Recently HDFC Life launched one more Online Term Insurance called HDFC Click2Protect Plus. This plan has lot options which confuses many new buyers and along with that, few readers raised doubts about choosing options. So let us discuss about this in detail.

Below are the eligibility criteria of this plan.

Eligibility features I liked a more

- Minimum age at entry-Because if someone starts to earn at 25 years and looking for a term plan till his retirement age (Approximately at around 60 Yrs of age) then he can easily opt this as 25 Yrs (current age)+35 Yrs (Term of Policy)=60 yrs of age (Retirement Age).

- Usually in online term plans, you find only single premium options. However, in this plan you will find all options like Yly, Hly, Qty or Monthly too.

- Minimum Sum Assured set as Rs.25, 00,000. Even a low earning individual may also choose this plan.

Below are the various options, one can choose in this plan.

1) Life Option-

This is a typical term insurance without having any additional features. So easy to understand to all (I feel so).

2) Extra Life Option-

This is nothing but a term insurance with additional feature of accidental rider opted equal to sum assured. Below are some exclusion mentioned about accidental benefits.

- If death occurs after 180 days of the accident, then no benefit will be payable.

- This rider will not be applicable to Intentional or self-inflicted injuries or suicide, irrespective of mental health.

- In addition, one must not be Alcohol or solvent abuse, other than drugs taken under medical supervision.

- War, invasion, hostilities (whether war is declared or not), civil war, rebellion, revolution or taking part in a riot or civil commotion will not be covered.

- Taking part in any flying activity, other than as a passenger in a commercially licensed aircraft

- Taking part in any act of a criminal nature with criminal intent

- Taking part or practicing for any hazardous hobby, pursuit or race unless previously agreed to by us in writing

3) Income Option-

If this option is opted and death occurs during the policy period then benefits will be available to the nominee as below.

- 10% of Sum Assured will be payable to nominee immediately.

- Rest of 90% of Sum Assured will be payable monthly as o. 5% of the death benefit for 15 Yrs.

4) Income plus Option–

If this option is opted and death occurs during the policy period then benefits will be available to the nominee as below.

- Full Sum Assured will be payable to nominee immediately after policyholder’s death.

- Along with this a monthly income will be payable to nominee at 0.5% of Sum Assured for 10 Yrs.

- In this plan, you have the option to choose flat equal monthly income for 10 years or inflated income at 10% per year.

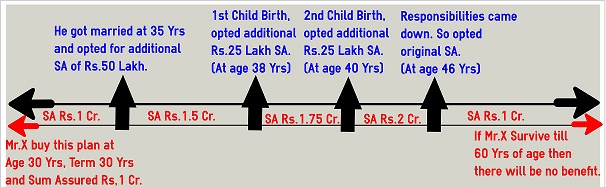

Life Stage Protection Features-

This is one of the unique features of this plan. The idea behind this plan is, as you grow older your financial responsibilities will also grow. So need additional insurance to cover those responsibilities. Hence, instead of buying the insurance at that stage, this option provides in built options once you enter to those life stages. At the same time once your financial responsibilities finished, then you can decrease them and bring it back to the initial term insurance you opted.

Below are the life stage events listed in this policy, for which you can increase your sum assured. However, do remember that these events must occur within the policy period.

- Marriage-You can increase by additional sum assured of 50%, but subject to additional maximum sum assured of to Rs.50, 00,000.

- Birth of 1st Child-You can increase by additional sum assured of 25%, but subject to additional maximum sum assured of Rs.25, 00,000.

- Birth of 2nd Child-You can increase by additional sum assured of 25%, but subject to additional maximum sum assured of Rs.25, 00,000.

Below are few conditions attached to this particular feature, if you are planning to opt during your life stage.

- Your premium will be recalculated based on the additional sum assured you opted.

- You must opt this to increase in sum assured option within 6 months period from the date of the event.

- Your age must be within 45 years while choosing this additional sum assured feature.

- This feature is available only for regular premium policies but not to single premium or limited premium policies.

- No medical test during this lifetime event while increasing the sum assured.

Reduce the Additional Sum Assured

As I said above once your financial goals are met towards, the above said life stage event and if you feel that there no more larger insurance cover required after 45 years of age, then you have the option to go back to the original sum assured you opted. If you opted this then again the premium will be recalculated for the rest of the period.

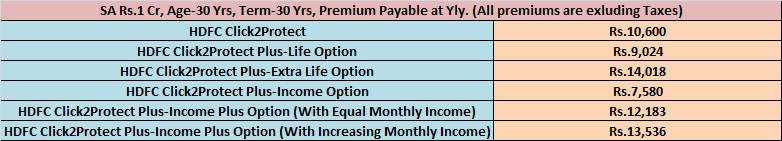

What about the premium to HDFC’s existing Click2Protect Plan?

Whether to opt this plan or not?

- You may notice from the above table that, the old HDFC Click2Protect plan is costlier to the HDFC Click2Protect Life Option. Therefore, this is an advantage of going with this plan.

- For extra additional accidental rider the premium looks costlier to normal plan (Notice the change from Rs.9, 024 to Rs.14, 018). Therefore, I felt it bit costlier than choosing standalone accidental insurance.

- Income Option seems cheap, but do remember that they only pay 10% of Sum Assured to your nominee. Rest of 90% will be with them and simply pay it instalment for the next 15 years without adding any return to that amount. So do not be in a mind that it is cheap means best.

- Income plus option (with equal monthly income) seems too good, but it will not take care of inflation. Hence, in my suggestion this option is not good.

- Income plus option with increasing monthly income at 10% is good, but will come with additional premium.

- Overall, I feel this plan unique and opt for those who feel their dependents will not be in a position to manage their money.

- In addition, even if one opts for monthly income, then when you consider current taxation rules, this income flow will be tax-free. Whereas if you opt for a typical term plan and invest in any product like monthly income scheme then there will be possibility of taxation on that income.

- Another unique feature of this plan called Life Stage protection features looks great only if you feel that your health will not be same in future. Because further raise in coverage in this option is without medical examination.

Overall, this product seems to be unique in the Indian Term Insurance industry. If features and budget are very much at your side then go ahead !!!

Hi Mr. Basavaraj,

1. Please suggest b/w Max Life vs. AEGON Life. AEGON has very low customer base, is that fine?

2. Recently met BIMAdirect representative during financial planning session at our office. He asks to take Term plan through them at same cost, as they can serve during claims and can act as a single point contact for other insurances like Motor, Accidental etc. Is that suggestible?

3. Will the Insurance companies treat this as a 3rd party intervention for claim settlements or any other problems might be there?

Can you be my Financial advisor?

Krishna-1) Yes

2) I am not sure about this. If the cost is same, then go ahead.

3) No such problems.

Hi Sir,

1. Suggest me b/w ICICI Prudential vs. Max Life.

I’m basically looking into lower premium and good settlement ratio. Please suggest in this regard.

2. I have a basic doubt is there any chance of the Insurance companies being stable for next 50 years?

If i start my policy in Max Life now 2017 and plan for 40 years, is there any guarantee that they will stay in market till the uncertain event happens. Or can any market conditions lead to their shut down?

How does IRDAI control this?

Pallavi-1_ For me both are good but if your concerns is cost then go for Max.

2) They can’t wind up their business like that. You no need to worry. If you still have doubt, then refer my post “What if your Insurance Company goes bankrupt?“.

Thank you for the information.

Also please suggest is AEGON Life preferable based on Claim settlement ratio?

AEGON is having lowest premium rates among all.

Pallavi-All are good but make sure that to declare all facts properly from your end.

Dear sir I want to buy online term plan. My age is 37 yrs& I want to take it for 21 years.please suggest me reliable plan.

Thank you.

Hemant-Refer my post “Top 5 Best Online Term Insurance Plans in India in 2017“.

Hi ,

I am planning to buy HDFC click 2 protect plus term plan with accidental disability,and critical illness. My age is 31 yesrs non smoker.For 1 cr insurance + 50lac disability + 15 lac CI yearly amount is 20000 approx.

Should i take these riders?

If not then from which company I should take critical illness insurance because i have pre hypertension symptoms.

Rishi-Never combine accidental or critical illness insurance with life insurance. You can buy them through general insurers.

which company general insurance you suggest?

Also I read that If i take critical illness insurance from outside then the installment can increase in every 2-3 years but with termplan it is fixed .

Rishi-I can’t name any one company particularly as it purely depends on the features you like. Term Plan premium may be fixed, but what about the limited features it offers??

Basuji,

Waiting for your view on HDFC Life Click 2 Protect 3D Plus.

but my birthdate is 1st june. so i have decide to buy term insurance and shorted two policy:

1.Max life Online Term Plan with Future Premium Waiver in case of Critical Illness or Disability rider

with 1 cr SI with 32 years term premium is 7781 Rs.

2.HDFC Life Click 2 Protect 3D Plus with Waiver of Premium on 34 Critical Illnesses with 1 cr SI with 32 years term with premium is 9224.

HDFC covers 34 Critical illness and max life online convers only 11 critical illness.

what you suggest which one is good deal for me?

1.HDFC click 2 protect with 9224 or

2.Max life with 7781?

is it worth to give more 1500 for HDFC Life Click 2 Protect 3D?

Waiting for your reply.

Please advice about HDFC Click 2 Protect Plus 3D, whats difference from old plan, shall we I can go for it.

Rajik-Wait for my next post.

OK will wait for your valuable advice.

Excellent post and so very helpful! In addition to the actual claim, in my death I will always be grateful for posts like these than helped me cover my dependents when Im not around! Thank you for being so honest and unbiased in your review 🙂

I think the premiums have gone slightly high from the “What about the premium to HDFC’s existing Click2Protect Plan?” table you added. I checked for the same SA and criteria, the yearly premiums have gone up by atleast Rs 1,000.

Demetrius-It may be varied now as the post was written long back.

Hi basavaraj- I’ve been following your blog for quite sometime and also have read your success story in other links.

Kudos to your job. I have two queries, please clarify.

1. What is your meaning of Emergency funds? How to plan for them?

2. I’m planning for term plan. Plz suggest which is better- Pnb Metlife Meta term plan (or) HDFC Click2Protect Plus?

Pnb Metlife is reliable?

Krishna-1) Emergency fund usually contains the cash which you can use it in case of emergencies without any hassle like withdrawing money from your savings account. It should be around 6-12 months of your committed expenses. Remember that you must use it only in case of emergencies.

2) Both are equally good and bad.

Does Pnb Metlife & HDFC click2 Protect cover suicide?

Krishna-All insurers cover suicide after one year of policy commencement.

Hi Sir,

I already have an LIC Jeevan Saral plan taken 6 years back and continuing (Rs. 12010 paid every year till now). LIC has closed this plan as of now.

After enquiry have come to know that this is a failure plan by LIC.

Please suggest if i can continue with this or close this.

Sharanya-What prompted you to buy this plan? What was your expectation?

Sir- One of my brother (LIC agent) suggested this for me.

The input given to me was if i continue for 31 years term i will get a lumpsum of roughly Rs. 8,94,000/- as per the pamphlet. However in the Bond it says as S.A. Rs. 2,50,000/-

I was not much aware of these plans earlier.

Please suggest how to proceed.

Correction in my previous comments. The term is actually 21 years & not 31 years.

Sharanya-Ask your brother about bonus rates he considered to arrive at this maturity value.

Is the LIC Jeevan Saral a better policy or not?

Sharanya-In my view a WORST.

Hi Basavaraj- Many thanks for your honest suggestion.

Could you please also provide a better clarity on its disadvantages. I’m sincerely lack information on this.

Sharanya-There is a limitation in sum insured, and lot of features a simple one is like kids education expenses when you are bed ridden.

Hi Sir,

I’m Uttam, 29 years old looking for Life Term plans. I have read few of your replies above and your responses are very informative. Please clarify my queries below.

1. Could you please clarify your opinion of excluding Riders (Accidental and Disability) in the term plan and go for General insurance. Any reason for this?

2. Is it good to go for Lump Sum settlement (or) partial Lump Sum with Income options?

I understand it is definitely my choice but you have any second thoughts?

3a. The final settlement amount received by the Nominee will be taxable?

3b. Is this taxation anything related to if the Nominee is working?

3c. I believe the income vested from the investment of Lump sum is taxable. E.g. Fixed Deposits done on the Lump Sum.

4. What are the prime differences b/w Online and Offline term plan other than the Premium amount variation. Does it play any role during Claim Settlement process.

5. If i go for Online policy does Insurance company do a next round verification to ensure the authenticity/ whether the documents provided by me are sufficient?

I’m specifically asking this because whether the Insurance company reject claims during settlement period stating the required documents are not provided (or) the information provided in the uploaded documents is not sufficient (or) incorrect document uploads done.

6. What are the common issues (Claim rejection scenarios) though accurate information is shared with the Insurer where special care need to be taken?

7. I have a plan to take 1 crore SA. Can i take a two 50 Lakhs plans. Will that be anyway problematic in future?

Uttam-1) Because riders have limited features. Standalone products comes with many more features.

2) Lumpsum

3) It is purely tax-free.

4) No difference other than premium amount.

5) Once the policy issued, then they can’t reject the claim stating documents NOT provided. It is their responsibility to collect the documents before issuing the policy. However, if information provided by you are incorrect, then whether it is online or offline product, insurers have rights to reject claim.

6) There are million reasons for a person to die and same way million reasons for claim rejection.

7) Problematic to your nominees. Because they have to run behind two insurers to get claim settled. Other than that, there is no logic in splitting.

Hi Basavaraj,

Thanks for your useful insights.

Also please clarify what are “Renewable policies”. Is this different from policies providing “Life Stage” option.

E.g. Life Stage option in Pnb MetLife.

Uttam-Where you heard about such policies?

Basavaraj- I beleive i have seen in some blog. Please ignore if that is not related to this context.

Uttam-OK.

Dear Sir,

I want to take HDFC click2 protect. Is it advisable to take a rider of Permanent disability or extra life option or any other riders.

Please suggest me.

Smarty-Don’t opt for any riders. Instead, buy them individually from general insurance companies.

Hi Basavaraj,

Can you brief about disadvantage of riders if we take it with term insurance ?

How it different from genearal insurance ?,Pls clarify

Venky-The disadvantages are-Rider will not cover partial disability or temporary disability. You check the features offered by accidental insurers to RIDER. You will notice the same.

Sir

Why LIC premium is so costly in comparison with others.

Is there any diference b/w Term insurance and Life Insurance

Gaurav-Premium fixing depends on many things. It is purely insurance companies rights to fix it. Term Insurance is pure life insurance. Term Insurance will come under life insurance.

Dear

I want to take a term and life insurance. im a smoker and drinker as well, will this affect my claim settlement and what should i do to avoid any problem other then mentioning it clearly

Gaurav-It will not affect during claim ONLY if you mention both the habits while buying insurance. Let your insurance company know about your habits.

hi,

Two questions I have?

Pure term insurance with Income plus option is cheaper from Max Life around 3ooo Rs when compared to HDFC click2protect plus for a 27yrs old male.

My brother is an HDFC agent and if I buy through him he gets 30% from the premium which effectively comes back to me.

So, shall i go for Max Life which is already cheaper or shall I go for HDFC offline? Which of the two companies are better as the claim settlement for Max was higher last year?

Shivam-Both are GOOD. However, the 30% commission payback by your brother is for first year. At later years the commission falls and whether your brother pass back the same to you yearly till the maturity of policy? Think and decide.

Hi sir

i am Nitin Sharma

Need to know about whether riders should be taken in term plan or not. I have read ur replies to others that rider should not b mixed with term plan…. i want to know your view for this. why rider should not be considered along with term plan.. i am planning to buy HDFC click to protect life option with disability rider of monthly income..

Regds

Nitin

Nitin-When you combine as riders, then the features and sum assured are limited than buying standalone accidental or critical illness insurance products. Hence, I advice you to stay away from mixing.

I have taken a HDFC click to protect plan in 2014. Kindly let me know whether I should proceed with this plan or should I take click to protect plus.

Regards,

Mahesh

Mahesh-Continue.

Hi Sir,

I am 29 years old(married) and i am suffering from diabetes from past 2 years and i want to take term insurance plan with HDFC clik2protect plus plan.

Which one is good for me either without medicals plan or with medal tests plan?

Whether i should tell all the details regarding my health or not?

Which one is good for me either HDFC click 2 protect Income plus option or extra life option?

or else is there any other term insurance plans especially for diabetes?

Raghavendra-If you selected HDFC, then go ahead. With medical is mandatory, it is not your option but insurance company option. However, even if they agreed for non-medical insurance, insist them to do medical. You HAVE TO inform about your current health status. Otherwise, during claim it may create problem.

Hey Sir

First of all, thank you so much for sharing all this information. It made me evaluate my decision that I made 3 years ago, when I purchased click 2 protect term policy.

My situation is bit tricky and I would really appreciateif your could guide me through it.

I bought this policy when I was in Delhi. 3 years later I got married to a British citizen and moved to UK. Later in my life I will apply for UK citizenship.

Please help me by answering these questions

1. Will the policy still apply when I loose my Indian citizenship, that is should I keep on paying the premium and keep the policy in force without being afraid that HDFC might withdraw the benefits once they know that I am no longer an Indian citizen.

2. If my policy will stay in force after my citizenship change over , for the complete term time , can I opt my husband or my child ( both being British citizens) as the nominee.

3. If HDFC will allow British citizen as nominee, and in case I die, how can my husband or child get access to the fund. Will it be transfered to their account after converting currency…or will the money remain in India.

I am really fretting over these issues because I do want to make sure that my effort and money don’t go to waste and my child is secured , while am there or not. Please help.

Thank you

Rimi

Rimi-Forget all these procedural issues. Firs think what will be the value of your HDFC Term Insurance in UK? For how long your dependents survive with that claim amount in UK? I don’t think it is too much money. Again, the insurer is from India. So your nominee must land in India to complete the process of claim. Whether your dependents do all these for you? If your answer to both these are positive, then we discuss further.

Sir

I took the insurance for 2 crore. Term plan. . Pure insurance… that will be good amount to secure my child’s life for a while and pay for her education or anything considerable that she might have to face before she starts earning for herself.

Secondly my husband can fly down to India to get the procedure done… If he could understand it. And itis upto me to make him aware of all the things tthat he might have to do to claim the sum when I am no longer there.

Kindly advise. Thank you

Rimi-In that case in my view, policy still holds good. Because in all term insurance products (as per my knowledge), there is no such clause which states that policy ceases once your residential status changes. You can opt your kid and husband as nominee to the existing term insurance. Regarding claim settlement, usually they settle the claim with transfer to nominee bank account (resident).

To get the clarity on this, I suggest you inform your change in status issue with insurance company. It is better to retain their reply for future reference. Also mention how the claim settlement be in your case (as husband is not Indian citizen).

Thank you so much. I have more clarity on this matter now. I will definitely question them for clear information. Thank you once again for guiding me through this.

Hi ,

I have already taken HDFC click to protect 3 years back but came to know accidental death is not covered n that .

So should i stop that and go for new Policy which will add accident cover or go for new accidental cover

Saurbah-Buy separate accidental insurance from general insurance companies.

Hi,

I purchased HDFC Click2Protect term insurance for 30 yrs in Dec 2013 (3 premiums paid so far).

I am confused if I should switch to the new Plus term insurance policy (being 1k cheaper anually), or continue with the old one. Kindly suggest.

Thanks!

Shekhar-Better to continue with old. Rs.1,000 difference is based on your current age and same term?

I am planning to buy 1cr term insurance from HDFC Click to protect PLUS and 1cr from Aegon Religare Term Insurance for 75 years. Is this the right thing to do or should I go wiith 1c+accidental rider with HDFC?

Nit-Go with one insurer only. There is no logic in splitting. Buy accidental insurance separately from general insurance companies.

I am having HDFC click to protect plan, but I heard that Its not having good settlement ratio as the site desplaying.

Its have silly reasons to reject claim, is that true?

I heard the examples of 26/11 attack and uttarakhand disaster where peoples claim were rejected?

Is that true? shall I stop the plan?

Jignesh-Please let me know the source of the news (rumour) that HDFC not having good settlement ratio or it is showing wrong ratio. If you feel so, then go to IRDA and check there itself. I don’t answer to rumours.

Hi,

I wants to purchase HDFC Click2Protect Plus,But i am confused abt how much premium increase after medical check up because i am diabetic patient.

Thanks

Hem-check your luck with HDFC ONLY.

dear sir ,I indrajeet singh is in bank 42yrs want to know which personal accident, which covers fully and partial disability cover is best for 10 and 20 lakhs cover. i am already in the line of uyinng of term insurancen 50 lakhs .thanks.

Indrajeet-Buy accidental cover separately. Regarding help, read my earlier post “Best Accidental Insurance Policy in India-How to choose them?“.

Hello sir’

I am a layman in investment,working as a teacher in private institute and interested in HDFC CLICKtoprotect plus plan as well as income plus plan.but i am confuse to buy which one is better for me as I earn 17500 per month. I want to know whether to buy from on line,if then how to check the fraudulence. I got the call from easy policy where I was searching and comparing policies.help me and guide me.

Nadeem-If your requirement is only LIFE INSURANCE then buy pure term insurance than any add-ons. Go for online.

I need suggestion to invest in SIP. Is it a good idea to invest for next 20years.

Franklin – 2500/month

Mirrae Asset – 2500/month

do we get the min interest of 10% even after market ups and downs. Please guide me.

Thanks,

Krishna.

Krishna-How can I know that it is good idea to invest for next 20 years or so? If your financial goals matches to 20 years period then go ahead. Also, by just naming mutual fund companies name, how can I suggest whether the fund is good or not. Each mutual fund company owns around 100+ funds.

I need suggestion to invest in SIP. Is it a good idea to invest for next 20years.

Franklin – 2500/month

Mirrae Asset – 2500/month

do we get the min interest of 10% even after market ups and downs. Please guide me.

Dear Sir,

Your post was very much helpful & I hope you can clear my doubts.

I’m working in a powerplant(handling boilers, chemicals & gas turbines) inside a refinery. My area is not that much hazardous which may lead to death or injury like permanent disability. But the adjacent units to my area are prone to explosions and that explosions may lead to such a situation in which I may be exposed to death or injury.

Now my questions are :

* What should be my risk coverage till the age of 80 if possible ( however I’ll work in hazardous area hardly upto my retirement 60 yrs) – my CTC is now approx 13 lacs. Already have 15 lacs company insurance(till I work in this company)+12 lacs LIC jeevan anand policy+Pradhan Mantri jeevan bheema yojana(2 lacs+2lacs).

* How clearly and what points should I mention about my job area in policy documents so that the claim should not be rejected in case of my death.

* Which or any points I should NOT MENTION and any reason for not to mention.

* Policy bazaar executive told that I can take LOW premium policy (pnb metlife) to save money. He told that after I mention all my job profile details, if the policy is issued that means they are agreed to give the amount even if I die as a result of accident while working.

* I’m confused that from whom I should take the policy. Should I take from LIC/HDFC/ICICI-high premiuim, birla sunlife/pnb metlife/bharti axa -low premium. Which one I Should see among premium rates, settlement ratio, features given etc.

* Who will gaurantee that claim is not rejected in case of my accidental death while working, all agents or my HDFC relationship manager tell that once the policy is issued, they are bound to give the claim after investigating. IS it true. Can I trust them. HOW TO ASSURE THAT.

* My problem in one line is : I’m ready to spend money upto a certail level but my claim should not get cancelled as my family will be dependent on that.

LASTLY, PLS SUGGEST ME WHICH PLANS TO TAKE. PLS GIVE THE LIST OR PLS WORKOUT ON THE ABOVE POINTS AND TELL ME WHICH PLAN TO TAKE. I’LL BLINDLY FOLLOW UR DECISION.

Madhusudhan-

1) Risk coverage is not required for you up to 80 years but up to your retirement age. Ideal coverage must be around 15-20 times of yearly income and you must revise it once in a five years at least.

2) You mention the profession you are into and if possible specify the details.

3) Nothing to hide. So no such suggestion to HIDE.

4) They earn commission by particular company. Hence, never trust these online portals.

5) Go with LIC/ICICI/HDFC/SBI or any particular company which you feel comfortable and premium within your budget.

6) Even GOD can’t give guarantee. Because they are into business and they look for reasons for rejection, including LIC. Hence, declare all facts properly.

7) I already answered this.

SIR,

I have taken hdfc life click 2 protect plus option.I am 22 years old.

I have rheumatoid arthritis but I didnt mention it since the agent misguided me that term plans dont need health conditions.only health insurance plans need such statement.But I still have doubt on what he said.

Please tell me whether I have to continue with this policy or I have to take a fresh policy stating my health condition.

Please guide me sir.

Kondaparthi-How strange !!! You have to mention now stating what the agent told to you (quote his name and code).

Hi Mr Basu,

The Extra Life Option means if I have 50L SA then by opting for this option the SA will be doubled in case of accidental death 50 + 50 ? . Also does the normal life option of any term plan cover accidental death .

Yatin-Just stay away from any riders or features. Instead, buy a pure term plan and add the accidental or critical illness insurances separately by buying from General Insurers.

Hi Mr.Basavaraj,

Can you pls. explain this in detail. How to get rid of adding riders and get the benefit of accidental death.

Madhusudhan-Getting rid of riders? Just say NO while buying term plan.

I did not get this –> “buy a pure term plan and add the accidental or critical illness insurances separately by buying from General Insurers”, as I understood, I’ll buy a term plan without any riders. But how to get accidental death/critical illness benefit other than this term plans, I mean which plans to take other than term plans to mitigate my risk.

Madhusudhan-From general insurance companies you can buy separately accidental and critical insurance products.

Hi,

I am a 35 year old & comes in smoker category. I want to take term insurance of 1 Cr,

but in LIC i cant make that . I want to take LIC E term plan as it is reliable. Which will be the another reliable company from which term insurance should be buy?

Thank you in advance.

Sachin-You can check with insurers like ICICI, HDFC, Bajaj, Max or Aviva.

Dear Sir I want know why the premium of Term Insurance of ICICI prulife is higher than the same of the HDFC life ins.

Praveen-It is as if asking why the price of food is different from one Hotel to another. It is entirely their decision to arrive at a premium. Hence, we don’t know why it is high.

Dear Praveen,

With ICICI Pru iCare, you need not undergo a medical examination for life cover up to Rs. 1 Crore.

We also have a claim settlement ratio of 94.10% as per IRDA Annual Report FY’14, which is one of the best in the life insurance industry.

If you need any assistance with our term plans, you can fill in your details in this link and we will have one of our experts call you.

http://www.iciciprulife.com/public/term-insurance-plans/buy-term-plan.htm?UID=25

Regards,

ICICI Prudential Life Insurance

Dear Sir,

First of all thanks for valuable information provided by you. sir my question is this. I want to buy a pure term plan from hdfc life (HDFC Life Click to Protect Plus) now i am confuse between the LIC and HDFC life Please suggest me which is better term plan or have any guarantee that claim will not be rejected in future.

Awaited you reply.

Thanks

Vinod

Vinod-Both are BEST for me. No need to worry and go ahead.

Hello,

I am 28 and I purchased the “Click-2-Protect” policy last year. My 2nd year premium is due in a few days.

I was thinking, maybe I should stop paying the premium for the plan (click-2-protect) and purchase the new plan “Click-2-protect PLUS”….the major advantage I see is the policy term > “40 years”.

For m , there is not much difference between the yearly premium (Click-2-protect > 10562 , Click-2-protect PLUS > 10771).

Is it a good plan to shift to Click-2-protect PLUS…or should I stick with Click-2-protect plan?

Paul-First understand for how long you need term insurance. Based on that take the decision.

Hi

I am looking for a pure term insurance plan.

Could you please comment on the following?

1. Which is better – having 2 term plans of 50lakhs each from two different insurers or to have a single insurance of 1cr from one insurer?

2. Is the death benifit, that is the SA taxable?

3. How reliable is it to take a term insurance from private companies compared to the goverment ones like LIC and SBI?

4. Do I need to declare my health/medical/accidental insurances while taking a term insurance?

5. While taking a term insurance, Do I need to declare the medical insurance provided by my employer?

Thanks

Prakash

Alfa-1) Better to have a single policy from an insurer of your trust.

2) No, the death benefit is not taxable.

3) They are equally reliable to LIC.

4) You have to declare only life insurance details.

5) Not required.

Hi

For point 1, do you have any particular reasons to go in favor of a single trrm insurance?

-Alfa

Alfa-What relief will it give in selecting 2-3 insurers than one insurer?

In case one has two policies, if the claim is rejected by one insurer and accepted by another then the entire sum is not lost. At least some relief. Also the rejected one can be contended basis the accepted one.

Alfa-What if after few years all insurance companies tie up to share their claim data with one another or they may track your claim through PAN number? In that case how you guarantee that a company rejected not share the info to another company? Many hypothetical questions…I feel to keep it simple as much as possible. Rest is left with you.

Dear si,

I have c2p plan cover till 65 year, I would like to take c2p plus till 75 year. I am eligible for 50L onlY. may I know the procedure to get new policy

Suman-If you already own one then why asking doubts for having second one? Follow the old procedure.

Dear Sir,

My current Age is 38 & I have already purchased HDFC clic to protect of 1 Cr in Sept 2013 for 25 Year which is valid up to Sept 2037 , Can I purchase another Click 2 Protect Plus Rs 50 Lac for next 37 Years.

My Yearly Income is around 16 Lac & I have two children 10 Year & 5 Year, Pl advice.

Hemandra-You can do so.

If I take 2 term plans from different two insurance company, then if in future insurer will be death then both company will pay amount as per Insurance ?

For Ex. 50 Lacks Insurance from HDFC and 50 Lacks from ICICI .

Paresh-Yes both the company pay the insurance amount. But do remember that while buying second insurance, you must mention the all existing insurances you have. If they found that you hid this information then the second company may reject the claim.

Dear Mr. Patel,

If you need details on our term plans, you may fill your details here http://bit.ly/iciciprulifetermplans and we will have one of our experts contact you to assist you with your queries.

Regards,

ICICI Prudential Life Insurance

Dear Sir,

My Monthly Income is 15000 Per Month and other Income (Interest Income) is 5000 per Month. Kindly advice How Much Maximum Insured I with Term Plan.

Any Which Company term plan is best ?

From Paresh Patel

Paresh-Your ideal insurance cover must be around 15-20 times of yearly income. Best plans of a year are already listed at my latest post “Best Term Insurance Plans in India for 2015-A comparative list“.

Dear Basavaraj,

Can you suggest the best pension plan.

Purushotham-BEST is yet to come 🙂

Hi,

Can you please suggest me some good pension plan?

I was thinking of going for HDFC Pro growth plan. At least the interest should be more than conventional pension plans and low risk and more guranteed than MFs… please suggest

Kulbhushan-What interest they are declaring and how it is low risk with what GUARANTY it declaring over MF?

Hi, I wish to go with click2protect with accident benefit, however I see it covers only after death. How about incase there is permanent disability. I wish to opt with life cover + accidental benefit +permanent disability. can you please suggest.

Rohan-That is a reason I always suggest not to buy accidental riders with life insurance. Instead buy it separately where you get all facilities of what you mentioned in your comment.

Thanks. now I shall go only with click2protect without accidental rider as I learned accident does get cover in basic policy. Regarding Permanent Disability can you suggest me any policy ?

In addition : I would like to thankyou for creating such wonderful forum. Appreciate it !!

Roahn-Permanent Disability option is available with accidental insurance you from general insurance.

Hi ,

Can you please help / guide me to built my finance portfolio.

My age is 32, Married, 1 year child.

My Salary : 15 lac per annum ( including tax)

Current investment :

1) Apart from PF : I add 50K to PPF annually Since last years.

2) 40 thousand EMI – home loan

3) Invested in HDFC life progrowth plus (ULIP) couple of month back for 15 years ( basically for child plan)

4) Currently have LIC policy – Jeevan Saral but I am planning to surrender next years since it will complete 5 years and I should get 100% paid premimum amount back.

5) Planning to buy life insurance term plan and accidental riders policy.

Can you please suggest if I am missing anything or need to add/remove from my profile.

Thanks

Rohan

Rohan-Why you opted the HDFC Life Pro Growth plan? Do you feel it is good or how the performance of that particular ULIP? What prompted you to buy this? Missing points are-Term Insurance, Health Insurance, Accidental Insurance, Emergency Fund, retirement planning and the most important is Goal based investment.

To be Honest..

1) I was looking for child plan and hence contacted Policy bazar, and they recommend me this. However I also did few research and learn that there is no specific child plan policy so finally I selected Progrowth plus balance as I thought it will be good investment since it has shown good growth since last 3 years. http://www.moneycontrol.com/insurance/ulip/hdfc-standard-life-insurance-HD/hdfc-life-progrowth-plus-balanced-fund-IHD389.html

2) I am planning to go for HDFC life term insurance.

3) regarding emergency fund , retirement planning ( I guess this is applicable only after age of 35 year ?) and Goal based investment..can you guide me please…

Rohan-Child Insurance? Insurance is required on those who have financial dependents. But no one dependent on your kid. So why Life Insurance at all? Retirement planning only after 35 years? Check your knowledge. Winner will be the one who start early and steadily.

Hi Basu – I am not talking about child insurance, I said somthing like Child investment plan.

Rohan-Child investment means better to choose equity than other products if your time horizon is more than 5+ years.

Hi Sir, i am planning to take 2cr term insurance for 30 yrs and i am confused between HDFC and ICICI – which one would you suggest to go for? ( i am 32 yrs old male with smoking=yes) Also if i take normal term insruance – which pays lumpsum to my family – it anyway covers accidental death – right? Additional rider for accident is good to have ? and which one you recommend then HDFC or ICICI?

also due to my job i travel a lot – so wanted to confirm if the life cover works even if i am abroad and anything happens to me in foreign land?

Manish-Both are good. First buy it and prefer to have separate accidental insurance instead of clubbing with this plan. Regarding your job nature, inform to insurance company while buying itself. So that they know in advance the risk of issuing policy to you.

Sir,

Im planning to buy HDFC Click to protect plus term insurance policy for Rs 1 crs (income plus option) for a 35 yrs tenure. My age is 25.

I have read that the settlement ratio of HDFC which is around 95% is second best in private players. Also, the solvency ratio is around 2.17 (as on Mar 2013) which is also decent per industry standards.

Can u pls advise if these two parameters are strong enuf to go for HDFC Life click to protect.

Also is a simple life option is better than income plus option. The extra premium outgo is around Rs 2000 per year.

Your views?

Rgds,

Ankit

Ankit-Both are not enough. It is your belief in company, your right disclosure and policy features along with budget that must match. If it is matching then go ahead. Regarding which option is better, please buy based on your requirement. How can I suggest which option is best to you?

sir

i have applied for that hdfc balanced pro growth policy and paid the first premium yesterday,shall i cancel it.can u pls suggest me some retirment plans so that i get good amount of pension in latter stage.pls help me sir.thank you for ur valuable suggestions.

Amar-I think the same question is answered below. Please check it.

Sir I thought of taking hdfc balanced pro wealth insurance policy.is this a good option for retirement planning. Pls suggest .

Amar-Please stay away.

My age is 30 yrs.I want to invest for next 30 yrs.if I survive after 60 yrs,do I get maturity amount?if so how much.pls suggest sir.

Amar-It is pure term insurance plan. So if you survive then you will not get anything.

Dear sir

Very Usefull Comments

I bought a insurance HDFC Click to protect plus ie) extra life option , last month . I recieved the policy document along online profile of HDFC Life.. But in my profile they not showing about extra life option ( iam paying premium for 1cr, in normal death my nominee eligible to get 1cr & in case accidental death nominee get double of sum assured, ) while asking to customer care they never saying that you ill get 2cr incase of accident death, they are saying lumpsum amount , idont know what is that lumpsum amount… till date iam confusing…. did i have done a mistake by buying private policy…

In case of any misshappening to me in future they can easily cheat my nominee by saying ———— reason….

please clear my confusion , it will help to me and every one following you..

Regards

Selvakumar

Selvakumar-No need to worry, if the policy bond mention that you opted for HDFC Click2Protect Plus with extra life option. Lump sum payable of what they are saying is equal to rider amount along with sum assured opted. So don’t worry.

dear sir,

why “OLD” HDFC Click2Protect plan is costlier to HDFC Click2Protect PLUS Life Option?

I asked the customer care executive regarding this. He said it is because company considers new mortality table for HDFC Click2Protect PLUS Life Option.

Can you please comment / elaborate on this? Because I don’t think I should buy the “OLD” click2protect plan because it is costly compared to new click2protect PLUS Life option

thanks

Patel-That might be one reason. But it is always company’s internal issue so no one can actually understand the reality.

Sir,

Could you pls elaborate the difference btw Income plus option with equal monthly income & increasing monthly income.

I want to take insurance of 1 cr is it safe for me to take 1 insurance or go for 2 insurance with a break up on 50 lac each as advised by my colleagues.

Hemalatha-I already mentioned the same above. In this option, either your nominee can enjoy the benefit at yearly increase of 0.5% per year for next 10 years. Another option is to opt for equal monthly income for next 10 years or inflating at 10% of Sum Assured. But do remember that, immediately they pay you the sum assured opted also.

Thank You for illustrated information on this plan.

I have a query. I have purchased the HDFC click to Protect plus with income plus option(increasing). But in my policy Document they have mentioned that we will not pay death claim in case you “Taking part or practicing for any hazardous hobby, pursuit or race unless previously agreed to by us in writing”. But in online brochure they have mentioned this condition for accidental benefit only. that why i am confused about that. can you please clarify that.

thanks

Neeraj-I am not sure about whether you opted accidental benefit or not. Also If you have doubt about policy wordings then better to contact HDFC directly.

Thanks for the article. It helped me in understanding HDFC term insurance plans

Sir,

I would like articles on health as well as critical health insurance. Which should come first, term insurance or health insurance?

Bhagwan-Both are equally important. Because both are meant for uncertainty of your life, which we don’t know when it happens to us 🙂

Excellent site……………. Extremely helpful for providing valuable information to the investors. The reveiws provide a better understanding of the finanacial instrument the investor is about to invest.

I have already invested in Rural Postal Life Insurance’s (RPLI) gram Suraksha in the year Nov 2011. At that time I was unaware of the facts that I am aware today. Can you please guide me on this policy. The benifits of this policy are not mentioned in the policy document. Thanks in advance.

Regards

P.S.Srinivas

Srinivas-Please go through policy document. They must mention it.

Hi Basavaraj,

Excelent article.

I’m looking forward to buy a new Term insurance. Previously i was insured with DLF under DLF Primerica policy. But since i saw an article by you which had the claim settlement ration for 2012-13, i have decide to cancel this policy and buy new one.

I haven’t done much research yet.

My aim is to cover as many riders as i can pay for and as are relevant to my lifestyle.

I’m thinking of buying the HDFC click2protech income plus option with Extra life cover.

I think the extra live cover is available with income plus as explained by you in a comment above.

My dilema is, will this be sufficient or are there any more offline plans that provide better riders?

My opinion is that insurance and investment should be kept separate.

Hence opting for Term plan.

Please advice.

Thanks in advance 🙂

Is accidental benefits provided with income and income plus option? .. I mean, can extra life options be combined with income/income+ option? …

Jaydip-No you can’t. That accidental rider available only with Income Plus Option.

Hi,

I am curious to know why they have 3 different benefits declared in case of policy holder’s death?

For ex: The statement is:

Higher Of:

* 10 times the Annualized premium or

* 105% of all premiums paid as on date of death or

* Sum Assured.

If I have taken a policy wherein sum assured is 50 lakhs, annual premium is say Rs.10,000 and term is say 40 years, what would be the individual amounts in the above 3 clauses?

Because, I flt that in any given case, it is sum assured(3rd option) that would be exercissed as an option.

can you please give me a scenario where first two would be applicable?

Hemanth-The showed such benefits only to make sure than insured get maximum benefits. The benefits depends on which year insured die once policy period starts. So how can you judge that now itself? But my general option is always SA will be at higher end than the others two. So Sum Assured will be the benefits that you will receive.

Dear Basavaraj,

Once again a very relevant and crisp article.

I personally believe that HDFC has better practices among the industry peers. what is your take on that. How will you rate HDFC claim settlement process with say LIC, ICICI etc. In short, what do you think about HDFC term plan if one does not have to worry about premium or are there other better options.

Thanks.

Shalabh-In my view all insurers are good if you benefit them or they find some fault in you. So buying term plan without hiding anything and being with company of your choice which matches your features and budget is best. But in case of claim settlement then are 3-4th place I think.

Hi,

I am Srinath from Hyderabad and am about 28 and single and i want to save 1500 to 2000 monthly.

So please help and suggest me to choose the right policy which gives me the assured returns at least what i have invested and high returns for my investments.

Please help me which policy is best for the Life insurance for me.

Please help me in this.

Srinath-ASSURED RETURNS along with HIGH RETURNS? Sorry friend 🙂 You need to compromise anyone on this.

Hello Sir,

I always read you blog and go through it. Can you compare this HDFC clickTo protect with e-term LIC (new).

Please suggest which one is up-to mark or good to take. As I’m buy SA of 50Lac and my age is 25.

I already take HDFC Ergo Health Insurance which cover my medical of 3lac and 10 lac in death which is going to complete two year in Jan2015. I’m also think to add in critical disease too this plan. Should I go for it.

Why the insurance company ask about that we had any insurance or not and specify there detail. What is the scene behind of it.

Thanks,

Anshu-Both are good but LIC’s plan is costly without any riders. So choose according to your requirement. You can view my review of LIC’s online term plan here “LIC’s online Term Plan e-Term-Review and Benefit“.

They ask for existing life insurance details to arrive at exact life insurance requirement of an individual. Otherwise a person who earning just around Rs.3 lakh may ask for term insurance of Rs.1 Cr.

Hello Sir,

Without any riders means, I didn’t get it. Or it means these options (Life, Extra Life Option.)?

I’m reading the enclosure of HDFC Life Plus. I found this statement can you please explain.

<<<>>>

The statement is:

Higher Of:

* 10 times the Annualized premium or

* 105% of all premiums paid as on date of death or

* Sum Assured

In the event of the unfortunate death of the life assured during the policy term and

” if all due premiums have been paid”, what it means?

the above mentioned Death Benefit will be paid to the nominee in the form of a lump sum.

Anshu-Riders in this plan is offered with Extra Life Option. Yes “if all due premiums have been paid” means no dues or policy must not be in a condition of lapsed.

Dear Sir,

How can you convert the old plan to new plan ?

By stopping payment of premium under old plan and buying a new plan ?

Regards

Anil A Shah

Anil-You can’t convert it. You need to buy new plan and cancel the old (obviously no surrender, paid up or survival…so by stopping the premium payment). But do remember that to cancel the old one only after having new one in your hand.

Thanks Sir for your review.

I have one query. If someone is having existing Click 2 Protect (old plan), can he convert into Click 2 Protect Plus plan. If No, so it is worthwhile to surrender existing Click 2 Protect (old plan) and buy new Click 2 Protect Plus plan?

Abhishek-You can convert the old one to new one. But yes you can go to new one. Do remember that cancel only after getting new one. Otherwise you may loose both. By the way may I know the reason of your plan to switch to this plan?

Reason to convert into new plan – 1] Cost

2] Monthly income option after death apart from S.A.

Abhishek-In that case first buy the new plan. Once it is issued then go ahead for cancellation of existing.

Sir,

Thnx for this feedback.

I need one more help so will the other readers be .. can you evaluate HDFC Life Click2Invest an Online ULIP designed to reduce the overhead charges drastically to just the FMC. Your feedback here will help me.

Rgds,

Shridhar N

Shridhar-My take

1) When you invest in ULIP or Endowment your required life insurance is at risk. You will select the insurance based on your premium paying capacity. But never look at the real value of insurance. So ultimately under insured.

2) Charges may be lower. But for a common person it is hard to track the fund performance.

3) They may offer you switching options. But never offer you come out of the product (easily), which is not the case of mutual funds. If fund not performing well then easily you can switch over to other fund of same AMC or to different without any hurdle.

4) In case of death you will get highest of Sum Assured, Fund Value or 105% of premium paid. But if you opted for Term Insurance with any other pure investment product then you receive term insurance sum assured and along with that the invested valuations as of that day.

Rest is left with you.

Seems like HDFC Life is enjoying the term Click 2 and launching every category insurance plans with this initials. I have gone through that Click 2 Invest plan. This is like any-other ULIP plan with few less charges. As ULIP plans are complex in nature it is very tough to track and follow after investing, as Basu said. Better to stay away from them and follow the typical investment options.

Santanu-Thanks for sharing your views 🙂

Sir,

I have just started earning, and I save 25000/month. Please suggest me how to plan my investments, regarding everything PPF, Insurance, etc.

Thanks in Advance

Saptarshi-This is too wide question. I can’t answer without knowing your specific requirement.

Can I take the HDFC Click 2 Protect Plus term plan from HDFC Agent or I need to buy online only? Is there any difference in claim settlement ratio if purchasing online or from agent. Please reply..

Krishna-Buy it online which is cheaper. Also, there is no difference by buying from agent or online. In fact the difference is, online buying is cost effective.

Thank you for the quick reply. Really very nice to see the quick reply.

I seen the very bad reviews by taking online. They wont respond properly even after calling many times and need to wait for the policy document for 45 days.

Agent said that he is charging 700/- extra to take care of all the processing till we get policy handed over to door steps. He said that he will be the complete responsible to get the bond in 25 to 30days.

Agent said that he will be available and help us if any issues at the time of claim if any risk happens. Please suggest sir.

Krishna-Waiting for policy document depends on the complication of case. It may sometimes take around 2-3 months. Getting policy document is not a big deal. The actual problem arrives when the claim happens. Will the so-called agent be in same industry for next 20-30 years to help your family? Agents claim all rosy pictures during buying. Also, charging Rs.700 from you to get policy document be delivered to your doorstep is illegal. He is purely misguiding you. Beware !!

ohh ok.

Online cost – 13400/-

Offline cost – 14100/-

Need to pay for next 40Years itseems.

Thank you for the info.