Many of us know that PPF tenure is 15 years. But we don’t know the PPF withdrawal rules and options available after 15 years of maturity. Let us discuss this aspect in today’s post.

I purposely did not cover this topic of PPF withdrawal rules in my last post “Public Provident Fund -20 unknown facts”. Because I felt these PPF withdrawal rules and options need a separate post.

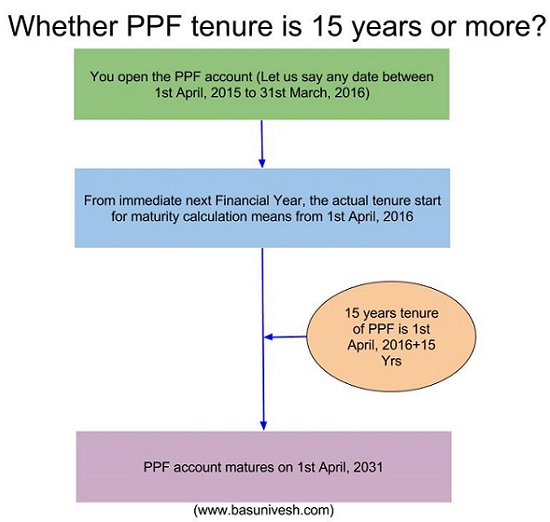

We all know that the PPF period is 15 years. But in reality, it is more than 15 years. I tried to explain the same with the below image.

You notice that if you opened the account on say 10th August 2015 then it will not mature on 10th August 2030 (15 years), but on 1st April 2031. Because the 15-year count starts on 1st April 2016. Hope this concept is clear now.

Once the PPF account matures, then you have three options. Many feel that once the PPF account completes 15 years’ tenure then it is over. However, you have three options left. I tried to explain the same from the below image.

1) Closing of PPF account after the maturity or completion of 15 years-

This option is known to all. We open an account, contribute till 15 years of completion, and finally close and withdraw the whole amount with interest. Even banks and post offices share this option alone when you enquire about the PPF feature. Therefore, I may say this is a universal option for the majority of PPF investors.

For example, if you open the account on 10th August 2015, then your account mature on 1st April 2031. You simply withdraw the amount invested and interest on that fully. The account closes there itself. If you want to invest freshly again after the closure of this account, then you have to open a new PPF account.

Do you know this? After maturity, you can withdraw the amount in installments too. But you can’t opt for this option for more than a year. This means, if your account matured on 1st April 2016, then you can withdraw the amount in installments up to 31st March 2017.

If your PPF account matured but you have not closed means you will continue to earn the interest as long as you keep it. However, no further contribution will be allowed for such accounts. Also, you will not be allowed to open a new account unless you close the existing account. After the wait of a year, the account will automatically be extended for a block of 5 years (without a contribution option).

2) Extend PPF account without further contribution–

This is the default option. Let us say your account matured on 1st April 2016 and you neither closed the account nor applied to extend the account for a block of 5 years WITH CONTRIBUTION, then this option will be automatically activated. Do remember that the application to extend the account with a contribution for a block of 5 years must be submitted within one year from the date of maturity. Otherwise, this option will be selected automatically.

This default option will be for a block of 5 years. This means, that if you have not withdrawn the amount nor applied to extend with a contribution, then the account will continue for 5 years. For example, the account maturing on 1st April 2016 will mature on 1st April 2021. After that, if not closed the account nor applied to extend the account without contribution, then again for another 5 years, an account will be extended. There is no limit to it. You continue to enjoy earning interest on the balance available in such an account. But you are not allowed to contribute any fresh amount in such an account. Neither you are allowed to change the option after a year of the first maturity of the account.

The best feature of this option is, that there is no limit to withdrawing the balance during this period. You are eligible to withdraw whatever the amount available in your account at any point of time without any restriction. The balance amount will continue to be earned. However, this option can be exercised only once in a year.

3) Extend PPF account with further contribution-Once account matures, then you have to submit the application form called

Once the account matures, then you have to submit the application form called Form H to either the post office or bank where you have a PPF account. Do remember that, you must submit the application before the completion of 1 year from the date of maturity. For example, if the account matured on 1st April 2016, then you must exercise this option by 31st March 2017. Otherwise, the second option mentioned above will be activated by default. Once you submit the form, then the account will be further extended for a block of 5 years.

If you have not opted for this option but continue to contribute as usual, then such a deposit amount neither earns any interest not eligible for Sec.80C tax benefit. To regularize it, you have to write it to the Ministry of Finance, (DEA) NS Branch through the Accounts Office to regularize the account which was continued by him without giving the option.

Once you opted this option, then you can’t go back to the 2nd option mentioned above. Few want to go back to 2nd option of above, mainly because of the liquidity available there. Because in this option, you will not feel so free to withdraw the balance as in the case of the 2nd option.

In this option, you will be allowed to withdraw 60% of the balance at the beginning of each extended period (block of five years) is permitted. It means, let us say the account matured on 1st April 2016 and the available balance is Rs.1 Cr. Then, you are allowed to withdraw 60% of this Rs.1 Cr during the block period of 5 years i.e. Rs.60 lakh. You can withdraw Rs.20 lakh in 1st year extension, Rs.10 lakh in the second year and Rs.5 lakh in the third year and so on until 5 years extension matures. The overall limit in the above example is Rs.60 lakh, this can be withdrawn either in a single withdrawal or in installments each year. However, only one withdrawal is allowed in each Financial year.

This rule applies to the next block of 5 years extension again.

Note that, for the first block of 5-year extension if you opted for the 3rd option, then in the next 5-year block period, you can opt for the 2nd option without submitting Form H. So you are free to choose the option after every such extension.

I hope this will bring you clarity on PPF withdrawal rules & options after 15 years of maturity.

Read our other posts related to PPF

- PPF-When to contribute to get higher returns?

- PPF-Loan and Withdrawal

- Interest of PPF KVP NSC SCSS and Sukanya Samriddhi for April-June 2016

- 15 Rules of availing Loan against PPF (Public Provident Fund)

- How to transfer PPF Account from Post Office or Bank to another Post Office or Bank?

- Excel PPF Calculator-Calculate goal, loan or withdrawal amounts

- All about Public Provident Fund (PPF)

- Post Office Savings Schemes -Changes effective from 1st, April 2016

Thankd basunivesh for detailed reply. The thread really helpful..!

I have 2 questions.

1.For option 3 with contributions for a an extended period of 5 years. The Form H need to be submitted only after maturity date(e.g my case maturity 01/04/2024) with in one year (31/03/2025) or the form H can be submitted before maturity(may in the month of jan-march 01/03/2024) ?

2.If we are planning for an extended period with contributions if we want an early investment do may be between 01/04/2024-05/04/2024 is it okay to deposit first through online and Form H can be submitted with in an year ? Is it acceptable?

Dear Appalanaidu,

1) It should be within the one year from the date of maturity.

2) Better to submit the application at first and then contribute.

Hello Sir

I have SBI PPF account opened in Aug 2003 which matured in 2019 with ~ 18L and I opted to extend it further for 5 yrs. with contributions. The current accumulated amount is ~25L. I need this corpus for my sons graduation by Mar-Apr 2024. Can I close the PPF account on 31st March 2024 post the 5 year extension and withdraw the entire amount?

Thanks!

Dear Ashish,

Yes, you can close it.

Whether all banks have implemented new ppf rules of 2019 for closure of ppf a/c. I want to close my ppf a/c of 40 years continued without contributions from 2015 onwards . I have to use form C or form 3 for complete closure of ppf a/c with SBI.

Dear Mahesh,

Yes, all banks have to follow this new rule.

I had a PPF. After 15 years, I closed it and took out the fund. Again I opened a new PPF. Can I again close it after maturity and open a new one?

Dear Sankar,

Yes.

I opened PPF account of HUF on 01 October,2016 with a Bank.Every year I am depositing Rs.150000.Now the Bank has sent a letter to me for closing the account.

What is the rate of interest payable to me.

Dear Vinod,

Refer my latest post “How to merge multiple PPF accounts into one?“.

Good Information !!!

Dear Sanjay,

My Pleasure.

Hi Basu, good post as always!

I extended my SBI ppf 2nd time with contribution and it’s 22nd year now. If the balance is 10 lakhs and I need 9 now, is it:

Allowed for 9 lakh withdrawal

Not allowed

Close and take full balance or

Any other options.

Please advise, as it’s urgent.

Thanks a lot.

Dear Tej,

You are not allowed to withdraw the whole 9 lakh. Closing is the only way for you.

When Minor PPF accounts gets matured, at that time can Father of minor withdraw/transfer the matured amount.

Dear Ricks,

As the son is major, the guardian is not allowed to operate.

Dear Mr Basu,

Thank you for your reply. Me & my wife both have PPF account in SBI. Both accounts matured after 15 years in Mar 2019 & we extended the accounts for 5 years with continuing subscription.

We suddenly required funds & applied for 60% withdrawal of the balance as was on 31/03/2019. My wife’s withdrawal has been paid, but in my case the bank is stating that the system is not accepting the withdrawal request.

What could be the reason & what is the remedy.

Thanks & regards,

Col AK Saha

Dear Col AK,

Software not accepting means it is THEIR ISSUE but not your’s. Either they have to process or let them give in writing that they are unable to process this request and so that you can knock the banking ombudsman.

The subject of maturity of PPF after 15 years & the options there after are very well explained.

My query is I have extended my PPF account using option 3 in April 2019. I need some money now, is it advisable to withdraw from this account or prematurely break Bank FDs

Dear Col AK,

Refer above post for the liquidity. You can’t close it now.

Hi,

The article is quite informative. However I have a question which I am not able to get answer to despite reading through the article several times.

I had a PPF account that was opened in 2003 and got matured in 2018. Apparently, I wasn’t aware of the “maturity” rules and did not submit any request for extension of the account or Form H with the Post Office. There were no submissions in FY 2018-2019 (i.e. 1st Apr 2018 – 31st Mar 2019) and no submissions for FY 2019-2020. For FY 2019-2020 the deposit was to be made around last week of March 2019, however due to lock down that wasn’t possible. Once a cheque was submitted with the PO in Apr 2020 stating that the amount should be considered towards 2019-2020, I was told that the PPF account was INACTIVE and MATURED so no further contributions are allowed.

I wish to know how to keep the account ACTIVE and keep making contributions to the account. Is there any provision to extend the maturity by making some PENALTY payment?

Dear Raj,

Your account was active for the block of another 5 years with an option of NO CONTRIBUTION as you not requested for account extension. Hence, you can’t contribute now. Once it matures after the completion of 5 years, then you can extend with an option of contribution.

Dear Sir, if account has completed q5 yrs and further extended with contribution, can i close the ac during this period and get full balance?

Dear Karthik,

You can’t close the account in the middle except you have certain valid reasons like health issues and all.

Dear Sir,

I had opened my PPF A/C. in 1992 and technically it got matured in 2007 but I continued to contribute in the same upto 2020 without submitting Form H.

I would like to know that what will happen to my A/c. Will interest credited to my A/c. after 2007 will be reversed or it can be regularised for further investment upto 2030

Dear Manish,

First approach the authority where you have PPF account and check what option they have selected for extending.

I have opened PPF in september 2003……have exercised option 3 after 15 years….in 2019…..now tell me when I should deposit my last dues of 1.5 lakh and when I can get my maturity.

Dear Prabeer,

If your account matured and reactivated on 1st April, then you can deposit before 31st March 2020.

Hi Basavaraj,

I had opened my PPF account in 2009 as an Indian citizen. I am a NRI since 2014. As I heard NRI’s cannot have PPF account(which I now know is incorrect), I went and asked them to close my PPF account in December 2019. As I see they have not given Interest for the year 2019 as it was closed/withdrawn before the completion of the financial year which would have been March 2020. Shouldn’t they be giving pro-rated Interest? Pls clarify.

Thanks,

Pratik

Dear Pratik,

You can continue the PPF up to the maturity. It is not yet closed.

Hi Basavaraj – Just to reframe my question , If I voluntarily close by PPF account as I am an NRI now in the middle of the financial year. Will I get interest for half a year on pro-rata basis?

Dear Pratik,

Obviously.

Sir i have extended my ppf account After maturing in2018 for another five years now in november 2019 i Wanted to withdraw A small amount but bank is saying i can’t withdraw before 1 st april 2020 . So kindky help on this

Dear Mahek,

Please refer the above rules properly and if they are not ready to accept, then let them give in writing.

Informative yes , but I Couldn’t find the answer to my problem that I was searching for .

my PPF account opened in July 1998 with SBI. Post maturity I even made a partial withdrawal of 60% in 2015 .

in 2016 I transferred the account to ICICI ,and the account number changed.

on 3rd June 2019 I got the notification that my account matured this past March2019 .

I went there to enquire as I wanted to make a partial withdrawal. But the eligible amount was only 762INR while the amount in my PPF was 4.5 lacs +

I couldn’t wrap my head around it . the bank employees have no idea on the partial withdrawal process. they told me partial withdrawal is available post completion of 7th financial year.

so my question is in case of account transfer are there any change in rules. ? the account did complete 20+ years also I got the acount maturity notification from ICICI as well that the 15+5block period matured. So why Can’t I withdraw upto 60% from my account . I mean I did in 2015 then why not now ?

-Avinash

Dear Avinash,

Whether in the current extension which option you selected (with a contribution or without contribution extension)?

Hello

Very informative article/blog

I have a ppf account with a bank which matured in

2015 and it is being continued under 2nd option since my form H did not reach them. My account is in New Delhi and I live in chennai. I had requested the bank to transfer the account to chennai for operational convenience but they have refused the same. I note from your article that it is possible to switch to option 3 in 2020. Where can I get the rules

Pertaining to this so that I can take it up with the bank.

Regards

Vasantha Rajagopalan

Dear Vasantha,

Such instances are happening with many. If the bankers are so rigid and unable to understand the rules, then let them give it in writing of their claim.

Hi, My PPF account completed 15 years and then extended for another 5 years expired in November 2018. I forgot to extend for next 5 years. I submitted form H but it was rejected by SBI stating they cannot extend and I have to withdraw the money. I read your blog and it says that if not extended it gets extended automatically. What’s the solution.

Dear Sanjay,

They don’t know the rules. Let them give in writing about their claim.

I opened a HUF PPF account in April 2004. As per bank it has matured on 31st March,2019.As HUF account can not be extended, can i keep the amount till March 2020 and then close before 31 March ,2020. Will I get interest for this period.

Dear Krishna,

You are not allowed to extend. Hence, you have to close it immediately.

on maturity Of HUF PPF account, if accountholder does not come to the back for closure for 3-4 years, is the HUF PPF still eligible for interest ?

Dear Mita,

NO. He is eligible for savings account interest rate.

hello sir

my husband’s PPF account has been matured on 31 march 2019 we don’t want to extend it but need the money after 7 months . how much interest we will get if we withdraw whole amount after 7 months.

Regards Arushi

Dear Arushi,

If you don’t want to continue, then you will get the PPF interest as of maturity date only.

Hai,

I opened the PPF account on 2015. Shall I withdraw the partial amount for house purchase as in EPF.

Dear Gifton,

Refer my post “PPF-Loan and Withdrawal“.

Hi Basavaraj,

I have one query. For example,

Let’ s say PPF is opened in 2000. 15 years will get completed in 2015. Here, I can withdraw all the amount(principal + interest). No issues here.

Queries to follow below:

Without contribution:

1. Suppose, if I extend it to 5 years block i.e.., until 2020 WITHOUT contribution, can I withdraw whole amount(principal + interest) at the end of 2020? Or are there any restrictions over here?

Without contribution:

2. Suppose, now if I extend it to another 5 years block i.e.., until 2025 WITHOUT contribution, can I withdraw whole amount(principal + interest) at the end of 2025? Or are there any restrictions over here?

With contribution:

3. Suppose, if I extend PPF to 5 years block i.e.., until 2020 WITH contribution, can I withdraw whole amount(principal + interest) at the end of 2020? Or are there any restrictions over here?

With contribution:

4. Suppose, if I extend PPF to another 5 years block i.e.., until 2025 WITH contribution, can I withdraw whole amount(principal + interest) at the end of 2025? Or are there any restrictions over here?

Regards,

Karthik.

Dear Karthik,

1) NO.

2) NO.

3) NO.

4) NO.

Hi Basu, My PPF account was opened on 28-02-1989 and I

made contributions till 03-05-2013. No contributions to the account were made till 25-03-2019.

Thereafter, as per SBI bank instructions, I revived the account on 26-03-2019.

Will I be eligible for the PPF interest for the new deposits after the account revival and the tax exemption benefit of 80c.

Dear Girija,

Yes.

Dear Basu,

Thank you for very simple and informative article. I have a question.

My PPF account has completed 15 years on 1st April, 2019. If I submit form H to continue for 5 years extension with further investment by January 2020 (before completing 1 year), will I earn interest as usual (similar to previous years)?

Thank you in advance

Dear Jignesh,

Yes.

After completing 15 years, I submitted Form H. Now after 3 years I have discontinued subscription.

I want to get all my money back to me. What are my options.?

Dear Anurag,

Refer my post “Premature closure of PPF account – New Rules 2016“.

I have my PPF ACCOUNT with SBI since March 2001. For certain time it was inoperative. I have got it activated by paying penalty and contribution for FY 2017-18 and contribution for FY 2018-19. When can I close my account?

Dear Alka,

If you activated and extended for another 5 years with contribution option, then you have to wait for 5 years completion from the date of last maturity.

My PPF account due for maturity on 1st Apr 19 after 2 extensions without contribution beyond 15 years. SBI Bank states there are no rules to refund 100% any time after maturity. What Govt. rules can I quote so that I get 100% back when I want and not 60% which the bank is proposing.

Dear Satish,

Let them show the rule book or give in writing that only 60% is possible but not 100%.

My friend has a PPF account with SBI for the past 27 years, every contributing and availing 80-C benefit. He has never applied for extension of the account and SBI has never asked for it. Your blog has given confusion in respect of automatic extension with contribution. Kindly clarify. Thanks, Regards, BALA

Dear Bala,

I have written this post based on the rules. I am not sure what went wrong with his account. Better to clarify it with Bank immediately.

Hi Sir,

This week Wednesday I created a HDFC PPF account online through net banking; the account got created, but in Chennai Anna Nagar branch.

I was not aware that account will be created in Chennai branch when I created online.

I’m staying in Bangalore and I’d like to transfer the PPF account to Bangalore which is my home Branch where my savings account is there.

Please let me know the procedure to transfer the account.

After maturity – should I visit the branch to with draw the amount or it can be done via net banking itself.

Thank you.

Dear Raja,

I am not sure why they created the account in that branch. Better you discuss with HDFC Bank for the clarity.

Hello Basavaraj

If I choose Option 2 and I do not withdraw interest amount, will this interest amount be added to the mature principal amount and fetch compound interest?

Dear Viswa,

YES, why not?

SIR,MY ACCOUNT HAS MATURED IN APRIL18. I HAVE EXTENDED IT FOR A FIVE YEAR TERM WITH CONTR OPTION. HOW MUCH CAN I WITHDRAW FROM THE MATURED ACCOUNT? I WAS TOLD THAT THE PERMISIBLE AMT IS SOME % OF MY PREVIOUS FOUR YEAR BALANCE. I WANT TO KNOW, AS TO HOW MUCH WITHDRAWL IS PERMITTED AFTER MATURITY AND SUBSEQUENT EXTENSION WITHIN A YEAR.

Dear Shashikant,

It is already explained in above post.

sir my PPF account matured in 2015. I got it extended for 5 years filling form H with contribution. I have been contributing every year in the extended period. I have got 2 queries.

1. Does the amount invested in the extended 5 year period earn interest or interest is paid only on the amount that was there in the account at the time of maturity in 2015.

2. Does the amount invested in the extended five year period qualify for deduction u/s 80C?

Dear Venu,

1) Your invested amount will also earn the interest along with already accumulated corpus.

2) YES.

Sir,

My PPF account matured (after 15 yrs tenure) on 1/4/2017. I got the same extended for another 5 years with contribution & also did a partial withdrawal in Apr’17. Today (Sep’18) I have urgent need of money for buying a house. My query is –

1. Can I close the account now, and withdraw complete amount? will it be taxable? Can I use it as down payment on Home Loan?

2. If I want to make partial withdrawal, the 60% amount will be calculated basis the amount on maturity, or on amount after partial withdrawal?

Thanks for your advice!

Dear Mithi,

1) You are not allowed to close now (however, there are certain rules to close it refer my post “Premature closure of PPF account – New Rules 2016“).

2) Based on the maturity.

Thanks for the information.

Sir,

My PPF account will mature this year. What form is required to be submitted for closure of PPF account upon maturity and withdraw all the money to my bank account?

regards

Dear Meetak,

You have to use Form C for the same.

Thanks you for prompt response. I saw an earlier post that when you withdraw; they do not give cheque anymore. Is that true?

I dont have SBI savings account in India. Will I need to open a SBI savings account if I need to withdraw OR will they transfer money to another bank?

Dear Meetak,

Yes, no more cheque issue. They will transfer the money to your savings account. They can transfer the money to your another (non-SBI account) also.

One more question. Would I need to submit an account closure form too?

Dear Meetak,

YES.

Thanks. Can you provide the PPF account closure form or name of form or share the link?

thanks

Dear Meetak,

Please Google it or check with your Bank.

On inquiring about withdrawal of Maturity amount in the Post office where I hold A PPF account, I was informed that it is mandatory as per govt norms that I first open a savings account with the post office bank , failing which I will be denied any cheque towards the maturity.

Is it true?

Dear Bina,

Yes, now they made it mandatory that they transfer the fund to your savings account rather than issuing the cheque.

Can I withdraw whole amount from PPF accountafter 15 years and still continue account for 5 years?

Dear Suheli,

If you withdraw the whole amount, then they not allow you to continue.

Sir,

I have closed my PPF account. Though it states that it is not taxable, should I mention this income while filing IT Returns or not. Kindly advise.

Thanks

Sujish

Dear Sujish,

Yes, you have to show under exempt income.

Hello Basavaraj,. Can you please clarify this.

I possess PPF account with post office and completed 15 years by 31-Mar-2018 and PPF account matured. The concern is, I have misplaced the PPF account passbook. Should I need to apply for duplicate passbook in order to close my PPF account? Please advise. What is the procedure for applying duplicate ppf passbook from post office. Thanks,

Dear Ram,

I am not sure about Post Officials procedure. Better you visit the nearest Post Office and get that information. However, in my view, they need passbook also.

Hi,

My account matured 7 years ago(hold it for 15 years before that)

I have made contributions for 6 years and earned interest.

I did not made any contribution in last year.

Now, I don’t know what status is my PPF account in.

Can I withdraw anytime or I have to wait for the 5 year block to finish?

Dear Ankur,

It was automatically renewed with the option as “Renewed for 5 years without contribution). Hence, you can close the account once such 5 year block complete.

Thanks for responding Mate.

Does that mean, if someone missed to do it in timely manner, it’s locked again for 5 years?

Dear Ankur,

YES.

Dear Sir,

Thanks for your informative post. My query is :

1. My wife’s PPF acct matured on1/4/18.

2. She wants to continue it for 5 yrs without contribution.

3. Whether the Interest paid on this acct during the the extended period is exempt from Income Tax?

4. Whether Interest is Paid at the same rate as the normal PPF acct.

5. Hope the withdrawals ( once a year ) will be exempt from Income Tax .

Regards

Ramani-3) Yes.

4) YES.

5) YES.

If PPF is extended without contribution, only one (unlimited) withdrawal is permitted per year for the next block of 5 years. To withdraw the amount, which form should be used?. Is it form C ?. Also, can the total amount be withdrawn after one year?.

Srirama-Regarding withdrawal form, better approach the bank where your PPF account is there. Regarding withdrawal rules, I already explained the same.

I have a PPF with SBI. It is extended twice. It is said that it can be extended totally thrice. Is there any restrictions for extending beyond three times. What is the present rules

Kannan-There is no such extension. You can extend it as long as you can.

Hi,

My PPF account commencement in 2003 and it was due to mature in April 2018 but unfortunately i forgot to make the last payment in 2017 and now it is locked and upon checking with Bank they informed me to submit:

1. Letter of authorization to deposit amount of subscription + penalty (as i am out of India)

2. Form-B – deposit slip

3. Form H – for extension (if i wish to extend for next 5 years)

My question is what If I want to close PPF account ? As, I have no plans to visit India before March 2019. If I do not do it now then it will go into default 5 year block with no contributions after March 2019. And I need this money once I’m back to India 2020.

Is there a way to close the PPF and ask bank to deposit amount in my Savings bank account in SBI?

I appreciate your help. Thanks!

Sachin-You can interact with concerned officials and send the PPF closure form.

Dear Sir,

My PPF account got matured on 1st April 2018, I wanted to continue contribution with extension so I added 50000 today 05-april-2018. But later to my surprise I found on your website and others that I need to submit FormH for this kind of extension. So I rushed to SBI and submitted same which was accepted also same day. Now I am afraid the 50k which I contributed just few hours before this official extension will be also considerrd for interest and 80c or not?

Praveen-You no need to worry. It will continue with extension.

Dear Sir,

Good Evening!

I have a P.P.F account in Indian bank. I had opened the account in 2000 and this got matured in 2016. however I was not informed by the bank about my P.P.F account maturity date and I continued depositing money in my account and now the bank is saying that I cannot extend the duration for another 5 years as it is too late to extend it for another 5 years. They have also cut down on my interest.

Please advise what can I do to save my interest.

Kanhaeya-In that case, how they accepted the deposit even after 2016??

Hello Nivesh,

First of all thanks a lot for this very useful post. Now my query is I have a PPF account in SBI, which is in extended period. This matures in april 2021. Now I want to withdraw the entire amount available in my account and close it. As per your post I understand that it is not possible. Is there any other way to withdraw full amount??? Please suggest

Manasa-Refer my post about latest PPF Advance Rules.

My ppf account is maturing on 1sr April 2918 after 15+5+5. Can I invest the amount in other post office schemes where principal and interest is tax free.

Rajesh-Which scheme in Post Office offers you tax-free interest like PPF? Whether such investments match your financial goals? If yes, then go ahead.

Is the PPF closure on maturity request form available online and if yes, could you please share a link?

Shyamala-I am not sure. But your bank or Post Office will provide that.

Sir , my ppf will complete 16 years in 31st March 2018. Under what circumstances Can I withdraw the money in April 2018?

Asha-Under what circumstances means?

I mean how can I withdraw? Need the money urgently.

Asha-Whether it is completing 15 years or 16 years?

Thanks for giving very informative and valuable information about PPF Rules.

I have the following Query : –

My PPF Account has completed 15 years in 2016, however, the account was renewed for further 5 years. Kindly Guide whether I can close my PPF account now since completed 16/17 years as funds are required for the purchase of flat. SBI is denying foreclosure of the account. If it is possible to close the account now/April 18 kindly provide the provision/notification of Govt of India to enable me to show it to SBI.

Deepak-Refer my post “Premature closure of PPF account – New Rules 2016“.

Thank you for the reply. I appreciate your instant reply, however, the link provided by you is not satisfying the query raised regarding rules of premature closure of PPF account when it completes 16/17 years. In the captioned link there is no mention about the premature closure of PPF account which has completed 15 years and extended for further 5 years.

Deepak-The same rule applies irrespective of you are in extension period or during 15 years period (after completion of 5 years).

The PPF rules are very clear. After completion of 15 years if the Account holder opts to extend the account prior another 5 years which is true in your case. There is no provision to withdraw funds and close the Account premature to completing the extend 5 year tenure.

Once you complete the extended period you may close the account.

SIR, there was a ppf account about which I had completely forgotten. At the time of opening Rs 500 was deposited.

Then after 4 years I forgot about it and then I opened another ppf account with another bank and have deposited Rs 150000 in the new one.

What to do now, how to close the first ppf, and the bank account in has also been closed where first ppf was opened.

PLS HELP

Varun-Refer my post “All about Public Provident Fund (PPF)“.

Hi Basu

I have one PPF account in Post office which will be matured on 1st April 2018 after completion of 15+5+5)

I enquired at post office regarding closing and get the matured amount

They said

1). Closing application to be submitted only to parent post office where I opened the account though I am presently staying in other city

2) For getting the amount I have to open a post office savings account where the amount will be credited .

They are not going to hand over any cheque in my name of the matured amount

Are the above correct?

Thanks and Regards

Prasad

Prasad-Sadly YES.

Can i open a ppf account online?

Please let me know this facility wether available in Bank of Baroda.

Rakesh-Refer my post “How to open PPF account online in ICICI and SBI Banks?“.

Dear Basuji,

I have an extended PPF account in SBI. Second block will mature in April 21. In April 17 I withdraw an amount as per there rules. Can I withdraw some amount this year also, in April 18?

Pratap-Please refer above post properly for your eligibility.

My PPF ac was opened on 22/10/2001. I think the ppf ac maturity date is 31/3/2017 and I can close the account on 1/4/17. So far I have not closed the account nor given Form H for extension.

My query is (1) If I close the account on 28/2/18 will I get the interest for the 11 months and (2j if not can I do nothing till 31/3/18 when annual interest will be credited automatically for the current FY and can I close the ac on 1/4/18 and get the proceeds without losing interest

Pancham-You can close the account now.

1) YES.

Will I get interest for the 11 months if I close the account on 28/2. The SBI manager says I will get only the balance as on 31/3/17 if I close now which means I will lose 11 months interest. The system applies annual interest on 31/3 only

Kindly advisev

Pancham-I don’t think so.

The SBI manager says I will get only the balance as on 31/3/17 if I close the Ac now which means I will lose 11 months interest. The system applies annual interest on 31/3 only

Kindly advisev

Pancham-Let him give in writing. It is not about their system but the question of your invested money.

Dear Mr. Basavaraj

My ppf completed 15 years in 2017. I deposited money in 2017 also which was the 16th year. Now I need the money to buy a house and so want to close the account. Can I do that at the end of this financial year ie March 31 2018 ? Kindly guide.

Asha-Even though your PPF account completed 15 years during FY 2017-18, the account will actually mature on 1st April 2018. Hence, you can close it on this date.

Good Morning Basavaraj,

My PPF account will mature on 01-Apr-2020. Is there a provision to transfer the money to my savings account with the same bank online?

Rahul-I think they will transfer to your bank account only at maturity (Hoping you are questioning about maturity proceeds)

Sir,

I opened a PPF A/c in PNB, about 27 years I got 2 extensions of 5 years each after first 15 year term. I have not taken 3rd extension after 15+5+5 considering to withdraw & already 2 more years have passed. If I wish to get last extension now with contribution, is it workable & will it be for balance 3 years (since already over 2 years have passed. Kindly reply.

Sushil-You can’t change the option in the middle of such 5 years block period.

My PPF A/C is maturing on 31/3/18 after an extension period of 5yrs after the mandatory 15 yrs. I got to learn that now the post office where i hold my PPF A/C is no longer issuing cheques for the maturity amount but is asking me to open a savings account in the said post office. Is there any Government notification which makes it mandatory to open such an account since i feel it is just useless to open such an account for PPF withdrawal .

Please inform me regarding the same

Kennedy-There is no such Govt Notification. If they have, then let them show it else issue the cheque.

Hi, If I have extended ppf without contribution beyond 15 years for two blocks of 5 years each. Now for 3rd block of 5 years, can I withdraw only interest amount on monthly basis or annual basis?? Please guide.

Eknath-During such extended period, there is no such separation of INTEREST or PRINCIPAL. Based on above said rules, you can withdraw the lump sum.

Suppose that my PPF account mature on 31st March 2018 then can i open another new account on 1st April, 2018?

Rakesh-Yes, provided you closed the earlier account.

Is any maximum age limit for the open a PPF account?

Rakesh-There is no such maximum age limit to open PPF account.

Sir,

My father opened my ppf a/c in 1999, and after its maturity I extended it to the block of 5 years. Now in case of emergency, i wanna to withdraw . I’ve the saving and ppf at same branch . So my problem is how long they’ll take to trasfer it… Either hand to hand or i’ve to wait for few days.

Harshita-In my view once you submit the request, then may be within few days they transfer the fund to your savings account.

Tnkew sir

dear sir ,

i have PPF account since 1999 , in 2015 i extended it for 5 years .

can i close my account before 5 years of completion .

Pankaj-Refer my earlier post “Premature closure of PPF account – New Rules 2016“.

I think the question originally raised was around PPF withdrawal AFTER extension …meaning 15 years are done and someone extended for 5 years…what are the rules for withdrawing during these 5 years?

I don’t think the article you mentioned above covers this scenario. Earlier premature closure or closure after extension are different scenarios. Could you please shed some light on this scenario?

Aks-Please refer the post, I clearly mentioned what are rules in case of withdrawal during such extension period (with or without contribution).

what if someone continues contribution in the extended period , can he withdraw the amount in between. My sons ‘ account is running 17th year , we have contributed every year. Now he is leaving the country . Can he close the account or he will have to wait till 5 years period complete

Laksman-Please refer above post where I mentioned extension with contribution rules. If he is turning to be NRI, then he has to close the account before his residential status changes. Refer post “PPF and NSC for NRIs – Amendment Rules 2017“.

Very Informative Article. I came to know many new things not known earlier.

Kumar-Pleasure.

Sir,

I openend a PPF post office account on 31st oct, 2002, please let me know when can I withdraw , now or in April 2018, thanks

Sathish-It will mature on 1st April 2018.

Dear Basavaraj ji,

My question- I opened my account in 1-sep.-2017 , I think my financial year will be start from 1-april-2018+15 years maturity, It means my maturity will be 1-april 2033. then my question ‘ how many rupees can deposit in my account on 31 march-2018, & How many rupees can deposit in my account in my first financial year 2018-2019.

Please suggest me…Thanks.

Vijay-Up to 31st March 2018, you can deposit up to Rs.1,50,000. From FY 2018-19, again you can start investing yearly up to Rs.1,50,000.

I had also opened a Post Office PPF account in my Daughter Name in April 1999 in DELHI when she was about 20 yrs old. In 19999 there was no system of PAN & AAdhar card etc

Yearly amount was deposited by me—-father—in her PPF account for 15 years without any Default. . PPF was then extended for another 5 yrs & payment deposited by me every year .

However in 2004 she went to USA for studies / Married there / Lives there & Is an AMERICAN citizen since 2012 so at this stage she Cannot get PAN / AAdhaar etc .

How ever I have my daughters Election Card made in 2002 & old driving licence pl

I have got 60 % withdrawl form signed from her but Post Office says now PAN etc is Required as per just introduced rules which i feel are to be done bu 31-12 -2017.

Kindly advise How to get this Advance 60% back / transferred into her SB account in same PO. . She has an OLD SB account in the same Post office & staff was told to transfer amount to her SB account.

Kindly advise pl

Surinder-This is your mistake that first you not updated the PPF account when her status changed from minor to major. Second thing, KYC is mandatory now. Above that, NRIs can’t hold normal savings account. That also she is holding.

Thanks, her SB account was opened much earlier @ 1994 pl & now I am the 2nd holder in that SB accttt —- E or S . I will close this account soon after transferring PPF advance 60 %/ or full closure amount & then withdraw from SB & CLOSE account pl .

I was Not aware of the advise now given by you pl.

what is the solution either to Close the PPF its extended period is upto 31/3 /2020.

Kindly guide pl how to Close or partial withdraw from her single name PPF in which I & my wife are Nominees . I am a Sr Citizen & Indivdual I-Tax assee of 30 % bracket

kindly guide what to do now as per these circumstances / situation pl pl . Thanks again

Further pl she was already a Major when PPF was opened in 1999 as she was born in 1979

Surinder-I thought you opened the account in her name when she was minor. Then let them process. Her not being in India must not be hurdle for closure of PPF.

Surinder-She can show her NRI status and inform the Post Office that she don’t have PAN card. So that they can process it. There is no such TDS rules for NRIs closing the PPF account. Based on that let them process. The problem is they are so rigid and not flexible and customer friendly.

My PPF account has been opened more than 15 years ago and has been renewed for subsequently for 5 years terms thrice with contribution option. I want to now close and withdraw all the amount before the current 5 years term gets completed (2 years are still balance for completing this term) What is the process? My account is with ICICI Bank. Please advise.

Dinesh-Refer my post “Premature closure of PPF account – New Rules 2016“.

First & foremost really appreciate your prompt response and thanks for the same !

Yes, had gone through your post referred above before posting this query.

Your post is very clear about “partial withdrawal” options after 15 years and I understood those.

However my query is specifically about options available for “closing the account and withdrawing FULL amount “ before the completion of current 5 year trench. Would like to know process for the same. Also any repercussions like reduction in interest rate like it’s there when we go for premature closure if FDs.

Thanks & regards.

Dinesh-I hope you have gone through the above-shared link where the new rules explained in detail. This rule also applies for you also (PPF extended period).

Hi, can you please advise how is the PPF amount paid by the post office on maturity? I do not recall any of my bank accounts connected to the PPF account in the post office. Do they pay by cheque? Also, once the PPF account matures, can I withdraw the amount by a single visit to the post office, or does the withdrawal involve ‘processing’ that requires multiple visits to the post office?

Sanjeev-In my view now they stopped paying by cheque. Instead, you need to have savings account with them.

I just noticed that my PPF account was maturing on March 31 2017 after my 5 year extension that I did in 2012. I had contributed 1.5 lacs in June 2017 but nobody mentioned my account was mature. they just accepted my payment as usual. I did not give any instructions or submit any forms. So does this mean the amount I deposited is not earning any interest? And what about the amount in the account till it matured? Does that keep earnign interest atleast?

Soni-Hard to believe. First contact the officials where your PPF is and let us know their answer.

Sir Maine ppf account open 2015 m kra ta uski maturity 2030 m h muje ek confusion h sir 2015 year s lekar 2030 year k between jitna Paisa Maine diffrent months and years m Submit kra ppf account m vo pura 2030 mil jayega jaise m 2017 m Paisa dala ppf account m vo b 2030 m mil jayega ya vo 2017 k next 15year baad mileage please sir answer my question

Manish-Refer above image properly.

Account khol ne ke baad 15 saal ke liye jo bhi aap deposit karoge or jo har 31 march ko vyaj jama hoga yeh poora paisa vyaaz jo diya gaya hain (har saal) poora apko 2030 main 31.03. ko interest credit hone ke baad milna hi hain.

Dear Sir,

If the option to extend the PPF account without contribution ( default option) is chosen then:

1. can one withdraw anytime between 15-20 year period?

2. does one earn interest during the extended 5 years

Kindly advise.

Saurabh-1) YES. 2) YES.

Dear Sir,

Thank you for the excellent article. Learnt a lot! I have a few questions, please help!

I had opened my PPF account with SBI on 21-Dec-2002. I became NRI in March 2016. Hence, I could not deposit any money in last financial year.

My Questions are as follows:

1. When will my account mature?

2. Can I avail 5 years default no contribution option following the maturity period though am an NRI?

3. How is the matured amount paid? By cash, cheque or account transfer?

4. Can I authorize someone to receive the matured amount since am out of country?

Thank you again!

Yours sincerely

Kaushik

Kaushik-1) 1st April 2018.

2) NO.

3) If bank is linked then account transfer (Nowadays no cash or cheque payment).

4) NO.

Thank you so much for your quick response! Truly appreciate your timely advise.

I went to the the bank today and they are asking to open a new account. But, I already have NRE & NRI account with other banks. Can’t I link that NRO account?

Also, can I transfer my PPF account to another bank?

Kaushik-Savings account is not required to hold PPF. You continue the same existing accounts. If they force you, then let them show the rule book. Yes, you can transfer the PPF account to another bank.

My PPF is maturing in 31st March 2018. Assume that if I have 12 Lakhs in it, can i withdraw 10 Lakhs and extend the 2 Lakhs remaining for another 5 years with contribution ? Or is there any max limit which i can partially withdraw when extending ?

Sudheer-If you are extending your PPF for 5 years with contribution option, then you are allowed to withdraw 60% of the balance available at the time of closure i.e. Rs.6,00,000. I clearly mentioned the rule in above post. Please refer it.

Dear Basavaraj, Great blog and highly informative. My question pertains to PPF extension: I opened PPF in Jan 1997 and it matures on 1 April 2017(I had extended for one block).I want to extend for another 5 yr block WITH contribution. I have not given Form H for the same.Meanwhile,I contributed Rs 1,50,000 towards 80C deduction for this FY.If I give Form H ..Now will this amount e considered for 80C benefit? Will they accept Form H?

Thanks

Gopal-You can submit Form H within the one from the day of maturity of PPF (which you did). Hence, your account is extended now with the option of CONTRIBUTION. Hence, you can claim tax benefits also.

Thanks.But I haveNOT yet submitted Form H.

Now, I have contributed Rs 1.5L after maturity on 16 April17.I have not yet submitted Form H (which I will do soon) at bank.

Question is: As on 16 April 17,the date of contribution,I had not submitted Form H for extension+contribution.So,is the cntbn eligible for this FY’s Tax benefits?.. Will I get Tax benefits after I submit formH now?

Gopal-Now you can submit and take the tax benefits. I think they were not noticed this.

Thanks Basavraj for taking your time.Will submit Form tomorrow

Basavaraj:I submitted Form H at my bank.They have made necessary inputs in their system for PPF Extension WITH deposit.Thanks for your inputs.

Gopal-Great to know this 🙂

I have extended my ppf account 2 times aftet 15 years for a block period of 5 years each. Thus completing 25 years on August 2017. Can I extend for another 5 years with contribution.

K N Nair

Nair-YES you can if you want.

Sir if i m extend my ppf account without contribution. Then how much intrest will be earned. Please clarify.

Pandey-The rate of interest will be same for all PPF accounts.

Hi Sir,

I have an PPF account which is matured in 2016 and i had missed to pay for the 2 years in 2014 and 2015.

1. Will the account be inactive since i missed out for 2 years ?

2. Will it be extended for 5 years since i didn’t intimate the bank for withdrawing or closure ?

3. If Inactive, do i need to pay the penalty with contribution for 2014 and 2015 and make it as active and continue for extension of 5 years.

What process do i need to follow?

Regards,

Prashanth

Prashanth-Refer my post “All about Public Provident Fund (PPF)“.

I opened my PPF in SBI in 2001 (before March) and contributed till March 2014. I did not contribute any amount for 2014-15, 2015-16 and 2016-17. My PPF matured on April 1, 2016 as per my understanding. I left the account unattended since then i.e. I did not contact the bank after maturity, did not submit any form to the bank and did not contribute any further money.

I would like to know:

1) Can I withdraw the full balance now and close the account completely ?

2) Is the account deemed inactive now?

2) What documents may I possibly be asked to submit by the bank when applying to withdraw full balance and close the account, given the fact that my last contribution was in March 2014 and the PPF is left unattended for over 3 years now? Will KYC be required?

4) Will I get interest for year 2016-17 and from 01-April-2017-1 i.e. since the account matured?

Srinath-For 1) and 2) my answer is YES. 3) Yes, you have to complete KYC process. Be in touch with bank for the same. 4) YES.

I have completed 27 years in PPF account . I want to know how much can I withdraw from

my account. What are the rules for that . Do the rules for withdrawal after initial 7 years apply to my such an old account also. Please help

Apurva-Whether your PPF is 27 years or 37 years, you can apply above-said rules and withdraw the money.

Thank you Sir

Dear sir,

I have a ppf account in my name and it will complete 15 years on 31.3.2018. Is it possible that i open a ppf account simultaneously for my 2 year old son on 1st april 2018 and enjoy the benefits of:

a) interest on my cumulative amount(for 5 year block) and

b) claim 1.5 lacs on the section 80C for depositing in my son’s account.

Gunjan-What about continuing the same instead of this CIRCUS? You earn the interest on whatever you accumulated and also you can enjoy Rs.1.5 lakh by yearly investing. Why complicate the things??

My PPF Account has matured on 01-04-2017. I am yet to withdraw the amount. If I withdraw the amount now, shall I be paid Interest for the period from 01-04-2017 to date of withdrawal?

Gaurang-YES.

My PPF account is 18 year old I need fund for my ailing parent for their operation …If I opt closure could I get returns with penal charges ??? Please clear it

Dipak-Refer the latest rules “Premature closure of PPF account – New Rules 2016“.

sir

my ppf account has expired during march 2016 but till now i have not withdrawn or havent told the bank officials that i am going to withdraw. I want to continue the ppf account for my income tax purpose. So can i continue with the present ppf account with interest benefit or shall i have to open a new account

Nagambas-Your PPF account was extended with the option “Extend PPF account without further contribution”. Because you neither closed it nor informed the bank or Post Office for your extension within a year from the date of maturity. Now you can continue but you are not allowed to invest. Refer above post properly for the clarity.

Dear Sir

I have PPF account opened in 1982 which was extended from 1/4/98 for 5 years . The last extension was in march 13 where it is extended till 31/3/18 . Now i wants the money to buy the house , can i close this account and get back the money for buying the house ?

Rajul-Another one year left for closure. Why can’t you take advance loan from this?

2 May 2017

Dear Sir

I am still waiting for a reply to my query of 29 April 2017.

Satindra-Check the below comments. I am unable to find your old comments. Can you re-post the comment once again?

5 May 2017

Dear Sir

I had asked whether a person who has closed and withdrawn on maturity after two five year extensions his PPF amount can again open a second PPF account in his name ?

Satindra-If the account is closed, then you are free to open the new account.

Dear Sir

Thank you so much.

Dear Sir,

If deposit towards PPF is missed out for one particular year and that year also happens to be the year in which extension was due [but missed], can I continue with my PPF account by paying penalty.

for example –

Deposit for the year ended 2016 Mar, was missed out. The last date of extension was also Mar 2016. Can the bank force me to close my PPF account?

Heena-You have an option to renew it by paying penalty and extend.

Hello Sir,

I have opend PPF account in 2005 in Post Office and due some problem not invested two years i.e 2007 & 2008 but again by paying penalty activated account and start investing again thereafter but now in year 2017 i need to withdraw partial amount , but post office people are saying that you will not able to withdraw because your account was not activated for 2007 and 2008 , is this coorect ? please guide me ,

Balu-Whether the penalty payment not reflecting in your passbook? Also, how they accepted deposit after 2008 without checking whether the account is active or not? They are just careless and most irresponsible.

Thanks , basavaraj , they have found that one of the year of penalty was not paid , they told me after so many discussion and then i am able to withdraw ,

Thanks for this forum you are helping people with your knowledge

Balu-Great to know this 🙂

Yes It does bring clarity and was very helpful. Thank You.

Ruchit-Pleasure.

Basu,

I have a few questions about PPF in particular and 80c investments in general.

1. PPF interest rate is declared every quarter. However, interest is credited once a year. So, which quarter’s rate do they use for the calculation? Or, are they calculating it every quarter but crediting it only at the end of the year?

2. Which of the 80c investments are allowed for tax deduction for retired or self employed individuals? For example, if I am a retired or self employed person and invest in NSC, can I deduct that amount from my taxable income (say, from my interest incomes from FD)?

3. Same as above for NPS. NPS has an additional 50k deduction over and above 1.5l deduction of 80c. Can a retired person avail that?

BTW, by retired and self employed I mean anybody who is a non-salaried person.

Chan-Sec.80C rules are same for salaried, self employed and retired.

Chan-1) The interest for the particular month will be considered based on the balance available between 5th to end of the month. The applicable interest for that month is considered for calculation. Hence, each month interest matters.

2) Sec.80C rules are same for an individual salaried, retired or self-employed.

3) YES. Retired person can avail tax benefit using NPS.

Dear Basavaraj sir,

Happy Ugadi to you and your family and all Basunivesh staff

regards

RAJESH PAI

Rajesh-Same to you and your family too 🙂

Sir,

1. I opened my PPF account with SBI in March 1992. I have done extensions with contribution , once in Apr 2007 and again in Apr 2012.

2. I do not wish to extend further. Can I now withdraw the entire balance amount available in my PPF account.

Thanks

V.Ramesh

Ramesh-Yes, you can withdraw and close the PPF after the end of the current extended block of 5 years.

At maturity, how do I get the money back? Do they give me a check? Or, is it credited electronically to my bank?

My PPF is with SBI and they are saying that the money has to go to an SBI account. Which seemed pretty restrictive to me.

Chan-Nowadays they transfer to your account.

Does it have to be SBI account in this case?

Chan-That you have to check with SBI.

Sir they issue DD and dont transfer the PPF amount directly to the saving account even in the same branch, this is after enquery with SBI branch where i had gone to ask the procedure to close the PPF account of my mother.

I got it transferred to my SBI account.

Dear Sir,

My PPF account open on 30.03.2001 , i made last contribution on Feb 2017 and in march i like to withdraw ( prior to one year complition from the end of maturity) .As my 15 years are complete and i didnt give any request to continue my PPF.

My question is

1) will i get tax exemption for deposit made on Feb 2017

2) Can i withdraw my PF before 30.03.2017

3) till what date i will get Interest ( do i receive interest on last deposit which was on Feb 17

Rahu;-1) YES. 2) NO. 3) Refer above post properly.

My mother expired in Dec 2016, she has a PPF account, with last contribution made in dec 2016, would like to continue the same without any contribution since the interest is tax free, Can i continue the same till i want or should the same be closed by end of this financial year .

Lalit-You have to close the account immediately.

After maturity if i dint extent it and it goes to start earning intrest after 1 year waiting period.

So from here onwards withdrawel is limitless right. Unlimited withdrawel in any year.

Mani-Refer above post properly. If you not withdraw or not intimate for closure, then the default option is extension of 5 years without contribution.

Limit is only one withdraw in one year allowed.

My PPF is going to complete 20 years in 2017; can I continue and add 1.5L every year or now I cannot make fresh investment !

Chanchal-You have to apply for renew by choosing option of extension with contribution. Then you can invest and continue your PPF for another 5 years. Refer above post for clarity.

My ppf account is due to mature on 1st Apr 2017.

I haven’t done any investment for 16-17 yet.

Can I deposit 1.5 lack before 1st Apr (sometime in Mar 2017) and claim tax benefit for 16-17?

Regards,

Chandan

Chandan-Yes, you can invest but you have to submit Form H immediately after it matures that you want to extend the PPF with contribution for next 5 years.

hi basvaraj,

my child was born in Dec 1999. PPF account {Minor} opened in Post Office Dec 1999 with his mother as Natural Guardian. account transferred to SBI in July 2013. extended with contribution in 2015.

amounts in the account on Apr per year: 2014 : 8L 2015: 9L 2016:10L

i want to do partial withdrawal in April 2017. how much maximum can i withdraw and in what percentage?

Ajit-I already mentioned the rules that you will be allowed to withdraw 60% of the balance at the beginning of each extended period (block of five years) is permitted.

thanks basu.

will go with this data to the bank.

thanks once again.

ajit

I opened PPF account on 20th-Feb-2017. This date lies in the financial year 2016-2017 , then the financial year ends on 31st March, 2017 . So the 15 yrs will be calculated from this date (31st Mar, 2017) and the lock in year would be 2017+15 = 2032. So the exact date would be 1st Apr, 2032 in this case..

So i can withdrawal the money on 1’st April 2032. Am i correct. If I am wrong please let me know when is the maturity date.

Thanks,

Ajay

Ajay-Yes, your account matures on 1st April, 2032.

Thanks sir ji

Sir,

I opened PPF Account in March 2007. I was making regular contribution every year.

Last year in August 2016, I made first partial withdrawal.

So can I make second partial withdrawal in April 2017? Since, I believe an account holder can make a partial withdrawal once in every financial year. (There is some confusion since the gap between two partial withdrawals is less than a year.)

Please clarify.

Thanks.

Ritesh-Refer my earlier post on this at “PPF-Loan and Withdrawal“.

Hi Basu,

My PPF account expired last March (i.e. March 16) and I am now looking to close it. Will it accrue any interest for the last 10 months, or will I get the balance as of 1st April 2016?

Hemant-If you not informed about withdrawal, then it will be renewed automatically for the block of 5 years (without further contribution option). Refer my post on the same at “PPF withdrawal rules & options after 15 years maturity“.

Sir I opened my ppf a/c on 8th April 1996 with Sbi after 15 year I extend my a/c for another 5 year I paid my last installment in April 2016.now I want to close my a/c when can I withdraw my full amount? What is the procedures please guide me thanks

Harish-Refer latest closure rules at “Premature closure of PPF account – New Rules 2016“.

Dear Sir,

My PPF account became operational in 2000-01. as per rules my accout has matured on 01 Apr 2016.

However, I gave last contribution in 2013-14. This anomaly was only due to oversight, and not any specific reason.

I want to close the account now. Would it be possible ?

Regards and Thanks

Pradeep-If the account matured in 2016 and you have not given any request for closure or extend, then the automatic option of auto renewal might happened. Hence, check with the PPF provider for the same.

Hello Sir,

My extended PPF account ( 15+ 5 Years) is maturing on 31/03/17 and I wish to further extend it for block of 5 years i.e upto 31-03-22. with contribution.My query is that during this extended period can I close the account anytime or I will have to remain invested till extended maturity.

Thanking you in advance

Viresh-You can close with certain new rules. Refer the post “Premature closure of PPF account – New Rules 2016“.

Hi Sir,

I extended my PPF account in March 2016 (extension with contribution) . Now I want to withdraw a part of deposited amount. And as per what I understand I can withdraw a total of 60% of my total balance before my extension in the first block of the extension(spread over a 5 year time span), withdrawing once in a financial year .

Please correct me if I am wrong.

I want to know if there is any restriction to what we can withdraw in a particular year. If I withdraw 10% this year(1st extended year) .Am I eligible to withdraw 50% in next financial year(2nd extended year)?

And is this withdrawal allowed once in a financial year or once in January to December?

Thanks in advance.

Sood-Once you extend the PPF, then you are allowed to withdraw 60% of the balance available at the beginning of extension (1st April). You can withdraw this 60% WITHIN the next 5 years extended period as per your wish (Once in a financial year or as many times as in the same year). There is no such restriction for withdrawal, that is what I already explained in above post clearly.

Sir,

It is with Contribution as stated in my query above.

I have been regularly depositing amount in the said account till date.

If I withdraw today, can I again withdraw in the next financial year ? If so, what amount ?

Thank you,

~ Sanmeet

Sanmeet-You are allowed to withdraw only 60% of the balance as on 31st March 2016. This is the only amount you are allowed to withdraw in next 5 years (if you planned to continue for another 5 years).

Sir,

It is with Contribution as stated in my query above.

I have been regularly depositing amount in the said account till date.

~ Sanmeet

I have completed 25 years of my PPF Account with Contribution in March 2015. I believe that today I can withdraw 60% of my credit balance as on 31 March 2015. Is that right ?

Subsequently can I withdraw more amount next year i.e. in financial year 2017-18 ? If so then how much ?

Thank you,

~ Sanmeet

Sanmeet-what type of option you chosen for this extension? With contribution or without contribution?

Dear Sir,

I have a PPF account which is maturing soon. I would like to know if I can receive the maturity amount by cheque instead of cash as the amount is large. The post office people say I should open SB A/C at the post office and transfer the maturity amount to this SB A/C. Kindly let me know if this is necessary?

Regards,

Ravi

Ravi-Do you feel receiving maturity amount through cheque is safe than direct credit to your savings account? Yes, post officials are right.

Can I withdraw PPF 10% of the amount and continue with the policy, every year after maturity, if so how long

Gopal-Is the extension with contribution or without contribution?

how much time takes to grant the ppf loan or withdrawl

Rakesh-It hardly takes more than 2-3 days time.

my PPF account will expire on 31st march 2017. What I have to do to get my money back. It will be taxed or not ?

Prabhat-You have to give the closure letter before maturity. Maturity amount is tax-free.

[email protected]

SIR, I’M HOLDING PPF ACCOUNT , 7 YEARS ,BUT NOW SITUATION HAS COME THAT NO JOB-(EPILEPSY) HEALTH PROBLEM-NO CARE TAKER JUST ON THE ROAD,STRUGGLING FOR FOOD AND SHELTER- CAN I CLOSE THE ACCOUNT AND GET MY BALANCE MONEY CAN SOME ONE HELP ME TO GET THIS AMOUNT.

THANKS

suresh bapat

9884044213

[email protected]

Suresh-Refer my earlier post “Premature closure of PPF account – New Rules 2016“.

Hello,

I have extended my PPF a/c for next 5 yrs in 2014 after completion of 15 yrs.

How much and how many times can I withdraw from my PPF A/C ?

Thanks

Anil

Anil-That extension is with contribution or without?

It’s with contribution

Anil-That case is already explained as “In this option, you will be allowed to withdraw 60% of the balance at the beginning of each extended period (block of five years) is permitted. It means, let us say the account matured on 1st April, 2016 and the available balance is Rs.1 Cr. Then, you are allowed to withdraw 60% of this Rs.1 Cr during the block period of 5 years i.e. Rs.60 lakh. You can withdraw Rs.20 lakh in 1st year extension, Rs.10 lakh in the second year and Rs.5 lakh in the third year and so on until 5 years extension matures. The overall limit in above example is Rs.60 lakh , this can be withdrawn either in a single withdrawal or in installment in each year.”

Sir, I have contributed in PPF for 26 years but not taken any extension after 15,20& 25years.how can i get my money back? Do I get interest? Do i have to go to Min of Fin?

Basavaraj,

I had opened an PPF A/C on 28/03/1989. I had not asked for any extension after 15 years ,20 years & 25 years because of my ignorance but I have been regularly depositing amount till this year. will i get interest till this year? how can i close my PPF A/C ?Do I have to go to Min of Finance?

Saini-How they accepted the contribution without extending? Check the status first where you have account.

Hello Basu,

Once 15 years is completed and if i want to withdraw the PPF,Do i have to visit bank with some proof and my pass book is enough.

I mean do we have to submit any documents for PPF withdrawl?

Sumit-If you have savings account then submitting withdrawal forms is enough.

Thanks a lot. Appreciate your quick response. Your site have got good information.Thumps up.

your article says

“The best feature of this option is, there is no limit to withdraw the balance during this period. You are eligible to withdraw whatever the amount available in your account at any point of time without any restriction. The balance amount will continue to earn. However, this option can be exercised only once in a year.”

at a different place you say

“Ravinder-You no longer withdraw it after the automatic option activated (this will be activated after a year of first maturity). You have to wait for completion of 5 years.”

which one is the correct position?

my account matured 2 years back and got automatically renewed for 5 years, without contribution from me. can I withdraw now or have to wait completion of 5 years?

thanks.

Sanjay-Advance withdrawal is possible but you can’t close the account. That is what I pointed in his reply. You can withdraw the amount. But closure possible after 5th year completion.

Thanks for the information.

After withdrawal of say 95% amount, can I choose to extend it for another 5 years and exercise option to contribute again (in the next block of 5 years)? If so, when do I fill that form H?

On completion of the current 5 year block or even before that?

Thanks again for the trouble you have taken.

Sanjay-Yes, you can extend it as many blocks as you wish. The extension notice must be given within one year of maturity.

sir can i close the ppf account during the extended period

Sathis-Refer my recent post on the same “Premature closure of PPF account – New Rules 2016“.

Sathis-What type of extended period it is?

Hi Basavaraj,

Is there any government website in which delay in filling Form H is covered.

This is in relation to lines posted in article

If you not opted this option but continued to contribute as usual, then such deposit amount neither earn any interest not eligible for Sec.80C tax benefit. To regularize it, you have to write it to the Ministry of Finance.

Gaurav-There is no such portal.

After maturity of 15 years extend for 5 years. One withdrawal in the month of August 2016 as per rule 3 years old balance. Now money required for higher education whether 2nd withdrawal is allowed without closing the PPF account?

Jai-Whether this extension is with contribution or without contribution?

Dear Basavraj

In case I have extended my ppf account after maturity of 15 years and I want to withdraw money form the account in the 17th year (15 + 2) as per option 3 – contribution with interest. then how much of the total can I withdraw in the 17th year. Take 20 lakhs as the available balance in the 17th year.

Xavier-Withdrawal will not be based on 17th-year balance. But you are allowed to withdraw 60% of the balance available at the start of 16th year (or at closure of 15th year). This is what I explained in above post.

Hello, I want to ask the maturity amount after 15 years of PPF account. Someone has told me that in PPF, interest rate compounded annually. So, instead invest in LIC 80 C section, PPF is better option because principal amount in both schemes are same i.e. not more than 1,50000 INR. Kindly tell the maturity amount in PPF.

Sugandh-Yes interest rate is yearly compounding and definitely best option to consider for long debt allocation of your goals than LIC endowment plans.

Hi, I have an PF a/c in SBI and in year 2015 , 15 yrs completed. I extended it for another 5 yrs with contribution and also opened another in Axis bank. Now some one said that I can open another a/c though my total contribution in a year in hardly 25,000(Both).

Pls. suggest the way forward.

Regards

Bipin

Bipin-You MUST have only one PPF account. Close the rest of all accounts immediately.

Dear Sir,

So can I withdraw or close the 1st PPF A/c of SBI and continue the second one (Axis)

Regards,

Bipin

Bipin-Yes, you must close anyone account immediately.

Dear Sir,

Thank you for giving advise to my problem.

Hi Basva,

I worked 5.10 years in a IT company, where i have a epf component. I have left the job and now i am joining a new company where i have options to transfer the epf amount to new epf account or withdraw it. I want to withdraw the epf amount and invest in some property. I have a below queries on epf withdrawal:

1. If i withdraw my old company epf amount, do i got the complete epf amount (employee + employer).

2. If i transfer the amount in new account. Can i withdraw the partial or full amount if still i am for compaby where i have tranfer the amount.

3. The new company can create a new epf account under san UAN no and i can withdraw only the old comapny epf amount after 3 months.

I have heard that recently some epf rule has changed, can you please check the above scenario and let me the your opinion based on recent epf rule.

Thanks in advance.

Vinod-1) If you are in job, then you are not allowed to withdraw EPF. You can only transfer it.

2) You can withdraw as an advance if you have certain emergencies. They are listed in my earlier post “All about EPF (Employee Provident Fund) advance withdrawal“.

3) You are not allowed to withdraw old EPF. Also, one UAN to one employee. So even holding two UAN is not allowed.

Dear sir

I had opened my ppf account on 10-10-2000 in SBI,Vijayawada and operating the same continuously . Due to my transfers the said account has been transfered from place to place where I worked and transfered to Hyderabad in which Iam presently working. Now I intend to close my account,but the bank officials told me that the computerised statement shows the account was opened on 08-02-2005 and the maturity date is 01-04-2020. At the time of opening the account manual pass book was issued. I have seen from the ppf rules that partial withdrawals can be made from the start of the seventh financial year after the account has been created.I had also withdrawn the amount on 30-01-2009. In case the amount was already permitted to have been withdrawn the period of 15 years has been also elposed. Am I entitled to close my account now?

Sai-First show them the proof of your first contribution and partial withdrawal you did in 2009. This makes sure to them that the account was opened in 2000 but not in 2005.

Hi,

I have worked 5.3 years in previous company. And I have resigned and joined new company. Is it possible to withdraw my PF?

When I approach my previous employer, they send the mail like below;

“PF Withdrawal process can be initiated only if you are unemployed or taken up employment outside India. In case, you are employed in another organization in India you can initiate transfer process from current employer. Please confirm on the same so we can guide you through PF Withdrawal/Transfer procedure.”

Please confirm whether i can withdraw my PF. I Do not want to Transfer my PF. Its urgent for personal commitment.

Also, If i say that currently i am unemployed will it be a problem. Please advice.

Thanks

Expecting ur reply.

Subbu-If you are in job, then you can’t withdraw it.

I opened a SBI PPF A/C in the year 1995 & completed 15 Year in 2010 and then I extended the account for 5 years i.e. upto 31.03.2015 & again extended for 5 years i.e. upto 31.03.2020. Now, I have an urgent requirement of money and for this I contact my Bank Manager for withdrawal of approx. 30% of deposited money but he refused me and said that your not entitle for withdrawal of any money upto 31.03.2020. Please advise, what can I do in this time?

Raj-Whether this extension is with contribution or without contribution?

If this is true, it would be very concerning because as per above article, both in option 2 & 3, there should be no problem with withdrawing just 30%.

Subha-The problem is, these officials neither know the rules nor ready to learn it. Let Raj clear my doubt.

Dear Sir,

Suppose on exercise of option 3, extension for a block of 5 years with contribution;

You have mentioned that withdrawal of only 60% of the balance at the beginning of each extended period (block of five years) is permitted.

My query is, what about the contributions that we make every year in this extension period? When will we be allowed to withdraw this amount?

Taking your example:

Balance at start = Rs. 1 cr

Withdrawable amount = Rs. 60 lacs.

Every year, I continue to contribute Rs. 1.5 lacs. When are those contributions eligible for withdrawal?

Gan-You can withdraw the same only after completion of 5th year.

Hello Sir,

I would like to know that whether the annual interest earned on PPF amount deposited, will be same or there is any difference if i deposit the amount in monthly or annual basis. Please help.

Thanks.

Deepak-Interest will not change if you invest in lump sum or on monthly base. It will be same for that particular financial year.

Hello Basu

As always great article.

Suppose the a/c matures and extended automatically without contribution and we too forget the maturity date,(!!!). Should we wait till the 5yrs tenure or we can withdraw as 15yrs completed. Plz .clarify.

PPF a/c will be in force even one contribution per year of a minimum amount. Correct me if I am wrong.

Thanks