Recently EPFO launched new EPF Composite Declaration Form-11. This facility allows employees to transfer EPF automatically while changing Job. Let us see the features and benefits of the same.

What is EPF Composite Declaration Form-11?

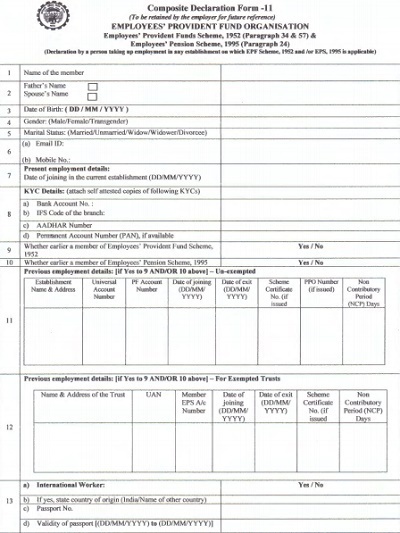

This is the form which you have to submit with your new employer at the time of joining. Usually, the employer asks you to fill this form if the organization comes under EPF act.

Remember one thing. Suppose your salary (Basic+DA) at the time of joining is more than Rs.15,000 a month, then it is YOU who has to decide whether you be part of EPF or not. If your salary is less than Rs.15,000 a month, then you will not have any such choice to opt out (even though it increased during the tenure of employment with that particular employer).

However, if once you became a member of EPF with your new employer, then you no longer be allowed to opt out even though during your job your salary increased to more than Rs.15,000 a month.

You have to share the details like name, date of birth, contact details, date of joining, KYC details (like Bank details, Aadhaar number and PAN details.

This form will replace the existing Form 11 and Form 13. Earlier you have to submit these two forms with your new employer while joining. They used to process it offline. I saw many instances where even though you shared these two forms, your employer might be created another UAN and finally, you ended up with multiple UAN numbers. In such situations, you have to request EPFO through your current employer for the merger of such multiple UAN numbers. (Refer-Allotted two UAN numbers -How to merge or deactivate EPF UAN?).

Now with the launch of this new composite declaration form 11, I think employers stop such bad practice of creating another UAN for new employees.

Download EPF Composite Declaration Form-11

How to transfer EPF automatically while changing Job?

Now you understood the importance of EPF Composite Declaration Form 11. As I pointed above, earlier the process was a physical one but not EPFO made it online and easy for you and your employers also. Using this option, you can transfer EPF automatically while changing job. There are two options here. One is online and another one is an offline mode. I explain both the process.

Transfer EPF automatically while changing job online

The online process is enabled to those employees whose UAN was linked with Aadhaar (How to link Aadhaar to EPF using online and offline?), your UAN was linked with Aadhaar but not verified or you are transferring EPF either from or to an exempted establishments.

The process of transfer EPF automatically while changing job online is as below.

1) Fill the new EPF composite declaration form 11 by providing details like name, parents name(s), Date of Birth, gender, your marital status, contact details, bank account number, bank IFSC code, Aadhaar number, PAN and date of joining of the current company.

2) Then you have to provide your previous employment details like – Company name, UAN, EPF account number, date of Joining, date of exit.

3) Finally, sign and submit this form to your new employer.

4) Your employer will then enter all these details in employer’s portal of EPFO and upload the EPF composite declaration Form 11.

5) An SMS informing the employee about the proposed auto-transfer will be sent on his registered mobile

number.

6) However, the actual transfer will be completed only if

a) Employee, not requests to STOP such transfer within 10 days said SMS.

b) The first contribution by the present employer is deposited to the EPF account.

7) On actual transfer of the account, communication would be sent to the employee by SMS on his mobile number seeded against the UAN and by e-mail, if registered.

Transfer EPF automatically while changing job offline

This process is NOT applicable to those employees listed below.

a) You have not linked Aadhaar to EPF account

b) You linked Aadhaar to EPF account but it is not verified

c) If your old or new company belongs to the category of the exempted establishment.

In such situation, you have to fill the Form 13 and follow the existing procedure and submit the same to your employer. It may take time but no option for you.

Hello Basavraj,

I have a query. Please guide me that, how to transfer PF from trust to emfo. Earlier my company was as PF Trust… Now I’m feeling difficulty in transferring. Some are saying form 13 needed to submit. Some articles saying it is possible online now… Not sure how to do it.

https://economictimes.indiatimes.com/wealth/personal-finance-news/epfo-launches-online-pf-transfer-facility-for-pf-trusts/articleshow/45388445.cms

Dear Nandeesh,

You can request for transfer online.

If someone applied for PF transfer and PF transfer is under process but person already resigned. What happens about PF transfer ? Is that get cancelled or process ?

Dear Ashish,

It will not.

Hi,

I was employed with an IT company for 2.6 yrs and then left the job. After 2 yrs of a break, I again get re-employed with an organization for 7 months and then I am continuing with my present employer.

My issue is that I can view the PF balance from my first employer but could not find a way to transfer it to my present employer. I tried the online transfer but the details of 1st employer is not present.

What are the possible ways to deal with it.

Regards,

Suvodeep

Suvodeep-It is hard to say why the last employer details not available. Hence, try to apply for transfer through your employer using OFFLINE way.

Sir is it possible to do the process offline without engaging the previous employer directly through the EPFO ?

Suvodeep-Yes, approach EPFO.

Sir, I worked 20 years in private company, Pondy, resigned and further working in Mumbai company for the past 5 years. The EPF amount withdrawn from earlier company and for EPS the scheme certificate received. Further in the new company deducting EPF/EPS. How to merge the earlier EPS SERVICE IN TO NEW COMPANY EPS.

Chandrasekaran-Better to raise an issue with EPFO Grievance Cell Online.

Dear Sir,

I am looking for transfer my EPF to my current PF account. 15 months before i have changed my job, after that new employer has opened my new pf account and provided me a new UAN number.

Now i want to merge both UAN.

But there is some problem, in previous account, there is mistake in father name & i think PF can not transferred to new account without correction.

Kindly guide how can i correct father name & merge both UAN.

Thanks & Regards

Vaibhav Jain

Vaibhav-First request EPFO through your current employer for the merger of both UAN. Once it is done, then do the correction and transfer EPF.

I have already submitted form 13 in October 2017, for PF transfer but still no action has been taken from EPFO.

How can i merge both UAN from cureent employer.

Kindly revert..

Regards

Vaibhav-Regarding merger, contact employer.

But employer has no idea.

They told me to submitt form 13.

Please help how can i transfer my pf and merge UAN

Vaibhav-If they have no idea, then let them approach the EPFO.

There is some technical problem is going on in EPF site so i want to transfer my epf account offline. so what will be the procedure for that.

Sorma-Visit the EPFO or the employer.

DEAR SIR

ONLINE EPFO TRANSFER PREVIOUS COMPANY TO CURRENT COMPANY AND I HAVE RECIVED ONLY EMPLOYEE SHARE AND EMPLOYER SHARE .

BUT PENSION CONTRIBUTION IS NOT TRANSFER MY NEW EPFO A/C .

SO PLEASE NEED YOUR HELP & SUGGTION.

I also online transfer clam from no 13 has sumtted

Sanjeev-Don’t worry, EPFO will just update your EPS details and they not transfer it.

It is intimated that during the transfer of EPF account, pension fund is not transferred in financial terms, only service of the previous provident fund account is added to your present EPF account number. Pension/ FPF Withdrawal benefit is calculated on your service.

Sanjeev-Yes it is correct.

Hi Basavaraj,

Nandeesh here. I have applied for EPF transfer from the previous to present company by manual process as my AADHAR is still in pending KYC.

Month before all the Employee share and Employer share got transferred and updated too. But 3.67% of pension amount not got transferred. In UMANG application it says that pension amount is still with old employer but if I enquire with them , they says we have cleared all to EPFO including pension. Please suggest me what to be done ..??

-Regards

Nandeesh

9980741530

nandeesh-Your EPS will never get transferred. EPFO just updates service records. If you still have concerns, then raise the issue with EPFO Grievance Cell Online.

So you mean to say EPS cannot be consolidated to one account like EPF….!!!!

If at all I need to take off all the EPF and EPS by quitting job permanently means, I need to request with each employer for my own EPS??

nandeesh-It will follow your EPF. But EPFO only updates your service records. Hence, you no need to apply for multiple times to withdraw the EPS.

HELLO SIR..!

SIR MENE APNA PREVIOUS EPFO A/C SE APNE NEW EPFO A/C ME ONLINE TRANSFER KIYA HAI BUT MENE TRANSFER HUWA HAI YA NHI CHECK KARNE KE LIYE TRACK CLAIM STATUS CHEK KR RHA HU TO … SOMETHING WENT WRONG ! PLEASE TRY AGAIN AA RHA HAI ..OR ME AGIAN TRANSFER KAR RHA HU TO TRANSFER CLAIM REQUEST IS ALREDY SUBMITTED FOR PREVIOUS ACCOUNT LIKHA AA RHA HAI… SIR TO MUJHE KESE PTAA CHALEGA KI HUWA BHI HAI YA NHI..!

BUT MENE TRANSFER KIYA TO PRESENT WALA OPITION PE CLICK KIYA OR MUJHE OTP NO BHI GENRETA HUWA OR FIR SUMITTD KIYA..

TO SIR YE AUTOMATIC PRESENT EMPLOYER K PASS CHALA JAYEGA.. SIR PLZ GIVE A GOOD SUGGTION

EPFO Grievance Cell Online. present company ka addres dalna h kya sir

Sanjeev-Please fill as per the process need for filing complaint.

Sanjeev-Contact EPFO Grievance Cell Online.

Sir

After the activation of my UAN for the first time I downloaded the UAN card which shows KYC,DOB & father name. But now it is not showing any of these and while applying for transfer it shows that these details are not available need to be updated from employer. But the employer has already updated.So I am not able to do anything.

Paramjeet-I think it is some technical issue. Contact EPFO through EPFO Grievance Cell Online.

Another condition under which the automatic transfer will not take place is if you do not have you Bank account linked to the EPF.

Avani-As per the notification, the above said only 3 conditions apply.

Hi,

Watching your blog. I feel very interesting.

I am having a clarification on my PF.

In my previous company they considered my name as G K Sunny (As per 10th Marks Sheet). But my current company considered my full name describing the initials.

When I tried to transferred my PF online, showing that the name is mismatch. However, my UAN number is same.

Need your help. As my previous company PF office is situated too long to get it done this.

Sunny-First correct your name and then apply for transfer.

Thanks Basu for your article.

Does the same concept applicable to companies like TCS who maintain trust.

Right now I am unable to transfer from my ex company(TCS) through epfonline.

Abhinay-Yes, if you understood the 3 conditions specified therein above posts are met properly.