suneel Kumar Yadav

Dear Suneel,

Your service period is less than 5 years. Hence, they asking for Form 15G. You will get the interest on withdrawal.

Sir,

2012 to 2019 it is 6 to 7 years and what about interest not shown in passbook?

Dear Suneel,

In my view, the passbook might not updated. Raise an issue with EPFO Grievance Cell Online.

Hi Basavaraj,

I want to transfer my PF amount(previous company) to my present PF account(present company),but somehow its getting rejected by epfo office everytime.

Kindly advice.

Thanks in advance.

Regards,

Gopa

Dear Gopa,

Raise an issue with EPFO Grievance Cell Online.

Dear Sir,

I worked in company for 1.5 years and left and working in other company at the moment. Hence, I transferred the last PF contribution to current employer contribution. Now I wanted to withdraw the last PF contribution, did apply for PF withdrawal online with form 31 for whole amount from last PF contribution. However, the claim was rejected saying DOJ is not correct.

I checked my DOJ is correct with current employer. KYC is updated, UAN is activated, bank details updated. Every thing is updated. Don’t know where the trouble is.

Is there a problem with the amount I mentioned?

Can you guide me what can be done in this regard. How do I correct with DOJ?

Please need to access that amount.

Thank you in advance.

Dear Fernandes,

Please check the date of exit with date of joining. If there is any overlap then that may be the issue.

How can I have exit date while I am still working in this company. I transferred last PF to current PF. DOJ is correct, date of exit how I correct it. Thank you in advance!

Dear Fernandes,

I am not mentioning about current exit date but your last employment exit date.

Dear Sir,

I have worked from 2010 to 2013 in one company.at that time there is no UAN numbers.now i want to withdraw that money.i have my pf number only and now the company was closed.can you please suggest which forms i have to submit to PF office and what is the process.please do needful.

Thankyou

P.Krishna.

Dear Krishna,

Please refer the above post once again.

Hello Basavaraj,

I have a small doubt on EPS amount. In My UAN number i have 2 PF accounts, Old PF account EPS amount is 10,300.00/- and Present Company PF account EPS Amount is 7,747.00/-.

I applied EPS amount in online, after 10 days i revived amount is 15,300.00/- which is less amount if we add both PF accounts EPS amount. Better to can i approach the PF office or Employer.

Regards,

Srinivasulu

Dear Srinivasulu,

If you are withdrawing EPS before 5 years, then you will get part of it only not fully.

Hello Basavaraj,

One of my friend is having UAN number he worked only 3 months, after that he is not working any other company also. He wants to close that UAN number. How to close UAN number please guide me for closing of UAN number.

Regards

Srinivasulu.S

Dear Srinivasulu,

Why does he want to close the UAN number?

Hi Basavaraj,

He is not interested to work any company. He is decided to maintained his own provisionary shop. In our AP if any of the person is unemployed, then he will be eligible to get a amount of 2000/- per month as per government(Mukyamantri Yuva Nestham), so he wants to close his UAN number. If this UAN number is actives then he is not eligible to get that amount.

So Please help him to close his UAN number.

Regards

Srinivasulu.S

Dear Srinivasulu,

I am repeating again, whether your UAN is active or inactive, the contribution to your EPF account is proof that you are unemployed.

Hello Basavaraj,

My UAN have linked with 2 PF numbers and previous company PF amount was transferred to current PF account but EPS amount was not transferred.

1. I already withdrawn the EPF amount, but due to EPS amount not transferred i didn’t apply the EPS amount.

2. In online i can withdraw current company EPS amount, but i am unable to apply the Prior company EPS amount.

Please help me how to apply prior company EPS amount.

Regards,

Srinivasulu.S

Dear Srinivasulu,

Apply for old EPS separately which is linked to your old EPF.

Hi Basavaraj,

Through offline we need to apply or in online only?

Dear Srinivasulu,

If your UAN is KYC complied, then you can apply online and otherwise OFFLINE.

Hi Basavaraj,

My UAN is already KYC completed and EPF amount also withdrawn. but the problem is i am unable to transfer the old company EPS amount to present company. while withdrawing the EPS in online only showing present company PF account, prior company PF account number is not showing in withdrawal option.

Please guide me how to get prior old company EPS amount.

Regards,

Srinivasulu.S

Dear Srinivasulu,

EPS will never be transferred. It simply follow your EPF. However, in your case you already withdrawn the EPF means you have to withdraw the EPS also.

Dear Basavaraj Ji,

My claim is for the year when UAN and Aadhar were not launched. I want to withdraw my PF, however as there is covid situation around the country and almost all the desktop jobs are WFH, can I get my attested scan copy digitally signed by employer and then send it via speed post with those print outs. Will this fix this up for me. Please advise and help me?

Dear Monit,

Yes, but the risk is if they not process it, then whom you ask?

Hi Sir,

I am moving to Finland with my husband for years. Can my husband and I claim for full PF. I have couple of questions.

1. Can I claim the PF amount through portal?

2. Do I have to show the visa in order to claim?

3. In how many does will the amount get credited?

Dear Deepika,

1) Yes, if your UAN is fully KYC complied.

2) Not required.

3) It depends on the case to case. However, within a month they process it.

Dear Sir,

My Basic details are not updated by previous employer in UAN website even after numerous calls,message and mails to them.Even visiting there office did not yield any result. Grievance through EPFO also did not work out.

Can legal action be taken against employer or follow the steps provided above by getting PF forms signed from govt officials

Dear Suresh,

Better to opt for legal process.

Hi Basavaraj,

I recently transferred my old company PF to last working Company PF account. PF amount is received, but Pension Contribute is not transferred to last working company. any advise to get Pension Contribute amount also.

its almost 3 months unemployed from last company. Can i apply online Full PF amount withdrawal. and how much we can get the PF amount.

I got the news that will get double of deducted PF amount, can i get double of amount or actual amount which they deducted amount only.

Thanks in Advance.

Regards,

Srinivasulu.S

Dear Singareddy,

EPS will never be transferred. EPFO just update the service records. Hence, you no need to worry. Regarding the withdrawal amount, check the balance available in your account.

Dear Basavaraj,

1). How to withdraw prior company EPS Amount.

2). We can apply both PF and EPS amount same time are we need apply only any one of PF and EPS at a time?

Regards,

Srinivasulu.S

Dear Srinivasulu,

1) Exactly like how you withdraw EPF.

2) You can apply both by using a composite claim form.

Hi sir,

I am immigrating to canada as a PR, i have left my job in 2016, now i want to withdraw my PF fully.

My employer has not updated the reason of leaving the job hence i am not able to withdraw the PF online.

What should be my steps to withdraw it hasslefree.

Thanks in advance.

Dear Saidkhan,

They no need to enter the reason but they have to enter the exit date.

Hello my epf claim got rejected reason give was enclose transfer in details from the previous employer please tell me the next step on how to withdraw

Dear Manan,

Check with your last employer or raise an issue with EPFO Grievance Cell Online.

Hi Basavaraj,

I have two PF accounts linked to one UAN number. I resigned my present company also its almost 2 months. Now can i transfer previous company PF to Last working company. Will they accept the transfer claim amount of previous company PF amount.

I spoke with old company company HR regards offline transfer of PF amount, she said you can transfer to Old PF to New PF account then you can withdraw both PF’s at a time.

Can i transfer my Old PF to New PF account, Will they accept the Transfer amount?

Regards,

Srinivasulu

Dear Srinivasulu,

YES.

Thank You.

Hi,

I have applied for online transfer of pf,status is showing accepted by employer.My doubt is how could i check that my pf was transferred and how can i withdraw the same.

Dear Pavan,

You have to wait for the same to be updated in online passbook.

Hi Basavaraj,

I have two PF account linked to one UAN . I’m able to see two members passbook one from my previous company and the other one from my present company.

I’m currently unemployed due to onsite travel i have left my job in July 2018.

i want to withdraw my pf but in online claim i’m only able to see my current company PF member ID i.e.from July 2017 to July 2018. How do i withdraw both PF ?

Dear Sonal,

You have to withdraw them separately. If you are unable to do so, then raise an issue with EPFO Grievance Cell Online.

Hi Basavaraj,

I have a small doubt in multiple PF accounts reflected in one UAN Number as you said “You can withdraw separately” , through online we can withdraw separately or offline need to withdraw.

Sorry to ask here.

Thanks & Regards

Srinivasulu.S

Dear Srinivasulu,

If your all EPFs are KYC complied, then online.

Hi ,

Please update your FATHER OR HUSBAND NAME in member details through your Employer/Unified portal

when i do the online withdrawal it showing for the same.how can i add father name online.if not possible how can i withdrawal amount any other ways please suggest me.

Thanks,

Sreenu

Hi Basavaraj,

1) I am unable to link previous PF accounts to present PF account and now i left from my present company aslo.

2) When i’m trying to merge previous pf accounts to present pf account its not showing, only one pf account is showing. Totally in my UAN Number 4 PF accounts are showing.

3) Can we apply PF through offline in previous company or not? i am absconded in previous company.

Thanks & Regards

Srinivasulu S

Dear Srinivasulu,

I am not sure what went wrong. Hence, better to raise an issue with EPFO Grievance Cell Online.

Hi Basavaraj, Today only I applied for of withdrawal, after withdrawal submission I came to know that IFSC code is wrong in my UAN portal…. So pls let me know is Ter any problem to withdraw n way should I do now…… Pls help me

Dear Bharathi,

It may create the problem. Hence, first wait what they do and then update the records.

I have resigned from my 1st company in March 2017,after joinning new company they have created new UAN and in march 2018 i have joined another company,so my current UAN and Last UAN has been merged,but my 1st company UAN not merged,Is i need to withdraw or that can also be transferred & that empoyer is also not supporting,please do solution without help of 1st employer.

Dear Rahul,

You have to merge that also. Request EPFO through your current employer for the merger of the same.

Hi – I have the same situation where my old pf account not activated UAN and i requested current organization HR to merge with activated UAN PF no, As they replied that my previous organization have not been updated my last working date so is it not possible to merge them form there end.

Old organization is no more now it has closed and i have been worked for 2 years from 13/11/2010 to 19/01/2012.

wanted to withdraw amount, Can you suggest how can i withdraw of my previous PF Amount.

Thanks & Regards,

Narender Mara

Dear Narendra,

Raise an issue with EPFO Grievance Cell Online.

i transferred my EPF amount from previous company to prasent company after this process i applaid withdrawel form using 19 & 10c indiviccually but EPF ppl rejected my request can i know the reason & pls tell me how can i get my total EPF amount UAN NO 100493538554

I HAVE A MEDICAL EMERGENCY

Dear Praveen,

Raise an issue with EPFO Grievance Cell Online.

step 1 ; i withdrawed present company total pf amount form 19.

step 2 ; i tranferred epf amount from previous company to prasent company form 31.

step 3 ; applaid form 19 and 10c but epf pple rejected due to already account has been settled.

step 4 ; Raising issue with EPFO Grievance Cell Online and result is rejected due to already account has been settled.

pls share your number

Dear Praveen,

In that case knock the regional EPFO.

pls share your number to explain my issue very clearly.

Hi sir, i have sent you a an email. I need your professional services. Pls chekand revert. Regards,

prahsanth

Dear Prashanth,

It seems I have replied also.

HI,

GM ,

MR.BASAVRAJ SIR,

I want to withdraw my full PF amount .

Already KYC done.

I want to ask you which documents are required to attach with aadhar based composite claim form to post direct resp.EPF office.

Dear Rasika,

Same KYC documents are required to be attached with composite claim forms.

Mr. Basavraj,

I have following query and would like to request you to clarify the same.

I have completed 5 years of consecutive service in 2 companies (A and B).

A with 3.8 years and B with 2.7 years. PF balance amount of A was already transferred to B and contribution was continued till I left company B.

Now, I have joined 3rd organization (C).

Each organization has its separate PF number linked to a my single UAN number.

At present, my Adhaar, PAN and bank details are KYC verified by my current employer (C). Now, I would like to withdraw my EPF and EPS both that was accumulated against my A and B employers since I have not yet transferred my PF amount of A and B to organization C.

So, my questions are,

(1) Can I withdraw my previous PF balance despite of being in service with organization C that maintains my different PF account?

(2) My current salary account of organization C is with HDFC but employer C has eVerified ICICI bank account which I used to have as salary account of my first employer A.So, does that mean my bank details are KYC verified and it is not required to get KYC done for HDFC bank details as well?

Regards,

Prasad

Dear Prasad,

1) As all EPF accounts are linked to single UAN, you are not allowed to withdraw.

2) Retain the KYC of Bank to be updated for the account which you want to retain forever. Otherwise, changing bank details will be cumbersome in future.

Mr. Basavraj,

Thanks for your feedback on this.

1) Does that mean, I can ONLY transfer my previous PF balance to my current employer till I am not in service for consecutive 2 months?

2) Lets say, I put down my papers and serving notice period for 2 months; in that case will I be eligible for withdraw claim for my current employer on the same day once my notice period ends?

3) Should I ask my current employer to update the KYC to my salary account i.e. HDFC by uploading new set of documents for bank KYC instead of ICICI?

Because I had already given them HDFC bank details required for KYC when I joined the current organization but I do not know from where did they get my first organization details.

4) One more thing I have heard that, once the bank KYC is done next employer need not do the bank KYC as its been already done.Is that true?

5) As far as bank account number is concerned; I have noticed that 2 leading zeros are missing for ICICI bank account which is mapped in EPFO portal even though I had given them correct details. Would that matter or cause any issue in case I would like to withdraw my PF balance in future by any chance? [Usually, leading zeros depict salary/saving account that is why]

Regards,

Prasad

Dear Prasad,

1) Yes.

2) Within 2 months you can’t withdraw. However, if join new organization, then you can transfer it.

3) Yes.

4) Yes

5) Better to correct.

Thank you.

Mr. Basavraj,

I have raised online PF transfer request using “Present Employer” option from EPFO portal this week and I have got one PDF acknowledgement regarding the same. But do I really need to handover this acknowledgement to my current employer after doing signature on it ?

Or just raising online request would suffice the requirement?

Regards,

Prasad

Dear Prasad,

That much is enough.

Dear BASAVARAJ,

I am facing a problem for final settlement of my epf.

As because in our city we are not getting our Addhar card. Without Addhar I can’t apply in online. Another problem is my last company has opened two EPF account in my single UAN no. How will I able to apply for final settlement.

Dear Rajib,

Aadhaar is mandatory.

Dear BASAVARAJ,

My AADHAR,PAN details are not able to link with UAN kyc stating not matching.

But same are linked with income tax. with out any problem.

Dear Sudhakar,

Whether there is any name mismatch in PAN, Aadhaar with UAN? If so then correct at first in UAN then go ahead with linking. If everything is OK, then try to visit the concerned EPFO and link the same.

Should I withdrawal the pension fund by 10C form for short service.

Dear Surinder,

Short Service means?

Agr employe is death ho jati h to epf kaise niklega aur kia process h

Dear Akash,

Approach either regional EPFO or the employer.

Hi,

I have applied for pf withdrawal through online. My claim got rejected stating pan and form 15g are not submitted. What has to be done after submitting claim through online. What documents are needed to be sent to pf office?

Dear Gowthami,

They already mentioned documents in the reasons for rejection. Please submit the same.

Hi Basawaraj,

I have left my job 2 months back and i am planning to raise PF Final Settlement (Form 19). I have overall 4 yrs of exp.

I have linked my aadhar and bank account with UAN and is verified also. But when i tried to add PAN , its status is unverified as PAN Card has my name with initials expanded and UAN/aadhar/bank details have initials .

When i tried to raise for PF Final Settlement by online it says 34.6% tax will be deducted as Tds. Is it possible for me to apply for PF Final Settlement Offline ie by sending PAN copy, Form 15G, aadhar copy , bank cancelled cheque , etc directly to PF Office so that Tds wont be deducted??

Dear Raju,

Avoiding TDS does not mean avoiding TAX. It is still taxable. If you are unable to link PAN, then no need to worry. Let them deduct TDS and you can later can claim it while filing ITR.

Hi Basavaraj,

Right. Since my tax liability for this fy is less than 2.5 lakhs, this pf amount can be excempted from tds. I have one more doubt. So i can go ahead with

e the

ccf with aadhar,

pan card copy

form 15g

cancelled cheque

and send it to the epfo office directly WITHOUT employers attestation?

At least they should accept my application and can issue the refund with or without tds right ?

PAN not verified status will it stops me from submitting PF Final Settlement application directly to PF Office WITHOUT the employer attestation?

Dear Raju,

It is always best to submit documents through an employer.

i have left the job in 2012 and now the company is closed now i have only pf no. and joining date only and in that no. the UAN also not Activated because of unliked of Adhaar kindly suggest.

Hi,

I am getting error while trying to claim the PF amount.

Error: Invalid key info in digital signature (this means that certificate used for signing the authentication request is not valid – it is either expired, or does not belong to the AUA or is not created by a well-known Certification Authority).

but the KYC is approved.

Kindly help that how can I get solution for this problem.

thanks & regards

Nagesh Babbur

Dear Nagesh,

I am not sure about this error as many are getting same. Please be in touch with EPFO.

Thank you

When I applied for claim an error message appear. ERROR :- INVALID INFO IN DIGITAL SIGNATURE(THIS MEANS THAT CERTIFICATE USED FOR SIGNING THE AUTHENTICATION REQUEST IS NOT VALID- IT IS EITHER, OR DOES NOT BELONG TO THE AUA OR IS NOT CREATED BY A WELL KNOWN CERTIFICATION AUTHORITY).

Please help what I do…

Dear Vipan,

Since few days many are facing this issue. I am not sure what may be the reason. Hence, better to raise an issue with EPFO Grievance Cell Online.

hii

i am facing the same issue i have also been trying to withdraw the pf and getting same error msg please let me know if you get any solution.

My previous company PF amount (Employee +Employer contribution) transfer to new company PF account but my pension amount is not transfer so please guide me how can transfer my pension amount to new PF account. I have 2 UAN one is previous company and another UAN created by new company. MY PF amount transfer done through new employer , so please guide me

Dear Rajesh,

Your EPS will never be transferred. EPFO just update your service records. Hence, you no need to worry.

So how can get EPS amount from old PF account

Dear Rajesh,

I already replied. It will never get transferred. Hence, you no need to worry.

Hi Sir,

I have been trying to withdraw my PF benefits through online procedure, but the claim is not getting

i was applied for 50k but 300 was credited to my bank account.

Please tell me the procedure to withdraw 50k .

Thanks

Bharath

Dear Bharath,

You have to follow the same procedure.

Dear sir,

I have transferred my 1st pf amount to 2nd pf account with same UAN online. While checking Transferred status it’s showing accepted my field office. While applying form 19 getting rejected sir while checking passbook it showing money transferred amount to new pf account.. When it is possible to get my amount. How many days it need to complete the process. Already 7 days over (Transfer accepted by Field officer)but while applying form 19 rejection only happening. so kindly help me sir.

Dear Gladson,

Wait for some more days. If your issue not resolved, then raise an issue with EPFO Grievance Cell Online.

Dear sir,

I contact PF Grievance cell. They told money transferred to sb account. Money not credited to my account. While checking UAN balance balance is available. But still I didn’t get my money. What’s the reason sir. While applying claim rejected.

Dear Gladson,

I am not sure what went wrong. Better to raise an issue once again.

Hi sir I contacted grivenance cell they told to apply again . I applied again am getting rejected. After 2 days I applied it’s showing max no of attempt exceed so kindly send through offline. So when they will release again when it’s possible to apply online.

Dear Gladson,

Sad part of EPF websites. Better to knock the regional EPFO.

Hi sir,

Is it possible to apply form 19 without employer signature form.

At present am in Tamil nadu sir. I have transferred my PF account to Hyderabad based company pf account. So where I want to send my forms.

Dear Gladson,

Yes it is possible. Be in touch with concerned regional EPFO.

Thank you sir

Dear sir kindly send me the form 19 with employer signature form link

Dear Gladson,

You can download the same from EPFO portal.

Hi sir,

I contacted PF Grievance cell. They told me to send advance stamp receipt. Why they are asking sir. Kindly help me regarding in this.

Dear Gladson,

I am not sure for what purpose they are asking. Better to interact with them.

Dear sir my online EPF is sattled to claim

I got a msg your claim is transfer to your bank account but money not get

Please help

Deepak 7988364572

Dear Deepak,

Wait for few more days (around 4-5 days). If the amount not credited, then contact the regional EPFO.

Hi Sir,

I submitted my Claim form in EPFO Regional office on 11 May 2018 for full & final settlement, how long it will take to disbursed my amount?

Dear Vinod,

If everything is fine, then it may be settled within 10-15 days.

Good Morning sir,

as i applied for change of name in EPFO as per aadhaar detail & other while i was working in company 1year before resigning the job, since i attached the copy of Joint application acknowledge copy, pan card aadhar card copy & bank detail along with the claim form.

hope every thing will goes right

Dear Vinod,

Let up hope for the best 🙂

Hi Sir,

I have been trying to withdraw my PF benefits through online procedure, but the claim is getting rejected due to the below reasons:

1)Form 15G not submitted by member

2)PAN Card copy not submitted by member.

My PAN And Aadhar details have been verified in the UAN Portal. In that case, is it necessary to submit the above said documents offline?

I had submitted the necessary documents to the EPFO office through my employer and have received the acknowledgement on 23rd February 2018. (Offline process). There are no further updates on this.

Please advise on how to proceed.

Dear Shruthi,

Better to raise an issue with EPFO Grievance Cell Online.

Hi Sir,

I was working with a software company then I resigned. Now I am unemployed for almost a year. I want to withdraw my full pf amount but the problem is that on EPF site it is showing that my service details are not present.

As I was unable to serve my notice period in that company so they have not updated my service details. Please guide me how can I withdraw the money?

I have

i) UAN No

ii) Aadhar is also linked with UAN

Dear Raghav,

If your employer is not cooperating, then try your luck by knocking EPFO through EPFO Grievance Cell Online.

Hello Sir,

I would like to withdraw my full PF amount, I was working with company A for 4 years then i left the and unemployed for 2 months then later joined company B and i have shared them the existing UAN number and its been linked up in compnay B. can i still withdraw PF amount of company A.

And in member portal i only see option for form 31.

Dear Mohammed,

You are not allowed to withdraw now. Because currently, you are working.

ohh, as i was unemployed for 2 month does it give me any advantage to withdraw PF.

Thanking your for you all support.

Mohammed-You have to be currently unemployed to withdraw.

what if company B generates new UAN number.

Dear Mohammed,

First thing, never allow second company generate new UAN. If they still generate, then you have to request EPFO through current employer for the merger of both UAN.

Hi Basavaraj,

First of all thanks for helping some many people with the PF issues with this awesome page.

Now coming to my query, recently my PF transfer claim was rejected with following :

Claim-Form-13 (Transfer Out)(Transfer (Unexempted to Unexempted in other region or to Exempted Establishments)) Claim id-GNGGN18035001XXXX Member id-GNGGN0026032000000XXXX has been rejected due to :- FOR APPROVAL PLEASE/OK

Please help me with reason for rejecttion because it is not clear with the comments.

Thanks again for your help in advance.

Dear Himanshu,

Even for me too it is not clear. Hence, better to raise an issue with EPFO Grievance Cell Online.

Thanks sir !

Dear sir my uan is activate and all kyc is approval Done but my date of joining and date of exit not available

Can i submit form 19 uan

Dear Raju,

Date of exit and joining are very much important.

Usually how much time will be taken care by field officer

Dear Shilpi,

It is hard to say anything accurately.

I have been part of a software company since 2.4years and i have resigned , currently i’m on my notice period (60 days) by the end of it i will have a total of 2.6 years of experience. I have quit my job to pursue higher education in India .

Note : 1) I will be working only after 3 years ( 2 years of higher education + 1 year gap now for preparation ).

2) Current PF balance : 31896 ( Employee Share) + 9754 (Employer Share)

22,123 ( Pension Amount )

3) I’m not in urgent need of money however if the interest rate is negligible with PF i would prefer investing in a fixed deposit scheme which offeres better return.

Please suggest ( Main concern ),

1) if i should withdraw the PF amount or not?

2) if its suggested to withdraw the PF amount then should i withdraw pension fund as well? I have heard ppl suggesting not to withdraw pension amount.

What are the pros and cons of withdrawing pension amount. Kindly elaborate on this.

Additional details regarding following are also much welcome.

3) IS the withdrawn PF amount taxable?

4) Upto what amount is it not taxable?

5) If the amount is not withdrawn at what rate is the amount multiplied ( Interest rate )

6) Procedure that i need to follow to withdraw the amount before i leave the company.

Looking forward for your response , your answers would help me take informed decisions as i do not have much clarity about the procedure.

Thanks a lot in Advance 🙂

Sara-1) You will be eligible for withdrawal if you are out of job for more than 2 months.

2) You can withdraw the both. However, as your service period is less than 10 years, you will not get the EPS full amount but only part of it.

3) YES.

4) Whole amount is taxable for you.

5) It is as per current EPF interest rate.

6) Contact your HR team.

Dear sir,

I already discussed with you sir. I have worked in Tamil nadu from 2015-2017(2years) after I have joined in Hyderabad so I have joined my old PF with the same UAN NO. Dec 17 I have resigned my Hyderabad job. Total 2yrs 4month PF .Yesterday present employer updated DOE. and also I transferred my old account to present 7 days gone still it’s showing submitted. While applying for form 10 it’s showing less than 2 months short period like that . So kindly help me in this sir.

Gladson-Raise an issue with EPFO Grievance Cell Online.

Hi……my past employer is not verifying my pan and account details in my of account due to which I am not able to withdraw pf amount. I went n spoke to him but he says he has done everything. In my of account it says bank details and pan not verified. What can be done??? inspite of regular saying they r not helping me….. I had my PF for two years n I’m jobless since almost ten months….plz help me

Pushpa-Raise an issue with EPFO Grievance Cell Online.

hello

i left my job on 31.01.2018, 60 +days passed my employ is not ready to update my aadhaar detail in online portion, how to withdraw the my pf amount

Vinod

Vinod-Visit the regional EPFO and try to link Aadhaar. Once it is done, then you can withdraw online.

Good afternoon Sir,

Yes, i visited the EPFO regional office and they say if company not able to verify than kindly bring form for withdrawal duly singed by employer. Don’t know what to do since compny HR giving silly reason for updation like system needs to upgrade for verifying doc online & EPFO say go to employer for signing.

Please help

Vinod-Raise and issue with EPFO Grievance Cell Online.

Hi,

I have UAN number

Two companies are listed in my UAN. one is previous company and one is which i am working currently.

Previous employer has updated my Last working day, But i am unable to take whole of previous PF.

I can withdraw only PF advance. How can i withdraw my prvious company PF as whole.

Jaffer-It may be showing an advance option only because you are currently working and UAN is linked to both EPF.

How much time it will take to get the settlement of claim as i have raised the claim on 06.4.2018 but the same is still showing the online claim submitted at portal.

Anupam-Around 10-15 days approximately.

If the status is showing that claim ent to field office then how much time it will take

Anupam-No such deadline set for them.

Hi Sir,

I want to know how can I withdraw my PF. I was working 4 years back in company since then I am not working anywhere. The company is closed. However, I have the details of my PF number. I have created my UAN but the details of UAN are not verified as I am not working anywhere. Can I withdraw my PF in the following cases

a) My surname is changed after marriage.

b) My details are not verified on PF portal

c)UAN is created through adhar card

If I can withdraw then please let me know the procedure for withdrawal and time for the same.

Regards,

Avi

Avinash-Visit the concerned EPFO and try to first update details and then you can withdraw.

Sir the EPFO office for the above said company is in Bangalore. Can I visit the regional office in chandigarh as it is nearby for the updation.

Avinash-Regional Office in the sense to where your EPF belongs to.

Hi Sir,

I want to know how can I withdraw my PF. I was working 4 years back in company since then I am not working anywhere. The company is closed. However, I have the details of my PF number.only and activated the UAN because of old mobile no.

Vinod-Refer above post for the same.

Dear Sir ,

I have worked in the private chits company but at the middle it has been closed due to the internal problems but in my salary the pf amount were deducted , but now i re-leaved the company past 6 months back, and also the the pf account in registered at the Chennai, Tamilnadu state, but i don’t know the way how to claim the pf amount without contacting the employer.

please inform the way of pf claim

Divya-You can withdraw without an employer. If your EPF is UAN based and fully KYC complied, then you can do it online. Else visit the concerned EPFO and submit the forms.

There is no need to visit u can send filled forms by courier or speed post

Hi Sir,

I have more than 50K amount is in passbook, can I withdraw this through online portal. Because I already updated all details in EPFO portal also verified by employer but while trying to raise claim I can see the error site is under maintenance. I want to withdraw ASAP.

Please advise.

Swatiri-Try after some time.

It is working as off now, try your luck and submit just for 19 not another,Good Luck.

Dear sir,

My sister claimed through offline 45 days gone still it’s showing under process only so we planned to claim online. Both date of joining and date of exit available . but while proceeding claim it’s showing Pf withdraw seperate and pension withdraw seperate. Form 19 and 10c seperately. So if we applied pf withdraw 1st. It’s possible to apply pension withdraw later once got settlement?

Hello Sir,

I left my job on 15.11.2017 and my KYC is also updated in my UAN account. My Date of Resign & Date of Joining both are also updated in my UAN account. But at the time of withdrawing my pf online. EPFO Portal just showing withdraw form 19 (Only PF Withdrawal) or Form 10C (Only Pension Withdrawal). I am not getting the option of PF Full Withdrawal. Kindly Suggest.

Saurabh- Not sure about error. Better to raise an issue with EPFO Grievance Cell online.

i left the job & started my own business, Now i want to withdraw complete amount from EPF as i am not going to job in future.

Also my UAN is activated , PAN & AADHAR & Bank Account details is updated and verified in EPFO database.

But when i am trying to withdraw it gives me only “Advance withdraw (Form 31)” option only.

Sanatan-I think your employer not entered the exit date.

Ok sir thank you

Hi sir myself RAVIKUMAR I was left my job on 18 01 2018 can I send request for PF full settlement ( including pension)

I have completed 6 years with this organization

Date of joining 16 4 2012

Date of leaving 18 1 2018

Unemployment declaration is mandatory? Can u pls confirm

Ravikumar-Yes, you can withdraw now. yes, unemployment declaration is mandatory.

Can you pls share format for unemployment declaration pls

Send to [email protected]

Ravikumar-There is no such standard format.

For form-31 claim, if I chose option of “Construction Of House” and Claim the amount then, If any reason if I don’t purchase house later then what will happen?

Manoj-They are wise enough. They not handover the cash to YOU.

Dear sir,

Good aftn sir. Am having 2yrs pf account in Chennai based company and then I resigned and I joined in Hyderabad based company in that am having 4 months pf account I resigned job.

I merged through same UAN no.

60 days over I with drawn advance amount. While checking for withdrawal date of exit is not available. While checking it’s showing 2 records 1st company and 2 nd company account in single record.

I asked my 2nd company HR asked me to send forms. So my doubt is I want to send forms to both the companies or else only 2nd company.

If he mentioned date of exit. Am I possible to claim all the amount or else only second company pf money alone. So kindly help me in this sir.

Gladson-If date of exit is not mentioned, then you have to contact your old employer.

I have received below mail from of gravience, please advise.

Dear Sir/Madam,

This is with reference to your Grievance registered vide Registration Number DELWE/E/2018/80769.

It is informed that your grievance is being treated as non-actionable due to the following reason(s):

If you have a copy of joint declaration please provide us to correct your name along with aadhar, pan etc.

Therefore, we are closing your grievance from this office.Please quote the same in your future correspondence.

Shilpi-Then approach your employer and create a joint declaration for name change and let employer send it to EPFO.

Hello Sir,

I have two PF accounts linked under single UAN. Company As PF & Company Bs PF.

I was unemployed since more than a year. While I was working I didn’t apply for transfer of PF. Since I’m out of both the companies I’m not eligible for transfer as suggested by EPFO office.

In UAN database the employer of Company B has approved my aadhar, pan and bank details.

I got the PF of company B but didn’t get the PF of company A.

My question is, recently I have made changes in my pan and aadhar by expanding my surname.

Now, how will I get the PF of Company A? Because the HR of Company A is saying she won’t process the PF offline only online mode.

Can the update of my new aadhar and Pan in UAN be made by the Company A?

Please suggest me.

Glory-Better to raise an issue with EPFO Grievance Cell Online.

Hi Sir,

I have worked in two companies. I am having two UAN number. How to close my PF and withdraw my PF amount from the first company. In EPFO office, they are saying that I have to go to my employer’s office to get the employers signature. I am confused as How to proceed

I am also not able to view my balance in online portal. It is saying me to contact the employer.

Sathivelan-Follow what EPFO officials told.

I have resigned my job on Dec’17.But employer still not authorized my AADHAAR against my UAN Number. How to claim my pf final settlement

I am 9 years working in same company.5 months ago I have take loan in my of balance.

BY R.SHANKAR

Shankar-Why not go to concerned regional EPFO and try to link the same?

Employee Share – 41,196.00

Employer Share – 12,587.00

Pension Contribution – 26,286

Total – 80069.00

How much PF advance Can I withdraw, Because it is giving only option of Form 31 in online transfer

Imran-You want an advance, withdrawal or transfer? For your information, if you are in job, then you can’t withdraw it.

Actually I am applying for the advance without my Employer, I am not in job but company have relieved me yet.

Imran-Advance for what purpose?

if you are currently working then you can apply for only advance as you want and if you have leave the work you can go to your employer and ask them to approve DOE (date of exit) after it you can withdraw your full amount of pf money.

you just need to link aadhar with UAN

bank paasbook link

Pan card link.

Sir

my pf claim settlement is done Amount credited in my account but 10% deduct by bank I was also inclosed the form 15 g, so sir how can I refund the amount pls suggest me

Vishal-By filing IT return, if your income is below that tax slab, then can refund it.

Hello sir I planned to claim online but in my account bank details is not linked after that I submitted details but it’s showing be approved by establishment . Waiting for KYC approve. So it ll automatically approved r else I want to send any mail to my old company to . So kindly do me favor regarding this. Thank you

Gladson-Let them approve, then go for withdrawal.

They will automatically update ah sir?

Gladson-If not happen within few more days, then raise an issue with EPFO Grievance Cell Online.

Ok sir thank u .

Hello sir another doubt. My sister claimed through offline on 5th Feb 2018 now it’s showing under process so how many days it will take time to credit in her account.

Gladson-Hard to say.

Ok sir but my colleague told that it ll take max 15- 20 days.

Gladson-If there are no issues then it will usually takes that much time.

Ok sir once she got credited ll ping u sir. Thanks for u info very useful

Hello sir my bank details updated . While claiming it’s showing only form 31 and DOE is empty and showing advance claim coloumn alone. So what’s the issue sir . Kindly help me regarding in this

Gladson-Because date of exit not entered by your employer.

But I applied for that form 30 sir. For advance. Once my employer approved date of ending shall I get my remaining amount? Totally got confused sir. Pls help me

Gladson-Raise an issue with EPFO Grievance Cell Online.

Sir i am resigned my job on sep 2016

Joined another company on 1 st October i have submitted my UAN to my new company but but the have not continue the UAN newly created another UAN i have noticed now only so i have to close the old pf I show my pass book my contribution rs: 96000 employer contribution rs:96000 how much i will get how to get the amount

Senthil-Better to merge both UAN by requesting EPFO through your current employer.

Hi,

I have updated my bank account number with ifsc in

https://unifiedportal-mem.epfindia.gov.in/memberinterface/

since ten days it is showing as – KYC Pending for Approval from employer end.

Please suggest me- Is there any option to update bank account details without Employer involvement for online pf withdrawal.

Manohar-Why not you contact employer?

with genuine process through my employer (private school), i got pf amount 3months less for 5 year service. but now i came to know that my remaining balance in my account,how it happened, employer not aware? how to withdrw the same do i meet my employer for kyc or directly i can go with zonal office please reply

Saradha-Better to go through employer.

HELLO SIR MY COMPANY HAD NOT UPDATED MY PAN ADHAR AND BANK ACCOUNT AND DER NOT EVEN SIGNING ON MY FORM WAT I MUST DO

Natraj-Better to raise an issue with EPFO Grievance Cell Online.

Sir , mere father ki death hue 6 months ho chuke h Jo ki ek company me Kam krte the unki Umar 62 year thi kya m unke pf k liye apply kr skta hu or kya unki edli k pse BHI mile ge or death case me apply k liye kya documents lagenge

Vinod-You can apply for his EPF and EDLI.

Documents kya lagenge sir

Vinod-Contact the concerned EPFO.

Ok thanks sir

Hi,

I have met all the conditions like updating Aadhar, PAN and Bank Acc. I have them approved by the employer however on the page when I try to claim PF I only get the option Form 31 which is PF Advance. Would you be kind enough to guide me? I want to withdraw the full amount of my PF.

Ripul

Ripul-Hard to say of what went wrong. Better to try after some time or raise an issue with EPFO Grievance Cell Online.

Dear sir,

my employer is not co operate for enter the date of exit at my uan portal so sir how I can withdrawal my pf

Vishal-Raise an issue with EPFO Grievance Cell Online.

IS it ok if adhar and bank details verified by employer and date of exit not updated

can I submit the form in epf office directly

Sachin-Sadly date of exit is mandatory.

I want to withdraw partially online. But OTP is not created as it says mobile not verified. My mobile no is already registered.So what does it mean?

Please guide

Supriya-I think it is some technical glitch. Either try afterwards else raise an issue with EPFO Grievance Cell.

Hi sir, I have joined my current company in Dec 4th,2017 but left my previous job in Dec 6th ,2017 because i was having leave balances..do i face any difficulties while withdrawing my pf? because the dates are conflict..Pls advice me

Selvalakshmi-It may as the date of exit should be before the date of new company joining date.

My previous employer haven’t yet update the exit date in my uan login..Can I ask my employer to update the daye before Dec 4th

Selvalakshmi-YES.

Thank you for your help

Hi ,

I got my UAN activated and Kyc Approved But DOE is not mentioned by Employer ,

my Previous Employer is closed down all the Local Offices,

I am not able to withdraw my EPF and Pension coz got only form 31 option in online withdrawal option.

i did job around 9 months please can you suggest what should i do for my money.

Please help.

Jay-Approach EPFO Grievance Cell Online.

I did create the grievance but they ask for some bank latter attestation for the company closer and ask to send them psychically.

I am at Ahmedabad and my registered EPFOHO is vashi.

Jay-Then no option but to follow the process.

Hi,

I want to know that if i want t withdraw my PF amount and unable to approach my previous employer and also bank account is not approved by him.

Kindly suggest me the alternate way out.

Anupam-Refer above post. Regarding KYC pending issue, approach the concerned EPFO.

Thanks a ton Basu.

But if My Previous Employer A does not get my DOE EPF and DOE EPS updated in the EPFO system and, I opt to follow the manual PF withdrawal process through my Current Employer B then I hope it should work.

Once again thanks for all your help

Regards

NP

NP-It MAY.

Hi Basu,

My employment with Employer A was terminated due to business reasons beyond my control on 15-March-2018. On this date my PF is falling short of 1 month to complete 5 years of continuous service. On 20-March-2018, I am going to join Employer B and can opt out of PF.

A) Can I withdraw my full PF held with employer A post two months from my last working day

B) Will my employment with employer B where I am going to opt out of PF will have any implication on my PF withdrawal

c) Will my PF be taxable?

I would appreciate your inputs

Regards

NP

Nitin-A) YES.

2) NO.

3) After 5 years completion, it will be tax-free.

Thanks Basu.

For Question 3) you mean although my PF with Employer A is falling short of 1 month of continuous service of 5 years, if I withdraw it after 2 months from my last working day with Employer A, the PF will be non taxable.

Please confirm.

NP

Nitin-Yes.

OK Thanks. Just one more question Basu.

If my new Employer B opens a New PF account and I don’t transfer my PF from Employer A to B.

A) In this case, Can I still withdraw PF from Employer A after 2 months of my last day with Employer A taking into account that my PF with Employer A was falling short of 1 month for continuous service of 5 years and my employment was terminated by Employer A due to business reasons beyond my control.

B) Will my PF be still non taxable in this case

Many thanks in advance. Appreciate your help.

Regards

NP

Nitin-1) If UAN is same, then it is not allowed to withdraw.

2) YES.

Thanks Basu.

So in summary – My PF with Employer A (who has terminated my employment) although falling short of 1 month for 5 year continuous service can be withdrawn after 2 months from last working day (15-March).

Although I opt out of PF in case of my next employer B, I am going to be employed and salaried starting 20-March.

Do you think even in that case I will be able to withdraw full PF from Employer A after 2 months from last working day with Employer A

and will it be still non taxable.

You advice would really help.Thanks in advance

NP

Nitin-I already replied.

Hi Basu,

Thanks for all your guidance so far. Just quick question before I proceed with my PF withdrawal. As mentioned earlier, my Company B had terminated my employment and at the end of my last day I am falling short of 1 month for 5 year continuous employment.

In the EPFO system, before I apply for PF withdrawal online,

A) Is it mandatory to have my company B to mention ‘Reason for Leaving’ as ‘Employment Terminated’ in the EPFO system

B) As the company B has stopped contributing to my PF post my last working day. I hope this would let the EPFO office know that I had left Company B. Is it still mandatory to have my company B to mention ‘Date of Leaving’ in the EPFO system.

C) Lastly, if my Company B does not get the above mentioned data filled in the EPFO system, Can I still withdraw my PF.

D) Alternately, should I get the PF form signed by PSU Bank Manager and apply manually for PF withdrawal? Would that be a better option?

Please advise.

Regards,

NP

NP-A) NO.

B) Yes, mentioning date of leaving is mandatory.

C) Yes, you can do so.

Hi Basu,

All the required data in terms of my Aadhaar, PAN and Bank Account has been set up and approved in EPFO portal. Before I proceed to confirm my PF and EPS withdrawal online, I need your help

Quick recap of my case for reference as follows.

I had worked with Company A and then joined Company B. My employment in Company B was terminated due to business reasons beyond my reach. Company A and B have entered the respective DOJ and DOE of my PF and EPS in EPFO database. I had also transferred my PF and EPS from Company A to Company B and both the PF accounts falls under the same and unique UAN assigned to me. However, my continuous service of Company A and Company B is falling short of 1 month to complete 5 years of continuous service.

Now I had joined Company C almost immediately after last day at Company B. The Company C falls under employee provident act but I was allowed to opt out of the PF and I did so. Thus, no EPFO account maintained for Company C.

Further progress as follows:

I had recently logged in my EPFO account and my Company B has put the Reason of Leaving as ‘CESSATION (SHORT SERVICE)’.

I tried to select ‘CLAIM 31, 19&10C’ option to withdraw my PF by verifying my Bank Account. I was able to proceed further and select the option ‘PF AND PENSION WITHDRAWAL (FORM – 19&10C)’ and it gives me a message ‘ELIGIBLE FOR PF AND PENSION WITHDRAWAL’. I have moved further and keyed in other details such as residential address and got the OTP generated via Aadhaar to confirm the claim. However, I had not proceed further because I do not know how the Tax will be deducted.

Could you help me with the following questions?

1. Although my continuous service with Company A and B is falling short of 5 years and post that I am employed by Company C where I had opted not to maintain PF, I am eligible to withdraw my PF and EPS. Hope this understanding is correct.

2. Since my employment in Company B was terminated due to business reasons beyond my reach, the PF and EPS amount will be Tax Free. Hope this understanding too is correct.

3. While doing online withdrawal, once I enter the OTP and my claim gets submitted, is PF authority going to deduct any Tax at Source? If so, how much %?

4. I am not able to see any option on the online procedure to mention that my employment in Company B was terminated due to business reasons beyond my reach as we see on the manual form. In this case, how PF authority will understand that that my employment was terminated?

5. Having understood my case, should I go online for PF and EPS withdrawal or should I go for manual where I had seen the option for the withdrawal reason as ‘employment termination due to the cause beyond the control of the member’ ?

My sincere thanks for all your support and help so far.

Regards

NP

Dear Nitin,

1) Legally if you are into job, then you are not allowed to withdraw EPF and EPS.

2) Your employment termination is in no way related to taxation.

3) Refer my post “EPF Withdrawal Taxation-New TDS (Tax Deducted at Source) Rules“.

4) It is no way related and hence no such option.

5) Refer my answer to your first question.

My account is set on EPFO site. Adhaar and PAN are approved by my previous Employer A and their ‘‘Online Verification Status’ is ‘Verified by UIDAI’ and ‘Verified by ITD’ respectively.

a) Hope this should be fine although Adhaar and PAN are approved by my previous Employer A around 2 months ago and not by my Current Employer B

My Bank Accounts too were approved by my previous Employer A around 2 months ago and their ‘Online Verification Status’ is reflected as ‘N/A’

b) Hope this too should be fine.

c) What does ‘N/A’ means? Is it ‘Not Applicable’ meaning ‘Online Verification Status’ is Not Applicable (Not Required) for Bank Account data?

Further, in my Employment History, Dates of Joining (DOJ EPF and DOJ EPS) are available for my previous Employer A, but Date of Exit (DOE EPF and DOE EPS) are not available for Employer A

Dates of Joining (DOJ EPF and DOJ EPS) are available for my Current Employer B

I got my PF transferred from Employer A to B through manual process and the transfer is successfully reflected in PF passbook for Employer B

d) Do I need to get Date of Exit (DOE EPF and DOE EPS) updated for my previous Employer A explicitly?

If that is not done, will it affect my PF withdrawal process as I formally leave my current Employer B on 15-March-2018 and, DOE EPF & DOE EPS (which in this case will be 15-March-2018) gets updates by my current Employer B

Apologies for a bit long query but would truly appreciate your response

Regards

NP

NP-a) and b) YES.

c) Yes not applicable as it is verified by your employer.

d) YES.

Hi Basu,

Your blog on EPFO withdrawal is very helpful. Thanks.

I had worked with company A starting 15-April-2013 and left it on 13-Feb-2016.I had joined new Company B on 15-Feb-2016. I got my PF transferred from Company A to B. I was about to complete my 5 years of continuous service by 15-April-2018 but my service got terminated in Jan-2018 and my last working day with Company B is 15-March-2018. I am falling short of 1 month to complete my 5 years of continuous service.

My questions are as follows,

a) Can I withdraw my full PF after my Last Working Day of 15-March-2018 (even I am falling short of 1 month to complete my 5 years of continuous service.) since my service was terminated due to business reasons beyond my control,

b) Would my PF be taxable in my situation explained above

c) Do I need to wait for 2 months post my last working day of 15-March-2018 for PF withdrawal.

Thanks

NP

NP-a) YES.

b) NO.

c) Better to wait for two months and then apply as it is the rule to prove that you are unemployed.

Dear Basu,

I truly appreciate your quick response.

Thanks for your help.

Regards

NP

Hello Sir,

I am currently employed with PWC for last 9 months but I want to withdraw my PF amount of previous employers that is HSBC and Accenture. For HSBC I have same UAN which is used by current employer however I have not transferred the account and second for Accenture I do not have UAN number I have only my PF number, I have already activated my UAN number which belongs to both my current employer and HSBC and currently it is showing kyc pending by PWC.Am I doing correct or please guide me that I can withdraw PF balance of both employer that is HSBC and Accenture….Thanks

Gunjan-You are not allowed to withdraw. Instead, you have to transfer all past accounts to current one.

Hi Sir,

I have submitted form 13 to my present employer which they submitted to RPFO pune on 10-oct17.

Under present employer member id

Claim type : form 13(transfer in/same office)

status : status is not available

Do I need to contact my previous employer or I have to wait further.

Kindly advice

Hamed-Better to approach previous employer immediately.

Just now my previous employer have confirmed that the transfer out has been processed from their end.

They have provided me with annexure also and date of full and final settlement is 3 oct’17.

Transfer to account is my present member id.

Please advice.

Hamed-Then now raise an issue with EPFO Grievance Cell Online.

Thanks for your help Basavaraj.

I really appreciate your quick response.

Dear Sir,

While going for online withdrawal. I am seeing below options for claim processing. My total amount is over 50000 inc EPS.

A). ONLY PF WITHDRAWAL(FORM 19)

B). ONLY PENSION WITHDRAWAL(FORM 10C)

Now I have some questions:

1. If I go for option A, I assume I will get amount minus EPS(In this case it will be below 50K, So will this amount be taxable).

2. What if I go for option A and after this financial year ends. Can I withdraw EPS amount again as online.

3. Why I am not seeing FULL PF WITHDRAWAL option. Although my KYC has been done by employer already.

Sir request you to respond asap. I need to apply the claim today itself.

Thanks in anticipation.

Ajay-If your EPF account is less than 5 years, then it will be taxable for you. It does not matter whether you withdraw EPF or EPS. If you are still in job, then you will not able to withdraw.

Dear Sir,

I left company A (Trust based) in 2014.I joined company B and got the EPF transferred of A to B through online mode.Later i left company B also and applied for EPF and EPS withdrawal.The amount got credited in my account in two transactions.1st transaction comprises of total of EPF from company A and B(aound 69251 which is total of EPFs of both company).About 2nd transaction, i am not sure(12384),may comprise of EPS of company B and interest).

I thought that i have got all my EPF and EPS,but recently i recalculated and found that i should have received around 104000 but received only 81635(including interest may be).This gap of around 26000 ,i have not received.I suspect that it is the EPS from company A which may not have been transferred to company B.

Pls guide with your expertise if i need to claim this amount of 26000.And how can i claim.

Company A

EPF Employee 38,886 Received

EPF Employer 11,900 Received

EPS 26,986 Not received may be

Company B

EPF employee 14142 Received

EPF employer 4323 Received

EPS 7419 Received may be

Amount received

69251

12384

Thanks

BR//

Birendra Bhardwaj

Birendra-In case of EPS, if your service is less than 10 years, then you will get a partial amount based on how old your EPS is (As per Table D). Hence, I don’t think there is any mismatch. Also, do remember one thing that your EPS will never earn a single rupee of return. They just keep that amount with them.

Thanks for early reply.

Dear Sir,

I want to withdraw the PF due to medical reasons at family. I am still working in the same company and no plans of leaving the current job. I have completed 5yrs in same company.

I am able to login to EPFO website and I can avail Online Services as my Employer has updated/verified the details like Aadhar/Bank details/other KYC documents. Once I click on Claim form under online services, I get Form 31 as drop down and I don’t how to proceed further.

Please let know how to proceed further and how much maximum amount I can withdraw and do I need to have any supporting documents

Below are my details:-

Employee Share: 55838

Employer Share: 1723

Pension: 33361

Basic Pay (Excluding other components) : 8190

Abdul-Refer my post “EPF Withdrawal or Advance for Medical Expenses“.

Hi Sir,

I left my previous job in Oct 2016 and had not withdrawn my PF due to some name mismatch in UAN which is corrected now. I am jobless and want to withdraw my full PF. I assume it to be around 55K(Including EPS as well).