Which are Top 5 Best ELSS Tax Saving Mutual Funds 2018 to invest in India? How can we shortlist among the so many ELSS or Tax Saving Mutual Funds? Let me ease your work.

Recently I wrote a post Top 10 Best SIP Mutual Funds to invest in India in 2018. In that post, I have not covered ELSS or Tax Saving Mutual Funds. Because yearly I used to write a separate for ELSS Funds. Hence, following the trend, I am writing this post.

Before proceeding further, let us first recap the recommendations of 2017. Last year I wrote a post on this (Top 5 Best ELSS Tax Saving Mutual Funds to invest in 2017). Hence, it is mandatory to review the funds.

You notice from above table that DSPBR Tax Saver Fund (G) has not beaten the benchmark since a year and ICICI Pru Long Term Equity Fund (G) since two years. However, when you look at their 5 years and 10 years returns, then easily beaten the benchmark.

What are ELSS or Tax Saving Mutual Funds?

- ELSS (Equity Linked Savings Scheme) or Tax Saving Mutual Funds are the special funds which are meant for tax saving purpose under the Sec.80C of IT Act.

- Lock-in period of ELSS or Tax Saving Mutual Funds is 3 years. This is the lowest lock-in period among all tax saving instruments you invest. However, do remember that each investment (monthly SIP) is considered as a fresh investment. Hence, such each investment or monthly SIP must complete 3 years for liquidating. Let us say you started the monthly SIP on 1st January 2017, then the first SIP will be eligible for withdrawal after 3 years completion means after 1st January 2020. Same way 1st February 2017 SIP will be eligible for withdrawal after 1st February 2020. It will continue like that. Never be in wrong belief that one year SIP in ELSS funds means after 3 years can withdraw FULLY. You have to wait for fourth-year completion to completely withdraw the amount.

- ELSS falls under EEE tax rule (Exempt-Exempt-Exempt). There will be tax benefit during investment, no tax on whatever you earn and no tax at the time of withdrawal. This includes the divided declared from such funds are also tax-free in the hands of investors.

- The monthly investment required is as low as like Rs.500. There is no maximum limit. But the maximum tax benefit under Sec.80C is Rs.1.50,000 as of now.

- All ELSS or Tax Saving mutual funds will not have same investment mandate or never feel that they all invest in same stocks or sectors. Based on the fund mandate, they have rights to invest accordingly. Hence, you must understand the fund portfolio before jumping into investment.

- Never invest in ELSS or Tax Saving mutual funds with the intention that after 3 years you can easily come out investment with POSITIVE returns. This is the equity product. Hence, enter into such products only if you are ready to wait for more than 5 years or so.

- Tax Saving ALONE will not be your motive to invest in such products. You must have a proper financial goal in mind and along with that proper asset allocation a MUST. If you are unable to do that then it is a sheer waste of investing randomly.

Why you have to invest in ELSS or Tax Saving Mutual Funds?

# You must have long-term holding period to invest (strictly not less than 5 years).

# You must invest in such funds only if you have a proper financial goal.

# You must do the proper asset allocation between debt and equity or among other assets based on the time horizon of your financial goal.

If the goal is below 5 years-Don’t touch equity product. Use the debt products of your choice like FDs, RDs or Debt Funds.

If the goal is 5 years to 10 years-Allocate debt:equity in the ratio of 40:60.

If the goal is more than 10 years-Allocate debt:equity in the ratio of 30:70.

# You must have proper return expectation of your OWN before jumping into investment.

# You must know what is your portfolio return expectation when you combine both debt and equity.

# Finally, if you are feeling the shortfall in tax saving benefit under Sec.80C limit.

Notice that I gave the priority of tax saving the LEAST. So understand first then jump into investment.

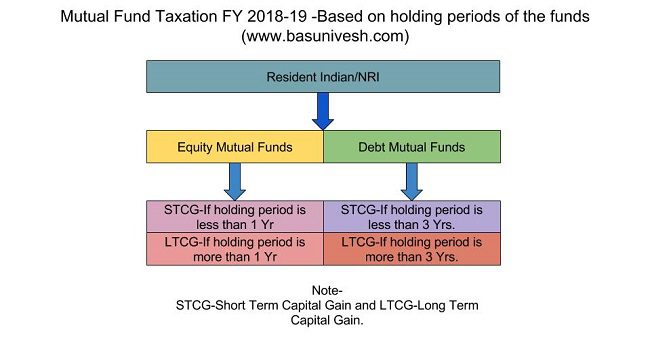

Taxation of ELSS Tax Saving Mutual Funds for 2018-19

ELSS or Tax Saving Mutual Funds are considered as equity mutual funds for tax treatment. Hence, they are taxed accordingly. I tried to explain the same in below image.

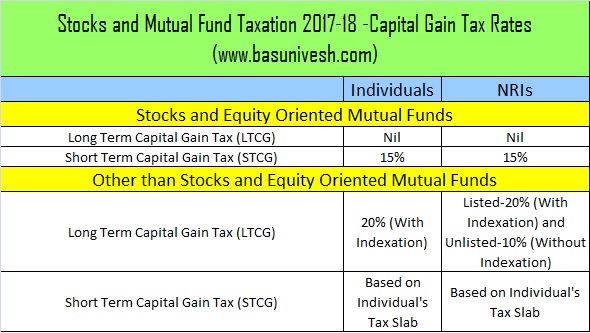

The rate of taxation is as below for the current FY.

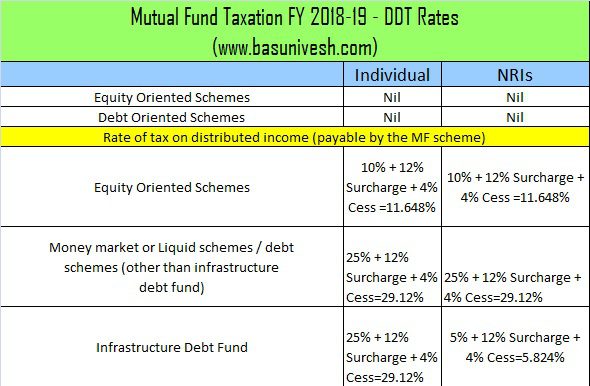

Also, refer the applicable DDT rates for Equity and Debt Funds after the Budget 2018.

Hope taxation part is clear to all of you. If you still have doubt, then refer my latest post “Budget 2018 – Mutual Fund Taxation FY 2018-19“.

How I selected Top 5 Best ELSS Tax Saving Mutual Funds 2018-2019?

I will first screen the top 10 funds based on their returns to benchmark since inception. The funds who consistently beaten the benchmark are listed in that 10. Once I have the list in my hand, then I select the funds based on Risk-Return Analyzer.

Many simply select the funds based on eye-catching returns. However, at what cost the fund is giving you a better return? To what extent it protects my investment during a downturn is what differentiate from good fund to bad fund.

Again, I am not saying that these 5 funds alone be considered as “Top 5 Best ELSS Tax Saving Mutual Funds 2018”. There may be fewer other funds, which are good to compete with these funds. However, I may be biased towards few Mutual Fund Companies (purely on their size and how long they are in MF business in India). Below are the metrics I used to arrive at finally selecting the funds.

If the fund cleared all these tests and given me around a minimum of 80% score since inception, will be added to my list.

- Beta-Volatility measure and tell how much the fund changes for a given change in the Index. Lower the beta, lower the volatility. Hence, your fund must have lower beta.

- Standard deviation-It tells us how for a given set of returns, how much do fund returns deviate from the average. Lower the standard deviation, lower the volatility. Hence, your fund must have lower beta.

- Alpha-It is the risk-adjusted measure. By taking risks, how much the fund manager generated the return over the benchmark. Higher the alpha, higher the outperformance of the fund.

- Sharpe Ratio-It is the risk-adjusted measure. Higher the Sharpe ratio, better is the performance.

- Sortino Ratio-It is the risk-adjusted measure. Higher the Sortino ratio, better is the performance.

- Treynor Ratio-It is also be known as reward ratio. Higher the Treynor ratio, better is the performance.

- Information Ratio-This is calculated by average excess return obtained compared to a benchmark and divides it by the standard deviation of excess returns. Higher the information ratio, higher the consistency in beating the benchmark.

- Omega Ratio- It is a risk-return performance measure of an investment asset.

- Downside deviation-This is also be called as BAD RISK.

- Upside potential-This is exactly the opposite of Downside deviation.

- R-squared- It is a measure of how correlated the fund’s NAV movement is with its index.

- SIP Returns-For how many times the fund’s returns are above the index when we invest in SIP.

- Lump Sum Returns-For how many times the fund’s returns are above the index when we invest in a lump sum.

Below are my Top 5 Best ELSS Tax Saving Mutual Funds 2018

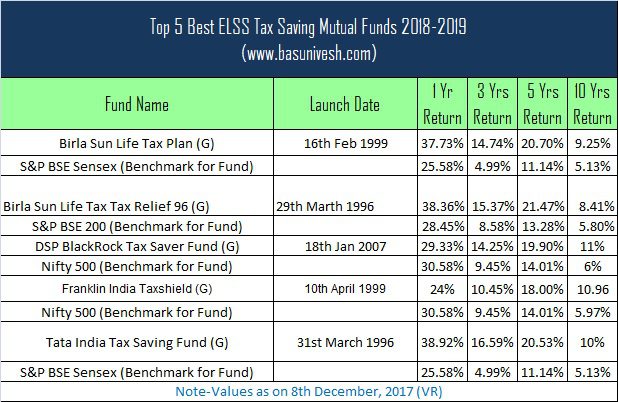

Top 5 Best ELSS Tax Saving Mutual Funds 2018-2019

Below are the 10 ELSS Tax Saving Mutual Funds under my radar. Based on these I shortlisted Top 5 Best ELSS Tax Saving Mutual Funds 2018-2019.

- Axis Long Term Equity Fund (Age 7 Yrs)

- Birla Sun Life Tax Plan (Age 18 Yrs)

- Birla Sun Life Tax Relief 96 (Age 21 Yrs)

- DSPBR Tax Saver Fund (Age 10 Yrs)

- Franklin India Taxshield (Age 18 Yrs)

- HDFC Long Term Advantage Fund (Age 16 Yrs)

- ICICI Prudential Long Term Equity Fund (Age 18 Yrs)

- IDFC Tax Advantage (Age 9 Yrs)

- L&T Tax Advantage Fund (Age 11 Yrs)

- Tata India Tax Saving Fund (Age 21 Yrs)

Among these 1o funds, I have selected the Top 5 and listing them as below.

You noticed that I did only one change. I removed ICICI Prudential Long Term Equity Fund due to it’s consistently 2 years underperformance to it’s benchmark and added Tata India Tax Saving Fund.

However, those who are investing in ICICI Prudential Long Term Equity Fund may continue as usual for few more days by keeping an eye on the fund performance. For fresh investors, I am suggesting Tata India Tax Saving Fund over ICICI Prudential Long Term Equity Fund.

Let me know if you have any doubts.

Refer my other posts related to Mutual Funds of 2018

- Top 10 Best SIP Mutual Funds to invest in India in 2018

- Top and Best Debt Mutual Funds to invest in 2018

- Top 5 Best Balanced Funds 2018 to invest in India

- Budget 2018 – Mutual Fund Taxation FY 2018-19

- Budget 2018 LTCG Tax on Stocks and Mutual funds

273 Responses

Sir, Thanks a lot for such an informative write up,its really very useful.

Please keep it up

Dear Chander,

Pleasure 🙂

Hello Basu,

Can you please advise as from when we would able to see the ELSS Mutual fund recommendation for 2019.

Thanks a lot

Dear Vijay,

I will publish it soon.

Hi Basu,

I am eagerly waiting of ELSS and top 10 Mutual fund recommendation for 2019. In one year of time span most of the equity fund are in negative. So i also want to know upto what time should i watch fund before making any decision. My plan is long term of 10 Years or more.

Also can you posts regarding Index Fund?? Advantage & Disadvantage.

Thanks a lot.

I am following you and reading all posts since 2015.

Dear Pranav,

I will definitely publish the post. This time my idea is to include Index Funds.

Dear Sir,

Aditya Birla TAX SAVING PLAN merged with TAX RELIEF 96. So better you can change first ELSS fund in given list as Aditya Birla Sun Life Tax Relief ’96 instead of Tax Plan.

Please check below notification:

The fund house released a notice announcing the merger of Aditya Birla Sun Life Tax Savings Fund into Aditya Birla Sun Life Tax Relief ’96. Both the schemes were tax-saving or ELSS schemes with a three-year lock-in period. The effective date of this merger will be May 21.Apr 20, 2018

With Regards

Srinivasa Vutukuri

Dear Srinivasa,

I am aware of this and this post was published a year back. Please wait for my 2019 recommendations.

Sir, I am a new investor and I have started my investment in ABSL tax relief 96- direct growth with 1500/month.

Can you suggest a value fund/ or any Elss fund which would give me similar returns at par with ABSL Tax Relief-96 but is less volatile ?

I have a time horizon of 6 yrs and expect an absolute return of 20% or more.

My Plan is to save tax and use this corpus for my child admission to a good school after 6 yrs and other expenses.

Dear Paresh,

If your goal is 6 years away, then stay away from equity products.

Thanks basu for getting back.

As I have already invested in an Equity, so what are the less risky ways of getting 20% return and how much would I need to invest to get to some 5 lacs in 6 yrs

Dear Paresh,

20% return expectation within 6 years???? Only GOD or some cheaters can guarantee you this.

Your blog is one of the best things to happen to beginners who are learning about Finance.

I just had one doubt regarding ELSS.

You have mentioned that,

“There will be tax benefit during investment, no tax on whatever you earn and no tax at the time of withdrawal”

But there’s also mention of taxation at the end of this article.

Which one applies?

Dear Vineeth,

The taxation rules of later part apply as new rules started from the current financial year.

Hi – I would like to make a SIP of 20k per month in ELSS funds ( Reason for ELSS funds is – Me and spouse are tax payers. So, 10k per month on each of us will suffice the 80c needs). My investment horizon will be a minimum of 15 years (specifically for my child’s education/marriage expenses). I feel it would be better to choose 3 to 4 funds (may be 5k each) with different risk combinations. Can you suggest the funds that I can start with now?

Dear Hari,

What risk varies by selecting the different funds?

Hi – Something like choosing the funds with different risk profiles. few may have more mid or small caps with high risk, few other funds may have large caps with moderate risk. I would like to choose 3 or 4 funds with different risk profiles. This is my assumption with limited knowledge. You can feel free to suggest any funds that best suites my goal.

Dear Hari,

For equity, you just need one large cap and one mid cap (if you are high risk taker then a small cap in small proportion).

Hello ,

Is it advisable to continue investment in ELSS if I have cross the 1.5 lac limit in 80c or i can discontinue the fund ?

Dear Tanuj,

Better to stop as the liquidity is an issue.

Hi Basavaraj,

i too have same question but i couldn’t understand what is issue here.

what do you mean by liquidity is an issue?

could you please explain.

Dear Muralisankar,

Irrespective of the fund performance, you have to stick to the fund for 3 years. Is it not an issue?

Hi ,

Am i right in understanding that ELSS Investments are part of 80C deductions of 1.5 Lakhs.?

As i am filing my return , isaw a section in ITR 1 Form , which says Section 80ccg – to show investments in ELSS which is over 1.5 Lakhs .

So where should i show my ELSS Investments ? 80 C or 80ccg ?

Please Advise.

Thanks,

Neethan

Dear Neethan,

ELSS are part of Sec.80C. Sec.80CCG is for Rajiv Gandhi Equity Savings Scheme, which is now not available.

Hi Basavaraj

Thanks for the detailed explanation.

This is my portfolio. All are Direct Growth only.

Could you please let me know can i continue the same.

I am investing from past 3 years

Axis Long Term Equity – 2500

Franklin India Tax Shield – 2500

DSP BR Midcap – 3000

DSP BR Equity Opportunities – 2000

L&T Mid Cap – 2000

SBI Blue Chip – 2000

One time inestment of 25000 in below 4 funds

Canara Robeco Dynamic Bond Fund – Direct Plan (G)

ICICI Prudential All Seasons Bond Fund – Direct Plan (G)

Reliance Gilt Securities Fund – Direct Plan (G)

UTI Bond Fund – Direct Plan (G)

Dear Siva,

Without knowing your financial life and goals, how can I blindly assume and suggest you?

Hello Sir ,

What type of portfolio does ELSS fund follow as in , is it like a Multi cap or a large cap funds .

Dear Anshu,

It depends on the fund portfolio. There is no such common portfolio for all ELSS.

Thanks for the reply Sir ,

I have two funds :

1. Aditya birla mutual fund tax saver 96

2.IDFC tax advantage .

What type of portfolio does these two funds fall ?

Dear Anshu,

Check the respective funds portfolio on their portal. Birla is heavy with mid cap and IDFC almost equally distributed among large, mid and small cap.

Hi Sir,

Please let me know which is best among the below ELSS funds for the period of 10 years.

1.Principal Tax Savings – Direct

2. ABSL Tax Relief 96-Direct (G)

3. IDFC Tax Advantage (ELSS) Fund

4. Reliance Tax Saver(ELSS)-Direct (G)

5. L&T Tax Advantage Fund Growth

Mohan-I already mentioned my selections in above post.

sir

i wanted invest in logistic sector ( UTI LOGISICT) throuGH SIP please guide is it ok to go with logistic sector

Mithilesh-You already has chosen the sector, then why the doubt?

I wanted to know uti logistics is good or any other mf in this logistic sector is best ?

Mithilesh-I does not follow sector funds. Sorry.

Aditya Birla Sun Life Tax Plan new subscriptions are stopped now

Akash-Then choose any other funds from above list.

I have done my asset allocation(goal 9 years)for debt I invest through ppf,for equity i invest in elss and other equity mf.For equity mf I decide to invest through Sip but for elss I can not decided wheather through sip or lumsum? Pl suggest

Mintu-If you did asset allocation then you can go ahead either with lump or under SIP. But PPF is 15 years product and your goal is 9 years, in that consideration, how PPF best fit for your debt?

Actually my investment in ppf completed 6 years but no investment in mf.Recently I read your blog I liked it & decided to invest in mf and I am a new investor in mf.As after 9 years ppf completed its 15 years so accordingly I set my financial goal.

Mintu-Then you can consider PPF if that maturity is matching your financial goal.

Dear Sir,

I have invested in ICICI Prudential Long Term Equity Fund (Tax Saving) – Direct Plan – Growth with SIP -RS 3330.

and want to invest Rs. 1 lakh in mutual fund for 5 years ,purpose is to make my money grow faster so which mutual fund should i choose.

Now there is one more confusion should i choose ElSS for tax saving because i cannot go for PPF or NSC as their locking periods are more as compared to M.F .Please suggest

Anubha-If your goal is just 5 years, then NEVER TOUCH EQUITY.

Sir what about my second question which M.F i should opt for tax savings??

Anubha-Any fund from above list.

Hello Basavraj,

I started SIP in some elss and mutual funds from Jan 2018.

Please have a look on my portfolio-

HDFC balanced fund -2500/month

Kotak select focus – 2500/month

ELSS funds-

Axis long term equity-2500/month

Birla SL tax relief 96-2500/month

Reliance tax saver-2500/mnth

Want to invest for next 7 to 8 yrs. Should I continue SIP in above listed funds or change?

Please suggest.

Onkar-Where is your asset allocation?

Sir I started SIP just 3 months back without help of any financial adviser. I don’t know much about asset allocation.

Sir, Can you please suggest about asset allocation. So that I can restructure portfolio. Guide regarding existing funds to be removed or new funds to be added.

Thank you.

Sir I started SIP just 3 months back without help of any financial adviser. I don’t know much about asset allocation.

Sir, Can you please suggest about asset allocation. So that I can restructure portfolio.

Thank you.

Onkar-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

My goal is to buy house in 1-2 year. For that I will take loan.

So how should I invest and where. I can do SIP for 10000 per month.

From 10000 only I want to invest some amount in ELSS so I can use is for tax saving.

Please suggest.

Ravindra-If your goal is just 1-2 years away, then in what sense today’s investment into ELSS helps you? Because ELSS comes with 3 years lock-in right?

That 1-2 year means, If I take loan then EMI will start so its kind of investment start and 80 C purpose will also solve. Then there is no need of ELSS. But for current I dont have any thing to show for 80C. That is the reason asked for ELSS. Once EMI will start I will invest in other MF not in ELSS.

What is your view.

Ravindra-Never invest for the sake of JUST TAX SAVING and also never go for long with a happy mode that you are saving tax. Both are wrong.

Hi Sir,

I seek your advice on the below query

I am doing a SIP of 2000 into Axis Long Term Equity Fund the past 1 yr. Do you suggest if I should switch over to any other fund ELSS fund or shall I continue with the same fund.

Thanks in Advance

Sowmya

Sowmya-Please continues.

SIR,

I SEEK YOUR GUIDELINES IN MY CASE, WHICH IS AS BELOW:

I AM INVESTING RS 2000 MONTHLY IN ELSS-SBI MAGNUM TAXGAIN SCHEME -REGULAR PLAN- GROWTTH SINCE 2011.

I HAVE REDEEMED 80 THOUSAND RS LAST YEAR FOR MY HOME BUYING PURPOSE.– AS IT IS REGULAR PLAN, I WANT TO SWITCH IT TO DIRECT PLAN, BUT I HAVE MY APPREHENSIONS:

(1) WHETHER IT IS WISE TO SWITCH AFTER SUCH A LONG PERIOD.

(2) WHAT WILL HAPPEN TO THE AMOUNT ALREADY INVESTED.

(3) SHOULD I STOP INVESTING NOW, AS I HAVE SUFFICIENT TAX SAVING SCHEMES COVERING 1.5 LAKHS

PLEASE PROVIDE YOUR GUIDANCE SIR

Nirmal-Switching to direct is entirely your wish. If you are capable of handling your investing on your own, then go ahead. Also, switching from regular to direct is nothing but withdrawing from existing fund and investing freshly in new fund. If your 80C limit completed, then no need to continue ELSS.

Hi, please suggest me any one ELSS fund for Lumsum amount in 2018-2019 for high return I am ready to pick high risk as well..

Bhushan-My selection is already listed in above post.

Hello sir

I want to invest in 2-3 elss funds in sip for financial yr 2018-19.i have invested in reliance tax saver in 2016 in lumpsum which units havr dropped recently.Do u think i should add reliance tax saver in my portfolio again or see some other elss funds like idfc and motilal oswal.

Plz suggest.

Ankita-Why 2-3 funds rather than one? Why you doubted Reliance?

I wanted to invest 8k monthly in 2 funds.

My invested amount has reduced to 57000 from 62000 in one month in reliance.

Ankita-One month reduction bothered you that much?

NO i am not bothered by that.i will stay invested in reliance. But my question was that as i m planning to make a new investment should i invest in reliance again in sip or invest in some other fund ?my previous investment was in lumpsum.

Ankita-That is what I am trying to fetch from you. Why not RELIANCE?

Because of inconsistency and underperformance

Ankita-How you arrived at the decision that the fund is inconsistent and underperforming?

Hi Basavaraj,

I am 28 years of age working in Housing Finance Sector. All my current Investments in Equity are through SIP only. I am investing 13000 in SIP every month since last 3 years. My current holdings are Frontline Equity- 3000, ICICI Discovery- 3000, Mirae Emerging Bluechips- 3000, HDFC Balanced- 3000, DSP Micro Cap- 1000. I have an Investment Horizon of 15-20 years with an Aggressive Risk Profile. I am in search of a Mid Cap or Mid+Small Cap oriented ELSS Fund. Please suggest one.

Thank You

Paras-First priority you should do is to do asset allocation between debt and equity. Regarding ELSS of your interest, I suggest above funds due to their stability.

As per my asset allocation, EPF takes care of Debt part . There is short fall in 80C tax savings limit, In this case shall i choose an single ELSS fund to make an short fall investment amount .

Till now , i have used PPF along with EPF for Debt part, But now EPF is very much sufficient to take care of Debt part ( due to recent hike in pay scale). So i have no other option to choose ELSS for tax savings.

Kalai-Yes, you can do so.

Thanks Basu,

I am planning to add Franklin taxshield for ELSS fund. Is it necessary to consider portfolio overlap with my existing funds in the portfolio. Because I choose is only to cover the shortfall amount in 80 C limit .

But My main investments goes to existing portfolio funds.

Kalai-Better to cross check once.

Yes i have checked overlap and it close to 16% .

Kalai-Then go ahead.

Hi Basavaraj ,

Lets say I am invested in an ELSS fund for last one year, now if I see the fund is not performing well (rather under performing), So shall I remain invested in the same fund, or switch to some better fund and if I switch , shall I redeem all the units from my previous fund (which is now under performing) .

Please advise.

Thanks

Tapan

Tapan-In case of ELSS funds, the lock-in is 3 years. Hence, you are not allowed to move or withdraw the money for the 3 years.

Thanks Basavaraj for your prompt response. Okay to summarize my question there are two cases here–

Case 1: If my ELSS is under performing and I am invested since last one year, shall I stop making any further investment( lets say I am doing SIP in that).

Case 2: If I see even after 3 years, the fund is still under performing, shall I remain invested in the same fund, or switch to some better fund and if I switch , shall I redeem all the units.

And lets also consider that when I started investing in ELSS back one year ago, that was solely for making wealth (and saving tax as well) with investment horizon of 10 years.

Please advise what should be the approach in both the cases.

Thanks

Tapan

Tapan-1) YES.

2) YES you can either remain invested or move to another fund after units complete 3 years.

Dear Sir,

I want invest lumpsump amount to best ELSS fund to save my tax.

Pl. Suggest which top best return fund I will choose to current year tax.

Thanks

DIPAK PATEL

Dipak-Try to invest to achieve your goals but not to save tax. My choices are listed above.

Hi Basu,

Could you plz tell me what is the reason behind the return rate for 1 yr and 3 yr .

1st year.. In every case the returns are more and in 3 yr it is less.

What happen if some one invest SIP for year and then take out the amount and try to do the same for every year.

Will it work?

It is the returns of last 1 year and last 3 years. The reason is markets did very well in 2017 and did only recently in 2015 and 2016. So obviously 1 year AVG is greater than 3 year AVG. But it is a total coincidence and the future returns may be completely different.

Ravi-Returns are more due to bull market since a year. But be ready to expect NEGATIVE returns of that much also. Longer period returns are the returns which adjusted to these short term volatility and giving you the clear picture.

Hello Sir I want to invest a lumpsum amount of around rs 130000 in a one go for tax saving purpose for the current financial year as well as also expecting good returns. My time horizon is 15 years. Is it right time to invest in the current scenario of market or switch to some other options. Kindly suggest.

Dinesh-Yes, RIGHT TIME TO INVEST IS TODAY!! Don’t invest 100% in equity products. Do the asset allocation and invest accordingly.

I want to invest Rs 150000/- in equity. Is the timing right or wait for correction. Which do you suggest

Rao-Hard to say anything without knowing much about your investment reasons.

Investment reason – Long term (>10 years) investment in growth plan

Rao-First do the asset allocation and then select the products. Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Thank you for this very helpful information.

Suppose I am investing 1000/month for 3 years which is 36K in 3 years so is it like that I cannot withdraw my total amount (i.e. 36k+ returns) in one go after locking period of 3 years?

if so how much can I withdraw and what is the calculation. Can you please give an example.

Each unit is locked in for 3 years. The units purchased in Feb 2018 can be redeemed in Feb 2021. The units purchased in March 2018 will be unlocked in March 2021

Nitin-Rajesh already replied to you.

Hello Basavaraj,

Could you please tell me which one is better in IDFC Tax Advantage (ELSS) Fund – Direct Plan (G) & DSP BlackRock Tax Saver Fund – Direct Plan (G), 3 sources including you are saying DSp & 3 sources including Money control are saying IDFC…please help me to choose one.

Regards,

Jayesh Chavan

Jayesh-Invest and go with the sources which YOU BELIEVE.

Hi

I am investigating for the long term(8 years).

I have just started investing in following MF.

1.Axis long term equity fund regular G (ELSS)-Rs. 1000.00

2.Birla Sun Life Tax Relief 96 (ELSS)-Rs. 1000.00

3.DSP BlackRock Tax Saver Fund (ELSS)-Rs. 1000.00

4.Reliance Tax Saver Fund (ELSS)-Rs. 1000.00

Please suggest me and my portfolio is good or not.

Vaskar-Where is asset allocation between debt and equity? Why so many funds and why not 1-2 funds?

The asset allocation of around 40:60 between debt and equity.For debt (tax saving) I have invested ppf. Please guide which fund should I select?

Vaskar-Birla.

Birla Sun Life Tax Relief 96-4000/-(SIP) for 8 yr.Is my understanding correct. please guide.

Vaskar-Yes, with proper asset allocation of debt and equity.

Thank you

Hello Sir,

I want to invest in equity that are mention below, that will consider in Tax saving. Please suggest me.

1. SBI Blue chip fund-Direct growth :2500

2. HDFC Midcap Opp Fund(G) :2500

Thanks

Amit

Amit-Both are NON ELSS Funds. Hence, you will not get any tax benefits while investing under Sec.80C.

Hi Basu Sir,

Great post! Whats is your opinion on Motilal Oswal Long Term ELSS and Reliance Tax Saver? Are they too volatile/aggressive?

Ragesh-Motilal Oswal Long Term ELSS is just 3 years old fund. Hence, I have to wait to check the performance. However, you can consider Reliance Tax Saver.

Thank you 🙂

I am a 38 year old Govt. Employee. My income is 3.5 lakhs per annum. I am investing in PLI Rs.3,000/-p.m. (10 lakhs policy). I want to invest another Rs.10,000/-p.m. for my two sons education purpose (one is 8 years & onether one is 3 years). please suggest a best way to invest for high returns for my two sons education purpose.

Thanks

Arunkumar-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Hello sir

I want to invest lumsum amount can I go with DSP BlackRock Tax Saver Fund please suggest Aditya Birla Sun Life Tax Relief 96 is aggressive in ELSS catgory or can I go with Birla tax relief 96

Jai-You can choose anyone of the above but with proper debt and equity asset allocation and also with the view of more than 5+ years.

I WANT TO INVEST AROUND 130000 FOR TAX SAVING IN THIS MONTH ONLY MEANS IN LUMSUM WHICH MUTUAL FUND WILL BE BEST FOR ME? I AM EXPECTING TO WITHDRAW THE MONEY AFTER BASIC LOCK IN PERIOD( IN 3 YRS.) AND WILL THIS RETURN AFTER WILL BE TAXABLE.?

Vivek-Stay away from equity mutual funds if your time horizon is just 3 years.

okk.. but is income means profit after 3yrs will be taxable..?

and please suggest me good mutual fund

Hello, I am targeting to create 5 cr wealth after 25 years as a retirement planning. Please suggest how and where to invest.

Dhaval-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Dear BT,

I am investing 4000/month in following funds since last 03 month & my time horizon will be 15-20 years.

L&T emerging business Growth-1500/-

Kotak select focus fund Growth-1500/-

Mirae emerging business fund-1000/-

Should I follow with same portfolio & please suggest me one Fund for SIP Investment 2000/- (ELSS /Equity Diversified fund

Regards

Prashant-What prompted you to doubt your investment WITHIN 3 months? Where is your asset allocation?

Pls guide about asset allocation?

Not doubt about investment, only your best advise for future guidelines.

Prashant-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Hi Basu,

I want to start a SIP of 5k in Elss for 10+ year .

I am confused between two fund :

1.Aditya Birla Sun Life Tax Plan.

2.TATA INDIA TAX SAVING GROWTH.

Which one should i invest? or should invest in both 2.5 k each?

which option would be good in your view?

Amit-My choices are listed above.

thanks basu.

should i split in two or invest in single elss?

Amit-Better a single.

Hi Basu,

First of all Happy new year.

I had selected ELSS Axis Long Term Equity Fund – Direct Growth since aug-2016 and continuing for 3000 rs/pm

Should I choose different ELSS funds or stick to the same fund.

Kindly suggest.

Deepak-Better to wait for another 5-6 months and then take a call.

Thanks Basu

Another query is i have investing rs 4000 since one year in HDFC mid cap fund . And it is also running in very low.

Should I stick for some days or go for any other.

Kindly help

Deepak-May I know the reason for investing in this HDFC Fund?

I have invested in equity and some in high-cap,mid-cap and in small-caps in 45-30-25 proportion for long-term goals.

Deepak-What about debt?

i am making PPF and general savings account for it

Deepak-Do the asset allocation as per time horizon. But I suggest you to retain HDFC Fund.

hi. It is generally advised not to invest in elss from tax saving point of view but as a part of equity portfolio.ELSS as a class are delivering returns comparable to multicap equities..At a time when 80C most probably will be taken care by EPF/PPF , home loan principal,term insurance premium etc, is it really necessary to go for an ELSS or one can rather invest in a multicap eqiuty?

The fund mandate in a multicap will be to switch between various market caps to get the best possible returns. ELSS has a mandate to invest >60% in equities. Does the fund manager have options to switch his stocks across various market caps in ELSS?

some financial planners are advising that in equity investments, there is no exit load after 1 year. so they are telling that instead of taking up sip plans for various tenures as per targets, go in for a long term sip of say 20 years. one has the option to redeem partially or fully at any point of time after 1 year without exit load or tax implications and also can stop sips without attracting penalty if he wishes so. what is your opinion on such approach

From when will the new regulations of sebi with regards to MF schemes come to effect? what will happen to existing schemes then. suppose a fund house has 2 schemes in a particular category, they will be merged for future investors, but for existing investors, do they continue as different funds or will be converted into the new single fund?

Satish-“Does the fund manager have options to switch his stocks across various market caps in ELSS?”-You have to check with fund itself.

“some financial planners are advising that in equity investments, there is no exit load after 1 year. so they are telling that instead of taking up sip plans for various tenures as per targets, go in for a long-term sip of say 20 years.”-INVESTMENT SHOULD BE BASED ON YOUR GOAL BUT NOT BASED ON PRODUCT FEATURE.

Mutual Fund Categorization will have to be implemented before March 2018. Schemes merger will happen.

sir

i just want shift my E Q mutual fund SIP (RP) To SIP(DP ) how can i change / what is procedure ?

please guide me as i came to know that for a long term ( like in my case ,my horizon is 10 yr and above ,sip 10 K ) MF SIP expense ratio eats our handsome amt of earnings ,

Mithilesh-First check the taxation and exit load applicable in such switch. Once you have the clarity about that, then you can do the lump sum transfer. Yes, regular plans eat commission. But check whether you are capable of handling the portfolio on your own or not. If the answer is yes, then go ahead with direct.

What exact difference between handling by AMC for RP MF and in DP MF by own as the set of share will be same in both If RP Increase DP will also increase isn’t it or please clarify me regarding handling own DP portfolio

Mithilesh-When you go with RP through an adviser, then choose an adviser who can handle your portfolio. If he is not handling or if any such middlemen not providing value addition to your portfolio, then you simply choose DP. It is actually your comfort with MF and the equity that matters more than anything else. If you are capable of handling this, then go ahead with DP.

what exactly means “handling a portfolio”? what value additions can we expect from an adviser normally?

Satish-Review of the portfolio, aligning them as per your goals and all those stuffs.

Idfc tax advantage

Mirae asset tax saver

Reliance tax saver

BOI Axa tax advantage

I need to invest lumsum 70k for 10 years. Please guide which fund should I select?

Anand-What prompted you to selected these funds ONLY?

Hi,

Mainly fund return, I’m thinking to invest lumsum1 lakh amount in IDFC or Mirae ELSS fund with time horizon 10-15 years and also start SIP in elss

I understand the benefit of SIP but understood late and for tax saving, I’ve not any better option than ELSS

PLease guide.

Anand-If you found NOT ANY BETTER OPTION THAN ELSS, then you can invest as per your risk. But for me the first priority should be ASSET ALLOCATION based on time horizon.

Hi Basavaraj, You mentioned to keep away from equity if the horizon was just 3 to 4 years. Did you mean not to invest in ELSS with this horizon? What suggestions do you have for this horizon?

Shibu-Yes when I say equity, it also involves ELSS. For such short time horizon, use debt products.

Hi Basavaraj,

I have one query… While selecting elss fund what should be governing factor? Past returns is one criteria, what other things I should check??

Please advice…

Lakshman-I explained the criteria in above post, which are also important in selecting the fund.

Sir m new in mf, and looking for tax savings with good return for my father of 20k p.a.

Can you suggest me-

~The good ELSS.

~The best way to invest(SIP/LUMSUM).

~The minimum lockin period suits good.

And most importantly can I select different ELSS if lumsum for every year as my father service tenure is between 4 to 7 year.

Majbool-I replied to your email. Also, stay away from equity if your time horizon is just around 4 years.

Hi Basavaraj,

I want to start sip kind of a thing with 10k per month, but i dont want to invest whole 10k in one fund only, so please suggest me 5 good funds with good returns for 3 years and also i am in confusion now with elss and sip, as elss comes under 80c but not sip. So please guide me, as i am new to mutual funds.

Thank you

Mohan

Mohan-If your time horizon is 3 years, then stay away from equity.

Thanks for your suggestion, I am going for 5yr or more term ELSS scheme and below are my choices. Please guide me are below are good for long term,

Axis Long Term Equity – Direct

Reliance Tax Saver(ELSS)-Direct (G)

ABSL Tax Relief 96-Direct (G)

IDFC Tax Adv. (ELSS) -Direct (G)

DSP-BRTax Saver Fund -Direct (G)

Mohan-Why so many?

I want invest 2k in each of upto 5 different one so. I am not sure is tht good idea or not. Please guide on this sir

Mohan-Just asking the reasons about why 5 different.

I want invest 2k in each of upto 5 different one so.

Mohan-First do the asset allocation between debt and equity (based on your time horizon). Then in equity choose one market cap fund from each class. Investing in 5 different funds within a category does not mean a true diversification.

I am planning invest my 10k in equity and debt with 70-30 ratio. For equity is small cap good to invest as i see it giving good returns but at the same time i read its more vulnerable also. Please guide me

Mohan-You read it right for small cap. Allocate small portion of your portfolio towards small cap and major chunk should be towards large and mid cap.

Hi Basavaraj,

Please guide me which is better to invest between large cap and small cap, considering vulnerable, risk and returns. I know I am asking little difficult question for you. Please guide.

Mohan-Large cap are safe bet than small cap.

Hello sir

I want some advice on which tax saving mf should i invest to cover up 80c deduction for the fy-2017-18

I want to invest 1lakh in one go because financial year is ending in 2 months..so i need to invest a big sum to cover 150000 tax slab under 80c

Siddharth-Investing for the sole purpose of tax saving is the biggest mistake. But it is up to you to decide as fund are already listed in above post.

Hello Basavaraj,

Based on your recommendations, I checked the portfolio, benchmark percent and performance for Aditya Birla Sun Life Tax Relief 96 and TAta India Tax Savings Fund. There is minimum overlapping of funds.

So I am planning to start investing in each 2500 SIP for the next 8 years. This is merely to get better returns than FD beating inflation and save tax.

Do you think this is wise decision? I already have LIC and PPF, but still not enough for 80cc.

Sowmy-Never invest for the sake of tax saving and beating inflation, BUT invest with a proper financial goal set up. You must know the time horizon of the goal. Also, never touch equity if your goal is less than 5 years or so.

Hello Basavaraj,

The goal is definitely 8-10 years. But because right now I have no home loans to pay or other ways to save tax, I am opting for these 2 funds. The goal is to have a set-aside fund for any purpose in the future – be it home, medical or education needs – a common pool.

Sowmya-Then first set asset allocation as per time horizon. Then choose the products within assets.

how to set asset allocation as per time horizon sir

Elavarasu-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Hi Sir,

First of all , thanks for such a great site.

I have a goal for 15+ year( need maturity amount ~ 50 Lakhs). i would like to invest (80:20 / equity: debt) 10000/month.

1.Please suggest 3/4 Mutual funds to invest.

2.what should i prefer investing direct from AMC site or Agents or third party online sites.(Is there any hidden charges through third party investment).

Amit-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Hi

I have 60000 to invest, please suggest a best way to invest for high returns for a tenture of 15years.

Thanks

Asween-Refer my post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Hi Basavaraj,

Thanks for writing blogs. These blogs Help a lot!

I had a small doubt, IDFC Tax Advantage has been in top 10 or 15 in ELSS category for past 5 years or so. But it still didn’t make it to your top 5.

I was thinking to start a SIP in IDFC fund for about 7-8 years of about 5000 per month. What are your views on this.

Please help

Thank You

Shubham-I can’t include all funds within Top 5. Hence, it may be out. But if you are comfortable with fund style, then you can go ahead.

Hello Sir,

I have registered for a SIP of 3000 in Axis Long Term Equity Fund, which will start from next month. As you have mentioned in one of the above replies that the fund is underperforming, so I’m a bit worried. Should I cancel it?

Also, I’m planning to start SIPs of 2500 each for Birla Tax Relief 96 and Reliance Tax Saver/IDFC Tax Advantage. Which will be a better option according to you – Reliance or IDFC? I have already read your post, but there was no mention of these two funds, that’s why asking. I’m looking for long-term investment for 8-10 yrs.

Thanks & Regards,

Krunal

Krunal-I relies on Birla.

Hello Sir,

Thanks for the reply. Yes, I’m planning to invest in Birla. But apart from that, Reliance or IDFC.. which one should I go for? Also, what should I do about the Axis Fund?

Krunal-One or two ELSS enough.

Hi Sir,

I am 30 years old and married.

Below is the portfolio of my investments.

ELSS

1. Axis Long Term Equity Fund – Direct Growth – Rs 1000/month

2. RELIANCE TAX SAVER (ELSS) FUND – DIRECT PLAN GROWTH PLAN – Rs 1000/month

3. ICICI Prudential Long Term Equity Fund (Tax Saving) – Direct Plan – Growth – Rs 500/month

Equity Mid Cap Fund

1. SBI Magnum Global Fund – Regular Plan – Growth – Rs 2000/ month

I intend to add the below Funds to my portfolio via SIP and Divide Rs 5000 in between these funds. Also, i wish to do these investments via in direct plan. Could you please check all my portfolio with your expert eyes and give your advice.

1. HDFC Balanced Fund

2. Kotak Select Focus Fund

3. Mirae Asset India Opportunities

4. SBI Bluechip

5. Aditya Birla Tax Saver Fund ( little confused if I should start SIP in this or add money to Axis long term MF which is already running)

All my investments are for long term. Also, check if the few funds will overlap with each other, I will remove in such case.

Looking forward to hear from you.

Many Thanks,

Kind Regards,

Saurabh

Saurabh-LONG TERM=Define and where is the asset allocation and how you shortlisted these funds?

Thank you so much for your prompt response. 🙂

With Long term I meant more than 10 years.

Initially, when i had started investing, my friend has suggested me the funds and i invested accordingly.

But the new funds I have selected based on my understanding and research. I am sure its not correct so needed your help.

Please let me know if you have any other questions.

Saurabh-Refer my blog post “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Hi Sir,

I have asked these questions after reading your above mentioned link only. I trust that you exactly would be able to answer my queries. It would be very helpful you can analyse my portfolio sir.

Saurabh-I am pushing you to read and understand than looking for readymade answers. It is more harmful to you than ME.

ha ha ha 😀 alright, Thanks 🙂

Saurabh-Read and come up with questions. I love to answer always instead of readymade solutions.

Hi Basu,

I am new investor (age 22). I am unable to decide where to invest for tax savings. Also what should be my goal at this age?

Raj-I can understand your thoughts. But make sure your emergency fund, Life and Health Insurance are well planned. Then start investing for long term.

Hello Basavraj

I started SIP Rs. 5000/month in reliance tax saver fund from Jan 2018. Also want to invest lumpsum Rs.40000 in ELSS.

Shall I go with birla tax relief 96.

Can wait for 5 to 7 yrs.

Please suggest.

Onkar-You can choose Birla Fund. But do invest with proper asset allocation and also with view of more than 5 years.

Hello Basavaraj,

I am new to SIP.

I have started with below SIPs on Jan 1,2018 :-

SBI Blue Chip Fund(G) :- Rs 2000/month

Aditya Birla Sun Sun Life Pure Value fund(G) :- Rs 3000/month

DSP Blacl Rock Small and Mid Cap Fund(G):- Rs 2000/mont

HDFC MidCap Opportunities Fund(G) :- Rs 2500/month

I want to invest further Rs 15000/month for long term SIP ( 20 years ) and my target capital is 1 Cr.

Could you please suggested any mid -risk SIP for this? OR if any ELSS can do the same with balanced?

tough I do not need any ELSS as Rs 150,000 is done for 80C.

Also if you can explain about asset allocation , will be a good help.

Regards

Arijit

Arijit-Why not start fresh investment in same existing funds?

Hello Basu,

Thanks a lot for quick response.

So you want to mean I should continue with these funds as my long term plan and divide Rs 15000/month among those funds?

Regards

Arijit

Arijit-Yes, you can continue the same funds but with proper asset allocation.

Out of these ELSS funds , how many funds can we have in our portfolio. I am planning for two funds in my portfolio.

My investment tenure – 10 Years . SIP of monthly 5000 , two ELSS funds with 50:50 allocation

1. Birla 96 : The funds Ten year returns (Lumpsum) is less than the category returns. It has high allocation in Mid cap with 53% and the Top 10 holdings are Mid cap stocks. However it shown as a Low risk fund in Value research.

As a Moderate risk taker , I am planning to Invest in

1. DSP

2. Tata India tax savings

or Shall I go with the Portfolio

1. DSP

2. Birla 96

Kindly suggest. Thanks in Advance.

Kumar-Go with DSP and Birla. But do asset allocation between debt and equity also.

Hello Basavaraj,

If all the money one can save is within the 1.5 L of 80C deduction, is there a way to do proper allocation to LC, MC and SC funds. Do you recommend to do the SIP in a ELSS fund and then move the money to different categories after 3 year lock in period? Or is it better to do SIP in non-ELSS funds itself without considering tax implications?

Sujith-My priority is how to achieve my financial goals rather than thinking too much on TAX SAVING. You can nowadays fill the Sec.80C gap easily with Term Life Insurance and EPF. If few part left, then you can consider ELSS. Think first about your goal than about tax saving.

Thank you!

Hello Mr. Basavaraj,

Its a very well written blog. I am not regular to investments in mutual funds. However, for tax benefits, I have invested in ELSS funds last year in following funds –

1. Axis long term equity fund direct (G) – Rs 50000

2. Birla sun life tax relief 96 (G) – rs 25ooo

3. Franklin India Taxshield – rs 25ooo

I want to invest 1 lac this year in the following funds (rs 25ooo each)-

1. Tata India Tax Savings Direct-G

2. Birla sunlife tax plan – Direct growth

3. IDFC Tax Advantage (ELSS) Direct-G

4. DSP blackrock tax saver direct plan – growth

Is it a good strategy. My aim is to maximize the fund value and can keep it for whatever duration is advised.

Also, is it advisable to split your fund in 7-8 different MFs or should it be limited (specially when your investment amount is say Rs 1Lac per year)? Appreciate your revert

Anirban-The biggest mistake you did is that investing for the sake of TAX SAVING. You must first identify your financial goals, then try to choose the asset class and products. Otherwise, you will be nowhere when you need the money for your financial goals.

Hi Basavraj,

Thanks for the write up.

I would like to invest in ELSS funds. Looking for around 10-12 years time frame. I have selected the below two funds. Which one would you recommend?

Aditya Birla Sun Life Tax Plan(G)

Tata India Tax Saving Fund(G)

Thanks,

Robin

Robin-Birla.

Thanks Basavaraj.

Should we wait till SEBI categorization comes in?

Thanks,

Robin

Robin-NO NEED.

Thanks!

Hello Basavraj,

My family has never invested in mutual funds. Now my parents want to invest in mutual fund both for long term (10 years for capital growth) and also short term (about 1 year for regular income needs in the form of monthly dividends). They are not very keen on taking risks and also because they are about 60 years of age they are looking for security and growth for their investment. Can you please tell some options which might be suitable for them; probably equity plan for long term and hybrid or debt plan for short term?

Thank you so much.

Swara-In one way you are sharing that your parents are not ready to take risk but in another way you are eager to enter into equity. May I know what is the exact view?

Equity I mentioned because they came to know about it through someone. You can suggest freely whichever options seem good for low risk takers looking for capital growth. Thank you 🙂

Swara-Stick to debt products and stay away from equity. You can use Ultra Short Term Debt Funds also.

Hi Basavaraj,

Could you please suggest ELSS funds for me, investment is for a duration of 5 to 7 years. Goal is to have maximized returns along with tax benefits. Going through the articles, rolling returns often dont match the trailing returns to make it a cake walk pick. Kindly suggest according to the equity waves i.e. based on current and future trends

Thanks in advance.

Divya-First do the asset allocation of around 40:60 between debt and equity. For your equity portfolio, you can select the above suggest funds. For debt (tax saving), you can opt for FDs or NSC as per your choice.

Hi

My longterm investment are as under:

1. ELSS – Axis Long term equity fund Direct (G)-Rs 15000 (03/01/2017)

SBI Magnum Tax Gain Scheme Direct (G)- Rs 15000 (03/01/2017)

BOI AXA Tax Advantage Regular (G) – Rs 50000 ( 02/02/2015)

2. SIP of Can robecco Emerging eqyuties Direct (G) – Rs 5000 (08/12/2017)

Now i want to invest in DSP black and Birla sunlife ELSS for Rs 25000 each.

Kindly share your opinion on my portfolio. My goal is to keep this portfolio till 2025.

Regards

Varun-Where is asset allocation? Why within a year of investment do you feel doubt on your decisions?

Hi,

I want to invest 1lakh in lumpsum ELSS –

Planning for

Tata india tax saving – 50K

Birla Sun Life Tax Relief 96 – 50k

Is this a good approach

Yuvraj-Without knowing the goal details and how you selected these funds, it is hard for me to guide anything.

I am looking for tax saving as well as with long term good return options so i am Planning for invest 1 lakh in

Tata india tax saving – 50K

Birla Sun Life Tax Relief 96 – 50k

Is this a good approach

Yuvraj-Be specific with your goals like how much is LONG TERM for you.

3 to 5 years

Yuvraj-Stay away from equity funds and use debt funds.

Basavaraj, I often see you ask people to stay away from equity if they are looking at 5 years of investment. But debt doesn’t offer the same kind of returns.

Sowmya-Those who CHASE only RETURNS but NOT RISK can even invest if their goal is less than 5 years or 5 months. But I prefer to stay away from equity if the goal is less than 5 years.

Is it good to invest in ELSS mutual fund or regular mutual funds based on their performance, considering my income has 5% income tax liability.

Vicky-You can invest in ELSS even if you no need to save tax.

Hi ,

Nice article.

One question,

I want to get tax benefits.

currently investing 6k per month in DSP BR ELSS.

Still have to add 70k in ELSS.

Can you suggest spitting of amounts to be invested in ELSS funds?

Thanks

Sopan

Sopan-You can use the Franklin or Birla Funds mentioned above.

After completion of locking period for ELSS ,returns(full amount) are taxable or nontaxable ,under which section returns are nontaxable

Kishorebabu-ELSS returns after 3 years are completely tax-free. You have to show such income under exempt income.

have sip of 18000 per month, details are as follows:-

1. Axis long term equity growth- 4500/-

2. Tata india tax saving growth- 4000/-

3. Dsp blackrock micro cap growth- 1500/-

4. Dsp blackrock focus 25 growth- 1500/-

5. Franklin india prima growth – 1500/-

6. L&t emerging businesses growth- 2000/-

7. Mirae asset emerging bluechip growth- 1500/-

8. Tata equity p/e fund growth – 1500/-

My lumpsum investments are:-

1. Bnp paribas balanced fund growth- 10,000/-

2. Dsp black rock tax saver – 50,000/-

3. Reliance tax saver growth – 50,000/-

4. Sundaram select micro cap sr 16 growth- 10,000/-

All my above investments are in regular plan

I want to know how is my portfolio and how much I can expect after 10 years or if there is any requirement for any change,pls guide

Manoj-If your goal is 10 years, then first you have to ado asset allocation, and then within equity, you just need 3-4 founds but not so many 10-12 funds. Refer my above post properly.

Dear Basavraj,

I’m investing 2.5k per month in HDFC TAXSAVER plan.

Shall i discontinue that and switch to other fund?

Regards.

Abhinav-Continue the fund.

Hi

I have an SIP of 10000 per month in Franklin India Tax Shield Fund (Direct-Growth).

Recently when i check my SIP transaction history i could see that i’m buying mostly when the markets are high for that month.

I want ideally to buy when the markets are low, so i was thinking why could i not invest 10000 everymonth regulary as lumpsum so that i

would have more control on my purchase.

Are there any difference or disadvantage for this method?

Or is there any kind of SIP method where we can modify the SIP date every month.

Would like to know your opinion.

Vishnu-As per me, timing the market is wrong and you will never get succeed. However, you experiment with your monthly lump sum and let me the result after a year or so. Stay away from such TIMING.

Namasthe Sir,

What About

1. Mirae Tax Saver (G)

2. IDFC Tax Savings (G)

3. Prinicipal Tax Saver (G)

4. Reliance Tax Saver (G)

Check and compare with your Top tax saver funds,

you Will Always Suggest Birla / HDFC / Franklin

even for SIPs also.

You are always giving advertisement to TOP AMCs

Naresh-These are my choices. If you feel they are unbiased then I never forced you to follow. I am neither for TOP AMCS or BOTTOM AMCs. For me, all AMCs are here for business not for social cause. Above that, I am in no way associated with any of these AMCs. In such a situation, why I have to bother which AMC is best or worst? I concentrate on existing old funds rather than new funds.

I am investing in these tax saving fund but I divide my allocation equally in Growth and Dividend fund, for eg 10000 in DSP Tax Saver (G) and 10000 in DSP Tax Saver (D), so that some money will start coming. Though it’s a low amount but over the time it may become substantive.

Is this a good strategy?

Puneet-I am not sure the reasons of investments and holding period, hence hard for me to comment.

Current reason is to claim deduction under section 80 C plus at the same time building strong portfolio which give me return.

Puneet-Create financial goals first then think of creating portfolio and tax bebenfits.

Hi,

I want to invest 1lakh in lumpsum ELSS –

Planning for

Axis Long Term Equity Fund – 50K

Birla Sun Life Tax Relief 96 – 50k

Is this a good approach?

Rajesh-Refer my above post.

i want to invest 30 k in the sector funds for one year , which sector i need to invest banking , pharma ,infrastructure

Arjun-As per me NONE. I am against sector funds. Rest you have to decide.

HI,

I want to invest 5000 per month.

my goal is for 3 year, 7 years , 10 years.

as time goes will increase my investment as well.

can you please suggest where to invest

Shrinidhi-First refer my earlier post and then think of choosing products “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Hi Basu

This taxation part does not apply to ELSS mutual funds. Since the minimum holding period is 3 years, how can equity taxation will be applicable to this.

Though you have written about the EEE but how come in pics you are showing as these funds are treated as equity mutual funds.

Ajay-ELSS funds are equity funds. Hence, they may be tax-free but there are certain people who are not aware of this ALSO.

But this can be confusing for these people as well as they are not aware about taxation, they may think that you can withdraw money from elss and pay capital gains.

Ajay-Regarding liquidity, I also mentioned that this product comes with 3-year lock-in.

The same way how you suggested me to select other elss mutual funds. By refering the other posts.

Thank you for ur reply.

Krishna-That’s OK.

Thanks Basu!!!

Birla Funds will be clubbed once SEBI categorization becomes applicable.

Is this correct?

Deepsh-Let us wait what they do.

Dear Basavaraj,

My Goal is to invest for 15 years expecting Good Returns. Monthly 12500/-

This month i started ELSS as SIP for 24 installments in

Axis Long Term Equity Fund 4000/-

Reliance Tax Saver Fund 4000/-

1. Is above invested funds are Good? or need to change scheme after 1 year or 12 installments?

2. The % of return is comparatively less, 1yr% > 3yr% > 5yr% >10yr%. Is that mean keeping funds for 10 years will give less returns than 5 years? As per that % withdraw at 5yr is Good Idea?

3.How we need to calculate the overall %. For eg: If i am investing monthly 12500/- for one year makes total of 1,50,000/- what is my redemption amount at end of 15th year.

4. Please suggest me one Funds for SIP Investment 1500/- (ELSS must) and one Fund for 2500/- (Equity Diversified fund)

5. Is there any reason for saying Allocate debt:equity in the ratio of 30:70

Note: I have no Idea about Mutual Funds. This is the first time investing in MF. So trying to understand.

Please answer the above questions.

Krishna-1) Missing is asset allocation.

2) Keeping funds for long term does indicate that in long run the volatility will reduce and you can expect the realistic return. 1 Yr or 1 month returns may be high and or too low. This indicates that volatility nature of the equity market. Hence, enter into equity if your time horizon is more than 5+ years.

3) You have to use XIRR function to calculate the return on investment.

4) Do you think you need ONE MORE ELSS? Regarding other types of equity funds, refer my latest post “Top 5 Best ELSS Tax Saving Mutual Funds 2018-2019“.

5) Yes, asset allocation is a must. This is where many investors fail and blame equity market at the end. Such diversification will protect your portfolio during the downtrend of the market or subdues the volatility to a certain extent.

If you have no idea of MF, then how you selected those two funds?

Request in chart to show other parameters of shortlisting in order of importance like SD /Beta etc. Current chart only shows refund.

Do you consider rolling returns also?

Thanks.

Also as equity is for min. 5 years should we only consider 5 year returns? For selection with above parameters.

Thirdly how we ensure we have funds from top10 in our portfolio. How frequently we can change ?

And if FM is Good current temporary downturn can be opportunity as in coming years it may perform better (lower base effect?)

Thanks.

Dilip-Yes, I considered rolling returns also. But the priority is for the fund consistency. We must consider 5+ years as a parameter for investing. However, 1 or 3 years return gives us an indication of how the fund is performing CURRENTLY. The fund you invest today will NEVER remain as TOP forever. Each fund has to undergo ups and downs. Reviewing is the mantra and keeping an eye on fund performance is a must. I will not time the market. Hence, for long term investors, the market always looks bullish.

Hi ,

What about axis long term equity?? Why are you remove this?? I am investing from last 30 months should I stop this?

Pranav-I removed it last year itself due to its underperformance. You no need to panic and continue the same.

Dear BT,

What are your views on Axis Long Term Equity Fund? I have been investing in this fund for the last 2 years.

Thank you

Rajiv-Please continue.

Dear BT,

As per your table there are only 3 ELSS funds who have given return of more than 10% in 10 year period. Then why go for ELSS (Equity mutual funds) as a whole ? Many in your list have given merely 5 % (For 10 years or more) which is much lower return than FDs too. In that case PPF and NSC etc . are much more advantageous.

Pls. give your views.

Also, if you can compile such table for longer periods (like 15 years, 20 years, 25 years, 30 years)It will be vey helpful in decision making and knowing the worth of ELSS and other Equity mutual funds in comparison to traditional govt. backed schemes.

Regards,

Abhishek

Abhishek-Equity investment is for long term. Also, investment does not mean keeping all your portfolio in one asset class or in one category of fund. You must include debt and equity. Along with this, you must also invest in large, mid and small cap also. You may feel 5% return just meager. However, if you compare with NSC or Bank FDs, I feel 5% still better than post tax-returns of such products (except PPF).

Hence, blind following in any asset or product is dangerous.

Thanks

Dear Abhishek,

None of the funds have given less than 8% return in 10 yrs period. The 5% what you are referring is the return from benchmark which the funds have beaten comfortably. Let me know if I am missing something.

Correct Sushanta,

My point is that these are the BEST TOP 5 funds selected thru a rigorous process by the subject expert. None of these have given more than 11% return in 10 year period. Is it worth going for these funds when an investor wants to invest for longer horizon (say 20 – 25 years). Pls. note that as the time horizon is extended, the rate of return is decreasing dramatically. Suppose if we extrapolate as per trend shown the given funds for 15 years or 20 years, their performance as per trend may be very dismal. { Keep PPF/EPF in mind }.

Pls. share any research/study on the same if you are aware.

Thanks and Regards,

Abhishek

Abhishek-Do you think 10% or 11% TAX FREE return for over 15 yrs or 20 years is not a great return????? First you must have a realistic expectation. I usually expect around 10% to 12% returns from my equity portfolio for long-term investment. I am not sure about your expectation.

Also, the fund you are investing today will never be BEST for the next 20 years. What wins is PATIENCE and the realistic expectation. Chasing the highest return will not fulfill your goals.

Sushanta-Thanks I too not noticed back while replying to him.