Whether you have multiple PPF accounts in your name? Then as per the rule, you can’t have multiple PPF accounts. Hence, How to merge multiple PPF accounts into one? We all know that one can’t hold more than one PPF account. However, many are knowingly or unknowingly opened multiple PPF accounts and held them as usual. To relieve from such multiple accounts, Government recently came out with a procedure in which the proper guidelines are set on how to merge multiple PPF accounts into one.

PPF is a wonderful debt product available for all of us. Hence, many try to open this account. But they forget the basic rule that one can’t hold more than one PPF account. Hence, knowingly or unknowingly they open multiple PPF accounts in multiple banks or with Post Office.

As per the old rule, legally you are not allowed to open two PPF accounts. One person must have only one PPF account. Suppose you knowingly or unknowingly opened two accounts in Post Office, Bank or one in the post office and another in a bank, then the SECOND account will be treated as an irregular account. Even you can’t open another account if you already have one discontinued PPF account. You have only option to continue it with a penalty and minimum subscription. Such a second account will not carry any interest. So in such a situation solution is, you have to write a letter to Under Secretary-NS Branch MOF (DEA), New Delhi-1 through the Accounts Office giving detail of each account and request for combining of both accounts.

However, how many will take the pain to write a letter and how this particular department will respond to each of our letters was the question mark. Hence, Government now came up with guidelines on the merge multiple PPF accounts into one.

How to merge multiple PPF accounts into one?

Let us see the silent features of these new and important guidelines.

# Accounts opened on or after 12/12/2019 are not eligible

As per the latest communication by the Ministry of Communications Department of Posts, accounts opened on or after 12/12/2019 are not eligible for such merger or amalgamation. You will get the invested amount without any interest. The notification’s wordings are as below.

“In case any one of the PPF accounts or all the PPF accounts is/are proposed to be merged or amalgamated is / are opened on or after 12.12.2019, such account(s) shall be closed without any interest payment and no no proposal should be sent to the Postal Directorate for amalgamation of such PPF Accounts.”

# The choice of which PFF account retain is left with investors

The notification mentions “Where the deposits made in both the accounts taken together are within the prescribed deposit ceiling, as applicable to the account from time to time, shall be allowed to be amalgamated and the account holder will be given an option to retain the account of his choice.”

This I think the biggest relief for many. I personally feel to retain the one which is older. The reason is that once the 15-year lock-in is over, then such old PPF accounts create lot of liquidity. Hence, always choose and retain the one which you opened at first to retain.

# You have to close all the existing loans on all your PPF accounts before request for merger

If there is any outstanding loan in any of the PPF accounts to be merged, you have to repay the entire outstanding loan amount along with the interest. That is, if there is any PPF loan account, it should be closed before the amalgamation of accounts is done.

# You have to submit the request for merger to the Post Office or Bank where you are intended to retain the account

Suppose you have your first PPF account with Post Office and second PPF account with SBI Bank. Suppose you wish to retain the PPF account which is with Post Office, then you have to give the request at Post Office for merge multiple PPF accounts into one, long with a photocopy of the passbook/statement of account.

The accounts office will forward the case to the other accounts office (where the account stands which is to be merged) and request to verify/send the details of annual subscriptions of all the financial years. The accounts office will then work out the annual subscriptions deposited by the account holder in all the PPF accounts keeping in view the prescribed deposit ceiling under the PPF scheme declared/decided by the Government from time to time.

On confirming subscriptions do not breach the prescribed deposits ceiling of any of the financial years, the accounts office will request the other accounts office to close the account and transfer the balances in the account keeping in view the relevant provision of the PPF Scheme. The date of opening of the retained account shall be deemed as the actual opening of the account for the calculation of maturity and other purposes. Date of actual transfer/credit of balance in the account which is to be retained shall be deemed to be the date of deposit for the purpose of loan/withdrawal, etc.

# Excess deposit in all PPF accounts beyond the maximum limit is returned bank to you

Suppose you have two PPF accounts and in both the accounts you are depositing yearly Rs.1,50,000. Let us assume the current maximum limit itself for understanding purposes. While the merger of these two accounts only Rs.1,50,000 is considered and an additional Rs.1,50,000 which you deposited in a different account is returned to you without any interest. Refer to the below wordings for a better understanding of the ruling.

“Where the deposits made in both the accounts taken together are in excess of the prescribed deposit ceiling, applicable from time to time, the excess amount breaching the limit will be refunded to the subscriber from the account to be amalgamated without any interest.”.

The history of minimum and maximum limits of PPF investments are as below.

For example, 5 transactions done in PO, 2 transactions done in Bank and then 3 transactions in PO; if the total deposit amount limit exceeds from the second transaction done at Bank, the last 4 transactions should be excluded for that financial year, subject to the deposit of maximum allowed amount. Accordingly, the last 4 transactions will not earn any interest. The interest calculation is done based on the date of first two transactions done.

# The date of opening the PPF account is deemed to be the actual date of opening of the PPF account which you wish to retain

The date of opening of the retained account shall be deemed as the actual opening of the account for the calculation of maturity and other purposes. Date of actual transfer/credit of balance in the account which is to be retained shall be deemed to be the date of deposit for the purpose of loan/withdrawal, etc.

Let me share you the example given in the guidelines itself for your understanding.

Assume that a depositor is having two PPF accounts with the transactions as detailed below. Interest is assumed as 7% per annum and the maximum allowed amount is assumed as Rs. 1,50,000/-.

If the amalgamation of the above two accounts is ordered, the annual subscriptions made in both the accounts are to be worked as follows.

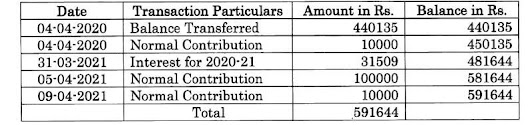

If the depositor requests to retain Account 1, the new amalgamated account will be opened with the date of opening as 04.04.2018 and the following ledger entries will be uploaded.

If the depositor requests to retain Account 2, the new amalgamated account will be opened with the date of opening as 04.04.2020 and the following ledger entries will be uploaded.

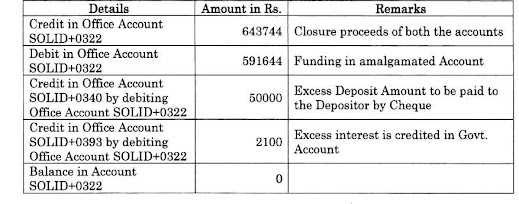

The final transactions shall be balanced in as below.

Conclusion:- It is now clear that the prudent idea is to retain either the oldest PPF account (as I told you that it gives you more freedom and liquidity once it completes 15 years term) OR cross-check your every year’s contribution. Retain the account where you invested at first than the second account.

Refer our posts related to Public Provident Fund-

- All about Public Provident Fund

- PPF-When to contribute to get higher returns?

- PPF-Loan and Withdrawal

- PPF (Public Provident Fund) Scheme 2019 – 5 Important Changes

- PPF Investment and Deposit Rules – Beware your Banks are unaware of it!

- PPF Account for Minor and Wife – Rules, Tax Benefits and Tricks

- Premature closure of PPF account – New Rules 2016

- PPF withdrawal rules & options after 15 years maturity

- 15 Rules of availing Loan against PPF (Public Provident Fund)

- Excel PPF Calculator-Calculate goal, loan or withdrawal amounts

Thank You Sir for replying.

Yes, I have shared your post with them and also many other articles from economic times and other posts also.

I have also got hold of the PPF SB Order released by the Post Office and have shared the same with them, but as per banks no such circular have been received by the banks, they even consulted with the GBD but no luck, as per them they have not received any such circular and so they can’t do it.

In such case is it a good idea to go via RBI Ombudsman scheme ?

Dear Tushar,

If they have not received the circular does not mean no such rules exist. Let them approach the government for that matter. It is their issue. You raise an issue against the bank with RBI Ombudsman.

Hi Sir,

I need your guidance, I have by mistake opened 2 PPF accounts, 1 with SBI (first) and the 2nd with Union Bank (2nd)

Both the accounts are opened before 2019 so I believe are eligible to be merged.

I have asked Union Bank to merge/transfer the account to SBI, but both the banks have denied such an Government order to merge 2 PPF accounts into 1.

They are closing my account and returning my invested amount, I am losing out on the interest amount here.

Can you please guide me with this issue.

Dear Tushar,

Many bankers are unaware of the rules. You can show above my post.

Sir,I had try to open a PPF Account(500rs) in Uco Bank by Ucombanking app 2 month ago,that time an error showed in app so i not submitted any KYC documents and any amount (PPF Account)in ucobank branch that time.

After that today I have been open a PPF Account in Post Office and now when i open ucombanking app that show I have already a PPF account,so now how to close PPF account in UcoBank.

please help

Hello Sir,

I have one PPF account which got matured on 1st Apr 21. I missed to deposit in FY22 and extend it for 5 years.

1.Can I now open another account without closing the previous account?

2.Can I open another account and then merge old account to new account?

Please suggest.

Dear Nimisha,

Sadly you can’t open one more account.

Hi Sir,

Unknowingly of the rules, I have two PPF a/c one in Post Office opened in 2008 & other in SBI in 2010. Total contribution amount in both account less than 1.5 laks/FY. 90% contribution made in SBI due to non-digitalize of post office & time taking services.

1. Now what i have to do.. please suggest

2. If I merge both a/c.. Will my interest earned in SBI carry or lost?

3. What is the process to merge.?

Please help

Sumit

Dear Sumit,

You can now merge both accounts. The doubts and process you asked for are already explained in the above post.

Hi Basu, I have PPF account with SBI since 30 years. Recently I have mistakenly created PPF account with HDFC bank . There is no transaction in the 2nd account. What I need to do. Will it impact interest earning on my first account ?

Dear Ashish,

Sadly No. But better to close the second account.

Hi Basu, regarding multiple PPF accounts (1 in bank and 1 in Post office) is there any specific transfer form available to transfer the money from bank to Post office or is it a written request for the same

Dear Jiju,

I don’t think so. But better you check with concerned branch.

Hi Basu, Thank you for the informative post, as usual!

I just want to know with 1 PPF account how to manage and track your investments for 2 different goals, say for example retirement and child’s education. Both will be having different investment time periods? Thanks!

Dear Mahesh,

Either you can calculate the yearly corpus on your own for each goal or use two PPF accounts.

Hi Basu, thanks for the response! But as you mentioned above, one can’t hold more than 1 PPF account?

Dear Mahesh,

Yes, one can’t hold more than one account in his name. However, as a guardian, you can hold one more account of your kids.