LIC launched one more traditional endowment plan on 9th December 2014. This plan named as Limited Payment Endowment Plan (Table No.830). Let us look into its features and review it.

As the name suggests, it is the limited payment Endowment Plan. It means, suppose you opted a term of 12 year, then you will not pay the premium for the full 12 years. Instead, your premium payment sieges earlier than the maturity period.

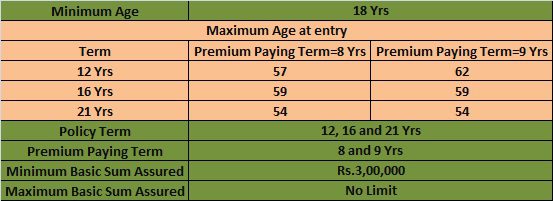

Below are the features of Limited Payment Endowment Plan (Table No.830)

Benefits-

Death Benefits-

On death of policy holder during the policy period, his or her nominee will receive Sum Assured on Death+Accumulated Bonus and Final Additional Bonus if declared by LIC.

Sum Assured on Death will be higher of below.

- 10 times of annualized premium paid.

- Absolute amount to be payable i.e 125% of Basic Sum Assured.

Also do remember that such death benefit shall not be less than 105% of all premiums paid as on date of death. Premium mentioned for this benefit excludes taxes on premium, any extra premium you paid and rider premiums.

Survival Benefits–

If policy holder survives till the end of policy term then he/she will receive Sum Assured on Maturity+Bonus+Final Additional Bonus (if declared by LIC). Here Sum Assured on Maturity is equal to Basic Sum Assured.

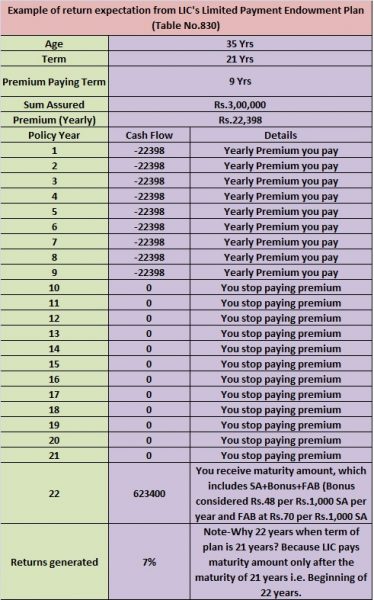

Let us take an example. Mr.X, whose age is 35 Years and buy this plan for a term of 21 years (I preferred a long term, as insurance agents usually pitch for long term product while selling) and premium paying term as 9 years. He opts the sum assured of Rs.3,00,000. Then the premium he has to pay for the next 9 years will be Rs.22,398.

Do you know, earlier LIC had a plan called Limited Premium Endowment Plan? It was closed after the recent IRDA changes. Currently bonus for that plan is Rs.48 per Rs.1,000 Sum Assured for a plan, which is more than 20 years old. Therefore, we consider the same bonus rate for above example. Also, let us consider that FAB for this plan will be at Rs.70 per Rs.1,000 of Sum Assured (I consider this too at the higher end). Then what will be return from this plan? It is around 7% only and that too if you invest for 21 long years. Otherwise, if you reduce the term, then return will be around 5% to 6%.

Whether you still eager to buy?

If you feel that waiting for long 21 years and expecting 7% return is good for you then go ahead. However, to be true, you can get more than this plan by simply investing into PPF and buying a term insurance from LIC itself. The tax benefits will also match with this plan. Decide yourself before committing to this trap.

103 Responses

Can u pls revise ur calculations with below changes?

PT 12yrs

PPT 9 yrs

deduct the equivalent premium of term plan (35ys age, PPT 21, SA 300000) from the outgo.

your IRR shall shoot up by 0.5 to 1 %

B-So you mean to say it will give 10% return?

Never said that..!!!

against 7% that u r showing it may show may be 7.5% or something of there about….if that’s the case isn’t it good??? tax free..(eq to 10% taxable FD)

by the way neither am I an LIC agent nor I have any money back / endowment etc policy…

just for the sake of a calculation..

B-I am not blaming and your views too. Even though you feel 7.5% tax free for long term attractive, the biggest issue with LIC plans is liquidity. I will consider this as a debt product. Hence, while reviewing you feel hard to rebalance the portfolio as per the defined asset allocation. Hence, I avoid such illiquid products.

I fully agree with u. Even my portfolio is almost fully liquid with zero RE and some physical gold.

I was just trying to take a neutral view of the product.

B-I appreciate your views and investment style. Liquidity is the KING for any investor (even though goal is long term).

i am planning to make a policy endowment plan of sum assured 500000.

for 12 years term and premium 9 years and as per my age premium for 9

years would be around 54740.

I have heard that if the premium is more than 10 % then it will be

taxable on maturity.

So please suggest me what can i do ??

Vishal-Refer my earlier post “Tax Benefits of Life Insurance“.

Hi,

I bought the limited premium endowment plan for my dad this year.

The agent is a total fraud. He dint tell me all the details of the policy.

I want to log a complaint against him.

What can I do?

Will that be of any help?

Reshma-To be frank, it will not help you. Because I think agent not given any assurance in WRITING. So how can you prove his fault or fraud?

Hi Basu,

Recently an LIC agent suggested LIC’s Limited Payment Endowment Plan (Table No. 830). In your blog, it is mentioned that the plan doesn’t generate good returns as there are other ways to get good returns.

I am 29 now and can invest 50,ooo – 75,000 an year. Kindly suggest one good plan for investing and another plan in LIC for life insurance.

Samrat-For life insurance, you can opt for LIC’s online term plan. Regarding investment, I don’t know much of your goals. Hence, hard to suggest.

I am 47 year old having 2 children’s, yearly income 2.5 lacks , have an lic policy – 6000/- yearly premium, want to buy another policy , pls suggest

One lic agent approached me with the limited payment endowment plan ..my age is 31 payment term 10 yrs .. maturity after 30 yrs.. total premium to be paid in 10yrs is 8.48 lacs .. and after 30 yrs ,he is giving guarantee of 56 lacs.. is d plan appropriate to invest . Our main purpose is retirement n also death benefit .

Pratik-First of all the maturity amount is somewhat at higher side. Second point, even if we consider that your AGENTS MATURITY VALUE is correct then the return on investment is around 8%. You are saying that your main purpose of investment is retirement and death benefit. In what way this 8% return can build you a great retirement corpus when inflation itself is around 7%? Also think for how long your family survive with the insurance coverage this plan is offering? Rule first, never combine insurance with investment. Rule second, for long term goals, invest in a product which beats the inflation. Then only you sustain. Buy Term Insurance and forget insurance part.

I am 29 years old I just start this policy but I don’t know how many gate the money after 21 years

birth date 25 march cheque paid dtd 25 march 2015 quarterly amount is 5745. please give mi details

Nirmala-Return from such policies will be around 5% to 6%.

Hi

My policy is endowment assurance with profit table 14

Policy start 25/o2/2009 after paying first premium the policy got lapsed and now I wanna restart my policy they ask around 65000 including premium and late payment to restart my policy I wanna ask is right to restart this policy or buy new policy and what amount I get on maturity ?

Sum assured : 200000

Tenure : 20yrs

Yearly Premium:9597

Maturity date :25/02/2029

Hi Basavaraj,

I contacted an LIC agent and he suggested Limited Premium Payment Endowment plan and said that I could use this to get returns on the 16th and the 21st year. I am 45 years old. The agent also said that I can convert this plan into a Pension plan and I need to declare this 6 months before the 16th year. The payment he said is only for 8 years . The premium depends on my affodability and what I want to get as return. The agent also said that the Insurance Cover is there for Death due to Natural causes and Accidents etc in this particular plan and the returns are absolutely non-taxable.

Is this a good plan as compared to State Bank Retirement ( Pension ) plan or do you suggest some other plan. Kindly sugges

Rgds,Manohar

Manoharaj-But what returns he quoted?

Sir,

I am 53 years old and working in a private firm. My son completed B,Tech and daughter is persuing CA. I can paid app 15000/- per year as premimum. Wants to take whole life cover of maximum amount and some maturity benefits. Please suggest suitable policy.

Regards,

Anil Kaushik

Anil-Why whole life plan?

Hi Sir,

This is regarding my LIC New Money Back plan policy having Table No.820.

Policy Term= 20 Years

Paying Term= 15 years

Sum Assured= Rs 2 Lac

I am paying half yearly premiums of amount Rs 7677. Could you please let me know if it is fine to continue with this policy and also how is the performance of the policy.

Thanks,

Ashish

Yes sir,

Kindly continue the same policy

dear sir,

please tell if i pay rs.100000 in sbi saral pension plan for 5 years what is the commutation value i get at 15 years/

what is the monthly pendion available/ is this policy better than lic jeevan nidhi/please guide

Gopala-First understand your requirement then choose a plan. How much you get from this plan depends on lot of things. How can I say that??

Sir,

I find this article very useful, especially because an LIC agent contacted me a few days ago about this new plan 🙂

You may recall that in another blog post of yours, I had mentioned considering giving up some of my table 14 endowment plans as I felt I had taken many such policies due to lack of guidance. Does LIC allow surrendering one policy after 1 payment *in exchange* for taking a different policy for a lower premium amount or a shorter term, i.e. *without* requiring the policy holder to lose the premium paid for the policy being given up? Asking this because you have mentioned that you are an LIC agent as well and hence likely to know such nitty-gritties.

Another request for advice – for risk-averse people who are not interested in making profit just want to ensure their savings don’t lose value due to inflation (agree no one can predict inflation rates beyond a couple of years at the maximum), is this new 830 plan any better than existing endowment plans? Please assume that the person also invests in PPF and is looking for additional savings instruments.

Amandeep-Each policy is treated as separate. What is the use of surrendering the existing one and buying a new low yielding lower premium policy? Do you feel it is necessary to have LIC traditional plans? 7% return which I quoted by calculating this plan is not at all good. Let him increase the contribution towards the PPF. If at all not interested then why can’t test the Debt Funds?

Hello Kindly suggest me some good and high return plans for my investment ideas.i still have not taken or made any policy yet.Pl suggest me your best views and suggestions as per :

I want to take a policy for my 2 kids aged 8 and 9 years for 15-20 years where i want maturity value of atleast 50 laksh to 1 cr. Secondly I want education plan for both kids for 10-15 years from now kindly suggest premium and return part.

I want policy for myself some sort of pension scheme where i can get a maturity value of 2-3cr in next 20 years from now and also some monthly income for rest of my life.

I also want Term plan for 2-3cr.

Sir i sincerely look for your best suggestions based on my requirements, thanks

Rahul

Rahul-First let me know how much according to you is HIGH RETURN?

Sir

For my childs i am looking for secured or guaranteed maturity return of 50 lakhs to 1cr or even more.i am prepared to pay monthly premium for this pla.And for education i expect atleast 30-5lakhs in 15 years time from now.

For my personal goal on my retirement/pension. I expect atleast 1-2cr and max 5cr for period 20-25years from now i am aged 34 yrs now.

And term plan i want policy 1-2cr.

Sir i sincerely request for your best suggestions on this enable me to take best policy and insurance as per my needs.

Thanks

Rahul

Rahul-Can you answer my questions?

1) How you arrived at kid’s goal amount and retirement amount?

2) What do you mean by secured and guaranteed?

3) Do you feel by investing in guaranteed products like Bank FDs you can achieve these two goals?

4) What about inflation attached to these two goals? Have you taken consideration of this?

Pl find my answer next to your questions

1) How you arrived at kid’s goal amount and retirement amount? — its an indicative return which i want to achieve considering the number of years and as per the specific requirement

2) What do you mean by secured and guaranteed? — I read there are several secured investment such as PPF and guaranteed return too from some private companies on the maturity but i am not sure how much they are reliable, so i seek your kind suggestion on the same to achieve my reuiqred goal ..though those two terms are not necessary but if they are available then more then happy to invest in those.

3) Do you feel by investing in guaranteed products like Bank FDs you can achieve these two goals?—– Sir DOes Bank FDs can raise Tax excemption on the maturity ? I am looking for higher returns plans,policies for my requirements purpose sir.

4) What about inflation attached to these two goals? Have you taken consideration of this? — I have taken the number of year into consideration and we can more or less amount as per inflation if you can advise on that.

Thanks sir and waiting for your kind reply

Rahul- 1) You considered the education inflation to arrive at this goal amount? Compounding of this done?

2) PPF bears interest rate risk. Because each year interest rate fluctuate. Company deposits bear risk of default of downgrade from rating agencies. But do you actually feel expecting a rerun of around 8% worth for your kid’s or retirement goal, when the inflation itself is around 7%?

3) Bank FDs returns are taxable. Also no Bank offers you deposit for more than 10 years. Hence bank FDs also bears the interest risk if your goal is more than 10 years. Stay away from any policies first. Separate your insurance need with investment.

4) Advising involves lot of calculation from my end friend. I can’t do nor we can discuss all things on this platform.

Sir,

I was only looking for possibility of avoiding the loss of surrendering/lapsing an existing policy by taking an alternative policy which has shorter premium payment term but a similar rate of return. Your reply seems to indicate that exchanging one policy for another is not possible; if so, I will not consider the new policy. Thanks for the information!

Thanks a lot – I was not even aware of this category called debt funds! Looks like debt funds with indexation are better than fixed deposits when the aim is to just protect savings from inflation. Are there debt funds that invest *only* in government bonds/securities and if so, can you suggest some good ones? Insistence on only government/non-private funds is not due to being risk-averse but due to some personal (you can say somewhat religion-based) principles that we want to adhere to.

Amandeep-Debt funds are good when we consider taxation only if you stay invested for 3 years or more. Otherwise Bank FDs good. Gilt Funds are those funds which invests in Govt Bonds. So you can have them. There is nothing called to choose as all funds invest in Govt Bonds and return will not vary that much. So choose according to your comfort with mutual fund company.

Sir – thanks for the information! I will look at availing these funds for a part of the amount that I would otherwise have put into long-term fixed deposits, after careful consideration of short-term and long-term needs.

Hi Basav,

I am 30 years old, annual income of 10 lacs. wife also working with annual income of 4 lacs and one kid 1.5 years old.

Below are my current investment:

Rd-15k per month

FD – investing 50K for 5 lockin for tax benfot under 80C

Wifes Investment:

Rd: 10k per month

Investment in Equity/shares through demat: 1 lac

Need advice on two things:

1) we are planning to invest more in FD or RD(9.25% per annumm). How can we save more with less tax liability. In my name, wife’s name or kids name. In Kids FD, does it attract TDS at first maturity if I select Auto-renew.

2) LIC Immediate annuity term plan, is it good option for fixed income life time, considering interest may be lower after 10/20 or 30 years in India? If yes, which option you will suggest in that plan?

Abhishek-Why so many RDs and FDs? How your wife investing in direct equity, is it based on her own research for long term investment or on brokers hot tips for intraday? Immediate annuity plan now? Please let me know the logic behind choosing each product you mentioned.

still i did not get the revert about my questiom mr .Basu..pls ..

Dear Mr. Basavaraj ,

My age is 52 yrs and I do not have any insurance policies at present. I want go for this new endowment 830 plan with 8 yr PPT, 16 yrs coverage. I propose to take this policy for insurance as well as investment. What is your advise in this regard? Be frank in advice.

Govinda-I don’t think it suites. Better opt for term insurance for a term equal to your working age and rest of amount invest in FDs or PPF will fetch you more. This is my FRANK advice, decision is left with you.

Hi,

Mr.Basu…i wanna to know about a good term plan for my parent with min and maximum premium n payment and age limit ..thanks .

Manoj-Why they need term plan? Are they still working? Anyone financially dependent on them? If so then go ahead otherwise NO.

Mr Bassu..they r not working..m only chief wage earner of my family..but why not a term plan…pls brief…

if not so…then which would be good policy for them as per following information…

age..about 57-58 yrs

my pa is a farmer

pls suggest..n what .about table no..830 or any other..

Manoj-Term Plan is required when someone financially depend on them. If none then not required. Also if they are not working then what income proof you submit to insurance companies? Without income proof even insurance companies will not issue any insurance plan (forget about term insurance).

Now this endowment plan is rolled out by LIC. I am a novice in this area. Looked for calculator online but it is missing. Here is what me as a 45 year old need. Sum assured 50 lacs for 21 years with payment of 9 years. Add term insurance rider of 25 lacs with accident death rider of 25 lacs. What would be the yearly premium? Here I want min 50 lac rupees on maturity. In case of natural death my family should get at least 75 lac (sum assured plus term). In case of death due to accident another 25 lac rupees extra will be paid by LIC to my family. Pls suggest.

Nikunja-First of let me know why you are fond of this plan?

Hi Basu, I appreciate your working on maturity amount on table 830. In order to substantiate your stance that PPF is better option rather than this LIC plan, will you please come out with your working on EPF investment return for the same amount, which will show fair view on the return on investment. Please consider the following in your working

1. interest rate at the discount of 0.5% from the current rate as interest rate risk

2. Assume you will buy term policy to cover the entire period

Thanks.

Thomas-Thanks for your suggestion and will do it soon 🙂

Hi Basu, I appreciate your working on the maturity amount on table number 830. In order to substantiate your statement that PPF is better option than this plan, will you please come out with your working statement so that the fair view can be disclosed rather than exchange of statements. While considering the PPF, please consider the interest rate risk as 0.5% less current rate for formulating the working on safer side. Thanks.

I want to know muturity of plan 830,for age 59 ,SA:3 Lac ,ppt 9,term12y

Maniram-One is done above, you can do it for yourself. No difficulty in that.

Hi Basu,

I fail to understand the calculations forwarded by you in relevance to you advise for going to PPF as well as Term Insurance………

Can you please work out…..in what way your advise is beneficial.Take for example: at 35 years of age: for a term insurance of 6 lacs you shell out a premium of Rs, 2900 apprx, for 21 years.and the interest earned by putting the equivalent premium of 6 lac policy under Table 830 in PPF(Rs. 44,000 approx)) yeilds Rs. 4400 as interest annually if INVESTED IN PPF. If out of 4400 earned as PPF interest, i need to pay 2900 as Term Insurance Premium….i am left with only 1300……………..IN WHAT WAY 1300 is greater than 7 % i am earning under Table 830.

Figures are not the actual ones i have taken, you can take the actual figures to substantiate your Analysis as a professional,

Can you please cite out some logic for your Advice

Kind Regards,

Rajesh Dogra

98722 89049

Rajesh-Hope you not understand the basics of PPF 🙂 Let us take your example, suppose a person opt for Rs.6,00,000 term insurance by paying Rs.2,900 and rest amount of Rs.41,100 into PPF for the rest of 21 years then he will definitely earn more than what he get from this plan. Also Term Insurance+PPF combination will have same tax benefits of what this LIC plan provides.

Why PPF for 21 years……………premium paying term is 9 years only

pls cut your calculations at 9 years.

kindly publish calculations table upto 9 yeaars……….i can put maturity amount in PPF at the end of 9 years also….so no point in comparing beyond 9 years.

Rajesh-You are correct, but how about the spread of premium to 15 years from same nine years? Or forget about PPF, what about Bank FDs? Do you still feel that this plan better to that too?? Even if you stop investing in PPF and withdraw maturity amount then too I assure you that return will be higher than this plan 🙂

I get Approx 15 lac in PPF for 9 years premiums at 21 years……..How much i will get under the policy in 21 years.I need to pay additional around 64000 to continue term insurance for 21 years so deduct 64000 also from PF returns…….Now pls let us know the differential benefit.

Rajesh-Why to deduct? Keep it separate ever year for term plan and simply invest the rest in PPF???

sir assume i dont have money after 9 years(just a vague assumption for calculation sake purely ) more than 2900 to continue term insurance.

sorry….taking your precious time.

Rajesh-Sir no problem 🙂 That is a reason I compared with PPF.

Rajesh-In that case you can stop PPF also. Then PPF will be in inactive mode. But you get interest on it as usual.

sir in Bank FDs again Taxability will make them Unattractive,,,,Pls consider making a table for our benefit……my request !

sir

mujhe agent portal ya marchant ke id password banane ke kuch halp karo ji

Dear Basav Sir,

It is high time to wish you Good luck for your future and bid you Good bye. I apologize if my comments have hurt your feelings. Hope lots will benefit from you Sir . Please check the details of this LIC policy- Date of commencement , date of first unpaid premium, date of death , date of death claim payment- LIC policy number 489783634 ( Life assured Lt Daniel Murmu) . A small piece of advise from a lesser known mortal from India’s most neglected region ( North East India)- Too much ego will kill your talents. Adieu Sir

Joydeep-I always welcome you for healthy discussion. Also there is nothing called ego, instead a I love to have quality discussion. Nothing hurts me, because I came across more harsh reviews about my idea than your’s. So don’t worry about that 🙂 Thanks for your wish and small request, don’t share such personal details on public platform. Whether you took the permission of the insured person, whose number you shared?

Dear Sir,

Thanks for your advise – you are a nice and fine person.I will definitely take note of your advise. Thanks and bye. Apologizing for any misconduct and unruly behavior. Sir.

Joydeep-Personal Finance is life long learning. I can learn from you and you can learn from me. At the same time we can learn many things from the readers. So I never feel that I am COMPLETE. I always say that I am learning. So no misconduct and no unruly things 🙂 Cheer up !!!

Dear Basav and Reddy Sir,

You can take Indians out of India but never India out of Indians. Last year there was a huge surge of sale of washing machines on Uttar pradesh national highways that sent the cash registers of washing machines manufacturing cos ringing. When the subject was studied it was found that washing machines are used in dhabas along UP national highways to prepare lassis and not to wash clothes. I have a rice cooker that I use to boil water. But the rice cooker is not intended to serve this purpose. It so happened that I had a long spell of bachelorhood and had to purchase the product to save time. But I got married two months after purchasing this stuff and so I am using it the other way. The huge sale of washing machines in UP highways to boost lassi production is not acceptable. But they are using this stuff that benefits them the most. Look at this :

In march 2007, I sold a policy to a customer to meet two objectives: Insurance and I.Tax Reducing Instrument. In August 2010, he redeemed his policy to raise funds for his daughter’s marriage. In July 2012, he suffered a massive heart attack and met the ultimate. He was uninsured when he expired. That’s why it is impossible to predict how an insurance policy will benefit a client. My widowed land lady ( you can check this LIC policy number 488561977) took an LIC policy Money plus after seeing a Tv ad that this product will generate good returns but died of breast cancer in 2011. Her daughters got the insurance amount.

As an LIC agent you also need to highlight the benefits of a product launched by an insurer. You seem to be an LIC turncoat …….. I live in the state of Assam where the dowry system is hardly prevalent. But the other day a girl was killed in the city suburbs and the motive behind the murder turned out to be ‘dowry harassment ‘ eventually. You never know…… LIC is one of the institutes that has given employment to lakhs of jobless youths, recruiting them as agents and is this not a social service rendered by LIC ? I have Agents who earn 5 times as I in a month…. Thanks Sir….

Joydeep-Again my answer will be in two lines 🙂 LIC creating employment to lakhs of jobless youths. But at what cost? Whether those lakhs of agents competent or at least know what they are selling? Their first priority is to sell the product which gives them a first year commission of 35%. If they are social responsible then let them insurance a family for the actual insurance need and then let the remaining money be in a simple product called PPF or FDs. They will not do. Because they know that they will not get a single penny by advising this method (except less commission from term insurance). Doing a typical business but showing as if in social service is too dangerous than purely into business 🙂

Sir, 35% commission is in records only !

They earn much less.

In the above policy, they are getting just 14%.

The services they provide, the work they do are according to their commission.

Mayank-Can you elaborate your claim of only 14% commission?

Fine policy

As expected, Basav has ridiculed the new plan launched by LIC. He went ditto when LIC launched Jeevan Rakshak. LIC sold over 2 lakh J Rakshak policies in a month…… Someone has rightly defined a CFP as- someone who will be able to tell you tomorrow why what he predicted yesterday just did not work today…………

Joydeep-Very much impressed with your new definition of CFP 🙂 But I wrote these posts only keeping in mind of buyers but not agents. For your information, I am also LIC agent since 12 Yrs. Hope your definition of CFP will now change !!!

10 % 1st yr and bonus 40% on that. totalling 14 %. strange ! Even You being an LIC Agent Don’t Know it ?. Realy Strange.

Lalit-But for me LIC gives 35% of first year commission !!! 25% for first year and 40% bonus on that 25%. So total 35%. Hope they are not doing any bias payment to you 🙂 Dear check the term your selling and the commission on that.

DEAR DEAR MR BASU,

I WAS QUOTING COMMISSIIN FOR THIS PLAN 830 ONLY. HERE FOR THIS PLAN AS THE TERM IS BELOW 10YEARS .I.E 9 YRS THE COMMISSION IS 10% FOR 1ST YEAR AND 40% BONUS ON THAT WHICH COMES TO 14 % IN TOTO. THE 5% FROM 2ND YRS ONWARDS. YOU ARE I THINK HEAVILY BIASED AGAINST LIC PRODUCTS. THANKS.

Lalit-Not like that. I am heavily biased towards buyers and investors 🙂

Again thanks for the smiley. Are you clear(educated) now about the commission of which you were so sure before ? and BTW your bias shows clearly from your views and it is now apparent as to how every self proclaimed professionals start advising buyers and investors without even knowing things properly. Hence i would like you to get your facts in place before writing something b’cause people are much much less ignorant these days and not dependent on such lopsided views.

Nayak-Do you feel even after your claim of less commission will drastically change the return of this policy? Check your facts and expenses (hidden) of these dangerous endowment plans. They are more dangerous than ULIPs. Because none of know the exact expenses. So I still stick to my claim and let us readers decide which is correct and wrong 🙂 If LIC is so expert in managing money then why LIC Mutual Fund managing their funds badly? Why can’t LIC teaches their own fraternity? Check all investments done by LIC and you find that LIC always acted as scapegoat to Govt policies formed time to time by respective Governments.

Hmm MAN trying to start another discussion on the return of this policy again and also mutual funds? btw how much do you know of fund management of mutual funds is easily fathomable from your various analysis which you propagate for easy readings. anyways its another long debate and your bias will not let you go deep into it because when you got caught with your confident claim on commission you started diverting to something else. MAN you are incorrigible! and i thing its meaning less to even waste time here in this forum. bye. happy haunting !

BTW I AM NOT AN AGENT.

CFPs are bent on making Term plans the only form of life insurance in India. In fact, some CFPs opine that one should only buy online Term plans, this will be cheaper than their Offline counterparts. Statistics however, reveal that not even 2 per cent Indians would like to go for a Term plan. Life insurance is based on 2 tenets:

1. Living too long

2. Living too short.

Hence, the returns from Life Insurance policy is something that one looks into while purchasing a Life Insurance Policy. Money Plus policies from LIC that were launched in 2007 could hardly generate any profit and LIC Agents had to bear the brunt. Many Agents had to flee. Ulips from other Pvt Ins Cos too had a similar story to tell . Consequently, many Agents had to call it quits. According to Hemant Beniwal, CFP, LIC has done it well to sell investment plans but never INSURANCE in the truest sense of the term. Agreed. But in a country of 120 crores, when only 20 crores are ‘insured’; is it worth to popularize Term plans ? The seventh pay commission has just been constituted and the prices of essential commodities are already soaring. LIC doles out the highest amount of Loan from insurance policies than PPFs or EPFs, according to a study. The markets are performing and the BSE SENSEX has crossed the 28000 mark , but Bank interest rates still continue to remain high. Under the illumination of these facts, it is not understandable why Term plans should be popularized. Whenever LIC launches any product, CFPs rubbish them away, branding them not a must have in any body’s kitty. But when LIC launches a Term plan, CFPs welcome the move….. Perplexing……. Yesterday, a doctor was manhandled , abused and asked to pay a penalty of Rs 100000 after a child patient died receiving his treatment. This doctor had successfully treated over 20000 patients over the last 7 years. The doctor had no other option but to apply for loan from his existing insurance policies. In India, you are never sure… You may purchase an FD of crore for the marriage of your daughter, but may end up utilizing the amount in paying bills of doctors for your Cancer treatments.

Hi,

I do not think any CFP has a grudge against LIC. The point here is about product features, returns, benefits etc., and not about a company per se. If any other xyz life insurance company launches similar product then i am sure Basu will give similar opinion.

As an advisor/agent/planner, it is our duty to let our client know the pros and cons of a financial product. After that it is left to the client to buy it or not.

Cheers!

Sreekanth

http://www.onlinefinancialplanner.in

Sreenkanth-I fully endorse your views.

Dear Basav Sir,

I under stand you are free to opine what you think best. This is a democratic country and of course this is also a democratic blog. You are free to write but you (or even I) are not empowered to establish your claims or opinions Sir. You can post the nitty gritty of a product launched by an insurer – even post your thoughts on the product- but not attempt to establish them . It’s not only me but a host of people who feel that you are desperately trying to belittle a product. And Sir, we want to hear the unique selling points of a product from an educated person of your ilk………… Expecting that you will educate us more by writing the unique selling features …. Authentically yours Sir…. Looking forward to a healthy relation ship with you Sir…

Joydeep-My blog is not about selling but airing my views and discussing. So I am not person for you, if you are looking for someone who called himself as MASTER in selling 🙂

Dear Reddy Sir,

I have observed that Financial Experts are of the view that Term plans are the ONLY FORM OF LIFE INSURANCE PLANS and strongly advocate these plans. My point is that if we are to track the economic guidelines set by US and the West , why are the bank interest rates not going down when the markets are performing? In India, the Gold prices and the BSE SENSEX plummeted parallel in 2005-2008….But these are against the theories of economics…..As a financial expert if you advocate TERM plans you must also raise eyebrows when the bank rates are not going down despite the market surge-ahead…. This lopsidedness demands an explanation. The seventh pay commission has just been constituted and the ripples are already being felt- prices of essential commodities are going up… This happened last time also when the sixth pay commission was set up…. As regards insurance you go with the West but when bank interest rates are considered, you remain mum. You appreciate the hike in bank interest rates….. If you want to make Term plans the order of the day you must strongly write against hike in bank interest rates as this is against the laws of a good economic establishment and good governance…… Hope you did not get provoked Sir . Apologetically yours Sir…..

Joydeep-You lack economic view. Check the drop in inflation and drop in Bank FD rates. I am not able to understand why you fond of surge in market to interest rate. They are inter linked. Infact if market is going high and high then it is indication that industry is growing and interest is falling. First give us a clarity of what you want to convey.

Joydeep-My short answer to “LAMBI ANSWER”…

When you buy anything and same is available at discount then which one you buy? Costly because agents are there and they help for life long? Why can’t you dig into data of agents drop out ratio? LIC doles out to bailout Govt. Interest rate high? Check the current FD rate of SBI..How about doctor invested the same in Bank FDs? Is he not able to apply for loan? So you mean to say that more illiquid means more better??? Lot to learn from you man !!!

Mr.Basavaraj,as I noticed you just pass comment against LICI product.Do you know that in India,till today 70% of total population can not spend Rs.20 per day.The country where people need food security from govt, PM has to run Jan Dhan Yojana there Pure Term Plans are nothing but luxury.I afraid you won’t understand all this things because you don’t have any idea about rural India.

Dipankar-You see all from one view. Do you feel the Govt data of “still 70% people can not spend Rs.20 day” a true reality? Visit villages and check rates of basic necessities. You will find that in today’s India, even beggar have higher expenses of around more than Rs.50. But these Govt agencies predict that 70% of population still at such low poor rate. This is nothing but a policy framework glitches of typical Indian politicians. Coming back to Jan Dhan Yojana, it is not intended to spread the awareness about this Jan nor Dhan. But to mobilize the undisclosed Indian savings. So that Govt can’t fall short of Fiscal Deficit. So first understand that reality.

what is commission rate for table number 830?

Sushil-Equal to any typical endowment.

SIR ! what is Commission % for this plan.Is it same like Raksha or higher.

Praveen-As of now, only this much information available.

Dear Pravin, this product will be available for sale from 9th Dec. Hence the nitty gritties of this plan are still not available…………..

Sir,

Currently which is good insurance plan with return.

I am not talking about term insurance.

Guide me in current market which is good insurance plan in any insurance company

and premium paying term i want to set 12 to 15 years.

Also suggest good plan for retirement planning for my son aged 23 years

Premium term may be more or equal to 25 years

Jivrajani-You are saying no to term insurance but asking for good insurance plan. First make your mind what you need. Insurance or investment, then search for product. Same applies to retirement doubt also.