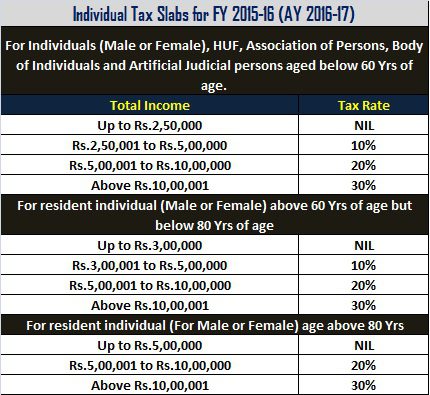

Many of you already know the budget implications on your finance. However, there are few changes to this budget when it comes to tax slabs. Therefore, I thought to update the Tax Slab Rates for FY 2015-16 (AY 2016-17) considering the Budget 2015.

Individual tax slabs were not changed. Therefore, I am updating the slabs as were earlier.

- If income exceeds Rs.1 Cr then surcharge of 12% will be applicable.

- Along with that 2% Education Cess and 1% (SHEC) Secondary and Higher Education Cess will continue.

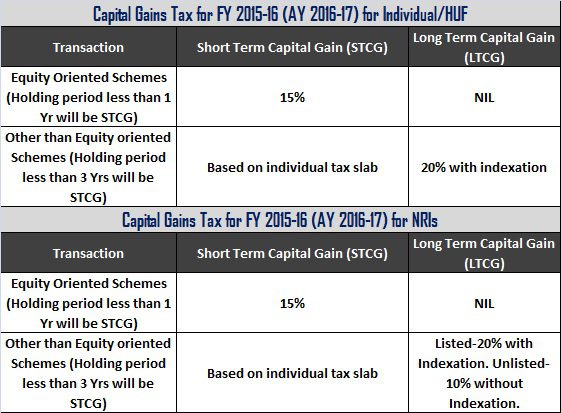

Below is the chart about Capital Gain Tax for FY 2015-16 (AY 2016-17)

Tax effect on Dividend received by holders–

Equity oriented-NIL and Debt oriented-Nil

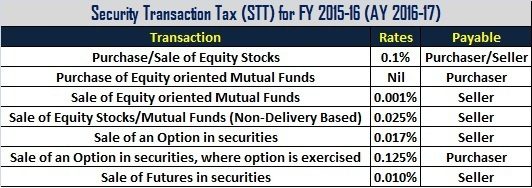

Security Transaction Tax (STT) Rates for FY 2015-16 (AY 2016-17)

Hope above information will be suffice to an individual to know about the tax he need to pay. A detailed explanation about the budget can be viewed at my earlier post “Budget 2015-20 Changes that affect your Personal Finance“.

15 Responses

Hi Sir,

Is it possible to explain about what and all the percentage of tax benefits we can get from salary based on common allowances like

HRA( if it is rs.15000), Conveyance(if it is rs.5000), misc allowance(if it is rs.10000), that is how many percentage of tax benefits we can get from above allowances apart from our personal investment like lic and debt like education loans.

Harish-There is no generic %. It depends on many things. How can I say?

How the age of senior or super senior citizen determined? please specify “born before —–” for assessment year 2016-17

Thanks

pattabhi Suri

Pattabhi-Senior Citizen or Very Senior Citizen attains their eligibility once they attain 60 Yrs and 80 Yrs of age respectively during a financial year.

Kindly suggest me best term plan can I opt for max life claim ratio issue any problem

Tapan-They are discussed in my earlier post “Best online Term Insurance Plans in India for 2015-A comparative list“.

Hello Basu,

Can you throw some light on 20% on Indexation with example?. I do not much about Debt Mutual Funds.

Besides that could you please have one article about Gilt funds like is this right time now to get it into this?

Thanks in advance

Chandra-Sure…I will do it soon and thanks for tip 🙂

I am sorry I meant FY 2014-15 (AY 2016-17)

My wife, Mrs TVPG Hymavathy is the holder of IDBI Federal Incomesurance Endowment and Money back Plan- 135 N01vo1. An amount of Rs 10,265.24 is being collected monthly from her bank account by ECS. She IS NOT WORKING and is a HOUSEWIFE.

I would request you to clarify whether the amount paid by her towards that policy can be claimed as deduction from my income under Section 80C clause (i) of the Income Tax Act for the financial year 2015-16 (AY 2016-17) as this section permits any sums paid or deposits paid in the previous year by an assesse to keep in force an insurance on the life of the individual, the wife or husband or any child of such individual.

Thank you very much

Nageswara-Yes you can claim the deduction.

Thanks for the quick reply.

Dear Basu,

Any Tax credit for the 10 percent slab this time ? Pls guide. Thanks.

Tax credit of Rs.2,000 for the gross income under Rs.5 lakhs u/s 87A is still available.

Joydeep-No such benefits.