Since long we were targeting agents commission as a reason for Endowment, Money Back, Traditional or Traditional Child Insurance plans low returns. It is true that these policies constitute a high commission for agents. However, the real culprit is neither agents nor insurance companies, but the expense limit rules insurance companies following.

Long back, when I wrote a post on the commission earned by Life Insurance agents, then I received mixed feedback. Some were supportive and a majority were rude. Agents’ fraternity fully defended the commission structure. Even though the commission is a major part of expenses in Life Insurance policies, the truth is different and that I am going to share with you all.

Recently I got news that IRDA drafted the new guideline pertaining to the expenses of all Life and Health Insurance product (This includes Agent’s commission too). This circular not yet published but sent for internal communication. This gave me a clear picture why the traditional or endowment plans unable to generate the return. Even they are failing to match the Bank FD rates. Below are some facts, which may surprise you.

Life Insurance companies follow the regulations, which formed in 1938 and 1939–

Yes, even after IRDA came into existence and the entry of private insurance companies, the expenses are still regulated by the rules of the years 1938 and 1939. These rules are called “section 17D of the Insurance Rules, 1939” and “section 40B of the Insurance Act, 1938“. These old rules still followed by insurance companies for the purpose of managing expenses.

Expense depend on the age of Insurance Companies-

The cap on expenses is based on how old the insurance company. For example, it is high for new companies and low for old companies. Therefore, it is you to be a scapegoat if you bought an insurance product with the new company.

Expense depend on the product–

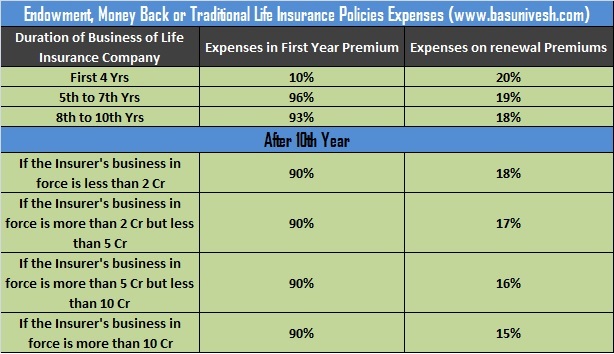

The cap on expenses differs for regular premium paying policies, annuity and for single premium policies. For example, the limit is set at 5% for an immediate annuity and single premium policies of an annuity. It is 10% for a deferred annuity with regular premium policies. For other products like the Endowment, Money Back or Traditional Plans the expenses are listed as below.

You notice that only 4 years of business the expenses are minimal (in first year premium) and later on it is almost 90% of your first year premium and later on it is around 15% to 16% of premium you pay.

Expense depend on the business in force of Insurance Company–

You notice from the above table that how the business volume of an insurance company also matters. First-year expenses are capped at 90% of premium collected. However, it decreases once the insurance company increases its volume.

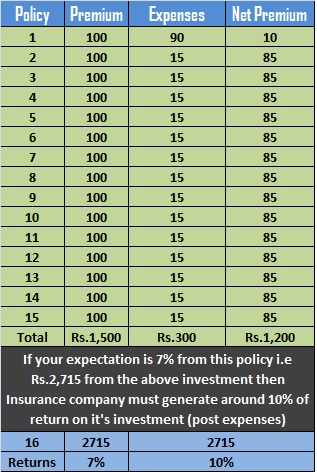

Below I explained why the traditional plans only giving you around 5% to 6%, even after investing successfully (especially LIC) in an equity markets. Let us assume that you took a traditional policy for a 15-year term and yearly you are paying Rs.100 as a premium. Then the cash flow looks like below.

Now being a buyer of this product, let us assume that your expectation is 7%. You assume that you invested yearly Rs.100 for 15 years and hence if we consider 7% return, then the maturity value must be around Rs.2, 715. However, for insurance companies the total invested amount during this policy is just Rs.1, 200 (excluding the expenses). Therefore, to give you the return of Rs.2, 715, the insurance company must generate around 10% return.

This is what all insurance companies providing you. They are giving you the DECENT 7% return by investing in equity or debt by smart ways 🙂 There is a huge cry whenever news items appear that LIC profited from equity investment and how much % it is actually holding in a particular company. However, for me as a buyer of Insurance+Investment product this does not matter. What matters to me is how much life risk covered and how much I get back on my investment. They are investing wisely and there is no doubt. Why? Because generating around 10%, is a proof. However, for an end investor what matters is 7% return, not the internal return of what insurance company generated (10%).

Now it is true that Endowment or Traditional Plans are most dangerous products than the ULIPs. Hope you understood why Endowment, Money Back, or Traditional Plans generate only around 6% to 7%, even after adapting wonderful investment strategies by insurance companies 🙂

Hello Sir,

Very recently I started learning about investments..Your blog is really good for beginners like me..

Sir, I have one query.

I have jeevan labh for 8300 premium quarterly ( SA : 700000)

Jeevan anand for 6500 premium quarterly (SA : 50000)

Jeevan lakshay for 5500 premium quartely (SA : 40000)

Overall I paying nearly 20,500 for every quarter.. all purchased on Feb 2017.. Its been completed 2 years. Now I feel that I am paying too much money for premium.. My age is 32..would like to know the rate of return for these..

Need your suggestions.

Dear Anand,

Returns may be around 5% to 6%.

Hello Sir,

I have one more query.

Should I suggest ULIP plan specially child ulip plans who intend to invest for child’s education instead of traditional plans?

Let me take a hypothetical example

A parent in the age group of 30 to 35 years approaches for a child plan. He is ready to invest around 35,000/- p.a. for 20 years. His yearly income is Rs. 5,00,000/-

There are two options.

One is to suggest a traditional plan where he is going to invest Rs. 35,000/-. His S.A. is Rs. 3,50,000/- At the end of 20 years, he will receive around 14,00,000/- (this includes receipt of Rs.1,00,000/- for previous 4 years before 20th year). If he dies before this term (suppose 5 years), all future premiums will be waived, S.A. will be paid to guardian and plan will continue as intended.

However, I believe this plan will not serve the purpose.

Now, second option would be to suggest him to buy a term plan with a premium of Rs. 10,000/- This will give him risk cover of Rs. 75 Lacs to 1 Crore.

Balance Rs. 25,000/- is invested in Child ulip plan where he will get risk coverage is Rs. 2,50,000/- In case of unfortunate death, future premiums will be waived and the same amount will be invested in one lump sum in the corpus in the year of death itself.

At the rate of 8% return he will get Rs. 9,60,000/- Survival benefit reflecting in IRR of 5.85% and cost 2.15%

However, this plan has the potential to generate much higher return. Suppose a plan generates a return of 10%. In that case IRR works out to be 8% and survival benefit of Rs. 12,36,000/-

Also, suppose that fund performs even better considering our country’s future development / GDP growth and generates a return of 11%. In that case, IRR works out to be 9% and survival benefit of Rs. 13,94,000/-

This plan should beat traditional plan as returns are likely to be same but investor will get additional benefit of higher risk coverage due to term plan element.

Is my understanding correct?

Thanks

Ritesh-Buying Term Insurance and investing in ULIP is still a costly way. Because there are mutual funds whose cost is less than 2.5%. Then why one must invest in such ULIPs? Lock-in of investment, no easy exit, no historical track record and hard to track the performance makes ULIP hard to digest.

Thanks

However, I though this ulip is cost competitive. (based on my understanding). Pls help me understand it better.

In the above-mentioned example, when I say as per Benefit Illustration statement at 8% growth rate scenario, IRR works out to be 5.85%. Hence, balance 2.15% should be cost.

This is my understanding. Correct me if I am wrong.

If this is correct, then at 10% & 11% growth rate scenario, IRR should be around 8% and 9% respectively. This is because cost of 2.15% would come down to near 2% since premium allocation charges, policy administration charges are percentage of premium amount and are fixed. Similarly, mortality charges are also fixed. (including service tax ) As fund performance improves, these fixed costs come down resulting in overall cost around 2%

In that case ULIP works out be better as compared to Mutual Fund schemes.( Cost wise)

The variable cost (Fund Management Cost) in case of ULIP is capped at 1.35%. So overall variable cost comes around 1.56% including service tax thereon.

So I think ulip is a cost competitive product. In the long term the only differentietor to be seen is the fund performance.

Unfortunately, there is no data available to compare long term performance of ULIP vis-a-vis Mutual Fund. This was due to very high charges in pre 2010 ULIP.

However, it would be interesting to see the performance of these two products in the decade to come.

Ritesh-When we say illustrate example with 8%, then it is the IRR but not the typical bonus add-on like what we do in endowment plans. Also, this 8% or 10% IRR is post expenses but not pre-expenses. Depending on indicative return and claiming that we get that much from such ULIPs is purely wrong. Because they are just INDICATIVE with no guarantee.

Hi Sir

Now a days, a lot of hype is being created on various media channels about a new product introduced by Bharti Axa Life Insurance co.

I think the product’s name is Invest Once ( or something like that) wherein a company guarantees a return of 7% for 5 year term plan and 9% for a ten year plan.

This is a traditional plan. However, I wonder how Bharti Axa guarantees such high returns?

I know these are simple returns. (not compounded returns – gimmick used by Insurance company). However, still return works out to be 6.19% for 5 year period and 6.63% for 10 year period which I think are quiet high when we compare traditional plans of other insurance companies (where return tends to be around 4.5% to 5.5% for similar period)

Is there anything I am missing?

Ritesh-Let me go through it and post an article on the same. Thanks for your pointing.

I have jeevan saral 20 years plan , table no.170 . I am paying quarterly 11337 premium since past 3 years for SA 5 lakhAlso i have money back endowment policy 20 year where i am paying 6337 premium half yearly for SA 2 lac. I have taken policy in 2007.

Kindly help me if this plans are good or any suggestion u have for investmnet on ther financial priduct.

Thanks in Advance

Ashrita-These products will give you return of around 5%. If you feel this much is BEST, then continue. Otherwise, seriously think of coming out from these two policies.

I have 2 questions

What happens if policy convert into paidup after maturity? Customer paid 2 premium and policy term is 20 years…can he get atlist premium paid?

2nd

My one friend got ulip policy form SBI life 1 lac yearly prem for 20 years what happened if she stop paying…..and what will be the good suggestions for her surrender or paid up….

Sir request you to write something on paid up policy

Ajay-You can’t convert the policy to surrender or paid up before 3 years completion. Regarding, SBI ULIP, you have to check the conditions of surrender carges and how the fund is performing now. I can’t blindly give suggestion on this.

Sir She invested SBI life smart wealth builder.

according to policy details net investable portion is 89060

Request u to suggest. this is big issue i cant write complete story

she is a caterrer in small villedge

Ajay-I think she purchased it recently (Maybe around 2014). You can’t do anything. Because even if you want to discontinue then there are charges on such acts. Hence, wait for 5 years, watch performance and then take a final call.

then which is thev safest mode of investmant

Vedhanathan-The SAFEST investment is your savings account only (that too if you bank on your bank).

Hi Basu,

Thanks for the article. Its is really eye opener for the me.

I have one endowment policy , i have paying on monthly mode with HDFC bank(ECS mandate). How can i stop payment of the policy. Is there any way to stop the ECS payment.

I am investing this from past 6 months.

Regards,

Krishnamurthy K

Krishnamurthy-Visit the bank and request for STOP of ECS.

Thanks a lot. I will do it right away.

Regards,

Krishnamurthy K

Please correct the content in the example “Low for new companies High for new companies” under heading Expense depend on the age of Insurance Companies

Do not post this comment

Well wisher-Thanks for pointing my error 🙂 Correct it. It’s alright to publish such comments and don’t worry 🙂

Really nice post.

Enlightening article.

Basa…very well written article. Thank you for sharing these new and valid points 🙂

Sreekanth-Pleasure 🙂

Use full thanks