Paytm recently launched a unique Gold based investment Gold Accumulation Plan called Paytm Digital Gold. This is claimed to be one of it’s first in the world. Let us see the features and review this product.

Paytm launched this product in alliance with India’s only Internationally Accredited Refinery MMTC-PAMP, enabling Indians to buy, store and sell pure gold instantly.

Features of Paytm Digital Gold

The features of Paytm Digital Gold are as below.

# Using Paytm Digital Gold plan which is also called as GAP (Gold Accumulation Plan), you can purchase gold using your Paytm account for as low as Re.1/-

# Live rate of Gold means the Gold rate in Indian rupees per gram of 9999 fine Gold, as posted from time to time, inclusive of duty, inclusive of taxes, exclusive of product manufacturing/making charges, delivery charges. Such prices is updated frequently. However, such live price is valid for 6 minutes.

# You may Buy or Sell the Gold in terms of fractions also like 0.1 gm or in Rupees, for example, Re.1 or Re. 2 etc

# You are allowed to Buy or Sell the Gold 24 hours a day, 7 days a week, 365 days a year, including public and bank holidays.

# You can see or monitor the gold price LIVE or real time on Paytm platforms including website, mobile application etc. in order to make your decision.

# You can redeem accumulated gold in the form of gold coins/minted products.

# If you don’t want to redeem the accumulated gold in the form of gold coins/minted products, then you can sell back your gold holdings to MMTC-PAMP through Paytm platform at the rate displayed on the Paytm platform This money gets credited into the bank account details provided by you.

# This product does not act like collective investment scheme (like Mutual Funds or other Gold Schemes).

# You will not earn any interest from this scheme. But your profit or loss depends on the price appreciation and depreciation of gold from the purchased price.

# You are not obliged to invest in this scheme regularly. It is as per your wish. If you want to buy Rs.5 gold, then using Paytm platform, you can buy it at any time.

# You can buy Gold at the rate displayed on the Paytm platform in either in rupees or grams. For example, you can buy gold worth Re 1 and above or 0,1 gram and above.

# If you not did any buy or sell for more than 6 months, then such account is considered as inactive. In such situation Paytm will you send a notification to make a transaction on your registered mobile number and email.

# Paytm has the full rights to close such inactive accounts. In such cases the gold held in your account will be liquidated at the “sales price” derived by MMTC-PAMP on the day of liquidation and the complete amount from these proceedings will be kept separately in a “dedicated GAP account” maintained by MMTC-PAMP.

# You can claim the amount by reaching out to MMTC-PAMP and providing relevant ID proofs and account details for settlement.

# You can’t visit and view your gold accumulation. However, you can view your holding records at their facility.

# Taxation of such gold buy and sell apply as it apply to physical gold buying and selling. Such all applicable taxes are included in your invoice.

# If account holder dies, then it is the responsibility of the legal heirs to inform about such gold holding to Paytm. The account will be closed and the gold holdings will be delivered to legal heirs.

How Paytm Digital Gold works?

The process is explained in above image clearly. Along with such holding of Gold, if you use your Paytm Digital Gold for buying 15% cash back on any buy of TV, Home theaters and more. Also, currently if you are buying the Paytm Digital Gold first time, then you will get the one time 5% cash back also.

Do remember that you can use this holding for any types of cash transactions exactly like your money in Paytm.

How to buy or sell Paytm Digital Gold?

You can buy Gold at the rate displayed on the Paytm platform in either in rupees or grams. For example, you can buy gold worth Re 1 and above or 0,1 gram and above.

You can buy Paytm Digital Gold using Paytm wallet, Debit/Credit cards, Net Banking, ATM Card, Or any other mode of payment as Paytm may make available on their platform.

You can download the invoice in order page of Paytm under “‘My Orders” section on Paytm Web or App and click on. Invoice is also sent as an attachment in the order confirmation email.

For selling your gold holding, there are two options. One is to redeem the gold as cash and another is in terms of gold coins/minted products.

# Selling Gold as cash

You can offer to sell your Gold accumulated on Paytm in either Rupees or Gram. For example, you can offer to sell either 0.1 gram or Re 1 and above. Do remember that your Gold account holdings should be equal to or higher than the quantity you offer to sell. You must share your Bank account number and IFSC code to enable the sell transaction.

After paying the convenience fee, you will immediately see the amount credited in your bank account while the Gold balance in your Gold account will be debited.

In the rare event of any technical failure, MMTC-PAMP may reject your offer to sell. The quantity offered by you to sell will be credited as per the Paytm norms in your Gold account.

Do remember that there is a price difference between buy and sell prices.

# Selling Gold as gold coins/minted products

You can request for all or part of your gold holding, between 1 gram and multiples thereof. You can select the quantity and denomination of the gold you wish to withdraw from the available options of coins on the Paytm platform.

Each coin will have different making charges, based on the weight and design of the coin. You must confirm the transaction by paying the additional making and delivery charge. Your gold product will be delivered at your notified address by a logistics provider arranged by Paytm, and you will receive a confirmation on your Paytm registered mobile number. You can track the delivery by logging on to your account from time to time.

Purity of the Paytm Digital Gold

Paytm Digital Gold offers 24k 999.9 purity gold. 24 karat gold is of 99.9% purity, while the gold you buy through GAP is at least 99.99% pure. Also, 9999 gold is the purest form of Gold used for trading purposes across the world.

Also, such gold comes with Hallmark of LIMBA (LBMA stands for London Bullion Market Association, which is an International trade association representing the market for gold and silver Bullion with a global client base. LBMA?s main role is setting and maintaining global standards for gold and silver, universally recognized as the de-facto standard of quality assured and assayed bullion. For more details, please visit http://www.lbma.org.uk).

Note that MMTC-PAMP is a BIS certified refinery. Hallmarking is done for only Gold items of 14, 18 and 22K. 24K Gold is not hallmarked.

You can select the quantity and denomination of the gold you wish to withdraw from the available options of coins on the Paytm platform. Each coin will have different making charges, based on the weight and design of the coin.

Delivery to your address will be attempted three times. If you are not available at your mentioned address to accept the delivery, after the third time you will have to pick up the package from MMTC-PAMP?s nearest registered office.

For details, contact Paytm customer care service – 0120 3888 3888.

How is Paytm Digital Gold is stored?

MMTC-PAMP is the custodian of your accumulated Gold, right from the point you buy Gold in GAP on Paytm. At no point does the ownership of your accumulated Gold transfers to either Paytm or MMTC-PAMP.

MMTC-PAMP instantly and store it in the country’s most secure, 100 percent insured vaults at no additional charge. The vault is fully insured for all eventualities.

You can buy and store your gold for a period of 5 years from the date of purchase with us. This will be kept in safe custody. You can sell/withdraw your gold anytime within these five years. When you want to withdraw your gold, you have to select in which denomination you want to withdraw it. You will have a range of minted products to choose from. Once this duration is complete, it is mandatory to sell or take delivery of the respective quantity.

In case of multiple purchases on different dates, you can keep your gold with us for 5 years from the date of purchase for each specific transaction. If you redeem your gold after the Custody Period of five years, additional charges, as applicable at that time will be levied.

Review of Paytm Digital Gold

Why you invest in Gold? There are three purposes to it and they are as below.

# Use as ornaments.

# Invest now in gold (in any form) for future ornament usage like kid’s marriage time.

# Invest in Gold as an asset class and diversification.

However, the biggest hurdle in this account is keeping the account active by transacting once in 6 months. Otherwise, such account may be treated as inactive and MAY be closed. In such situation, you have to visiting to MMTC-PAMP and providing relevant ID proofs and account details for settlement.

This means that if you once hold the gold in this account, then either you have to SELL within 6 months or buy once in every 6 months. This I think one of the biggest drawbacks of this product.

Also, investing in Paytm Digital Gold means you have an option to redeem in physical gold. However, the format is Gold Coins (which also includes the making charges). Hence, once you get this physical gold, then again you have to go to a jewellery shop to buy the ornaments of your choice. This I think makes it COSTLIEST way of investment. Because you pay the making charges at the time of redemption from Paytm Digital Gold and once again at your jewellery shop.

The tenure of your account is just 5 years. Hence, if you are planning to accumulate gold for your kids marriage, which if is more than 5+ years, then such buying will not serve any purpose. After 5 years of your holding, you are forced to SELL. This I think not serve any purpose of long-term gold investors.

If your intention is to buy the gold for your kid’s future usage, then use the simple products like Gold ETF, RBI’s Sovereign Gold Bonds or Gold Mutual Funds. In such a products, there are no such restrictions of redemption. Also, there is no such obligation that you must buy or sell once in every 6 months.

Therefore this product purely failure in answering the Indian Gold investors purposes in two ways. Buying gold ornaments using this platform is not cheaper. The second thing is you can’t hold your gold not more than 5 years. Hence, what is the use of such launch?? Just a gimmick of “Buy gold for as low as Rs.1”.

Also, if the account holder dies, then it is the RESPONSIBILITY of legal heirs to approach the Paytm. It means there is no nomination facility. Something horrible it is. Also, the process seems cumbersome.

Here, I have not concentrated on the gold price the Paytm Digital Gold quoting to the actual physical gold price you get in shops or the NAV of Gold ETF.

In my view, this is meant for all middlemen who are in the chain of gold buying but fewer benefits to BUYER or INVESTOR.

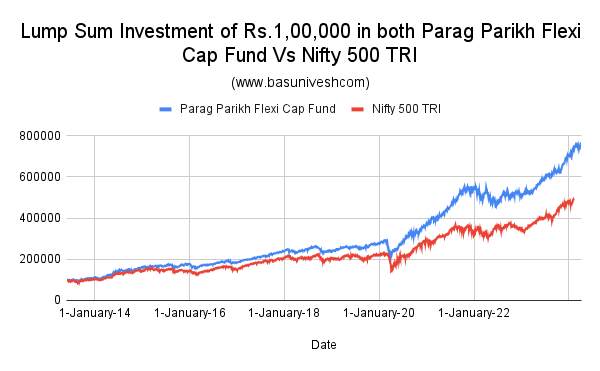

Note-Do remember that you can invest in gold if you need it for your personal usage. However, if you are planning that GOLD is the BEST investment, then you may check historical data and you find that “GOLD is volatile like Equity Market (stock market) but gives you the returns of Debt Products like your Bank FD returns.” Now decide whether you consider GOLD as for consuming purpose or for INVESTMENT purpose.

3 Responses

yes, the digital gold investment plan of the paytm is valuable. Though it is a short time plan you can make it long term by investing more money. The price of the gold generally constant and then it tends to fluctuate and you can sell the gold for profit when the rate is high.

good content btw.

Extremely detailed post. I’m thinking the process for legal heir to take ownership of holding in case of customer death may be tedious as they don’t have any branches and everything should be done through email. I was not aware of this 5 year max period condition which I feel now is a major set back personally. Please make a post also on their payments bank when possible.

Sreekanth-Thanks for that death case point, which I missed in the review area. I update the same. Yes, you are right. In plain, it looks the BEST way of investment. But truly a horrible way of investing in Gold.