What is the difference between Tier 1 and Tier 2 Account in NPS? Many Government employees or others subscribed to NPS. However, the majority of them do not know what is the meaning and difference of Tier 1 and Tier 2 Accounts of NPS.

Let us first brief about NPS.

NPS or New Pension Scheme is a retirement product launched by Government of India. It is managed by PFRDA (Pension Fund Regulatory and Development Authority). This product helps you to create retirement corpus.

Any citizen of India (whether resident or NRI) can invest in this scheme. The age of the subscriber must be within 18-60 years of age. However, an individual of unsound mind or existing members of NPS are not allowed to open new account.

Therefore, an individual can open only ONE NPS account.

How to open NPS Account?

You have to fill the application form and provide the relevant KYC documents at your nearest POP-PS (You will find the list in PFRDA portal).

However, if you want to open new Tier 2 account, then the process is different. You have to approach POP-PS with copy of PRAN (Permanent Retirement Account Number) and Tier 2 activation form.

The subscriber has to make the first contribution while opening the account. Minimum contribution for Tier 1 is Rs.500 and Rs.1, 000 for Tier 2.

Note-Now you can open NPS account online and also contribution can be made it online through eNPS portal. Refer my latest post on the same “eNPS – How open and invest in NPS account online?“.

What are the investment choices?

Asset Class E-Invests predominantly in the equity market. You may say high return and high risk.

Asset Class C-Invests in fixed income instruments other than Government Securities. Risk is medium in this category.

Asset Class G-Invests in Government Securities. So lower risk and lower return.

Along with that, you have two different options to choose regarding allocation.

- Active Choice-You have the option to choose your investment among E, C or G asset classes. However, if you opted for E asset class, then the maximum equity exposure is 50% only.

- Auto Choice-If you don’t want to take active part in switching asset class, then PFRDA will do it according to your age. It is predefined.

You can change both scheme preference and investment choices at any point of time. But it is allowed only once in a year.

Please remember that there is no ASSURED RETURN from NPS.

Your retirement fund will be managed by fund managers appointed by PFRDA. Currently there are six fund managers. They are as below.

ICICI Prudential Pension Funds Management Company Limited, Kotak Mahindra Pension Fund Limited, Reliance Capital Pension Fund Limited, SBI Pension Funds Limited, UTI Retirement Solutions Limited, and Annuity Service Provider (ASP).

You can change your fund manager at any point of time. This change is allowed only one time in a year.

Along with that, PFRDA tied with IRDA approved Life Insurance companies to pay the pension once the subscriber reaches 60 years of age. They are as below.

Life Insurance Corporation of India, SBI Life Insurance Co. Ltd., ICICI Prudential Life Insurance Co. Ltd., Bajaj Allianz Life Insurance Co. Ltd., Star Union Dai-ichi Life Insurance Co. Ltd., Reliance Life Insurance Co. Ltd. and HDFC Standard Life Insurance Co. Ltd.

How to exit from NPS?

Once you attain the age of 60 years, you can withdraw up to 60% of accumulation as lump sum and rest 40% will be converted into pension.

If you want to exit from NPS before 60 years of age, then you are allowed to withdraw only 20% accumulated amount. You have to buy a pension product with that 80% fund.

However, in case the death of the subscriber, a nominee is allowed to withdraw 100% of NPS.

I wrote a post on recent changes about new withdrawal of exit rules of NPS. Refer below post.

This is the brief about NPS.

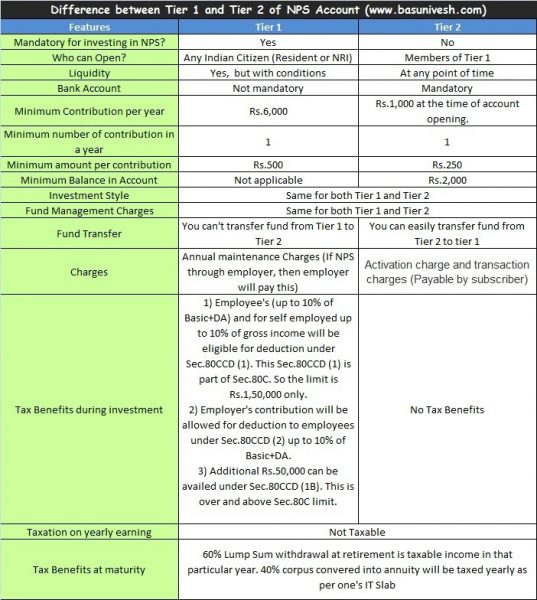

Let us come back to the main purpose of this post. I tried to put it the difference in below image.

Note-

-As per recent PFRDA circular dated 8th August, 2016, the minimum contribution in Tier 1 Account is now reduced to Rs.1,000 a year. There will be no minimum investment limit for Tier 2 account (Earlier, it was Rs.250). Also you no need to maintain the minimum balance in Tier 2 account (Earlier, it was Rs.2,ooo).

-From Budget 2016, the 40% withdrawal at the time of your retirement from NPS will be tax-free. Rest 60% of the corpus will be treated taxable income as per old rules. Hope this above table cleared your doubts.

-Effective from 1st April 2019, if Central Government Employee contributes to Tier 2 account, then his such contribution will be eligible for deduction under the Sec.80C limit of Rs.1.5 lakh.

Also, the Central Government will contribute 14% of Basic+DA to NPS rather than the earlier 10% of Basic+DA. However, there is no change in employee contribution rules.

Conclusion-You notice that when it comes to taxation, NPS is one of the worst products. Everybody concentrating on the tax benefits of NPS while investing. However, they forget the tax issues at retirement or at withdrawal. Along with that, liquidity is an issue with NPS. For Government employees and corporate employees, no option but to invest.

Thanks for wonderful article. I have a query. I am 53 yrs old government employee. Investing rs 5 lakh in my GPF account. Rs 1.5 lakh in my PPF. My equity mutual fund investment is around 50% I don’t want to increase it.I have rs 1.5 lakh pm in hand for

investment.where should I invest (1) in GPF where excess of 5 lakh will be taxed (2) NPS Tier 2 auto conservative (3) long term gilt fund .. time period 4-7 yrs

Dear Sundeep,

Hard to say BLINDLY without knowing your risk appetite and financial life to the fullest.

What will be the income tax on capital tax gain after switching from tier 2 to tier 1

Dear Sundeep,

There is no clarity in this aspect.

Sir, the new tier II tax benefit with three years lock in period is notified for central govt employees, so it is not applicable for the state govt/psu/psb employees?? Does the state govt/psu/psb employees is under the tax exemption benefit for the employer’s contribution under 80ccd(2) or not??

Dear Sumit,

As of now, the tax benefit under Tier 2 is for Central Govt Employees. Regarding your next question of Sec.80CCD(2), the answer is YES.

Dear Sir,

Can I withdraw the lump sum amount after one or two years retirement age. If I withdraw as said how the taxes are applicable i.e by default lump sump amount 20% of 60% is taxable at the retirement age or whenever withdrawal year. Because at the retirement age generally will get more money and adding other money would increase the tax detection.

Regards,

karthigeyan.D

Dear Karthigeysan,

You are not allowed to withdraw as per your wish from NPS Tier 1 Account.

I am trying to do an online contribution in NPS. I have registered to Tier 1.

Now in payment page I see below options. Which option should I select to do the payment. Please let me know.

NPS Subscriber Type* NPS CRA NPS Swavalamban

Dear Ravindra,

NPS CRA.

Thank you very much sir for the response.

PRANAM SIR,

i m a govt employee since 4 years. and i have an nps tier 1 account. if i leave or resign from the job then will i get the money that i have contributed. how will i claim i. pls guide.

Dear Aparna,

Refer my earlier post “Latest NPS Withdrawal Rules 2018“.

Is investing in NPS Tier 1 is really a good option as of now.

Dear Vivek,

Sadly NO.

Hi sir,

I have one query is it good to invest in nps tier 1 for future reference.

Dear Sanjay,

As per me NO.

Dear sir,

I contribute in ppf and vpf. Please let me know if I should opt to go for increased contribution in vpf or nps. My age is 41yrs and want to invest additional 6k. Please guide. Thanks.

Dear Kirti,

Better opt VPF.

Dear sir, it was a very informative blog, thanks for that, I am a govt bank employee, covered under old pension scheme, should I go for nps to get extra 50000 tax benefit? Is there any other scheme from which I may get that benefit? Should I go for atal pension scheme rather than nps? Plz reply.

Dear Abhishek,

Never invest in a product just for the sake of TAX SAVING.

Hello Basavaraj Tonagatti ji……..

I’m Anoop from Lucknow, U.P. I want to know that ” can I start My carrier as a website owner”, I mean How much and how I can earn from a website in starting. Please say some facts My Contact No.-7607616354

Dear Anoop,

It is the content that will make you earn. By mere owning a website will hardly give you any income.

DearBasavaraj

Thanks for this valuable information …I want to know i worked for govt org during which my NPS account including my and govt contributions stands around 8lakh but i am not working in the setup for last 1 year and Is there any possibility i want to withdraw full money as i need this money for funding my work.

Dear MS,

Refer my latest post “Latest NPS Withdrawal Rules 2018“.

Working in a private firm. At this point i donot have NPS account. Have PPF account. I have investment and other contributions for 80C. Now i want to save tax. Will investing under NPS for additional tax waiver of 50000 a correct option. If not pls let me know other options.

Dear Kala,

Never invest in a product just for the sake of TAX saving.

Thanks. Can you pls let me know other alternate options for tax saving and investment for future. M 40 years.

In order to save tax, what are other methods? If not NPS for the additional 50k, then what would you opt for?

Dear AK,

Do you invest to save tax or to achieve your financial goals?

Nice article! I am 40 years old. Is it still a good time invest in NPS for the sake of investment? Should I invest more in Tier 2 compared to Tier 1? And which option is best for Tier 2 looking at the current market?

Dear Abhay,

Stay away from this product as of now.

How can i invest online in existing NPS A/C?

Dear Ujjwal,

Using their App, you can do so.

Is it necessary to invest immediately after get the pran or there a option to skip time as I wish? Can any one change the invest amount anytime according their economy?

Dear Kiran,

No such obligations but yearly minimum contribution condition have to be fulfilled.

Is the payments in NPS account auto from my bank account? Or I have to pay separately every month.

Dear Kiran,

You can set in auto mode.

Dear Sir I am aged 47 working in nationalised insurance company and having pension facility at superannuation. I am in 20 percent tax slab. If things remain unchanged, 30% slab will be applicable next year. To save income tax, should I go for NPS ? I am presently investing150000 for 80C benefit and 2 lac for housing loan interest.

Dear Akshat,

Never invest in a product just for the tax saving purpose.

Dear Sir, what’s wrong with investing in NPS for mainly ( but not only) tax saving purpose that to only 50000 per year for 30% tax payers. Because as I understand they can at ‘minimum’ saving 30% of 50k = 15000 which would otherwise be lost in terms of ‘income tax’. Now let’s say this 50k earns minimum 8% returns in that FY, then also it’s beneficial. Request your explanation on that regard.

Dear Jay,

If you are OK with LIQUIDITY ISSUE, NO CLARITY ON PORTFOLIO and TAXATION at maturity, then you are FREE to invest.

Sir, I m working in Bank for the last 7 years, I am planning to leave the organization before completion of 60 years, as on today my approx balance is around 8 lakhs. how much will I get, if I resign in a year or so. Please advice

Dear Shyam,

It depends on the returns how much it generates.

Sir, my mother’s present age is 60years. She is a govt service holder and will retire after 2years. Is NPS account will be beneficial for her?

Dear Srabani,

Sadly NO.

ALSO PROCEDURE FOR OPENING NPS ACCOUNT

Dear Ajay,

You can open the NPS account by visiting the nearest NPS Point of Service.

I am age of 55 years earning appx 13 lacs per year from interest and rent and invest 1.5 lacs in ppf regularly pl suggest should i invest in NPS and if yes then in which scheme and how and benefit thereon .

Also thesame question for my son of age 26 yers and having same income and investment.

Dear Ajay,

It is not at all useful for you considering your age. Stay away from NPS.

Sir my son is an Officer in a Nationalized Bank. His age now is 28. Both he and his employer bank are contributing to NPS. As an additional retirement benefit, is it possible for him to open another NPS account and like PPF contribute independently to create a healthy retirement corpus.

Dear Rana,

As per the rules, one person can have one NPS account. But do you feel NPS a great product for retirement?

Is it mandatory that one should withdraw 60 percent of the corpus after 60 years age or retirement. Can’t it continue with the corpus and draw pension on the entire corpus.

Dear Srinivasan,

It is not mandatory.

Is it better to invest in NPS to avail extra Rs. 50000/- deduction from taxes or pay taxes now itself as ultimately NPS returns are taxable?

Dear Shubham,

Never invest for the sake of TAX SAVING ALONE.

I am planning to open eNPS a/c, I am working as Software Engineer.

Which a/c shall i open – Teir 1 and Teir 2 both or only Teir 1

Dear Sahil,

You can open Tier 2 account only when you open Tier 1.

hi

i want to invest rs 2000 for next 24 years.

shall i open tyre I or tyre II.

which can give me max returns

Dear Jyotiba,

Stay away from a product which LOCKS your money for so long.

Ji

Nps tire 1 account.

My monthly contribution 500.

Can I change my monthly amount 2000.

Dear Raju,

Yes you can change.

Hi sir, Thanks for this useful info. I worked in IT company till september for 2 years and now i am joining in central govt. can i transfer EPF to this NPS tier 1 account?

Dear Ramki,

Sadly as of now it is not possible.

How many maximum transactions allowed in Tier1

Dear Sasikala,

There is no such limit.

I am a govt employee and my employer’s contribution towards NPS is not counted while calculating gross salary in Form 16. Am I still allowed to avail such contribution under section 80 ccd(2)?

Dear Avanti,

YES.

Thank you for your help.

will this not be getting deduction even if it is not included in the gross?

Dear Avanti,

You have to show it under gross.

Oh..that means in gross, I add GoI contribution (as not included) and then I take deduction u/s 80 ccd(2).

Dear Avanti,

Please check with your employer.

Withdrawal:

One can withdraw the entire accumulation from EPF at the time of retirement at the age of 60 while in case of NPS, 40 per cent of the accumulation have to be compulsorily invested in annuity.

before 60 which amount is available for withdrawal in both

And what amount is available for nominee in case daith after 65 age.

Dear Ravindra,

Refer my latest post on this “Latest NPS Withdrawal Rules 2018“.

I am employee of private IT company. For additional tax benefit I am planning to take this NPS. Is that correct or wrong decision? Am I eligible for Tier 1? Because some one from SBI told me that individual not able to apply for tier 1.

Since already my employer detecting some amount for my EPF. Is this will merger with that or separate one?

Dear Babu,

Yes, you can invest in NPS. But never invest in this product just for additional tax benefits purpose. NPS is separate from EPF and you are eligible for Tier 1 and 2 accounts.

We can max widraw 60% from NPS but what will happen with 40% Annuity…..will i get monthly intereston this 40 % .. can i widraw this 40% also,, or after me what will happen with this 40% amount plz describe…

Dear Vikas,

Refer my latest post on this “Latest NPS Withdrawal Rules 2018“.

Can we withdraw 25percent value on NAV on my contribution

Suppose my and employer contribution is total 260000

and NAV is 60000

Total fund 320000

How much i can avail after 3 years of withdrawl?

Dear Sam, Such 25% withdrawal is only for your contribution and not for your employer contribution. Also, such withdrawal is allowed for higher education of his/her child including legally an adopted child, the marriage of his/her child including a legally adopted child or property purchase.

Hi Sir,

Thank you for the detailed explanation. I would like to understand what does this statement mean – “Please remember that there is no ASSURED RETURN from NPS.”

Amith-NPS will not give you guaranteed returns.

Is investment in Tier 1 and Tier 2 both comes under additional 50k saving from Income tax ?

Ashish-Only Tier 1 will comes under IT Tax Benefits.

My contribution in NPS tier 1 is being running from last 6-7 years. Now I want to avail partial withdrawal from this. How much amount can I withdraw and what is the options available for withdrawal for me and advise me how can I repay it?

Suresh-Refer my post “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

As per recent rule, Can subscriber withdraw

25 percent of subcriber contribution only ?

Or

25 percent of subscriber contribution +NAV ammount?

Which equation he can derive 25 percent withdrawl?

Ricky-It is 25% of subscriber contribution.

Hello sir,

I am Samson Shirguppi currentlyworking in Indian railways and having tier -I account and my query is can I transfer the account to tier – II and will my whole amount transferred to tier II from tier I account and can I withdraw whole amount from tier II.

Thanks in advance

Samson-Please refer above post properly. You are not allowed to transfer money from Tier 1 to Tier 2. However, the reverse is possible.

HELLO SIR I AM 32 YR OLD PRIVATE JOB SALARIED PERSON WHAT IS THE BASIC DIFFERENCE INTO TERI I AND TIER 2

AND WHAT IS BETTER FOR FOR ME.

PLEASE SUGGEST

Rupesh-Difference is already explained in above post. Based on this choose which is best suitable to you.

hi I have opted for 5% of my basic salary +50000 in NPS. I want to invest minimum amount in NPS given that I now realize that it is not a great tool. what is the minimum that I can deposit. What happens if I stop depositing even the minimum amount?

Anjali-Refer above post for the minimum contribution. Yes, you can stop at any point of time.

The eligible age to open an NPS account is given as 18-60, so can a student open an NPS account?

Is it necessary to have a job or an employer to open NPS account?

If possible to open NPS as a student should I go for Tier1 or Tier2?

I am 23 years old and I was curious about it

Tel-Yes, anyone can open if he is 18 years old. One must not be necessarily in job or earning. Choosing Tier 1 or Tier 2 is left with you.

I have invested some amount in nps tier1 on 31st march 2018 but credit of units will take at least 2 working days.can I claim for exemption in tax in FY 2017-18.

Upendra-But the statement shows as per the credit date. Then how can you prove that?

If someone resigned after 10 years of service ?

Can he get pension through Nps ?

If yes then how much proportion ?

Ricky-Many don’t know that NPS will only help you to accumulate retirement corpus but will not give you pension. Hence, from the accumulated corpus you have to buy an annuity product.

I m salary person, sir inform me to Tier-II is where account from amount dedution…

Sameer- Can you elaborate more about your doubt?

Hi sir

I m a govt employee 10 percent of my basic and DA is deducted in NPS. Can I get tax benefit above 150000 under section 80ccd(1b)??

Santosh- As per me, yes.

Hi Sir,

My self shekhrappa Adaragunchi, currently am 62 years age now . I was retired from govt sector last year nd I got 60% my nps amount but I didn’t get remaining 40% as it’s part of anuraity. could you please help me how I can withdraw that 40% or else how I can invest that 40% in any of the pension fund so that I will get some amount monthly as pension.

Please help me in this,am not able to understand this nps concept exactly

Shekharappa-You have to buy an annuity product from the remaining 40%. Please be in touch with PFRDA for the same.

Hello sir

I was working in a govt organization so was entitled for Nps scheme. Now I have left the job after serving 6 years and moved to Canada. I want to withdraw my Nps but in the form it is mentioned that I can withdraw only 20%. Why can’t I withdraw my 100 percent and if I want to do so what should I do as Iam settling in Canada so don’t want to stuck my money. Please help

Amandeep-Refer my post “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

What is the monthly invest limit in tier 2 account.

Hariom-There is no such maximum limit set.

Thanks for the detailed article. Couple of questions, i am 32 now, for suppose I deposit 2500 per month in tier 1 account which will be 30000 per year and I do it till I’m 60. After that if I do not want to withdraw any money and use it completely to buy annuity, will it be a good option. So I don’t have to pay any tax as I’m not withdrawing and only taxable money will be on the pension that I will receive.

And I read above that if contribution is through employer then it’s fixed with some percentage, I work in a private company so can I apply for nps without my employer involvement, so that I can either save more or less than the fixed percentage.

Harsha-You can do so that to buy the full accumulated corpus be utilized for buying an annuity. In your case, it is up to you to contribute to NPS.

Thanks for the quick reply. What if my employer is involved, then do I have to save more?

Harsha-Yes.

Thanks for your reply.

To avoid withdrawal limit constraints from tier 1 a/c …can I contribute min amt in tier 1 and max amt in tier 2 ?

Say 1000 in tier 1 and 49000 in tier 2

Rupesh-You can do so.

Hi Sir

After reading your views I think you are not in support of this NPS so wanted to know which are the better tax saving options as I am in higher tax bracket and exhausted 80c & 80D already.

I am planning to invest 50k this year also to save tax.

Regards

Leena

Leena-Invest to reach your financial goals rather than JUST TO SAVE TAX.

Hi,

Im salaried person and investing in APY from last 2yrs but here want to ask that can i open both NPS and APY ??? Secondly it will works on single PRAN???

Rahul-Yes, you can both. Regarding PRAN, check with PFRDA.

i want to ask few question-

1- I am a govt employee. is It my choice how much to invest in NPS? can i invest 1000 Rs.? (other employee deduction is 10percent of their salary).

2- If me and my wife both are died at the age of 55, then who will get that money????

Akhil-1) It is usually fixed as per your salary structure.

2) It will be to legal heirs.

Sir

I want to purchase NPS for Rs 25000/-only. I have some following inquiries.

1) I am going to choose tier-I, Is is allowed rebate under income tax 80CCD(1b)?.

2) I am working with private organization having PF accounts- Is i am eligible for purchase NPS?.

3) The contribution per year is mandatory up the age of 58 for Rs 25000 or amount may be decrease if yes then min amount?.

4) Procedure for withdrawal?.

5) How to calculate maturity amount?.

Hence you are requested kindly clarify the matter so that i can purchase the NPS.

Thanking you

Regards

israr ahmad

Israr-1) Yes.

2) YES.

3) NO.

4) At retirement, you have to process it by contacting PFRDA.

5) You can view the statement as and when you need. Hence, no question of calculating maturity value.

Dear Basavaraj,

Hi. I am Dhilip age 35 years and planning to invest in NPS scheme. Need some suggestion in tier 1.

My Main intention is tax savings as I have exhausted all possible tax options like 80C, Medical, Home Loan.

I am getting into 20% Tax bracket from this year and hence thought of savings tax. However Only thought of NPS as an option as of now to save tax. Planning to invest 50 K per year as I would get additional tax savings per year on 50K.

Hope this is a good option for me.

Dhilip-Never invests for the sake of TAX SAVING ONLY. Now you are saving few % of tax, but whether you did some research that how NPS will be taxed while withdrawing money??? I hope NOT. Please do research and let me know what you learnt.

After submit of documents to claim pension how much time EPF office taken to release pension with arrear?

Ricky-Hard to say.

Hello Basvaraj,

I have a couple of questions

1. What is the difference if I invest in Mutual Funds vs investing in NPS. For both the options, I am looking for a long term investment to build a corpus for my retirement.

2. Online investment in NPS is possible through OTP only and using India mobile number. I plan to move abroad and still want to continue with NPS contribution. How can I do that?

Rajesh-1) In MF you have free hand to go away at any point of time. However, in case of NPS you stuck with few fund managers with LOCK IN and also the taxation at maturity is a clutter.

2) Let them develop that feature in future.

Thanks Basavaraj.

Based on this I believe the best option would be to prefer MF instead of NPS.

Since I have already accumulated some corpus over the last one year in NPS, what would happen to that if I stop investing in NPS. What options do you suggest.

Rajneesh-I replied to your email.

Hello Basavaraj,

Could you please forward this email to me. It would be really useful for me. I left government job and not contributing to NPS anymore. I really wonder what are the options I have since I am not working in Government sector.

Best regards

Dear Vijaykumar,

You will get that notification from PFRDA portal or can contact POS of PFRDA to fetch the same.

Fantastic and nicely explained Sir.

I am a first-time investor and just got the acknowledgement number to open this account but didn’t get the account opened till now as i have many doubts. I am working in a private sector in Assam (Maths Teacher and not a Businessman) earning Salary between 5-7 lakhs per annum want to know certain details from and would be of great help if you suggest.

Being new investor to NPS having absolutely no idea about it please clarify the following:

a) who is the best pension fund manager, can be trusted upon?

b) which is the best investment option auto or active?

c) which type of life cycle fund will suit to my earnings?

Working in a private sector is not like working in a government sector to have worry free life. So think and help me to plan so that i can open this account immediately.

Please, please and please reply Sir.

Thanks & Regards,

C.S.Shankar.

Shankar-a) To be frank there is no such difference. You may choose any one of your choice or refer my post “NPS Returns for 2017 – Who is best NPS Fund Manager?“.

b) It is left with you and hard to suggest anything BLIDNLY.

c) It is left with you and hard to suggest anything BLIDNLY.

But do you think NPS a great product to invest for your retirement? Think and decide.

Hi Basavaraj.. Agreed. NPS is not a great option for retirement investment; in that case, what are the other better options to look upon? Could u pls suggest?

Renganathan-Create your own corpus by utilizing equity and debt product based on your retirement time horizon.

When we claim pension through form 10d in which present address of the applicant is according to present address and in passbook address is old rental house.

Differs address

Will it be the point of rejection of form 10 d?

If yes

Then what is the remedy?

Ricky-As per me NO.

Pan card required with form 10 d after 19 yrs service?

Ricky-What is an issue for providing PAN card?

Just want to clear my point that recently my sister has compiled pancard during fund claim after 5 yrs service?

Same pancard will be required for pension claim or not?

Plz clear my point

Ricky-Same one.

I want to exit from NPs opened tier 1 in 2015

Please advise

Om-Refer my earlier post “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

Csn a state govt employee invest in 80cccd(1b)50000 who already eligible for pension

Aditya-Refer my post “NPS Tax Benefits – Sec. 80CCD(1), 80CCD(2) and 80CCD(1B)“.

Hi,

I had a query regarding tax savings from investment in NPS.

If I’ve already exhausted the INR 1.5 Lac limit under 80C by investing in ELSS funds, will I get any additional deduction by investing 50k in NPS?

Thanks,

Rahul

Rahul-YES.

In nps, corpus means:

return on investment+deduction ammount+employer contribution ?

Now we can withdraw 25 % of this total corpus?

Or exclude return on investment

Ricky-It is 25% of your contribution ONLY.

I have two queries about EPF

A person resign job at the age of 57 years doing 20 years of service..due to dcocumentation 4 years passed pension still not start ..Now her age is 61..how much porportion she will get pension..according to present norms?..before march 2014 (resigned date) she’s basic ia 6500

CAN she get interest with pension arrear of 4 years?

Ricky-Hard to say as there is no clear notification of how EPFO compensate in such delayed settlement. Better to knock EPFO through EPFO Grievance Cell online.

Hi Sir, Is CPS different from NPS. Being a govt. employee am I eligible to get a tax benefit under 80CCD1B

Kalavathi-I am not aware about CPS. Hence, hard for me to comment.

If women claiming epf pension after 20 years..he doesnt have FIR/DEATH CERTIFICATE of missing husband more than 7 years..can she provide affidavit through decleration that if he comes then he doesnt have right to claim pension after my death..affiadvit is allowed as per rule or not

Ricky-It is legal matter. Hence, better to consult lawyer.

HI Basav,

I am currently 30 years of age, working in private organization (IT) hence no pension. I invest in SIP’s, have a home loan going on, is NPS(Tier 1 -2) a good investment for me. If yes, how much should I invest. And if NO, can you suggest some other way.

Prateek-Avoid products which are branded as Retirement or Pension. How much to invest depends on you.

Hi – is it compulsory to withdraw 60% as lump sum withdrawal at the age of 60? Can we convert the entire 100% corpus into annuity? If we convert the full 100% into annuity, what is the tax that will apply on the pension received every month in that case?

Shiv-Not compulsory to withdraw 60% of the corpus. If you convert 100% into an annuity, then the whole monthly annuity is taxable income like salary (as per current tax treatment).

I have opened TIER 2 acount and started contribution.my doubt is on 1.2.18 i have observed the nav of my pfm is low and made my contribution to get more units.

Do nsdl purchase units in realtime for that NAV ? Or is there any soecific date or day for ourchase of units?

Murali-It is real time based on daily NAV as and when they realize your money.

About EPF

My husband is missing and i worked for 20 years as tacher in pvt school.And fir was not lodged that time 26 years ago.now they ask for death certificate ..undew which law they ask for death certificate..since its my contributuon towards pension infact they already release my fund..plz suggest remedy to start my pension

My second question is i attain my age 61 now and resign job 4 years bach ..how percent of pension now i can get?

My husband is missing and i worked for 20 years as tacher in pvt school.And fir was not lodged that time 26 years ago.now they ask for death certificate ..undew which law they ask for death certificate..since its my contributuon towards pension infact they already release my fund..plz suggest remedy to start my pension

My second question is i attain my age 61 now and resign job 4 years bach ..how percent of pension now i can get?

Ricky-You have to prove legally that either your husband is missing or died. For that missing complaint is compulsory. In my view, better to consult a lawyer.

I put case infront of pmo..pmo has consult EPF..and they again invite woth filing papers..what should the remedy they ask for?

Ricky-Let us wait for PMO reply then.

Hi Sir,

I have one doubt regarding NPS Tier-I account. If I invest 1,50,000/- in all other savings options which comes under 80(c), then my limit of 1,50,000/- is over as per the government’s consideration.

After the above 1,50,000/-. if i invest 50,000/- in NPS TIER-I, will the government consider under the section 80CCD(1B) , per tax deduction purpose.

IF govt consider then only i will invest in this to get the tax saving option. other wise i dont choose it. I need the total 2Lakhs Tax deduction from my monthly income. Please provide me the clarity. I am interested only as per tax deduction option. Thanks for your complete clarity.

Sravan-Yes, you can invest so and can claim tax benefits.

The table was really very helpful.

Just a suggestion, the reply section should be at the top so that it is easier for the audiance to ask questions/leave suggestions 🙂

Regards

Prateek-Thanks for your suggestion. If I put reply section above the post, then they not read the post but start to ask question without reading 🙂

How much percent subscriber can withdraw from tier2 account in nps?

Harpreet-There is no such limit.

Sir can we tranfer funds from tier1 to tier2 for withdrawl.

Harpreet-NO.

Hi Basavaraj,

I read your above blog and almost more than 50% comments and reply, its really a nice way to explain and clear the doubts but still i didn’t get the answer of my doubt which i am trying to explain with below example:

My Current age: 28 Years

Suppose open Tier 1 Account now and will start 50k every year up to age of 60 Years, in this way total i will invest 16 Lac (i.e. 50k * 32 Years)

Assume at the age of 60 Years that invest cost will be 25 Lack (means suppose 9 Lack will get profit) in that case after 60 year age i can withdraw 60% amount means on and around 15 Lack.

So my question is that 15 lack is complete taxable as per that time income tax slab and the remaining 40% amount which we deposit for annuity is taxable in single shot or tax on every month pension.

Please clear this doubt i read lot of blogs but still didn’t clear with this doubt.

Also if possible please let me know on what basis annuity/pension will be calculated?

Thanks,

Ankit

Ankit-Annuity will be taxable income for you as and when you receive.

Hello Sir,

I am investing in tier 1 of nps for Rs.500/- per month on ecs basis, but the amount credited to my account is Rs.477.60/- (after collecting charges). When I declare in the tax returns should i declares annually as Rs.6000/- or Rs.5730 (approximately).

Kindly advise

thanks

swaroop

Swaroop-Declare Rs.6,000.

Dear Basavaraj,

I am working with a Pvt company named as TVS Credit Services Ltd. and wanted to have NPS benefit for income tax benefit, I have declared Rs 50k NPS invesement for FY 18 but still could not invest on it…I need clarity on this how to invest 50k now…I have an HDFC securities trading account also, Can I use this account for investment purpose.

Current age is 43 years 11 months.

Please suggest

Vimal-Do you think investing for the sake of tax benefit is the BEST strategy?

Basavaraj- Agreed with you point but I have already exhausted the 80 C bucket so it was opted in IT declaration to my employer.

Request your suggestion

Vimal-There is no obligation that whatever you declare with your employer must be investable. They take the pledge to make sure that how much they deduct TDS at year end. Hence, don’t act based on that declaration itself only. Try to understand your requirement rather than only at TAX SAVING.

Sir,

where we have to submit the withdrawal form (in case for using HDFC bank) and what is the maintenance, withdrawal, manage..etc charges for tire-2 account.

Shamse-You can submit the form at PFRDAs designated POS. There are no withdrawal charges. Regarding NPS charges, refer PFRDA portal.

Thanks For your comments.

I have another query- I have seen near about RS. 23 deducted from my investment in each month. why this deduction happening , Is there any way to bypass this charge ?

Shamse-Not sure about charges, better you check with PFRDA POS.

Dear Sir,

I was open NPS, (eNPS) Tire-1 the first Payment 500 INR I already paid

So My Doubt is how i pay (Yearly 6000) the balance of 5500 INR. is every month pay or one time yearly pay, I confuse the payment system

Baburaj-You can go for monthly NACH auto deduction or lump sum as per your wish.

Sir, I am working at Bank and having NPS. on verification of the scheme preference of my NPS investment, it shows the scheme preference type C and under tier I. I would like to change the scheme preference type.

This scheme preference and asset class is the same thing?

Can we change the scheme preference or asset class in NPS as well as the find manager?

Anand-As per scheme preference the asset class will be set. Yes, you can change the scheme preference.

THANKS SIR

Basavaraj,

You mention in one of your replies that starting NPS at the age of 54Yrs. is not a good idea. Why is that? For instance I am 53 and was about to apply when I saw your blog.

Regards

Khalid-Retirement planning at the age of 54 yrs is a good idea? That also with the product called NPS, where it just allow you to accumulate the retirement corpus but not provide you pension. You have to buy the pension plan from some other insurers and again such pension is taxable for you.

Thanks

I have pran number that pran number took from nsdl when i am in paramilitary constable but now i am join rajasthan state teacher job i what to generate new pran number it possible if not possible sir please you guide me

Ghewar-Instead of generating one more PRAN, provide the same PRAN to your new employer.

My age is 54 years, we have opened NPS Tier 1 and invest online 1.22 Lac . At the age of 60 , we can withdraw 40 % tax free amount. for balance 60 % , whether will i have to pay income tax on it or on pension money after purchasing pension scheme.

Please suggest whether should i invest normal amount or go for good amount till retirement

Suman-Entering at this age is bad idea. The pension you receive is taxable. Hence, try to avoid such products.

Hello Sir,

I took NPS when I was working in a MNC and later I changed my job and moved to another company who doesn’t have NPS. I continued paying the contribution online.

My account still shows the MNC name as CBO Name. What should be my next steps to get the name of my previous employer and also I will be able to still contribute in Tire1?

Sunny-Whether you can’t contribute now?

I can contribute. But is it worth to contribute? How to get my previous company name delinked from the account

Sunny-As per me not a good product. Why you want to delete your employer name?

I moved out of the company. If I don’t contribute what will happen to money accumulated?

Sunny-It will earn returns as long as you withdraw or retire.

Dear Sir,

I have applied for NPS through SBI and opted for both Tier 1 and Tier 2. Will both of these accounts run separately? I have gone through various links and found difference between Tier 1 and Tier 2 but go confused, if I will be getting the advantages of both Tier 1 and Tier 2 if I keep investing in both of them or I will NOT be getting the advantages of Tier 1 at all (like Tax benefits) if I have opted for Tier 2.

Regards

Puneet

Puneet-Please refer above post properly.

sir, I applied for pran no on online e- NPS and filled my details up to the last stage of payment but now I don’t want to continue ,I want to apply off line. what should I do now?

Navneet-Even if they issue PRAN to you, then no issues at all. No harm to you.

sir I am in government service and government deposits in three schemes whereas by applying on line I am able to invest only in one viz SBI or uti or lic, so according to govt notifications I have to apply offline through my nodal office so please tell me how can I get rid of the registration which I have done on line using my pan card and is it possible to register afresh for pran no using adhar card this time ?

Navneet-I am not sure why you are unable to do that ONLINE but OFFLINE. Check with PFRDA directly.

Hello sir, you replied for my last query, thank you so much. For now my query is: I am private employee in private organization, there is no deduction from salary towards NPS. So, if i contribute towards by NPS, can i claim that contribution towards initial 1.5 lakh bracket(the maximum contribution for this 1.5 lakh bracket is 10% of BASIC+DA) which i assume for my entire year is 50,000 rupees(if my salary is 5,00,000 combining basic+DA).

Hemant-Yes.

Sir, at the exit after 60 years, tax on remaining 60% will depend on the tax slab and corpus accumulated right ?

Hemant-Yes and also the annuity is taxable income for you.

What is exact difference in Tier I & Tier II account? Why these 2 accounts are separate? What are advantages/Disadvantages of both? I started NPS in both accounts 3 months back on my own. How I will be benefited in long run carrying these accounts?

Ankur-Refer above post.

Respected sir,

I have one doubt on withdraw on NPS Tier 2

If I have invested 50000 in tier 2 and after few month if It will be increased by 58000

Then after few month if I will withdraw whole amount then on which amount tax will be paid as per my understanding tax on its gain only means on 8000 pls clear

Second question form 58000 if I withdraw 30000 then how tax will be considered

Pls clear my doubts

Thanks

Jay-Tax will be on gain only. Hard to say in the partial withdrawal case as there is no such set of rules!!

Excellent replies from you.

Please help to clarify the following:-

1) Switch in schemes in Tier 1 from one fund manager to the other is actually a switch out from one fund and switch in to the other, Does this come under capital gains taxation I hope not. One switch in a year is permitted.

2) Can you please give the latest information on NPS tier 2 withdrawals tax implications

Many thanks

Reply

Excellent replies from you.

Please help to clarify the following:-

1) Switch in schemes in Tier 1 from one fund manager to the other is actually a switch out from one fund and switch in to the other, I hope this does not comes under capital gains taxation. One switch in a year is permitted.

2) Can you please give the latest information on NPS tier 2 withdrawals tax implications

Many thanks

Sanjay-1) It will not.

2) As of now no clarity.

Dear Sir big thanks for your valuable article. I am a central government employee. My necessary NPS contribution is Rs. 71739/ and same amount by government and I put Rs. 130000/- in PPF.

Can I claim Rs. 130000/ in section 80C, Rs. 50000/- in section 80CCD(1B) and remaining of NPS rs. 21739 in Section 80CCD(1)?

Kapil-Refer my post “NPS Tax Benefits – Sec. 80CCD(1), 80CCD(2) and 80CCD(1B)“.

Sir

I hv accumulated PF in my previous co which is Pvt LTD, contributed in PF there for 3 yrs. Currently I m working with some other co. which is contractual job n does not hv PF a/c here. Can I transfer PF from my previous co. to NPS tier 1 a/c – it should not deduct TDS/IT on this. Pls guide.

Regards

Nayan Agrawal

Nayan-As of now you can’t transfer to NPS. The only options are either to withdraw or let it be like that.

Hi

Is there any way out to withraw it tax free ?

Nayan-NO but only in case of death claims.

“-From Budget 2016, the 40% withdrawal at the time of your retirement from NPS will be tax-free. Rest 60% of the corpus will be treated taxable income as per old rules. Hope this above table cleared your doubts. ”

1) Sir – Have the limit of lump sum withdrawl reduced from 60% to 40% ? Or is it just a Typo ?

2) Also, the minimum limit for Tier 1 is reduced to 1000 – Is this applicable for all the Tier 1 or specific to some POP only? Because even now in ICICI site, still the minimum contribution shows like it is 6000 rupees. In below link.

https://www.icicibank.com/terms-condition/national-pension-scheme-tnc.page?#toptitle

Balaji-1) Refer my earlier post for your doubt “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

2) Yes, this limit is for all types of Tier 1 accounts.

Sir i worked at railway and i have nps tier 1 account now i want to leave railway job and want to join state government higher grade pay job can i use my old PRAN account in state government job where as my PRAN is activated during central government’s railway job. Please suggest me the real process to use it

Aayush-Yes, you can use the same PRAN.

Sir can i change my account details online. I mean i want to change my bank then how can i .

Aayush-Yes, you can. But I doubt that such facility is available online. You have to update through POS.

Hello sir. I m done online activation fir tier 2..now need to send documents..so after that only vl it open? And another query is how much amount I can transfer from tier 1 to tier 2 so that I can withdraw from tier 2… And after online activation how much time it takes till I transfer amount from tier 1 to 2 and withdrawal….

Jyoti-Yes, you have to send documents and once they verify, then only. You are not allowed to transfer money from Tier 1 to Tier 2 account. Please refer above post properly.

if i change to tier ii from tier i nps account, what will happen to the sum accumulated in tier i, considering it can’t be transferred to tier ii?

IRIS-If one can not transfer from Tier 1 to Tier 2, then why such CHANGE means?

what i meant was that when i open a tier ii account, will the tier i deduction (that my employer makes as 10% of gross pay) still be mandatory or will only one account be operational at a time? and if the latter is correct, what will happen to the fund accumulated in tier 1?

Iris-Your Tier 1 will continue as usual. You have an option either to invest in Tier 1 or 2 on your own.

Sir,

I want to choose one account as aggressive and one moderate kindly help which one should i keep agressive and which one moderate from tier 1 and tier 2 and in which account should i invest more if my age is 34.

Thanks

Mayank-Why this set up?

Then what should i do ..if i opened both tier 1 and tier2 account

Mayank-You have to follow the rules as I explained in above post.

Sir

I have completed 7 years in state govt service and have around seven lakhs in tier 1. If I open tier 2 from online application than can I withdraw some from tier2 and tier 1?? Why tier 1 cannot be withdrawn sir??? And why tier 1 cannot be transfered to tier2 since I have money in tier 1 which was opened by the department itself. We don’t had choice for tier 2 at the time of opening Account. Pls help.

Bhutia-It is the rules set by PFRDA. If you like then continue. NPS is meant for long term wealth creation.

sir i am investing in tear1 account last 5 year and that time i m not investing in tiar 2 . now i want to invest in tiar 2 account, my tiar 2 account is already active but on line i am unable to invest in tiar 2. please tell me how it is possible.

Pandey-what error message you are getting? If it still persists, then contact PFRDA.

Thank you for your article. still I have some questions which is not clear

01.what is yearly fund manager charges

02.Exist charges after 60 years and any other hidden charges as per present rules

Alpesh-1) It is 0.01%.

2) There are no exit charges.

Dear Sir .I just red your Article nd find it really useful please advise me for resolution of my queries

1. I am State Government Employee , Joined in service in year 2008 . contributing my Fund as per government rules in NPS Tier-1 .now my present ccumalated amount is Approx 18 Lacs + I want to know whether I can transfer my fund to Tier 2 ? as of now I have not TIER-2 Account but once / within next 2 months if I open Tier -2 account and then if I transfer my some fund (accumulated in Tier-1 account) to the Tier-2 account then , can I withdraw any amount from the Iier-2 account or I can withdraw only the Amount whatever I deposited or earned by my investment in Tier-2 And I can not transfer any amount from Tier-1 to the Tier-2 AND CAN NOT Withdraw any amount from Tier-2 account ?

2. What procedure I have to follow to open or activate Tier-2 Account online ?

3. How much Amount can be withdrawn from Tier-1 account before the age of Retirement ?

please dvise me.

I am awaiting your detailed resolution to my request.

Mehta-1) You can’t transfer the fund from Tier 1 to Tier 2, but the reverse can be possible.

2) You can activate Tier 2 using eNPS or contacting the nearest POS.

3) Refer my post “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

Dear Sir,

Thanks for this useful blog. I have my S/B A/c with Axis bank. Is it possible for me to open a NPS account with my present bank account? Because I can’t find my bank name in the enlisted bank.

Regards,

Raja Dey

Raja-Yes, you can open NPS. Read this Axis Bank link for more.

Hello,

Is the additional Rs. 50,000 tax benefit under Sec 80 CCD, applicable to freelancers as well?

Ananta-YES.

DOB of my 2 sister are 11/11/1957 (59+ Age) and 13/11/1958 (58+ Age). Can both of them opt for NPS? Thanks

Radha-Yes, as the maximum age of entry in NPS is 60 Yrs.

1. In long run which is advisable Tier 1 or Tier 2.

2. If I want to invest 25k in NPS…. how do I allocate this fund in Tier1 and 2

3. Can I fix my own annuity? Or is there any fixed %.

Gayathri-If liquidity is a priority to you then Tier 2. However, tax benefits while investing are priority, then Tier 1. There is no fixed annuity in NPS. In fact, NPS will not provide you an annuity. It ONLY helps you to accumulate the retirement corpus. Later you have to buy an annuity on YOUR OWN.

Hi,

1>What are the returns percentage in NPS?

2>If i apply through online do i have to pay AMC?

3>Which is better tier 1 & tier 2? DO they invest in different funds?

Dear Sir,

I am working in aided college drawing Govt pay , compulsory pension as I joined before 2004 . My question is that Can I get tax exemption for Rs.50000/- if I invest in NPS under Tire 1 account.

Please advise.

Nagarajan-Yes, provided you claim that under different head of IT Sections.

Dear sir,

For the govt servants joined before 2004 (with pension scheme not NPS).

The additional 50000Rs investment in 80CCB(2) IS ABOBE 80 c??

OR IS IT ONLY FOR EXSISTNG NPS SUBSCRIBERS joined service after 2004?

can you gothrough the incometax rules and provide me the link to the document that person joined before 2004 can save 50000 in 80CCB(2) and avail tax exemption .

Pruthvi-It is Sec.80CCD(2) but not Sec.80CCB(2)..Am I right? I am not sure about your case. But if your contribution fund is notified by Govt as pension scheme, then you are eligible. Check with your employer for the same.

yes sir you are right.

employer is confused and not considering this amount in to tax calculation. he is asking me to claim it as a refund through retuns..

I am saving in NPS which is notified by govt. kindly clarify whether i can get the tax relief for the 50000 Rs if i invest in 80CCD(2). I have joined govt service before 2004 .

Pruthvi-Refer my post “NPS Tax Benefits – Sec. 80CCD(1), 80CCD(2) and 80CCD(1B)“.

Dear sir PRAN NO IS WRONGLY GENERATED FROM BANK, WRONGLY applied TIER 1 instead OF TIAR 2, ALREADY HAVE PRAN NO FROM EMPLOYER. HOW CAN REVERSE CONTRIBUTION AND CANCEL THE PRAN NO.

Pawan-You have to contact PFRDA for the same.

Dear sir

I have tier 1 account and there is 170000 rupees avaiable in my account now i want to register for tier 2 account online then in last stage i.e. payment detail asking me for first contribution amount in tier 2. I could not understand this. So sir please explain me that what is this and how much or how less amount should be contribute.

Dear sir

I am 26 years old and service or tier 1 account is 4 years old. Am i eligible to register my tier1 account to tier2 account

Aayush-“register my tier1 account to tier2 account” means?

Will this contribute amount be deduct from my salary each month

Aayush-Check with your employer.

I mean . I have now tier 1 account and i want to register for tier 2. Am i eligible

Aayush-YES.

Aayush-Its about how much you want to contribute (I think).

Sir, i am a railway employee and my service is 45month long and i have NPS TIER 2 account . can i withdraw cash from my account if yes then how much and what is the process?

Saroj-You can withdraw any amount which is available in your Tier 2 account.

Sir i am only 28 year old and my retirement is 32 year rest if now i withdraw all amount available in my account then will there any loss to me in retirement.

Saroj-Why you invested and now why you want to withdraw?

Dear sir, If i want to resign from service or leave my service then can i withdraw my money from NPS tier 2 account.

Saroj-Yes, you can withdraw money from Tier 2 account as and when you wish.

Dear Basavaraj

Hi i am deepak kapoor age 37 year and live in faridabad and i want to invest in NPS scheme so suggest to me invest in tier 1 or tier 2 is better for me

Deepak-What is your main reason for investing?

Nice Article…

Can you help me with one point?

If I have only Tier-1 account can I invests in equity instruments or to invest in Equity or Govt Bonds I Must have Tier-2 account?

Angshuman-You can use Tier 1 for equity investment. But you have to specify the asset class to PFRDA.

Ok. Got it. Then what is the benefit of having Tier-2 account? Is it only one can make liquid cash at any point of time?

Angshuman-Liquidity and no tax benefits are main features of Tier 2.

Sir, I am private employee & is in 30% tax bracket. Already contributed 1.5 L under 80C. If i invest 50,000/- p.a. under NPS, can I claim additional tax exemption? Pl. suggest.

Ramesh-Yes. Refer my earlier post “NPS Tax Benefits – Sec. 80CCD(1), 80CCD(2) and 80CCD(1B)“.

Dear Basavaraj,

I am an NRI, currently residing in Middle East and I am 40 years old. All my investments were going to Fixed deposits for all these years. I am planning to retire by age 55-60 years.

Is NPS is good option for me?

Will I get better returns than FD as per the current interest rates and the expected interest trends?

Which Tier I should invest more money Tier 1 or Tier 2? I may not require the invested money back by Age 60, but definitely require the monthly pension amount say roughly 50k.

Could you please give me some suggestions.

Thank you for your help

John

John-I am not the fan of NPS. Reasons are illiquidity, no control over your money and taxation at withdrawal. Rest you have to decide.

Can a Government Servant already subscribing to General Provident Fund also open NPS account to save income tax on additional saving of 50000 in NPS? Please advise.

Arora-Yes. But do you feel investing only for TAX SAVING a BEST idea?

In my case – yes. I am in 30% tax bracket and retiring after 3 years. I think if I save about 31% of the invested amount by way of tax rebate and then have to keep 60% of the corpus for earning pension (may be less than earning in equity but safer) after 3 years, it is not bad. What do you suggest.

Arora-Do you feel equity is BEST for your 3 years time horizon?

Hi ,

I’ve a NPS account from last two years & I’m contributing only in Tier-2 and a minimum contribution of 1000 in Tier-1.

So my question is ” Which one is better ,Tier-1 or Tier-2 ?. and if both the tiers are same then why NPS introduced tier 1 and 2 separately. Please suggest whether to invest in Tier-1 or Tier-2.I’m really confused.

Panda-Both meant for different usage. Check the features, liquidity and taxation. Then you will come to know why two than one.

Hello, Sir I have NPS TIER I account which I attached to my bank but at the time of filling information by mistakeI have entered TEIR II account but my account is TEIR I account.I have made contribution with this wrong information.Can I get my money back and what is the procedure for it.?

Narent-First check the NPS statement of whether the invested amount is in Tier 1 or Tier 2. If it is in Tier 1, then leave it. Otherwise, stop the further automated ECS process of your bank and move the money from Tier 2 to Tier 1.

Sir on bank receipt it is showing TEIR II account but nothing in my NPS TEIR I account about the transaction.Means amount is debited from Bank account but not credited to NPS account.Can I get my money refunded

Naren-Whether you checked properly where the amount deposited (like Tier 1 or Tier 2)?

Hi Basavaraj,

Thanks a lot for such a detailed blog. I am a private employee and fall in 20% bracket.

I covered my 1.5L of 80C . so wanted to know if it good to invest 50K in NPS to get the tax exemption.

Thanks

Srinath-Better to concentrate on goal rather than too much on tax saving or fancy product.

As per given infromation, AMC is paid by employer for Tier 1 account. What if non-government employee opens NPS account. Will he/she will be charged AMC for Tier 1?

Amol-Yes.

SIR, I AM PSU EMPLOYEE. I HAVE AN NPS TIER I AC. IT IS SHOWING ACTIVE MODE WITH LIC PENSION FUND CORPORATE CG AS PFM. MY QUESTION IS 1.WEATHER I CAN CHANGE PFM. 2 WHAT ARE THE BENEFITS OF TIER II AC. 3. NOW MY CONTRIBUTION THROUGH SALARY IS BEING CREDITED TO TIER I AC, IF I ACTIVATED TIER II AC THEN WILL MY CONTRIBUTION THROUGH SALARY GET CREDITED IN TIER II AC.

Makarand-As of now for PSU employees change of fund managers option is not available. Please read the above post fully for the features of Tier 2. Your employer will not credit to Tier 2. But you can voluntarily can contribute to Tier 2.

Sir Should I go for tier II or other MF for investment in pension fund

Makarand-Better to avoid Tier 2.

Value of investment in respect of your NPS Tier I account (XX8628) as of31/12/2016 is Rs. 534961.65. View Transaction Statement athttp://www.cra-nsdl.commy father getting this type of msgs to his mobile what may be the reason please tell me

Sashi-Whether he invested in NPS?

Dear Basavaraj,

I am a central Govt. employee who joined the services before 2004, so NPS account has not been opened by my organisation for us, can I still enroll for NPS account?

How do we get tax exemption of 50000/- over and above 150000/-? Do we need to contribute 150000/- in NPS Tier 1 account first or can we invest under any scheme in 80 C and then invest 50000/- in NPS tier 1 account separately?

SIR, I HAVE THE SAME POSITION AS SUMAN JAIN QUESTIONED ON JAN. 3, 2017 AT 11.55 PM. SO PL. EXPLAIN ABOUT ABOVE PROBLEM.

Amarjit-Am I not replied?

I am a psu employee sinci 1990.so nps account has not been opened by my orgasitation for us (GPF account opened). can I still enroll for NPS account?

How do we get tax exemption of 50000/- over and above 150000/-? Do we need to contribute 150000/- in NPS Tier 1 account first or can we invest under any scheme in 80 C and then invest 50000/- in NPS tier 1 account separately?

Amarjit-Yes, you can open NPS account on your own. Regarding tax benefits, refer above post properly.

Hi,

I have just completed 30 and planning to invest in NPS. This article is really helpful.

Sorry but still I am not able to understand the difference between the Tier-1 and Tier-2 account. Also, for Tier-1 account, do I have to pay monthly (mandatory) or I can pay my contribution in one go at any point of time between 01st April to 31sr March?

Please suggest.

Regards,

Abhishek Srivastava

Abhishek-You can either pay on monthly basis or in one go. There is no such hard rule. What other doubts you have?

Hi, I was a GOI employee and had a Tier I NPS account. Now, I have shifted to corporate sector where there is no NPS facility, but I want to continue investing some amount in the same account for tax rebate purpose.

Is there any process/ form that I need to fill for this, or I can directly continue investing through eNPS portal?

Also how many days does it take to reflect the online investment in transaction statement?

Ashita-The convenient way is to use eNPS. They usually update on regular basis and hence once transactions completed then it will reflect immediately.

Good Evening Sir,

i am govt employee having teir 1 account can i open a teir ii accont and can i draw part of amount?

olz specify that what is the procedure?

thanku sir

Rathna-Yes, you can open Tier 2. You just have to provide application for activating Tier 2 account.

Good Afternoon sir

plz mention how to open tier 2 account

tq

Rathna-It is the same way like you started in Tier 1. You just have to give an application to POS.

Thnaku sir

can i transfer the amount which is in the tier i account to tier ii account and with draw the same

plz inform the details sir

Thanku

Rathna-You can transfer the money from Tier 2 to Tier 1 but reverse is not possible.

Thanku sir

Hi Basav,

What do you mean by “You have to buy a pension product” ?

Thanks for the article.

Abhijeet

Abhijeet-Once you retire, NPS will not give a monthly pension. From the accumulated pension, you have to buy annuity plans available at that time in market (for example LIC’s Jeevan Akshay VI).

Hello Sir,

I am a PSU employee holding mandatory NPS account. Tier-I contribution, which is automatically debited from my salary, is below 50k in a financial year. Can I invest more in Tier-I and if yes, how? Through SBI e-NPS, it shows I can only invest in tier-II, which will not provide me tax-rebate.

Please clarify.

Piya-You can invest using eNPS portal.

Hi,

I want to open an account in NPS. But I am confused whether I will get better returns in NPS or should I opt for a good mutual fund with monthly investment of 5000 INR. What do you suggest? Is NPS a good platform to invest money and expect good returns in Future as I am aged 24 as of now and can invest maximum amount allowed under this scheme in equity and take risk.

What do you suggest Sir?

Harjot-If you are planning for retirement, then stay away from NPS.

Thanks for the suggestion.

What else can I opt for investing? Are the returns showed in Stats of NPS not real?

It will provide me tax rebates when I will fall in 30% tax rate slab. Can you please elaborate a little?

Harjot-Returns of NPS are real. Tax benefits while investing are eye catching. But check the taxation while withdrawing.

okay…thank you for the help. Will stay investing through Mutual funds only.

Is there any tax liability, if I withdraw periodically after every 15 days of my investment in NPS tier 2 account

Rakesh-There is no clarity about taxation of NPS Tier 2 while withdrawal. I have written the same in my earlier post “NPS Tier 2 – Alternative to Savings Account, FDs or Debt Mutual Funds?“.

I am working in a private industry & open a NPS account at bhuj Gujarat during stay at bhuj 2010, from bhuj P.O. now I am working at Allahabad & my phone no also change but now face a big problems for eNPS online money deposit because I reside 50 kilometres from Allahabad city & three times trying to change my phone no through request for changes Annexure UOS-S2 but no reply kindly guide me & also my permanent address at kolkata so I want to contribute money at kolkata post office, where in kolkata?

Subrata-It is procedural matter. You have to contact PFRDA.

Sir, I have opened a nps account with icicidirect last year. Now i am not using this demat account and want to close it because i have been charged 750/- per year as AMC. Now icicidirect is saying that because of the nps account they can not close my demat account. I have no other demat account. Please tell me what to do?

Sanjay-Slap them your answer that for NPS demat account is not required.

Hello,

Which is best product for me? I am 28 year old Software Engineer and comes under 10% tax slab.I want to open PPF or NPS account. one from these two options

I want to open for mainly tax saving and retirement planning saving. currently i have not any retirement planning.

which option is best for tax saving as well as retirement planning.

I am currently investing 1500 INR per month in Axis ELSS.

Thanks for Help.

Vishal-Continue the same mutual fund for both goals for long term.

Under which section i will get tax benefit if i invest in PPF or NPS?

I want some secure investment so which is good from NPS or PPF?

Vishal-Which is SECURE investment on this earth?

Hi,

1. Can I transfer money from my Tier 2 account to Tier 1 account

2. Is this type of transfer eligible for Tax Benefit under 80C or 80CCD

I have some spare money, I want to put this in tier 2 account, and use this money for transfer to Tier 1 next year for tax benefit. is this possible.

Linus-1) YES. 2) YES.

1. Can u please explain the taxability on redemption/withdrawl from TIER 2 account if done in 6 moths and 12 months respectively ?

2. i had opened my TIER 1 account with CRA 1 with whom I have been depositing my contributions. Can I approach CRA2 for opening my Tier 2 account and transact with them for tier 2 account ?

Mukesh-1) It is taxable income.

2) Yes, you can.

Thanks for yr valued advice.

A. Considering the low expense ratio of NPS fund managers, does it make sense to park short term money in TIER2 account for 6 months time with investment choice of 50% corporate debt and 50% Gsec as compared to debt/liquid funds ?

B. What is the option you suggest for investing with 1 year time horizon to get a reasonably assured returns ? Are the equity orinted balanced funds a good choice considering that there will be tax free returns due to holding period of 12months ?

My queries are strictly for 6months and 12 month horizons with reasonable returns.

Mukesh-1) Do you feel Corporate Debt and Gsec not volatile?

2) Liquid Funds or Bank FDs.

Any Option to take benefit of extra 50000 investment as declared by finance minister by investing in tier 2. I have alreay invested 2 times in tier 1 for my wife. Since i m a govt employee , i have to invest in tier 1 every month.

Amit-There are no tax benefits if you invest in Tier 2.

Sir,

I have a nps tier I account since March 2011.Now I want to exit from this. Please tell me the process.

Achintya-Refer my earlier post “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

Hi Vasu,

I already exhausted my 80C limit of 1.5 Lakhs and now wanted to invest Rs 50,000 in 80CCD(1B) component of NPS.

I also understand that NPS will have multiple asset classes to choose from and each has a NAV associated with each of asset call as per Market Value.

My question is, if I make a Lump-sum investment of 60K per year as compared to staggered 5K Per month, will it make difference to my end result? Which approach is preferable?

I am confused because, I downloaded an app in my mobile for NPS and it always shows higher end value if I invest in Lump-sum as compared to Staggered approach. Where as my thinking was different as staggered approach will have Rupee cost averaging factored in it.

Please advise.

Regards

Koustav-There is no guarantee that monthly or yearly investment will GENERATE better return in FUTURE. Choose the one which comforts you.

Hi I m working in private sector my basic annual salary is only 2lack and we don’t get any da. How much tax benefit I can avail. Only 20k?

Rajesh-If DA is not your part of salary, then you have to consider only 10% of Basic.

Is it possible to withdraw case from tire 2 before 60 years? If I withdraw some cash from time to time from tire 2 AC of NPS then what is the tax implication ?

Jayabarata-You can withdraw at any point of time. It is taxable income.

THANKS.

WHAT % OF TAX SHOULD BE APPLICABLE IF I WITHDRAW FROM TIRE II ?

IS THERE ANY LOCK-IN PERIOD ?

Jayabrata-It will be as per your tax slab. There is no such lock-in.

What is the advantage and disadvantages between NPS tire2 a.c. and liquid mutual fund ? Which one is better in respect of liquidity, tax implication and return?

Jayabrata-You can’t compare highly secure liquid product like liquid fund to equity oriented less liquid product called NPS Tier 2.

Sir how many times can we withdraw amount from tier-2

Pradeep-As many times as you wish.

Sir,

I have opened an Atal Pension Yojana account online in State Bank of India without doing too much research. I work as a Solution Architect and I would like to open an NPS account. I think I cannot open both NPS and APY. How can I change the already APY account to NPS account ? Is it possible. Please guide me.

Vinay-You can open BOTH.

thank you Sir. I will try eNPS. I have to find out how can I use my existing PRAN.

If you have NPS T1 enrolling for T2 is simple process:

1) Visit https://enps.nsdl.com/eNPS/LandingPage.html

2) Click on T2 Activation

3) Enter your PRAN, Date of birth and PAN number

4) Follow step by step procedure (5 steps with basic details like bank detail, nominee fund house). Note: site provides option to copy from T1, making it further simpler

5) Upload soft copy (scan/photo) of PAN card and cancelled cheque

6) Download the completed form

7) Print form and attach self attested PAN & cancelled cheque

8) Send it to address specified (to be sent with in 90 days of application else account will be temporarily placed on hold i.e. you cannot make additional payment)

NOTE: You can make payment along with activation process

Kaushal-I already wrote a post regarding eNPS “eNPS – How open and invest in NPS account online?“.

Hi Sir,

Again a very good blog on the NPS (including the how to open, invest & exit rules ). Now I have a question here. since I am working in private sector & aged 30. I Fall under 30% tax bracket. I want to invest 50k in NPS only to save TAX. Then whether it ‘s good idea to invest in NPS? If not what are all the different options which I can make out?

Amar-During investment you will get tax benefits. But what about at maturity? Think and invest.

I think its good to invest now, you are any way saving 30% of 50k i.e. 15k per annum. You can plan your withdraw such that net tax on income per annum (post retirement) is minimized.

Just assume amount of corpus you will be creating for your retirement just by the tax saved now.

Kaushal-Is it BEST retirement product??

Kindly let us know which would be best retirement product?

Swapnil-As of now NONE.

If I open an tier -1 a/c on December, do I steel need to invest Rs 6000/- on that year ?

Suduesontu-A year count is based on FY.

Dear sir, I am attaining superannuation age by this month end. I have joined in NPS in March 16 and invested ?50000/-. Since I am in 30 percent slab, what would be the best way for me; 1) to contribute another ?2.00 lacs in the scheme to get additional tax benefit on?50000/- for the year and get a reasonable pension from total annuity or 2) withdraw the fund amount of ?50000/- plus and pay additional tax on such amount.

Nana-It depends on you like whether you need retirement or not.

Basawaraj ji. can I open Tier I a/c only without TierII account for opening NPS. I am in 30% tax bracket . I would like to open an NPS account @ 5000 p.m . clear the ambiguity of Ter I/TierII account

Syrun-You can open only Tier 1 account. However, to open Tier 2, you must have Tier 1. Hence, go ahead.

Dear Basavaraj, Can you please suggest, whether having LIC Jeevan Anand Policy is good or Investing in NPS scheme (Tier 1) is fair?

Hemantha-It depends on your requirement. Without knowing that, how can I say?

how much money can be invest in tier 2 in one year

Or can we choose different fund manager in tier 2 option

Narender-Yes, you can choose.

Narender-There is no such maximum limit set.

Dear Sir,

Nice to learn about you.

I was working with Indian Bank since July 2015. I had NPS account with Indian Bank (as they opened it at time of my joining). Now I have not deposited any amount in my NPS account from last 11 months. I had only PRAN number and online password with me. Please guide me on following:

1. How to deposit the money? Now I need to deposit on individual capacity.

2. Can I deposit the money online by using e-NPS?

3. can I change my bank from Indian bank to other bank? If yes, how?

Please help.

Mukul-1) Yes, you can do that. 2) Yes. 3) Yes, you can do that using the eNPS option.

Dear Sir,

Thanks. But how to change the Bank.

Mukul-I am not sure about the process. You can contact POS or PFRDA.

u started the question ….what is the difference between tyre I and tyre II but in this whole disscussion u dnt clearfied this question …..kindly provide the approprate answer ….and also tell my what are the benifits of Tyre II

Farhan-If you at least have patiency to look at the image of the blog, then you will find your answer.

Hi Friend,

I will ready to invest through the NPS Tier 1 option.

If I will invest Rs. 8000 Per Year up to 60 Years ( Now My Age 31 Years) means at the end of 60 years how much i will get.

Is it possible to get the full contributed amount with normal interest. Otherwise not possible to get the invested amount.

Because don’t have idea about the below mentioned scheme.

SBI PENSION FUND SCHEME E – TIER 1 – 50%

SBI PENSION FUND SCHEME C – TIER 1 – 30%

SBI PENSION FUND SCHEME G – TIER 1 – 20%

Please advice me!!!!!!!!!

Sakthi-You can expect around 8-10% return. Regarding NPS withdrawal options, refer my post “National Pension System (NPS)-New Partial Withdrawal and Exit Rules“.

I think better to inverts to RD instead of the Tier 1 ?

Sakthi-It depends on your requirement.

Sir,

Example for clarification of retirement fund :

NPS tier-I , If I my wealth @ age of 60 years is 1 lack, and I will get 60% of 1 lack , i.e 60,000, and remaining will get 40,000.

Now suppose unfortunately @ age of 62 years I am no more, then the remaining amount from 40,000, can it get to my children if spouse is also no more ?

Thanks…

San-From remaining Rs.40,000 you have to buy an annuity. This depends on the option you chose while buying.

Thanks Sir…

This purchased annuity will be having nominations option, so that in my absence nominees will get the amount.

Correct ?

Sant-YES.

How many years nominee will get.

Prasad-It depends on the option of annuity you opt.

San – On demise of investor the nominee is provided an option either to fully withdraw the fund or continue with annuity. There is option of adding nominee later as well but the process might be tedious for stressed family as good practice all your investment should have nominees defined before hand so that its helpful to the survivors

hi, which gateway i can invest on nps. ICICI demat account or eNPS website? the problem is eNPS not supporting private banks

Elango-I feel eNPS at later stage. Currently if you have demat account then continue with that.

http://www.sbipensionfunds.com/docs/Monthly%20Corp%20CG.pdf

thislist shows that nearly 60% of the investment goes in govt and public sector bonds..15% in equities and money markets

25% in private bonds approx.. so can we be sure about that gov bonds.. which are maturing max in 2035-2045 range… having rate of interest ranging from 7.28% to10.63% ..so can we be sure that 60% of our investmets will yield positive amount for us.. 15% in equities can help us to beat inflation by getting highest returns in the scheme.. andthe 25% pvt bonds may depend upon the economy at the time

so is it ok to invest in nps??

Dheeraz-I personally not fond of NPS. Because of it’s regulatory issue, illiquid and taxation at end. Rest is left with you.

Hi basu,

In my opinion,NPS is one of the best retirement plan.Its cheap(infact one of the cheapest) ,no wonder there is no agent to promote or market it. Yes, the taxation on maturity is a disappointment(40% tax free in this budget),but nps is a comparatively new product,. You never know, sometimes in future,it might get an EEE tax status. More than the tax status, its the dismal returns of annuity which worries most. Hope the government & IRDA takes action on this FRONT.

annuity doesnt change ..it remains the same.. it also depends upon the option we tend to choose.. in lic a 60 years individual with annuity of 1lakhrupees wil get annuity ranging from 9350rs per month to 7010rs per month.. nterest rate varying from 9.35% to 7.0%.. now a days banks are having 7.5% rate of interest..which is changing every quarter and then..what i feel is that we shouldnt worry much as there is 15% equity exposure and the rest 85% in gov psu and pvt bonds