Yesterday I wrote a post “Top 10 Best SIP Mutual Funds to invest in India in 2016“. In this post, I thought to list the Top 5 Best ELSS or Tax Saving Mutual Funds to invest in 2016. Because ELSS or Tax Saving Mutual Funds are main hunt of salaried.

- Refer our latest post related to Top 10 Best SIP Mutual Funds to invest in India in 2017 at “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

What is the tax benefit of investing in ELSS or Tax Saving Mutual Funds?

Many of you who searching for ELSS or Tax Saving Mutual Fund might know the taxation of these products. To simplify, whatever you invest in ELSS or Tax Saving Mutual Funds, will be eligible for deduction under Sec.80C of IT Act. These funds will come with a lock-in of 3 years. However, do remember that if you invested say Rs.1, 00,000 in October, 2015, then you can withdraw it ONLY in October, 2018.

Also, the important mistake individuals who invest in ELSS or Tax Saving Funds commit is, they start investing through SIP and consider the first SIP date as investment date and maturity will be after 3 years from 1st SIP. However, do remember that each SIP is considered as fresh investment. Hence, each monthly SIP must complete 3 years. Therefore, if starts monthly SIP in October, 2015 then this will be free to withdraw in October, 2018. The second month SIP i.e. November, 2015 SIP will be eligible to withdraw in November, 2018 and so on.

As these funds are equity oriented mutual funds, the returns from such funds are totally tax-free. So people throng to such products. Because it gives a tax benefit while investing, shortest lock-in (only 3 years) product available among tax saving instruments and after 3 years the return is tax-free.

In addition, being locked-in product, the commission is also high in such products. Therefore, definitely advisers push to SAVE TAX. However, sadly neither advisers nor investors completely forget the basic principle of equity INVESTMENT i.e. equity investment is meant for the LONG TERM. Finally, after 3 years, if investors have some positive return, then they cheer up, otherwise blame it on EQUITY.

Recently almost all mutual fund companies renamed these ELSS or Tax Saving Mutual Funds from their earlier name as “Tax Saving” to “Long Term Equity”. For example, HDFC Tax Saver Fund now changed its name to “HDFC Long Term Advantage Fund”. This is to make sure that at least by name investors can feel that such funds are meant for the LONG TERM.

How I shortlisted the funds?

First, I screened the top 15 funds in each category based on their returns to benchmark since inception. Those among top 15 and with consistency score of 100% are below-mentioned funds.

- Axis Long Term Equity Fund

- Birla Sunlife Tax Plan

- DSP BlackRock Tax Saver Fund

- Franklin India Tax Shield

- ICICI Pru Long Term Equity Fund

- IDBI Equity Advantage Fund

- Reliance Tax Saver

- Religare Invesco Tax Plan

It is hard to choose the BEST among these. However, I finally arrived based on the risk-return criteria. Below is the list of “Top 5 Best ELSS or Tax Saving Mutual Funds to invest in 2016”. To arrive at the final decision, I checked the funds for below-mentioned tests and if the fund cleared all these tests and given me around a minimum of 80% score since inception, will be added to my list.

- Beta-Volatility measure and tell how much the fund changes for a given change in the Index. Lower the beta, lower the volatility. Hence, your fund must have lower beta.

- Standard deviation-It tells us how for a given set of returns, how much do fund returns deviate from the average. Lower the standard deviation, lower the volatility. Hence, your fund must have lower beta.

- Alpha-It is the risk-adjusted measure. By taking risks, how much the fund manager generated the return over the benchmark. Higher the alpha, higher the outperformance of the fund.

- Sharpe Ratio-It is the risk-adjusted measure. Higher the Sharpe ratio better is the performance.

- Sortino Ratio-It is the risk-adjusted measure. Higher the Sortino ratio better is the performance.

- Treynor Ratio-It is also be known as reward ratio. Higher the Treynor ratio better is the performance.

- Information Ratio-This is calculated by average excess return obtained compared to a benchmark and divides it by the standard deviation of excess returns. Higher the information ratio, the higher the consistency in beating the benchmark.

- Omega Ratio- It is a risk-return performance measure of an investment asset.

- Downside deviation-This is also be called as BAD RISK.

- Upside potential-This is exactly the opposite of Downside deviation.

- R-squared- It is a measure of how correlated the fund’s NAV movement is with its index.

- SIP Returns-For how many times the fund’s returns are above the index when we invest in SIP.

- Lump Sum Returns-For how many times the fund’s returns are above the index when we invest in a lump sum.

1) Axis Long Term Equity Fund-This is the fund which is catching intention of many investors. I noticed that few invested in this fund because it has provided good returns since 5 years.

Due to some data error, I can’t share the image of a risk-return analyzer. But it cleared the test since its inception from the lowest score of 83% to highest score of 100%. This seems too impressive to me.

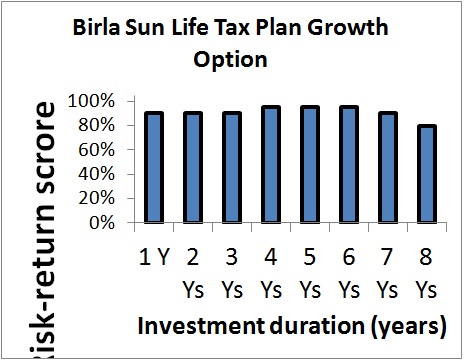

2) Birla Sunlife Tax Plan-The fund is in the market since 1999. Below is the result of its consistency and reason for why I selected this fund.

You notice the consistency of fund since 8 years and it is the eye-catching among many.

3) Franklin India Tax Shield-This is one my favorite fund, which is in top since its launch in 1999 and below is the result of the risk-return analyzer.

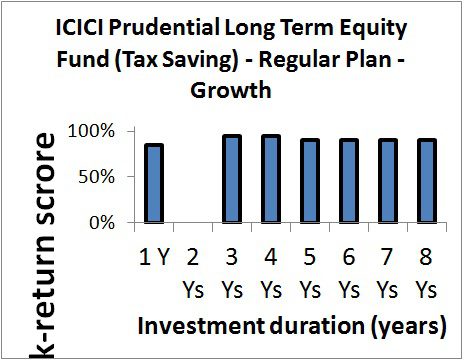

4) ICICI Prudential Long Term Equity Fund-This is the one more fund, which I suggested last year, along with Franklin India Taxshield Fund and I again recommend this fund.

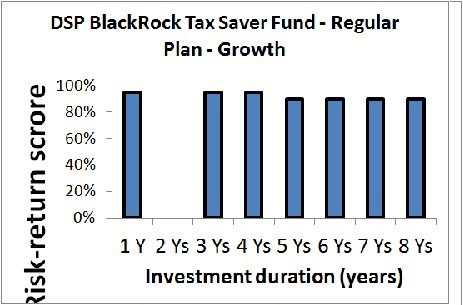

5) DSP BlackRock Tax Saver Fund-This is the fund which is in the market since 2007 and consistently performed well. Hence, I included this fund in my list.

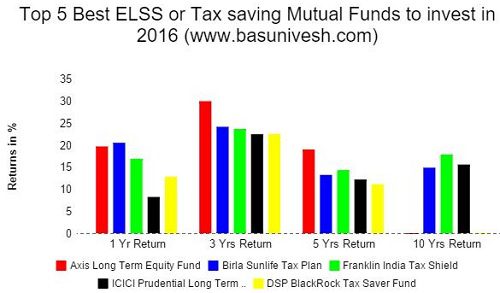

How these funds performed in case of returns?

You noticed that only 3 funds from above selection are more than 10 years old funds. Hence, I stress to consider those funds as a priority.

Hope this information will be useful in selecting the Best ELSS or Tax Saving Mutual Funds to invest in India in 2016.

367 Responses

Hi Vasavraj,

Very good article. keep up your good work.

My 80C investment is:

1. Axis long term – Direct growth – ELSS – Rs 5000/month.

2. Which other ELSS I should choose? DSP BR or Birla SL tax 96?

3. Also, Is it okay to distribute the ELSS to 3 funds or keep it in 1 MF only?

Saikat-In my view one fund enough. However, if you feel to add then you may go and select anyone of above.

1.I am a retired person.My age is 64 years.I have some tax liability due to FD`s in banks.Around 60000 is my tax liability.Under these circumstances,which tax saving mutual fund will be better for me??

2.Can i withdraw as soon as the lockin period is over?

3.If i invest this year under lumpsum investment,i believe this can be shown in my return only for the next assessment year only??

4.In the subsequent years,again i have to make investement??

5.Is these any SIP scheme which will work for only 3 years at the msot maxiumum,since i am already 64 years,i want to withdraw in another 3 years or so

Mohan-Whether your CONCERN is only Tax-Saving??

Main concern is tax saving.But in the process,if some savings is created,then i do not mind

Mohan-This is completely wrong process. Your main concern is to meet your financial goals.

Sr, I am planning to invest in mutual fund SIP of rs 3000 for tax saving and earnigs.

Please suggest best 3 sip plans.

Santesh-Refer my above post and also the latest one at “Top 5 Best ELSS Tax Saving Mutual Funds to invest in 2017“.

i have taken 3 sips TAX SAVING DSP ,SBI MAGNUM AND RELIENCE FOR FIVE YEAR.THIS IS RIGHT OR WRONG

I INVESTED 1000 RS EACH MONTHLY.

Bharat-Without knowing your time horizon and financial goals, how can I assume??

sir

please let me know the risk in a direct plan.

Jagadish-Risk of blind investing for a sake of saving cost of middlemen. Risk of not knowing what is the product and how it can benefit you. Risk of not knowing how the volatility works and how to manage that. Also, risk of not knowing what is re-balancing or review of fund. But at the same time your adviser don’t know all these stuffs then there also a risk. Hence, a final solution is Do It Yourself.

Thank you sir

Dear Basuji

I am doing job in Govt. Sector.

Already my 4 SIPs are running Like Birla Sun Life Tax Relief 96, Tata Rerirement, Axis Long Term Equity and Reliance Money Manager. i also Invest PPF, PLI, LIC and Term Plan.

I want to start New SIP For rs 1000/- for 20 Years,

Suggest Me best AMC & Best SIP

With Regards,

Dipak Modi

Modi-Why can’t the same funds?

I want to invest 50000/- lump sum in two funds(50:50) ELSS for tax saving and good returns. my time horizon is 5-10 years.kindly suggest two diversified funds.

thank you

Davinder-They are listed in above post.

Hi Basavaraj,

Very useful article and the comments section gave more insight. I had a personal query as well please do respond.

Most websites that projected ELSS tax saving funds showed avg 20% return in 3years (3year lock in for tax elss). But in the comments section you said, don’t invest unless you are looking for waiting 10+ years. Are the projected returns false? Why do you say if we are looking for 5 years of investment, then equity is not advisable?

Thank you, Sowmya

Hi Basavaraj, Please reply.

Sowmya-Sorry for missing the reply. Yes, I always defend that you must enter into equity instruments only if your time horizon is more than 5 years. Many portals may say 20% returns for a period of 3 years, but you have to remember that there may be negative 20% returns also. Are you ready for such volatility? None will teach you about how to cope with volatility of equity market. We always look for positive or fancy returns. But what if immediately after your investment market start to fall??

Volatility defuse as long as you invest. Hence, I alway suggest equity as a long term investment but not for short term. If someone suggesting for short term goals, then you must believe that either he don’t know what is volatility or he is the SELLER of mutual fund products.

Thank you for clarifying. Right.. so they are projecting only positive returns. And it seems market is slowing/dropping now with indo-pak problems.

As a 29 year old, what investment would you suggest I take? I have already invested in 5-year FD, PPF and unit linked HDFC pro-growth fund (5years). Nothing long-term though because who knows about tomorrow?!

Thank you for your time!

Sowmya-Perfect…who knows about tomorrow? But what about your retirement or kids education and marriage goals? Are they uncertain or certain goals? How you are ready for such goals?

Thank you for your reply!

You are right about those goals, which is why I invested in moderately safe options of short term. Because when somebody goes Long term, it is with confidence and surety that a job will be at hand.

With this uncertainty of not having a job five years down the line, I decided for short term investment only, even if it requires lump sum investing.

Sowmya-Thanks for understanding my views 🙂

Dear Basu,

Currently I am investing 5000 pm from 2015 in ICICI prudent long term and axis long term both are elss 2500 each, now I want to invest 5000 more pm please suggest in which elss fund should be considered

Kamal-What is your timeframe? Also, why can’t infuse more money into the same existing two funds?

Time frame is long term..but how to increase existing installment or two new installment need to be Set up,my age is 32 and reason for investing in ELSS is 1.2 lakh in 80 C,pls suggest best suitable

Kamal-You can increase the SIP by registering one more under same folio.

Can you pls suggest two or three best ELSS sip funds to invest for long term goals… I’m planning to invest 7500 to 8000 per month..

I am planning to invest in ELSS Mutual funds SIP.

I am planning to invest 7500 to 8000.

Also planning to invest in the beginning of the month one sip on all mutual funds, middle of the month one sip on all mutual funds and end of the month of the month one sip on all mutual funds..

for ex: if i want to invest in axis LT tax saving fund 1500 per month. I will split 1500 into three sip’s as follows,

between 1 to 10 date of the month 500 sip

between 11 to 20 date of the month 500 sip

between 21 to 30 date of the month 500 sip

is this good method to follow or only one sip any day of the month is good.if so suggest better dates to invest sip every month.

Pls suggest which are all elss sip mutual funds from the below list can I invest and how much i can invest on each as per ur selection:

Axis Long Term Equity

Birla Sun Life Tax Relief 96 D

Franklin India Taxshield Fund

ICICI Prudential Long Term Equity (Tax Saving)

Reliance Tax Saver (ELSS) Fund-G

BNP Paribas Long term 23

DSP BlackRock Tax saver

Sundaram Taxsaver D

HDFC Taxsaver Fund

Hari-There is no such logic that spreading your SIP gives you more return. I listed my top funds. You can choose anyone from the list.

Dear basu,

I need your guidance to me.sir, i will spent 6000 Rs every month.How to invest my invesment(6000/month)?which is the best way invest only one fund (axis long term equity fund-Rs 6000) or split the amount (invest two funds ) like Axis LT fund(Rs 4000) and another fund (Rs 2000)?This is Wrong decision(amount & fund selection) please give alternate ideas for me. I so confused.please clear my doubt sir.

I am awaiting your Reply sir.

Mohandas-Where is your plan of asset allocation at first?

Hi basu, I don’t know about asset allocation.pls tell about asset allocation?

Mohandas-It must be based on your timeframe of goal, like how much you have to invest in debt and how much in equity. If you don’t know then you must first understanding all these basics before jumping into investment or take help of your adviser.

Good morning sir,

i have just started working and i need to invest in a portfolio to ensure max tax saving.. please help

Shivani-For me it is hard to do whole tax planning personally on such public platforms. Hope you understand the difficulty.

Dear Basu Sir,

I view of entry, exit and other loads, isn’t it better to SIP into ELSS instead of non ELSS mutual funds?

Pl suggest.

Regards

Girish

Girish-Use ELSS only if you have tax saving option in mind.

Dear Basu Sir,

Pl explain why to Use ELSS only for tax saving.

Actually i want to start investment(Rs.18000 per month SIP for 15 years for target of 40 Lcas corpus target) in large cap equity mutual fund. (My 80C is completed with PF, SSY,PF, Term Insurance Premium etc)

My understanding is that Axis Long Term MF is meeting above requirement along with less entry, exit and other loads s compare to non ELSS Mutual Funds.

Pl correct my facts and suggest Mutual Fund

Regards

Girish

Girish-What if the fund not performing well exactly after 3 years, are you able to switch?

Dear Basu Sir,

Unable to understand your point.

Even non ELSS fund also can start non-performance.

Do you mean switching is easier in case of non ELSS funds?

Regards

Girish

Girish-Yes, because ELSS comes with lock-in. Three years without touching fund even if it is underperforming means danger sign.

Hi Basavaraj,

I want to invest 6000 per month in 3 ELSS funds

Axis Long Term Equity Fund direct plan (Rs 3000)

Birla Sun Life Tax Relief 96 (G) (Rs 1000)

Franklin India Tax Shield direct plan (Rs 2000)

What is the best possible way to invest in SIPS .

Should i invest monthly 6000 to above the list(3 plans) or is there invest only 2 plans? Please suggest

And also please suggest me go to 3 plan or 2 plan or only one to invest for long term?

Can you please confirm me if i can go ahead with these funds or any changes required?

Mohandas-How you selected these funds?

Thak you sir ,

i was selected from MF related articles sir.i need your suggestion?

Mohandas-Refer the comments of my blog post “Top 10 Best SIP Mutual Funds to invest in India in 2016“.

Good morning basu…. I need your guidance how to invest my investment (6000/month)?I want ELSS FUND.Which is best way?please guide me.

Mohan-My selection is above. If you can handle your portfolio, then go ahead for DIRECT funds, otherwise invest through and adviser or online portals of your choice.

Basuji, It was not given to me personally. In your one answer to some one, i read as to come out of reliance fund. So i asked. Sorry.

Pratap-It may be based on his portfolio. Please be specific to your own investments.

…Reliance equity opportunities fund.

Dear Basuji,

As your guidance I want to come out of reliance equity fund. It has given me returns of 41,000 to 54,000 in 41 months by SIP. Now, how I should come out and where to invest or thru STP to HDFC Mid cap SIP. Which should be more appropriate?

Pratp-When I gave you an advice to come out? Can you give me a flashback of the same?

Hi BAsu,

i need ur guidance in investing ELSS MF

in which one i should invest and how much and for how many years

Thanks

Sreepriya

Sreepriya-I listed the funds. How much is depends on you. How long means minimum 5+ years.

Hi Basu,

I invested in below ELSS (lump sum) long back (below are the details), what is your suggestion…should I keep them or switch to other equity funds. My time frame is 15+ years.

1. HDFC Tax Saver (G) – Invested 30000 Rs (in 2007/2008) – Current Value 109973 Rs

2. HDFC Long Term Advantage Fund (G) – Invested 15000 Rs (in 2010) – Current Value 32719 Rs

3. Kotak Tax Saver – Regular Plan (G) – Invested 20000 Rs (in 2008) – Current Value 70288 Rs

4. SBI Magnum Tax Gain Scheme (G) – Invested 12000 Rs (in 2007) – Current Value 20551 Rs

Please provide your advice.

Kapil-Do you feel these returns less or more, which makes you to think?

Thanks Basu for quick response.

I feel returns have been good but from past couple of year these funds are performing relatively week as compared to others finds in same category like Axis Long Term Equity Fund, Birla Sunlife Tax Plan etc…..so I am feeling is this the right time to switch to better performing funds ??

Kapil-Don’t compare other funds. If the fund is delivering your expected return then continue.

just now i have started 4000 pm in hdfc tax saving fund for years . shall i continue or not

Alok-You already started so why immediately reviewing the fund?

please help i have invested in two fund one is in

ICICI value discovery 1000

franklin prima focus 2000

please suggest want to invest more 3500 for long terms.

Kashyam-Without knowing your financial goals, it is hard for me to suggest anything.

On my earlier query of investing horizon of 12-15 years my current age 52 years, you had suggested 60/40 ratio in equity mutual funds and debt funds. Is it ok if I invest in Balance funds with 65/35 ratio of equity and debt funds.

Amrit-Yes, you can.

Hi Basu,

Can i invest 2k sip monthly in UTI MNC Fund for better returns in 3-5 years ?

Please suggest

Nataraj-Don’t invest in any equity funds if your time horizon is 5 years or less than that.

Hi Basu,

I am planning for a fund which can give at least 20% returns per annum for 2 or 3 years. I wanted to invest 5k per month in SIP to buy a car after 2 or 3 years, I am ready to take little risk also. Please suggest me some good funds to achieve the above goal.

Thank you

Nataraj-Even I too in search of a product which can give 20% return in 2-3 years of time 🙂 Stay away from equity.

Hi Thanks for your reply… What’s the maximum benefit I can get in 3 years in equity funds??

Pleser suggest me some non equity funds also for better returns… I am ready to take some risk…

Regards,

Nataraj

Nataraj-In 3 years from equity it may be +30% or -30% are you ready for both?? If your investment horizon is 3 years, then it is too short for equity investment.

Hi,

Many thanks for your prompt reply.

Can you suggest some non equity funds for better returns in 3 years?

thank you

Nataraj-Use Arbitrage Funds or Bank RDs.

Sir my portfolio is as under

1)4000 sip in icici long term equity tax for 20 yrs

2)2000 per month in franklin smaller company for 20 yrs

3) 2000 per month in hdfc mid cap for 20yrs

Is portfolio wise or u will recomment something else

Aji-Where is your debt portfolio?

Hi Basavaraj,

I Want to Plan my retirement . My Target Amount is above between 80 lac & less than 2.5 Crore.

Currently my Age is 31 . Please suggest me funds for 20-28 years.

Regards

Shakti

Shakti-One large cap fund and one small and mid cap fund for equity. For debt you can opt for PPF or short term debt funds. Equity funds are listed in my blog post “Top 10 Best SIP Mutual Funds to invest in India in 2016“.

Hi Basu,

I have selected below Equity funds in Small & Mid Cap for Long term. ( 1000 Rs. for each)

SBI Magnum MidCap Fund- Direct Plan(G)

Mirae Asset Emerging BlueChip– Direct Plan(G)

Please suggest is these funds are ok & I am also searching some low risk funds( like debt & large cap funds)

I can invest 5k per month & can increase gradually over years. Please suggest.

Regards

Shakti

Shakti-Without knowing about your goal tenure, how can I suggest? On what basis you selected these funds?

Sir, for large cap SIP Birla Frontline Or SBI blue chip?

Pratap-I am bit inclined towards Birla.

Hi Basavaraj,

I want to invest 3000 per month in 3 ELSS funds (Rs.1ooo in each fund).

Axis Long Term Equity Fund – Regular Plan (G)

Birla Sun Life Tax Relief 96 (G)

What is the best possible way to invest in SIPS and to avoid the transaction charges.

Should i invest monthly 1000 to each of the 3 funds ? or is there any best way to invest 3k per month ? Please suggest

And also please suggest me 3 best ELSS funds to invest for long term.

Nataraj-Why three funds? Why not one fund? My choices are listed above. If you have so much concern about COST, then opt for DIRECT funds.

Hi Basavraj,

Thanks for your reply. As per your suggestion , I will choose one elss fund and will invest 3k per month in that fund…..

So is there any chance to save transactional charges if I invest quarterly instead if monthly?

Please guide me regarding this..

Regards,

Nataraj

Nataraj-NO. The cost of DIRECT fund is minimal. I am not sure anyone can go beyond and SAVE few rupees.

Hi Basavaraj,

Many thanks for your quick reply.

Is Axis Long Term Equity Fund – Regular Plan (G) is a direct plan ? If this direct plan , i wanted to invest into it for 5+ years ..

If not , Please suggest a direct ELSS plan to invest for 5+ years and also for my tax savings purpose

Thank you

Nataraj-All direct plans will have name DIRECT along with fund name but never REGULAR. So, Axis Long Term Equity Fund – Regular Plan (G) is a REGULAR plan. There is no such restriction of investment whether it is direct or regular. Direct plan of Axis will be named like “Axis Long Term Equity Fund – Direct Plan (G)”.

Hi Basu,

I am planning to invest 5 to 6K on monthly basis for 5 to 7 years. in below schemes. My motive is to save tax and invest in Direct plans through (https://www.mfuindia.com)

Axis Long Term Equity Fund – 3000/month

Birla Sunlife Tax Plan – 3000/month

Can you please confirm me if i can go ahead with these funds or any changes required? I am concerned about overlap in selected funds and I am not much aware about it, request you to confirm on this front as well.

Thanks

Santosh-Go ahead. But make sure that it must be long term.

Thanks Basu.

Can you please let me know how many years i need to stay invested (as you mentioned as long term)?

Santosh-Enter equity only when you have time view of at least 5+ years.

Hi,

I am want to invest for 2500rs and 2500rs monthly seperately for 10 yrs for kids education , as i am new to MF , which SIP i should choose Equity or debt or Tax saving plans.

Do suggest me how to proceed and some names of mutual funds which suits my needs only for education from which i get good benefit on return for investment as i have PPF and LIC.

Thanks in advance

Rahul

Rahul-It is hard to suggest in this way. First try to learn basics of mutual funds, then jump.

sir, in above posts you suggested to sagar…..Sagar-Why so many funds? Invest in one fund. Also don’t invest all into equity funds………if i want to make my investment 50 lac including principal amount in 10 to 13 year.in that case how is it possible to achieve my goal by investing in one fund>>>please help

Veer-Do you feel by investing more funds you can easily achieve your goals? What if all those funds investing in same sector or stocks??

Hi Basu,

I have started investing Rs. 2000 per month in SBI Magnum TaxGain Scheme from last 4 months and I am ready to wait for 10-15 years. I have’nt knowledge about finance and investment. You have shortlisted some funds on the basis of your research but in that you have not compared the SBI Magnum……

Due to reason I am investing in that will you give some merits and demerits of SBI Magnum….?

I am a business owner, 52 years of age. I have a son who has mental disabilities. I will require close to 50 Lakhs for his settlement after say 12-15 years. I am in a position to invest any amount you suggest either at once or on monthly basis on the schemes of your choice. Prefer if you can suggest two year monthly investment plan.

Amit-If your goal is around 12-15 years away, then I suggest a debt to equity in ratio of 40:60. Try to select debt either as PPF or short term debt funds. For equity, refer my earlier post “Top 10 Best SIP Mutual Funds to invest in India in 2016“.

Hi Basu,

My monthly income is 60k and staying with rented house with 15k and my investment are below

LIC — 60k per year

UTI MF –3k motnly

PPF -30k per year

sukanya sambridhi-60k per year

Please suggest if it is not good or where should invest

Deepak-Without knowing your financial goals, it is hard for me to guide.

Hi Basu,

I have to buy home after 5 years so this way I need your suggestion.

my daughter is one year old so for higher study and marriage purpose I need your suggestion.

Thanks

Deepak-For 5 years goal, stay away from equity. For your kid’s future, refer my earlier post on MF selection “Top 10 Best SIP Mutual Funds to invest in India in 2016“.

Dear Basu Sir,

Can i start SIP in Axis Long Term Equity Fund(ELSS) to save tax.

And after 3 years i will encash it without any capital tax gain and again reinvest it for 3 years to save tax.

By this way i have to create SIP cycle of 3 years & then it will maintain itself alongwith tax saving.

Correct me i am wrong in any point.

Also throw some light on entry or exit load(generally) in this case else i will loose tax saved in this loads.

Also is it advisable to start SIP on Axis MF website or ICICU Direct demat account(I am holding it) to save on loads.

Regards

Girish

Girish-You can do so. There is no harm in this. But keep in mind that equity is for long term investment. There will not be exit load if you withdraw money after 3 years. Better to start SIP using Axis MF portal or MF Utility portal.

Hi Basu,

I am investing money like below.

Long term goals for my baby education/Marriage.

DEBIT:

1) 24000/- yearly in sukanya samrudhi.

2) 60000/- per annum in Jeevan anand.

3) 5000/- monthly in RD

EQUITY:

1) HDFC mid cap (1000/- monthly)

2) HDFC Balanced (1000/- monthly)

3) ICICI pru chip fund (1000/- monthly)

Below are questions from my side

1) Fund selection is good? 🙂

2) i want to invest money for short term goal (<=5), Please suggest me short term fund in ICICI, HDFC (Or) Shall i take RD?

3) If i want to invest money in equity for long term goals, Shall i increase the fund amount either in HDFC mid cap (or) HDFC Balanced (or) ICICI pru chip fund?

Thank you in advance

Karthik-1) YES. 2) Specify exact timing. 3) It depends on tenure of goal. Bsed on that we can diversify.

Thank you Basavaraj for quick response.

1) Thanks for your confirmation

Below are the time frames for remaining 2 questions

2) Time frame is 5 years

3) Tenure of the goal is 15 years

Karthik-2) No equity required.

3) For 15 years goal, try to allocate debt to equity in ratio of 30:70.

Hi Basavraj,

Need your suggestions to select proper MF for the following investment plans.

1) Tax Saver (80C) , Time – 3-5years, Amt- 20k (one time payment)

2) SIP for Max returns , Time – 3-5years, Amt- 10k p.m.

Please suggest appropriate MF names and the optimum duration.

Thanks,

Indra

Indranil-Don’t touch any equity based product for your timeframe.

Thanks for your response.

Could you please suggest what could be ideal to invest in for such timeframe of 5yrs(+- 2yrs)?

Indranil-Minimum 5+ years.

Hello,

I want to have a SIP of amount Rs 8000. Out of this, I want to keep Rs 5000 in ELSS fund and remaining amount in fund having high return in long term of around 8-10 years and can take high risk as well.

Please suggest me two ELSS funds(I already have an SIP of 2000 in Axis Long Term Equity Fund and Rs 1500 in Franklin India Tax Saving Fund.) Whether I should increase SIP amount in these funds or take another fund.

Also suggest two funds with High Risk and High Return in a term of 8-10 years.

Also have an opinion on NPS. Whether it is worth investing or not.

Hare-Can you define what is HIGH RISK and HIGH RETURN??

High Risk means I want to risk mine investment amount i.e. if I don’t get any return or very less return for the investment amount. Higher return means that mine investment amount get higher % return.

This is the term I got to hear on Business News Channel.

Please guide me for the ELSS mutual funds as well.

Hare-Business News Channel will not take responsibility for any loss in your money. May I know that % of return you are expecting?

I am expecting a return of around 20%.

Also suggest ELSS fund, we can invest. I already invested in Axis Long Term Equity Fund and Franklin India Tax Saving Fund

Hare-Do you know 20% expectation from equity means? My ideal expectation is around 10% to 12%. One ELSS fund is enough.

Hi Basu,

I want to invest 10000/- to 20000/- rupees in Rajiv Gandhi Equity Savings Scheme under 80CCG for tax benefit(FYI,I have exceeded 80C#150000 limit.)

Please suggest me it will be good to invest in RGESS?

Karthik-Do you feel tax saving of Rs.5,000 or Rs.10,000 is most important than investing wisely to meet your financial goals?

Hi Basu,

Below are my portfolio

1. HDFC infrastructure fund (G) – SIP 1500/- from Jun ’14 Continuing

2. HDFC Tax saver fund (G) – SIP – Rs. 4000/- from Apr ’15 continuing

3. ICICI Pru Long term equity Tax saver – SIP Rs. 3000/- from Apr ’16 continuing

2 & 3 above are tax saving, my aim is for long term investment for a min of 10 years

For 1 as well i’d like to invest for min 10 years.

Kindly suggest me whether shall I continue the above especially 1 & 2 as I fell it is under performing (or) shall I continue.

Regards

Jagan

Jagan-Avoid sector funds like Infra. 2 and 3 are fine to me.

Thanks Basu for your prompt response

Hi Basu,

I’m planning to change the portfolio from Infra to HDFC Mid cap opportunity fund for SIP of Rs. 1500/-. planning for long term like 10 years.

What about your opinion

Hi Sir,

I have recently invested in 2 funds, Certainly my plan is to save tax as well as create some wealth.

I am looking at staying invested for 06 years.

The funds that i have invested in are :-

(1) Axis Long term Equity Fund G -Rs.2500/-

(2) Birla Sun Life Tax relief 96 G -Rs.2500/-

Please guide if the funds that i have invested are right or not and time frame of 06 years is enough or i should wait for more time.

Would appreciate your revert on the same.

Thanks & Regards,

Abbas

Abbas-Whether you can shift to other funds if I say they are wrong? Stick to your plan.

This was just my first experience of investing and since you do lot of researches so thought of understanding from you.

Just for satisfaction that I’m not wrong completely?

Good choice or Bad choice do let me know? Since it can always be changed post few months

Abbas-For 5-6 years of investment, equity must not be more than 30% of your investment.

HI Basu

I have recently purchased HDFC ULIP for 5 years which have 8 funds,as of now fund manager has put whole amount(100%) in Opportunities Fund only,its performing well but i am afraid it might be rsiky to continue with 100% in one fund.Could you please advise me which fund should i prefer and what % in that fund to get max benefits.

HDFC Life Click 2 Invest Balanced Fund

HDFC Life Click 2 Invest Blue Chip Fund

HDFC Life Click 2 Invest Bond Fund

HDFC Life Click 2 Invest Conservative Fund

HDFC Life Click 2 Invest Diversified Equity Fund

HDFC Life Click 2 Invest Equity Plus Fund

HDFC Life Click 2 Invest Income Fund

HDFC Life Click 2 Invest Opportunities Fund

Thanks in advance

Jaydeep-Without knowing your time frame of investment, how can I guide?

Hi

I have invested just before 2 months and its for 5 years of period

Thanks

Jaydeep-For 5 years period, equity is not suitable.

Thanks,Could you please advice me better option for 5 years period ?

OR above ULIP can be extended from 5 to 10 years to have good benefit from market ?

Jaydeep-First understand when you need money, at 5th year or 10th year?

I am looking for 5 years period at a moment but as i have already invested so can any of above mentioned fund(HDFC ULIP fund) will give me better output.

Hi Sir,

I have 9 months old baby boy. I need 20 Lakhs for his education and other needs after 15 years.

I have started 2 ELSS SIP in Axis and Franklin with 1000 each. I can invest 5k per month more for his purposes.

Please suggest where to invest. I am not much concerned about tax saving.

Sahu-Where is your debt investment for this goal?

I don’t have any investment other than these two . I mentioned earlier. I just started investment hence need your suggestions accordingly.

Regards,

Sahu-You continue Axis and Franklin but make sure you must have debt:equity in ratio of 30:70. For debt, you can use PPF.

Basu Ji,

If I look for investment point of view (and not tax saving), how are ELSS different from other MFs?

My doubt is, can I select Axis Long Term Equity Fund against other MFs such as ICICI Pru focused bluechip or Frankline India Bjuechip?

Regards,

Praveen

Praveen-You can’t generalize all ELSS funds to regular funds. You have to check the underlying portfolio then you can decide. You go with ELSS only in case you need tax saving option. Because, during lock in period, if fund not performing well, then you still have to continue. Liquidity issue.

Dear Mr. Basu,

Are ELSS good for one time annual investment or SIP ? The mentioned ELSS MFs screened for SIP kind of investments as well ?

Chandan-If your time horizon is long term, then SIP or lump sum, it does not matter.

Hi Basavaraj,

My question is not on ELSS but Debt fund. I am 28, already investing in MF since 3 years and have a long term horizon (10+). Till now all my MF allocation were on Equity and returns are good if not spectacular and am looking into rebalancing some.

My question is, now I want to increase my investment in Debt funds to bring asset allocation ration to at most 70:30(Eq:Dbt). I have chosen Franklin India Ultra Short Bond Fund-Super Inst(G) [in SIP] based on comparisons. However I mean my debt portfolio to be long term, same as my equity portfolio. Should this fund be right for me? All the long term bond/income/etc funds I searched had lesser returns than this. Any recommendation apart from this is welcome.

I also mean to keep another debt fund for parking savings bank surplus amounts, to be available for withdrawals as and when required. I am meaning the same fund(Franklin ultra short) [but not in SIP] for this purpose. Is this correct strategy?

Shamik-It is institutional plan. Not meant for retail investors. Do you feel higher return from all debt funds means BEST fund?

Hi Basu,

I am looking for some pension plan to secure financially after attain my age 60 years and also that pension will be useful to my wife/daughter.

Please suggest me any pension plan , it should be like i can withdraw when ever i want.

FYI ::: i am investing money in HDFC midcap, Balanced fund and ICICI pru chip for long term

Thank you.

Karthik-There is no such plan. Suggest you to accumulate on your own by investing in MFs. At retirement period you can use annuity plans provided by insurance companies or can manage the money on your own.

Hi Sir,

I want to start a SIP for Franklin India Tax shield Fund. i opted with online mutual fund from HDFC Bank. so how can i invest will i go with online Franklin India site and invest or hdfc bank directly. i case i invest by Franklin India site so at the time of withdraw will bw any problem?. thanks a lot in advance for help.

Rohit-HDFC Bank is middlemen. If you know what you are investing then go with direct funds from Franklin portal.

Hi Basu,

Could you please clarity below doubt

1) HDFC mid cap fund -growth

It means we are investing money in the mutual funds through agent/ fund manager

2) HDFC mid cap fund -Direct growth

It means we are investing money in the mutual funds without agent/fund manager

Am i right? Please clarify

Karthik-Only error in your knowledge is you can’t invest without fund manager whether it is direct or regular.

Hi,

I want to invest in ELSS for tax saving purpose. I can invest upto 5000 in SIP. I am little bit confuse in between Axis or ICICI equity fund. please suggest me for better option.

Ashish-Invest in anyone.

sir ji check your updates on funds hdfc tax saver and hdfc long term advantage fund both r diffrent funds

and hdfc amc not change the name of hdfc tax saver….dont give wrong information.

Deepak-I gave an example but not said that it changed. Check my above post. Also, I will not get anything by saying such wrong things.

sir ,i am 30 yrs old wid 5 yr son nd 6 mnth daughter and already contributing 5k/pm in PF @ 8.75% and still hv another 6k/pm for taxes. i want both tax saving nd return wid target of @ least 15 years .. so what suggesion sir.. any SIP or increase in PF contribution.. contribution will increase by 2000 per year.. or think about midcap,equity or other sip than elss.. my finacial goal are more money for childs. home is not in my target as already invested in land. can u suggest a profile.

Chauham-You have to include equity. However, considering the tax benefits option, include ELSS schemes. You can start with any one scheme of listed above.

hi ,

I did mutual fund investment in SBI magnum tax gain plan 4 years back. after maturity I have stopped investing now I want to restart the same. Please let me know is it good to reinvest in same scheme or I can move to another MF scheme.

which one is good option?

Girish-Select the funds from above list.

Hi Basu Ji,

I am 35 years old and want to save for 2 goals with time horizon of 10 years.

1. Education of my 5 years old daughter and 3 years old son. Want to save 1 crore for both children. Will save for 10 years and then start using that money after 10 years.

2. Marriage of both. Want to save 1 crore for both children. Will save for 10 years and then leave that corpus for another 10 years, considering the current age of my children.

For above goals my strategy is:

1. 1.5 lacs in PPF

2. 1.5 lacs in Sukanya

3. 2Lacs in ELSS or any other good plan.

Kindly suggest. Investment amount can be increased in future based on my future financial position.

Regards,

Darpan

Darpan-Keep like Rs.2 lakh in either PPF or Sukanya and rest Rs.3 lakh in equity mutual funds.

hi

Planning to invest in ELSS . Tax saving and wealth generation is the motive. So if I start an SIP of 15000pm , i can only get the whole amount after 6years right? Can i continue it for 10 years or so? iIs that advisable?

Thanks

Dini-You can withdraw each investment of a month after 3 years. That means if you invested for a monthly SIP of a year, then you will be eligible to withdraw all amount after 4th year. However, keep in mind that equity investment is meant for long term. Hence, enter into ELSS only if you have waiting period of 5+ years. Yes, you can wait for 10 years…20 years or as long as you want. No such condition after 3rd year.

I want to invest in ELSS. so, pls suggest which way should I go I.e. Lumpsum amount or SIP ? and Franklin or Birla sun life Tax relief 96 fund which one is better?

Kumar-Chose the one which comfort to you either lump sum or SIP. Funds are already listed above.

Hi,

So as per IT if I am allowed to save tax on upto 1.5 Laks (Based on my Tax slab)

If I start SIP in all of your 5 suggestions with amount 2500/- each

i.e 2500 * 5 ELSS * 12 months = 150000

Period: 3 years

How much can I save Tax v/s Return on investment after 3 years on last SIP month (6 years from now)??

Ansari-First myth, don’t invest in equity if your time horizon is just 3 years. Second is, don’t run for investment only to save tax. But align each of your investment to your financial goals.

Dear Basavaraj

I want to invest 1000rs per month for about 10yrs for marriage of my niece. Kindly suggest an investment plan which requires a regular investment.

Also can u please suggest what are the hidden deductables in these investments and what could be my in-hand return after 10 yrs with the above said amount.

Someswar-You can use debt:Equity in the ratio of 50:50. In debt you can use short term debt funds and in equity one large cap fund and one small and mid cap fund.

Hi…I want to invest 5000 per month for tax saving as well as investment, investment period is not an issue. please suggest the best fund to invest.

Varun-For me knowing your investment period is MAJOR issue. Without that I can’t guide you.

Basavaraj thanks for your post, quite informative. I already have a SIP with Reliance tax saver(RTS), which has given an overall -ve return for the last FY. Would you suggest I switch to the top 5 you have shared or stick to RTS.

Bibek-Check why it is underperforming? Whether the fund is not doing good or the market itself is not good? In my view the fund. Because check the funds like Franklin Tax Shield, it has give -6.52% return, while Reliance -14%. Wait for few more days. If it is continuously down, then you can take a call.

Dear sir my self kiran and working with one of the pharmaceutical firm my current CTC is 7 Lack/anum, i m 34 yrs old and my son is 10 yrs old.

Now he is in 3rd standard and i want to invest around 15K to 20K per month for his higher education.

Recently i have 2 policies for that i am paying around 5K per months.

I want my money approximately after 8 years for his higher education.

Please suggest me some good plans which are having good returns and TAX saver.

regards,

Kiran….

Kiran-Use large cap fund and short term debt fund in ratio of 40:60.

Dear Basavaraj,

Kudos to you for all the good work you are doing in simplifying financial jugglery for novices like me.

I am 39 & planning to start a 5k monthly sip from May’ 16 in Axis Long Term Equity Fund with a investment horizon of 10 yrs +. I already have couple of ULIPs with more than 5yrs investment which I am planning to stop. I would request your help on the below queries.

1) Is this a regular or direct fund as I would prefer regular fund?

2) Can I invest through my bank’s (HDFC) mutual fund service or I would be constrained to HDFC funds only in this scenario? Otherwise I’ll have to go through fundsindia route as suggested to some other query by you. Which of the two is a better (beneficial in terms of other charges) way of doing it.

3) Can I increase or decrease (without stopping) my SIP in future depending on financial situation?

4) I have a LIC Jeevan Anand policy since last 6 years with 25 years term & 21k annual premium. Do you suggest to continue or withdraw & invest in any other ELSS fund

My objective is investment for financial growth rather than tax saving.

Thanks,

Mohit

Mohit-1) The said fund is available in both versions.

2) In my view FundsIndia.

3) Automatically you can’t increase or decrease. But you can modify the existing SIP by cancelling the one and registering the new one.

4) If you feel 5% to 6% is a great, then continue. Otherwise, you have to quit at the earliest.

Dear Sir,

I need your advise for financial planning,

I want to invest 15 per month and i am planning 5000 in ppf , 5000 ELSS (monthly 5000 or in one shot 60k in a year) and 5000 nse, pl. let me know is this ok,? and also suggest which fund and scheme should i go>.. pl. consider that I am having LIC policies so I dont want to go for TAX saving

Thnz n Regds

Amit Vyas

pl. note that i want to invest for 3 or more years, and i heard that if i go for SIP then every monthly sip has 3 year locking period,

Amit-Yes, each monthly SIP is considered as fresh investment. So each SIP must complete 3 years.

Amit-When you don’t want to go for Tax Savings, then why ELSS and NSC? Whether your ivnestments aligned to your financial goals?

Dear Sir,

I am having LIC for tax saving, now i want to save monthly 15k for 5 years , So can you suggest me for planning?

Thnx n Regds

Amit

Amit-For what purpose you want to save?

Which elss is good

Vinitha-I already listed them in above post.

Dear Sir,

I want to save / invest for future , i can save monthly 15 to 20k, So can you pl. suggest me how and where to invest I want to save for 3 to 5 years or even more

Thnx n Regds

Amit J.Vyas

Amit-First let me know your exact timeframe. 3-5 years or even more means a wide guessing. Investment can’t be done on wide gueesing.

Dear Sir,

thnx for quick reply, I want to save 15k per month for 5 years, pl. suggest

Thnx a lot

Amit-No equity investment for you.

Dear Basu,

I had recently joined a central government job. My primary aim is tax saving with good returns. My Gross income is around 9 lakhs per year. I want to invest around Rs.9000 per month for tax saving purposes. What will be the best options for me. Also time frame is not a problem. I can invest for long term. Can you suggest me a diversified portfolio options.

Abhinav-Define your goals first, then ask questions specifically.

Hi,

I am house wife, recently quit my job. I am planning to close my PF account where i am expecting to get around 5lakhs and to invest in MIS or MIP. Can you please suggest me which scheme or mutual fund will be better to get standard monthly income. I read some article that MIP is not guaranteed. Please advice.

Deepa-MIPs of mutual funds are not guaranteed. They may give you income or not and also of how much is not sure. Why can’t you check with postal MIS?

Than you. I will check that for sure.

Dear Basu,

Which is better between birla sun life tax plan and birla sun life tax relief-96?

Why there is two funds?

I would like to invest for 5+years.

Uday-Definitely Birla Sun Life Tax Relife-96. Why two funds? Because they have to run the show called BUSINESS.

Hi Basu,

Nice to see u r sharing your knowledge with people who are looking for help !!

My Question –

I am planning to invest in ELSS 3000 rs . monthly for next financial year in SIP mode.

One scheme i have finalised is Axis Long Term Equity Fund Direct Plan (G).- 1500 rs.

Now looking for other scheme which shouldn’t be overlapping with the above one.

To make it more clear below are the schemes which are running in my mind :-

1> Birla Sun life Tax Relief’96 Direct plan (G)

2>Franklin India Tax Shield Direct (G)

3> ICICI Pru Long Term Equity Direct (G)

Out of 2,3 and 4 schemes please suggest me the better one with minimum overlapping, good returns in 3 and 5+ yrs by considering my eagerness in diversification of holding , not overlapping much . My aim is to continue in this ELSS for at least 5+ years.

Thanks !! waiting for response.

Sorry typo * ,its 1, 2 and 3 funds mentioned in numbers :-

1> Birla Sun life Tax Relief’96 Direct plan (G)

2>Franklin India Tax Shield Direct (G)

3> ICICI Pru Long Term Equity Direct (G)

Also suggest 1 or 2 other better funds for me which you find urs personal favorites.

Adarsh-NO EQUITY RECOMMENDATION for time frame of 3-5 years.

Sir I m a business man and I am having lic of 150000 per year and 9000 mediclaim where I should invest to save my tax

Ankit-Whether Rs.1,50,000 is sum assured or premium?

Sir, I am a central government employee. I am not having any tax saving investment schemes till now. I would like to invest in a tax saving mutual fund, which gives the best return within 3 years. Kindly suggest me the best performing tax saving scheme.

Harikrishnan-Sadly ELSS will come with 3 yrs lock-in also equity is meant for 5+ years. So I will not recommend any ELSS scheme for you.

Hi,

I want to invest Rs. 50000 for one time only for tax saving purpose. . kindly suggest me where I have to invest my 50 k .

Amit-Kindly let me know your financial goal.

Hello Basavaraj,

I am planning to invest in SIP of amount 1500 per month. I am like starting this for the first time and I am looking for long term investment for around 8 – 10 years. Which is the best options for investing to start up with SIP. This should meet both requirements like tax savings and good returns in terms of long term. I am presently 32 yrs and I donot have any Policies, MF’s etc.

Please suggest how do I start investing in SIP and idle amount to start with.

Satya-They are already listed above.

So one SIP will be ok or I need to invest in more then 1?

Satya-One is enough.

Hi Basavaraj

I am a software employee and I don’t have much knowledge of ELSS schemes, my intention to invest in ELSS is to avail the tax benefits, so as a reason last year (Aug 2015) I have started investing in

“Axis Long Term Equity Fund – Direct Growth – G” – 2000 per month

How ever my invested amount in the above scheme is showing negative withdrawal balance, Now I want to invest 3000 more every month in ELSS to avail tax benefits, so what should I do now, should I add 3000 to the existing “Axis Long Term Equity Fund – Direct Growth – G” or I can start investing 3000 in “Franklin India Tax Shield” which is another best scheme from your list with consistent performance from the last 10 years.

What is Direct growth and growth in ELSS scheme, which one should I choose.

Thanks and regards

Vikram Modhugu

Vikram-The problem with you is not understanding the volatility nature of equity and concentrating ONLY on tax saving aspect. First identify your goals, then align your investment which also must be tax efficient. You are doing reverse of what I suggest. You can invest in Franklin fund also. You claim to be already investing in DIRECT fund but asking me the difference between regular fund to direct. What prompted you to invest in DIRECT?

I have invested in direct growth with out knowing the difference between direct growth and growth, but now from your other article tried to gain some knowledge

hi sir, i heard that if we invest in one fund it has more risk compare to invest in different funds. for mitigation of risk what can i do.

Kiran-It depends on what type of fund you have and your time frame. We can’t generalize it. For example, I can be happy with single equity oriented balanced fund.

Dear Sir,

I have started SIP of 500/- each ( Currently INR 3000/- per month ) in ELSS mainly for tax savings.

As on date I have invested in Following Funds

Sr. No. Name of Scheme Amount Remark

1 Axis Long Term Equity Fund – Growth 10,000 Investment Going on

2 BNP Paribas Long Term Equity Fund – Growth 4,000 Investment Going on

3 BSL Tax Relief’ 96 fund – Growth 2,000 Investment Going on

4 Franklin India TAXSHIELD -Growth 11,500 Investment Going on

5 HDFC Long Term Advantage Fund – Growth 7,000 Investment stopped

6 HDFC TAX Saver – Growth 9,000 Investment stopped

7 ICICI Prudential Long Term Equity Fund ( Tax Saving )- Growth 4,500 Investment Going on

8 SBI Magnum Tax Gain Scheme – Growth 7,000 Investment stopped

9 Tata Long Term Equity Fund – Growth 2,000 Investment Going on

My aim is to create a corpus of nearly 25 lac towards education of my child & also save tax.

Please advise whether I should continue with this or should diversify my portfolio.

Regards,

Tushar

Tushar-I suggest only one fund.

Investing in only one is never suggested anywhere, its always better to diversify/Split so as to lower the risk, at least 2

Kiran-Great…but what if the two funds underlying stocks same? Is it not create overlap??

dear sir i am investing in axis long term equity fund and hdfc long term adv fund. but later fund (hdfc) is performing well in recent past. Is it due to volatility or fund is not ok??? kindly suggest me whether to continue sip in hdfc lta fund or not??? pse reply its urgent..

Prajapati-Why you invested tax savings right? There is a lock-in to such products. Also, what was your purpose? I hope it is long term. Then to worry about day to day movements?

Hi Basavraj,

I am planning to invest 50000/- for tax saving. Investment should be of minimum duration. Which is the best option ? And what should one think before investing regarding security ?

Mahesh-Can you let me know what is the definition of MINIMUM DURATION?

Locking period should be minimum.

Mahesh-But equity is meant for LONG TERM investment.

Hello,

I am 29 years old started investing in elss sips and gonna remain invested with atleast 10+ years

1. Birla sun life – 2000

2. Rel tax savr – 4000

3. axis long term – 4000

4. franklin – 2000

and ppf yearly 1lac.

All this investment will be for long term.

can you pls advice whether i m into right funds or if thr are any changes pls advice?

Regards,

sagar

Sagar-Why so many funds? Invest in one fund. Also don’t invest all into equity funds. You must have at least 40% of your investable amount into debt.

First of all Thnx for your prompt respons. really appreciate

1. pls suggest me some debt funds whr i cn invest.

2. pls sugest me some good sips in large and mid cap again invested horizon will be 10+ years.

3. investing in soo many funds – reason is me and wife we botth r working and each one holds two funds and each invest 1lac ayear in ppf as well. really sorry to mention this before.

Regards,

sagar

Sagar-1) PPF is debt product. Invest in that if your goal is 15 year or so.

2) They are listed in my earlier post at “Top 10 Best SIP Mutual Funds to invest in India in 2016“.

3) It’s alright. But still both can have in same funds.

Thanks Mr. Basavaraj for all the guidance regarding investment in mutual funds…

It has been helpful for me to begin to understand a few things about investment in MFs…

I am planning to invest Rs. 36000/- per year starting this financial year in an equity linked saving scheme fund for a period of 15-20 years.

Considering the volatility of the market at present would it be a good idea to invest Rs. 36000/- as a lump sum with in next 10 days or should I invest in ppf for the time being to save tax and start an SIP of Rs. 3000/- per month in the next financial year.

Also suggest a good ELSS fund to invest in.

Regards.

Rakesh-Current volatility matters to you as you claim to be long term investor? Simply invest NOW.

Hi Sir,

Happy Friday.

I am an IT company person, I have made my mind to invest 3 to 5K atleast for 10 years . I have already 2 LIC policy and investing in Sukanya Soubhagya policy. I want to invest in something which will get me good returns for my early retirement time as a whole amount which I can get in that I can start up a small company of my own. Please suggest me whihc is the best investment like mutual fund SIP or something else trustworthy as I am really very bad in finance and understanding the policies. Also please suggest me if I need to increase the amount of saving 5K to more for a good return for future.

Thanks a lot in advance.

Regards,

Vandana

Vandana-I don’t know your target amount so how can I say whether Rs.3,000 or Rs.5,000 suffice? Also, I dont know meaning of “GOOD RETURNS” as per your view, then how can I recommend a product?

Hi Basu,

I invest in three tax saving MFs from last month in SIP mode.

1.axis long term equity-3000

2.reliance elss-1000

3.franklin tax shiled-1500

My investment horizon is 5 years.You said in the post that it is not good to invest in ELSS through SIP mode,because each sip in elss is new investment.Is it true?

Sethurajan-I never said so. Please so where I said so. It is true that each SIP must complete 3 years to withdraw. But I definitely said that don’t invest in ELSS if your time horizon is less than 5 years (In fact in any equity funds).

Hi Basu Ji,

I’m following your blog regularly, going through question and answers.

I need a clarification about “ICICI Prudential India Recovery Fund – Series 4”. Recently ICICI Prudential Mutual Fund House introduced this closed ended fund. I would like to invest in it. I am going to invest for the first time in MFs.

My question is is this fund falls under ELSS?

Hi

This jamil

Age 29

Currently investing in through SIP 0f 1000 rs. in fallowing funds as….

1.Reliance eqity oppt fund since Marc2013

2.hdfc mif cap oppt fund since march 2014

3.DSP Black microcap rp g since jan2015

4.franklin high growth companies fund feb2015

5. ICICI technology fund jan2014

ELSS

1.axis long term 50k in 2015

2.Reliance tax save 40 k jan2015

3. ICIcic pru tax plan rp g 5k jan2014

4.PPF 75k 2015

I want you plz hav a look on thease funds and suggest me where to invest more as i wanted return aftr 10 years

And also sugest me where should i invest for yearly finnacial obligation

Jamil-You are at risk by investing in small and mid cap funds and also sector funds. You just need one large cap and small portion of small and mid cap. Also, why you need two to three tax saving funds? One is enough. If your time horizon is 10 years then don’t go beyond 60% of your investable surplus into equity.

Thnk you so much for kind suggestions.

And m sure this year i am going to invest in axis lt for ELSS . And plz suggest me which fund should i quit and which fund should i opt instead of that in large or diversified fund…plz let me know.

Jamil-One equity oriented fund like HDFC Balanced Fund is enough. Otherwise major portion into large cap funds and one small and mid cap fund from above list.

Hi Babu,

How is TATA Tax Saving Elss Fund.

Hi, I am 42 years and earn 85k per month. I nvest 1 lakh every year in PPF. I do not have any equity exposure. I want to start with SIP of 5000 in Axis Long Term Equity with a horizon of at least 8 years. Is that fine or should I break this 5000 into multiple funds?

Amitav-If you need tax saving product, then go ahead with Axis.

Dear Basu,

As I have noticed that SBI-Pharma is consistently performing well in terms of return since last 5 years. And in future there is plenty of opportunity for Indian Pharma Sector due to expiry of several patents of the drugs (off-patents).

I’m interested to have SIP of Rs 5000 for next 5 years. Would you recommend to have that?

Thanks in advance!

Atul-Try your luck 🙂 I am inclined towards diversification than being exposed to sector.

Dear Sir,

I want to invest a sum or Rs 2500 PM in ELSS named by BNP PARIBAS LONG TERM EQUITY FAND . for around 15 years time frame . Still i am 25 Years. Kindly suggest will it be worth it ? or should i also seems for some other LONG TERM Funds ?

THANKS in Advance

Arun-I think you raised this question in Facebook and we discussed already.

Hi,

I would like to invest in ELSS, Market seems to be in the down trend, is it the right time to iunvest or do i need to wait for some more time( i mean till 31March).

In some of the article’s, it mentioned that there is chance for a crash. if it happens to what level i can go.

Thanks in advance

Manoj

Manoj-Forget about so-called equity experts, even GOD also can’t predict market. Then why you are believing on this noise of media and experts? You must enter into equity ONLY if you have long term view of around 5-7 or more years. For such long-term investors, such noise does not matters. Go ahead and stay away from noise created by these so called EXPERTS.

Hi Basu

Appreciate the way you have heard to each one’s query and cleared the doubts.

I want to invest in an ELSS seeking for high return as have already diversified my areas of investment like LIC, NSC, MF.

Hence as per your sugestion planning to invest in Axis Long Term Equity Fund. Can you please guide me how can I invest it directly so that I can save the brokerage part as well. what would be the link for dircet portal investment.

Thanks. Awaiting your reply.

Bandita-Go for direct if you know how to manage the fund and related service issues. Otherwise go with an adviser. There is no special link for DIRECT. However, while selecting the funds, you just have to select direct fund of particular mutual fund product.

Hi,

Greetings!

Karthik Aged 32, already invested in LIC Money Back for a premium of 25K PA and another 35K PA towards Life Insurance. Planning to Invest another 50K towards tax saving this year.

I am planning the below.

FD – 10000

PPF – 10000

ELSS – 30000 (All risks equally divided)

This year in ELSS i could do only as Bulk and not as SIP as almost we are around year end. From next year planning to do SIP in ELSS.

Can you suggest ELSS accordingly for me, holding period can be 3 – 7 years.

Please advice is this is a sound investment.

Thank You

Karthik-Whether your investments linked to financial goals? I don’t think so. The only motive for you is to SAVE TAX. At the end you will starve of cash when you actually in need. Also, do remember that ELSS is not for short terms like 3 years or so. Enter into equity only if your holding period is minimum 5 years. There is a 4 years gap between what you say as 3-7 years. Be specific with your money. After all it is your hard earned money and you have to take care of it.

Hi, thank you for your time on my profile. My financial goals are high and i prefer to take moderate risk at this time. I actually saving around 10k PM separately to meet unexpected expenses apart form my house hold expenses. This money as you said is purely to save tax also to meet financial goals. I actually planned to split money in different ELSS schemes like one will be redeemed at 3rd year and another at 5th year and another at 7th year. Since i dont want to fully get into MF i planned to allocated few in FD and in PPF. Since PPF returns are tax free and safe i preferred for that and i assume i would not need that money for next 15 yrs. I have also invested around 1L in direct equities.

Hi Basavaraj,

I want to invest some money for Tax saving. Am looking for short term investment and ready to take some risk. I was enquiring about ICICIs’ ELSS. But then the guys at bank suggested me about Guaranteed Wealth Protect plan. Am not sure about where to put in the money now. Guaranteed Wealth Protect plan has some luring elements like, its insurance cover, flexible investment options, 101% capital guarantee etc. Where in ELSS has high returns and short investment duration of 3 yrs. Can you help me out here by throwing some more light on pros and cons of each of these?

Thanks in Advance,

Suraj Bhandari

Suraj-When you are saying as you looking for short term investment, then I suggest you to stay away from ELSS and the dangerous product called GUARANTEED WEALTH PROTECT plan. Simply use tax saving FDs.

Sir

Name: Vaibhav Gupta

Age: 27

Monthly income: 45000 per month

Investment(Planning): 10000 per month (for tax saving purpose)

I wants to invest in following mutual fund for tax saving purpose.

Axis Long Term Equity 4000

Birla Sun Life Tax Relief 3000

Q1 Is the fund selection is correct? what sould be the time horizon? I have seen that most fund perform better in 3year term than 5yr term.

hence what should be my time horizon for these two fund?

Q2 What would be the best way to invest the rest 3000 money in term of fixed income that can give me tax saving benefit?

Please suggest?

Thanks.

Vaibhav-1) Equity investment meant for long term. Enter into it if your time horizon is 5+ years. Fund performance looks good when you see 1 years, 3 years or 5 years than 10 years or 15 years. But you see the volatility also. Hence, look for return of more than 5 years or so.

2) It depends on your financial goals.

Q1 As per your suggestion what would the best fund to invest in(with the benefit of tax saving) for a term of 5-10 years?

Q2 As in I have not set any goals. I want to just invest that amount so that it can give me secured return and advantage of tax saving. Can you suggest any such instrument?

Vaibhav-1) They are listed above. 2) Keep the amount in savings account. It is safest to a CERTAIN EXTENT.

HI Sir,

Actually I invested in Max Life insurance for tax savings a+returns( as per their conversation), paying 24k/year from 5-6 yrs. But I do not see any returns on it. Should I take out the money and invest lump sum amount into some good ELSS fund that has tax savings + good returns? Pleas suggest.

Sudha-Don’t concentrate ONLY on tax saving. You must understand about your financial goals. Otherwise, you will again do this mistake of liquidating it at your wish. The first mistake you did was to buy a insurance+investment product. Second thing is your expectation from ELSS as a tax saving and good returns. Please understand that ELSS is an equity product. Invest in such product, only if you have more than 5+ years of time horizon.

Hello sir

What is the difference between axis long term equity fund growth and direct growth?

I can see there is difference between NAV of them

AXIS LONG TERM EQUITY FUND DIRECT GROWTH 13-Jan-2016 30.6531

AXIS LONG TERM EQUITY FUND GROWTH 13-Jan-2016 29.5503

which is beneficial ? Like advantages /disadvantages.

Hari-One is regular fund where there a cost of an adviser or middlemen. Direct is a fund type where they not include the cost of middlemen. That is the reason, direct funds have cheaper NAV than regular. You read my earliest on this at “Mutual Fund Direct Plans-Who can move?“.

Yesteray I brought one through their site but only two options was there direct growth and direct dividend or something why the other two options was not there?

Hari-Growth in the sense your money will grow and whatever the earning they re-invest, this automatically creates long term wealth. Dividend means, they pay you the profit as and when they feel to distribute it. If your goal is long term wealth creation, they try to opt growth.

Between.. thank you very much for your support. Hats off to u for your dedication.You are finding time to replay to all the queries. Great work sir (y)

Hari-Pleasure 🙂

Hi Basu,

Thanks for yet another fantastic article.

In most of your previous posts, I observed that you have been suggesting to go for one large and one small&mid cap funds.

I have been investing in AXIS LT fund from last 6 months. I want to start investing in one more fund.

How do I know that ELSS fund is a large cap or mid or small cap, specifically AXIS LT fund ?

Meher-You have to check it’s underlying holdings.

Dear Basu,

A timely article as March approaching, Thanks for spreading financial awareness.

Keep up the good work.

God bless you!

Ben

Sir,

if a fund I invest in has a lock-in period of 3 years ,then should I do SIP for all 3 years or I should do upto 6 months or 1 year?

Thanks,

Harsh

Harsh-There is no such restriction of doing it for 3 years investment (SIP) in a fund which has a lock-in of 3 years. You can invest one time, a year, 5 years or whatever you feel comfortable. But do remember that each SIP must complete 3 years to liquidate.

Hi Sir,

Is it possible to invest in ELSS or Tax Saving Funds online? I do not want to go through the process of going to these offices or DSA for the same. Also, do these funds have a high management charges, portfolio allocation charges. Can you throw light on these charges by different copanies?

Thanks very much

Prashant

Prashant-If you don’t need physical process then opt for regular funds and use the platforms like FundsIndia. Fund charges differ based on AUM of the fund. You can check the expense ratio of the fund you selected from respective mutual fund company portal. For your information, there is no concept like “management charges, portfolio allocation charges” but the only expense ratio, which is based on AUM. I felt you are new to MF.

Yes. I am new to MF. I checked FundsIndia and it seems interesting. From your articles, my understanding is that if I invest through FundsIndia instead of direct AMC, I will incur an additional cost of 0.5 % to 1%. Please correct me if I am wrong. One more apprehension is – If FundsIndia or any other intermediary closes down, how will I be able o track my investments? I believe the investments will be secure since it is invested with AMC and not FundsIndia.

Prashant-Yes, your understanding about expense part is correct. Regarding closure of any intermediary, they are just middlemen. What will happen if they close the shop? Your investments will continue as usual and you can get the statements directly from mutual fund companies at any time. Tracking investments is not an issue. Yes, your investments will be secure irrespective of closure of middlemen.

Dear sir

Is any differnce these elss mf and equity mf returns ?

Muzeeb-You can’t compare ELSS to regular funds unless the underlying stocks and portfolio is 100% matching.

Hi,

I’m planning to invest 50k on ELSS for tax saving. I am thinking about Axis Long Term Equity Fund.

Can you please suggest shall i go with this fund or shall i invest into one more ELSS fund to have diversified and safer folio. I would be investing the money at least for 5 years.

Avi-If your time horizon is 5 years ONLY, then don’t enter into equity. Second thing, whether you invest in single fund or 100 funds, check the overlap. If it is more then it will not serve the purpose of diversification.

Hi Basu,

First of all thanks. Very nice and informative portal. ( I am yet to go over it fully though)

I have a need of some investment beyond 80C to contain my tax .

I have exhausted 80C limit and HRA is also fully utilized.

So you have anything to suggest, what can i look into?

Thanks,

Murali

Murali-Don’t think too much on tax saving part. Your main concentration must be towards fulfilling your financial goals. While selecting the product which matches your goals, try to select the tax efficient products.

Hi Basavaraj,

I’m planning to invest 50k on ELSS for tax saving.Can u suggest how should i distribute the 50k into different funds.

I heard that investing in single find involves huge risk.

Hari-Go ahead with only one fund.

Hi Sir,

i am very much interest to learn stock marker before entering that field i need proper education.

can u help me for that…?

Sudha-Yes, why not. But nothing is easy. So you must have eager to learn, act and think of long term investor.

Dear Sir,

I am Sasikumar from Tamil nadu. I am 40 yrs old.

With a aim to invest for 15 years, i have started to invest in the following funds from SEP 2014.

HDFC Midcap oppurtunity – Rs 3000/-

HDFC Equity Rs 1500/-

ICICI Value Discovery fund Rs 1500/-

Franklin india High growth fund Rs 1500/-

Birla MNC Rs 1500/-

SBI Pharma 1500-.

Pl offer your remarks on my fund selection. Does any change required.

Pl guide. Thankyou.

S.Sasikumar

Sasikumar-Other than sector funds, all are good.

Hi Basu,

I currently have SIP for CANARA ROBECO EQUITY TAX SAVER – REGULAR GROWTH for last 50 months and the amount is 1000 rs Per month.

I also have Sundaram Tax Saver G SIP which i have already stopped after completion of 3 years.

I am looking to invest more in ELSS – could you please advise which fund should i invest.

Regards,

Ganesh

Ganesh-They are already listed above.

Hi Basu,

I am a big fan of your blog. I appreciate your work of spreading the knowledge about finance which many of us are illiterate. I thank on behalf of everyone who follows your blog for every advice. I have invested first time today in Mutual fund on Tax saving funds. Just wanted your advice on the below funds;

1. Axis LT Equity Fund(G) – 10 years – 2k

2. Franklin India Taxshield(G) – 10 years – 2k

3. BNP Paribas LT Equity Fund(G) – 10 years – 2k

I had not seen BNP in your list but i tried since it was a good one. Please await for your advise.

Regards,

Arvind Maithry

Aravind-Why three tax-saving funds? Whether you checked the overlapping of these three funds? If the overlap is too much, then better to reduce the funds.

I am sorry I have no idea regarding overlap..can you pls explain..

Hi Basu,

I did a overlap check with fubdpicker fundoo.com reference through Google.. I received following results..

1. Axis vs BNP – 24% overlap and 9 common stocks

2. BNP vs Franklin – 38% overlap and 16 common stocks

3. Axis vs Franklin – 21% overlap and 10 common stocks..

Please advise what’s best and way forward..

Thanks,

Arvind Maithry

Aravind-Try to come out of BNP or Franklin (because the result is around 38%). But I still feel the overlap is not that much.

Hello Basu

I am investing in BNP tax saving fund from more than 2 years

my question

1.should i continue in BNP or change it to other fund if yes then which one

2.i want to invest LUMP SUM in tax saving fund please tell me which one is best for me please tell me one.

I am waiting for your ans .

i want LUMP SUM for my 2015-16 tax rebate

is it best to invest in mutual for lumpp sum ar any other scheme

Nitish-Equity is meant for long term. So I don’t see any harm in investing lump sum.

Nitish-You can continue the same fund. If your view is long term, then invest lump sum in same fund rather than having too many funds.

i feel atleast two funds in tax saving

like axis and BNP if i choose and if one perform not well then other will do

and in your choice which one is more effective

axis or icici tax saving fund

Nitish-How come you decided that if one not perform well, then other will perform better? Check underlying portfolio and then decide. What if both the funds portfolio is same?

Aravind-Please go through my old post “How to compare Mutual Fund portfolio overlap?“.

Dear Basu,

Thanks for the useful information.

I am planning to invest 2000 per month through SIP in axis long term equity fund for tax saving purpose. I would like to run the sip for 4years and have the fund invested for 7years so that I can withdraw all the sips at the end of 7years.

1. Is that a good decision of investing through sip for 4years and have the fund invested for 7years?

2. Can I go with axis or franklin or icici? Cab you suggest me based on the expense ratio

Udaykumar-1) Invest 60% in ELSS and 40% in debt products like Tax Saving FDs or some other investments which matches your time horizon. Because investing all money in equity is not a right strategy.

2) Go with Axis.

Sir,

Thanks for the reply.

Can you suggest best debt funds considering my time horizon.

Am at 10% tax bracket. So is it wise to invest in debt funds or bank fds?

Please clarify.

Udaykumar-If you are into 10% tax bracket, then I feel FDs over debt funds.

Hi

I am just curious but why would you suggest FD over debt funds for 10% bracket? Just trying to understand the logic?