In my earlier posts, I listed my top equity and ELSS funds to invest in 2017. In this post, I will try to give my Top 5 Best Liquid Mutual Funds in India in 2017.

What is liquid fund?

Liquid fund is a type mutual fund that invests money in Bank Certificate of Deposits, Bank Fixed Deposits, Treasury Bills, Bill Rediscounting, Commercial Paper, Collateralised Borrowing & Lending Obligation and other debt securities with maturities up to 91 days.

The NAV of the funds is computed for 365 days, unlike other debt mutual funds where NAV is computed for business days only.

In the case of other debt funds for purchase applications received within the cut-off time (3.00 P.M) having the value up to Rs.2 lakhs, the NAV as at the end of the day of the application is applied. For applications of more than Rs.2 lakhs, within the cut-off time (i.e. 3.00 P.M.) the allotment of units is subject to realisation of funds.

However, in the case of liquid funds, for all transactions (irrespective of the value of investment) received within the cut-off time (i.e. up to 2.00 P.M.) where money is also realised within the cut-off time, the units are allotted as per previous day NAV.

Let us say if a purchase transaction in a liquid fund is submitted on Monday before 2.00 P.M. and amount is also realised by 2.00 P.M. on Monday, then NAV of Sunday is applicable.

Similarly, when redemption request is submitted before cut-off time on Friday, then applicable NAV for redemption is of Sunday, i.e. the day before the next business day. This means, your investments generate returns for every single day of investment.

Who can invest in Liquid Funds?

The popular theory is that park your IDLE money in liquid funds. However, you must understand for how long the money be IDLE. Based on that time horizon you have to take a call. Idle money of one day is different than idle money of 1 year.

Few suggest that we must use liquid funds to keep our emergency fund. But in my view, liquid funds or not so liquid in nature. Because if you request for redemption (before cut-off time), then the money will be credited on the next working day.

Few funds offer you the card for withdrawal but there are certain withdrawal restrictions.

Hence, my suggestion is to park your PART of emergency fund in liquid funds rather than parking all 100% into liquid funds.

However, the best idea to utilise liquid funds is to invest for your short term goals. You can expect a better return than your savings account (4%). Some funds generated around 8% to 9% and some funds around 5%. But we assume liquid funds generate higher than your savings account.

As the liquid funds invest in low maturity papers, the volatility is very less. Also, they invest in high credit rated papers (higher than AA rated), so the default risk is also very minimal.

Hence, you may say highest safety, more expectation than your savings account are the primary reasons for investing in liquid funds.

What is the tax on liquid funds?

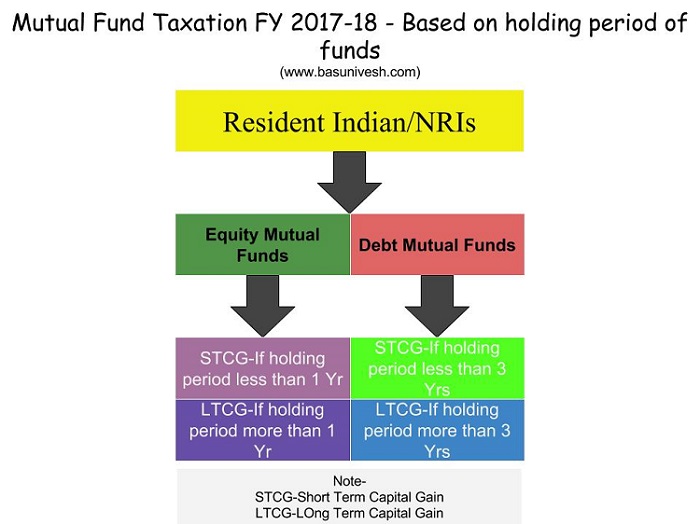

Liquid funds are treated like other debt funds for taxation purpose. If you hold the fund for less than 3 years, then it is considered as Short Term Capital Gain (STCG). However, if you are holding for more than 3 years, then it is considered as Long Term Capital Gain (LTCG).

Short Term Capital Gain Tax for Debt Funds-It will be taxed as per your tax slab.

Long Term Capital Gain Tax For Debt Funds-It will be taxed at 20% with indexation benefit.

I will try to explain the same from below pictures.

Hope you got the clarity about the taxation classification. Now let us understand the rate of tax.

Refer the complete Tax Benefit of Mutual Funds in my earlier post “Mutual Fund Taxation FY 2017-18 and Capital Gain Tax Rates“.

How I shortlisted Top 5 Best Liquid Mutual Funds in India in 2017?

As I said above, all liquid funds invest in debt papers which mature in less than 91 days. Hence, I don’t think there are sure short method to say that Fund A is best than Fund B. However, with certain other criteria we can again go deep and shortlist the fund.

Again, the best way I suggest to invest in the liquid fund is in same AMCs funds where you already investing in equity funds or you already have online access or folio number already generated.

But as I said above, I shortlist the liquid funds based on below criteria.

# Average Maturity–

I select the fund which shows higher average maturity. All liquid funds invest in the papers which mature within 91 days. Lower the maturity means the fund is holding more cash which in return gives me less return. Hence, I avoid the fund which show lower average maturity.

For example, SBI Magnum Insta Cash Fund’s average maturity is 0.003 means one day. Hence, it indicates that the fund is holding the cash highly. I will not touch such funds.

# Average Credit Quality–

I will select the funds which hold the papers not less than AAA. Lower to AAA rating is AA. Few funds shows such ratings. They may be exposed to some low rated papers. Hence, I will not select those funds.

Why returns not matter?

We look at liquid funds mainly for safety than anything else. Also, our expectation from such funds should be always to get more than savings account returns. Hence, I don’t think 1% or less than 1% returns matters to us.

Hence, I overlook the return part and consider only on quality and safety.

Top 5 Best Liquid Mutual Funds in India in 2017

Based on above assumptions, I have shortlisted Top 5 Best Liquid Mutual Funds in India in 2017. Remember that this is not the FINAL best liquid funds. Also, as I pointed already, my priority is for highest safety than return. Hence, even though few funds like Escorts Escorts Liquid Fund performing consistently and with a good return than the fund I listed, I neglected such funds. Two reasons for that may be. One is these funds holding average credit rating as AA and the second thing I may be biased towards fund houses.

Below is the list of Top 5 Best Liquid Mutual Funds in India in 2017 I have selected.

If you find the ratings of these funds in valueresearch, then you find that all these are rated less than 5 or 4 rated. The reason is, the 5 and 4 star rated funds average credit rating is AA, which I completely avoided for selection.

Hope my above methodology and the funds selection will help you in short listing the Top 5 Best Liquid Mutual Funds in India in 2017.

Refer my earlier posts related to Mutual Fund Investment in 2017-18

- Top 10 Best SIP Mutual Funds to invest in India in 2018

- Top 10 Best SIP Mutual Funds to invest in India in 2017

- Top 5 Best ELSS Tax Saving Mutual Funds to invest in 2017

- Mutual Fund Taxation FY 2017-18 and Capital Gain Tax Rates

Sir

would you pl suggest Best Liquid MF 2018?

Is it not the appropriate period to evaluate? pl

I have CICI Pru Blue Chip Regular, SBI Blue Chip Regular, L&T EMERGING BUSINESS FUND being invested thru SIP with one DP, NOw I started direct SIP simultaneously in another DP for Invesco Midcap, Axis Focused 25 and Kotak India EQ Contra, I am looking to put money lumpsum in either ABSL money manager or ICICI Pru Liquid in direct plan.. DO you see my allocation correct ?

Dear Anand,

Without knowing the reasons of the investment and financial goal details how can I guide you?

Sir, I want to keep my emergency fund amount in ICICI prudential liquid plan. but, there different options like

1. ICICI Prudential Liquid – Growth

2. ICICI Prudential Liquid – Direct Plan – Growth

3. ICICI Prudential Liquid Institutional Plan – Growth

4. ICICI Prudential Liquid Plan Retail Growth

So, please tell me which one is best.

second query is, How much percentage of emergency fund is to be kept in liquid fund?

Awaiting for your reply

Dear Sachin,

First understand the meaning of each of these options. If you still have doubts, then I will guide you.

Hi Basavaraj,

Really an informative article on liquid funds.

As a part of the Emergency Fund, I am planning to park some % of total amount into one of the Liquid Fund in a lump sum( rather than keeping all the above fund in a savings account and I was want to maintain liquidity).

Would you suggest going for the liquid fund for this purpose a better option or are there any alternatives which would provide similar flexibility?

After reading above article and few other ones , there are possibilities that liquid fund might give negative returns.

Please advise if the liquid fund would be suitable or any other instrument, and provide some evaluation on Franklin India Ultra-Short Bond Fund.

Thanks.

Balaji-For keeping an emergency fund, I usually suggest like below.

1/3 in Savings account, 1/3 in eFDs and another 1/3 in Liquid Funds. Liquid Funds may give negative returns if you do not understand the underlying portfolio risk. Refer my post related to debt funds “Top and Best Debt Mutual Funds to invest in 2018“.

Don’t you think , when safety is so important , in your short listing process you also look at the portfolio of funds and pick funds with greater % of T-Bills compared to CPs (Commercial Papers ) .. especially after the Taurus Fund’s experience

Think lesser the % of CPs in AUM and greater the % of T-Bills is a very important criteria to follow , in shortlisting of Liquid Funds

Nagendra-Treasury bills riskier that CPs?

No…That is why is said “Think lesser the % of CPs in AUM and greater the % of T-Bills is a very important criteria to follow , in shortlisting of Liquid Funds”

isn’t it ? …is it so in all the funds you have shortlisted ?… I’am asking

Nagendra-I am asking you again what is the risk difference between CPs and T Bills (when it comes to credit quality, modified duration and average maturity)?

My Basic understanding is T Bills are government bonds , with no default risk , unlike CPs which can default despite the ratings … as rating agency in India will never take the blame for defaults … That is the level of my knowledge

Nagendra-Commercial Papers may be unsecured than T Bills. But in case Liquid Funds, where the maturity of such Commercial papers are very less, the risk is also minimal or you may say NIL. Risk factor we have to consider when the fund invests in CPs of longer maturity.

OK. Thank you

I have some amount parked in my savings account (keeping aside some emergency fund )which I will be needing in 15-18 months from now .

So how do you suggest me to invest it in liquid funds as in lump sum or through SIP .

Thanks.

Anshu-In Lump Sum.

Hello Basu,

I am really in confused state after investing in Regular plans with the help of distributors . My monthly SIP was abut 1 lakh/month for last 2 years and now I would like to switch to Direct plans as it gives better returns. I was reading many posts in internet and most of them are showing and suggesting to switch to DIRECT instead of Regular plans. What should i do now ? all my SIP’s have given me decent returns for last 2 years and switching at this time to the same fund but direct will start all over again. Will this deviate from my financial goals in long run?

and also some of the stocks are over valued in the recent past and the sensex/nifty going beyond 26 k and 11 k respectively, will this impact my switch?

Please advise

Mrityunjayagouda-In what sense it is again the START ALL OVER AGAIN and how it deviates your financial goals when you are just moving from regular to direct? The market will treat your current regular investment and future direct investment in the same way without bothering whether you are in regular or direct. I don’t know what bothers you. Just go ahead.

Hi Basavaraj – Sorry for the delayed response.

What i mean to say is .. if i switch from Regular to Direct plan now, the date of investment will set to current date(this may be today’s date). This may rest my return or XIRR % start from 0(Zero) to whatever i get in he future.

Another thing is the Sensex is really going crazy last week/today and too much of fluctuations in my MF values, is it right time for me to switch over to some debt fund ? if yes then can you advise few where in i can get some decent returns.? and low risk ?

Mrityunjagouda-Assume you invested Rs.100 in the fund ABC and the current value is Rs.120. Now assume that you want to move to same fund, then its like you redeem and reinvest in same fund with that Rs.120. Then where comes the question of loss of gain? In such situation, XIRR return has to be calculated from the initial investment but not from the switch.

If you are long term investors (5+ years) and did proper asset allocation, then you no need to worry.

I appreciate your quick response on queries. I am still waiting for 2nd part of my query. I will paste the same here again for your reference

Another thing is the Sensex is really going crazy last week/today and too much of fluctuations in my MF values, is it right time for me to switch over to some debt fund ? if yes then can you advise few where in i can get some decent returns.? and low risk ?

Mrityunjaygouda-If your goal is long term (5+ years) and you did proper asset allocation, then why you have to worry about such news based events? If you can’t digest such volatility (which is part and parcel of equity market), then first learn how to handle risk before starting investment.

Hi Basavaraj,

Have few questions

1.I plan to start a new SIP of Rs 5k/month for more more 5 years in a large cap Fund, either in SBI blue chip fund or Mirae Asset India Opportunities fund. My question is if i invest 5k on a particular day of the month it takes the NAV of date of investment, rest of the month there will be variations in the NAV. Is it wise thinking to break 5k in to 4 pieces and invest Rs 1250/week ? to gain the benefit of market fluctuations? Please advise

2.Do i really need to bother about CRISL rating for each fund? On what basis these ratings will be give? Should i look forward only for the top rated Funds by crisil?

Mrityunjaygouda-1) There are enough studies which showed that no such things work out. I know that you want to average it. But to be frank, there is no such huge difference.

2) Each portal follows it’s own method to arrive at a rating. Just neglect them.

Hi sir,

U said that we have to invest in direct funds know so may I know the difference b/w a direct fund and a normal fund

Ex: whats the difference between SBI BLUECHIP FUND(G) and SBI BLUECHIP DIRECT FUND(G)

THANKS IN ADVANCE

Praveen-Refer my latest post “Best Direct Mutual Funds Platforms in India to invest online“.

Thanks for a reply

I have read what u have suggested and I am a new investor so I am planning to invest an SIP of 6K in 2 different funds like SBI BLUECHIP growth and Birla sun life was that a correct decision or I need to change please help me

Awaiting for ur suggestion.

Praveen-It is hard for me to suggest anything BLINDLY without knowing goal details, time horizon and exact fund names.

Time horizon would be 5 years from now goal will b for future studies for about 4-5L so suggest me some good funds.

Praveen-Use Ultra Short Term Debt Fund or Short Term Debt Funds.

Hi Basu

I am planning to invest 20000 every month for my annual expenditure such as premium of insurance, kids school fees and etc.

I was planning to put money in liquid funds but I am confused now between RD and Liquid Fund. RD for 9 months in ICICI gives you 6.25 % Returns which is guaranteed in contrast to Liquid Funds which can give anywhere between 6-8 % but its variable.

I guess both will attract similar taxes on returns.

I may need money periodically or every 2-3 Months.

What will be best strategy ? Cash ? Liquid Funds ? RD ? FD?

Sandeep-You can’t book an RD for 2-3 months. Hence, better to use Liquid Funds. Regarding FDs, I don’t think there is a much difference of returns between Liquid Funds and FDs. However, if you want to liquidate FD, then there will be a penalty clause. This penalty is not there with Liquid funds.

Pranam sir.

I want to invest 1 lakh for 10 yrs or above.I have also a SBI bluechip fund rs 3000/ (monthly) for 10 yrs.

So PSE suggest in which fund I invest to get a better return and security .

Debendra-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Sir I want to invest in mutual funds but I dont know any thing about it and i dont have large amount to invest plz help me to invest in short term plan.

Chandan-Refer my latest post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Now Yes bank and Kotak bank are offering 7% guaranteed returns on Savings account, then what’s the point investing in these Liquid Funds which are giving less returns compare to Yes Bank’s 7%.

Prabhakar-Yes, they may be offering BUT with certain restrictions like balance you have to offer. Second thing, if you park the money beyond 3 years, then tax advantage is towards debt fund. Also, in banks, there will be a TDS, which reduces your compounding effect. However, in case of liquid funds, the taxation will come into picture when you withdraw the money.

Hi

I wanted to is there any Exit Load charged in Liquid Fund at the time of withdrawal.

Sudharshan-NO.

Thank You.

Can You please advice with some of the mutual fund (Liquid Fund ) I can invest as of now

Sudharshan-They are listed in above post.

Hi Basavaraj,

I have some saving of 2 lk in FDs but its earning lesser interest rate. I am thinking of investing 50% of my savings in liquid fund for a year. Is it a wise decision?? Please suggest

Vicky-If this money is requried for your at anytime within a year, then use Liquid funds.

Hello Basu,

I am bit confused with your answer to the above query: You suggesting him to park his money if he needs that within a year. However, as per taxation rule, it would attract STCG if he does so, right? That means he has to pay more tax when compared to tax based on LTCG if withdrawn after 3 years? Correct me if I am wrong.

The other doubt what I have is: When you say that Liquid Funds invest in various instruments which have maturity of 91 days. I believe that our money get reinvested automatically once the maturity period over (i.e. after 91 days) unless we withdraw it, right?

Mahesh-Yes, I recommended liquid funds. There are two reasons to it. One, he is not sure when he need money. Also, even if he keep the money in one year FD, the taxation will be same as of liquid funds and along with that if he liquidates it early, then he has to pay the penalty for that. The goal is too short-term and not sure of when he need the money. Hence, the priority should be safety than earning MORE return.

Hi Basu – As LIQUID funds are not equity oriented, so both STCG and LTCG would come into picture depending on withdrawal of money. And comparing STCG (Based on individual tax slab) & LTCG (20% with indexation) , it is good to withdraw the money before 3 years. Please correct if other wise ? Please explain ‘INDEXATION’ here as well.

Sandeep-Yes, your understanding of taxation is correct. Regarding indexation, let me write a separate post on that. However, debt funds hold good compared to FD even if the taxation is same for less than 3 years. Because there is no TDS and hence money available for next year compounding is more than the same investment of Bank FDs and also there is no premature penalty like FDs in liquid funds.

Hi Basavraj,

Thanks for reply. Me too was guessing the same. I think you missed my second question on liquid funds’ maturity period of 91 days!

Never mind. I am repeating that here: When you say that Liquid Funds invest in various instruments which have maturity of 91 days, I believe that our money gets reinvested automatically once the maturity period is over (i.e. after 91 days) unless we withdraw it, right?

One more thing, when we can expect your blog on “Best Debt Funds for the year 2018”? Thank you very much for your latest blog on “Best MFs for 2018.” That was very useful.

Mahesh-“Never mind. I am repeating that here: When you say that Liquid Funds invest in various instruments which have maturity of 91 days, I believe that our money gets reinvested automatically once the maturity period is over (i.e. after 91 days) unless we withdraw it, right?”-YES.

Soon I write on debt funds also.

Considering the current market conditions when most stocks are overvalued i am a bit skeptical to invest through SIP or buying share.one of my frinds advised me to park money in liquid fund,but if STCG is 3 yr then i am not feeling like going ahead with liquid fund schemes.

I request for your advice that should i wait for market fall or should i spread my investment from my sb account for 1-2 years or buy the units at a one go, or do STP? Utterly confused.please help.

Barsan-If you have long-term view (5+ Yrs) and did proper asset allocation, then the best time to enter is NOW.

thanks

I want invest in liquid fund which is best for investment funds

Vrushal-They are already listed in above post.

Hi Basavaraj,

I am planning to create a emergency fund of 3 lac by Dec 2018. I have accumulated 1.7 lac till now and can afford to invest 10,000 every month from Nov 2017. I have currently invested 1.45 lac in Reliance money manager fund- growth plan and the remaining 25k in reliance liquid fund-treasury plan. I am planning to continue investing the remaining 1.3 lac for my emergency fund in either of these 2 funds. My intention for parking my emergency fund in these funds is safety and better returns than the bank savings account and also liquidity. Is this a good investment for my scenario? In case you have any better options of investing please let me know.

Vignesh-Parking all 100% into liquid fund of your emergency fund is completely wrong. Even though they say instant liquidity, but the limit is there. Also, if you want to liquidate the whole amount, then it takes around 2 working days. Hence, I suggest like 1/3 in savings account, 1/3 in one year bank FD using internet option (this leads to liquidating it even in mid night without physically going to the bank) and another 1/3 in liquid funds.

Thanks for the suggestion, Basavaraj. The breakup you have given favors liquidity primarily followed by returns and safety. I recently read your post on direct plan vs regular plan comparison in mutual fund investments. You have mentioned that the direct plan gives a better return when compared to regular plans. As I had invested primarily in regular plan I am planning to shift the entire investment to a direct plan. Can you suggest a liquid fund under direct plan in which I can look to invest a part of the emergency fund?

Vignesh-All funds offers direct plan facility. Hence, you can select the same fund which you are already investing.

?My target is Rs. 30 Lakh in 10 years, 50 lakh in 15 years and 50 lakh in 20 years. Today I have started few SIP after review: My target is Rs. 30 Lakh in 10 years, 50 lakh in 15 years and 50 lakh in 20 years. Today I have started few SIP after review:

SBI Bluechip Fund Regular Growth- 4000/-

SBI Magnum Multi Cap Fund Direct Growth- 2000/-

HDFC Mid Cap Opportunities Fund Direct Growth- 1000/-

HDFC Balanced Fund Direct Growth- 3000/-

Mirae Asset Emerging Bluechip Fund-Direct Plan – Growth- 2000/-?

Mirae Asset India opportunities fund 1000/-

L & T India value fund- 2000/-

Reliance small cap fund- 1000/-

Is these plans ok or I need to change, i have just reviewd and selected plans for 10 years, 15 years goal.

Magnesh-Do you think these many funds required? Also, if you already started then why such doubt immediately? Where is the asset allocation? Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

Thanks for your reply. Still I am looking for 4000 in debt fund like Birla Sun Life Short Term Fund or SBI Ultra Short Term Debt Fund. I have invested lumpsum 5000 in Reliance Liquid Fund Treasury. So 13k in equity and 4k in debt and 3k in HDFC balanced fund. For liquid fund I thought of reliance liquid fund. Please guide, I am new and I don’t believe in those agents, everyone says something. I have just registered for all these funds and not debited money from account except liquid fund.

Mangesh-I understand your confusion. You go ahead with Reliance Liquid.

Nice post , really helpful

Hii Basu, I have been reading your blogs regularly and they are a wonderful source of information.

Kindly suggest as presently I am doing STPs in 4 AMCs from Liquid fund/Debt fund to Equity fund. Should I continue doing it or change-over to SIPs, as I read in one of the queries that these are all made for the advantage of advisers and AMCs.

Thank you.

Manish-If your intention of investing in equity is for long-term goals and you did proper asset allocation between debt and equity, then why not direct SIP in equity rather than this exercise?

Hii Basu, Thank you for your response. The only reason was to fetch some more interest on the amount lying in S/B account. Park the money in a deb/liquid fund and then STP from there.

Manish-Your intention is to earn for your long-term goals by investing in equity products or earning more than savings account from liquid or debt products? If you are fearful about the current market condition, then you can manually spread this investment for over 6-12 months. But exercising this activity for the sake of STP, I don’t think it is wise.

Hello Basu,

If I am planning to do monthly STP from my Liquid fund to some schemes in the same fund house,

1. Will this is considered as a withdrawal and am I need to bare STCG? ( I am in 30% 🙁 )

2. If so, where will I get the capital gains for the the month?

3. Do I need to show the capital gains in ITR form?

Also advise which part I need to mention the the capital gains in ITR form? because I usually get form 16 from my company and mimic the details to ITR form. unfortunately these STCG are captured by our office.

4. I understand there is no tax deducted from source for the STCG? Is that right ?

Please advise.

Basu,

Just to reiterate my point

2. If so, where will I get the capital gains for the the month?

This means from which portal/statement I can know how much capital gains for the tax year I got (either monthly or yearly?). All I need is a capital gain figure from somewhere..

Hari-If there is a gain from what you invested to what you withdrew, then this the capital gain (month or days but you have to calculate it for a whole year for taxation purpose). You have to calculate the gains.

Hari-1) STP is nothing but redeeming from one fund to investing in the new fund. Hence, the charges, exit loads, and taxation apply like redemption.

2) I already replied.

3) YES. You have to show under the income head of Capital Gains (STCG or LTCG based on time horizon of holding an asset).

4) TDS is not applicable to resident individuals. But you can’t skip from taxation.

Many thanks for the swift response!

So is it always better to invest directly from bank SB accounts than the liquid fund?

I thought of getting the extra 2-2.5% intensest due to recent Savings account interest rate cuts 🙁 . But these taxes anyway will eat the extra returns.

Then I am wondering why people mostly prefer Liquid funds for STP than bavk Savings account?

Hari-STP is the game created by advisers and Mutual Fund companies to garner money business 🙂

Honest answer !! Only place where I can get unbiased answers!! Many thanks Dear Basu…

Hari-Pleasure 🙂

Hi Basu,

Missed this query!

As part of asset allocation , I am increasing my debt allocation to keep 30% -70% portflio. So could you advise which is best ? duration 20 years.

1. Add any ultra short term debt fund SIP or

2. increment my VPF along with EPF? –>

By adding VPF, I will get guaranteed interest rate like EPF, I don’t mind my lock-in period as my goal is nearly 20 years from now. This is EEE as well in terms of taxation.

Debt funds can help in re balancing my portfolio.but not reliable as EPF.

Which one is effective? Please advise.

Hari-EPF is best to me.

Thanks Basu!

Dear sir, I have 25 lakh in my hand. I am 35 years old & am conservative over this hard earned money.

I am salaried person & do not need this money for next 5 years at least.

I am planning to put this money in fd under my wifes name to avoid tax(she is housewife) & invest full yearly fd return (1.7 lakh) in equity mutual fund.

What do you suggest. Thanks.

Nik-Use Ultra Short Term Debt Funds than equity funds as your time horizon is just 5 years. Even though you transfer to your wife’s account, the earning from such money will be counted in your head due to clubbing provisions of IT Act.

Dear basavaraj..

Thanks for your eyeopening articles..

I have 3 to 4l in sb ank account.. I would like to park in suitable MF for a time horizon of 1-3 months. Kindly pinpoint liquid MF suitable for me.. Thanks in Advance

Ashish-They are already listed in above post.

I am having Rs 20 lakh in bank. I want to invest the same for 5-6 years. My expected returns are 12-15%. My age is 41 and I am ready to take risk. Could you please suggest the portfolio for me. Shall I do STP? then could you please suggest accordingly.

Thanks and regards.

Umesh

Mumbai

Umesh-May I know the meaning of READY TO TAKE RISK?

Hi,

I’m planning to invest 10lakhs in LMF, but I want to lock it for very very short period. It could be even 2 months or less. What will be the returns after consider the all the safety aspects you mentioned above? Can it be better than the 6.70% return that I currently get from FD for 60 or less days? Ofcourse, I don’t mind paying 10% TDS.

Thanks,

Natarajan

Natarajan-It may be or may not be more than 6.7%. But when it comes to taxation and if your holding period is more than 3 years, then debt funds scores over bank FDs. Also, keep in mind that in case of MF, there is no concept called as TDS for resident Indians.

Hi. Only today I hv read your articles on liquid mutual funds and quite impressed.

In fact I was googling for good investment in liquid funds and came across your article.

I am due to retire in another year. I have around 2 lakhs in equities(since 2 yrs) and, by grace of god, the current appreciation is over 100%. Should I sell the equities and invest in liquid funds? Further I have around 5 lks to invest now. These amount may be required in another 10-12 months. Suggest me some good funds.

Thanks

Narayanan-Come out from equity investment immediately. Put all money in liquid funds which you need within another 10-12 months. Funds are already listed above.

Ok. Can u suggest good liquid fund as on date to invest? I will be having about 7 lakhs. Thanks.

Narayanan-They have listed in above post already.

Yes, I missed it.

Should I put all 3-4 lks in one liquid funf in one go or split in diff funds?

Narayanan-One fund is enough. Don’t complicate.

Hi Please share your thoughts on Indiabulls Liquid Fund – Direct Plan (G) , what is the reason for not having this in list

Shahnawaz-What prompted you to doubt that this fund must be in TOP?

hi. after reading all your articles on debt funds, I have some query Please guide and clarify.

1) You have suggested short term Gilt fund over short term Debt fund.I have investment horizon of 1-2 years.It is considered to enter in gilt funds when Interest rates are high & exit when interest rates falling.Now interest rate are already on lower side , is it advisable to invest in gilt fund

Manoj-I am not fond of the idea of chasing interest rate cycle movement. NONE on this earth know what will happen next. Hence, I prefer calm by keeping my money in less volatile. I look for debt to diversify not to play. I have enough volatility through equity. Timing will not work.

hi. after reading all your articles on debt funds, i have made a few conclusions and have a few doubts also. Please guide and clarify

1. if your investment horizon is 1 year but upto 5years go for Ultra short term funds or short term gilt funds

3. stay away from income and credit opp funds as far as possible

4. dynamic bond retuns are variable and subject to risks/error of judgement of fund manager

5. You have suggested asset division between equity and debt for long term (>5year) goals. Which type of debt funds you recommend for such long term goals in the debt portfolio?

Suresh-1) YES but not only for 5 years but also for 5+ years as they are safe than other types of funds. You can experiment lot of volatility by investing in equity. You look for debt to diversify.

2) YES.

3) True.

4) It may be again Ultra Short Term Debt Fund, Short Term Gilt, EPF or PPF.

thanks for your reply.

1.What about long term gilt funds for >5yr debt portfolio.

2.Also can we consider(and count) investment into equity oriented balanced funds as investment in debt portfolio for long term.

3. what are your suggestions as alternative to RD account for 1-2yr investing with short term(3yrs and below) requirement

Suresh-1) They are volatile in nature. Avoid such funds (especially if you are investing in debt funds to diversify from equity).

2) Yes the % of debt portion such equity oriented balanced fund is holding.

3) Use Ultra Short Term debt Funds, Short Term Gilt Funds or Arbitrage Funds.

ELSS vs Liquid Funds, which is better ?

Hi Basu,

I have following query ?

1. For NIL tax on LT capital gains on Liquid fund, the lock in period is 36 months. Is my understanding correct ?

2. If Yes, then ELSS clearly provides much better returns for a period of 3 years than liquid funds. Why one should invest in Liquid funds at all if he / she doesn’t want to do tax calculations(in case of redemption before 36 months) for liquid funds redemption.

Best Regards

Sachin

Dear Basavaraj,

I have in hand 20 Lacs rupees to invest, however in current uptrend market I am bit of in a confusion what should be my portfolio to get a return of min. 20%.

Please could you help to advise.

I am planning to diversify across Equity, Balance, Debt. and Liquid. Looking for a winner portfolio to achieve 20% return.

Thanks,

Deep

Deep-There is no MAGIC with me nor with any so-called experts. My expected return for long term goals (10+ years) from equity is 10% to 12%. I am not sure who on this earth can give you this much return. Be realistic. If someone guiding you with 20% return (as MINIMUM), then assume he is cheating you. Rest you have to decide.

Thanks Basavaraj for the inputs.

I value your opinion its an eye opener. Now I am re-thinking my investment strategy, I am not in contact with agents.

Basically my requirement is bare minimum to secure a regular income after the age of 50 years (currently 42 yrs.), with flexibility to withdraw after lock-in of next 8 years.

So lets say I invest 1 Cr. today, what do you think is the best way for me.

Best Regards

Deep

Deeop-You mean to say that you need regular income from this Rs.1 cr from today?

Hi Basavaraj- I need regular income after the age of 50 years (currently I am 42 yrs. old) for 25 yrs. till reach 75 yrs.

Thanks

Deep

Deep-If your intention is to invest for another 8 years, then invest around 70% in debt and another 30% in equity.

Thanks for you advise sir.

DEAR SIR,

My friend is getting LIC maturity amount of Rs. 1 lakh. He wants to invest the same instead of keeping in Savings accounts. He is 55 aged. Apart from investing a part of it in FD, please suggest some good mutual funds and how much he can invest?

GKMysore-Without knowing much about his requirement and goals, it is hard for me to guide.

Dear Sir,

His goal is to protect his maturity value and earn interest more than in SB. Please suggest some good mutual fund or other investment avenue. since postal MIS transfers interest earned to SB a/c, he is not interested.

Please suggest.

GKMysore-His concern is to earn more than SB account (which is currently at around 4%), then why can’t he use the FDs? I am not suggesting him any type of mutual funds (either debt or equity). However, if his holding period is more than 3 years, then he can try Ultra Short Term Debt Funds or Short Term Gilt Funds (Refer-Top and Best Debt Mutual Funds in India for 2017).

THANK YOU SIR.

I want your mail id.

Ananda-It is [email protected].

HI Sir,

I have following portfolio recently invested for long term basis 5+ years. 50 k each in

Kotak select focus

BSL Frontline equity

DSPBR Tax Saver fund

BSL Tax saving fund

ICICI Pru Multicap

ICICI Pru Dynamic Plan

HDFC Balance fund

DSPBR Balanced fund

I also wish to invest 5000 each as SIP in midcap of Franklin smaller cos and HDFC Equity

I m of 40. Goal is daughter’s education (daughter is 1o yrs of age)

Pravin-What asset allocation you are following?

Dear sir,

First of all thanks for running a such an informative blog.

1. My question is regarding liquid funds as you have told most of them hold AAA rated but when i saw their portfolio holding in value research they show more than 60% in A 1+.Am i missing something here.

2. What is the meaning of having cash equivalent in negative value.

Mathus-1) I said overall portfolio also A1+ means highest credit ranking.

2) Where you read?

Hi Basu,

In my opinion, Emergency funds are for Emergency. Safety & accessibilty are more important than returns. And for that nothing beats the ordinary SB account. Anything beyond 6 months need can be invested in liquid fund/ debt funds /bank FD.

WHO CAN INVEST IN LIQUID FUND?…….In addition to the points mentioned by you, liquid funds can be used by someone who wants to use it as a base fund to park his lumpsum money,from which he can do a STP to same AMCs equity fund

Sreekumar-Why that extra activity of STP??

Hi basu,

why the extra activity? well, suppose you get a lumpsum money,eg pay arrears, which you want to invest in a equity fund as SIP……..woudnt it be better if you park the lumpsum in liquid/debt fund(then do a stp to corresponding equity fund),to get that extra returns, rather than keeping in SB account. Also, if you park the in SB account, there are chances of spending it on other expenses.

Sreekumar-Equity SIP is compared with KEEPING MONEY IN SB ACCOUNT? Enter into equity if your time horizon is 5 years or more (with proper asset allocation). This activity is created by advisers to get constant stream of income to THEM.

Hi basu, Let me put the point more clearly. I am not comparing equity SIP to bank SB account. I too, am a firm beliver that invest in equity the money which you dont need for atleast 5 to 7 years( if not more).I am rather comparing liquid fund to bank SB account. Suppose, one has Rs 10000 as lumpsum, and he wants to do an SIP to equity fund…..he has two options. One, put tht 10000 in a SB account& do an 1000 SIP to a equity fund. He WILL earn guarenteed 4% per annum on the remaing amount after the SIP. OR. Two, he may put that 10000 rs in a liquid fund, from which he can do a monthly SIP of 1000 to its corresponding equity fund. Here, he MIGHT(i repeat might…. not guaranteed) earn more intrest than bank SB from the remaing parked lumpsum amount.

Sree-What I am pointing here is, if the agenda is to invest in equity then why such STP and why not lump sum? Anyhow we are investing for long term and with proper asset allocation, then why not at one go? If uncomfortable with one go then at least once in a month or twice in a month like 25% of investable surplus. Timing the market is wrong. This is what I am pointing.

Hi Basa,

You are not getting the point of Sree !! Do u also invest like this at one go and if one is investing monthly then one has to keep the money somewhere..liquid fund would be better in such case?

Adesh-I understood and it is not his own trick but some agent might have infused that idea in him, that “he MIGHT(i repeat might…. not guaranteed) earn more interest than bank SB from the remaining parked lump sum amount”. Let us assume keeping Rs.1 lakh SIP money in savings account or Rs.1 Lakh SIP amount in a liquid fund and then move to equity in respective funds. But do you know the complication for the sake of 0.5% to 1% higher returns (MAYBE) than SB Account? He has to create one more liquid fund within same AMC. So let us assume he is investing in 3 different funds of 3 different AMCs. Then he has to create 3 more liquid funds. Separate them and let SIP be withdrawn from this. Why complicate life??

Hi ,

can you suggest will it be good to invest on debt/Liquid fund on SIP or onetime?

Thanks

Shetty

Shetty-For your information, SIP is the way of investment but not a product.

Ok , may be i need to reword this question and sentence. can you suggest will it be good to invest on debt/Liquid fund through SIP or onetime way ? I understand for equity SIP is highly recommended, but how about for Debt/liquid funds ?

Shetty-Each type of funds meant for a specific reason. If you have lump sum and long term view, then why SIP in equity HIGHLY RECOMMENDED?

Hi sir I have a long term investment view on wealth creation. I have 4 ELSS Mutual funds via SIP. My age is 25. Please suggest me whether I am investing in right direction or not.

Investment time – 10 yrs, goal – Purchasing a house.

1. Axis Long Term Equity Fund – – Direct(Growth), 1500

2. Reliance Tax Saving Scheme – – Direct(Growth), 1000

3. SBI Magnum Tax Saving Scheme – – Direct(Growth), 1000

4. Franklin India Tax Shield – – Direct(Growth), 1000

Apart from this I have a PPF account with annual investment of around 30000. I have sufficient life insurance so now my only focus is to get better investment returns.

Please suggest any other investment scheme.

Thanks

Ashu-Why 4 ELSS funds and what asset allocation you are using for 10 years goal?

I have 4 ELSS funds, 2 Small cap/ Mid cap funds which I started a month back, DSPBR Multi cap fund and franklin smaller companies fund. I also have demat account with stocks of around 50000.. Basically i have investments in equity based schemes only, no debt or balanced funds so far.. Please tell me if I am investing in right direction.

Ashu-Do you feel having investment only in equity for the sake of so-called high returns a good strategy?

That’s what I am asking for. Please tell me what are the other options. I’m not rich enough to invest in property so I choose to create wealth in long term so as to buy a house in next 10 years. I can invest around 15000 in a month.

Ashu-Do you think real estate INVESTMENT is the WISEST? Think twice. For 10 years goal with asset allocation of 60:40 in equity and debt a must. In Equity if you feel ELSS required then a single ELSS fund is suffice. Dump the rest.

Dear Basavaraj, Thanks for your wonderful cum comprehensive blog on investments !

Below is my current portfolio investing since 3 months and would like to take suggestions on the same if I’m consider 3 years period from now, for marriage expenses.

1. DSPBR Tax Saver Fund (G) – 1500/- p.m

2. Kotak Select Focus Fund (G) – 1000/- p.m

3. ICICI Pru Balanced Fund (G) – 1500/- p.m

Equity – Kotak, I want to consider for long-term, rest can be for short term 3 yrs, please advice? Kindly help me if I will need to consider Debt Funds if I were to look for a period of 5 years from now.

Vikas-Equity not suitable for goals which are less than 5 years. For long term also, asset allocation a MUST between debt and equity. Having one equity fund for long term goal is risky.

Thank you sir. Please suggest way forward if I consider for long term as well as short term. As you pointed out, what Allocation would be appropriate if I target long term >5years and short term ~3years. I can invest UpTo 6k/- p.m including current 4k/-.

Vikas-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

Hi my name is Deepak bhor 29 yrs old married man

Can you help me out regarding my Mutual fund Portfolio

My Currnetly Portfolio :

DSP BR Micro-Cap Fund (G) (Growth) – 1000

Canara Robeco Emerging Equities (G) (Growth) -1000

Birla Sun Life Frontline Equity Fund (G) (Growth) -3000

Mirae Asset Emerging Bluechip Fund (G) (Growth) – 1000

Tata Balanced Fund – Regular (G) (Growth) -1500

ICICI Prudential Value Discovery Fund (G) -1000

ICICI Prudential Focused Bluechip Equity Fund (G) -1000

I have started my monthly SIP in above mutual fund schemes before one year. As you have seen i have purchased too may schmes

Investing in too many funds will not help me gain maximum profit,So i have decided to close some scheme

for e.g I am planning to close either DSP BR Micro-Cap Fund (G) (Growth) – 1000 or

Canara Robeco Emerging Equities (G) (Growth) -1000 and contine with one schme with monthly sip 2000 Because both the schmes are in Small & Mid cap

Same in case of Birla Sun Life Frontline Equity Fund (G) (Growth) -3000 & ICICI Prudential Focused Bluechip Equity Fund (G) -1000

Kindly advice me which should i close and contine.

My risk taking ability is Moderate and I have a long term wealth creation horizon(10 Years Or More than 10 Years)

I select Large cap funds for my long term goals(more than 10 yrs) like child education,child marriage etc and Small & Mid cap funds(more than 7 years )for wealth creation.

& Balance fund for goals for repayment of of home loan premium after it complete.

Thanks in advance

Deepak B

Deepak-Two funds are enough and where is your debt portfolio? What asset allocation you are following? Balanced funds for home loan repayment??

For Debt i have bank’s RD ,FD and Balanced fund i have taken to maintain balance/stable my portfolio.

Deepak-RD and FDs liquid enough to rebalance once in a year to manage the ratio? Think and decide.

So Should i buy debt fund because currently my future goals are buying home for which i am going to take home loan of 20,00,000 Lakhs in june 2017

Child higher education after 16 yrs from now and his marriage after 24 yrs

Retirement after 30 yrs These are my current goals and these are mandatory goals

For that i have designed my portfolio which i have shared you in previous comments can you advice me should i modified my portfolio as per my goals

Thanks ..

Deepak

Deepak-Whether your goal is one or two. For all long term goals, 2-3 equity funds are enough.

yes i agree with you that’s why i decided to minimize my funds from 6 to 3 or 4 hence i am confusing which funds i should contine for my above mentioned goals & which i should closed. Thanks for advice sir.

Deepak-I already pointed also.

I want to minimise some funds in my portfolio can you suggest me which should i close.

Deepak-Birla, Tata and ICICI Pru Discovery are enough.

Hi basu,

Can you please do an article on possible impact of demonitisation on debt funds.

Sreekumar-Surely and thanks for your tips.

Basavaraj

Good evening

I liked the article and the whole blog as well. I am enjoying reading old articles. Great work in passing on knowledge as well educating people.

Do you advice on individual scale basis as a financial planner or as a profession?

Ashish-As of now NO.

ssa g….i want ro know about 10(10)d tax rebate..i heard that we have pay tax on maturity of policies …plz throw some light on this…..thanks

Ramnik-Refer my post “Tax Benefits of Life Insurance“.

Hi Basavaraj,

Very helpful article. Looking for some instrument for short term investment. One query comes in my mind is that, returns after tax deduction either in growth or dividend option, is more than bank interest rate or FDs?

Mudit-It depends which product you choose. Either more or less. Keep in mind that Debt Funds are also volatile in nature 🙂

Thank you for much awaited article and well explained.

1. Can we do SIP while investing in Liquid fund or is it Lump sum investment.

2. How many SIP should one have to park emergency is it advisable to have multiple or a single fund.

3. Will this be considered as Debt or Equity in assets allocation.

Sachin-1) Both can be possible. 2) Single FUND. 3) Debt.

What is Best SIP or Lump sump to put money if i have ideal money.

Does investing by SIP make difference over a period of one year or more ?

Sachin-Define IDEAL money and for how long this will be IDLE for you?

Emergency fund

Sachin-I personally prefer keep 1/3 in savings account, 1/3 in eFDs and 1/3 in liquid funds.

Liquid fund suited for what horizon of Investment.

In consideration with Short ter m Gilt fund and Ultra short term fund when is it to be used instead of liquid fund

Sachin-Use liquid fund which you want to keep in your savings account for emergencies (as I said they not so liquid as advisers claim). A part of it can be invested. I expect more than 4% returns. That’s it. Safety is also one more priority in selection of liquid fund.

Is there any specific lock in period for liquid funds.

Say if i but a liquid fund today with the ideal fund today and then after 3 months if i want it back .How much will get in hand i e after Interest and tax deducation ).

Will i loose fund if i exit less than 1 year and is there possibility of loss of some fund ?

Sachin-There is no such lock-in in liquid funds. But you have to pay taxes as per the holding period.

I personally liked your suggestion to invest only ‘part’ of the emergency fund into liquid funds. It appears very practical. And another comment that a minor difference in “returns” is inconsiderable for liquid funds is also very sensical.

For the logic in investing in the same AMC where a folio already exists – I guess you say so because the new (liquid) funds can be added to the existing folio number of the AMC while purchasing (?). I mention it so that readers may not confuse why you say so.

Sreekanth-Yes, your understanding is correct regarding investing in existing AMCs liquid funds. At the end of the day it is ease of managing money that matters.