We all investing in NPS and assume that it is managed by PFRDA. But the reality is that there are some fund managers who manage your money. Hence, it is important for you to understand the NPS Returns for 2017 and who is the best NPS Fund Manager?

What is Scheme Preference in NPS Account

In NPS, there are two types of options available to create your portfolio. They are as below. Remember this scheme preference is not available for Government Employees Tier 1 Account Type. However, they have a freedom to choose scheme preference in their Tier 2 account. For rest of all investors, you have an option to choose scheme preference.

# Active choice – You will decide on the asset classes in which the contributed funds are to be invested and their percentages (Asset class E-Maximum of 50%, Asset Class C, and Asset Class G ).

# Auto choice – Lifecycle Fund– This is the default option under NPS and wherein the management of investment of funds is done automatically based on the age profile of the subscriber. At the age of 18 years, the auto choice will invest 50% of pension wealth in E Class, 30% in C Class and 20% in G-Class. These ratios of investment will remain fixed for all contributions until the participant reaches the age of 36 yrs. From age 36 yrs onwards, the weight in E and C asset class will decrease annually and the weight in G class will increase annually till it reaches 10% in E, 10% in C and 80% in G class at age 55 yrs.

At the age of 18 years, the auto choice will invest 50% of pension wealth in E Class, 30% in C Class and 20% in G-Class. These ratios of investment will remain fixed for all contributions until the participant reaches the age of 36 yrs. From age 36 yrs onwards, the weight in E and C asset class will decrease annually and the weight in G class will increase annually till it reaches 10% in E, 10% in C and 80% in G class at age 55 yrs.

Such changes will be done on the birth date of the subscriber. Such changes can be done once in a financial year.

What are the types of funds available in NPS?

There are three types of NPS funds available. They are as below.

- Asset Class E : Invest in equity market instruments. This is the riskier asset class among all three.

- Asset Class G : Invest in fixed income instruments. The best example of this is central government bond. This is the secured among all three.

- Asset Class C : Invest in fixed income instruments. Examples of these are bonds issued by firms or companies. this neither risky like Asset Class E nor safe like Asset Class G.

What are the NPS Returns for 2017?

Now let us see what are the returns of NPS for 2017. I am updating this information as of 28th April 2017.

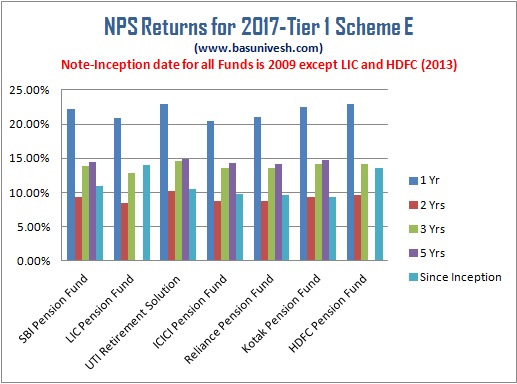

NPS Tier 1 Scheme E Returns for 2017

Below is the chart of the same.

You notice that one-year returns of all funds are more than 20% due to the best-performing equity market. But I am eyeing for 5 years and since inception returns. In those categories, UTI, Kotak, and HDFC performed well.

The Benchmark returns of these schemes returns are as below.

1 Yr-21.21%. Only four funds beaten this and they are SBI, UTI, Kotak and HDFC beaten this benchmark.

2 Yrs-8.25%. All funds have beaten the benchmark easily.

3 Yrs-13.53%. Except for LIC, rest of all funds beaten this benchmark.

5 Yrs-13.42%. All funds have beaten this 5 years benchmark easily.

NPS Tier 1 Scheme C Returns for 2017

Below is the chart of the same.

Scheme C funds performed well even for 3 years and 5 years returns. However, if we consider the period of since inception, then the worst performing funds are Reliance and UTI. Rest of other funds given us the return of around 11% since inception.

The Benchmark returns of these schemes returns are as below.

1 Yr-10.68%. Only three funds beaten this and they are ICICI, Reliance, and Kotak.

2 Yrs-10.18%. Except for SBI and UTI, rest of all funds beaten this benchmark return.

3 Yrs-12.18%. Only ICICI fund gave the return. Rest of all funds underperformed.

5 Yrs-10.75%. All funds have beaten this 5 years benchmark easily.

NPS Tier 1 Scheme G Returns for 2017

Below is the chart of the same.

The Benchmark returns of these schemes returns are as below.

1 Yr-10.47%. Except for UTI, all other funds easily have beaten the benchmark.

2 Yrs-9.76%. Four funds have beaten the benchmark and they are SBI, LIC, Reliance and Kotak.

3 Yrs-12.44%. Only HDFC failed to beat this benchmark. But rest of all funds easily achieved this.

5 Yrs-10.43%. Only UTI failed to beat this benchmark. But rest of all funds easily achieved this.

NPS Tier 2 Scheme E Returns for 2017

Below is the chart of the same.

The Benchmark returns of these schemes returns are as below.

1 Yr-21.21%. Except for ICICI, all other funds easily have beaten the benchmark.

2 Yrs-8.25%. All funds have beaten this benchmark easily.

3 Yrs-13.53%. Four funds have beaten this benchmark (SBI, UTI, ICICI and Kotak).

5 Yrs-13.42%. All funds have beaten this 5 years benchmark easily.

NPS Tier 2 Scheme C Returns for 2017

Below is the chart of the same.

The Benchmark returns of these schemes returns are as below.

1 Yr-10.68%. Except for SBI and UTI, all other funds easily have beaten the benchmark.

2 Yrs-10.18%. Only ICICI and HDFC funds were able to beat the benchmark.

3 Yrs-12.18%. Sadly all funds failed to beat the benchmark.

5 Yrs-10.75%. Only ICICI fund was able to beat the benchmark. All other funds failed to beat.

NPS Tier 2 Scheme G Returns for 2017

Below is the chart of the same.

The Benchmark returns of these schemes returns are as below.

1 Yr-10.47%. Except for HDFC and UTI, all other funds easily have beaten the benchmark.

2 Yrs-9.76%. Only SBI and LIC funds were able to beat the benchmark.

3 Yrs-12.44%. Except for HDFC funds, all other funds have beaten the benchmark easily.

5 Yrs-10.43%. Only UTI fund failed to beat the benchmark.

Who is the best NPS Fund Manager for 2017?

In above charts we the NPS Returns for 2017 (as on 28th April 2017). Now based on those performance returns, who is the best NPS Fund Manager? To identify the best NPS fund manager, I considered last 3 years returns of each scheme. I purposely avoided 5 years returns as two funds not yet completed 5 years.

In below chart, I show you the highest return generated fund manager for each asset class for a different time period of 1 year, 2 years and 3 years. The data looks like below.

You notice that in a case NPS Returns for 2017 for both Tier 1 and Tier 2 “E” type of account, HDFC and UTI Pension Fund Mangers did well than others.

Same way, NPS Returns for 2017 for both Tier 1 and Tier 2 “C” type of account, ICICI and Kotak did well. Only for Tier 2 account, HDFC’s returns for 2 years are best.

Also, NPS Returns for 2017 for both Tier 1 and Tier 2 “G” type of account, no one can beat the LIC Fund Manager.

Considering all these data, I may assume that for “E” type of account, HDFC and UTI are Best Fund managers. For “G” type of account, I go with ICICI and Kotak. But for “G” type of account, LIC seems best.

Do remember that this selection of fund is based on some random numbers. We can’t judge specifically that who is BEST. Because they are not so old to judge based on past performance. You can check the monthly NPS Returns at NPS Portal.

Hope the above information will help you in judging the best NPS fund manager and tracking your NPS returns.

Sir I made mistake by investing in NPS 4 YEARS BACK as I was unknown to all other products And not know to financial planning and your blog also lol. So I can read about nps .

So after 4 year it is given me -2.89 return.

Sir my question is can we use this as. Our debt fund. Stay away from E invest in pure Equity Mf . Is it good idea to do that

Dear Vikram,

Better to stay away from debt part of NPS also. It is also not completely risk free.

I am united bank of India employee , started investing in NPS from SEP 2015 at the age of 43 year.till now almost RS 350000 invested. The rate of return is very poor. It is almost 4.5 percentage. My fund manager is lic and fund named is lic pension pension fund.can any body reply how it so lower than even bank interest.

Dear Raj,

Which option you have selected?

Sir my nps tier1a/c shows it’s corporate scheme I chose auto choice, under which my fund manager is sbi pension corporate scheme, but initially in2016 nov it showed 14% returns while it reduced at present to 2% it doesn’t even seem better than pf , so should I change scheme of tier1. My age is25

Dear Ashutosh,

In Equity related product this the beauty and risk also. If you are uncomfortable with such volatility then better not to invest.

Hello Sir,

I’ve been investing in NPS since 4 yrs now primarily for Tax purpose (Only employee contribution). The % distribution of funds are as below. Scheme E – ICICI Pru Pension Fund- 50% Scheme C – ICICI Pru Pension Fund – 40% Scheme G – ICICI Pru Pension Fund – 10%. I read in one of the article that even though maximum % allocation is capped at 50% for equity fund, we can still do away with that by investing in LC-75, which is by selecting Auto choice and allocating 70% to equity. Please let me know how can I do that & be more aggressive to reap the maximum benefit.

Regards,

Nikhil

Dear Nikhil,

Regarding enhancing your exposure, be in touch with PFRDA POS and request them for the same. By the way, do you feel investing in any product or asset just for the sake of tax saving is the best investment strategy?

Hi,

Thanks for your comments. I do have many investments in MF, both in equity-linkee and debt funds. I also need to save tax, hence NPS was an added option. R my funds in each category OK or any change needed? Please advise.

Dear Nikhil,

I am still asking the same question. Do you feel investing in NPS for the sake of tax saving is best strategy? Refer to my recent post “National Pension Scheme (NPS) – 5 Biggest Disadvantages”.

Hello,

I have changed NPS fund manager from ICICI to HDFC.But the fund which i have already invested not shifted still it shows me ICICI.Please guide me what i have to do now.

Dear Vaskar,

Approach PFRDA POS.

I invested in ICICI PRUDENTIAL PENSION FUNDS MANAGEMENT COMPANY LIMITED PFM with

E : 50.0% | C : 30.0% | G : 20.0% |

It has given negative return

Should I change anything before investing for this year?

Sweta-Negative return of month, quarter, year or 5 years?

Today its showing 2 % profit for 1 year. Not negative

-1.30% was in February 2018 . I invested in November 2017

Sweta-If you can’t digest such equity volatility, then better to stay away from any equity product.

Hi Sir,

I have started investing in NPS Tier-1 through my employer and have chosen HDFC Pension Fund management with Aggressive Auto Choice LC-75 (75% Equity , 10% Corporate, 15% Government Bonds) as I under 35 years and want more equity exposure. Now I switched to Birla Sun Life considering it to give good returns than HDFC, do you think this is a good choice ? Please suggest !!

Anup- Changing Fund Manager especially in NPS may not help that much. Instead you have to change asset allocation.

Hi,

Can you publish similar analysis for the next FY ?

Thank!

Akshay- Yes, surely.

Hi Basu for 2018 , whos is the best NPS fund manager , NPS fund fall under which kind of invessment I mean we have debt, equity , is it another type and seprate from regular investments !

Shahnawaz-Let me write the post on this. It is part of debt and equity as your investment is spread between these two.

My Age 51 Years, I want to start NPS of RS.50000/- Annually. Please advise in section of best Fund Manager.

Vishnu-You can select any fund manager of your choice. You noticed that there is no such huge difference.

In NPS, I have invested Rs.40000 in Jan-2017 & Chosen ICIC fund manager

1)Is there option to change the Fund manager now?

2) If so, Limitation, Intervals and Fee to change them?

3) Can we select different fund manager for E, G & C?

Vijay-1) Yes, you can change the Fund Manager. You have to submit the request at PFRDA POS.

2) You can do so twice a year ONLY.

3) YES.

The nps tier 2 is not allowing to choose different fund manager for E,C and G.

I am trying through the mobile application.

Pls help/ guide me on how to do it

Dear Sameer,

Try to do the same through desktop.

Thanks for sharing this information.

Dear sir,

Thanks for the brilliant article with detailed data and figures. I have read many of your articles. However, I’m still confused on one thing. ULPP or NPS. I’m 38 yrs old and planning to retire by 56, currently working in a private firm. I am ready to take moderate risks in investing. I am planning to invest around rs. 9,000 per month for the next 18 years. But, i’m not very clear on whether to go for a unit linked pension fund or whether to invest in NPS. I’m seeking a pure retirement solution and don’t want to club life insurance with it. i’m fine with the rigid premature withdrawals norms of NPS. I’m also not looking at the tax benefits either. Just want the best post-retirement plan for me and my family. Could you pleas suggest which one would be better (ULPP or NPS). Or should I start SIP in MF and later think of retirement plans once I accumulate sufficient corpus. Please suggest a detailed reply with your suggestion + share any articles which throws more light to my confusion

Thanking in advance,

Vikram

Vikram-You don’t want to combine insurance with investment, but asking my opinion on ULIP? Start to accumulate on your own by investing in mutual funds with proper asset allocation. For me, both NPS and ULIPs are not better options.

I am from private sector is it ok to open an NPS account is it safe to make monthly installment of 1000

Ruby-YES.

Ruby,

I think it will be better if you invest in one go as otherwise you will be paying more charges. So, instead of investing 1000/month, invest 12000 in one go.

Sir,

As tax savings season is near by, I am facing the question wether to open NPS account or not. I am at 20%bracket , so by putting 50000, can save 10000 extra. By invest this amount in Equity MF, can made extra….this is the argument in NPS support.

Against to this, taxation and annuity making it difficult to adopt.

Should I go with it or not??

Pl guide.

Dear Sir,

This year due to 30% tax bracket I want to invest in NPS. Pl suggest me best option with higher equity exposure, Tax benefit & which fund shall I choose LIC UTI HDFc or SBI.

Deepak-Investing for the sake of TAX SAVING is the BIGGEST MISTAKE.

How about bajaj allianze “future gain fund” , 30% gain 1 year?

Praveen-It is ULIP and I am against the product which combines Insurance with Investment.

Sir, if possible, chart out and upload a half yearly, chart as it is done in the following link for Tier -1, http://m.premium.thehindubusinessline.com/portfolio/big-story/nps-rebooted/article9852971.ece

http://m.thehindubusinessline.com/multimedia/dynamic/03198/NPS_chart_3198252d.jpg

Nowadays, CRA is doing a lot of NPS account holder friendly options. So, it will be easy for persons like me. This chart is so easy to comprehend and update ourselves. Thank you Sir.

Since, for TIER-1, it is there, at least for Tier-2, you can upload one.

Durai-Surely I will try to do.

Basavaraja – Very nice blog. This Dashara I received an email from CRA which says Treat T-2 as your savings account / and emergency fund, start investing and withdraw whenever you need. I see the returns over 1 year is like 22% and for 5 years it goes to 11% or even less. What you suggest, after 1 year of investment take this money out with whatever profit gained and reinvest again?

Eg. I invested 1L in year 1st and got 1.20L at the end of the year. Shall I withdraw it and reinvest again? if I keep this 1L for 5 years I see this becomes 1.10L.

Also how much Tax I attract if I withdraw, I fall in 30% tax bracket. If I withdraw something and reinvest again and I show 15G for that, will I be taxed?.

Thanks for your time,

Saurabh

Bangalore

Saurabh-Refer my post “NPS Tier 2 – Alternative to Savings Account, FDs or Debt Mutual Funds?“.

Thank you. You have done lot of hard work. As there is no clear info on Taxation post withdrawal I am unable to take any decision.

Saurabh-Pleasure.

Hi,

I have invested in tier 1, my allocation is 50%in E and 50%in C, I want to know can I switch my corpus in C to E after maybe 1 year or 2 year. My choice is active choice.

Anuj-You can’t switch all your portfolio from debt to equity. Based on predefined asset allocation you can choose C or E. You have to give the request for transfer.

HI, Can a central government employee (who is already covered under regular pension scheme) invest through NPS? Will he get PRAN ? What about employer contribution?

Pls elaborate the scheme with eligibility details and advice a better Fund manager.

Thank you sir.

Srinivas-Whether he is covered under NPS already?

Respected Sir,

Kindly help me out on the following clarification even though they are may be annoying 🙂

1) I am under Tier I and chose ICICI fund (Corporate plan 10% of my Basic – Active E 50%, G & S 25% each), Does the rules allow me to choose 3 different funds for each category like HDFC for E, ICICI for C and LIC for E ? So that if possible I can change the best for each category?

2) Based on current performance, will you suggest me to stay with ICICI to see if it improves or Do you suggest me to change the Fund manager? If So, overall which one to go with?

3) Whether to see the performace every year and take a decision to go with best fr that year or to stay with the same fund manager? IF changing constantly, what are the disadvantages ?

Balaji-1) I don’t think it is possible.

2) There is no such huge difference. Stick to ICICI.

3) YES.

Respected sir,

In NPS new fund is introduced named Birla Sun Life Pension Management.

It is reliable to change fund to newly introduced fund because having low NAV give greater units

I have SBI Pension fund in Tier 1 Account and ICICI Pension Fund Management Company Limited in tier 2 account

what is your suggestion?

Is it good to change in both tier 1 and tier 2?

i have opened NPS 6 month before i.e april 2017

Jay-Never run behind NAV. It will never matter whether the NAV is at Rs.10 or Rs.1,000. What matters is the fund performance. In my view, better to stick to your fund manager. Wait for the fund performance of Birla, then you can take the call.

Patel and Balsavaraj Sirs, one month back, I have opened Tier 1, through post office. So I have been allotted by default, SBI Pension Fund. By default, E=50,C=25,G=25. How to scheme change, as of now. I want around 10 to 20 percent with E, 30 to 45 with C, and around 50 with G. If I choose auto, which one to choose among Moderate, Conservative and Aggressive? So that, if needed, later I can change my PFM. Or now itself, is it better to choose SBI as my PFM? In that case, with ECG, how much percentages to allot for each?

Two days back, I have activated ed my Tier 2, through eNPS, choosing auto conservative as of now, LIC as PFM, since it allotted E=16, C=27, G=57, which is almost equal to the percentages I preferred. So, if needed, I can change my PFM, later.

Since, Tier 1 is done through Post Office, is it better to change, Tier 1 also as eNPS like my Tier 2? SBI is my Bank.

Kindly suggest me sirs, since I am totally an alien to this area of investment! U can suggest, if you want to tell me anything more!

Patel sir, I am also eying on ICICI, as my PFM for my Tier 2, for next time. If I choose ICICI, how much percentages preferred for ECG respectively? U can also tell anything more if you want. Tell me ICICI performance in general as of now as well.

Durai-Asset allocation and how much you have to invest depends on individual’s finance. Hence, hard to generalize.

DURAI SARAVANA SABAPATHI JI

as per Basavaraj Tonagatti sir comment, I totally agree on the selection of fund, for that you must have check fund performance for some duration. since as per my knowledge all fund of NPS which reach 5-year duration having closely returned on both asset E & C of tier 2

so as per Basavaraj Tonagatti sir’s guidance we must see fund performance for a 1-2 year duration then we will decide to switch to one fund to another

Thanks

Jay-Thanks for endorsing my views 🙂

Durai-You can choose asset allocation (maximum cap for Equity is 50%). You can stick with SBI. No issues in that. Whether you can’t transact or see your Tier 1 through eNPS? In my view YES.

Respected sir

I have recently started ELSS also what is your opinion to invest towards ELSS as SIP ( 4 different funds of 1000 per month) and Continue Tier 1 account as mandatory account(invest roughly 5000 per year) and more invest in Tier 2 (10000 per year for 10 years)

I am planning to invest in ELSS as 10-15 year duration

Jay-As you are planning to invest in ELSS for long term view, I don’t have any concerns. But make sure that based on your time horizon of the investment you must also do asset allocation between debt and equity.

If I wanna earn at least Rs 5000% from Tier 1, after 60 years, how much to invest annually? I am 45 years old now. By default, they have allotted, only SBI as my PFM for ECGs of my Tier1. Sorry for asking posting this much of questions couple of times!

Durai-50000%???? Great to know about your expectation. Sorry…I don’t have any such magic to even think beyond 12%. If someone is recommending you such product which generates 50000% then in my view he is the biggest cheater to himself and to you. Rest you decide.

No sir, it’s not Rs 50000, but Rs 5000 p/m, that I want to get after 60 years as my pension return for each month. So I wanna know as to how much I have to pay to Tier1, per month?

Durai-You mean to say Rs.5,000 per month you want to expect from your annuity? But do you think that much when you retire is suffice?

Sir, I have other investments too. Even then, now I want you to suggest a monthly contribution amount to my Tier 1, to get a pension of Rs 10000/- per month

Durai-Retirement calculation needs a lot of data from your end. Use online available retirement calculators to arrive at how much you need to invest per month.

Is it possible to choose three different PFM’s for E C and G? Which one is to choose among the moderate, Aggressive and Conservative? First time, I want to allot for Tier 1.

Durai-Result is already infront of you in above post.

Dear Sir,

I would like your guidance on which pension fund manager to choose for investing in a Tier 1 NPS scheme. Planning to open a e-NPS account online soon

Read your blogs on the NPS topic….very useful and helped me make a decision.

Mohan-Refer above post properly. You can choose the one as per your wish.

Hello sir! Is it possible to invest in different fund manager, say equity in uti, Gilt in kotak, govt bond in luck with same pran account number? Asking because my POS saying to select a single fund manager for all . Is it true? Arin

Arin-May I know the reason?

Hello sir,

I really don’t know the reason either, that’s why I asked you. After reading your blog, I asked the pos that to reshuffle my money to different fund manager that is, E, G, C. They said one can change portfolio and allocation twice a year, but can’t be individualised to three separate fundanager . So I asked you. Thanks.arin

Arin-They are right.

How is the returns calculated in NPS. When I switch between schemes how does the NAV and the current accumulation gets managed?

Sreejith-It is exactly like you are coming out from one fund and freshly investing in new fund.

Ok..which means the existing corpus would be redeemed and made as a fresh investment into the new scheme ..Right?

Sreejith-Yes.

Dear Sir,

What is the return expect from NPS for 25 Years (Rs. 1000 per year).

Suman-If you go with active choice (where the maximum equity exposure is around 50%), then you can expect around 10% returns.

Dear Sir,

I am a big fan of your blog. My age is 35 years. I have the followings investment P.M. :

1) EPF – Rs. 1500/- P.M. (For Pension)

2) SBI RD – Rs. 2000/- P.M.(For my Child education)

3) SBI Blue Chip Mutual fund Rs. 600/- P.M. (Can be withdraw amount may be – 30,000/-)

4) Emergency fund Rs. 40,000/-

I am feeling uncomfortable in Mutual fund due to private sector. I want to withdraw my mutual fund and start a NPS Tier – I Rs. 1000/- Per Year. (1000×25 Year) = 25000/- Investment Amount.

Tier _ II Rs. 7000/- Per year. ( for 10 years Goal) (Because of NPS is fully Govt. and I have received a PRAN Card)

Is It suitable for me or not ?

Samir-Do you think NPS fund managers are by a government? It is a highly illiquid product. Hence, better to start investing in equity and debt based on time horizon of your goal.

Dear Sir,

But I invest in Tier _ 2 and it is like savings A/c.

In Tier – 1 Rs. 1000/- per year. and it gives me above PPF Return.

reply me, presently it works like a balanced fund. It is better to invest in mutual fund balanced fund or NPS Tier – II.

Samir-Never think that Tier 2 flexibility means equal to a savings account. Understand the risk involved in such funds.

Dear Sir,

BALANCED FUND OR NPS TIER – II RETURN WHICH IS HIGHER RETURN AND SAFE ?

Suman-Never compare blindly. Analyze the underlying equity and debt portfolio, and then better to compare. Also, for your information NOTHING IS SAFE ON THIS EARTH.

Samir-Easy to say plainly. But you may not know the risks involved. Tier 2 is like savings account? Refer my post “NPS Tier 2 – Alternative to Savings Account, FDs or Debt Mutual Funds?“.

What is the difference in investing in Tier 1 ,Tier 2 separately or both together ? Any additional benefit

Priti-I already written a detailed post on this, refer “Difference between Tier 1 and Tier 2 Account in NPS“.

Can I choose different fund manger in different type of Acount in a single pran number?If yes please tell me the process.

Mintu-Yes, you are free to choose different fund manager in different type under single NPS.