Atal Pension Yojana or APY is the Government Of India’s flagship social benefit pension program. Earlier when it was launched, there were no tax benefits. However, now APY is treated like NPS for tax benefits. Let us see the APY or Atal Pension Yojana Tax Benefits under Sec.80CCD(1) and Sec.80CCD(1B).

Before jumping into understanding the APY or Atal Pension Yojana Tax Benefits under various IT Sections, first, let us understand the features of Atal Pension Yojana or APY.

# Features and Benefits of Atal pension Yojana

# Any citizen of India whose age is between 18 Yrs to 40 Yrs can join this scheme.

# He should have a savings account or must open the savings account.

# One person can open only one account.

# You can open the APY scheme by visiting the bank where your savings account is.

# You will start to receive the pension when you turn 60 years of age.

# If the subscriber dies before the age of 60 years, his/her spouse would be given an option to continue contributing as usual, for the remaining period, till the original subscriber would have attained the age of 60 years.

# If the spouse of the deceased not interested to continue the APY account, then he or she can close the account there itself and can claim the amount.

# In case of death of subscriber, the same pension would be available to the spouse and on the death of both of them (subscriber and spouse), the pension wealth accumulated till age 60 of the subscriber would be returned to the nominee.

# You can change the mode (monthly/quarterly/half yearly) of auto debit facility once in a year during the month of April.

# You can opt to decrease or increase pension amount during the course of accumulation phase, once a year.

# It is mandatory to provide nominee details in APY account. If the subscriber is married, the spouse will be the default nominee. Unmarried subscribers can nominate any other person as nominee & they have to provide spouse details after marriage.

# Exit before age 60 would be permitted only in exceptional circumstances, i.e., in the event of the death of the beneficiary or terminal disease.

# There is guaranteed minimum monthly pension for the subscribers ranging between Rs. 1000 and Rs. 5000 per month.

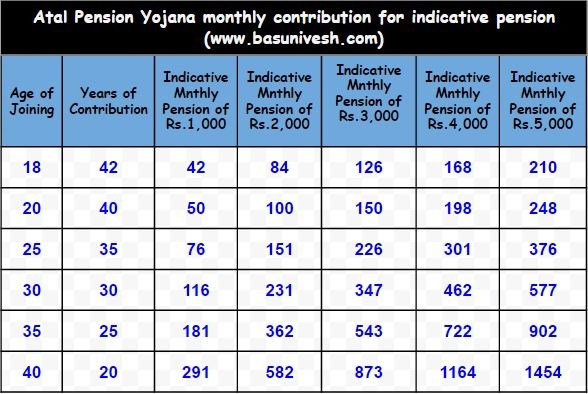

# Below table will show the contribution and the pension you receive from APY.

To know more about Atal Pension Yojana or APY, refer my earlier post “Atal Pension Yojna (APY)-New Pension Scheme details and benefits“.

Atal Pension Yojana Tax Benefits

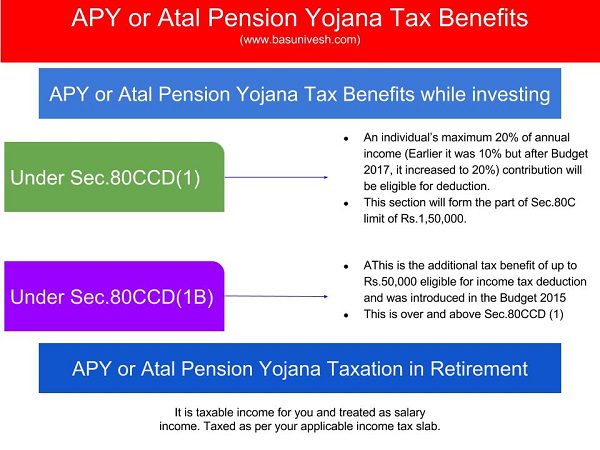

Let us now discuss the APY or Atal Pension Yojana Tax Benefits during the time of investment and also at the time of retirement. I summarized the same in below image for a glance.

# Atal Pension Yojana Tax Benefits – During Investment

Earlier there was no clarity about the APY or Atal Pension Yojana Tax Benefits. However, recently CBDT clarified the doubt and now Atal Pension Yojana enjoys the tax benefits exactly like NPS Tax Benefits. There are two sub-sections under Sec.80CCD. I explained the same in below image.

1) APY or Atal Pension Yojana Tax Benefits under Sec.80CCD(1)

- The maximum benefit available is Rs.1.5 lakh (including Sec.80C limit).

- An individual’s maximum 20% of annual income (Earlier it was 10% but after Budget 2017, it increased to 20%) contribution will be eligible for deduction.

- As I said above, this section will form the part of Sec.80C limit.

2) APY or Atal Pension Yojana Tax Benefits under Sec.80CCD(1B)

- This is the additional tax benefit of up to Rs.50,000 eligible for income tax deduction and was introduced in the Budget 2015

- Introduced in Budget 2015. One can avail the benefit of this Sect.80CCD (1B) from FY 2015-16.

- Both self-employed and employees are eligible for availing this deduction.

- This is over and above Sec.80CCD (1).

# Atal Pension Yojana Tax Benefits – During Retirement

The pension you receive during retirement is considered as salary income and taxed as per your applicable tax slab at that time.

70 Responses

HI Basu,

How are you?

After a long time, asking questions here :).

My Financial Goal is to get the pension after my age reaches to 55, not for the Tax saving FYI. Could you please suggest me best pension product.

My age as of now=35

Dear Raja,

Thanks for your comment 🙂 Sadly there is no such perfect pension product in India. Hence, suggest you to accumulate the same through mutual funds and other available debt options.

Thanks Basu,

Could you please suggest me good mutual fund to invest.

currently i am investing ICICI pru bluechip large cap , monthly 1000. so i want to invest in few mutual funds.

I have financial goal for 10years and also following 60:40 ratio.

Dear Raja,

Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2020“.

Thanks Basu,

As i said earlier, I have been investing (1000/-)in Large gap from past 1 year, will continue the same for long term 10years goal and i want to invest(1000/-) in 2 Hybrid funds for diversity and less risk, can you please advice for below funds(7 years)

1) ICICI equity & debt (or) balanced advantage fund? which one is good

2) ICICI multi asset

Shall i take above 3 hybrid funds because i do not want to put in mid gap/small gap..

Dear Raja,

I prefer Parag Parikh Long Term Equity Fund.

Can I take benefits of income tax for my house wife’s contribution in APY under section 80CCD 1B

Dear Sheo,

Yes.

Sir,

I have savings of 1.5 lakh under 80(c)…me & my wife also contributing into APY ….will I get tax benefits under 80ccd1(b)

Dear Jaipal,

Source of your wife’s contribution?

Dear sir ,my 80 C limit now above 1.5 lacs and my housewife having APY account, can I claim for tax benefit under income tax? In which section uptown what amount..I m a semi government employee..please guide

Dear Ramakrishna,

Do you feel investing just for the sake of tax benefits is the best strategy?

Can Public Sector employees & Central Govt Employees contribute for APY.

are they eligible to get Pension benefit

Dear Chandrasekar,

YES. But do you feel it is a GREAT product?

Hi My name is Prabhangshu. I have applied for APY and from last two months deductions are being going on from my savings account.

I would like to know how to claim that in 80C as I have not received any deduction statement from APY which I could submit scan copy or pdf etc at the time of tax submission or Income tax return file.

I have checked with the bank and I was being told that they will not be able to provide me any statement for deduction as its a Govt. scheme.

So I would like to know how to mention that during tax return file. Just like for eg: if a person takes loan or have insurance policy they will be having documents which they can submit. But for claiming via “APY” how to do that, kindly let me know @–> [email protected]

Dear Prabha,

Your bank account statement enough to show as proof.

you can download the APY statement from this link :

https://npslite-nsdl.com/CRAlite/EPranAPYOnloadAction.do

using your PRAN and bank account no.

you need to select the “SOT view” option from the drop down, then you can get the complete statement of your APY account for the selected FY.

I am PSU bank employee. You said one can take tax benefit for wife(house wife) APY contribution too. Pls clarify if tax benefit can be claimed for both APY n NPS contribution for wife too.

Dear Pratap,

YES.

Sir,

I have both NPS & APY. Can I claim tax benefit of Rs. 50,000/- under Sec. 80CCD 1(b) by investing 15000/- in APY and Rs. 35000/- in NPS.

(for claiming 80C benefit I have deposited Rs. 150,000/- separately)

Thanks,

Subhamoy Pain

ear Subhamoy,

Yes, you can claim so as both offers same tax benefits.

I have an APY account running (and a PRAN with it), if i want to open a NPS tier 1 account how to go about it? There cannot be 2 PRAN for Tier 1 accounts. Kindly guide on this confusion

Dear Gaurab,

Officially one person to one PRAN but in practicality it is not happening.

How much should i invest in both the schemes per year to get tax exemption of 50,000 now i have opened NPS tier 1 account with a initial deposit of 500rs , please guide me further.

Dear Darshan,

Never invest in any product just for the sake of TAX SAVING.

Sir,

I am a software engineer and also a tax payer .So please let me know can go for APY.

Thanks,

Pravat Kumar

Dear Pravat,

Do you feel the retirement benefits APY offers will sufficient for you in future? If so, then go ahead.

What document we need to produce for tax exemption under APY ? Can we download any tax certificate online ? Please help.

Gyan-You have to download the statement from NSDL portal or using the APY NPS Lite App and can submit.

My age is 33. Lets say I contribute around 1000pm till I reach 60 years to get 5000pm pension. But how will 1000pm contribution will get me 50000 deduction under 80ccd(1b)?

Siddharth-You will not get the full benefits of Rs.50,000 as you are investing only Rs.12,000. You can claim up to Rs.12,000 under either of the both mentioned sections.

What can I do to claim 50000? I mean how can I invest 50000?

Siddharth-I am not getting your question. Sadly I feel you are more concerned about tax rather than reaching your financial goals.

Hi, Can I pay for me and my wife and claim both the investment under my name. The total amount is about 20,000

Dear Sanket,

In which section you want to claim the deduction?

Dear sir,

I m a psu bank employee and a tax payer.. and I also a subscriber of NPS.. whether am I eligible for apy..

Perachi-Do you feel APY is a great product and fulfil your retirement corpus? What prompted you to choose APY?

Sir, investment amount was very low as compared to returns.. that’s what I want to go for apy..

Perachi-But what about the future return?? Be specific with your requirement.

My age was now 25.. if I entered now my monthly contribution ll be around 386.. my contribution up to 60 years around 165000. After that I ll get pension, after my death my husband ll get pension.. after that my child ll get a corpus AMT of 8.5 lack.. I think it was a great return..

Perachi-Is it? In what sense?

Finally apy is good for me or not.. give ur suggestions..

Perachi-How can I say whether it is suitable to you or not (without knowing much about your financial life)?

Sir i agree with Perachi Selvi, as it is written in frequently asked questions regarding APY, that in case of death of subscriber pension will be payable to the spouse or subscriber and on the death of both of them (subscriber and spouse) the pension corpus will be return to the nominee.

Dear Dhiren,

It may be so. Thanks for correcting.

Hi.. I am a salaried woman.. For tax deduction can I use APY for benefit of tax deduction excluding 80 C

Banti-YES. Refer above post properly.

i have applied APY in my wife’s name. Can i claim the income tax in current year on behalf. Please answer.

Prabhakara-YES if the source of investment is from your income.

I have opened Apy account in 2015 now i am tax payer in 2017 -18 how much i get deduction in tax through Apy scheme? My monthly deposit 762 (approx ) for 5000/pm pension now my age is 36 and i have already saving upto 109000 under 80C

Batra-Please refer above post properly.

Dear sir,

I have a doubt whether to give a nominee name as my husband name or my child name in my apy..

1) if I give my nominee as my husband name the corpus amount will get to my child or not???

2) Or if I give my child name as nominee,

A) pension amount will receive to my husband after my death or not.. ??

B) after my death my child receive a corpus amount or pension

Kindly clarify sir.. it will be more useful for me..

Perachi-The first legal heir for your money is your husband and then kids.

.I had opened a APY Account in the year 2016 SEP Month but now i got a GOVT now i am a tax payerJob should i am eligible to continue this account.Should i get tax benefit in this Apy account ?

Roshan-YES.

Dear ,

I am a regular PSU employee. May i get the tax benefit under section 80CCD(1B) from APY of my unemployed wife ??

Regards,

Ayananta Ghatak

Ayananta-You can’t claim tax benefits under Sec.80CCD(1B) by investing in your wife’s name in APY.

what is effective IRR of APY…

Dixit-It is hard to calculate for all ages. You can do so for your age.

You may like to add a separate tag in navigation bar for “Pension Scemes” or something like that so that those planning to invest or join pension schemes can directly benefit as you already have enough material on this subject it will be really helpful and timesaving for those who wish to use your site for advice/help. Thanks & regards.

Goswamy-Thanks for this idea. I will do it soon.

Basu,

Can we have an write up on ICICI Pru Heart and Cancer Protect insurance scheme and its benefits. Is it really worth taking it?

Ajith-Let me dig and come up with a seaprate post.

My name is Deepak Vanjani and I need a little help from you to understand the EPFO functioning in India. I would like to mention this that I was researching online to understand if I can withdraw my pension fund associated to my provident fund or not and I got through to your blogs and comments on https://www.citehr.com (https://www.citehr.com/member.php?u=1685835). This is how internet introduced you to me and I am looking forward to hear back from you which will definitely help me. Below is my question:

I was employed with an organization (ABC) in Gurgaon and have recently switched jobs and employed in new organization (XYZ) now. I have got the provident fund transferred from my previous PF account to my new PF account (UAN is still the same as it was with previous organization). Passbook for the previous PF account shows employer + employee contribution has been transferred and new account also has the receiving entry for the same however the old PF account also shows pension fund of Rs. 52,227/- which hasn’t been transferred to the new account. I need to ensure Can I withdraw this pension fund of Rs. 52,227/- associated to my old PF account. If yes, Do you have any clue on the amount that would be paid out, I mean would it be complete amount of Rs. 52,227/- or will there be any deductions? Would this be taxable.

Details:

Date of Joining – January 9, 2012

Date of Resignation – January 2 2017

Tenure of Service – 4 Years 11 Months and 3 Weeks (Almost 5 years)

Deepak-I replied to your FB message.

Hi,

My name is Krishna. I have a very similar scenario and query on Pension fund as outlined by Mr. Vanjani. I am glad that I stumbled upon ur blog in Basu Nivesh.

Appreciate if you could guide me with a reply on [email protected].

I am also keen to engage with u on few other things and will take it up based on ur reply there with ur co-ordinates.

Krishna-Elaborate the situation.

Sir,

Good article !!

If I go for NPS and uses 100 % of accumulated amount on maturity to buy annuity.

In this scenario which one is better : NPS or APY ?

Saket-APY comes with a limited defined pension. However, in case of NPS, your pension depends on the accumulated corpus. Hence, comparing both is definitely a wrong.

i am apply AYP 8 months back I want to close account any help me