Recently Government Of India changes the rules in relation to PPF and NSC for NRIs. Let us see the new amendment rules of 2018.

NOTE:- GREAT SUCCESS TO ALL THOSE WHO FOUGHT AND BRING IT TO THE NOTICE OF GOVERNMENT, NOW THIS NEW CHANGE KEPT IN FOR ABEYANCE (Refer the latest notification).

PPF and NSC for NRIs -Rules before Amendment

To give you the better understanding of current changes, let me give you in detail the existing rules of PPF and NSC for NRIs. This will clear you the changed rules.

PPF for NRIs

As of now, NRIs were not allowed to open the account. However, if they already opened the account when they are resident Indians, then they can continue the account till maturity.

Do remember that they also can’t extend the account for the block of 5 years. Hence, if you complete the 15 years period, then you have no option to close it. At the same time if your account is already extended for the block of 5 years, then you are not allowed to extend for another block of 5 years.

NSC for NRIs

As of now, NRIs were not allowed to invest in NSC. However, the rule was clear that “Provided that if a resident who subsequently becomes Non-Resident Indian DURING the currency of maturity period, shall be allowed to avail the benefits of the certificate on maturity on a Non-Repatriation Basis”.

Hence, if you are resident Indian at the time of buying NSC, and later your tax status changed to NRI, then you can continue the NSC up to the maturity.

PPF and NSC for NRIs – Amendment Rules 2017

Government Of India amended these rules in case of PPF and NSC for NRIs on 3rd October 2017. Now the new rules are as below.

PPF for NRIs – Amendment Rules 2017

The notification says “Provided that if a resident who opened an account under this scheme, subsequently becomes a non Resident during the currency of the maturity period, the account shall be deemed to be closed with effect from the day he becomes a non-resident and interest with effect from that date shall be paid at the rate applicable to the Post Office Saving Account up to the last day of the month preceding the month in which the account is actually closed“.

Hence, as per this new amendment, NRIs are not allowed to continue the PPF up to maturity. Their account will be closed immediately once their status changes to NRI from resident Indian.

Now the interesting point in regards to interest payout once you turn to be NRI is “interest with effect from that date shall be paid at the rate applicable to the Post Office Saving Account up to the last day of the month preceding the month in which the account is actually closed”.

This means let us assume your residential status changed from Resident Indian to NRI on 25th October 2017 and Post Office Savings Account interest rate for September 2017 was at 4%, then your PPF will earn 4% interest from 25th October 2017.

NSC for NRIs – Amendment Rules 2017

As I told you above, earlier only resident individuals are allowed to invest in NSC but not NRIs. However, they can continue it till maturity.

Now the notify says as “Provided that if a resident who purchased the certificate, subsequently becomes a non Resident during the currency of the maturity period, the certificate shall be encashed or deemed to be encashed on the day he becomes a non-Resident, and ab interest shall be paid at the rate applicable to the Post Office Saving Account, from time to time, from such day and up to the last day of the month preceding the month in which it is actually encashed“.

Hence, as per the new amendment rule, you no longer be allowed to continue your NSC till maturity. Your account will be closed immediately when your residential status changes from Resident Indian to Non-Resident Indian.

Also, after closure, the applicable interest rate will be Post Office Savings account interest rate.

How it affects to NRIs?

I think this is a big jolt to NRIs. They used to enjoy PPF and NSC up to maturity with high-interest rates. Especially with PPF as it long-term product and they can easily earn a higher return in PPF for a long term. However, now the Government closed this option for them.

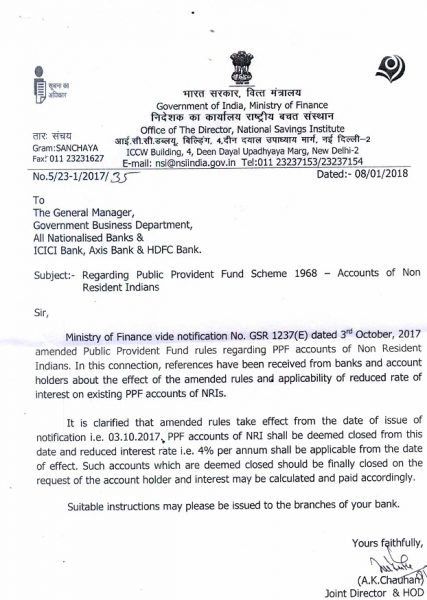

Few asked me about notification. One of our blog readers shared this Government of India clarification in this regard. Hope this will clear the doubts of all NRI PPF Investors.

Refer our few posts related to NSC and PPF

- PPF Account for Minor and Wife – Rules, Tax Benefits and Tricks

- Premature closure of PPF account – New Rules 2016

- PPF withdrawal rules & options after 15 years maturity

- 15 Rules of availing Loan against PPF (Public Provident Fund)

- How to transfer PPF Account from Post Office or Bank to another Post Office or Bank?

- Excel PPF Calculator-Calculate goal, loan or withdrawal amounts

- All about Public Provident Fund (PPF)

- PPF-When to contribute to get higher returns?

- NSC-Accrued Interest taxation and way to reduce it

- How to transfer NSC from one person to another?

- NSC and KVP in e-mode and Passbook mode from 1st July 2016

- How to encash or withdraw NSC bought from different Post Office?

- Post Office Savings Schemes (RD, NSC, MIS, SCSS)-Premature closure rules

I have few NSCs which have matured long time ago around 2017.

It was with my son who was minor at the time, and now is 25. Both of us are NRI . At the time of taking the certificates, we didn’t know about the rule as the broker did not inform us .Is it possible to transfer the NSCs is to our relatives? There is no way that he is able to travel to India for this work. Do post offices except authority, letter ?

What documentations may be needed.

Dear Preeti,

Sadly such transfer not possible.

Hello Sir,

I have a PPF account which was extended for a 5 year block in 2017. I became an NRI in 2019. Can I close the PPF account before the completion of the 5 year block which will be October 2022?

Dear Nish,

You can close in October 2022 (now not required).

Hi Sir

I am an NRI, My PPF account matured in 2000. I have not made any investment post maturity. I turned NRI in 1997. SBI is not paying me interest for the money for a period post maturity. I want to know whether i will be entitled for interest on the amount in my PPF from 2000 till now?

Dear Shubham,

Sadly NO.

Hi Sir,

I am an NRI for the current financial year and will remain so till Aug 2020. I have a PPF account opened in 2012. Suppose the amendment comes into effect, then my PPF account will close and will get savings interest after that. Please address my query below.

When I return in 2020 and my resident status changes from NRI to resident. Will the account be reinstated or my funds will be locked till maturity earning only savings interest rate?

Dear Deepak,

Please read the post properly. Govt canceled this new notification and you can continue and contribute as usual. But if your status at the time of maturity (after 15 years completion) is NRI, then you can’t extend the PPF.

Hi Sir,

I have a question related to PPF for NRI.

My sister has a PPF account and now she is staying abroad.

She is visiting India in December this year and after this may not visit India for few more years.

Should I ask her to close the PPF account? Please advise.

Thanks,

Harsh

Dear Harsh,

You can inform her to close. But if the maturity is far away, then let her continue till maturity.

Thank you sir

I will chk and tell her accordingly.

Dear Basavaraj,

Trust you are doing well. I appreciate you running this very informative blog.

I have read about recent notification that the people with NRI status can invest in PPF account until further notice. Could you please confirm on this.

Also I am out of India from last 7 years, so I do not have aadhar card, does this impact my PPF account status at SBI bank?

Do I need to inform them ? Also is there any kind of other document required from NRIs to keep their PPF account active?

I look forward to hearing back from you.

Warm Regards,

Kulbhushan Kaushik

Kulbhushan-Yes, you can continue your PPF up to the maturity period (as per old rule). As you are an NRI, you are exempt from linking Aadhaar to any of financial products. But you have to inform the same.

Thank You Basavaraj for the information. I truly appreciate it.

One more question, is there any document I need to submit as proof that I am an NRI and can it be done over phone/email.

Thank You,

Kulbhushan Kaushik

Kulbhushan-You better prove with valid documents (like visa and all).

What about if I already have a foreign citizenship. I am not an NRI then. I have no PIO nor OCI and I am not interested to have one. Then do I submit a copy of my local passport (Canadian) as proof that I don’t reside in India or aren’t foreigners like me not allowed to continue PPF?

Winston-Regarding process, each bank have their own set of rules. Hence, better to check with your bank.

What is the use of informing the bank in the first place???? You do not get any extra credit informing the bank. They do not give you any extra interest or so on being an NRI? If one shows that he/she is a foreign citizen by producing a non-Indian passport then the banks will create more trouble especially if there are just 2 years left for maturity. Foreign citizens are not allowed to open PPF. This is meant only for Resident Indian. NRI’s are very much Indian as they hold an Indian Passport. PIO/OCI’s are just glorified words without meaning. They are given a lifetime Indian visa and can invest in India and do most things except vote, hold Govt offices.

Please let me know if it is better to be silent on the matter if a person is a foreigner or risk the chances of getting into trouble. Finally, how will the govt ever come to know if a person has become a foreigner? On maturity of my PPF, I can just fly to India (after applying for a visitor visa) collect the amount, convert into USD, via transfer it to m bank in Canada and leave the country. If I had invested something, then I should be able to take it with me to the place I call my home.

Winston-I explained the rules. Rest is left with individuals on how they take or interpret the rules.

1. If govt. has its way, you have to furnish aadhaar in ppf. If u don’t u are NRI and they can make rule to u get even 4% from date u become first time NRI. How the will know start date, they can simply ask u to goto FRRO or some MEA office and get proof of ur date. Now u will have to run to them to get such proofs not them.. So don’t play or underestimate govt. machinery.. If u make excuses than imagine what will happen when they start making same.

2. Why the hell you feel

“”They do not give you any extra interest or so on being an NRI? “”

Are u downtrodden(except ur thoughts) or oppressed that you need more interest. Do you know the interest comes from govt. money which should have been given to needy.. Why morons like you feel NRIs should get something more than residents..

3. If you by chance have Aadhaar and linked that too, your aadhaar might be linked with PAN and your PAN is anyway linked with NRE accounts in case u have. so again its just matter of time such queries vomit all wrong doers.

4. How will one convert INR to $ :). If you use banking channel, govt. will ask source of money even in next 6-10years and will make u come to India for tax evasion with good penalty..

so at end, don’t act smart. Follow rules else your name itself is enough proof for the Financial Intellgence Unit (its a divsion of IT deptt if u dont know but it normally doesn’t deal with small fellows) report to track and act.

Shame on such NRIs who want to get free money meant for nation needy even when they are blessed with sufficient in their new place to live happily. Such greed shows such morons must be harassed to maximum by calling N times to india in cases for their 2 year interest scam and than finally a bailable warrant for tax evasion..

Dear Mr. Basavaraj,

Greetings!!

Me and my spouse have received Canadian PR few days back and will be moving permanently to Canada in July this year. She has a PPF account with a Bank and we wish to close the same. Its been running since many year now but less than 15 years. As per the rules, is she allowed to withdraw all the amount and transfer the same to her savings account. She visited the said Bank and have been told that due to RBI notification she is prohibited to do so. We do not wish to continue the account now. Can you please let me know if this is possible.

Regards,

Anjani

Anjani-You can close the account as a regular PPF. However, you will get 1% less interest rate of what you accumulated. Refer my post “Premature closure of PPF account – New Rules 2016“.

Hi Basu,

I opened a PPF account in 2013 and became NRI in 2014.

I have been depositing the maximum account for the last 2 years.

Seeing all the recent Govt notification, do you suggest to continue investing or should i just meet the minimum required deposit each year from now on?

Kindly suggest!

Thanks,

Arghya

Arghya-As the Government cleared all doubts, you can continue it up to maturity.

Hi Basu, I have maintained my ppf account after maturity even after becoming an NRI and Bank(SBI) did not object to it. It has entered now in second auto renewal of 5 years .They even accepted the contribution from my NRI account as well couple of times. Could you please tell me how the interest be calculated in my case if I close my account today? Will I get 8% and then 4% for the remaining period after maturity? Your answer will definitely help. Thanks

Anil-You will get the regular interest up to the maturity. However, if you discontinue now, then they reduce 1% interest on the last extended period interest rate.

They have been saying that since NRI’s could not continue the PPF account so I would get interest only up to maturity and there will be no interest after that. Is it right interpretation?

Anil-If you renewed when you are NRI, then it is fault and you have to pay the penalty for that by accepting NO INTEREST from the date of that maturity to till your closure.

Hi

Opened PPF account in 1988.Matured in 2003.(15 years)

Became NRI in 1994.

The 5 year extension will be over on 1 st April 2018.

Would like to close the account.

Will I get 7.8% interest up to 3rd October 2017 or 4% from 2003 onwards?

Is one extension of 5 years allowed to NRI ?

Thanks

Rakesh-Extension is not allowed to NRIs. Hence, better you have to close it immediately after maturity.

Hello sir

Your website is very informative and clear. Congratulations.

i have a PPF account since 1978 and became NRI in 1994. I have kept my account open till date contributing sums every year.At that time I was under the impression that even NRI can keep on holding the PPF account. Now with all these thoughtless changes almost every month I want to close the account.

What if I come to India and not telling the bank about my status collect the cheque?It would be no problem even if they want to transfer the amount directly to my bank account as I have a resident account.

Is it ok to do it or should I wait for further “amendments”?

many thanks

Rakesh-Better to close. Because as per the existing rules, you are not allowed to extend after maturity. But not sure what prompted you to extend it.

Confirmation from SBI

https://www.sbi.co.in/portal/web/personal-banking/public-provident-fund-ppf

Omkar-Thanks for sharing 🙂

Hello Sir,

https://economictimes.indiatimes.com/wealth/invest/nris-can-continue-their-ppf-account-now-earlier-it-was-to-close-on-losing-resident-status/articleshow/63079381.cms

So it appears that the notification has given breathing space to those who have not yet closed by hurrying themselves to closure. I had previously pointed in my comments unless we have clarification should not hurry to closure.

Thanks

This seems the best news for our discussion till date..!

Priyank-And the result also turned positive 🙂

Raj-Sad part is that this new notification is silent on those who already closed hurridly.

Looks like a temporary suspension. The intention to not allow NRIs to invest in PPF still remains. The question is – if there is no new development until the first week of April, as an NRI, can I deposit new funds into my PPF account? Should I risk a new deposit given the previous directive of 4% savings rate since the date you become an NRI?

MS-You go ahead and invest.

I agree with MS. This series of unclear notifications will make investors nervous. Oct 3rd came the first unclear notification. In Jan, clarity came on interest rate. It reassured many people that they now can close ppf. Finally, this temporarily suspension. Who knows what will come next. I would not risk my money on ppf anymore.

Since something is already closed cannot be re-instated as funds are distributed to owner of account.

There are multiple questions about reliability of govt orders.

Agreed there are chances of revoking decisions always there hence I wanted to wait than hurry. The 1st notification in itself was very unclear & left so many questions unanswered.

The problem with system is lack of unity, had all united and raised concern may be decision would have been much earlier and saved those who had closed.

But again there is hanging sword of uncertainty.

Thanks

Raj-Completely agree 🙂

This is really a great news ! At last good sense has prevailed !! Hope they will come out with something sensible soon

issue is nris cant’ close from abroad immediately. It has to conincide with their travel plan mostly. Even when I was physically in SBI Delhi, that govt. servant even she was having printer/copier just behind her asked me to get copy of this or that page of passport when I submitted main page and my alien card.. And told copier is just outside and when i went outside it was two blocks away and by time i was back office was closed.

Next day for some policy of mutual fund, anotehr young employee was using same printer on back to copy something for some new investor..

So it takes time to even close when u are there. But now those NRIs who closed it, they lost money as now they can’t put back the same in PPF and they can not open PPF account as well..

This is pathetic.

Hi, my name is rajeshthalkar and I want to know about scheme of savings in india for nri people. Pls guide me whether money should be in indian currency or foreign currency

Rajesh-There are many schemes. But before that set your financial goals.

As per the earlier rules, NIRs were permitted to continue their PPF accounts. When a person before becoming NRI opened the PPF account, the rules prevailent at that time did not contain such clause that the interest can be reduced with retrospective effect. Hence the new rules are clearly a breach of contract. Affected persons should join together and challenge the new rules. The BJP has lost morality.

Ashalata-It is now hard to change the rule even if you join together also.

We can file a Writ Petition challenging the arbitrary amendment with retrospective effect, violating article 14 of the Constitution. The NRIs are required to unite and fight back the unjust amendment.

its already put on hold. its not retrospective even when not on hold. its from Oct3. I closed in SBI and they gave full interest till Oct3, 2017

I agree but the post office they are calculating interest from date of becoming NRI not 3rd October

Mario-It is wrong.

We understand this is wrong and absolutely rubbish. The fact is Post offices are refusing to apply PF interest rate up to 03 October. They say they have instructions in writing that savings bank interest is to be paid from retrospective effect. Who ever is issuing such directions against the government clarification dated 08th January should be thrown out of job. We have sadistic rogues everywhere.

Jabir-Let them show that WRITTEN INSTRUCTIONS or give the same in WRITTEN LETTER.

I am trying to get their internal circular, which they are quoting to deprive the correct payments. Hopefully I will get the same today and will forward to you.

Jabirvtareen-Surely.

I am trying to get the same Mr. Basvaraj. Hopefully I will have that Postal departments internal circular by evening today, and I will forwar

the same to you for putting it on your portal.

Jabir-You can email me otherwise at [email protected]. I will share the same in this post.

I mailed the circular to you 4 days back, but the same has not been published by you. Would you like to do it now for every ones information.

Jabir-I was not published it because Govt of India clarification holds higher than the Postal self-interpretation.

I spoke to postal authorities. They say 08th Jan clarification is not from Govt. of India but the National savings Institute, under govt. of India and therefore not enforceable. How frustrating can this be. how can you correct an attitudinal problem amongst decision makers.

Jabir-I can understand your frustration and their ILLOGICAL behaviour.

But boss what is the way out. Do we need to take to a legal recourse. I have also tweeted to Finance minister of India, but will he have the time to look at his own inefficiencies and wretched attitude of his own babus. If legal recourse is the only way out, I then request all effected NRIs to come together and engage a legal guy to file a petition on behalf of all NRIs. I wonder if some one can take this responsibility through well wishers living at Delhi. All can contribute to the legal expenses and lawyer’s fee.

I spoke to the Joint director in Ministry of finance today, and he confirmed that the earlier notification of 03 October has been withdrawn and a new notification is under issue. This I hope is true and very soon we should hear it.

Regards,

Jabir

Jabir-I already shared the latest notification in this regard. Please refer the first image of the post.

Thanks boss, saw the latest notification and relieved to a great extent. Hope it will not get revoked as it is only holding the old notification in abeyance. Anything is possible with this government.

Jabir-But sad part is that this notification is SILENT on those who closed the account post that 2017 notification.

Sir, please give us an update on the possibility of the PPF notification being reversed. You had indicated last month that Ministry of Finance was considering taking back the notification which adversely impacts so many NRIs of their PPF/NSC savings for their retirements. Thank you.

Hi Sarita, It looks like the Govt does not wish to address the grievances of NRI’s. This is all vote bank politics. Are NRI’s not Indian citizens???? This is a way of a gift to show how much the Govt loves us. This is a slap in our face and a way of punishment from the Govt for remitting funds to India and helping India with the foreign exchange inflow. Secondly, lets us please speak in terms of thousands and millions (not Lakhs) as some people (especially NRI’s) are not familiar with this term. Thousands and million are used in every corner of the globe, so it is a universal language. I too need a calculator to do the conversion.

Finally, it was mentioned by someone that the PPF will close automatically if you become an NRI so I wonder how the bank will come to know. They have no record of our residence status. If they close the account, it seems that the millions will be lost forever as we are not physically in India. So they can do nothing in our absence. What if I have no account in India???? They have to transfer the amount to my foreign account.

Sarita-As of now, there is no such reversal.

I am told to understand the proposal to reverse the 3oct notifications is still making rounds in finance ministry and is likely to be approved by end of this month. Let’s keep our fingers crossed and wait.

Jabirvtareen-Let us wait then 🙂

If the government is considering to take back this notification then what will happen to people like me and others who have already closed their PPF accounts after the notification came into force ?

That make me to expedite close PPF.

The interest is going down and it does not make much sense to continue PPF-there are plenty of lucrative alternative to park same money for better returns :):)

The Government cares 2 hoots for us. They will simply say that you should have waited.It will be your fault.

Some people have already closed their accounts and got correct amount as per Jan 8th notification (i.e., PPF interest rate will be paid up to Oct 3rd, 2017).

If such reversal notification comes, will it allow people to reopen the PPF accounts even if they are NRIs? Does not make sense to me.

AJ-I think Govt will not reserve it.

On its official twitter account, SBI on Feb 4 has posted a video that explains how PPF accounts will be closed in case of NRIs. This is helpful. Clears the point about the rate of interest until October 3, 2017. In other words, NRI PPF holders will get the PPF interest until this date.

Here is the link. https://twitter.com/TheOfficialSBI/status/960143843004993536

If the link doesn’t work, go to the twitter account and check for Feb 4. Thanks, Sarita

The problem is not the banks, but the post offices. Because of one wrong circular, issued by the ministry, contradictory to the government of India, Ministry of Finance letter dated 08 January 2018, post offices are refusing to credit PPF rate of interest until 03 October 2017. This has to change, but when and how only God knows. Hope good sense will prevail on the so called bureaucrats in communication ministry/ finance ministry, and they stop harassing the NRIs. I will be happy to join any group which wants to go the legal way of issuing a legal notice to the Postal department.

Sarita-I am of the same view since the day one of this notification.

The question is how will SBI know that you are an NRI customer. I think this is only for SBI NRI customers. If you have an NRE account in any other branch, they will never know. I have spoken to the SBI branch and asked them if they knew whether I had any other account. They said that I have a local account in another SBI branch. So my friends, don’t shoot your self in the foot by closing the PPF account right away. If you wish to move your money abroad, then it is okay. Secondly, this rule is to create panic among people and make them close their accounts. Secondly, I have spoken to NRI’s in my home country here, none of them knew about this rule till I told them. So, how can the Govt implement this rule without planning? What if the person needs to transfer this amount abroad immediately.

Sir, just saw your latest post saying that the October 3rd notification has been put in abeyance. Is this is decision that Mr Jabir Tareen said was under consideration in the ministry of finance? Can NRIs rest easy now with regard to their PPF accounts? What wonderful news! This update has not yet been covered by the media. Thanks, Sarita

Sarita-Yes, it may be the news which Mr.Jabir shared with us. Now, those NRIs who have PPF account can continue up to maturity. The last year rule will not be applicable now after this latest notification.

Hope you are happy now Sarita. The 3rd october notification has gone into hibernation now with this new notification dated 23 Feb 18

Yes, Sir, I sure am happy! I really appreciate the way you followed up with the Ministry of Finance as well. You kept our hopes high! Unfortunately the new notification is silent about NSCs. The other thing that concerns people like me who became NRIs during one of the block years— much after the 15 year maturity. I became an NRI in 2016, a year after my second 5 year extension began! Somehow the PPF rules don’t address folks like me who become NRIs during the extension phase. For us, the PPF is our main retirement corpus. NRIs are not supposed to extend but what about those who become NRIs during the extensions! Can happen to some!

Sarita-They are not allowed for one more extension once they turn NRIs.

A lot of views on banks. What about PPF with post offices. They are talking only of retrospective effect not 3rd Oct 17.

I understand there is a government grievance cell. Could the link of the department of posts be shared for airing such grievance.

Regards Mario

Mario-The notification and clarification by Govt apply to Post Office also.

this is pure common sense Mr. Basvaraj, but the same is missing in our postal department authorities. Why in the world did they issue a internal circular, contradicting finance Ministry Circular of 08th January 2018. Is it a mischief, or ignorance. either way the responsible person should be held answerable.

Jabir-It is their stubborn 1942 ATTITUDE.

what is the solution you think, all I can think of is a legal way. Is there a way we can reach out to the finance minister on his tweeter account

Jabir-Try your luck with Twitter.

Mr. Basvaraj, any idea if the new PPF policy changes, which the government is making

in accordance with the announcements during 2018-19 budget presentation, would address NRI related problems also?

Jabir-As of now, there are no changes in regard to this notification.

Basavaraj Ji

I opened a PPF account in 1999, became NRI in 2002. Maturity was in 2014 but extended that to 2019. How will my interest be calculated.

Shelly-Up to 3rd October 2017, you will receive the regular interest. From that notification date to till your closure of the account, you will receive 4% returns.

My observation on Mr.Shelly’s case is as under:

the 15 year maturity is over depending on the account was opened before 31 March 1999 or after this date during the year 1999.Assuming it was opened before march 1999,the 15 year maturity period is over on March 2014.The maturity amount as on March 2014 will be considered for PPF interest upto 3rd October 2017.

Regarding the contribution made made between April 2014 till date is likely to be dealt as under in

accordance with the Ministry of Finance letter F.No.3/4/2012-NS-II dated 16.7.2012

Non-resident Indians are not eligible to extend/continue after maturity period,therefore any subscription made by the depositor is irregular and not entitled for interest. Amount deposited after maturity shall be refunded to the account holder with out interest. (This clarification is available in the PPF rule under para Non Resident Indians)

Sh.Basavaraj may kindly comment on this.

Thiruvengadam

Thiruvengadam-Those who turning NRI and extended the PPF without bothering the eligibility are liable to pay penalty by accepting the invested amount without interest. That is true of what you pointed.

But how wIll the Government know if you do not tell them. I am still not clear on that point.

your blog is very much helpful in dealing with closing of ppf account of a nri

Raj-Pleasure 🙂

Hello,

I have been living oversees for last 10 years. My PPF will mature in April 2020. Bank does not know that I live overseas. I have a few questions about this. Could you please help?

1] If I can’t visit India until December 2020, what happens to the account? Will it be automatically renewed? If not, can the account be closed online now?

2] If at the maturity, I do not inform the bank that I am a NRI, how would they know? Will they transfer the money to my NRO account without knowing that it is a NRO account?

3] Is it possible to then transfer the money from NRO to NRE & then to my local bank account overseas?

Thanks.

Omkar-1) Legally speaking you must not continue the account after 3rd October 2017. If you are ready to take the risk, then you can continue even after maturity as it will auto-renewed for the block of 5 years (considering without contribution PPF). However, NRIs will not be allowed to continue PPF as per new rule.

2) If while transferring the money they came to know that your holding NRO account, then you will earn only 4% return from 3rd Oct 2017 to till maturity.

3) It can be but first set your PPF right as per the rules. Playing with Govt rules as they can’t identify your NRI status may harm you more than them.

Thanks for the reply Basavaraj.

1] I do not wish to do anything illegal. However I do not see any other way to close the account from overseas. Are you aware of anything? If there is any way of closing the account today, I will do it right now.

2] Could you please explain the usual procedure banks follow when the PPF is matured? How would they know if the account to which the money is to be transferred is Savings account or NRO?

Thanks.

To my understanding and based on my experience so far,

1. PPF A/c can be closed sending them application (and some bank specific form, like Form C etc) through courier. Every bank entertain phone calls and Courier works from across the globe. In my exp. I talked to the people concern in bank, they helped albeit with initial bureaucratic hurdles.

2. Banks do ask for the account details to transfer the matured (pre-mature in this case) amounts.

But that still involves expenses from ourside.Sending courier is not cheap. Making international phone calls is not cheap. That too for no fault of us. Will the bank deposit the in the NRE account. I don’t think so. Secondly, how would the millions of NRE’s who have ongoing Ppf know of this rule. Does the bank send individual emails to every NRE. I did not get any from the bank. The Government is playing with our money that’s all.

Winston-I can understand your frustration.

Mr. Basavaraj, Is there any announcement about PPF in the budget speech of the Finance Minister?

Winston-Sadly NO!

Akhil-Nowadays many ways to do. But it depends on how you think about the ways. Thanks for sharing your experience. As the maturity amount will not be handed over to invested person in the form of DD or Cheque (like earlier cases), it is hard for anyone to hide their residential status.

Akhil= How can a residential address not be hidden?? I don’t get it. If it is by direct deposit then you can give your local bank account details.That will have your local residential address in India

Omkar-I think Akhil’s reply is the best one to choose. Better first interact with Bank.

I had a phone conversation with another bank in India (not SBI) as the branch manager is my friend. He told me that my NRE account is not linked to any Aadhar number. The SBI too don’t even have a clue that I have an NRE in another bank. So, on maturity, the best thing I can do is visit the branch (where I have the PPF), collect the DD and deposit it to my NRO account. Then transfer it to my NRE account. The rules in India change at a drop of a hat and why should we suffer in the end. We are depositing our honest, hard-earned money. One good thing is that I have not remitted any money to India in a very very long time, so the Government is clueless as to my whereabouts. People who have remitted money to India may face a problem as the RBI might track the money. So why shoot a person in the leg, to lose money?? As I have mentioned before, there is no reason why you have to tell the bank anything. Even if you tell the bank, you are the looser. Imaging the courier cost, telephone bills and unsurmountable headaches. The bank phone numbers hardly work and just giving a letter and filing up a form will never work with banks in India particularly SBI. They are the worst bunch of people.

Have u given pan no. In same. Have u claimed ppf rebate for ur pan no? In gew years when systems in place with big data to get such data is just one query.

Hi Omkar, I and you are in the same boat. My ppf will mature in 2026. I live in Canada. How does the Government of India expect me to close my pod at a drop of a hat without y physical presence????? I will come to India for a vacation after 5 years or so. So the Government of India does not know your NRI status and don’t tell them anything as it will harm only you and not them. They will gain from the interest you have earned.

If they ask you why you did not declare. I will just say that I am not supposed to know the rules as no intimation was ever sent to me by email.

When it matures, they will give you a Demand Draft. You can just deposit it in your NRO account.

Winston-Do you think at maturity they issue you the DD?? 🙂

Basavaraj ji, one ques:- Can NRI keep their PPF account with reduced interest rate without withdrawing the amount for short period like 2-3 years. And after permanently return to India , Can he restart the same PPF account with higher interest rates? Pls clarify ?

Prashant-May be YES. But do you feel it is best strategy and also notification clearly states that you must close the account? If NRI returns back and his residential status again changed to resident Indian, then he can again open a fresh account right?

Basavaraj Ji- Thank for instant reply, because Sir , I am planning to return back to India in next year , if I closed the account now, I have to start from bottom again.

Can you ensure that we can hold existing PPF account at reduced interest rates & resumed back ??

Thanks again

Prashant-In that case you can hold it but you have to satisfy with 4% return up to return.

No Problem Sir, but after returning, will bank convert it to normal PPF account with higher interest rates?? Is there any problem?

Prashant-There is no clarity in this front. In my view, they will pay the interest as per the above notification period to your residential status change.

Dear sir,

Can you please put out the full notification above showing which office has issued the same, and addressed to whom.

Jabir-I replied to your email.

Can you please send us the copy of the circulars from SBI and RBI as mentiond in your mail.

You can send it to my personal email: [email protected]

Rajesh-Whatever I have received, I shared the same in above post. You can refer the same.

Thanks Mr. Basavaraj for not only opening this blog but also helping all of us to discuss and share our experiences. This blog has also helped us to clear many of our doubts relating to the circulars

Thanks once again

Sankar-Pleasure 🙂

The notification screenshot was from the computer screen of a PNB Manager. Since it is an internal memo, the actual memo cannot be shared, hence the screenshot with all the details, memo number and date.

Thanks for sharing the circular copy of PNB. It refers to a clarification from finance ministry dates 8 Jan 2018 upon which ONB have issued their internal circular.

Does anyone know where and how a copy of this clarification from ministry of finance can be got hold of?

I believe we will need it in case SBI continue to frustrate the account holders in their Herculean way of managing it’s business.

Damodar-The best option is to file an RTI to Ministry of Finance.

I just cannot understand this. Someone mentioned about a possibility that the Govt will reverse its decision on the NRI notification. Now, I just cannot understand how an NRI can close his deposit without being physically present. What if he does not have anyone to do his job. Can’t the NRI just send the forms to the SBI branch and the Branch should just close the PPF account and transfer the proceeds to his/her NRE account? Just suppose I will come to India after 3 -5 years on a holiday. What happens then??I will get 4% interest for no fault of mine and only because of this silly notification. The SBI cannot give me the money, so who is the loser???? Only me. Secondly, how will I have come to know about this notification (if I was not part of this group)? The SBI never sent me an e-mail in this regard.

Wnston-Sad but hard facts you have to face by banking with such banks.

Hi,

Am able to close PPF Account and they have calculated the Interest as per the PPF till 03-Oct-2017 and Credit the net amount.

Following documents submitted:

1. FORM-C(PPF Closure)

2. PPF & linked Savings Account Passbook

3. Request Letter

Branch: SBI Chitradurga, Karnataka

They took a over month to process and but the Manager good enough in communicating his difficulties.

Thanks a lot Mr.Basavaraj for sharing the SBI eCircular and helping the needy one with the quality,timely & reliable advises..

For any financial related queries/doubt first thing I do is search in ur blog before “GOOGLE”.

Am following your Mutual Fund advise since 1 year and looking forward for your Pay Basis ‘Personal Financial Advise’ once it is official launched …

Regards,

Basavanagowda

Basavanagowda-Great to know this and thanks for your kind words.

Hi,

Can you please advise,

Is it right time invest the Lump sum amount(5 Lacs) in Mutual Fund for 12-15 Years..

or Any better options for Children Higher Education fund

Regards,

BG

Basavanagowda-If you did the proper asset allocation between debt and equity and also your time horizon is long term, then you can invest NOW also.

Thanks BG,

Appreciate if you can clear following doubt :

The screenshot of SBI eCircular (posted above, Page2) clearly indicates that period between turning NRI (1.1.2015 in the example) to 03.10.2017 will be paid as Post Office Interest (H-D).

How did they pay full interest (PPF interets) till 03.10.2017?

Appreciate if others too can enlighten me.

Thanks and much appreciate sharing your experience.

Akhil

Hi,

My case was bit different, the PPF account was in my Wife Name and as per the resident status, and she became NRI in this current Financial Year …. I have furnished details of details of her stay in India… have not calculated the Interest minutely just verified that Interest Paid was more than Interested credited on 31-Mar-2017 (For Last FY)..

Sir as per circular 3-10-17 on ppf , can an NRI close account prematurely , before 15years, say in 12th year ,after becoming NRI after Oct 2017 without penalty to get better returns elsewhere?

RP-YES.

I do not think it is clear from the screenshot. What happens if “I” is negative?

If ‘I’ is negative, they will deduct from principal, IMO.

AJ-That bank has to decide again as per their definition.

How can the same bank apply different rules for different people, leave alone the ambiguity that has been thrust on us with this notification. Effectively we are at the individual mercy of the officials in the branches that we operate our accounts and pray that lady luck will smile on us. This defies all financial investment logic and they are playing with our hard earned money

Sankar-Definitely they are playing by interpreting the notification as per their wish.

That’s so true. You have hit the nail on the head. Not just banks but even post offices are the same. A couple of years back the post master refused to give me my money on maturity as I had transferred the certificate from one post office to another and it was done manually at that time. The excuse was that it is done electronically now.

Basavanagowda – Was bank looking for any NRI proof? If yes, what was an acceptable proof? I have an NRO account opened with SBI itself. Will it be an acceptable proof?

Also, without knowing the actual amount how are you filling-up your FORM-C(PPF Closure)?

Reshma-Holding your NRO account is a valid proof.

Reshma- How about not disclosing to the bank that you are an NRI. In India being an NRI has little advantages except on taxation. PPF has no ta attached to it, so just remain quite and don’t disclose to the bank. I have learnt it a really hard way.

Winston-As of now MAY BE easy. But what if Govt started a system to track?

Dear Basavraj, Thanks for your mail. I know that it may be easy now. but what about the comments made by some of our fellow readers who are having problems. Some say that the bank manager is not ready to listen. As per the notification, it is said that a person must close his/her PPF the day he/she becomes an NRI. It does not talk about implementation at all. Thus some managers take it that way. It does not matter if you became NRI in 2007 or 2017. It really does not matter to the bank. That the bank and the Govt of India care less about us is another matter. So what option does the person have other than losing all the interest earned over all the years. They did not allow us to close PPF at that time, now they are penalizing us for keeping the PPF. That is the irony. The best is not to disclose to the bank that you are an NRI. I should not be telling this in a forum like this but deep down in my heart I feel that there is no way out. The Govt will not come to know at all. If you have an NRI account in India, them put the Aadhar number of your wife (who may be an NRI). If possible remove your name from the NRI account. There is no other way out. Even if a person has to break his PPF, how can he do it when he lives 10,000 miles away from India. What if he has no relatives or friends he can trust. So there is no option. If there is any other option, then I would like to know.

Winston-Someone emailed me that SBI Bank received a notification stating the effective date of this change will be from the notification date but not from the date when you turned NRI.

If this is the case it is really good news. I was about to close the a/c and withdraw money with whatever interest rate SBI offering but refrained at last moment, instead decided to wait for clarification.

Rajesh-I suggest all to wait for some time as long as we get the clarity.

What an irony…..after investing our money as per the laws of the land we are now unsure if the same laws will stand by us and guarantee the returns.

Sankar-Sad but true.

That indeed is a good news!!!!

More appreciation if we can get any back up to this new notification.

Thanks Basavaraj for your support!!

Akhil-Pleasure 🙂

Thank you dear.Please let everyone know as soon as you get the copy of clarification notice.

Hi Rashmi,

I have submitted the Passsport Copy, Overseas Resident Card & VISA Page on Passport and details of our stay in India for the past 6 Years(i.e. Derived based on the Immigration stamping)

Discussed with the Manager and left the Amount field blank and he said he will fill it up..

Seems to be my branch manager was co-operative, helpful & flexible, he was saying sorry for the delay caused by his side in closing the PPF

Regards,

Basavanagowda

Thanks.

SBI has issued a eCircular dated 11th January 2018. It is clarified therein as under :

‘IT IS CLARIFIED THAT AMENDED RULES TAKE EFFECT FROM THE DATE OF ISSUE OF NOTIFICATION, I.E., 03.10.2017. PPF ACCOUNTS OF NRI SHALL BE DEEMED CLOSED FROM THIS DATE AND REDUCED INTEREST RATE, I.E., 4% PER ANNUM SHALL BE APPLICABLE FROM THE DATE OF EFFECT. SUCH ACCOUNTS WHICH ARE DEEMED CLOSED SHOULD BE FINALLY CLOSED ON THE REQUEST OF THE ACCOUNT HOLDER AND INTEREST MAY BE CALCULATED AND PAID ACCORDINGLY”

Alex-Please share the notification so that all of us get clarity.

This is indeed some light at the end of the tunnel. As also mentioned by Mr. Basavaraj, please share the copy of the internal notification and it will help all of us in this forum. Except for the fact that the account will now attract only a meager 4% i will not have to worry about it anymore and will be at least assured of regular returns till 03.10.2017

This is to inform all my NRI friends that Government of India, Ministry of Finance, office of Director National Savings institute New Delhi vide their Letter No.5/23-1/2017/35 dated 08/01/2018, have clarified that the interest as per PPF rates is payable upto 03 Oct 2017, and SB rate thereafter. This has been further clarified by SBI circular dated 11 Jan 2018, bearing reference No. GAD/MDS/33/2017-18. Please approach your post office/ bank and close your account if you so desire. However, I would wait for a month or two more as the Government is considering withdrawal of the gazette notification dated 03rd October 2017, and maintaining the status quo as before. This is under process as confirmed by a reliable source in the Ministry.

Wg Cdr JAK Tareen

Jabir-This is what I am saying since the beginning. Thanks for sharing.

Please let us all knows when the ministry withdraws the notification. That will be great news for all of us.

Winston-They have not withdrawn the said circular, but they clarified of what I was saying since day one.

Thanks Dear Basavraj.

Dear Mr Wg Cdr JAK Tareen, Thanks for the information about the circulars.

Please send the link to download these two circulars.

Based on your post ,I am considering to hold my PPF accounts for few months.

I have the SBI circular with me but I am unable to paste it on this thread. Can somebody guide me on how to do it.

Regards

Mr. Basavaraj, request you to please assist for the benefit of all members. This will be a valid proof to take to our bankers and get what is rightfully due to us

Thanks in advance

Sankar-I searched for the same notification. But said the PDF file uploaded was not clear. Hence, stayed away. But I am sure that within few days the doubts will be cleared.

Jabir-You just send me ([email protected]). I will upload the image format.

Sir, I humbly request you to send the the copies of the circular as attachment to my email Id [email protected]. In the absence of the actual copies they are not ready to accept our plea.regards.

Rajesh-I received the above notification in the image format, which I shared with you all.

Sir,

As per the sub-para 2 of para-2 of above Notification, the provisions of the substituted Proviso, is applicable wef the date of its publication in the Gazett. Contrary to this view, the State Bank of India is intending to apply this Proviso from the date of becoming NRI, which may even be earlier to the date of Notification (03-10-2017). The SBI is considering cut off date as early as of 2001.

Say, if one has become NRI on 1st April 2005, than in view of the Bank his PPF a/c would be treated as closed on 01-04-2005 and from this date interest of Saving Account, viz., 3.5 to 4% would only be allowed.

It is, therefore, requested to kindly guide me, so that SBI closes my PPF a/c from prospective date i.e. from the date of Notification (03-10-2017) or from the date of its publication in Gazett (30-10-2017) and not from retrospective date.

An early response is solicited.

Thanking you.

Narendra

Narendra-How can they interpret in wrong way when it is clearly mentioned in the notification? Also, how can Government bring in the harsh rule that this notification applies effective from the date of one turned to NRI? It is completely wrong. As per me, the rule will be effective from the date of notification.

I have PPF account since 2006, effectively became NRI in 2007. I have been contributing to PPF account for these years but now SBI says that they will give only 4% interest rate since 2007. I tried to argue but they are not ready to listen. Feeling really helpless as don’t know what to do.

But if interpretation as done by SBI is correct then this is clear fraud from GoI, how can they frame a rule with retrospective effect for individuals.

Rajesh-Sadly all banks understanding it differently.

It should never be back dated. If notification had come earlier people would have closed the account at that time.

If its implemented in back date then if someones account matured and who had withdrawn money can also be asked to refund excess interest paid. Some of these SBI staffs are crazy, don’t have common sense. May be you get it transferred to some other branch which interprets it correctly and then close.

I had sen this to Finance Ministry and NITI Aayog.Some action hopefully would be taken.NRIs forum should pursue this.

“I have a couple of suggestions on the above-

To avoid confusion,it should be clarified to all that the reduced interest would apply from October 3,2017 or the date the individual’s status has changed to NRI whichever is later and

In the absence of consequent directions from RBI and Department of posts to Banks and post offices, the latter are refusing to implement the scheme ie close the NRI accounts.This will open up the possibility of people going to consumer courts etc to claim loss of opportunity cost .NRIs could have closed the accounts and invested elsewhere for higher returns?”

Krish-Let us wait for clarity.

Agree with you, is there a thread or way to post to Fin Min or RBI ?? lot of grey areas in notification

I have written to the General manager and Nodal Offer NRI division of SBI Mumbai division to clarify this issue but so far they have not replied.

I request all the forum members of this thread to flood them with the query -letters. Possibly they may wake up in that case.

What about the case of a person who holds OCI (Overseas Citizen of India) and is currently resident in India for past 14-15 years continuously? Will this person be still treated as NRI (Non Resident Indian) for PPF Purposes? What type of account this person can hold – Ordinary SB / NRO / NRE or is it mandatory to have NRO/NRE account?

Prakash-OCIs residing in India are considered as resident Indians. Hence, they can enjoy the PPF as usual.

I still have doubt. OCI are not Indians.. Even if they reside here all life, I feel they won’t be Indian as per rules..

Do we see anywhere any rule that says OCI residing in India are Indians? I am not able to find anything..

So i somehow feel its risky to take create a PPF or Sukanya account for OCI kids even if they are living in India for long..

I wish there is some clarity on such rules but unable to find that.

Krishna-But OCIs residing in India are not considered as NRIs but residents. Hence, based on that they can invest.

I think oci r not indian and all schmees say resident indian..indian i feel is one who has indian citizenship. Its our thoughts only and i dont see anywhere official site saying or denying it.

Yes Krishna you are quite. Having an OCI (or any other thing like PIO) is just a visa, just as some countries issue Permanent Residency (PR). Having an OCI/PIO allows you an unlimited travel without applying for a visa. You cannot vote like an Indian citizen. Technically you are a foreigner. If the Indian Govt was really serious they would have issued a dual passport or citizenship scheme but they want to issue all these useless things like PIO/OCI etc. All the clauses that state that if a person resides for more than 180 days in a year, he becomes a resident. Just suppose, I am a foreigner and have over stayed my visa and am in India for 200 days or so, do I become a resident???? NO. Many people wanted an official notification regarding the PPF amendment. Here is the link.

http://corporatelawreporter.com/2017/10/13/public-provident-fund-amendment-scheme-2017-notified/?s=Public%20provident

The person responsible for this notification is Prashant Goyal. The details are in these 2 links.

http://dea.gov.in/divisionbranch/telephone-directory

http://www.dea.gov.in/whos-who?field_whos_who_category_tid=All&title=&field_email_feedback_email=&page=3

Winston-Your points are valid. But when it comes to resident Indian, there is no clarity that OCIs MUST NOT be considered.

Krishna-You are right. But when it comes to definition of resident Indian, then it never states that way.

Thank you Basavaraj & everyone else for the clarities. The reason for confusions which exist are: No where in rules they define a category called OCI – Residing in India for X period of time will be called a resident Indian. The moment this clause is defined the confusion will go away.

Prakash-I shared what it is currently. Let us hope for clarity.

Hi,

I have successfully closed my PPF account using this amendment to rules.

5 year old PPF account.

Vijay Congrats,

Please help us :-

1. Did they pay PPF interest till 03-Oct-2017?

2. Which bank ?

3. Normally bank people are aloof on this, please share/guide your experience on how to deal with ignorant/unwilling bankers?

Thanks

Yes, interest was payed till 3rd October.

Account was held with SBI.

Even my bankers were aloof. It took me weeks of persuasion, reasoning and escalation to make them see the light.

BUT, I am a PR holder and a potential non returning citizen. That was the case I made.

Let me know if you have any further specific questions

Thanks

Thanks !!!!

What SBI branch? Kindly specify. It will help when we approach SBI. Do you know if this branch had received any notification from the head office on how to proceed with your request for ppf closure? Most SBI branches have no idea. Thanks, Sarita

Hi Vijay,

1. Can you please share the Branch Details so that we can give reference to my banker.

2. Do they received any notification from RBI or SBI Head office ?

Regards,

BG

Vijay-Great to know 🙂

I had a similar experience as Vijay’s. I am hoping that banks will get more clarity as they will process more cases.

I have one question

A) I am Resident Indian but my daughter aged 7years is OCI and USA citizen.

B) I have a PPF account in which I invest 1.5Lac each year.

Now can i open a new PPF account in name of my daugter and invest another 1.5Lac so total of 3lac in a year.

Is this possible?

thnaks

Krishna-The combined limit for an individual (in your case) is Rs.1.5 lakh a year.

1) is not clear. Is resident India OCI (USA citizen) can open PPF account once they reach 18yrs?

krishna-OCI holders who are living in India are considered to be residents in India. Hence, they can open a PPF account.

Thanks for starting this blog. I have three questions.

1. If a person has become NRI before Oct 3rd 2017 (PPF rule amendment date), then his/her rate of interest should be lowered with effect from Oct 3rd 2017. But, if the bank insists that they will reduce the interest with effect from the date he/she became NRI then what should be done? The rule amendment is not very clear.

2. Is there any last date for actual closure of PPF account by an NRI or can it be continued till maturity with reduced interest rate without actually closing the PPF account?

3. Is it mandatory to open NRO account and deposit the amount received from PPF after closure or can it be directly gifted to parents in their resident account?

AJ-1) The notification is clear that this rule will be effective from 3rd October 2017. So they can’t deny in this way.

my sbi bank manager refuses to listen stating the legal team says the law is applicable retrospectively….what to do in this case?

Vishal-You have to wait until they receive notification.

Hi Basavaraj – the notification above states quite clearly that the lower interest rate will apply from the date the account holder becomes a NRI. So your reply to AJ that tas per notification the lower interest is applicable only from 3rd Oct is confusing. When I discussed with my SVI branch manager he has taken a few days time to raise a ticket internaly anf get clariication. So overall, this still continues to be a greay area?

Bhasker

Bhasker-Please cross-check the notification. It is clear about the effective date of interest rate application.

Basavaraj- maybe I am misinterpreting the notificication : “Provided that if a resident who opened an account under this scheme, subsequently becomes a non Resident during the currency of the maturity period, the account shall be deemed to be closed with effect from the day he becomes a non-resident and interest with effect from that date shall be paid at the rate applicable to the Post Office Saving Account up to the last day of the month preceding the month in which the account is actually closed“.

Is’nt the with effect from that date in the above referring to the date the account holder becomes a NRI? The SBI bank manager that I am dealling with is quite adamant about it

Bhasker-What you shared is applicable to all those resident Indians who turn NRIs post this notification. But for those who are already NRIs and continued their PPF, for them the effective date will be notification date.

Can the PPF amount be withdrawn fully (premature closure) if I want to buy a house in India? I am an Indian citizen and stay in India.

There seems to be some rules amended recently.

Bhavin-Refer my recent post “Premature closure of PPF account – New Rules 2016“.

Hi Basavaraj ,

I am NRI and I am investing PPF every year and i have invested in PPF for this year also for tax savings.

But after my investments , now for NRI’s PPF and NSC are closed from date became NRI.

This means I cannot claim for 80C for this year.

Also what happens to claims i have produced on PPF for last year for tax benifits?

Thanks & Regards

Mallik

Mallik-Please refer the above post and below notification, your PPF account not closed. But will earn savings account interest rate effective from the date of notification.

Thanks BasavaRaj.

But whether I am eligible to show this under 80C for NRI

Regards

Mallik

Mallik-As of now YES.

ok Thanks BasavaRaj

Regards

Mallik

Basava Raj,

You are doing an excellent task. Now , seek some more clarification. It will be great if you can respond. I am a NRI since last 2 years and have been running the PPF account. I need your help on below:

1. Do you have any copy of govt regulation of amendment on this? I have only the media article and not govt notification.

2. As per logic and as per your response, the 4% rate can be applied only from date of notification or date of conversion of status to NRI whichever is later. Am I right? I believe the bank or government cannot apply the lower rate of interest for period earlier to notification which in my case is 2 year since I have a NRI status with the bank for almost 2 years.

3. Will the bank charge me any penalty on pre mature closure since I am closing on account of new regulation and not at my dscretion. As per PPF law, if there is a premature closure, the bank will charge a penalty of 1% for entire PPF tenure.

Keshav-1) Please search for the same (as many did and refer below comments, I think someone shared the link also).

2) Your understand is correct.

3) That rule of 1% penalty does not apply here.

Dear all, Thank you for the comments every one has posted online. The main question is how will the Govt of India know you are an NRI. I have left India 6 years ago. I have a PPF account opened in 2010. I have been regularly depositing INR 150,000/- (One Hundred and fifty thousand) every year without any problems through the Internet banking mode. I don’t have any NRE account nor have I sent any funds to India by way of remittance. So how will the Govt of India ever know about a persons NRI status. Passport is not linked to Aadhar. I have around 8 years remaining in PPF, I will come to India only after 8 years (to claim the PPF). I have just 1 local bank account in India (from which I send or fund the PPF money). The PPF is in SBI and I have absolutely no other account in that bank for them to even know that I am an NRI. Secondly, the bank (in this case SBI) never ever informed me that such a rule is in existence (about the PPF for NRI’s). Being thousands of miles away, I am not expected to know about all the changes that happen (especially if no one informs). I am busy with my own work and I am not bothered about the rules that keep changing from time to time. Finally, even if I wish to break the PPF, there is no way without me being physically present. Even if I send the papers by mail, someone has to deposit the DD in the account. I have no relative in India so that is out of question. When the PPF matures, then I will open an new NRO and NRE account, deposit the PPF amount in the NRO account and then to the NRE account. I will then take the money out of India.

Winston-Govt may not AT PRESENT not have a system to track your status. But it does not mean we throw all rules and do other things. One day or other day if Govt track your status by any means (which they will do soon), then it is YOU who will be under loss. Breaking rules is a PROUD moment for us. But why not stick to rules? Having normal savings account after your residential status change to NRI itself is a biggest mistake for you.

Think seriously at the end it is your money. I am not giving you serious suggestion. But at the end it is YOU who has to suffer.

Then what options do I have. The bank will not close my pod without my presence. I have no relatives/family/friends in in India.I will visit India after 4 years because I have to complete my residency requirements here. When I left India, I couldn’t open an NRE account as I didn’t have an overseas address when I left India and the manager was very strict in th I regard. I tried to close my pod 2 years ago but Sbi did not allow me to. I am sure that 80%of NRI’s may be facing a quagmire of problems.so what can I do now. How can I be in problems. The next time I visit India, I might be a citizen of my country. So no one will know anything. I am not flaunting any rules but I have no option.

It is no pod but ppf. It was automatic correction from my phone.

Winston-Sadly no option but to close when you are in India.

Thanks basavraj, I will come to India in a couple of years. That will already be the maturity date. No one here who are Indian nationals know anything of this rule. So the bank should have informed each NRI by mail. This is the way to get the information through.

Winston-True but banks itself in confusing mode.

Dear All,

I was recently in Mumbai and went to SBI to close my PPF account as I am a NRI. The lady incharge of PPF told that I cannot close as the bank did not recieve official letter from the government yet. I showed her the notification which I printed from the web but she still refused. Then I went to the branch manager who then scolded the lady that the customer has a copy of the notification so his account should be closed immediately. The branch manager signed PPF closure form and I got DD for the full closure amount which I deposited in my NRO account. I obtained CA certificate 15CA/CB and got the entire amount transferred to my NRE account and made FD @ 6.5 %.

Surprisingly my wife was in Mumbai and she went to close her account twice but she was not refused. I told this to the branch manager and explained him that we NRIs visit India only once in one or two years and he understood my problem. He told to get my wife’s form filled and send the original passbook with NRO bank account details through my wife’s father. He said that he will help and send the closure amount electronically to her NRO account. My wife is preparing the doccuments and will send to her father tomorrow. Let us wait and see what happens.

Sunil-Great sharing. Let us hope all individuals will have the same mentality typed Branch Managers.

Hi….I was today at may SBI Branch and the manager at the branch told me that they will reclaim the additional interest paid beyond 4% for the period since I became a NRI. So am surprised how could the gentleman get his full amount in the PPF account from SBI when my branch manager tells me that as per their legal team the excess amount of interest has to be charged back to my PPF a/c. Can the gentleman please let me know the name of the branch and the manager in there along with contact details. Regards. Vishal

Vishal-Let him reply.

I have just sent my wife’s papers to my father in law. He will visit the branch and let us hope the branch manager will take action as per what he promised me. I will inform the branch name once my wife’s ppf account gets closed and the job is done. This branch is in Mumbai.

Hi Sunil

Thanks for sharing your experience- an encouraging one

Would you please be able to share the duration you stayed invested and the name of the branch? This could be a very useful reference for the rest of the branches to follow!

HI sunil,

from where did you find notification on web? any link?

Hi Sunil

Thank you for sharing your experience. Could elaborate on ‘CA certificate 15CA/CB’. What is is for and how do we get one?

Thank you

Satya

Satya says:

December 12, 2017 at 2:02 PM

Hi Sunil

Thank you for sharing your experience. Could you elaborate on ‘CA certificate 15CA/CB’. What is it for and how do we get one?

Thank you

Satya

All,

I did a bit of googling to find some background info.

The initial PPF rule published under GSR1136 dated 15-6-1968 and there are subsequent amendments.

See below link for a detailed rule and amendments or simply search for the referrerd GSR number.

https://www.dacollege.org/GOs/index_files/PPFRulesindetail.pdf

In the above document there is a reference under Notification GSR225 dated 13.03.2014 under which there is an article I have reproduced which reads as follows:

(3) Non Resident Indians are not eligible to open an account under the Public

Provident Fund Scheme:-

Provided that if a resident, who subsequently becomes Non Resident

Indian during the currency of the maturity period prescribed under Public

Provident Fund Scheme, may continue to subscribe to the Fund till its maturity

on a Non Repatriation Basis.

The next amendment would be the GSR 1237 published on the 3rd October 2017 ( if you google the GSR number, you will find a PDF file notification)

Based on the two amendments, my interpretation therefore would be that the account opened prior becoming a non resident would deem to continue to accrue interest at the prevailing rate until 3rd October to the least or until the date a non resident applied for the closure of the account as per the new notification.

I believe presenting these two notifications to the bank will support the above argument and help process closure of the accounts. I would like to see the views of other readers in this form.

I am currently out of the country and therefore would not be able to visit the bank to present the case myself! So rely on anyone who may be in the country to visit the bank and clarify/ challenge them process account closure.

Thank you,

PS: Thank you google, without which we would not know where to knock!

Kumar-But still Banks put the reason saying they have not received the notification.

You have to go to a Chartered Accountant and tell him that you need a tax clearence certificate to transfer the funds from your NRO account to NRE account. You will have to provide him the details he asks. My C.A charged me Rs 2500/- for this certificate. Once you have it then you have to go to your bank where you have NRO/NRE savings account.

[email protected] is the email ID of responsible guy in FinMin. All write to him.

hi…Sunil can you please provide me the telephone number , name of the branch manager in SBI along with the branch details…..would like to speak to him/her regarding my own PPF with SBI where in am having troubles with my branch manager who insists that the rule is retrospective and i have to give back my already earned interest.

Dear Basavaraj,

Great Q&A above and thank you for sharing your knowledge. The awareness level at each bank is different and now finally I hear that banks have received the circulars in this regard. Although lot of unclear areas like many individuals have asked above. I have also read the amendment itself but that fails to provide clarity on so many questions being raised (http://corporatelawreporter.com/2017/10/13/public-provident-fund-amendment-scheme-2017-notified/?s=Public%20provident).

In my situation, my kids are US citizens by birth and have OCIs. We are India citizens. In old days, banks opened the PPF accounts (2005 and 2011 respectively for 2 kids) for them and we are listed as guardians. All of us live in India since 2015 so we are resident Indians in that sense. I have 2 questions:

1. Does being resident India allow kids to keep PPF open (even though they are OCI)?

2. In case we need to close the account, from above Q&A, I understand that banks should pay 7-8% PPF interest (whatever was the declared PPF rate, not savings rate of 4%)from the day accounts were opened till 3rd Oct’17. My concern is that banks don’t understand the matter fully and easiest interpretation is that close account and pay at 4% from whenever account was opened. Is there any reference that we can provide to them to correct their understanding and get paid PPF interest rate till 3rd Oct’17?

Your guidance is very much appreciated.

Bhavesh-1) As per this notification YES. Because notification is SILENT on OCI.

2) It is clearly mentioned in the shared notification about the EFFECTIVE date.

Thanks for the prompt reply.

1. Agree that it is SILENT in this notification. Were OCIs allowed to open PPF?I am referring to cases like my kids who are US vitizens by birth and hence PIO or OCI holder since birth per se? I am asking to understand whether bank should have opened their PPF to begin with or was it done incorrectly?

2. Yes, I re-read and it says that it becomes effective from the date of publication. I think the confusion occurs because bank officers (I have met couple of nationalized banks) are reading the language within quotes and looking in to the past. i.e. if someone opened account in 2010 and became NRI in 2014 onwards then they are reading the language and saying that account will be deemed closed as of 2014 (based on this notification. Where as correct interpretation will be to apply it to this case and say that s/he has to close the account immediately and the rule doesn’t get applied retrospectively, correct?

Bhavesh-1) OCIs can open and invest in PPF is they are resident Indian.

2) Yes.

All,

I have visited SBI in Mumbai last week to close my PPF account. Per discussion with the manager, they have not received a formal notification to implement the new ruling and they are waiting on RBI to act on it and inform all the banks (those who administer PPF accounts)

I showed him a copy of the notification that I downloaded from the web, which he had not seen before/ or aware and asked for a copy which I obliged thinking it would help progress account closure. However, he was insisting bank would not be able to close accounts without a formal notification. He even stated banks would have to recover the interests and asked me to give a self declaration on my date of becoming an NRI!!

Like Mr Basavraj states, I too of the opinion that the effective date is 3rd October until which the interest must be paid at the prevailing rates.

I guess we all need to wait till the official notification is sent to the banks with a clear instruction for them to act on it.

I visited the bank after many many years and the way the bank employees conduct themselves, serving the customers puts the country to shame in a technologically advanced / digital India.

Kumar-Thanks for sharing your views and experience.

Basvaraj,

Thank you, Your feedback is very useful and helping a lot of people like me to express our view and obtain additional information on the topic.

I agree with Bhavesh’s comments as bank managers are not interpreting the notification correctly and they are confused or simply not wanting to take responsibilities. ( due to the fact the monies belong to the Govt of India and not the respective banks they work for)

Perhaps this is because they are used to act on what their superiors advise them to act on and therefore it is extremely important for the the internal notification within the bank to take place and quickly.

In your experience, how long does it usually take for the banking authorities (I assume RBI in this case) to send a circular/notification to all banks with guidelines for implementation of the change in PPF rule?

It is now 2 months since the new rule has been published, would the bank be liable for applying the prevailing interest rates if they are delaying the implementation? Would you be able to share your views on what we can expect as to how the PPF account be treated between 3rd October and the actual date of internal notification that the bank is waiting for.

I believe the new ruling will cause a large sum of cash withdrawal by NRIs and the banks may not be prepared for thus causing additional delays…!

thank you,

Kumar-Sadly I too don’t know sir.

One of my friends father has opened ppf account in the name of his grand childrens, even when they were NRI in year 2009. What should be done to close this accounts opened wrongly.

Deepak-Let him approach the Post Office or Bank and apply for closure.

As mentioned by others, Post offices are waiting for formal orders from the Ministry.They are not closing any account.And of course unless the GOI says effective date for lower interest rate will be Oct 3 2017 or the date of change to NRI status whichever is later,confusion will prevail

Krishnan-Let us wait.

In meantime, people may sue Govt/Banks/Post office for loss of interest from October as they are not allowed to close and get better interest ( more than 4%)elsewhere

Today, my mother visited State Bank of India (goregaon west, Mumbai) and she was told that they have not received any such instructions (though they have read this in newspaper) – as such they cannot close the PPF account and give the money. They told to check next month or come when PPF account matures.