A majority of us are aware of the Sec.80c options. But are you aware of the Tax Savings options other than Sec.80C for FY 2017-18? In this post, let us explore those options and how wisely you can save tax.

In my earlier post, I explained in detail about what are the investment instruments you can use to save tax under Sec.80C. (Refer Deduction under Section 80C – A complete list“).

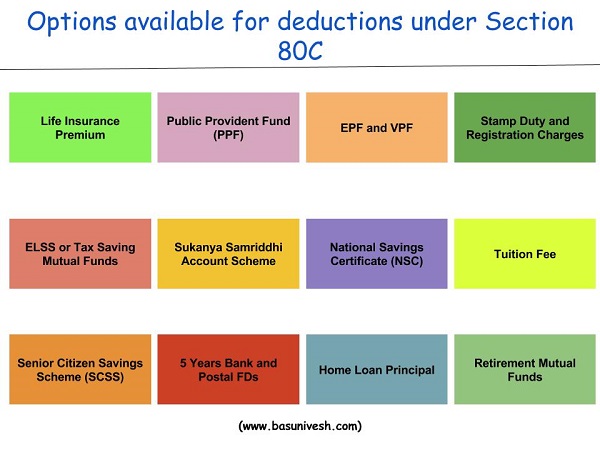

Let me recap more about Sec.80C with below image.

NPS or National Pension Scheme also comes under Sec.80C. Refer the same “NPS Tax Benefits – Sec. 80CCD(1), 80CCD(2) and 80CCD(1B)“.

Before jumping into discussing Tax Savings options other than Sec.80C for FY 2017-18, let us also understand the tax saving allowances which you can easily utilize and save tax.

Tax Savings options other than Sec.80C for FY 2017-18-Allowances

# Mobile/Telephone Reimbursement-If your employer offering you the mobile/telephone connection or internet connection which requires for work, then you can claim 100% of such cost. However, you have to produce the bill. Only the postpaid connections are allowed for reimbursement.

# Medical Allowance-This is the allowance provided to the employee to meet the treatment cost to him or his family. The maximum limit per year is Rs.15,000. Anything more than that will be taxable income to the employee.

# Leave Travel Allowance-The bills for your travel against LTA can be claimed for exemption. It is allowed to be claimed twice in a block of four years. The current block is 2014 to 2017. You can carry forward your unclaimed LTA to the next year. You can request your employer to not deduct tax on it and allow you to claim it next year.

# Entertainment Allowances-You may be getting this allowance. However, the exemption is available only for Government employees. The amount of exemption is least of the following.

a) Rs 5,000

b) 1/5th of salary (excluding any allowance, benefits or other perquisites)

c) Actual entertainment allowance received

# House Rent Allowance (HRA)-This is the famous exemption which is used by many salaried individuals. However, the wrong belief is that whatever the rent they pay is actually exempted from their income. The reality is different. The amount of exemption is least of the following.

a) Actual HRA Received

b) 40% of Salary (50%, if house situated in Mumbai, Calcutta, Delhi or Madras)

c) Rent paid minus 10% of salary

(Salary= Basic + DA (if part of retirement benefit) + Turnover based Commission)

Note :-HRA will be fully taxable if an employee who is living in his own house or if he does not pay any rent. Also, it is mandatory for employee to report PAN of the landlord to the employer if rent paid is more than Rs. 1,00,000.

# Children Education Allowance-If your employer providing this allowance, then you can take exemption up to Rs.100 per month per child (maximum of up to 2 children). Therefore, monthly you can save Rs.200 from this allowance. The exemption may seem so low. But why to pay the tax?

# Hostel Expenditure Allowance-If your employer providing this allowance, then you can take exemption Up to Rs. 300 per month per child up to a maximum of 2 children is exempt. Therefore, you can save around maximum of Rs.600 from this allowance.

# Transport Allowance-This allowance is provided to you to meet expenditure on commuting between place of residence and place of duty. The extent of exemption is Rs.1,600 per month. For blind and handicapped employees is Rs.3,200 per month.

# Conveyance Allowance-This is the different allowance than transport allowance. It is the expenditure granted to an employee to meet the expenses on conveyance in performing of his official duties. There is no limit for this. If such conveyance allowance is Rs.5,000 a month, then the whole allowance is exempt. Hence, you may this may be exempt to the extent of expenditure incurred for official purposes.

# Any Allowance to meet the cost of travel on tour or on transfer-Here also no limit. The employee can claim exempt to the extent of expenditure incurred for official purposes.

# Allowance to meet the cost of travel on tour or on transfer-Here also no limit. The employee can claim exempt to the extent of expenditure incurred for official purposes.

# Daily Allowance-If you are not placed in normal duty place, then your employer may provide you such allowance. The employee can claim exempt to the extent of expenditure incurred for official purposes.

These are the major allowances, which can be utilized to save tax on salary income. There are few other allowances also to claim the exemption. But many of such allowances are not so famous. Hence, I left them to list.

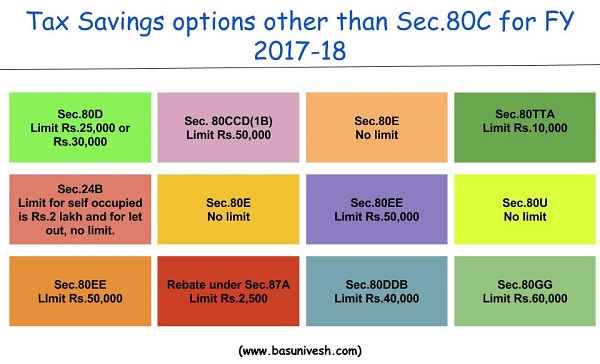

Tax Savings options other than Sec.80C for FY 2017-18

Above we discussed few allowances, which you can use wisely to save tax. Now let us move on and discuss more the alternatives to Tax Savings options other than Sec.80C for FY 2017-18.

Note-Effective from FY 2017-18, the limit under Sec.24B for both self-occupied and let out the property (loss from house property) is set as Rs.2,00,000. Earlier there was no such limit for let out properties (for set-off of the loss when the interest payment is more than the rental income).

# Sec.80CCC

Deduction under Sec.80CCC is available only for individuals. Contribution to an annuity plan of the LIC of India or any other insurer for receiving the pension. Do remember that the amount should be paid or deposited out of income chargeable to tax.

The maximum amount deductible under Sec.80CCC is Rs.1.5 lakh. Do remember that this is also the part of combined limit of Rs.1.5 lakh available under Sec.80C, Sec.80CCC, and Sec.80CCD(1).

# Sec.80CCD

This is all about your investment in NPS. I explained the same in my earlier post “NPS Tax Benefits – Sec. 80CCD(1), 80CCD(2) and 80CCD(1B)“. But I will recap the same here as below.

NPS Tax Benefits under Sec.80CCD (1)

- The maximum benefit available is Rs.1.5 lakh (including Sec.80C limit).

- An individual’s maximum 20% of annual income (Earlier it was 10% but after Budget 2017, it increased to 20%) or an employees (10% of Basic+DA) contribution will be eligible for deduction.

- As I said above, this section will form the part of Sec.80C limit.

NPS Tax Benefits under Sec.80CCD (2)

- There is a misconception among many that there is no upper limit for this section. However, the limit is least of 3 conditions. 1) Amount contributed by an employer, 2) 10% of Basic+DA and 3) Gross Total Income.

- This is additional deduction which will not form the part of Sec.80C limit.

- The deduction under this section will not be eligible for self-employed.

NPS Tax Benefits under Sec.80CCD (1B)

- This is the additional tax benefit of up to Rs.50,000 eligible for income tax deduction and was introduced in the Budger 2015

- Introduced in Budget 2015. One can avail the benefit of this Sect.80CCD (1B) from FY 2015-16.

- Both self-employed and employees are eligible for availing this deduction.

- This is over and above Sec.80CCD (1).

I explained the same in below image for your simplicity.

Note-Under Sec.80CCD(1), now the limit for an individual’s limit is increased to maximum 20% of annual income (Earlier it was 10% but after Budget 2017, it increased to 20%) or an employees (10% of Basic+DA) contribution will be eligible for deduction.

# Sec.80D

Deduction under this section is available if you satisfy the following conditions.

- The taxpayer should be an individual (resident, NRI or Foreign Citizen) or HUF.

- Payment should be made out of income chargeable to tax.

- Payment should be in NON-CASH mode (for preventive health check up, you can pay either through cash or non-cash mode).

I will try to summarize the whole benefit from below image.

Note-Parents means dependent or non-dependent. Father-in-law or mother-in-law are not included.

# Sec.80DD

A resident individual or HUF is allowed to claim the deduction under Sec.80DD. You can claim the deduction if you incurred an expenditure for medical treatment, training, and rehabilitation of dependent relative (being a person with a disability).

A deduction can also be claimed if an individual or HUF deposited or paid for any approved scheme of LIC (or any other insurance) or UTI for the maintenance of such dependent relative.

Here, dependent means spouse, children, parents, brothers, and sisters, who is wholly and mainly dependent upon the individual.

You can claim a fixed duction of Rs.75,000 under this section. A higher deduction of Rs.1,35,000 is available if such dependent relative is suffering from severe disability.

# Sec.80DDB

An Individual’s of HUFs expenses actually paid for medical treatment of specified diseases and ailments subject to certain conditions can be claimed under this section.

The maximum deduction is Rs. 40,000 (Rs. 60,000 where expenditure is incurred for a senior citizen and Rs. 80,000 in case of very senior citizen[w.e.f assessment year 2016-17]).

With effect from the assessment year 2016-17, the taxpayer shall be required to obtain a prescription from a specialist doctor (not necessarily from a doctor working in a Government hospital) for availing this deduction.

You can claim the deduction for the medical treatment of self, spouse, children, parents brothers, and sisters of the individual.

The ailments covered under this section are as below.

# Neurological Diseases where the disability level has been certified to be of 40% and above;

(a) Dementia

(b) Dystonia Musculorum Deformans

(c) Motor Neuron Disease

(d) Ataxia

(e) Chorea

(f) Hemiballismus

(g) Aphasia

(h) Parkinson’s Disease

# Malignant Cancers

# Full Blown Acquired Immuno-Deficiency Syndrome (AIDS) ;

# Chronic Renal Failure

# Hematological disorders

a) Hemophilia

b) Thalassaemia

# Sec.80E

An individual can claim deduction under Sec.80E. If the loan is taken by an individual for any study in India or outside India, then they can claim the deduction. The interest part of the loan on such education loan can be claimed for deduction for pursuing individual’s own education or for the education of his relatives (Spouse, children or any student for whom the individual is legal guardian).

The entire interest is deductible in the year in which the individual starts to pay interest on the loan and subsequent 7 years or until interest is paid in full (i.e for total 8 years). But do remember that interest should be paid out of the income of chargeable to tax.

# Sec.80EE

First time Home Buyers can claim an additional Tax deduction of up to Rs.50,000 on home loan interest payments under this section. Below are the few conditions for this.

- He must be an individual (Resident or Non-Resident).

- Loan must be taken for the acquisition of the property.

- Loan should be sanctioned in FY FY 2016-17.

- Loan amount should not exceed Rs. 35 Lakh.

- The value of the house should not be more than Rs 50 Lakh.

- The home buyer should not have any other existing residential house during the sanction of loan.

Do remember that if you claimed the interest under this section, then the same can’t be claimed under other sections for deductions.

# Sec.80G

Donations to certain approved funds, trusts, charitable institutions/donations for renovation or repairs of notified temples, etc can be claimed as a deduction under this section. This deduction can only be claimed when the contribution made by cheque or draft or in cash. In-kind contributions like food material, clothes, medicines etc. do not qualify for deduction under this section.

The donations made to any Political party can be claimed under section 80GGC.

From FY 2017-18, the limit of deduction under section 80G / 80GGC for donations made in cash is reduced from current Rs 10,000 to Rs 2,000 only.

# Sec.80GG

I have written a complete post on this section. Refer “Section 80GG Deduction-Get Tax Benefit on rent paid if not getting HRA !!!“. I will give you the brief about this section as below.

This section only applies to those who have not availed HRA in their salary or not claiming the deduction on their rent in any of the other sections of income tax. Below are a few conditions to avail the deduction under this section.

- This section is only applicable to Individual or HUF.

- Tax Payer may be either salaried or a self-employed. However, must not be getting HRA.

- Tax Payer himself or spouse/Minor Child/HUF of which he is a member should not own any accommodation at a place where he is doing a job or business.

- If Tax Payer owns a house at a place other than the place noted above, then the concession in respect of self-occupied property is not claimed by him [Under Section 23 (2) (a) or 23 (4) (a)].

- Tax Payer has to file a declaration in Form No.10BA regarding the expenditure incurred by him towards the payment of rent.

How much amount of deduction one can avail under Sec. 80GG?

If the above five conditions are satisfied, the amount deductible under Section 80GG is LEAST OF THE FOLLOWING.

- Rs.5, 000 per month;

- 25% of total income of taxpayer for the year; or

- Rent Paid less 10% of total income (Rent Paid-10% of Total Income).

# Sec.80TTA

A deduction of up to Rs.10,000 can be claimed by an individual or HUB in respect of any income by the way of interest on deposits (not on FDs) in a savings account with a bank, co-operative society or post office.

# Sec.80U

To claim tax benefits under Sec.80U, the taxpayer should be an individual and resident of India. If he is suffering from 40% or more than 40% of any disability, then he can claim a tax deduction.

You can claim the fixed deduction of Rs.75,000. a higher deduction of Rs.1,25,000 is allowed in respect of a person with a severe disability (i.e. having a disability of 80% or above).

# Sec.24 (B)

Interest part of your home loan EMI will be claimed under this section. The maximum limit for the self-occupied property is Rs.2,00,000 per year. For let-out property, earlier the entire interest payment of home loan (Loss from House Property) can be allowed to set off against any other income source without any limit. However, effective from FY 2017-18, this set-off now limited to Rs.2 lakh per individual (irrespective of the number of properties you are holding).

# Rebate under Sec.87A

The tax rebate of Rs.2,500 for individuals with income of up to Rs 3.5 Lakh has been proposed in Budget 2017-18.

To avail this benefit, there are certain conditions and they are as below.

- The taxpayer must be a resident individual.

- Your Total Income (Less Deductions from 80C to 80U) is equal to or less than Rs.3,50,000.

- The rebate is the 100% of income tax on such income or Rs.2,500 (whichever is less).

Conclusion-Do remember that there are many Tax Savings options other than Sec.80C for FY 2017-18. However, it does not mean that we MUST utilize all those to save tax. Use the tax saving options wisely than with the sole intention of SAVING TAX at any cost.

Understanding your requirement must be given priority. Then comes the tax saving options. Never jump into any product with the sole intention of tax saving. Never heed to your friend’s tax savings tips. Use options wisely if they suit you.

HI Basavaraj,

Can you please explain me how can I get money invested in NPS back after 60 yrs ? Will it be monthly wise. Also which do you think beneficial for money growth , NPS or equity based mutual fund ?

Dear Amrita,

Who said you that NPS will give you monthly income once you reach 60 years of age? Refer to my post “National Pension Scheme (NPS) – 5 Biggest Disadvantages“.

good day, I am receiving fixed amount LTA from my company every year which is included in my 16A income side, no one in our company claimed deduction against this. This Oct’17 i travelled within India with my family can i ask my company to show deduction in 16A or can i show directly in my return

Kshirsagar-If you took holiday to claim this and you have valid travel proof then you can claim.

Thanks for the reply,

We travel through Tour company , railway tickets were booked by us , but all the internal transfers, hotel food were done by Tour company , then what type of expenses we can claim in exemption

Kshirsagar-Whether you took the holiday mentioning you are travelling using LTA?

As always, you are a bundle of knowledge and very responsive with queries. I own a house and am claiming exemption for the interest portion. We are blessed with our second child and have moved in with my in laws. It is a 2 floor house, we are staying on one floor and paying rent. What are the precautions I need to take as I will be needing exemptions for both HRA and interest on home loan. My in laws have a pan #, however have not filed returns as they are retired and income limit is not beyond the threshhold.

Abhay-Which place is near to your office location?

Not much. It’s 2km from my place.

Abhay-I am asking WHICH Place?

It’s my in laws place that is closer to office , but that’s only by 2 km. My place is 17kms from office and in laws place is 15 kms.

Abhay-It is then can be claimed that your office is near to in-laws house and hence paying rent. But it purely depends on how your AO treat the case.

Thanks a lot. Appreciate the quick response

Great work….

nicely put…

I am asalaried person employed in a reputed company, I am goiung to Purchase a SECOND HOUSE ( Residetial Flat) which will be an under

construction property. My first House ( a Residential Flat ) , Not Rented , is being presently occupied / looked after by my Parents. .

i am going to avail home loan [ House Building Loan from Bank or my Company (Employer) or my Provident Fund(EPF) Account or in suitable

Combinations of these options to finance the Purchase of my said Second House / Residential Property.

Now, Kindly Advise from Income Tax Point of View and considering all relavant aspects.

Nath-One house is considered as own use and another as let out property. Also, do you think to buy a property just for the sake of tax saving is worth?

Dear Mr. Basunivesh,

Many thanks for initial reply to my queries.

Now, Kindly Note that :=

The Second House Purchasing, I mentioned, is Very Much Required for my / family use in a different location suitable for my family . The first house is occupied by my parents. The Second House purchasing is required for my family use.

I want to avail House Building Loan either from Bank or from my Company

(Employer) or from my Provident Fund(EPF) Account or in suitable combinations of these options.

( My 80C investments are complete (more than Rs.1.5 lakhs).

Now I solicit your well thought-of ADVISE before proceeding with Purchasing of my Second House (to be used by my family) for Saving of maximum Income Tax aswellas considering other relavant aspects.

( Hope My Queries are Clear to You now. If you require any further clarifications I am ready to furnish the Same gladly).

Regards,

S. K. NATH.

Nath-Once you own two properties, irrespective of status, one property is considered as let out property.

Hi Basu- My organization telling me that there is no option to claim IT exemption on mobile/ telephone/ internet bills undet IT act. Please tell me the section of IT act under which this exemption is there. tnx a lot.

Sandeep-If such facility is provided by your employer as allowance? If so, then you can reimburse under allowance.

Hi Basu- yes I do get Internet bill reimbursement but my employer saying exemption not possible under IT act that’s why I’m looking for section under which I can claim while filing returns/ ITR. Please advise.

Sandeep-Show THIS.

Dear Basu,

I am a PSU Employee. I have a home loan with interest payment of more than Rs. 200000/annum. Our Finance Department deducts Interest Income from other sources i.e. Savings account (Rs. 5000.00 ) from home loan interest rebate which comes out to be 195000 only. While preparing Form-16, they don’t consider this interest under section 80 TTA for rabate.

Can I claim it while filing IT returns under section 80 TTA or is there any restriction that we can not claim it if we claim home loan interest rebate?

Rahul-Sec.80TTA interest you earn from keeping money in your savings account. How can your employer deduct that from your such savings account interest earning?

They deduct savings account interest from Home Loan Interest rebate (loss from house property). Can I claim it while filing IT returns under section 80 TTA or is there any restriction that we can not claim it if we claim home loan interest rebate?

Rahul-I am not sure how can they deduct savings account interest to home loan loss of property interest (which comes under Sec.24)?

Sir,

Even if they do that, can I claim Rs. 5000 (Interest income from Savings Acct) while filing IT returns under section 80 TTA or is there any restriction that we can not claim it if we claim home loan interest rebate?

Rahul-How can you comparing your savings account interest to home loan interest? Both are different and both can be claimed under different sections of IT.

Hi Basu. Great post. Really helpful. Thanks for sharing.

Can I claim 3200/ incurred against preventive health checkup of my non dependent Sr.citizen father? I do not have any documents & paid by cash.

Priyajit-Yes, but if IT Dept ask for the receipt, then you must provide it.

Hi Basu,

Thank you so much for sharing the best information on this topic.

Singh-Pleasure.

Dear Basavaraj Sir,

Very well explained article. Sir, I have a doubt. This financial year I have received reimbursement of medical expenses of Rs. 50000/- , spent for my father around 3 yr back. This was actually supposed to be provided last year. they delayed it. Which section i should claim deduction sir? is it 80D? is it taxable sir?

regards

Rajesh-You are not allowed to claim exemption NOW. Because you incurred the expenses 3 years back, not in this FY. Hence, it is considered as your salary income and taxed as per your individual tax slab.

I think Book reimbursement is also one of the deduction available, when employee produces bills.

Uniform maintenance allowance.

Dixit-May I know the details about BOOK reimbursement allowance?

Its reimbursement like conveyance allowance or mobile/internet. Employee need to update his/her knowledge for ever changing environment. So employer will define the amount (Designation wise) so employee can purchase books and on producing bills he will get reimbursement of same. this reimbursement is also to charge off his official duties.

Many manufacturing companies provides uniform to employee. So an allowance of Uniform maintenance can be paid to employee for washing, dry cleaning, ironing etc of that uniform.

Hope its clear now.

Dixit-It may be and many such allowances I left (exactly like some tax saving deductions I left). Becuase here my point is to pin point the major things which applicable to mass.

Boss, Book reimbursement is applicable to all.

Anyway nice article. Thanks and keep it up..

Dixit-Many employers never think of providing BOOK 🙂 Anyhow thanks for sharing your views.

Can self employed professional get benefit of NPS contribution of Rs 50000 above the limit of Rs 1.5 Lac of sec 80C?

Tapan-Yes, under Sec.80CCD(1B), self-employed can also claim the additional benefit by investing in NPS (above Sec.80c).

Excellent summery.

# Sec.24 (B)

Interest part of your home loan EMI will be claimed under this section. The maximum limit for the self-occupied property is Rs.2,00,000 per year. For let-out property, the entire interest payment of home loan can be claimed for deduction.

This needs correction as the interest payment for let-out property is now capped at 2 Lakhs

Ajith-As Deepesh pointed, the cap is in case of “Loss from house property” which is set at Rs.2,00,000 ONLY.

Hi Basu,

As I understand, the loss under income from house property is capped at Rs 2 lacs. There is no separate limit for self-occupied and let out property.

So, this makes it even more restrictive. There is no income from self occupied property. Rent from let out property can be adjusted while calculating loss from income under house property.

Deepesh-Yes, I updated that part.

Great!!! Thanks.