During this falling interest rate, we all look at better alternatives than Bank FDs. The choice is debt mutual funds. But many of us don’t know how to select the Top and Best Debt Mutual Funds in India for 2017. Let us discuss this and shortlist the funds.

Before proceeding further, let us understand the basics of investment. I am repeating this again and again for the benefits of all investors. I repeated this in my earlier post of “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

You must have a proper Financial Goal

I noticed that many of investors simply invest in mutual funds just they have some surplus money. The second reason may be someone guided that mutual funds are best in long run compared to Bank FDs, PPF, RDs, or even LIC endowment product.

If you have clarity like why you are investing, when you need money and how much you need money at that time, then you will get the better clarity in selecting the product. Hence, first identify your financial goals.

You must know the current cost of that particular goal. Along with that, you must also know the inflation rate associated with that particular goal. Remember that each financial goal to have it’s own inflation rate. For example, education or marriage cost of your kid’s is different inflation that the inflation rate of household expenses.

By identifying the current cost, time horizon and inflation rate of that particular goal, you can easily find out the future cost of that goal. This future cost of the goal is your target amount.

Asset Allocation is MUST

Next step is to identify the asset allocation. Whether it is short term goal or long term goal, the proper asset allocation between debt and equity is a must. I personally prefer the below asset allocation. Remember that it may differ from individual to individual. However, the basic idea of asset allocation is to protect your money and smoothly sail to reach the financial goals.

If the goal is below 5 years-Don’t touch equity product. Use the debt products of your choice like FDs, RDs or Debt Funds.

If the goal is 5 years to 10 years-Allocate debt:equity in the ratio of 40:60.

If the goal is more than 10 years-Allocate debt:equity in the ratio of 30:70.

While choosing debt product, make sure that the maturity period of the product must match your financial goals. For example, PPF is best debt product. However, it must match your financial goals. If the PPF maturity period is 13 years and your goal is 10 years, then you will fall short of meeting your financial goals.

Return Expectation

Next and the biggest step is the return expectation from each asset class. For equity, you can expect around 10% to 12% return. For debt, you can expect around 7% return expectation.

When your expectations are defined, then there is less probability of deviating or taking knee-jerk reactions to the volatility.

Portfolio Return Expectation

Once you understand how much is your return expectation from each asset class, then the next step is to identify the return expectation from the portfolio.

Let us say you defined the asset allocation of debt:equity as 30:70. Return expectation from debt is 7% and equity is 10%, then the overall portfolio return expectation is as below.

(70% x 10%) + (30% x 7%)=9.1%.

How much to invest?

Once the goals are defined with target amount, asset allocations is done, return expectation from each asset class is defined, then the final step is to identify the amount to invest each month.

There are two ways to do. One is constant monthly SIP throughout the goal period. Second is increasing some fixed % each year up to the goal period. Decide which suits best to you.

Hope the above information will give you clarity before jumping into equity mutual fund products.

How many mutual funds are enough?

How many mutual funds do we have? Is it 1, 3, 5 or more than 5? The answer is simple…you don’t need more than 3-4 funds for investing in mutual funds. Whether your investment is Rs.1,000 a month or Rs.1 lakh a month. With the maximum of 3-4 funds, you can easily create a diversified equity portfolio.

Having more fund does not give you enough diversification. Instead, in many cases, it may create you portfolio overlapping and leads to underperformance.

Now let us move to the selection of mutual funds.

Points to understand before investing in Debt Mutual Funds

Credit Risk-

Debt Mutual Funds invest in treasury bills, government securities, Certificate of Deposits (CDs), Commercial Papers (CPs), bonds, money market instruments and many more. The credit quality of these underlying instruments are measured in terms of ratings.

Usually higher the ratings leads to lower the return or risk. It is a misconception among many that credit risk refers to risk of default by the bond issuing entity. However, the truth is something different.

There is a possibility that the credit rating of a bond or instrument the fund is holding may change at any point of time. Let us say ABC Debt Fund holding the bond of XYZ which is rated as AAA by credit rating agencies (highest rating).

It does not mean that this rating is permanent. It may change at any point of time if the company XYZ’s finance changes.

Hence, never be in a misconception that credit rating refers to default risk and also credit rating of bond will NEVER CHANGE.

Modified Duration-

It is a measurement of a bond’s sensitivity to movements in interest rates. It is usually measured in years. For example, if debt mutual fund with the modified duration of 3.1% means if there is a 1% interest rate movement then the fund will undergo the movement of 3.1%.

Hence, higher the modified duration means higher the interest rate risk.

Average Maturity-

A debt fund portfolio usually consists of a number of bonds where each could have a different maturity date. Maturity is the time period remaining before which a bond comes up for repayment by the issuer. Average maturity is simply the weighted average time left up to the maturity of the various bonds in a portfolio.

Higher the average maturity greater the interest rate risk of debt fund.

Exit Load-

Some category of funds will charge you exit load. Hence, you have to be careful while selecting the funds and the conditions apply regarding the load structure.

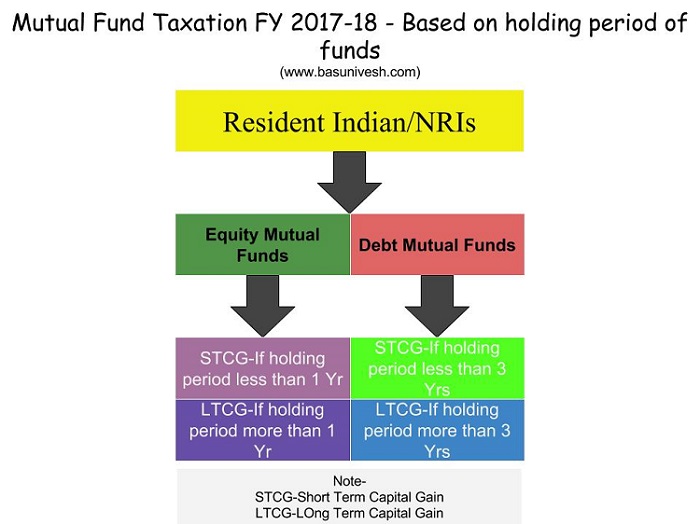

Taxation-

Remember that all debt funds are taxed differently than the equity funds. Hence, you must understand the taxation part as well before jumping into debt fund investment. I tried to explain the same in below image.

The rate of taxation is as below for the current FY.

Hope taxation part is clear to all of you. If you still have doubt, then refer my latest post “Mutual Fund Taxation FY 2017-18 and Capital Gain Tax Rates“.

How I selected Top and Best Debt Mutual Funds in India for 2017?

My first priority should be safety and less volatility. We look for debt funds first to diversify our asset and second to have sufficient non-volatile asset class.

Hence, considering these two points I am going to select. The main criteria in my mind is lower the credit risk, modified duration, and average maturity.

Those who want to time the interest rate movements or taking advantage of RISK by investing in corporate debt funds or other volatile risk funds can do so. I selected few funds for them too.

Again I am pointing here that the funds I selected are not final and BEST. These funds are selected based on my own assumptions. It does not mean that they must be BEST for you also.

Top and Best Debt Mutual Funds in India for 2017

I already covered the listing of best liquid funds in my earlier post. Refer the same at “Top 5 Best Liquid Mutual Funds in India in 2017“.

Here are the funds which I selected as Top and Best Debt Mutual Funds in India for 2017.

Top and Best Debt Mutual Funds in India for 2017 -Ultra Short Term Debt Mutual Funds

Ultra Short Term Debt Funds are safest after liquid funds. Usually, these funds invest in instruments which mature from 3 months to the maximum of 3 years. But I found that many Ultra Short Term Debt Funds invest in less than a year average maturity instruments.

Below are my top and best Ultra Short Term Debt Mutual Funds.

I selected these two funds among the list. The criteria involved is 3 years and 5 years return ranking. Along with that, the credit quality instruments the funds invested.

I also selected the fund which not goes beyond 2 years average maturity nor less than a year.

Top and Best Debt Mutual Funds in India for 2017 -Short Term Debt Mutual Funds

These are the next level of debt funds. Usually, short-term debt funds invest in the instruments which mature from 6 months to 6 years. Hence, they are riskier than liquid and ultra short-term debt funds.

Below are my top and best short-term debt mutual funds to invest in India in 2017.

I selected Birla Fund mainly because of its credit quality, consistency since 5 years and the moderate risk. Same way, I selected Escorts Fund for the reason of quality of the fund and consistency in return.

Top and Best Debt Mutual Funds in India for 2017 -Gilt Short Term Mutual Funds

These are the funds which invest in Government of India Bonds which mature from 2 years to 5 years. There are very fewer funds in this category. But I prefer these are best funds over the Short Term Debt Mutual Funds. Because the credit risk and credit ranking risk is not there in such funds.

You noticed the returns of these funds with above shared short-term debt funds. With same interest rate risk (modified duration) and average maturity, the returns are spectacular. Then why not think about such funds where risk is minimal and returns are best?

Top and Best Debt Mutual Funds in India for 2017 -Income Mutual Funds

Income funds invest in corporate bonds, government bonds, and money market instruments. However, they carry the highest risk to the changes in interest rates and are suitable for investors who have the higher risk-taking ability. Entry and exit from these funds

Usually, those who track interest rate movements will try to invest in such funds. Personally, I avoid such funds as I want peace of mind not interested in tracking news items. The CORRECT time to invest in these funds is when the market view is that interest rates have touched their peak and are poised to reduce. I am neither aware of those who time the interest rate movements CORRECTLY nor bother to such time-based investment.

The average maturity of such funds ranges from few months to around 17 years. Hence, be cautious while selecting such funds.

Still, I am listing the funds by scrutinizing the minimal risk basis.

Here, I tried to balance between credit rating, modified duration, and average maturity. The decision was tough but I did my best.

Top and Best Debt Mutual Funds in India for 2017 -Gilt Medium and Long Term Funds

These funds primarily invest in medium to long term Government Bonds. Hence, default risk and credit rating risk is minimal. However, considering their longest average maturity values, these funds prone to highest interest rate volatility.

Just notice the modified duration and the average maturity with respect to returns such funds generated due to falling interest rate. Hence, now may be the better time. But I am not suggesting such funds for the investors who unable to track interest rate movements.

Top and Best Debt Mutual Funds in India for 2017 -Dynamic Bond Funds

Dynamic Bond Funds invest in debt securities of different maturity profiles. These funds are actively managed and the portfolio varies dynamically according to the interest rate view of the fund managers. These funds Invest across all classes of debt and money market instruments with no cap or floor on maturity, duration or instrument type concentration.

Considering the nature of the fund, it is hard for an individual to track which debt securities the fund is holding. However, as the fund is actively managed, you may assume the next interest rate trend.

As currently, the trend is falling interest rate, these funds holding long-term debt securities.

Top and Best Debt Mutual Funds in India for 2017 -Credit Opportunities Fund

They are Debt Mutual Funds. Credit opportunities funds adopt the accrual strategy to provide the better return. They take the credit risk for the sake of generating high yield. Usually, they invest in low credit rated funds like less than or equal to “AA” rated. Lower the credit rate leads to higher the return.

Refer the full details about such funds in my earlier post at “What are Credit Opportunities Funds?“.

You notice the change in credit rating from earlier funds of AAA to AA. Rest you decide whether you need such funds or not.

Myths about Debt Mutual Funds-

# Debt Mutual Funds are SAFE

It is the misconception among many of us that Debt Mutual Funds are safe and we treat these products like Bank FDs or PPF. But in reality, you check above fund categories and notice how the modified duration and average maturity change from Ultra Short Term Debt Fund to Long Term Gilt Fund or Credit Opportunities Funds.

Along with interest rate volatility, the risk of credit rate downgrade or default is always there. Hence, I purpose selected AAA rated funds for my selection.

# We must match our goal with average maturity of the fund

This is one more myth. Because the experts who recommend it feel debt funds are SAFE. However, these funds also carry the variety of risks. Hence, if your goal is 5 years, then the average maturity must be around 1-2 years of a fund.

Reson behind this is if the NAV falls due to any risk involved in the fund it may get time to bounce back.

# Timing the interest rate movements

It is hard for common man to track the interest rate movements and investing based on the call. Hence, never do such things. Instead, the priority should be to reach your financial goal safely.

# Credit Rating is constant

Few believe that if currently the bond instrument is rated as AAA, it will remain same forever. It is not like that. Based on the financial health of bond, the rating may change. Hence, never be in wrong belief that ratings are constant.

Hope this much information is enough to understand how debt mutual fund works. My main intention is to educate about debt funds rather than providing you readymade tips of funds.I purposely avoided FMP as they are closed ended in nature. I also avoided debt-oriented balanced fund as I felt they are not necessary when we can actively manage debt and equity separately.

Refer my earlier posts related to Mutual Fund Investment in 2017-18

Hello Sir,

I am planning to invest 6000 per month for another 10 to 15 years for my child’s education purpose, please suggest me some good plans where I can rely upon, to make it clear I want to let you know that I already have an ongoing PPF. Though I have come to know about SBI smart scholar and HDFC sampooran nivesh but I am unable to decide any and also unaware of these funds performance, my knowledge is very much limited on how these works, so not necessarily I have to invest on these type of child plans, rather I need to know what would be best options or plans or mutual funds which will give me good return after 10 years, please suggest me some. Thank you.

Rishi-Use debt and equity mutual funds with proper asset allocation and start invest. If your knowledge is limited, then take the help of an adviser of your choice.

My age is 57.i will retire in 32 months.So planning to invest 35lacs in debt funds under Ultra short term debt fund category as a lumpsum for less than 3 years. So can I expect capital protection for sure??? and returns 7-8% ??? Since I read ultra short term debt comes with lowest risk in debt funds…is my 35 lacs safe right???also they said birla sunlife floating rate is good in ultra short term debt fund category…so please advise for above questions, mainly 35 lac capital protection and returns at least 7-8%. My wife is a home maker so I put some fixed deposits of another 40 lac on her name..but since she does not have income as she is a housewife, and I heard debt funds less than 3 years has tax based on tax slab…so since my wife is not earning and only having 40 lacs fixed deposit..if I invest in debt mutual fund in ultra short term category on her name, tax will not be deducted right???

Prakasa-Safety depends on in which fund you invest. Also, it depends on your monitoring. NOTHING IS SAFE IN THIS WORLD. Also, I expect around 6% to 7% returns from such funds. Regarding investing in your wife’s name, this is best idea.

So i want to Choose BILRA SUNLIFE FLOATING RATE FUND LONG TERM with Lumpsum of 35 Lacs?

Is this a good fund? or any better funds available in Ultra debt fund category better than BILRA SUNLIFE FLOATING RATE FUND LONG TERM??

Also If i invest in my wife name there will be no tax right since she is a housewife and only has bank fixed deposits on her of 40 lacs approx.

Prakasa-My choices are listed above. Do you think by simply investing your money into wife’s name (as she is non working) makes you to skip the tax? Due to clubbing provisions, it will be taxed on your head.

What are your ultra short term debt fund recommendations for 2018?

Vignesh-Wait for few more days.

Hi basavaraj,

My parents retire in 2 and half years. Our family survives only one 1CR corpus which comes as PF .so my goal are to meet monthly expenses of 50k .So we are planning to do SWP of 1lakh per month from lumpsum 1CR ultra short term debt fund and reinvest remaining 50kin equity for children marriage, studies which has goal for 20 years .So can I invest this corpus 1CR as lumpsum in ultra short term debt fund for 10-30 years and do a monthly SWP of 1lakh per month??

Satya-I am not sure about your plan due to limited sharing. Also, I am not sure about the SWP or entry into equity. However, YES you can do the lump sum in Ultra Short Term Debt Fund and can do the SWP.

Which investment I should do for child education

My gole is 1cr by 2029

Which sip will be better?

Prasanna-Refer the post completely. You will get answers.

Hello sir, i have 10 lac in fixed deposit planning to invest in ultra short term debt funds and from there i want start sip investment for my wealth and retirement. So my current age is 35 years please can you suggest me some good funds for investment.

Rahul-If goal is long term and you did proper asset allocation, then why not spread the same debt investment into equity for 5-6 months and enter?

Hi Basavarj,

I have currently approx. 6 Lac which was in FD earlier. As interest rates are very low now, I am planning to shift to equity/balanced funds. Currently market seems to be at its peak, I am planning to invest them in Debt Funds and then do STP of 50K per month to avoid the risk of timing market.

Please suggest some good debt funds for this.

Kalpit-Without knowing time horizon and the reasons for this investment, it is hard for me to guide.

Time horizon is 5 years. Goal is to create a down payment of a flat.

Though timeline is 5 years, I don’t want to keep amount for long duration(I e. More than 18 months) in Debt fund.

Kalpit-If your time horizon is JUST 5 years, I suggest you to stick to debt funds than equity funds.

Thanks Basavraj. Please suggest some good debt fund for this.

Kalpit-They are listed in above post.

Mr basav if i want to delete all my comments how to do that?

Kalprit-May I know the reason?

I dont want anybody check my personal information.

Kalprit-What your personal information is at stake here?

I want to start SIP of 2000 in debt fund.

My time horizon is 3-4 years and my goal is Car DP.

Please suggest me Good Debt Fund.

I am currently Investing 5500 in Equity Fund SIP and 4000 in Post office RD.

Thanks a lot

Vishal-Use Ultra Short Term Debt Funds from above list.

Is it good time to invest in SBI Dynamic Bond Fund? for a lump sum amount for > 5 years. As i do not want to invest in too highly priced equities. My goal is to get better returns than FD which are tax efficient.

Nitin-If your goal is more than 5 years away, then why you are worrying about equities? Do proper asset allocation and start investing. The best time to invest in equity is TODAY, if your goal is long term and you did proper asset allocation.

Hello!

I want to invest monthly SIP of 27000 across the following mutual funds. I am ok to have the money locked for 10-15 years, hence looking at a horizon of over 10 years. Risk preference is moderate. Is the following combination ok:

1) 9000 in ICICI prudential focused bluechip equity

2) 9000 in HDFC Balanced fund

3) 9000 in ICICI long term fund

Is it ok or should I go for a different permutation?

Thanks in advance and awaiting your valuable advice.

Regards,

SB

SB-First do the asset allocation before jumping into investment. Refer above post.

Since my time horizon exceeds 1 year, I am reorienting my debt SIP to 8100 instead of 9000. For this debt Investment is it ok to invest in 9000 in ICICI long term fund, which is a dynamically managed debt fund. I understand that it is risky to go for long term debt funds as it is more prone to volatility due to interest rate movements, more so since chances of interest rates falling significantly further is low currently. Please guide.

please read 1 year as 10 years, typo.

SB-Stick to short term or ultra short term debt funds.

sir,

what u suggest for this 3 ultra short term fund can we invest in these fund

1- Franklin India Ultra Short Bond Fund – Super Institutional Plan

2- Aditya Birla Sun Life Savings Fund

3- ICICI Prudential Flexible Income Plan

Jai-Refer my above post of how to select a debt funds. Then based on your risk appetite you can.

Hi Basu,

I am retired from govt job( 63 years) and get pension for my regular monthly expenses. Also have sufficient exposure ( 40L) to bank FDs/ Post office MIS etc. and 10 Lacs in ICICI Pru long term plan( invested 6 months ago).

I wish to invest 15 Lacs ( matured from a bank FD recently) in lumpsum in a debt fund/Liquid fund and start an SIP of 25K every month in a balanced fund.

No specific goal for the investment apart from getting a decent return in say 7-10 years horizon with a medium risk appetite.

Additionally, i also have 15K at my disposal every month saved from the monthly pension.

What would be your best advise for investment?

I am also not able to decide whether i should choose a liquid fund or debt fund to start an SIP.

Thanks and looking forward to your reply.

Regards, Raj

Raj-Use Ultra Short Term Debt Funds or Short Term Gilt Funds and for equity use one large cap. The asset allocation between debt and equity should be around 70:30. Better to avoid Balanced Funds.

I want to park 2 lacs for the next 15 to 20 years. I already have exposure to equity and I am contemplating debt funds. Which debt fund is suitable?

SB-Refer my above post and few comments.

Hi Basu,

Currently investing in follwoign fund in SIP, Want to increase the investment, I am thinking of HDFC balance fund.

Your suggestions please.

1. SBI BlueChip Fund-Reg(G) : 3000

2.Mirae Asset Emerging Bluechip-Reg(G) 1000

3.Aditya Birla SL Frontline Equity Fund(G) : 2000

4.HDFC Medium Term Opportunities Fund(G) 1400

5.HDFC Mid-Cap Opportunities Fund(G).1500

6.ICICPri Balanced Fund(G) 1500

7.Kotak Select Focus Fund(G) 1200

Amrendra-Without knowing much about your financial goals, how you selected, what asset allocation you are following and what prompted you to raise the doubts about your investment, it is hard for me to guide.

Hi Basu,

This investment is with a plan to invest for a period of 10 years. I am not in doubt about this investment as they are performing good. I need suggestion regarding If i need to increase investment say 2000-3000 more do I need to select other fund or in this funds which one to select.

Amrendra-First do the asset allocation as I explained above.

hello sir

is it good after retirement 12-15 lakh invest in senior citizen savings plan (post office) and itnerest gain amount invest in milti cap or balance fund though sip could u suggest if any change required i am planning this investment for my father

or if u have any better suggestion please suggest me

Jai-Why this exercise if he is looking for long term, then let him do the asset allocation and directly invest in debt and equity.

dear sir

vood morning

I agree with you but i fill post office senior citizen plan much safer then debt liquid fund so i need your advice i want two go with 2 SIP for 5 years

so can i select 1 Balance fund and 1 debt fund so please suggest which 2 fund better for sip

Jai-Is the Postal SCSS provide you the same liquidity like Liquid Funds? If your time horizon is 5 years, then don’t enter into equity. Use only debt products.

Thank you for your prompt rply then which debt fund sip should continue

gilt fund or dynamic bond fund where i can get 11-13? return

Jai-11% to 13% from debt funds??

may be its not possible in ddbt fund but in which ddbt fund is better sip for good return in 4-5 years can u please suggest me there are lot of debt fund anable to decide sip iwant sip 8000/-

Jai-Use either Ultra Short Term Debt Funds or Short Term Gilt Funds.

Dear Basu,Recently read somewhere that Gilt funds may not be there any more after new classification of sebi.Is it possible?

Bansal-Nothing like that. Gilt funds now come up with two categories. One with 80% investing in GSEC across different maturity and another one with 10 years maturity.

Dear sir

You always suggest short term Gilt funds for debt short term but i found that Gilt fund return not good as compare Ultra short term Short term what is your opinion on dynamic bond fund.

Jai-Yes, long term gilt funds returns are good compare to short term. But RISK and volatility is also HIGH. We look for debt fund to reduce our volatility which is already there in equity.

Hi Basu,

Your suggestion needed.

Amount needed: Rs 12000/- every year by September

Amount be withdrawn every year in October

Which MF should I invest?

Awaiting for your reply.

Sir, I am a senior citizen, I want to invest Rs. 3 lac for more than 5 years. Please advise where to invest? Give name of fund

Bhardwaj-More than 5 years MEANS?

Up to 10 years

Bhardwaj-Then refer above post properly.

Dear Sir , I need some financial advice from you .Please share your email id

Manish-My email id is [email protected]

Dear Basuji, for SIP distribution amongst funds, how much overlapping is proper?

Pratap-There is no such hard rule. Follow my earlier post “How to compare Mutual Fund portfolio overlap?“.

Sir , I’ve planned to invest Rs.8000 pm through SIP, in which I’ve already started Rs.2000 sip in reliance small caps fund for at least next 10 years.

Please suggest some other funds for Rs.6000 SIP for next 5 yrs for investment as well as tax saving.

Mrina-Refer above post properly. Also, if your time horizon is less than 5 years, then better to stick to debt funds than equity funds.

Basuji, I want start SIP of 3000 for period of 10 yrs in large cap fund. Which is good, SBI blue chip or Kotak select focus?

Pratap-May be SBI.

Hi Basu,

I want to invest 50000 for a period of 10 year or above. Which fund to select ?

Amarendra-Funds are already listed. Do the asset allocation as I shared above and start investing.

Hi Basu,

First of all, Thank u for your valuable guidance. God bless you.

I am 38 yrs, Goal at 3 to 5 yrs. Planning for debt invest as lump sum. I have two queries.

1. ESAF bank promises FD returns at 9%. Is there any credit risk?

2. I have already SIP running in US term debt and Short term gilt, so can I choose a short term debt fund?

Pappu-1) I am not aware of bank financials and hence it is hard for me to comment in this regard.

2) In my view better to stick to Ultra Short Term Debt Fund or Short Term Gilt Funds.

Hi Basvaraj,

I am 30 years old unmarried working professional.It was great reading your post.

I have invested in the following Mutual funds: DSP BR tax savings scheme-2k , Kotak select focus fund-4k and Mirae Asset Emerging Bluechip-3k keeping a time horizon for about 10 years from now.Apart from this I also have 3k per month investment in PPF. I can invest more up to 3k per month.Now wanted to check should I have to invest in any debt funds or balanced funds for a time horizon of 6 yrs from now? Please suggest

Vineet-If your time horizon is around 6 years, then your asset allocation must be 60:40 between debt and equity. For debt, you can use Ultra Short Term Fund or Short Term Gilt Fund. For Equity, one large cap fund is enough. Regarding your existing investment, I am not sure about your time horizon and hence unable to comment.

Hi Basu,

Yesterday, i have posted one query, but i could not see that here in the comments section. Any issue with the query as it seems it was stopped by the moderator?

Saurabh-I am not sure of that. But you can repost the same now.

Hi Basu, I have following query.

I am 30% tax bracket and since bank interest rates are very down these days, i have invested lumpsum amount in following debt fund:

BIRLA Sunlife MIP savings 5 – dividend payout.

I need your suggestions on this fund and the tenure until which i can hold. Personally, my objective is to stay invested for 3+ years.

Also, as per your article, it seems that gilt funds are the safest options as far as debt funds are concerned. It this is the case, it seems like if one is ready to take some risk and is looking for alternatives of FD’s, then gilt fund can be best choice. Please advise.

Saurabh-MIPs include some portion of equity. If your time horizon is 3 years or so, then stick to short term gilt or ultra short term debt funds.

Hey Basu can you tell a little about franklin india low duration fund. I have 2 lakh to invest in debt fund with a horizon of 4-5 years. Moreover I am confused about SBI SHORT TERM debt fund vs SBI Magnum Gilt fund short term. Can you please suggest in terms of relative safety for same duration as above

Robin-Franklin India Low Duration fund is short term fund. I suggest you to stick to short term gilt or ultra short term.

Hello,

First of all, I am little bit surprised that someone is helping out people for free. I really appreciate it.

I need your help in financial planning. I am 29 years old, unmarried, living in Mumbai. I am new in this investment world. 2 days back, I invested in 3 funds (as SIP), as mentioned below:

1. SBI Blue Chip (G) – Rs. 1500 (Equity)

2. L&T India Value Fund – Rs. 1100 (Equity)

3. Birla Sun Life Dynamic Bond – Rs. 1200 (Debt)

I am looking to invest more and as per my research till now, I have found following funds as good:

ICICI Pru Value Discovery Fund

Mirae Asset India Opportunities Fund

DSP BR Tax Saver Fund (G)

Kotak Select Focus (Regular Plan)

BNP Paribas Fund (G)

I can invest around Rs. 5-6k per month (SIP) more and risk appetite is above moderate. However, I don’t want to go entirely into high risk zone. Can you please suggest me funds?

Also, I have around Rs. 150k as saving for funds (I have enough saving for emergency purpose apart from this). Since, market is going down, should I wait for it dip more or invest right now? What will be the best funds to invest, if I bifurcate it as 3 parts each of Rs. 50k.

I have home loan pending for next 3 years, so tax saving is not a concern for next 3 years. I am planning for life after marriage, and after family size grows.

Keep the good working going.

Ankit-Without knowing much about your financial life it is hard for me to guide. Also, please read my post “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

Hi Basu for having 10+ year of goal which DEBT fund to choose , please advice

Shahnawaz-Short Term, Ultra Short Term or Short Term Gilt.

Hi Basu thanks for response since my goal is 10+years so the DEBT allocation which I have 30% , shall I invest all in one Debt fund or here also I have to distribute or shall I drop the idea of DEBT fund and deposit all this 30% to PPF or distribute between PPF and FUND

In addition please advice as I have choosen the fund SBI Ultra Short Term Debt Fund – Regular Plan (G) is this Ok or need to change

Shahnawaz-One debt fund enough. Why PPF when the tenure of it is 15 years but you are claiming your goal 10 years away? Please read above post properly and understand the procedure and risks involved. If you still feel that is OK by understanding the underlying portfolio, then go ahead.

Thanks ignoring the Tenure part , what is the best Debt product as per your feedback ?

Shahnawaz-Any investment depends on TENURE. NO product on this earth is BEST or WORST. Each product or asset has it’s own positives and negatives. What we select based on our requirement is BEST TO US. Hence, there is no such UNIVERSAL BEST DEBT PRODUCT.

sir,

Generally, most equity products are for long term, but debt products are preferred for short term. People tend to invest in EPF/PPF, NPS etc( by force or by choice) for long term debt portfolio. When it comes to intermediate and short duration, debt or debt oriented hybrid funds come into picture. There are various types of debt funds with variable returns which we can think of for 1-5/6 year targets.You have generally preferred short term/gilt short term/ultra short term for investment in such horizon. If we look at returns of all debt products over last 3-5 yrs, other products like gilt MT/LT, credit opp, dynamic, MIP debt oriented hybrid , long term bonds etc have given better retuns(apparently).

Considering the fact that interest rates have probably hit rock bottom, looking at various economic indicators,directions/hints we get from RBI outlook, credit rating agencies, can you please write an article on merits and demerits of each debt product, probable outlook over next few years, advise for fresh and existing investors. I know it is impossible to guess what will happen, but an educated guess may be!

Sreenivas-“products like gilt MT/LT, credit opp, dynamic, MIP debt oriented hybrid , long term bonds etc have given better retuns(apparently).”-But at what risk? What is the modified duration and what is the average maturity? Also, one not invest in debt only for short term purpose, but to diversify his portfolio.

Sure and thanks for your hint to write a post. Let me write on the same.

1.what is your view about debt oriented hybrid funds(aggressive/conservative) in general and also for investment horizon of <5years(after proper asset allocation)?

2. Do you suggest equity oriented hybrid funds for mid term(around 8yrs) time horizon of investment?

Suresh-1) Depends on need and the portfolio of the fund.

2) May be and depends on individual’s risk profile.

Which are the best Debt Fund and Balanced Funds to invest in as on today? I have a horizon of 3-4 years.

Also please take into account the tax burden while suggesting. Will balanced fund attract 20% long term capital gains tax?

Saurabh-Stick to Ultra Short Term Debt Funds. Regarding taxation, refer above post properly.

Why not Gilt short term debt funds. The returns on these, as shown in the article is much higher.

Saurabh-You can opt those also.

For SBI Magnum Gilt Short term fund, the yield to maturity is 6.54%. How can the 1 year return is 12.95%?

Satya-May I know where you saw this 6.54% and for how many years this is? Also, check the date of the article.

Basavaraj – I saw in the SBI MF website https://www.sbimf.com/en-us/debt-schemes/sbi-magnum-gilt-fund-short-term#Performance

SBI MAGNUM GILT FUND – SHORT TERM

Quantitative Data As on 30-Jun-2017

Expense Ratio*: 0.64

Modified Duration*: 2.12

Average Maturity*: 2.85 years

Yield To Maturity*: 6.54

Satya-Yield to maturity is something different than the return it generated which I showed above. YTM means if the fund holds the underlying bonds till maturity, then what will be the yield on maturity. However, the price movement of bonds changes based on supply and demand. Based on this, the price go up and down. Your returns of the fund depend on such ups and downs.

I want to invest 10 L for 3-4 years. How should i diversify.. How is SBI dual advantage fund which is for 1100 days. ?

I have an FD OF 2.5 LAKHS which will.mature this september. This amount i may be requiring next year around same time for my daughter’s education purpose. Can you advice me which is the best investment mode for this amount for a period pf one year

Chandran-Use Bank FDs.

Sir, could you please let me know the best fund to invest in for the time horizon of 4-5 years?

Sumit-Use Ultra Short Term Debt Funds from above list.

Hi Basavaraj ji,

I have investments in the following funds. Should I continue these investments for next one or two years ?

1. Franklin India Short Term Income Plan – Retail Plan (G)

2. HDFC Corporate Debt Opportunities Fund – Regular Plan (G)

3. HDFC Short Term Opportunities Fund (G)

4. ICICI Prudential Short Term Plan (G)

5. IDFC Super Saver Income Fund – STP – Regular Plan (G)

6. L&T Dynamic Equity Fund – (G)

7. Reliance Dynamic Bond Fund (G)

8. UTI Short Term Income Fund – Institutional (G)

Pradip-Stay away from equity funds if your time horizon is less than 5 years.

Thank you so much Basavaraj ji for your prompt reply. So I am assuming other than L&T Dynamic Equity Fund , I can continue with the rest. Please also let me know if you have any other recommendations. Thanks once again.

Pradip-In debt funds also, you must restrict to only investing in ultra short-term debt funds.

Hi Mr.Basavaraj,

I have a some amt which i need only after 3-4 months. Kindly suggest me 1-2 funds to invest so that my capital is safe. Kindly name the fund where I can invest.Thank you.

Pratap-Use ONLY liquid funds. Refer “Top 5 Best Liquid Mutual Funds in India in 2017“.

Dear Basu ji,I am regular reader of your ongoing discussion on debt funds.I have invested in ultra short term debt fund and short term gilt fund.Can I remain invested in these funds for 3-5 years.? Kindly reply.

Jawahar-Yes.

Hi Basu, once again, I sent a query dew minutes ago on liquid fund, modifying my query again. I have 2 lacs, which I don’t need for about little over one year.. I am thinking of investing this fund, one time, I am looking for avenues beyond FD, what do I do, invest in debt or liquid fund? please advice.

Rakesh-Use Ultra Short Term Debt Funds.

Dear BN,

Very nice article on debt funds. I would like to invest 10K pm in debt fund and my time horizon is 10 years. What debt fund do you recommend.

Krish-Why only debt funds if your time horizon is 10 years??

Thank you. I am doing SIPs in few equity MFs and do not have debt portfolio.

Krish-You must.

I would like to get your personalised advise on financial planning & fund allocation in debt & equity mutual funds.

Pl. inform how do I get in touch with you with my details like financial goals, funds available for investment, Time horizon etc etc.

I am not in any social media like facebook, twitter etc

Sujoy-Mail me at [email protected]

Dear Basu ,

Great post which really helps understanding for anyone entering debt market.

I am trying to build my debt portfolio with an average timing of 5 yrs . My plan is as below :

– want to build the debt portfolio with overall allocation of 30% debt (with 70% running in equity already)

For debt portfolio want to add money into u/s term debt and short term gilt funds. However I have an active SIP in ICICI Purdential long term (dynamic fund) for 10 k running, so will continue that

– for any surplus money in savings account , start parking in liquid fund listed in your post.

Please suggest is this sounds like a plan to follow.

Thanks

Nitin-Check the modified duration of the ICICI Fund. Avoid especially considering the time horizon of the goal. You can keep surplus money in liquid funds. But do remember that Liquid Funds are not so liquid. You get the money after a day or two. Hence, considering this issue, you may park.

Thanks Basu. Understood. ICICI Long term average maturity is 13 yrs, so I’ve to stay invested for long if I need to realise benifits. I will modify and stop/reduce SIP and park in gilt or u/s fund.

Nitin-Better you do it at the earliest.

But one q Basu . If my investment horizon is long term for Debt i.e I’m ok for parking money long term, them does Dynamic fund make sense?

Nitin-You have enough exposure of volatility in equity. You are using debt funds to buffer that. Hence, it is always best to stick short-term debt funds. Also, dynamic funds call mainly depends on the fund managers view on interest rate movement and economy. This many a times manager misses. Hence, why to chase?

Dear Basu,

I started a monthly SIP of 1 lakh each(For 3years) in BSL MIP II Wealth 25 plan (Direct growth) 6 month back to accumulate corpus for regular income. Initially I planned to start SWP after 3 years. Now I decided to start SWP after 5 years. Is it a wise decision to continue in this fund after completion of SIP or switch to Balanced 95 fund after 1 year for getting a LTCGT efficient return.Please advise ?

Kumar-What prompted you to select this fund?

To minimize the risk by avoiding more equity exposure and better return compared to FD except LTCGT.

Kumar-But as per me, for your time horizon, you must not touch any Equity (whether it is MIP, where around 15% to 20% is equity exposure or other products which are 100% equity). Stay away from equity as your financial goal is too SHORT. Never go beyond Ultra Short Term Funds or Short Term Gilt Funds.

Sir,

I have a PO MIS & RD maturing in Oct 2017. Value 9.00 lacs. Want to invest as retirement fund for 10 yrs.

I am 50 now. Please suggest so that I may maximise my gains.

Bkscmehak-You can use debt funds (ultra Short Term or Short Term Gilt Funds) and equity mutual funds (mainly large cap) in the ratio of 70:30.

Thank you sir.

I have chosen SBI Magnum Gilt Fund & Franklin India Prima Plus. Any corrections?

Please suggest how to go further – thru’ SIP or lump sum investment.

Regards.

bkscmehak-I suggest use pure large cap fund over this Franklin fund.

Hi Basu,

We have a group of companies, and every year we deposit money in FDR from each company. Depends upon the revenue. We don’t have any time frame in mind, whenever any FDR gets matured, we renew it again. Doing it from past 20+ years.

My question is, shall we continue with FDR, or switch to debt MF? Reason is taxation. In debt MF, we can have indexation benefit, and no tax liability after 3 yrs.

If your answer is yes, then shall we switch to Ultra short term or Short term gilt? As you have understood, We want safety first. According to your post, after liquid, US and Gilt are safer relatively.

In US debt, i selected BSL Floating rate and Franklin Ultra short term. while in Gilt, not much choices.

Thanks,

Rahul

Basu, I was expecting a reply from you..

Rahul-Extremely sorry for missing to reply. Yes, you can use Ultra Short Term or Short Term Gilt Funds. But do remember that after 3 years, there will be taxation but with indexation benefit. In my view use Short Term Gilt than Ultra Short Term Debt Funds.

Considering indexation, I think say after 3.5 yrs, it’s almost no tax.

Also, i found that few other funds like Icici rsf or HDFC rsf too has relatively low modified duration and avg. maturity. Can they be considered ?

This year I made a mistake by investing in dynamic bond funds, so obviously will be careful now.

Thanks

Rahul-It is not ALMOST NO TAX, but taxation will be there. Never look for modified duration alone, but also consider the credit quality of the underlying papers.

Hi Basavarj,

If I want to invest lets say 10000 for 5 years should I invest in hybrid fund or buy different fund for equity and debt seperately ?

I am thinking for something like HDFC Balanced Fund (G) . Your views please.

Thanks in advance

Amrendra-Stay away from equity. Use Ultra Short Term Debt Funds or short term gilt funds.

Hi Basu ,

Any sugestion for 5000 and time frame is 10 years. actualy I am new in this field so your help will be highly useful. It would be good if you could directly name the funds to invest in please.

Thanks in advance.

Amrendra-Use equity-oriented balanced fund.

As per your recommendation , one should use 30:70 into debt and equity, so does this fund cover this aspects ?

and in equity oriented should I go with both or single one and if both what ratio ?

I am planing for 4 funds

1.Birla SL Frontline Equity Fund(G) : 1000

2.HDFC Balanced Fund(G) : 3000

3.ICICI Pru Balanced Fund(G): 1000

Should I include this L&T India Prudence Fund-Reg(G) ?

Amrendra-Why so many balanced funds??

Amrendra-Yes, usually such funds carry a ratio of 35:65 in debt:equity. A single fund is enough.

Basavaraj ji, thank you very much for making such platform for investors.

My biggest question starts here: I have Rs. 50,00,000 ready to invest. I don’t have any clue how to invest and how i can earn maximum return? Time period for this is 5 to 10 years. I don’t have any goal, I just want to earn maximum return.

What should be the ideal ratio between equity:debt?

Should I invest lump sum? Or shall I invest through SIPs?

If I have to invest through SIP, How can I inevst?

Where should I park this money till it get finished after investingn in SIPs? Please help

Purvang-The biggest problem here in your case is identifying the time horizon. Between 5-10 years there is a BIGGEST 5 yrs gap. Be specific with your investment. Never invest randomly. Second thing, identifying the exact return expectation. You must have the realistic expectation from any investment. Maximum means how much? Before jumping into investment, understand these basics and also read the above post properly. Then I am here only to clear all your doubts.

Time horizon for investment- 5 years

Return expectation- 12% (if it is still unrealistic and not advisable- 10% is fine)

Purvang-Use ultra short-term debt funds and expect around 7% to 8% return.

Hello Sir.

Is there any mutual funds(debt) available should be return up to 15% , for 1 year, investment 10000 monthly ?

Harsh-Debt Funds and return expectation of 15% within a year? Forget about debt funds, I do not touch equity if my goal is less than 5 years and my long term equity expectation is 10% to 12%. Be realistic in your expectation.

Hello,

Thanks for the reply, but I am a little know about the mutual fund. What’s the difference between midcap, small cap and equity. I see some of mutual fund got return up to 30% while another 20%. And tell me the which SIP is good for 3 year, monthly investment upto 8000.

Harsh-Google it to understand each word which makes you difficult in understanding. Don’t enter into equity if your time horizon is just 3 years.

Hello,

Is Hybrid mutual fund is good for 5 year ? If yes,tell me the which hybrid fund is good.

Harsh-I avoid equity if your goal is less than 5 years.

Hi Basavaraj,

Thank you for your blog on debt funds. I am 35 yrs old. I have invested around 7.5 Lacs in equity and balanced funds with ongoing SIP of 25 K per month.

Apart from this I have around 20 Lacs of savings in FDs which I am planning to shift to debts funds. I am moderate risk taker for 3-5 year duration.

Could you please suggest me at what proportion should I distribute this amount in debt funds categories.

Also, is it good idea to distribute in more than one debt funds of same category?

e.g.- instead of 1-1 ultra short-term debt fund and liquid fund distributing money in 2-3 liquid or ultra short-term debt funds

Thank you

Amogh

Amogh-Use the above said Ultra Short Term Debt Fund or Short Term Gilt Fund. A single fund is enough.

Hi Basavaraj,

Kudos for your great work. I am 30. I need a corpus of 2 cr to buy a house after 3 to 5 yrs.

I have 20 lakh of savings and can invest 2.5 lakh per month for next 3 to 5 yrs. I am moderate risk.

Please suggest me how to invest

1. Debt vs Equity ratio

2. What type of debts (Debt funds, FD, NSC, postal)

3. How to distribute among them

Sreedevi-For you equity is not suitable. Hence, you must rely on debt funds only. Use Ultra Short Term Debt Funds or Short Term Gilt Funds.

Hi Basu,

Thank u very much for your valuable blogs.

I am 36, Goal – House after 5 yrs, Can invest 2 lakh per year. moderate risk taker.

I want to know,

1. How to split among, US debt, Short term gilt, FD and others..

2. Can I have mild equity exposure? If so MIP or Debt oriented Hybrid or pure equity (<20%)

Pappu-Use Ultra Short Term Debt Funds or Short Term Gilt Funds to the extent of around 70% and rest 30% in Arbitrage Funds.

Thanks for your prompt reply. I will allot 70% to Ultra short term debt and Short term Gilt.

I have two doubts.

1. I read in ET that, currently Arbitrage funds are not worth investing (in view of their increasing AUM with limited choice of buying equities). What is your opinion on it?

Instead of 30% Arbitrage, shall I take 10% Arbitrage, 10% short term fund and 10% equity.

2. Can I use FD/RD/liquid fund partly for the same goal?

Thank u in advance. Your are simply superb in your advice and approach.

Pappu-1) Basis of their claim? AUM increase may be an issue. But the real difference is who identify the arbitrage opportunity at first. Also, the tax advantage over debt funds is the main positive.

2) You can.

Hi Basu,

I dont have any idea regarding mutual funds, but I am willing to invest 10000 per month as SIP for 10 years. Allocation of Funds as i came to know is debt : Equity 40: 60.

What fund should I allocate , your guidance may be very useful and praiseworthy. Kindly Guide please.

Amrendra-I already listed my funds. Go through above post and also the “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

Sir,

The words super, great, wonderful not enough to appreciate your service.Realy this site giving knowledge that making future safe.so thanks from heart.

Am NRI, 27 year age. My Financial Plans are,

• Buying House -40 lk (5yr) (Short term)

• Business Capital -50lk (11yr) (Medium term)

• Children Marriage -1cr (20yr ) (Long Term)

• Retirement Plan-5cr (30yr ) (Long Term)

So my question is I have to maintain different portfolio’s according to my goals because from my understandings for this corpse at least I need 80k-1lk per month. That I can’t now.so I thought first I will invest for my short term goal (1) and meanwhile for second goal.after 5 year I plan to continue for my others goals gradually. Hence for Short term I choose debt funds.

For 1 goal (short term-5yr) (some equity funds for 2-goal)

• L&T Ultra Short Term (Debt) -5k

• Birla Sun life Short-term fund (Debt)-10k

• SBI Magnum Gilt Fund (Debt)-5k

• Franklin India Prima plus (Diversified) -2.5k

• Birla Sun life Frontline Equity Fund (Large)-2.5k

• HDFC Balanced -5k

Total Sip=30/month

After 5year (rest of goals –long term)

• Franklin India Prima plus (Diversified) -5k

• Birla Sun life Frontline Equity Fund (Large)-10k

• HDFC Balanced -10k

• Franklin India Smaller Companies Fund (Small)-10k

• Mirae Asset India Opportunities Fund (Diversified) -5k

• Birla Sun life Short-term fund (Debt)-10k

Total Sip=50/month

Gradually depend upon my future growth I will increase sip on large and Diversified funds. For assets allocation I remain invest in debt.

So please advise is this portfolio and plan will help to achieve my goal?

Michael-For a goal (5 years), one ultra short term debt fund or short term gilt fund is enough (NO EQUITY). Also for goals which are more than five years, you must allocate equity and debt again based on the time horizon of the goal. All long terms goals in equity is not a good strategy. Instead you have to separate each goal and do asset allocation.

i have accumulated rs 100000 by surrender my lic Jeevan shree plan..now i want to invest the whole ammount which i required after 8 years..where i shud invest sir..in debt fund or equity based sip or to do bank Fd

Jaynta-Combination of debt and equity in the ratio of 70:30.

THANK U SIR..I HAVE 4 SIP STARTED JUST NOW MEANS FROM APRIL… I HAVE STARTED. SBIBLUECHIP..RELIANCE TAX SHAVER,AXIS LONG TERM EQUITY,ICICI VALUE DISCOVERY,MIRAI ASSET EMERGING BLUECHIP AND FRANKLINE BULIT INDIA OF RS 500 EACH PER MONTH…KINDLY SUJJEST WHETHER I CAN GO FOR ANY NEW PLAN(SIP) OR TOP-UP OF (RS 30000) WITH THE ABOVE PLAN..KINDLY SUJJEST PLZ SIR..

FURTHER IN DEBT 30 %(RS.70000) …SHOUD I GO FOR SBI GLIT FUND OR ANY NAME U SUGGEST SUITABLY..PLZ PLZ GUID ME SIR

Jayanta-Why you felt doubt about your recently started funds and that too within a month time?

no i dont have any doubt as im new born in this segment..but plz guide me in IN DEBT fund 70 %(RS.70000) …SHOUD I GO FOR GLIT FUND OR Ultra short term fund or ANY NAME U SUGGEST SUITABLY..PLZ PLZ GUID ME SIR

Jayanta-Refer my above post for your debt portfolio. In my view, short term gilt better.

thanks

My investment horizon is 30 yrs. I want to invest fixed amount every month for next 30 years and use that money to fix my knees or heart after I turn 60. I think for this goal, equity fund should be safe in such long term and give me relatively better returns than debt mutual funds with almost 100? chance?

Vivek-How much sure you are that after 30 years YOU WILL undergo KNEE and HEART SURGERY?? Strange BELIEF.

Ha! Okay, on a serious note, my main financial doubt is “Considering a >20 year investment horizon, is there any reason to choose debt fund over equity fund?”. There’s no specific goal for this investment except to act as post-retirement one-time bonus.

I tried searching on your site but could not find a similar article for equity funds or a comparison between debt funds and equity funds. For my short term needs, I have invested in multiple debt funds, but for this particular investment, I wanted to go for gilt fund considering 100% safety but then the thought came to my mind that over 20-30 year period, equity fund like franklin bluechip fund should at least be as good as gilt fund. I want a single fund for next 30 years with “buy every month and forget” strategy.

Thanks.

Vivek-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

I am a sr.citizen (80 years) & I can invest Rs.5,000/-per month. Kindly advice me where I can invest.

Rao-What is your time horizon or reason for this investment?

To augment my income/intrest to meet my monthly expenss

Rao-Stick to Postal MIS kind of product if your requirement is based on this monthly income.

Hi,

As per our discussion last year, I have invested in following funds monthly for a year. I was investing total 10k per month equally in mentioned funds.

1. SBI Blue Chip

2. Franklin INdia Prima Plus

3. SBI Magnum Mid Cap Fund

4. SBI Magnum Balance Fund

My goal is to invest for 13-15 years. Please let me know should i continue in these funds or should i choose the new funds for next year.

Sarvesh-You can continue the same fund with asset allocation in debt funds. Refer what asset allocation you have to follow from above post.

Hi Basavraj,

I have invested heavily in Birla SL Dynamic bond fund. But in past 3 months, fund has performed poorly, because of no change in interest rates, and it has majority of long term gov securities/bonds. What is your view on this fund particularly?

Thanks, Rahul

Rahul-I will never rely on such Dynamic funds who claim that they RIGHTLY forecast the interest rate cycle and accordingly change the duration.

what about HDFC GILT Long term?

Mani-Refer my above post properly and you understand my view on this fund also.

I agree. But seems atleast for coming months time is for accrual funds. Can you name 2-3 good accrual funds?

Thanks,

Rahul

Rahul-My choices are listed in above post.

Dear Basavaraj

In mid-November 2016, I had invested Rs 4 lac in IPru Constant Maturity Gilt Fund. Today, the invested principal has eroded by Rs 10k and XIRR stands at -7.6%. Should I book my loss and exit?

Tarun-Should I book the loss is purely your call. Also, I am not sure what prompted you to select this fund and what is your goal. Hence, it is hard for me to guide.

I wish to invest Rs. 10 lakh for 3 year horizon. What options should i explore and what reasonable return can i expect.

Jaspal

Jaspal-Use either liquid fund or ultra short term fund. You can expect around 7% return.

Thanks,7 % return on liquid/ ultra short fund will not do better than fixed deposits of RBL and Bandhan bank which offer 8.20% to senior citizens. For 5- 6 year goal cumulative option of GOI Bonds with 8% half yearly interest and 10% cumulative for 6 year maturity will be advisable or not.

Regards.

Jaspal

Jaspal-Think about taxation and risk involved in investing in banks you mentioned. GOI Bonds are not like FD, it is a BOND.

While investing in liquid funds, should i opt for monthly dividend option or growth option. I have been told that dividend option will get me near tax free returns even for duration of less than 3 years as post DDT Dividend will be reinvested. KINDLY ADVISE.

JASPAL SINGH

Jaspal-What is your requirement?

I am a retired person with handsome pension of 1lakh per month with investible funds of Rs 15 lakh. In a previous post keeping in mind my investment horizon of 3 years, option of liquid and ultra short debt funds was suggested to me. I wish to knoe whether to opt for dividend reinvestment or growth plan of liquid/ ultra short funds. I have been told that in dividend reinvestmen plan even short term capital gain will be near tax free as Post DDT Divedend gets reinvested.

Regards.

Jaspal-What is your requirement from this Rs.15 lakh investment?

Wealth addition with low risk to my capital.

Thanks and regards.

Jaspal

Jaspal-what about time horizon and define two terms definitely which makes me clear about your expectation “WEALTH ADDITION” and “LOW RISK”.

Time horizon is 3 years. Wealth addition means return of at least 7-8% to beat inflation. From low risk i mean capital protection.

Thanks.

Jaspal

Jaspal-Use Ultra Short Term Debt Funds.

My age is 32. I have a home loan of Rs 2500000 and I have planned to pay part payment for which I have a plan to put RD of Rs 50,000 every month. Once the required amount is accumulated in RD I can withdraw and pay home loan part payment.

Is this a correct strategy? ?Or kindly advise some suitable strategy. My aim is to close the hom,e loan as soon as possible.

Also advise whether I can go for debt funds at the moment considering the interest rate cut down cycles.

Mathi-For how long you want to do the RD? Why not prepay monthly towards home loan?

Hi Basu, Thanks for your reply..

I plan to do the RD for next 3 years so that it will be accumulated 6lack per year ( 3x6lakh=18lakh) so that i can complete my home loan accumulated with RD interest in 3years.

Do you think it would be a better idea to prepay in months directly towards home loan. Please suggest

Mathi-I think prepay is best as what you earn by investing in RD will fetch you less than what you pay as home loan right?

Yes you are correct. My current EMI is 30000 rs

Monthly i can able to pay 70k to 80k around to my home loan(EMI). Thought to save some amount in RD for making part payment instead of monthly payment, however as you suggested i will make a prepayment. thanks

Hi Vasu,

First of all, i would say big thanks to you for your hard efforts which is helping a lot of people who is having none or less knowledge on investment.

On your advises I have done lots of investment by setting goals across different instruments. I would like to know, if one start monthly SIP investment on ICICI Prudential Long Term Plan (G) Debt Mutual fund for the next 12-15 years, how much annualized return he can expect from this fund? I know this return can be much greater than the Post office RD but I want to check whether taking risk associate with this fund as compare to post office RD which is pure safe investment is worth?

Thanks in advance.

Avi

Avi-Whether you checked the modified duration data of the fund? Whether you can sustain such volatility of the fund? How you judged that this fund will generate more than FD over long run? NO INSTRUMENTS ARE SAFE including the Post Office RD.

Hi, which is the best 3 year tax saving debt mutual fund scheme?

Susan-Sadly there are NO DEBT funds which qualify for tax saving.

Sir,

I see safety in different funds as below;

Liquid fund> Ultra Short Term Debt Mutual Funds> Gilt Short Term Mutual Funds> Short Term Debt Mutual Funds> Income Mutual Funds> Gilt Medium and Long Term Funds> Dynamic Bond Funds> Credit Opportunities Fund

Is it correct?

Jatin-YES.

Sir,

How can one decide which debt fund falls under which category as shown below?

I see some different names iin each category. Like floating rate fund in ultra short term fund, banking and psu debt fund in income type funds, long term fund name in dynamic bond fund categoty)

Ultra Short Term Debt Mutual Funds (Floating rate fund, Ultra short term fund)

Short Term Debt Mutual Funds (Short term fund, Short term debt fund)

Gilt Short Term Mutual Funds (Gilt fund, Govt. Sec. fund Short term plan)

Income Mutual Funds (Medium term oppor. Fund, Banking and PSU debt fund)

Gilt Medium and Long Term Funds (Gilt fund long term plan, Gilt fund investment plan)

Dynamic Bond Funds (Long term fund, Dynamic bond fund)

Credit Opportunities Fund (Income opportunity fund)

Dear basunivesh now the market is trending up I want to surrender my health protection plus lic policy should I wait further or should I surrender it now will the trend continues for some more time in other words when should we surrender ulip policy with this market rate going up

Rahul-None know in this world about the market trend of future. If anyone predicting 100% perfectly, then he is the biggest cheaper. So don’t wait and take decision as per your comfort.

I have invested in long term gilt funds just before the recent correction in Feb. But facing heavy losses now. I invested for a time frame of about 1 year. Should i consider holding it or should i book loss and redeem. Is there any chances of getting some profit in an year in these funds?

I really dont want to face further losses. Pls help.

Sachin-It may bounce back, but not surely within a year. Hence, better to come out and consider liquid funds.

Thanks for your answer.

How about if i continue for 3 years or more…

Is it risky for 3 years also…

Sachin-Long term gilts are more volatile in nature like equity. If you have strength to consume such volatility (like just what you faced), then carry on. However, you said your goal is just 1 year. Hence, I suggest to restrict your investment to liquid funds.

The funds are not invested in one place; the portfolios are kept diverse so as to minimize the risk of massive losses. While other investments offer lock-in periods of 6 to 15 years, these mutual funds tend to offers only 3 years of a lock in period.

Rishika-Which investments offer 6-15 years lock-in? What is your point of saying?

I was referring to investments in NSC & PPF. As Far As I know Lock in period for NSC is 6 Years and for PPF its 15 Years, request you to correct me if I am wrong.

Thanks & Regards.

Hi Basu,

I am planning to invest Rs 1000/- month for 2-3yrs in debt funds( Investing amount: Rs 15000/-) . Which is best either SBI MAGNUM GILT FUND – LONG TERM Regular/ Dividend (OR) Birla Sun life Floating rate for Long term plan.

Financial goal is: After 3 years i need money Rs 1lakh. Please suggest.

Praveen-Use Ultra Short Term Funds or Short Term Gilt Funds.

Hi Basu,

I seen the below types of funds in SBI mutual fund website:

SBI Magnum Gilt Short Term Fund – Regular/Direct – Growth/Dividend

SBI Ultra Short Term Debt Fund – Institutional plan/Regular/Direct – Daily/Monthly/Weekly/Fortnight /Growth plans .

Which one i have to select from the above plans. I am planning to purchase from SBI MF online website.

I am awaiting for your reply.

Praveen-Between these two Gilt bit volatile than Ultra Short Term debt fund.

Basu,

In SBI ultra short term debt fund, which type of plan ,should I select and purchase from the above.

I am waiting for your reply.

Praveen

Praveen-It is growth.

So, as per above post, SBI magnum gilt short tem and long term funds are safest and giving highest returns. Correct?

Parul-Who said Long Term Gilt Funds are safe and less volatile?

You noticed the returns of these funds with above shared short-term debt funds. With same interest rate risk (modified duration) and average maturity, the returns are spectacular. Then why not think about such funds where risk is minimal and returns are best? >>> So you mean, ONLY Short term gilt funds are safest with good returns?

Parul-Modified duration and average maturity of short term gilt funds and long-term gilt funds are same?? Just first cross check and let me know.

Yes, you are right and I am getting your point. I have 2 goals. One short term and one long term. For both goals, I have enough fd, ppf amount, mutual funds but as fd’ s rates are decreasing day by day so I want 2 plans (Low risk) where I can get more interest than fd’s. Thanks!

Parul-Everyone in India want to earn more than FDs. That is not a question. But try to first understand the time horizon of your goal. Accordingly you can do asset allocation.

Few questions please. 1 ) Ultra Short Term Debt Mutual Funds (Birla – first option which you suggested) >>> When we say, short term here means we invest here for 2-3 years then take money and choose any other fund and again invest as internet rates seems good? I mean, my horizon is 5 years so, should I remain invested in the same fund for 5 years (reinvest) or once maturity period is over then decide and question with SBI magnum gilt fund >> As you said, it is the safest in all.

2) Sorry, not understanding tax point. When you say indexation 20%. I mean, suppose, after maturity my invested amount + interest = 10,000 >> now, how much tax on it?

I have good equity and fd’s. Just wanted to diversify little more cause, fd rates are now too low.

Rahul-1) Whether your target is to reach financial goals or changing strategy once in 2-3 years? If your goal is 5 years, then stick to single fund.

2) You will pay the tax only on the additional return (as you said interest) with indexation benefit (which is not with FDs).

Basu,

In current interest rate cycle, experts advise people to go for funds with accrual strategy as opposed to duration strategy a year back. Can you also classify you list based on this? May be it will be good if we get a couple of funds each under both these categories.

Pradeep-Accrual strategy will work out with depending on infusing low rated bonds for the sake of generating returns. However, in case of duration, they just play with average maturity without risking on credit risk. In my view, duration funds are best than to go for accrual. Sure, let me write a separate post on these strategies and publish the same.

I am wondering how much percentage is actual floating rate in this fund? You may be very right its mostly a conventional fund just called floating rate? The numbers in front of debt name usually are fixed percentage return?

Venkat-Instead of relying on either mine or the link you shared, check with fund’s fact sheet. You will get the clear image.

Hi Basu, first of thanks for your patient replies. I track your advice very carefully and hence value it too. The fund fact sheet is a bit contradictory, it says minimize interest rate volatility plus invest in floating rate bonds. Now if the GOI keeps dropping interest rates, so will firms. Hence relying on floating rate funds in a falling rate environment would be risky, provided it is a floating rate gund to begin with. Where i think we are safeguarded, is the logic thst most of the investment seems to be in, as you noted, high grade debt plus from the ICRA link, with fixed duration interest, not floating rate. So even if interest rates fall, all is well. Point taken about tempering expectations to 7percent. Am ok with that, just worried i shouldnt lose my principal if interest rates fall.

Venkat-You no need to worry. Concentrate on three things (I am stressing again)-Credit Ratings, Modified Duration and Average Maturity. This much enough to understand the risk involved.

Basu, isn’t investing in the BSLI Floating Rate fund very risky? In a falling interest rate environment. Its existing securities since they are floating rate, will drive down yield and hence fund will underperform. I invested in this fund after reading your article but am now thinking is it better to shift to a more conventional fixed term/interest ultra short term bond?

Similarly, wont the yield of SBI Magnum Gilt fund not go down, driving down fund performance?

Venkat-Check the BSLI Fund’s average maturity and also the modified duration. You chose Ultra Short Term just to avoid volatility of interest rate movements. Stable return expectation is the another expectation. Yield will goes down when price goes up. Price will go up when interest rate falls. Which scenario benefits to you? Falling rate or going up? I will not expect more than 7% from ultra short term debt funds. I am not aware about your expectation.

Check the average maturity and modified duration of SBI fund also. If you entered without knowing the risk involved, then it is a biggest mistake.

Interest rate now stable since 1-2 months. Hence, debt funds may be providing less return than compare to traditional FDs. Which one to choose is rest with you.

To invest in the Debt fund in lump sum is there any particular month to invest in order to get the maximum returns at any point of time just like the PPF where April 1- 5 is the best time to invest to get the maximum out of PPF account

Sachin-There is no such date.

Hi Basavaraj,

In short term debit fund category for 3 year investment, I have invested in Franklin India Low Duration Fund – Direct but you suggested for Birla Sunlife Short-term fund. I have to do additional lumpsum investment so I was wondering that should I do fresh investment in Birla or still go with Franklin?

Many Thanks

Parimal-What doubted you about Franklin?

Only worry is that- Franklin is not in your short term debit fund list, otherwise I am satisfied with this fund past record but

does not finding franklin in your list put question mark for the future performance?

Parimal-Then simply follow your instinct 🙂

In Short Term Gilt fund there are Short term and Long term plab for SBI Magnum Gilt fund.

So your recommendation for above Gilt fund is SBI Magnum Short or Long term Gilt fund

Sachin-Short Term.

For Ultra short term Debt MF plan it is the Long term plan

Sachin-Please refer above post properly.

What is the Best Debt investment option while asset allocation for a tenure of 18 yrs.

Thanks

Sachin-I already opinioned my views in above post.

Thank you

But which specific type of debt fund from above would be an ideal for tenure of 18 yrs

Sachin-That too I already explained in above post.

Hi,

You mentioned LTCG for debt funds is 20% with indexation.

can you please explain 20% with indexation i.e. how to calculate.

Suresh-Refer this file of IT Dept.

One of my BIG FD matured and without giving much thought, I invested the maturity amount in Birla SL MIP II-Wealth 25(G) on 25 Nov. 2016 and the investment is now quoting -2.61% return as of today 🙁

Have I picked the wrong bet as I entered into the DEBT fund when the NAV was high? Should I exit or wait?

Deep-Why you selected that fund? What is the goal of your investment?

I do not need this money for at-least 3 years, my goal here was to keep the principal safe, earn maximum returns and save taxes on returns.

Deep-Use Ultra Short Term Debt Funds.

If I exit now it will attract 1% exit load, I will have to book 3% loss 🙁 .

As I said, the minimum holding period is 3 years but will continue to hold this for very long term if it gives better post-tax returns then FD. Just wanted to know whether I have entered the fund at the wrong time when the NAV was high?

It is holding mid-cap stocks in equity and in case of debt it is holding high-interest sensitive papers. That may be the reason for higher volatility. But in my view, such products not suitable for 3 years view of investment.

Be specific with time period of your holding. Holding 3 years and if you get better return then you can hold for longer period means you are not sure about your financial goals.

Even I have invested my lumps up money in this fund in beginning of this fund. But my period is 2-3 years. What should I do now?

Shweta-For 2-3 years time horizon, I stay away from equity.

Now that I have invested money I will have to stay for more than 3years to get better return. Is it? I don’t to exit

Shweta-How can I say that without knowing the reasons of your investment?

In Birla SL MIP II-Wealth 25(G)- For units in excess of 15% of the investment,1% will be charged for redemption within 365 days so from my point of view wait for 1 year- if you anyway have to exit then see if you are in profit, exit after 1 year as there will be no exit load but STCG only.

And by chance if you can hold 4-6 years approx rather than 2-3 years, you will get expected return.

Thanks for writing very informative article on debt funds.You suggested in a reply that you like to invest in ultra short term funds and short term gilt funds.Should we invest in these funds in SIP or lump sum ? Kindly reply.

Jawahar-Yes both can be possible.

Debt funds very well explained, However you missed one more option of Investment i.e. Tax FREE Listed AAA Bonds. as they offer longer tenure and tax free returns for Individual in Higher tax slabs .

Rajesh-Tax Free Debt Funds? I am not aware. Can you name the few if they exist?

Not tax free debt funds? it is tax free AAA Listed bonds like PFC/NTPC/IRFC etc…. which can be purchased

through NSE or BSE

Rajesh-Those are meant for different requirement like who in need of constant stream of tax-free income.

What Debt fund should be used for following tenures of investment :

1) 3 years

2) 5 years

3) 5 to 10 yeards

4) More than 10 years

Sachin-Others may have different view, but for me Ultra Short Term Debt Fund or Short Term Gilt Funds.

Is there any lock in period for Ultra short debt and Gilt fund

Sachin-NO.

Which would be the best debt fund :

Liquid ,Ultra short term or Short term gilt fund for 3 / 4 / 5 years respectively.

Should i park in each fund or one of the fund is ok among the above three.

If only fund then which should i select for 3 years horizon

Sachin-Others may have different view, but for me Ultra Short Term Debt Fund or Short Term Gilt Funds.

Dear Basu sir!

Thanks a lot for your artilce which explains very clearly about Debt funds. Whenever I cross your advice about Equity:Debt ratio I could not have idea how to choose and invest in Debt. This article gives clear idea. In additon, there are so many articles about how to invest in equity/debt MFs. Can you write an article about what stategy can we use to come out from equity/debt MFs while nearing goal period. Once again thanks your your such an informative article!

Kumar-I wrote about that long back. But let me update and share with you.

Thank you so much for your kindness sir!

Thank you for giving us insight about debt fund. After reading your article i have a query that when we are doing asset allocation between debt and equity so can we choose short term gilt fund?

Shweta-They are the best and secured than others.

So that means according to you for asset allocation I can choose gilt funds over debt fund and can I choose short term gilt fund if I want to invest for short period of 2-3 years.

Shweta-Never go beyond Short Term Gilt Fund or Ultra Short Term Debt Fund.

Thank you for guiding us and clearing our doubts.

Sir , I just want to be double sure before putting my money on debt funds. I have to invest 7k per month as sip in debt fund for 2-3 years and to balance out the risk. So could you plz guide me where to put my money short term debt fund or short term gilt fund and also help me to distribute my money in different funds. I mean how many funds should I select and under which category.

Thank you

Shweta-Use Ultra Short Term Debt Funds.

Hi Basavarj,