There is a big shocking news for all those who planned to enjoy tax-free EPF interest on their EPF accumulation up to their retirement. However, recently Income-Tax Appellate Tribunal (ITAT) changed some misconception in relation to Tax on EPF after resign, retire or terminated. Let us see these changes.

Before we proceed, there are two confusions for many of us. The first one is that how long one will earn the interest rate on his EPF after resign, retire or terminated. The second one is the tax on EPF after resign, retire or terminated. Let us discuss one by one.

How long your EPF account will earn interest after you resign, retire or terminated?

I already wrote a post on this in detail (Ref-Interest on Inoperative EPF Accounts up to 58 Yrs of age). However, for your understanding, I will share the same once again.

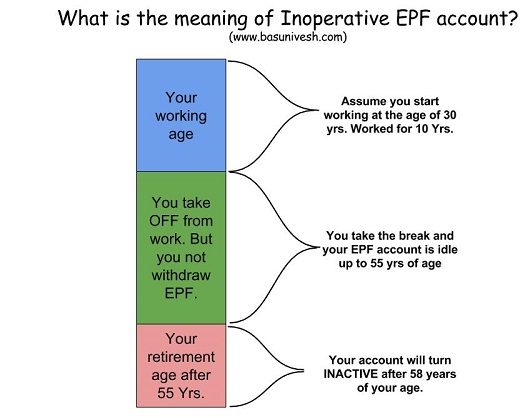

Before jumping into the recent changes, let us first understand what is the meaning of Inoperative EPF Account. I will try to explain the same through below image.

You might have now got the clarity that your account will turn to be INACTIVE once you attain the age of 58 years. As per EPFO rules, the retirement age is 55 years. If you do not withdraw the money within 3 years from the attainment of the age of 55 years, then such accounts are called as INACTIVE EPF ACCOUNTS.

Interest on Inoperative EPF Accounts up to 58 years of age

Now as per the clarification from Ministry of Labour, your account will fetch the regular interest up to the age of 58 years. Whether you contribute to it or keep it idle, EPFO will credit to such accounts as long as you turn 58 years of age.

Here is the press report of the same.

This new rule will be applicable from 11th November 2016.

Tax on EPF after resign, retire or terminated

Now, this is where the changes will come into effect after the recent ruling of Income-Tax Appellate Tribunal(ITAT). This gives a shock to many who continuing their EPF even after resign, retire or terminated.

Because earlier it was believed that amount received is a fully exempt tax on EPF after resign, retire or terminated in case of an employee who is in continues service for a period of 5 years or more. Full exemption is also available for employees who not completed 5 years because of his ill health, discontinuance of employer’s business or any other reason which is not in control of the employee. If the account is transferred to the new employer then the previous service from whom the account is transferred is also considered as a service period.

Now let me discuss the case detail in relation to this change. I will copy the history of the case which is shared by an article published in recent Time of India dated 16th November 2017. After this ruling, tax on EPF after resign, retire or terminated changed drastically.

“In the recent case, the man had retired from a prominent Bengaluru-headquartered software company after 26 years of service, on April 1, 2002, and the total amount in his EPF account then was Rs 37.93 lakh.

Nine years later, on April 11, 2011, he withdrew the grown sum of Rs 82 lakh from his EPF account. This amount included the interest of Rs 44.07 lakh that had accrued post his retirement till the date of withdrawal.

The retired employee did not offer this interest amount to tax, as he viewed it would be exempt under Section 10 (12) of the I-T Act. During assessment proceedings for the financial year 2011-12, the I-T officer sought to levy a tax on this amount and the litigation finally reached ITAT’s doors.

Based on a reading of Section 10(12) and also the definition of “accumulated balance”, the ITAT held: “The exemption is limited to the accumulated balance due and payable to an employee up to the date of his retirement or end of his employment.”

ITAT pointed out that the term “accumulated balance due to an employee” is defined as the balance standing to his credit, or such portion of it as may be claimed by the concerned employee under the regulations of the fund “on the day he ceases to be an employee”.

Thus, the ITAT agreed that the interest earned postretirement was taxable in the hands of the retired employee. However, it added that the aggregate interest of Rs 44.07 lakh should be taxable in the hands of the retired employee, in the respective financial years in which the interest income actually arose.”

This gives us two conclusions to arrive at and they are as below.

# Once you resign from the job, retire or get terminated, then whatever the interest you earn from that day to till your withdrawal will be taxable income for you. Even if you retire at 55 years of age and hold the money up to 58 years of age thinking you will earn the interest up to the age of 58 years, will have to pay the tax from the whatever interest you earned from 55 yrs of age to 58 years of age.

# Such interest income will be taxed in the year in which it is accrued. For example, if your age is 40 yrs and you resigned today. However, you wished to withdraw it in FY 2020-21. Then whatever the interest you earn from today to till FY 2020-21 will be taxed yearly based on the interest amount you earned yearly.

I will explain the same from below image for your clarification.

I hope it is now cleared to all that how the tax on EPF after resign, retire or terminated. Also, it might be disheartened many who planned to enjoy Tax-Free return till their retirement after quitting the job.

I changed by Job in July 2023 and my EPF with the old company was under recognized trust. My last date in old company was 8th July 2023 and I joined the new organization on 10th July 2023 who were maintaining EPF account with EPFO.

I requested for my PF transfer on March 14, 2024 through Form 13 on online EPFO portal and also sent signed hard copy of Form 13 to old employer in March 24.

The old company however made the transfer in July 2024 only and they have shown the whole interest earned in 23-24 ( including employee , voluntary and employer contribution ) after July 8th as taxable. They are saying that since request for transfer has came late , they have shown the whole interest after July as taxable in Form 16.

Can I claim the interest as non – taxable during ITR filing. What does the rule say about it

Dear Rohit,

Any interest earned during non contributory period is considered as taxable income.

But there were contribution from my new employment under same UAN

Dear Rohit,

Then it is considered as active.

1. I worked from 2000 to 2007, ‘seven years’ and withdrawn my EPF in 2009.

2. Again in 2011 to 2015 i worked for 3yrs7mnths. After 2015 i started working as a freelancer. For this 2nd period of service the amount in EPF i have not withdrawn till date and getting interest added annually to EPF account.

Now since i have already worked for more than 7 years in my 1st company (but withdrawn EPF amount), then the clause of 5 years continuity should not be applied again to EPF amount earned with 2nd employer. What is the Tax Rule for such scenarios.

Dear Prakash,

It is taxable.

Dear sir,

I was working with a company for 11yrs and 6 months i.e upto March 23.

I have withdrawn my total epf in month of August 23 after 4 months of my last job

Now I have joined a company with provident contribution included in the salary from month of September 23.

What will happen to my epf account and whether I have to pay any tax on epf withdrawal done as now the balance in epf account is nil.

Please update me.

Nishtha

Dear Nishtha,

I have already cleared this point. It is tax free.

Dear Sir,

I mostly worked outside of India during my carrier. However I worked in India during Aug 2016 till April 2019(2years 8 month). I was member of epfo scheme and contributed along with my Employer a good amount.

After April 19 I came back to Middle East for another job. Now I am 59. Is my withdrawal of epf amount is taxable?

Dear Abhay,

I already cleared this point that it is taxable.

Hello,

Interest is taxed in year of accrual , however, which year ITR is the interest to be reported ?

The years of accrual or only in year of withdrawal ?

I was with previous employer for 15 years, gap of 1.5 years and started working again , then how is period of continuous service calculated ?

Thanks

Dear PS,

It is on accrual basis.

Hello Basu,

Very informative article.

I am calculating tax to be paid on EPF interest during non – contribution.

Now EPFO is working on Wage Month. However, ITAT ruling mentions date.

Looking at EPF website.

My Date of Exit is 9 March from previous employer. There is a contribution for Wage Month March in April.

My Date of Joining is 5 October in current employer. There is a contribution for Wage Month October in November.

Should I use exact dates for calculating taxable interest ?

Or is the entire wage month in which there is a contribution as non-taxable ?

Thanks

Dear PS,

For better simplicity, use month rather than the dates.

Can I refile an ITR that has already been submitted, processed and a refund issued to me too? This ITR is for the Fin year 2019-20

I realized an error whiling filling in the NPS details for this financial year 2020-21, and hence wanted to check if i can go back and correct the the ITR for 2019-20

Dear Ganesh,

Yes, you can revise your ITR.

Correct me on this, From the entire PF withdrawn including the interest part, in the ITR I should declare as follows:

– Interest part alone for all the years where there was no salary, to be declared under head ‘Income from other sources – Interest from EPF’

– Entire PF amount received minus the above interest part, to be declared under head ‘Exempt Income – Sec 10(11) Statutory Provident Fund received’

Is this assumption correct?, please advice

Dear Ganesh,

Yes.

Hi Basu,

I was in service for 1.5 years, then resigned, was unemployed for six months (no contribution to EPF during this period) and then rejoined the same organization in Sep 2017. I transferred my previous accumulated EPF balance to new account (both under the same UAN). So, in aggregate I have completed more than 5 years (1.5 years+3 years 7 months), but with a gap of six months between both the jobs, so

1). Will this be considered as “continuous service”?

2). If I withdraw my EPF corpus now, will it be taxable?

Dear Hari,

The gap is considered as the break up of service. Hence, as per my view, taxable.

Dear Basu

I have migrated from a private company to central government after working for 12 years. But I have ceased to be part of EPFO as we have NPS in center government.

How my interest earned after resign shall be treated. I am doubtful as in contrary to the ITAT explanation I am neither retired nor unemployed.

Dear Basu

My case is slightly different. I was working for a private company for last 11 years and in feb 2021 I left that job and joined central government job where there is no pf. Instead there is NPS.

Now I want to continue with accrued EPF balance to earn interest.

Referring to “”” Section 10(12) and also the definition of “accumulated balance”, the ITAT held: “The exemption is limited to the accumulated balance due and payable to an employee up to the date of his retirement or end of his employment””

My case is neither end of employment nor retirement will interest earned by me be taxable or not

Sir, I resigned from my job at age of 47 years. Can I keep earning interest on my EPF till 58 years of age (although taxable), if I am not working anymore.

Dear Susheel,

You can but it is taxable.

Dear Basu,

Thanks for a very relevant and insightful blog. It would help if you could provide further insight on the following aspect:

As per the ITAT verdict, the interest accrued on EPF interest post-resigning will be taxed on an annual accrual basis. Does this mean that the annual EPF interest will be added to my taxable income for that year and the sum will be taxed as per the applicable tax slab?

What happens in a scenario where annual income + annual EPF interest is below taxable limit. This actually happened in my case where I took a sabbatical for two years after resigning and had almost zero income and lived off my savings.

Dear Sharad,

“Does this mean that the annual EPF interest will be added to my taxable income for that year and the sum will be taxed as per the applicable tax slab?”-YES.

“What happens in a scenario where annual income + annual EPF interest is below taxable limit.”-NO TAX LIABILITY.

I resigned from my Corporate job in 2014 (31-Jul-2014 being last day), post which till date I didn’t get any job and hence no income except for the duration Feb-2017 to Mar-2018. I have been filing my returns despite no income as i do have some interest on some investments made.

From Aug’2014 till date my EPF has no contribution till date and the small duration i worked in 2017-18 that company did not give EPF as it had less than 10 employees.

In Jun’2020 i withdrew my entire PF amount and have deposited that in a bank FD. While doing so i realized that i should have paid tax on the interest received from 2014-2020 but didnt know that back then. So my questions are:

1. The interest income received for the past 6 years can it be accounted under the head ‘income from other source’ and its tax duly paid now while I file my returns for 2020-21? Any specific inputs i must be aware of while doing so?

2. What tax slab does this EPF interest income fall under, the usual Tax slabs which is normally used for calculation? or is there a different slab altogether?

Dear Ganesh,

1) Yes, it is taxable under the head of “Income from Other Source”.

2) It is as per your tax slab.

The EPF interest income i received for past 6 years for which i did not pay Tax until now, would there be any penalty applicable for all those years i did not pay Tax but i should have?

please advice

Dear Ganesh,

Yes, better you declare in this year and clear it off.

Dear Basavaraj, can you pl enlighten on EPF status in following situation:

I worked for 30 years and decided to take a break @ 52 yrs of age earlier this year. If there are no more contributions in future, for how long I can keep the accumulated corpus with EPF :

1. To continue to earn tax free interest?

My understanding is for another 3 years.

2. To continue to earn taxed interest?

My understanding is after 3 years until the age of 58 years.

Am I correct in my understanding? Will appreciate if you can share your wisdom.

Dear Dhiraj,

Any non-contributory period interest is taxable.

Dear Bsavraj,

After having worked for 17 years in a Pvt Ltd Company, if I retire today at the age of 46 and withdraw my PF balance in full, will my PF be taxable?

Dear Bobby,

NO.

Dear Basu,

I have worked from April 2013 to June 2020, and joined other company with 3 months of gap. Now if I transfer money from epf accounts one to another then whether the mentioned gap will impact my continuity for of service. Or it will be calculated as previous employer tenure+ new employer.

Dear Deepak,

Obviously, the gap will be there.

Sir, thank you so much for this article. This is very informative.

Below is my understanding based on this article.

1. Even after the contribution stops (resignation or termination), the EPF account continue earning interest for 3 years, but the interest will be taxable. The interest will be considered as that year’s income. There will NOT be TDS but the account holder needs to declare it while filing return.

2. After 3 years the account will be deactivated and there will not be any interest

3. If small withdrawal is regularly, the account will remain active and will continue earning interest even beyond 3 years (obviously, taxable)

Is this correct Sir?

Dear Rajesh,

1) This one is correct.

How about 2 and 3. Is that correct?

Dear Rajesh,

Wrong. Please read the above post properly.

Dear sir,

I have worked in a company for last 10 years. Now i wish to take a break for 6 months and join new company. I plan to continue the same epf account. In the new company if i work only for 2 years and leave the job and want to withdraw my entire epf will the old service is considered as continous service or only last 2 years is considered. So now my entire corpus is tax free as total years of experience is 12 years or my entire corpus is taxed as i worked only last 2 years continously.

Regards,

Anitha.

Dear Anitha,

If you are using the same EPF, then the history of service is inclusive of past and current service.

Dear Mr. Basavaraj

I worked for a firm for 3 years and 4 months, then took a retirement in Dec 2017, at the age of 55 years. Then for 3 years, there was no contribution and after reaching 58 years of age in Dec 2020, I filed for withdrawal of EPF. Do i need to pay Income tax since i have withdrawn after 58 years of age and due to other income, I still pay income tax. Please help.

I shall truly appreciate your support

Dear Ramesh,

I have replied to your email.

Hello Basu,

This is a very informative article.

I was employed for 23 years till March 2020; my PF account with government EPFO.

Last contribution is in April 2020 as per member passbook.

Q1 ) Interest which was accrued till March 2020 was credited in Jan 2021. Is this taxable ?

Q2) I assume future years, it will be taxable. EPFO is crediting interest much after due date for filing ITRs ; and they are not even declaring rate earlier. How can I calculate interest accrued for the purpose of filing returns before due date ? Is it okay if I assume the year of credit instead of the year of accrual for reporting the income ?

Q3) Assume I start contributing again in the future after a gap of a few months or years. Then will interest to be accrued after resuming contribution be taxable ?

Dear PS,

1) NO.

2) There are many such practical errors that neither EPFO worries nor IT Dept.

3) Tax-Free.

At the age of 40 yrs in 2020, I took VRS from the company after 16 years of the job and not Woking with any company neither have plan.

Please answer the following questions.

1. As per your post, I will get the interest till 58 yers of age. Yes or No ?

2. Will it be the same interest rate which EPFO will be deciding on yearly base is for epf accounts ?

2. If I withdraw my money at the age of 58 yrs that mean I earn interest till 18 yrs that means I will have to revise 18 ITR for filling the return for each year earning interest ? Please clarify.

Dear Karan,

1) Yes.

2) Yes.

3) Yes.

Hi Mr. Basu,

Thanks for your wonderful effort.

I have a concern.

I worked for the period Mar 2006 – Feb 2016. Post that I have not been working and have other sources of income and hence I have been filing ITR for last 3 years, ie, FY 17 – 18, FY 18 – 19 and FY 19 – 20. This income is not the part of any salary.

I am planning to withdraw my PF now.

As per the ITAT case you have mentioned, such interest income will be taxed in the year in which it is accrued.

Please let me now while filing IT return for FY 20 – 21, where will I show the PF interest for previous financial years, ie, FY 17 – 18, FY 18 – 19 and FY 19 – 20? Also, for each of the Financial years in last 3 years, my tax slab was different. Is there any provision in ITR forms for these?

Thanks,

Manish

Dear Manish,

You can show them under the head of “Income from Other Sources”.

Dear Basu,

But isn’t it that the interest of previous years will be taxed as per my current FY income slab if I just add it as Income from other sources while filing IT return for FY 20 -21.

Actually, for last 3 years, my income was under 10% bracket only and now it is under 30% bracket.

Dear Manish,

Either you have to revise earlier ITR and file it or in the current year you can show it.

Hi sir,

I worked 5 April 2005 to 31 March 2016. 11 year’s service. After 2016 I didn’t work. Now I m going to withdrawal pf money. Is it TDS applicable?

Dear Ganesh,

NO.

Hi Sir,

I worked in a company from April 2015 till October 2019, for almost 4years and 7months and then the company got shut down in October 2019. Since they I am not serving any employment contract. In March 2020, I applied for withdrawal an I received the same in May 2020 after deducting TDS. As far my if there is termination of a employment contract before 5years then the pf amount withdrawn us not taxable..

Whether the above-mentioned amount is taxable?

Thanks in advance

Dear Lavina,

Your employer has to inform the reason of termination with EPFO. Contact your employer for the same.

Dear Basavaraj,

This has been a very helpful article for me.

I have a situation, which I presume many would be going through.

I joined a company in February 2014 and quit my company in June 2019 (>5 years).

I was not paid the salary of June as it was to be paid with the final settlement

As per the final settlement, the money was paid in the month of July, and at that time, they deducted PF contribution.

So my PF slip shows

June – 0

July – 1350

Now I joined a new company in the month of October 2019 with a gap of 4 months.

Can you please let me know if I will have to pay tax for the interest accrued during these Non Contributory Periods (NCP)?

i.e June, August, September

If yes, how should I go about calculating my tax liability? And how should I declare it?

Also will I be liable for tax for the month of July interest, as my employment ended in June?

Thanks for your response.

Regards

Adi

Dear Adi,

Yes, it is taxable income and you have to pay it. By checking the passbook and calculating the interest on it for these months, you can pay tax on it.

Dear Basavaraj,

Thanks for providing the answer.

Request clarification:

Will I have to pay the tax for the month of July as well (as my employment ended in June), even though there was a contribution done in that month?

Or do I just calculate the interest applicable for June, August and September?

Please clarify.

Thanks

Adi

Dear Adi,

“Will I have to pay the tax for the month of July as well (as my employment ended in June), even though there was a contribution done in that month?”-NO.

Dear Basavaraj,

I worked with my employer for 13 years and now i want to withdraw my EPF amount. My doubt is how much % of interest will they add to my total Pf

Dear Jyothi,

It is based on pro-rata basis.

My retirement age is 60 with my employer, how long can I retain my PF account after retirement. When likely can I close my PF account after retirement

Dear Kishore,

Please refer above post again.

Sir, My EPF was paid till I attained 60 years of age and retired on 17-12-2020. The interest has been credited in my PF account till date. I sent an email to EPFO and they replied that your account can earn interest till 36 months from last pf subscription.

Dear Rama,

But such income is taxable for you.

Hi,

Thanks for a detailed explanation.

I have a question. What if an employee works for 10 years or so then takes a break of 3-4 years (works abroad maybe) and then works again in India continuing contribution to EPF.

So how will the tax on interest be calculated for those intermediate years?

Regards,

Sharan

Dear Sharan,

If you are using the same EPF account, then all these contributory period is considered as your service period.

Hello,

I served a PSU for 10 years & 3months till Dec 2018. After that I hv not joined any company till date.

1) For how long would by epf gain interest?

2) Is the interest taxable ? If yes, since when ?

3) can I withdraw a part of the epf ?

Dear SN,

1) Up to 58 years of age.

2) Yes, on yearly basis.

3) Not partly.

I worked in a company for 6 years and changed my job. Transferred my epf to new company, but I quit the new company after 3 years. Will my whole pf be taxed as I did not complete 5 years in new company?

Dear Goutham,

It is considered as total period of last and current company as you used the same EPF.

So wen I quit in my 2nd company before 5 years, the entire amount will be tax free

Dear Goutham,

Yes, because your EPF account contribution is more than 5 years in total.

I am joined epf member from 2011-12 , I service up to2019-20, at this stage I attain the age of 58, pl tell me how much pension I will get.

Dear Malleshappa,

Approach the regioanl EPFO.

I have resigned from my company and been unemployed for over 2 months. I’ve contributed to EPF for over 5 years continuously. I’d like to know what parts if any would be taxed if I withdraw now.

Dear Padfoot,

As your account is 5 years old (contributions), it is tax free.

Hi Basavaraj,

If my period of employment with one company is from 1-Apr-2009 to 21-Aug-2011 and with another company is from 8-Sept-2011 to 16-July-2016. Could you please suggest if I am eligible for TDS free PF withdrawal

Dear Mukesh,

Yes if you used the same EPF.

Suppose a person has withdrawn his full PF at 60 when he retired from company A and joined a new job at company B at 61 and superannuated at 65 .- he has 4 years of PF in the second stint after superannuating. Is his PF taxable?

Dear Vijay,

If he is using the same old EPF, then NO. If new one, then YES.

DEAR Basava Raju,

I have worked in Indian Railways for 28 years. Deputation period to PSU for 5 years. Technical regignation to IR after 33years and absorbed in PSU in june 2013. Retired on super annuation on april 2018.

My query is

1) for my continuous service of 4 years 318 days the PSU is neither paying gratuity nor replying to my appeals.

MY gratuity in IR is less than 6 lakhs.

2) is this rule of 4 years 240 days for treating as 5 years continuous service is applicable for claiming exemption of tax on EPFO amount received

OR

can be claimed under beyond the control of the employee since PF cannot be transfered from SPF to EPF

Dear Satya,

The first is the right assumption.

Sir,

Thanks for the reply. Pl clarify on 2 also.

Dear Satya,

The answer is YES.

Thank you Sir.

In earlier mail you have responded to Mr. Shah who retired after 41/2 year that he will have to pay tax. But as I understand retirement falls in the purview of “other cause beyond the control of an employee.” and it should be non-taxable

Dear Smith,

If the EPF is less than 5 years old and retirement age is also less than 58 years, then it is taxable.

Thanks for your response. EPF is less than 5 years(41/2 years) where as retirement age is 58 years. (actually I retired at 58 yrs+1 month).

Dear Smith,

In that case, it is taxed.

Sir,

I have worked for 2.5 year in a psu from Aug 2015 to Dec 2018and after resignation joined a central govt. Job where nps is applicable. I can’t continue my epf account. So I have withdrawn my epf last year. Will it be taxable???

Is there any way I can get the exemption???

Dear Sayan,

Yes, it is taxable and there is no option than to pay tax.

Dear Mr. Basavaraj,

I resigned from a PSU in the month of May 2018 after working closely 12 years. I have withdrawn the entire PF amount in FY 18-19. Now I have the following queries

1. Is the total withdrawn PF amount (paid to me in July 2018) considered earning for filing ITR for FY 18-19.

2. Is TDS applicable on the total PF amount for filing ITR in the assessment year 19-20.

Dear Sanjoy,

1. It is tax-free income for you.

2. NO.

Dear Mr. Basavaraj,

I resigned from my Indian company in Oct. 2018 after 5+ years of service.

As I am currently abroad and plan to be so for next couple of years.

I have mainly queries on 2 scenarios.

1.Treatment of tax on epf interest income after resignation till complete withdrawal (No jobs later).

a) Is the tax deducted every year from the interest income?

If so, what is the tax slab (like ‘flat 10 % on FD insturuments’ or ‘progressive rate based on interest income’)?

Here, is it possible to avoid TDS of interest income (by submitting 15G forms)? Any other procedure?

b) OR is the tax applied on total interest income (resignation and thereafter years) if the epf amount is withdrawn?

2. Once I return to India, I become an employee and start contributing to EPF again (say in 2022). In this case, will the epfo continue applying tax on break period interest income(Nov 2018 to 2021)? or will it completely stop?

Thanks in advance,

Ganesh

Dear Ganesh,

1) a) There is no concept of TDS on yearly basis for such inactive accounts.

b) Your EPF is more than 5 years older. Hence, it is tax free.

2) Yes, as per the rule any interest on idle account will be taxable income for that particular year.

I have a query:

For a retired govt employee, who did not withdrew his EPF amount post retirement needs to pay tax on interest for that FY. Can you guide me in which section/category of other income should it be reported?

Dear Vignesh,

If there is no EPF contribution, then for that particular year it should be considered as income. You can show it under the head of income from other sources.

Dear Basavaraj,

Thank you for all the efforts in sharing your knowledge in this blog

My scenario is-

My age is 30 years and currently working abroad

I worked in India from 03/2012 – 05/2014(contribution to EPF for around 2 years). Now I want to withdraw the PF amount 06/2019 (After 5 years). Will the PF amount be taxable given the scenario that I am withdrawing after 5 years(but not 5 years of continuous service as employee)?

Dear Prasad,

Yes, taxable.

Dear Sir,

You are doing a great valuable service to the public. Thank you for the same.

I am 62 years and still working in a private company where retirement age is 65. Both employee share and employer share are being contributed regularly to EPF account. Is the interest earned beyond 58 years till 65 years, the year of retirement taxable? How many more years beyond the retirement at 65 years, the EPF account can be maintained without contribution?

Dear Kumar,

As per my knowledge, if your retirement age with your employer is up to 65 years, then you will earn up to 65 years of your age.

Thank you sir.

Hello my name is Govind prasad & my UAN no. is 100768772734 my Settlement amount is 53075 but i had received 47767.

Please clearify to me this what happened

Dear Ovind,

Raise an issue with EPFO Grievance Cell Online.

i am 44 years old and i planned to resign from my job from june 2019. can i get eps from july 2019. i am contributing 22 yeras in eps.

Dear Manoj,

You are eligible for EPS pension.

In my company age of retirement is 60 years. Contributions to EPF continued after 58 years and will go on until I attain age of 60 and retire. Will EPFO not pay interest for last two years ?

Dear Ravi,

As per the current rules, you are not eligible to earn the interest after 58 years of age.

can i withdraw pf attain 58 years of age my retirement is 60 years

Dear Sekhar,

Yes.

Dear sir

My father join his job 2008 and his boss terminate him 2018 it’s complete 10 years, but when he is 58 years that time his job period 6 years and when he terminate his age is 64.but when his boss terminate him he is not feeling well he have paralise attack and his boss terminate him. We withdraw his epf amount but no one guide us he is eligible for pension or not please help me sir

Dear Sandeep,

Better you immediately approach the employer or regional EPFO.

Hi,

I have served 4.5 years for a company and resigned. Later I have moved to different country and doing job there. Could you please let me know when I can withdraw epf amount without cutting Tds.

Thanks a ton in advance.

Dear Hemadri,

You can withdraw now.

Dear Basavaraj,

I have quit my org in year Aug 2011 at that time there were no UAN numbers. I have submitted by PF withdrawal form in Nov-18 which the regional PF has received in Dec-18, its been 3 months & the PF is still not processed. The PF office says the account is now inoperative & there is extra interest that was added to the account so that withdrawal cannot be processed

Is there anything that can be done to resolve this matter.

Dear Mag,

It is wrong that one can’t withdraw if the extra interest is added. As per me, you can still withdraw if you are out of job. Raise an issue with EPFO Grievance Cell Online.

Please confirm if any futher appeal has been made against the ITAT order to a higher authority.

Dear Anand,

As far as I know, there is no such appeal.

Dear sir

My service started from April 2014 and contribution to EPF from 05/2014 now i will be retiring on 31st march 2019 at the age 62 . My service is one month less than 5 years .

My withdrawal of EPF will be taxable if i withdraw only after 5years and 3 months ???

Dear Majumder,

It is tax free.

Dear Mr Basavaraj,

I have taken retirement, but continue with my EPF account in the private company that I worked with.

This EPF trust has invested in ILFS bonds, in which there is risk of running losses due to the toxic bonds.

https://m.economictimes.com/industry/banking/finance/provident-funds-face-crores-in-losses-from-ilfs/articleshow/67546640.cms

My question is :

1 ) Is there a possibility that I would lose money, or is it mandated that these firms have to make good any losses , as per the condition laid out by Employee Provident Fund Organisation, wherever it permitted such funds management.

2) Are the Private trusts mandated to make good any loss for the retired employees also ( ie, inoperative accounts ) , or is it for the operative accounts ONLY ?

Dear Sandeep,

1) They have to deliver as per the EPF rules.

2) It is for both.

Can you please elaborate on your comment – “they have do deliver as per the EPF rules”.

Are you confirming that the companies are mandated to make good the losses, and that I DO NOT STAND TO LOSE MONEY ?

Kindly do confirm.

Thank you.

Dear Sandeep,

YES.

I am in a 0% tax bracket for last 3 years and my accumulated PF is earning interest. However, if I withdraw my PF after another 5 years(Say 2024), will I need to pay tax on the full accumulated interest for 5 years based on the bracket I fall in in 2024 or will the interest be taxable as per the slab I was in when the interest was earned ?

Dear Raju,

Your withdrawal will be taxable in the year of 2024. Also, as your account is idle, each year’s interest is taxable income for you.

I have resigned in October 2016 at age 55. EPF interest is credited. Do I need to show as income in current year ITR or can show as taxable income in October 2019 financial year Tax return. My income is below 2.5L.

Dear Devendra,

Yes, you have to show it in your IT Returns.

Dear basavaraj

Thanks for the detailed note. I have a queer situation. I was employed in my last firm for 12 years and hence accumulated a reasonable PF corpus. I recently became a partner at a leading LLP and thereby while I am still employed, there is no contribution to the PF. Does this mean that the interest on the PF when there is no new contribution is taxable ?

Dear Ram,

Sadly YES.

Dear Mr Basu,

Q1) I am 59 years old & is continuing employment as well as contribution to PF(both my share & employer share). Will interest accumulated in current year (after 58 yr)on both my & Employer share is taxable ?? Am I supposed to consider as income in this year return.

Q2) If I chose to get extension in same company. Do you suggest me to continue towards employee & employer contribution or I should take this amount directly in my salary?

Thanks in advance for your advise.

Dear Basant,

If your EPF is active (with contribution), then it is not taxable for current year. Better to continue EPF.

Hello Mr. Basu,

I have a query about EPF taxation. My DOJ for EPF is 23-Aug-2010 and DOL from EPF is 8-May-2015. I resigned – short service. I have withdrawn the EPF in Nov 2018. They have deducted the TDS 10% while withdrawing. From which year onwards I have to do the IT return revision for accommodating the income tax implications?

Thanks

atul

Dear Atul,

The ruling came into the picture in November 2017. Hence, you have to revise it from FY 2017-18.

Thanks Mr. Basavaraj,

I have further queries.

1. In FY 2017-18 there was no employee or employer contribution. Hence I need to revise my return by only the interest earned in that year (i.e. 2017-18) under ‘Other Income Source’. Is my understanding correct?

2. Also since there is some interest shown in FY 2018-19 as well, I need to take care of it while filing return of AY-2019-20. Is it correct?

3. Since there is no contribution to my EPF from 2015 onwards, I need not change 80C numbers in my return (deduction by the employee contribution amount). Am I right here?

Thanks once again

Dear Atul,

1) YES.

2) YES.

3) YES.

Thanks Mr. Basavaraj,

The EPF departments has not credited the TDS to CBDT. My main question is when can I claim the TDS benefit? I have received the settlement in Nov 2018, hence I feel TDS reflection will happen by March 2019. So shall I go ahead with IT revision of earlier year without waiting for the TDS reflection?

Dear Atul,

It is better to wait the same to be reflected in TDS.

Dear Mr. Basavaraj Tonagatti,

1. I worked for a company from feb 2012 to apr mid 2016 (4 years+1.5

month) then i loss my job. After a gap of 11 months in march 2017 i

again got a job and currently working. So, now if i withdraw my pf for

last employer (march 2012 to apr 2016) is it taxable. Please clarify.

2. If yes then a question i served 4 years +1.5 month then and after gap i

am in serving 1 year + 9 months now total is 5 years and 9 month

(before gap 4 years+ 1.5 month and after gap 1 year 9 month). 5 year will calculate last service + current service or what. please suggest.

Dear Jai,

1) No, as the service period is less than 5 years.

Hi. it has been 10 years since i left my private job. I was asked to resign after which I started my own in freelancing. I worked in my last company for around 2 years. my total experience then was about 10 years. all my EPF has always been transferred from one company to another whenever i shifted. My queries are

1. Will i get interest till 55/58 years of age?

2. Will the interest be tax free?

3. I am planning to withdraw .. will i need my last companies involvement in withdrawing the EPF?

Please help

Thanks

Dear Bhavana,

1) Yes.

2) Tax-Free up to last year and from now onward it is taxable.

3) Not required.

Hi thanks for such a detailed write up i understood .one question i resigned after 8 yrs service in 2016. And 2018 feb i closed pf account and money was credited to my bank ac. How to find out how much of the amt credited is interest(taxable) and how much is not ? Please let me know

Dear Diya,

Through your passbook.

Hi Sir,

I was told to leave the company stating reason due to organisational changes, this decision was taken. I am short of 4 days to complete my 5 years service. wanted to know if taxcan be avoided here as it was company’s decision and not in my control. Also,there is a contribution in epf account with less amount for that month which i guess is every month in 5year tenure,some amount was deposited in epf account, kindly reply.

Dear KK,

Yes, the amount is tax free for you.

Thanks sir,that would be a great relief for me.On what basis , this would be tax free.Kindly provide ur inputs

Dear KK,

Refer above post again.

Dear Mr Basavraj,

Thank you very much for all the information that you have provided.

I have a query regarding interest on PF after leaving the organization.

1 )Are the private organizations, which manage and maintain their own PF trust, ALSO supposed to continue paying interest on PF on inoperative account after the employee has left the services, in the same manner as for the EFPO accounts maintained by the government ?

2) Are private PF trusts bound by ALL the rules framed by EFPO ?

Dear Sandy,

There is no such difference between who manages the EPF. Rules are same for all.

Thank you for your prompt response.

I have two follow up questions. I am 52 years old and am planning to quit my job.

1) If I do not withdraw the PF amount, till what age will I be getting interest on my PF. I am 52 years old .

2) Since I have worked for more than five years, I am assuming that the PF amount accumulated till the date of my resignation will not be taxable.

Kindly advise on these two points.

I work in a private company, which manages it’s own recognized PF trust.

Thank you

Sir

I resigned from a company after serving for 3 years and 5 months. My previous pf accumulation was not transferred to the last employer. Now i am 58 years and 5 months of age and resigned and presently not employed.

Pl advice me:

Whether the Pf accumulations are taxable?

Regards

Raviganesan

[email protected]

77083 55333

Dear Raviganesan,

Yes.

Basav,

I need your urgent advise. I had withdrawn my ppf in Dec17 while I was made to quit in Sep15. The amount given to me was minus 10% citing sec 192. Also when I am supposed to file my IT returns now I am told that this PF refund will be treated as an income and I have an additional tax liability. The total service tenure in 2 organizations is six and half years.

Dear Abha,

If you used the same EPF for both of your organizations, then the amount received is tax-free. However, if there are two EPF accounts, then both are taxable.

Hello Mr Basu,

This taxability rule of EPF interest for non-contributory period came in 2017-18. Does this apply retrospectively or it is applicable from the FY 2017-18 only? For example if my non contributory period starts from 2015-2016, then the interest on EPF is taxable from 2017-18 only or from 2015-16 onwards itself?

Dear Vatsan,

It is from 2017-18.

Hi Sir, I am in continuous service for 9 (3 companies and got my EPF transferred on each occasion) years, the company am joining now is yet to be registered with EPF. I want to make part payment against my home loan but as I understand that it requires 10 years of continuous service. What remedy do I have? Can I withdraw the entire amount and make a payment to Bank, will it attract income tax.

Regards,

Vikram

Dear Vikram,

In my view, better to keep EPF for your retirement. However, if you still want to go ahead to withdraw, then you can do so as it is tax-free income for you now.

Thank You 🙂

Sir

Is this ruling of ITAT also applicable Government provident funds which are governed by 1925 Act? Is this applicable to 10(11) exemption? Pl clarify

Dear Ankit,

It is applicable to EPF. I am not sure about which provident fund you are pointing.

Dear Basavaraj ji ,..

Basis following referenced dates, please advise taxability of interest for following periods:-(DOE 30.11.2015 [age 55 yrs, 6 mths.,27 years membership],

Date attained age 58 – 31.5.2018 )

1. Interest from 1.12.2015 to 31.3.2016

2. Interest for 1.4.2016 to 11.11.2016 (date of notification)

3. Interest from 11.11.2016-31.5.2018

Dear Alok,

If the age of EPF is more than 5 years, then it is tax-free.

Sir,

My query was with reference to the ITAT ruling of 2017 referred in your article above, would it not have implications on taxability of interest in 3 parts mentioned in my query?

Kindly clarify again regarding taxability of each part of interest.

regards

Dear Alok,

Let me know your exact doubt (even after reading above post).

sir,

Query 1.

I exited EPF membership after 27 years service at age 55 yrs, 6 months, on 30.11.2015. After attaining age 58 on 31.5.2018, I have applied for withdrawl of PF balance with interest.

Interest for which of the following periods is taxable :-

1. Interest from 1.12.2015 to 31.3.2016

2. Interest for 1.4.2016 to 11.11.2016 (date of notification)

3. Interest from 11.11.2016-31.5.2018

Query 2.

Though I joined EPF in 1989 and exited on 30.11.2015, however my service period with last employer was only 3 months before exiting EPF contribution, though I completed continuous membership period of 27 years. The online system is not accepting my EPS claim form as last service was 3 months (less than 6 months)….please advise

Dear Alok,

1) Yes, it is taxable income for such non-contributory period of EPF.

2) I think it is due to all your past EPF accounts are not transferred to single EPF or your employer not entered the exit date. Check with an employer for the same.

Sir,

2) My EPF accounts have been transferred till end of membership, my last date of exit is also entered, my UAN is showing correct PF contribution till last date of exit, EPF withdrawal form has been filled and is in process…..

But I am unable to fill up and submit Pension form. – I will need to get pension from EPS

Pl advise

Dear Alok,

In that case, raise an issue with EPFO Grievance Cell Online.

Good Evening Basavaraj Sir!

I have a query on similar line and wanted your guidance. I worked with TCS since Aug 2010 to Feb 2016 (which is more than 5 years with TATA’s PF Trust). Now on Mar’2016 i joined my next IT company and didn’t transfer the PF amount from TCS Epf account.

Last year (AY2017:18), when I filed my returns, all was fine based on 26AS. But this year I got a notice from IT team, that there is a mismatch in based on 26AS of (AY2017:18).

While looking closely, mismatch was due the TCS’s Provident Amount row, which was added on 26 AS of last year. It was the interest amount earned from the PF accumulation at TCS. And they had also deducted tax on it at 10%.

So my question to you is :

1) is it right that i was charged tax for interest earned on PF amount, just because i resigned and didn’t transfer to my new company? (Please note : My Age is 31 and at TCS i worked for more than 5 years and I have not withdrawn any amount)

2) If IT Dept, is right then I will just go ahead and refile the last year return again with addition of the PF sources of income. But if NO , can I claim the refund of TDS on PF interest?

3)And how to claim that while I am refiling the AY 2017:18 .

Will appreciate your help, in this sir.

Regards

Jeet

Dear Jeet,

1) They are wrong.

2) You no need to do as the income interest taxation came into picture from FY 2017-18.

3) Approach your last employer to correct the TDs.

ok sure . thanks sir.

One of my friend (age 42) has taken voluntary retirement from british council and she has withdrawn pf amount after 2 years and 9 months of her retirement. She got approx Ra. 9 lakh as interest on pf. Kindly advice if this amount is taxable or not.

Dear Dheeraj,

What is her service length?

Sir, after resigning from a public sector bank, i have received my terminal benefits such as FULL EPF AMOUNT, GRATUITY AMOUNT (BELOW 10 LACS) and LEAVE ENCASHMENT (BELOW 3 LACS). My question is whether i have to show these exempted amounts in ITR while filling my Income Tax return. If yes , then under which head of ITR i have to put the above data in ITR. Kindly advice me

Dear CBM,

You have to show under exempted income fields.

SIR,

THANKS FOR YOUR REPLY.

MY QUERY IS WHETHER I HAVE TO SHOW TERMINAL BENEFITS( FULL EPF AMOUNT, GRATUITY AMOUNT (BELOW 10 LACS) AND LEAVE ENCASHMENT (BELOW 3 LACS) ), 1ST IN INCOME FIELDS OF ITR AND THEN PUT SAME DATA IN EXEMPTED INCOME FIELDS OR I HAVE TO PUT DATA IN EXEMPTED INCOME FIELDS ONLY. KINDLY ADVISE ME.

Dear CBM,

You have to just show it in exempted income.

thank you Sir for your valuable advice …

Dear Basavaraj,

I am an NRI for the last few years and recently quit my Indian Company last Financial year after 16 years of continuous Service. My company and me have been contributing the requisite amounts as per law to the EPF account till resignation.I have not made any voluntary additional contributions to the EPF. I applied for withdrawal of EPF lumpsum with the reason of “Permanent Migration From India”. My company has not charged any TDS on the withdrawn TDS amounting to 18 lakh except on interest for the 3 month period after I left the organisation. I am aware that the interest for the period after leaving the organisation is taxable under “Income from other sources” and hence have no problem with that. I have the following queries:

1) Is tax applicable on the Employee contribution and its interest for the 16 years of EPF accrual during employment. If yes, how and where do I declare that in the current Assessment Year in ITR 2?

2) Under the Exempted allowance of Section 10 (12) should I declare the entire withdrawn amount of 18 lakh, OR only the employer contribution, employee interest and employer interest accrued over the last 16 years OR some other combination?

3) Should I be declaring any other amount in ITR 2 with respect to my EPF withdrawal?

Dear Raghu,

1) The tax applicable is for the interest earned for those periods of idle (In your case 3 months).

2) Under exempted income category, you have to declare EE+ER+interest on both.

3) NO.

Thanks and I really appreciate your prompt and wonderful response on this. Just a few followup queries:

1) Does this mean that I will have to declare the following value in Exempt Income:

Entire EPF amount withdrawn of Rs 18 lakh (which includes Employer Contribution, Employee Contribution, Employer Interest, Employee interest) “minus” the amount of Taxable EPF interest after leaving the employment of the company (ie 3 months of employer and employee EPF interest) “minus” the TDS deducted on the 3 months taxable interest

2) Does this mean that the entire value arrived at 1) above is exempt from any tax?

3) Also in ITR2 Under Schedule S, There is a section 1 subsection 7 called “Allowances exempt under section 10 (Not to be included in 6 above)” . Part (iv) of this subsection refers to “Other allowances”. Under this one can select “Nature of Income” as “Sec 10(12) Recognised Provident Fund Received”. Is this the right place to declare the amount arrived at in point 1) above?

4) Should I add the amount of Taxable EPF interest after leaving the employment of the company (ie 3 months of employer and employee EPF interest) to the schedule “OS” of ITR2 ie “Income from Other Sources” under Section 1 , subsection b) “Interest, (Excluding taxable at special Rates) Gross” ?

Dear Raghu,

For all your doubts, the answer is YES.

Thanks and really appreciate your timely response.

Dear Sir,

I resigned from a company after 10 years of service. I closed the EPFO account as I have moved abroad. I am filing IT return now. I have the following questions regarding the same. Request your help please.

1. The amount I received as closure proceeds – Should I declare as income on my IT return & will that be taxed again ? or Will that be exempted ?

2. In the passbook I see that I have been charged 30% TDS. [There is a difference between amount approved & amount received.] What is the reason ? Is it because I am an NRI ? Is there a way to get that TDS amount back ?

Thanks.

Dear Praveen,

1) It is tax-free income and you have to show under exempted income list.

2) You no need to worry about TDS. While filing ITR, you can claim the so.

I quit my job in 2016 at the age of 55 after 25 years of continuous service and took a break of 11 months. I took up another job in 2017 and have quit it after 8 months in 2018. The clarifications sought are

1. will the interest earned for the non employment period in financial year 2016-17 be taxed on withdrawal or in tax returns.

2. Since my EPF was in the process of being transferred to the current organisation will the continuity be considered and consolidated or the the 8 months PF also be taxed along with consolidated interest.

3. Is it advisable to withdraw in one go or in small amounts as shall turn 58 in 2019.

Dear Meera,

1) Please refer the notification date of such change. As per my view, the interest earned by you during 2016-17 still to be considered as tax-free.

2) Yes your 8 months period is also considered along with your earlier service (if you are transferring the EPF with the current one).

3) It is up to you to decide.

Dear Basavaraj,

I tried going through the comments before posting my query here but lost it around 100 comments or so. Pls refer to the post if my query is repetitive.

I had to quit my job due to health issues of a family member after 4 years of service. I understand that my PF amount is liable for tax. I want to know to what extent it is taxable ; Total PF amount accumulated along with interest? Or PF amount for the current FY only?

Dear Nikhil,

Refer my post “EPF Withdrawal Taxation-New TDS (Tax Deducted at Source) Rules“.

Hello Sir

My question is if the private EPF trusts are also governed by the same rules on crediting interest etc. Specifically – I am 40 years old and worked in an IT company which maintains its own trust) for last 15 years. Now I will be quitting.

a) If I do not withdraw my EPF till 58 years, is the private trust bound to give me interest till that time?

b) If I do not withdraw my EPF and join in some other company which takes part in EPF after 3 years, will I be taxed for the interest earned during these 3 years

Regards

Dear Anshuman,

1) For your information, EPS will not earn a single rupee of interest. Also, irrespective of the type of EPF (managed by trust or EPFO), EPS is always with EPFO but not with your company trust.

2) Yes, as per above recent changes.

Thanks Sir for getting back.

Regarding first point, I am not concerned about the EPS part. My question is if the PF part maintained by the private trust of my current company is mandated to give me interest till I withdraw it (even after quitting my job)

Regards

Dear Anshuman,

YES.

Dear Sir, I left my job in 2014 and continue to have my EPF account assuming I will earn interest till age 58. On taxability of interest after last date of employment some questions for your help 1. Is interest on the EPF balance on date of leaving exempt? 2. Hence only interest earned on the interest is taxable? or the total interest earned after last date of employment is taxable? 3. Since the ruling came just now, I can show the interest income in the previous year 2017-18 even for the past years? Please help by clarifying. Thanks and Regards

Dear Mohan,

Once you leave the job, then the interest earned on your EPF balance is taxable but not total interest. However, if your employment peirod is less than 5 years, then the whole interest at the time of withdrawal is taxable. Start showing the interest effective from the notification date.

I worked in A company with EPF contribution for 4 years and resigned. I joined another company B which also contributed for EPF. But there was a break of 2 months between joining the company from A to B. Now I am leaving this company B after 4 years and going abroad. I have total 8 years service but there is break of 2 months in between. So I believe the five years are not complete with continuity.

If I withdraw the EPF it would be taxable @10%.

Is there any way to get the exemption of 2 months break so that I can get tax free withdrawal?

Dear Karnail,

Whether you used the same EPF account in both companies? If yes, then there will not be any tax. If NO, then you have to pay the tax.

Dear Sir,

I was working in a company till Jan 31st and i got an oppertunity to work abroad , i submitted the PF withdrawal ater 60 days , now almost 1 month now its not yet credited in my account , its holding by my pf trust ( of the organization) , my query is whether i am eligible for getting the interest of all the last 3 months including the withdrawal submission month ? if i understand correctly i should get the interest till the day of disbursment ? correct ?

Dear Pkumar,

Yes, your understanding is correct.

Hi Sir,

I have worked for 6 years in a private Company and resigned and joined another company with another PF account.

I have 2 questions

1) Can I withdraw the amount from first pf account of previous company?

2) If I am transferring the amount in second account and then can I withdraw the amount? If yes then would I be taxed as this would be a running account?

Regards,

Aman Mishra

Dear Aman,

1) Yes.

2) If you transferred, then you can’t withdraw.

ihave a epfo account in NGO from 2006-2013,but i left the job in 2013.yet not i with draw my EPFO account .my question is

Is my account is blocked or get interest from the EPFO accout

suggest me what to do

Sir,

I joined one private company on 15th sept 2013 at the age of 60 years. The contract ended om 31st March 2015 i.e when I was 62. My company opened a new PF account ( as I had already closed my previous account after retirement). Both were contributing to this account. I had kept EPF account even after my service ended thinking that to avoid income tax on my EPF, I need to keep the account alive for 5 Years. My question 1. Whether will there be any tax if I with draw now ( will be completing 5 years in sept 2018). Whether I will get interest on my inoperative account till completion of 5 years or 3 years from last EPF contribution month.

Please reply urgently.

Somanath

Dear Somanath,

It will be taxable income for you as EPFO consider the contributory period to understand the age of EPF. Regarding interest contribution, there is no clarity if we consider your case. Hence, I suggest you to raise an issue with EPFO Grievance Cell Online.

Hello Sir, i worked for 12 years in a pvt company and am on a sabbatical for 12 to 18 months starting 1st jan 2018. After sabbatical i will be working again. I have resigned feom the company where i worked 12 years.

My 4 questions are –

1. Will i get interest on my pf during my sabbatical ?

2. Normally which month does this interest get credited ? ( as of april end 2018) the interest waa not credited).

3. Is that interest taxable and which year should i be paying tax on this interest ?

4. When i start working again ( around june 2019) can i start accumulating pf in the same pf account, by getting it transferred to my new company ?

Dear Abhijit,

1) YES.

2) Hard to say their updates.

3) If you are not working then interest will be taxable for that year income. If you are working, then it will not be taxable.

4) YES.

I have worked from 2015 August to 2016 November, then I worked in a different company from May 2017 to July & thereafter from 2017 September to date.

I have seen my PF Account & observed that Interest was credited for the first company & 2nd Company upto my discontinuance & thereafter no interest was credited to the account.

I did not transfer my PF Account to new company as I was Unaware of it.

Will there be any other section of the PF Account I need to see for the interest that has been credited for the first & 2nd Company even after my discontinuation? Kindly advice

Dear Praneesh,

It may not be credited due to earlier notification. However, in my view, after this above said recent notification, it will be credited. If not, then raise an issue with EPFO Grievance Cell Online.

Should I see in the passbook itself for interest credit or is there any other section that I should be observing for interest & in how much time can I expect it to credit according to your estimation

Dear Praneeth,

You have to check the passbook itself. If it is not reflecting, then knock EPFO.

Thank you

Hi,

I resigned my job at the age of 57 years in March 2017 and now 58 years old in March 2018. Can you please provide clarity on my two questions:

1. Upto what year can I continue my EPF account and will earn interest on accumulated balance

2. What will be the treatment of interest earned after 58 years of age

3. Any other advice on EPF if you would like to add

Dear Gurtejbir,

1) Up to the age of 58 years.

2) Refer above reply.

3) Hard to advice blindly.

I am 51 years of age and was in service from April 2010 to 03-10-2017 and propose to withdraw entire balance in my EPF a/c in April 2018. I presume that I will have to pay tax on interest accrued from 04-10-2017 to 31-03-2018 for the financial year 2017-18 and on interest accrued from 01-04-2018 up to the date of withdrawal for the FY 2018-19. Please confirm

Vinayak-Yes.

Hi Sir,

I am Filled Inoperative Account Form on 20th_Mar18. But Still i Have no Respond from EPFO

Please Suggest

Raj-Raise an issue with EPFO Grievance Cell Online.

Hi, I have resigned after working for 6 years in a PSU. I am going to study for a year. My PF is held in a trust by PSU. I wish to keep it and transfer it to a new employer after I finish my studies. But they say this is not possible and that there are tax implications to this and are asking me to withdraw. Kindly advise. Is there a way to transfer from trust to EPFO and keep it dormant for a year?

Ashish – You can hold and transfer. But better to withdraw.

For some reason trusts avoid transfer to PF. I suffered significant loss of interest as my company’s trust issued a cheque which was encashed by PF office months later. Nobody paid the interest to me in the intervening period. Online offline complaints / requests did not help.

Anyway it appears Govt. is hellbent on milking PF. Better to keep it with you, as far as possible.

HI,

I have transferred my Trust EPF from my previous employer (5.5 yrs of service) to my current employer.

The process took me about an year and my previous employer has deducted TDS on Interest earned from my last working day to date of transfer.

I want to know if im liable to pay such tax and if yes at what rate (any special taxation policy)

Rasu- Please be in touch with your employer. As per me TDS is not applicable. Because you are transferring rather than withdraw.

Hi Rasu

Yes,tax will be applicable on the accumulated interest on PF from the time you have resigned till the time it has taken for the amount to get transferred.This is as per tax rules.Since there is already a TDS of 10% you have to pay the remaining tax as per the FY income tax slab since this is accounted as income from other source.Say for example,you fall under the 30% tax slab then you have to pay the remaining 20% tax while filing the return on this accumulated interest through PF.There is a difference between tax applicable on withdrawal vs transfer vs accumulated interest on PF between the time you leave a firm and the time it takes for the money to get transferred.Unfortunetly there isn’t much information available about this on the internet and one has to get in touch with a tax consultant to get these queries cleared.

I had earlier sought your advise as to how long my PF account will attract interest on the balance , as I superannuated at my 57 years of age during march 2017.

To which you had replied that it will get interest till mar 2018, i.e. when I turn 58.

I checked with my past employer, who is maintaining my PF in a trust. I was told, i will get interest for 3 years from my retirement i.e. till mar 2020, by which I will turn 60.

Can you please confirm and advise.

I don’t want to park my funds where I won’t get ant interest.

Thanks and regards

Gurumoorthy

Gurumoorthy-The above post is the latest one. Refer the same.

Can you also share me details of itat order number etc. In this context

Thanks and regards

gurumoorthy

Gurumoorthy-Please search for the same on EPFO portal.

I couldn’t locate either in epdi or in itat website or Google. Hence i requested.

Various blogs and authors have quoted that order but without any ref no.

Anyways, Thanks for both the reply.

Gurumoorthy-You have to dig into EPFO circulars.

Dear Basuniveshji,

Hi. I’m back with one more query. I have not withdrawn my PF (i retired from service at 57 years. Since balance in my PF account will earn Interest till 58 years of age. That is 55 years plus 3 dormant years) i shall be withdrawing it only in next FY.

My query is do i have to pay income tax on the year on which interest earned by the balance in of account. If so, do i have to pay advance tax by 31 mar 2018? That is FY 17-18.

Or can I pay it on accrual basis. In next financial year.

Pl advise.

Thanks in advance

Gurumoorthy

Gurumoorthy-Interest on such inactive accounts will be taxable on the year in which it earns.

Hi , There are three columns in the passbooks.

Employer’s contribution(E) and Employee contribution(EE) and pension contribution(p)

How much will I get if I withdraw my PF amount now?

Is it E+ EE+ P? or just E + EE?

One more thing is…if I apply for ONLY pension withdrawal online? How much will I get .

Thank you

Ramesh-You will get full of employer and employee share and interest on that. Regarding EPS, it will be payable part of that based on the Table D.

I was in canara bank. taken voluntary retirement in 2001. The accumulated balance is still maintained in the bank and they provide interest in the account every half year. They send statement of account by post. I would like to know the difference between the account maintained at bank and epf department. Further, whether the interest amount is taxable at the time of withdrawal from bank.

Kannan-There is no such changes in rules. You can refer above post for the same.

Thank you, sir, for your reply. Now I have an idea to draw the balance in my account and pay tax, by working yearly basis from 2002 till day of withdrawal. I would like to know whether tax is payable at the time of withdrawal or I should have paid tax yearly since 2002, every year as per rules.

If possible, inform the IT form applicable for filing.

Kannan-You can pay it now as the rule changed recently.

Hi,

I quit my job in March 2015 (after a service of 7 years) and started my own venture. Now If I look at the passbook, it shows the contributions (of mine and Employer’s) and Interest till March 2015 and after that just Interest Entries for last 3 years i.e. March 2015, March 2016 and March 2017. I have following questions:

1. Based on current rules, would the account keep on earning interest? I heard few months back that non contributing accounts stops earning interest after 3 years.

2. If I withdraw amount in April 2018,

a) Would everything be tax free?

b) If answer to above questions is No, what components would be taxed ? I heard that Interest earned for the periods where there is no contribution are to be considered as Income, please confirm.

Thanks in advance

Raj

Raj-Your all questions were answered in above post. Please re-read the same.

Pardon my ignorance, but I had read all the post before posting my queries. Could you please either reply to my specific points or at-least refer to exact posts where you feel my queries have already been answered.

Raj-Refer above post and also the post related to TDS on EPF.

After being an NRI for more than 9 years, I am planning to join an Indian Company as an employee. (I had withdrawn my accumulated PF from my previous employment in India in 2009 itself when I left India for employment outside and I do not have any .

1) Can I start a new EPF with the new organization?

2) If yes, will I be eligible for tax free employer contribution to my PPF Account?

3) Am I allowed to keep the EPF account till the date of my retirement at 60 Years of Age?

4) If yes, will the balance in the account and fresh contributions earn interest after I attain the age of 58 Years?

5) As I will not be completing 5 years of service at the time of my retirement at 60, is the final withdrawal at the time of my retirement taxable?

Ashok-1) Yes.

2) PPF is different than EPF. Hence, don’t link that to this product.

3) and 4) Read above post for the same.

5) YES.

I worked 1 year under 1 company only. I am self employed after that since 2 years. I am going to withdraw the amount in financial year 2018-2019. So, for FI 2017-2018, I just have to pay tax on interest. In FI 2018-2019, I would have to pay tax on total (epf+eps amount – interest of FI 2017-2018). Did I guess correctly?

Shashank-Tax for FY 2018-19 is again only on interest not on principal contribution.

I had read, PF withdrawn before 5 years of continuous employment is taxed. I was employed only for 1 year. In FY 2018-19, I would be withdrawing the whole amount.

Shashank-Then it will be taxed. However, refer above post for recent changes.

I worked in an organisation for 6 years and then worked in another organisation for 5.5 years. I transferred the PF from my first company to the second one (It is Statutory PF)

I left the second company about 4 years back and I have not withdrawn my EPF.

If I withdraw now, will it be taxable? or Fully exempt?

Srivatsan-NO.

Mr Basu,

Sorry could not make out…

Are you saying – No It will not be taxable -So I need not pay Tax?

Or

No – It is not exempt and so I need to pay tax?

Srivatsan-It is tax-free as your EPF account is more than 5 years old.

Is the interest earned in the EPF account during non contributing period also tax free – if the EPF account is operated for more than 5 years?

Or the Interest is taxable for the 4 years of my non contributing period after 11 years of EPF account contribution?

Dear Srivatsan,

Refer above post. I have clearly mentioned that for any such non-contributory period, the interest earned is taxable for you (irrespective of the age of EPF).

I was given compulsory retirement after 31 yrs of job. And EPF has been withdrawn. Is the amount exempted or taxable. Kindly suggest

Akash-Tax-Free.

Dear Sir,

I left my last company 3 months back. I want to withdraw the PF amount entirely. But I am told that I cant withdraw as I joined another company by now and they have opened a new PF account and it is showing online under my UAN profile. Now there are two PF accounts under the UAN. But the previous PF is not transferred yet to the new one as the new company is yet to deposit PF money in the account and I haven’t received any transfer SMS from EPFO. Can I withdraw the previous company PF or it has to be transferred?

Kindly suggest.

Regards,

Sandeep Das Gupta

Sandeep-I already replied to your email (I think so).

Hi Basu,

I want to fully withdraw my PF/PS balance. My previous employer has informed that form 15G is not applicable to exempted Trusts (My previous employer is an exempted trust). As my total yr of service is less than 5 yrs,is there any way to avoid TDS deduction if I’m withdrawing before 5 years?? & also as no more contribution shall be made after I leave my prev. org. that means I can never attain 5 yrs of service. So regardless of time when I withdraw, TDS will be deducted. Pls find me a way to avoid TDS. I’m not working now & have lot of financial need.

Khan-Do you think avoiding TDS means avoiding Tax?

Is there any way to avoid??

My prev. employer told me “In case TDS is deducted then we will provide you TDS certificate which you can submit while filing IT returns.”..what this means?? pls clarify

Khan-Whether TDS deducted or not, the income for YOU is taxable and you have to pay the tax. If you are unable to understand these, then better to contact any tax expert of your area.

Hi Basavaraj,

In case some one has worked 4 years and 10 months and moved abroad. If he withdraws the epf after completing 5 years. Will he be taxable provided that there is no contribution in last two months ??

If a person withdraws it in next financial year it is less taxable as person has no income in india. Or in that case also epf is fully taxables?

Vish-Once your EPF account completes 5 years, then it will be tax-free.

Sir I worked for an Airline for 11 years, and I have just quit, when I checked the passbook it had 3 slots.

1 My contribution,

2.Employee contribution,

3.Pension Contribution.

I chose to withdraw my whole EPF as I am not working anywhere now.

Will it get the money from all 3 contributors? and if yes will it be taxable?

Thank you for your help.

Pavan-Yes, you will get all three. It is tax-free.

Thank you so much Sir…:-)

Dear Mr Basu ,

I need your professional answer related to a issue which urgent in nature .

1. The person is a IW ( Japanese )

2. he started working in india at the age of 64 ( for Three year )( 2014-15 to 2016-17)

3. His PF and interest for 3 year of JOB ( around 13 lakh )

4. Now he is back to his home Land and want to withdarwl his whole PF with Interest

Kindly let me know whether this whole sum is taxable if not what will be the tax implefication of this lumpsum withdrwal( Please mentioned the Income tax section if Possible )

Biswal-Yes it is taxable income.

Hi

I resigned from a company in July 17 after I worked there for 3Yrs. Since then I am working independently on contract as a consultant.My age is 41 I hav UAN no. So if I wish to withdraw the amount what portion can I withdraw and what are the Tax implication? Is there any other way out to save tax on such Withdrawl?

Mandar

Mandar-I explained everything in above post. Please read and let me know if you still have doubts.

I worked for a company from June 2012 to may 2014. I left my job unceremoniously due some issues with employer hence there is no date of leaving the employer is present. From 2014 to till date I am working for an exempted organization. My all emoluments in respect to epf are lying with my epfo account. If i withdraw my epf now, will it be taxable???My services length with my first employer is less than 2 years but my pf is lying in epfo account for more than 5 years.

Jaspreet-It is tax-free.

Sir, I retired from govt job 5 years back . I Did not withdraw my GPF at retirement ( I may mention it was GPF and not epf or cpf where employer contributes matching amount ).

My question is whether intt on GPF earned after retirement is also taxable or is new provision applicable only for epf / cpf .

Sir, the retirement age in Govt was 58 years

Gautam-This rule applies to EPF ONLY.

Thanks , then should I remain invested in GPF to earn tax free interest?

Gautam-You can if the applicable rules of GPS are tax-free interest.

is this not discrimination

Ashok-May be.

Hi!

I joined an organization in July 2012 and retired at the age of 60 in Dec 2016. My PF was deposited for 41/2 year. If I withdraw it now then do I have to pay tax on it? I don’t mind paying tax on interest earned after age of 58 years (if it is payable). Also PF office is asking me to fill in form 15G, where as my income now is much higher and I am still in 30% tax bracket. Then should I submit this form?

Regards

Shah

Shah-Yes, if you withdraw not then it is taxable. However, even if you keep also, the yearly earned interest is also taxable on the same year. If your income limit is more than basic exemption limit, then you no need to submit Form 15G.

Sorry, I am confused with your answer. If I withdraw now – i.e. post retirement but only after serving for 41/2 years, is it taxable?

Regards

Shat

Shah-If you withdraw after 5 years completion, then it is tax-free.

Hi Basavaraj,

I totally hold over 5 year 10 months experience.

1st company – 2 y 11m – PF withdrawn.

2nd company – 2 y 10m – PF not withdrawn

Just wanted check if I withdraw PF now will I be receiving amount with 10% tax deduction?

Rohith-NO.

Thank you for prompt reply

I left my previous job on 6th March 2017 after completing 24 months of service, due to some financial crisis i withdrawn the amount.

I got the amount in June 2017.

Currently am in Tax slab and i need to file tax return for 17-18. Till now i never filed IT return.

That amount i received in this financial year will be taxable or not as it belongs to previous years ?

Kindly help me as soon as possible.

Thanks & Regards

atel-It is taxable in the year when you received.

Hello Basavraj, I worked for a company in North India for 40 months ( 3 years 4 months) and have a Uan and epf number. I left company eleven months back, now I have a consultant based job with no EPF, to fall under ambit of non taxable of withdrawal shall I wait for another 10-12 months so that I can withdraw EPF and eps completely tax free and can I withdraw complete 100% EPF both contributions and eps. Thanks

Girish-Yes, you can wait and then withdraw.

Hello Basavaraj,