Which are the online Top 5 Best Term Insurance Plans in India 2019? What is the claim settlement ratio of these best term insurance plans? Let us choose the best term insurance plans in India by comparison with charts.

We have around 24 Life Insurance Companies and as of now, all insurance companies offer online term insurance plans. Hence, it is hard to shortlist the BEST among them. This post will help you in shortlisting the Top 5 Best Term Insurance Plans in India 2019.

What is Term Life Insurance?

Term Insurance is the type of Life Insurance. If death occurs of the policyholder during the policy period, then his/her nominee will receive the Sum Assured selected. If policyholder survives till the end of the policy period, then he/she will not receive any maturity amount.

This is the reason, these policies cost you very less and cover a large amount of life risk. This is the PURE LIFE INSURANCE. Hence, anyone who has financial dependents must buy this product immediately.

However, nowadays there are so many variants in Term Life Insurance. For example, the return of premium, Term Life Insurance up to 100 years of age, a variety of riders and variety of claim payable option.

But instead of complicating your dependents, buy a simple plain term life insurance. Why you complicate your dependents when you are buying this is that this product’s benefit will come into picture when you are not here.

What are the advantages of online Term Insurance Plans?

Nowadays all Life Insurance companies offer you online term insurance plans. The advantages of online term plans are as below.

# It is convenient to buy as with the click of a button you can buy it.

# As there will not be any middlemen involved, the price is cheap than offline term insurance plans.

# You fill the proposal form on your own. Hence, an error of margin is LESS.

# Undue influence by agents is not there.

# Along with the discount of DIRECT purchase, if you buy through online then now life insurance companies will give you 8% on your FIRST YEAR PREMIUM. This is to promote cashless online transactions.

Top 5 Best Term Insurance Plans in India 2019

Now let us shortlist the Top 5 Best Term Insurance Plans in India 201. How I selected the Top 5 Best Term Insurance Plans in India 2019?

# How old are the companies

# Claim Settlement Ratio

# Premium Cost

# Plan Features.

How old are our Life Insurance Companies?

Below is the chart which explains the age of all life insurance companies. I am comfortable with the company which is at least 10 years old.

You notice that among 24 Life Insurance Companies, 22 companies completed 10 years or more. Therefore, my target is among these 22 companies only.

IRDA Claim Settlement Ratio for 2017-18

I have already written a detailed post on this at “IRDA Claim Settlement Ratio 2017-18| Best Life Insurance Company in 2019“.

However, for the better understanding purpose, I am putting the data again in this post.

The reason behind this criteria is that Life Insurance is a long-term contract between you and insurance company. Hence, the older the company the more comfortable I feel.

You notice that among 24 Life Insurance Companies, I marked 11 companies in green due to their claim settlement ratio of more than 95%.

As usual, LIC tops the list. But don’t feel happy. Let us see the claim amount settled by individual companies to arrive at best companies.

Average Claim Settlement Amount of Life Insurance Companies in 2017-18

As I said above, the claim settlement ratio will not give you the clear picture about which type of products the insurance companies settled. However, we can assume the types of products they settled by looking at the average claim settlement amount of Life Insurance Companies in 2017-18.

Here come the results !! LIC stands in lowest with red in

It shows that, even though LIC settled the highest number of claims, the majority of such claims are less than Rs.2,00,000 Sum Assured. Hence, it is indicating indirectly that LIC’s claim settlement is mainly in the category of Endowment Plans but not Term Insurance.

Hence, the moral of the story is that DON”T RELY TOO MUCH ON CLAIM SETTLEMENT RATIO ALONE!!

Premium Cost of Term Insurance Plans

Now I will consider these 5 Life Insurance Companies premium only to arrive at best. The Insurance Companies which I shortlisted are as below

- LIC (Why? Because the oldest and Government backed mammoth)

- ICICI

- HDFC

- Max Life

- Aegon Life

Even you can consider the companies like Bharti Axa or Tata AIA Life. However, I have to choose only five among 24 Life Insurance Companies. Hence, I have selected these 5 as per my choice and comofrt with the companies.

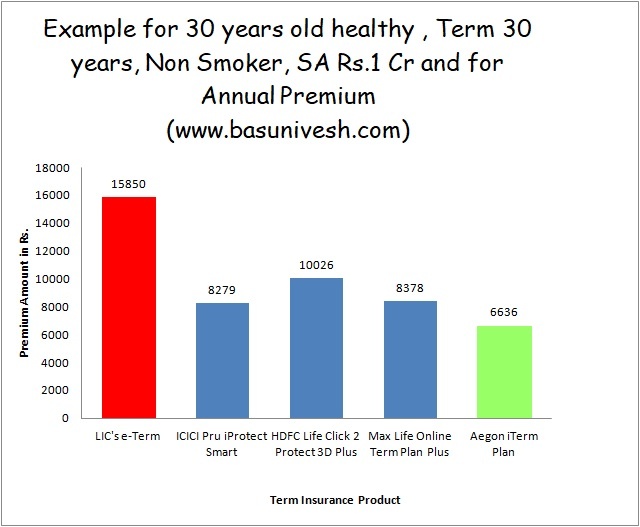

Now I will consider an example of a person whose age is 30 years, Term of Plan as 30 years, Non-Smoker and healthy, Sum Assured Rs.1 Cr and yearly premium payment. I selected plain vanilla product without any riders or add-on features.

One thing I noticed is that LIC REDUCED it’s premium when we compare to last year. Last year it was Rs.16,060. However, this year it is Rs.15,850.

Now let us look at the plan features and decide which are the Top 5 Best Term Insurance Plans in India 2019.

Few points to consider while buying term insurance

# Never rely on Claim Settlement Ratio

Claim Settlement Ratio is raw data. This data will not give you enough picture of what type of products the insurance companies settled. Hence, relying too much on this single data and selecting a product is not a good idea.

# Quantum of Life Cover

Ideally one must have at least 15-20 times of your yearly income. This is the basic calculation.

# Fill the data properly

Sharing data especially materialistic information must be accurate. If you are unable to understand anything, then immediately contact Life Insurer for the help. Understand the questions and fill only when you know what you are filling.

# Never allow someone to take over your decision

Never budge on the decision which is against your wish. If you are fully comfortable, then only go ahead and buy.

# Term of the policy

Ideally, it should be up to your retirement age. Because you retire when you are financially free. Hence, Life Insurance is not required during your retirement age.

# Splitting of Term Insurance

There are few who are apprehensive of relying on a single insurer. Hence, they try to split among few. But in reality, there is no logic in splitting. What is the guarantee that the all insurer will accept or reject the claim?

# Stay away from riders

Never combine Life Insurance with General Insurance requirement. You will get better-featured covers from general insurers regarding accidental and critical illness covers. Hence, simply avoid riders.

# Never heed the aggregators choice

Nowadays there are so many online aggregators. You may not know that they act exactly like insurance agents. Hence, never rely on their claim. Do your own research. If you are satisfied, then only go ahead and buy. Refer my post about the same “Beware of Insurance Comparison portals in India“.

# Know about Sec.45 of Insurance Act

After the recent clarification about Sec.45 of Insurance Act, the customer became king. It states “No policy of life insurance shall be called in question on any ground whatsoever after the expiry of three years from the date of the policy, i.e. from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later.”

Refer the complete post at “Term Insurance-Claim Settlement Ratio no more a big criteria“.

# Review your life insurance cover

Buying Life Insurance of Rs.1 Cr or Rs.3 Cr is not a one-time affair. You must review your life insurance requirement at least once in the 5 years. If required, then you must increase the sum assured.

# Be cautious with premium payment

In case of term insurance, you have to be very cautious when it comes to premium payment. It is always better to opt for yearly premium payment and also if possible make it automated by the way of ECS. If policy lapses due to your negligence, then you have to undergo medical tests and all kinds of stuff once again. If there are any health issues, then the insurer may reject to renew the policy.

# Never go for Telemedical Examination

Recently one of my blog readers pointed that few Life Insurance companies insisting just Telemedical Examination by questioning about your health details in the phone (Refer-Can I buy Term Life Insurance with Telemedical Verification?).

It may be the easiest process for you and for life insurance companies. However, I feel suspicious of such kind of medical examination. Because in future insurance companies may find 100000 reasons to reject the claim on health ground.

Instead, I suggest you to go for medical examination. This will really clear the dust or doubt in your mind about future claim settlement.

Final Note:-The list of “Top 5 Best Term Insurance Plans in India 2019” is my personal choice and comfort with insurance companies and by verifying features. However, it does not mean that my selection will be the UNIVERSAL selection.

Hence, if you have a different opinion from my selection, then it does not mean you are buying a wrong product. My only concern here is not to shortlist “Top 5 Best Term Insurance Plans in India 2019”, but to give the

Hi Sir,

I currently have a term insurance plan without accidental death benefit. I guess the insured sum is also low compared to my present income. Is it a good idea to discontinue same and avail a fresh one with accidental death benefit rider?

Dear Raj,

Buy a new one from the same insurance company and buy accidental insurance separately from non-life insurance companies.

if the term insurance company had done the medical and issued the policy. can they reject the claim due to any medical conditions??

Dear Singh,

Yes, they can. Medical test done doesn’t mean they must accept.

Dear Sir,

I am 36yrs old and a diabetic patient. I am planning for a term insurance in Max life.

I believe, they will conduct the medical test and based on this they will accept or reject the application. If in case they accepted with higher premium. Can you please go ahead with this or is there any risk that I need to consider before proceeding.

Regards

Manoj

Dear Manoj,

If they accepted it with higher premium and knowing your health status, then what is wrong here?

Sir, i m 44 yrs old married and have 2 school going kids. I m in a pvt sector having annual net salary Rs.12Lac. I do not have any term plan.

Kindly advice for how much should I insure and the duration. should i opt for yearly or one time premium. Can I choose one among the top 5 listed.

Regards

Thiruvengadam

Dear Thiruvengadam,

The ideal insurance coverage should be at least 20 times of your yearly income. Opt for yearly premium payment.

Most of the insurance companies conduct only questionnaire based medical examination but not conduct direct in person medical examination. During online form filling they ask some questions about our medicals conditions.

1. How can I insist them to conduct direct medical examination instead of the questionnaire?

2. If I disclose any disease for which I had taken treatment in the past (3 years back), but it is completely cured now, will they deny the claim if the death is caused by the same disease?

(here disease means any curable respiratory disease, such as TB, Pneumonia…….)

Dear Rajan,

You can’t insist them as it is their wish to do so. Denying or accepting depends on the underwriter’s decision. Hard to predict.

So still, there is a change to deny the claim if we disclose our existing diseases, Then why should we disclose all the diseases?

Dear Rajan,

If you not disclose then it is a BIG opportunity for them to deny 🙂

Dear Rajan,

I am Anurag from Bangalore. Kindly advice on the matter.

I have already invested in INVESCO INDIA CONTRA FUND – GROWTH . The history shows that the fund is steady for a long time now. I want to continue for a long time in SIP route.

Is it ok to continue?

Dear Anurag,

What prompted you to invest in this fund? It is hard to say BLINDLY.

Should I Buy Aegon Term Plan with 36 Critical Illness Cover or It is Better to Buy It from General/Health Insurance?

Sir, You have Commented not to Buy CI with Life Insurance. You Told, “You will get better-featured covers from general insurers regarding accidental and critical illness covers.”

Suggest me 36 CI Covered is Good or I have to Opt it From General Insurance ….

Dear Dharmilkumar,

Better not to go for riders. Regarding which one to choose, refer my earlier post for the same.

Sir, Saperate CI Policy From Heath Insurance Compancy will give me Claim when I’ll Hospitalize. And It’ll give me Only Hospital Expenditure.

But In Life Ins. Critical illness Rider, If I Took Cover of 20,00,000, Then Compancy will give me Claim when Critical Illness is Detected. And They’ll provide Full Claim of 20 LACS Instead of Only Hospital Expenditure…

Is it Good Na…. or Any Hidden Prospect is Present That I don’t Know….

PLZ Suggest…

Dear Dharmilkumar,

Please read the features properly with respect to standalone critial illness covers.

dear sir can we ask insurance company to send the copy of medical test done by them to me before accepting their proposal?

bharti axa has low premium but can the bad condition of Airtel in telecom can affect this company or this is totally separate entity ?

please give your view about bajaj allianz.

Dear Man,

You can’t ask before the issue of the policy. Both are different entities.

These companies just shows 1crore cover to lure the customer. I have tried max and ageon for term insurance. Ageon reduced the cover from 1crore to 30lakhs on basis of my salary(which i have told then in starting of process) even while their no problem in medical test. (

Max rejected the cover after all process saying they did not cover the my address pin code ( while their representative visited my home to verify address).

Mr. Basu what should i had done in those conditions.

Dear Man,

It is completely depending on their decision. Yes, sum assurance should also match your income. Otherwise a person earning monthly Rs.50,000 may ask for Rs.5 crore, whereas his human value may not be that much. Regarding Max, I am not sure what prompted them to reject the claim.

That what I am saying if they cannot give a person salary of 500000 a one crore cover why the hell they doing all process at first place . On their portal they ask income at first place. Totally non sense process by them.

Max knowing pincode at first place cancel the proposal on basis of pincode not covered . Can we take those firms to consumer courts for wasting the time .

Dear Man,

It is their calculator providing options. Default option does not mean default option for YOU.

I am term insurance process in TATA AIA.Is TATA AIA IS trust worthy to continue with insurance policy.shall I shift to other term insurance company.

Dear Pabitra,

If you are comfortable with product feature and premium, then go ahead.

Hi Basavraj sir,

first of all thanks such a wonderful & informative posts.

I’m 29 yrs old, planning to get LIC’s Newly launched Tech Term plan (854).

My query is , 1) Does IRDA has stipulated any guildelines on medical tests to be conducted by Insurer’s while issuing Term Plan ? or it is left to the discretion of Insurer’s ?

2) Do they share Medical reports if a person comes out fit through medical tests ?

3) It is advisable to retain a copy of medical reports from Insurer’s ? (For our information pupose only )

Dear Rahul,

1) It is left with IRDA.

2) YES, they will without whether you asked for it or not.

3) Usually, they send it with policy bond.

Hello Sir,

Nice and very informative blog you have written. My Question is that

1. Is there any premium differ between like if i go to direct life insurance Company like HDFC life, ICICI life, Max life and purchase Term plan OR if i go to there related website and purchase same Term Plan online?

I went to respective HDFC life Office and ICICI and ask same Question then they refused and told me that if you buy from us OR Company’s respective website and buy online, premium will be same .

Please suggest sir.

Dear Vandana,

There will not be premium difference. However, they may enforce their choice on you. Hence, be cautious while dealing with such online aggregators.

Thank you so much for Quick reply. i will not go with online aggregators. in my research HDFC provide lowest Premium ( basic Term with permanent Disability ) than Max, ICiCi pru. what do you suggest among this three.

Dear Vandana,

Go with the one where you are comfortable with features and premium.

Hell Sir,

I want to buy a term insurance plan of Rs. 1 CR but a little bit confused please help me.

1. My wife (nominee) is not a techie so will it be better for me to go for offline which would be helpful in case of need in my absence.

2.Fix sum assured or Increasing sum assured

3. LIC tech term or HDFC or Aegon

Thanks.

Dear Aravind,

1) Claim process is not online but offline. Hence, no need to worry. But you make sure that whom to contact if you are not here today.

2) Fix.

3) All are FINE.

Dear Sir,

Thank you very much for your prompt and fruitful reply.

Hi Basu,

I have been reading your blogs and i must say i appreciate your efforts and hardwork.

I am a 30 yr old, non smoker, working in IT in Bangalore. I earn 15L+. We are expecting a baby soon.

Please guide which plan should i use? I’m confused between HDFC C2P, Max and TATA AIA?

Will 2Cr be enough? I am keen on having my medical done – however, only TATA AIA is offering one?

If you think i should look for some other plan, pl suggest.

Again, you’re doing a great service to us all. Thank you.

Dear Shantanu,

Check with recently launched LIC’s Term Term also. For me all are the same. Go with the one where your requirement matches with respect to features. Ideally, the life insurance coverage should be around 15-20 times of your yearly income.

Hello Sir,

I and my wife are planning to choose term insurance from TATA AIA for 100 years. I am 38 & my wife is 31. Our Combined income is 30LPA.We both will have seperate term

insurance cover.I would keep her as nominee & vice versa. We both work for Tata Concern.We shortlisted “TATA AIA Sampoorna raksha Plan”.

We shortlisted 2 options

1) Option 1 (only Lumsum sum assured amount @ death)

2) Option 2 (Lumsum sum assured amount @ death + 1% of Sum Assured as monthly income for 10 years from time of death)

1) Which of the above option is better?

We plan to go for 1.5cr or 2CR (both of us each).We plan to pay for 10 yr payment only & not for complete term of policy.We don’t have option to enhance enhance sum assured once we begin.

2) What are usually the reasons why a death claim may be rejected & how can we avoid this..

Thanks

Avinash

Dear Avinash,

1) 1st Option

2) There are MILLIONS of reasons for death and there may be MILLIONS of reasons for rejection. Only one thing is in your hand is DISCLOSING THE FACTS PROPERLY.

By the way, DO YOU NEED LIFE INSURANCE UP TO 100 YEARS OF AGE? THINK TWICE.

Dear Sir – Thanks for your Reply. The way i thought is we both would definitely not survive till 100, but good chance of going beyond 80 or 85 going by our family history.. So we if pass away by 90 something at least our son/Grandsons would benefit.

Is my way of thinking wrong? Pls. let me know Sir.

If its wrong, then pls. let me know a suitable age till which it would be appropriate to get term insurance.

Thanks – Avinash

Dear Avinash,

May I know the value of today sum assured you opted to when you turn 80 years or 85 years?

Sir – I used this link, had inflation set as -7 %. For 2 CR Sum Assured, after 30 years, value is around only 23L. So after 40 years its going to be even less.

https://www.advisorkhoj.com/tools-and-calculators/future-value-inflation-calculator

Ok so as per this you recommend having may be till 60 or maximum till 70 years..

Another thing, i found a plan called Sampoorna Raksha+ with Tata AIA. Here, they give back the premium if policy holder survives.. So a plan like this with 30 to 35 years term and then monthly premium would be good i feel.

Here monthly premium is only around 5k for 30 years.. So here even though i am paying more, the value of money would be less as years pass on.

Let me know your thoughts Sir.

Dear Avinash,

Return of premium is not FREE.

Sir – I compared as per what you said. For the same term return of premium policy charges extra 12k to 15K per annum. So then you suggest to go without return on premium..

Thanks

Avinash A

Dear Avinash,

Yes.

Dear Sir – Thank you for Guiding..

Sir, One more Thing. I thought py paying premium in 10 years, we finish our commitment (And also less premium by not paying for 30 years). But i realized that value of money is less as my premium paying term increases. For eg if my premium is 1L/annum and i finish in 10 years, i pay 10 L. But instead i pay 30K for 30 years or something, then the value of 30K is less may be after 15 years or so. So what is your thought Sir.. I feel paying premium for longer terms is better..

Dear Avinash,

If you can afford limited premium option, then go ahead. For me it is always a regular premium.

Sir – By Regular premium i guess you mean monthly or yearly premium for policy term (i.e 30 or 40 or what ever term).Is my assumption correct here..

Thanks

Yes Avinash.

Thank you Sir.

Hi! Am Completing 54 years in the next two days . Have a 50 L Term plan completing at the age of 62 years . My annual income is approx. 25 L . Kindly advise the min. coverage I should have which can be comfortably paid for ? Am also planning for a Pension Plan like Jeewan Shanti – is it advisable to go in for it .

Dear Binod,

The ideal insurance for you should be total of your future income stream as of today to till retirement. Check the above mentioned plans.

Hi Basavaraj,

If i consider the tables in your post, the avg amount settled is the highest for Aegon(9.28L) and then ICICI(6.38L). Can this be a parameter to consider for taking a top up on my policy

No Benefit % Benefit% Avg Claim

Aegon 554 52 95.67% 94.58% 9.28

ICICI 11459 777 97.88% 92.03% 6.38

Edelweiss 189 11.57 95.25% 97.78% 6.28

Bharti 888 44.11 96.85% 96.29% 4.94

Tata 2850 140.25 98.00% 94.00% 4.72

Birla 5491 274.17 96.38% 90.51% 4.69

HDFC 12566 544.7 97.80% 88.63% 3.93

Max 10332 370.99 98.26% 95.26% 3.48

SBI 18885 640.78 96.76% 92.13% 3.23

Exide 3357 86.21 96.81% 89.61% 2.38

LIC 739082 11379.4 98.04% 94.45% 1.48

Dear Samrat,

To certain extent. But never depend just on CSR for buying a policy.

Sure. My intention of asking the same is that if I’m looking to buy a 1 Cr+ policy in that case should it make a difference in my choice(Aegon, ICICI) basis the average amount settled(which is in lacs) for most of these private insurers

Dear Samrat,

It hardly matters.

Dear Basavraj, thanks for the detailed article. I’m 30 yrs, married, earning 30LPA, wife earns another 10LPA, staying in Mumbai. Current term insurance cover for myself is 1cr, planning to extend it to 2cr. No health insurance(apart from the 2.5L group insurance company provided). Here are my few concerns. Request if you can address them?

1) Considering 30LPA as income, my ideal cover should be 4.5 – 6Cr. Is this the right mechanism to calculate the cover or can I look at a lesser figure considering my current expense(1L household maintenance, 50K investment, net expense 50K)

2) My spouse doesn’t have a life cover, will taking a joint term make sense or separate policy will be better? I’m not considering her tax savings 80c cos that’s done by ELSS

3) How much of a health cover is fine for me and spouse, read some articles which mention 5lac is fine, others say 10lac should be minimum? Will it be good to start with 5lac and then top it upto 10lac later?

4)Considering my expenses should I take a disability cover which can pay me after I meet with an accident? What are few policies that can help me in that?

4) Planning to take a critical illness cover for my father(60yrs), but he smokes 8-10 sticks per week, takes a quarter of whisky everyday. Can a claim be rejected for alcohol/smoke abuse – How do insurance companies define alcohol/smoke abuse?

Dear Samrat,

1) There are two ways to calculate. One is income replacement method and another is expenses replacement method up to your retirement. However, the fair number should be at least 15-20 times of your yearly income (but not less than that).

2) Better she must buy separately.

3) Around Rs.5 lakh base plan and Rs.25 lakh super top up.

4) You have to buy accidental insurance of at least equal to one year of your monthly income.

5) While buying better to mention these habits. If the insurance company still issues the policy, then no issues.

Really appreciate your quick response. Thanks a ton Basu!

Dear Samrat,

Pleasure.

Quite an informative article..Though Aegon Life has been recommended by many, the marketshare of Aegon is very low which leaves a question mark on its sustainability in India in the long term. Any inputs on this would be appreciated

Dear Deepak,

I don’t think that should be a criteria to select.

Market share indicates Sustainability..Aegon despite having a good plan and a good cs ratio has not been able to make a significant impact and its market share is falling..This would raise questions regarding its long term plans..

Dear Deepak,

How can you assure that the market share is for TERM LIFE INSURANCE? The classic example is LIC.

Dear Basu,

Good and informative article. I am working with Engineering Consultancy organisation. We occasionally visit Petrochemical Plants during commissioning (for short duration of 2-3 months). Otherwise do not operate the plants. How do we define the occupation in proposal form.

BS Khatri

Dear Khatri,

You mention to the nearest profession and at the same time, write in an email or attach a letter with proposal form about description of the nature of your job.

Hello Sir, I read your concern about Telemedicals. However, I think now it is compulsory for Insurance provider to settle claim after 3 years of policy start date by the law. Will it make any difference now?

Dear Bhavesh,

3 years Sec.45 is not GUARANTEED.

Dear Basu Sir,

Kindly advise me , for a concern while applying for job category in term application

I am working in a general engineering company in UAE as projects engineer and my company mainly have projects in offshore island in oil & gas fields. for the last three years I was on head office and not in site but in future I may need to visit the site regularly. but we are on new projects or maintenance part where close working with hazardous chemicals or plants is required. however my job is entirely different from working inside a chemical plant or refinery but we work just outside the process boundary of such areas. So should i declare yes for the question ” Is your occupation associated with any specific hazard or do you take part in activities or have hobbies that could be dangerous in any way ? (eg – occupation – Chemical factory, mines,

explosives, radiation, corrosive chemicals j – aviation other than as a fare paying passenger, diving, mountaineering, any form of racing, etc ) ”

Kindly advise. My agent saying since you are not a direct employee inside the plant, you do not need to say YES to this!

There is a correction on above … you are requested to read the below statement as “working with hazardous chemicals or plants is NOT required “

Actually I had received the policy document today and with few errors

weight actual is 73 but agent disclosed as 71 however during tele medical, i confirmed as 73 but policy document saying 71

height actual is 174 but agent disclosed as 179 and same was corrected by me while on tele medical but document still showing 179

alcohol status – agent disclosed as non-alcohol and when I noted I asked to put occasional and same was confirmed while tele medical, agent said he updated via ACR (he showed application proof)form but still the policy document showing non-alcoholic.

the policy was just issued as soft copy today and in case required, i may request to cancel it and re apply siting application error from agent. Agent created a terrible error here… worried on these !!

agent still saying the hard copies, everything will be fine !! should i trust ?

Dear Adarsh,

I think your agent and the insurance company not bothering about future results. They are just desperate to issue the policy to you. Don’t do that and better to cancel it immediately.

Dear Basu Sir,

After discussion with AGENT and Insurer, They finally agreed to change 3 points in my Insurance Bond. And advised new bond can be issued

1) my weight and height now corrected

2) Alcoholic status updated to occasional from non-alcoholic (I am a minimal drinker or party drinker only with maximum 1-2 pegs/month)

3) Work Status changed to work in hazardous environment based on my written clarification and letter regards to oil&gas fields.

Now all my wrong entries in policy document are corrected and still some 10 days balance in free look period.

The reason I select the agent is, for me the premium difference via online and agent is some 750 rupees per year which can be ignored as small belief that someone can be there to approach.

So what is your opinion to accept the same? any points i am missing in my matter

I understand now, why should I take a financial advisors service, any how… I am accessing myself from last 6-8 months for all expenses and income and conditions and I definitely approach someone !

Dear Adarsh,

Wonderful. You made them to bend and correct their mistakes. Please go ahead.

thank you sir, i am awaiting their official documents either as soft copy or hard copy. Thank you for the support

Dear Adarsh,

But in future there is a possibility to visit the site, it is advisable to mention as YES.

many thanks basu sir, Lesson learned is, Agent Just want to sell the policy. Online self application is better ! My Agent was Geojit!

Hi,

Recently i bought a online term insurance of 1 crore cover from Bharthi Axa Life (Bharti AXA Life Flexi term).

They have already issued a policy to me but there was no medical tests been done.

I have reached out to their office and they have informed me that they are not doing medical tests from certain organization employees within a certain age group.

I am 34 years old and not sure if i should continue this policy or return it within lookup period as no medical been done.

What should i do? My only concern is if they dint take medical tests, will it affect the process of claim in future?

Please suggest.

Pradeep

Dear Pradeep,

If you declared all your facts properly (including if you have any health issues), then I don’t think you have to worry.

Sir, how you have pulled the data from IRDA annual reports. Could you help me in this regard.

Dear Alok,

It is available in IRDA Annual Reports.

Sir I tried there, but unable to get the list of data you have shown here, could you mention in which section it is available in annual report.

Dear Alok,

You can search with annual reports. You will get it.

Thanks for sharing so detailed analysis and useful information. One Question, You looked at claim settlement ration only for 2017-18, Why not for longer period, eg. last 5 years or entire period since the inception? Probably we will know which company is consistent in CSR and also what is there trend. Appreciate if you can include this information as well

Dear Chanpreet,

They hardly change such drastically. Also, never rely on CSR to judge and choose this product.

I am referring to CSR as one of the parameter as you did in your above analysis. Sir you mentioned the CSR is not changed drastically. Can you pl share the data here. I am sure it will be useful for all the readers. Thanks

Dear Chanpreet,

I have written posts on CSR since 4-5 years. You can refer the same and come into the conclusion.

hello sir

Sir, I have taken ICICI Pru Life Insurance and have changed in the free looking period. .. and when the final welcome kit was received it has only changed on the first and second page. the rest is the same, then there will be some problem sir. Or I should take a fresh policy by filling in fresh proposal form or it is fine. Please guide

1) Earlier it was 40 years now it was 50 years.

2) Removed critical illness

3) First 50% lumpsum + 50% income (now only 100% lumpsum)

Dear Kishor,

I don’t think they will change these on the already issued policy. Better you discuss with the insurance company.

Then what should I do sir?

Can take fresh by canceling?

Dear Kishor,

First discuss the same the company and then take a call.

ok thanku sir

Hi, very good article and really difficult to find such good article in today’s time when lot of people are writting lot and having their opinions.

I had one question: Did having raider in term insurance is good or bad?

As you mentioned stay away from raiders, but out of top 5 term insurance listed by you 4 have raiders. Did I need to pay extra amount than premium amount if I opt for raider?

Dear Nil,

Stay away from adding riders (even though they offer for marketing sake). Yes, obviously you have to pay a certain extra premium if you opted for the rider.

i am S.Kala 52 year old want to take jeevan shanthi policy in august 2019 my husband 56 years 5 months old, daughteer 25 years 3 months old.Deferment term-8 years till iam 60 years(iwill be 60 in april 2027).sum assured-rs ten lakhs. how much premium i need to pay, what annuity i will get please enlighten me

Dear Kala,

Please check the same through LIC website or with any officials.

Your analysis is illustrative & impressive. Article is excellent guide to make an term insurance decision. Thank u very much.

Dear Syed,

Pleasure 🙂

Hi Sir, as per your Annual Premium charge, LIC is charging Rs.15850 i.e. almost double than others. Whereas, the plan features are also not great as per your next table. Not sure, why such high charges? I noticed you haven’t commented on this.

1. Other than LIC being an old hog and very less chances of going bankrupt, are there any other reasons I am not seeing here?

2. I prefer LIC but are they worth double premium with no riders and payment options too?

Thanks.

Dear Syed,

You can’t question the premium rates of Life Insurance Companies. Also, they are not bound to disclose the reasons behind high rates. Hence, it is completely their business module. However, LIC is about to launch a new term plan which is online and with more features. You can wait for a week or go ahead with private players rather than waiting.

Hmmm….that’s a fairly good answer. Thanks for the info on new policy from LIC. I’ll surely wait for it. Thanks a lot.

Dear Sir,

You mentioned earlier LIC is about to launch a new online term plan with extra features. The only policy released recently (Aug 1st week) is LIC’s Jeevan Amar which is offline.

1. Is there another policy yet to come? Can you please provide further info on this if possible.

2. Can riders be added to the current LIC’s e-Term Online Policy?

Thanks.

Dear Syed,

It is yet to launch. Refer my post “LIC’s Tech-Term (No.854) – Online Term Life Insurance Review“.

Thank you Sir, very much appreciate your services. 🙂

Your referred policy has just launched. Thank you so much for the timely update Sir.

Dear Syed,

Yes and pleasure 🙂

Basavraj sir ,

Thank you for detailed information. Where can I purchase LIC Tech Term (Table 854) I did not get link for it

Dear Sandip,

Refer THIS LINK.

thank you for your help

And I guess part of the answer to my comment is here in your Blog itself.

https://www.basunivesh.com/2015/08/25/what-if-your-insurance-company-goes-bankrupt/

Dear Vyshwanara,

Yes.

Sir ,

Thank you for your writeup sir. very educational. Now I have Couple of doubts.

When I am doing a term insurance , I am looking at a 30 year horizon.

1)WIth whatever info in public domain , Can we say all the private term insurance providers are good and sound.

2) Does the IRDA have any authority to protect us from a situation .. say like company running into trouble and getting closed.. (the perennial fear of middle class .. that makes us go for LIC knowing the high premiums and shitty returns they give ? )

3) In my case I opted for aegon , due to lower premium for my needs. I convinced myself that Aegon can offer lesser premium due to their digital only approach. (after considering MAX , ICICI, SBI ).

Hope my reasoning is correct.

4) Will aegon have any drawback? i mean most of the other providers have their partners also belonging to core insurance business. like prudential, standard life , Mitsui sumitomo etc.

But in case of aegon ( though they are MNC with insurance as Core business) their partner is Times group , who donot have a background in insurance. will it be drawback ?

5) and finally what will be the scenario say if a term insurance providing company runs into trouble ? will it be closed ? are there any safeguards presently for the existing customers…again a middle class cocern 🙂

Hope I can get my answers.. Thanks again for the writeup

Dear Vyshwanara,

1) Do you believe public sector insurers are safe? Check their balance sheet and financials. They are more horrible than private players. However, I am not defending private sector companies. I am just asking your reliability.

2) Yes, I have already written a post on this “What if your Insurance Company goes bankrupt?“.

3) We can’t predict the price difference just on this front.

4) As of now, NO.

5) I have already replied the same in 2nd point.

SIR , i like max online term plus for my insurance , but they are providing telephonic medical only , what should i do ?

my next question : is endowment cum life cover better thing to than plain term plan??

Dear Rajit,

I usually not insist for telephonic medical tests. How can endowment plan the better replacement of term plan?

Information aboutAditya birla returned of premium plan.term plan

Dear Rahul,

Why need the option of RETURN OF PREMIUM?

LIC issuing online e-term policy without doing any physical medical examination .

Dear Deepak,

Who said so?

hi

nice info . thanks . i am 44 years old self employed looking to buy a pure term 1 cr policy & I dont hold any other policy . what will be your suggestion regarding the same . thanks again ..

Dear Dees,

My suggestions are already explained in the above post.

what i meant was is LIC e term the best option for me …

Dear Dees,

If it is the best option for you, then go ahead.

Aegon iTerm Plus has a rider around Critical illness. If that rider is taken, can the tax exemption be claimed under 80D?

Dear Prashant,

Yes.

Hello Sir,

I came across your article while researching for the term insurance plans. Thank you for all the information. I have one question regarding Telemedical verification. You have advised not to go for the telemedical verification, instead go for the medical examination. But if the company like ICICI itself says that they only do telephone verification. my question is how can we avoid this? or what if they actually reject claim after this on the basis of tele-verification grounds.

Dear Neeraj,

Simply avoid such companies.

Thank you for such a nice explanation..

Two query

1)is all term insurance cover death by all means (natural from illness + Accidental)

2)# Stay away from riders,

Can you plz eloborate it,to understand

Thank you

Dear CK,

1. It depends on product feature.

2. Riders limit the features. Hence, better to buy separately.

Nice article.. thank you for info. I want know.

1. if I buy one term insurance, one critical, and one accidental insurance, will my nominee will receive payment from all insurance after death or only one insurance payment will they get.

2. Can we have multiple nomiees

3. In future ,is it possible to increase the cover and change of nominee.

4. Most importantly.. after 30 or 40 will these private insurance provider will pay sum assured

Dear Rajan,

1) Yes, your nominee will receive the claim from all.

2) Yes, but better avoid.

3) Yes. But enhancing the cover in the same policy is not possible. You have to buy a seprate one.

4) Yes.

Very informative article, and sincerely appreciate.

Sir, didn’t understand what you meant ..why not two or why not one meaning.Can I buy two more term plans what is your advice?And please let me know apart from aegon and lic which two policies should I go for.

Dear Singh,

Go ahead and buy as many as you wish 🙂 The logic is simple that just with mere spreading your Life Insurance, there is no guarantee that few accept and few not. Same way, the more spread, the more cumbersome process for your dependents to claim. Rest up to you.

Which is better option to buy plan in the following ?

Term insurance website

Or

Ploicy bazaar app?

Dear Ravi,

Respective Life Insurance Companies website.

Your article gives us detailed insights on term insurance.. and thanks for that sir. Can you please help clarify below questions of mine?

1. You are discouraging splitting of term insurance among multiple companies by saying that there is no guarantee all insurance companies accept the claim. But, in this approach, we are reducing the risk of rejections due to splitting right?

2. If I decide to split, will it have any issue during claim settlement, at the time of submitting any (original) documentations etc.,?

Dear Amar,

1) What is the guarantee?

2) There may be like submitting original death certificates and all.

Sir,

first of all many thanks for such an informative article..But, i’m confused & unable to find one correct suitable plan for me ..your help will be of great help..my age is 43 –

1..want lowest possible yearly premium upto 20k

2..cover of 10L will be ok

3..premium term 10 yrs.

4..policy term 20 yrs.

Dear Dhaval,

If your first priority is the lowest premium, then check among the above said companies premium for your age.

Hello sir ,My age is 38 and I have two term plans right now,one in aegon which is of 50 lakh bought in 2012 and one in lic which is of 50 lakh bought in 2017.Iam planning to buy 2 more term plans of 50 lakh each .Is it ok if I have 4 term plans in total and also please suggest which two policies should I buy at last.

Dear Singh,

Why not two new plans and why not ONE?

Thank you sir for such an informative article. one query, is it beneficial to take term plan with Married Women’s Protection Act (MWP Act)? Please suggest

Dear Vivek,

Better.

I’m 32 year old male non smoker . I have a iprotect basic plan for 50 lakh with icici from December 2015 . When I called customer care to increase the sum assured. They said it’s a basic plan so I can’t increase the sum assure . So please suggest me what can I do . I want to increase my sum assured to 1 Cr . Can I stop this and buy a new one from other company. And can I go with icici or any other you suggest me . And for how many years do you suggest

Dear Lloyd,

Why can’t you buy with the same insurer?

Hi Mr. Basavraj…First of all a big thank you for writing such an article. I follow many such blogs but believe me it is one of the best I have read till date.

Now coming to my question : I am 29 years old and will turn 30 in this October. I am thinking of buying ICICI iprotect smart term insurance. I am planning to take life cover of 10 times of my annual income and the term I am thinking is 30 years from now i.e. up to 60 years of age. The premium for the same is coming around to Rs.10,489. Also after going through your blog I am avoiding the critical illness and accidental death bed rider but I just want to know that which are the best individual critical illness and accidental plans that one should opt for. Thanks in advance and please keep enhancing our financial literacy.

Dear Tanmay,

Try to increase your life insurance cover for around 15-20 times of your yearly income. Regarding Critical Illness cover, refer my post “Best Critical illness policy in India – Comparison Table“. Regarding Accidental Insurance, refer my older post “Best Accidental Insurance Policy in India-How to choose them?“.

Hi Basavaraj……. Thanks for the article, it is invaluable. It cleared many of my queries at once.

Got a quick question: You mentioned not to include any riders as they will be available in general insurance. So you meant medical insurance or something else. Sorry i am new to this world of insurance and your help is highly appreciated.

Dear Siva,

Not Medical Insurance. You have to buy Medical Insurance from Non-Life Insurance companies ONLY. Here, I am pointing at Critical Illness and Accidental Insurance products.

Dear sir,

I m planning to buy a term plan from ICICI PRUDENTIAL for RS.1.5 Cr. Plz suggest the pros and cons of going online and offline to purchase the same.

Dear Vivek,

Go for online and buy it. The reason is that you can save premium and second the advisor (many times a bank or insurance company employee) may not be in same chair when the actual may come forward.

This is a wonderful informative article. Thanks for the heads up insight into the world of life insurance.

Dear Arun,

Pleasure 🙂

Hello Sir,

Thanks a lot for such a Wonderful post, I was looking such a post since long. Last year I have taken LIC online term plan. But there we do not have any rider for accidental coverage and critical illness. I feel I need to have those too for my dependants.

Do you have any suggestion what should I do, I thought to take some other term with those riders to have a fixed premium as compared to other policies?

Please suggest what policy should I take for Accidental coverage and Critical Illness.

Dear Pradipta,

Try to buy accidental and critical illness insurance separately rather than buying as riders.

Hi Basu,

I had bought a term plan from LIC for 10 Lakhs few years back. Medical tests were conducted for this and the policy is still in force. I recently purchased another term plan ICICI Prudential iProtect smart for 50 Lakhs. However, IPru issued me the policy only only on the basis of a tele-medical and did not have any medical tests conducted. Is this a risk? Will my nominees face any challenges in receiving payout in case of, God forbid, any unfortunate event? Please let me know.

Thanks

Rishi

Dear Rishi,

As the sum assured is not so high, they might have done tele medical tests. You no need to worry.

Thank you Basu!

Hi Basu, I am planning to buy Term Insurance. I am 42 years old and currently live with my family in US. I do not have any health issues. My questions:

1. Whether should i buy insurance in India or US? and why?

2. If India then my agent is proposing me Tata AIA for Rs 4 Crore. Please can you provide your opinion about the same?

Thanks, AA

Dear Ashish,

1) It depends on how you planned to continue your future stay. If you are going to settle in India, then go ahead and buy in India. Otherwise, it is better to buy in USA.

2) Why to go with AGENT? Why not ONLINE?

Thanks for the prompt reply. My follow up questions:

1. Is there any harm to take insurance here although i live in US as i am not sure whether i will come back or not.

2. Please provide your feedback about TATA AIA insurance

Thanks

Dear Ashish,

1) No harm at all.

2) My choices are explained in the above post.

Hi Basu,

Thanks for providing this valuable information in a field so few understand.

I’m 27 yrs of age and I hold iTerm plan of Aegon Life since last year and the sum assured is 2Cr. I have opted for Waiver of Premium on Critical Illness rider.

1. Do you suggest I continue with this rider or remove it? as the cost of the rider is quite minimal.

2. In the reports of the medical exam shared with me by the insurer, I see that the result for 1 particular test is missing. Should I be concerned about this? Would this is be something that can be held against me in the future?

Thanks in advance

Dear Mallu,

1) You already opted it and hence continue.

2) If you have concern about missing report, then ask them and get it.

Hello sir thanks for the good information. I have did research on six companies. LIC, max life, HDFC, ICICI, SBI, Aegon life. I am a 33 year old & having family of parents, wife, 6 month daughter. Below is the plan details

1. Aegon life: 50 Lakh for 37 year term + 20 lakh accidental death + 20 lakh disability due to accident & seakness plus premium waiver in both case = Rs 7344.

2. Max life: 50 Lakh for 37 year term + 20 lakh accidental death + 20 lakh disability due to accident + premium waiver due to 40 critical illness & disability = Rs 7801

3. HDFC : 50 Lakh for 37 year term + premium waiver in both case accident & 19 critical illness disability = Rs 8590.

4. ICICI: 50 Lakh for 37 year term + premium waiver in case of accidental disability = Rs 6738

5. SBI: 50 Lakh for 37 year term = Rs 8500.

6. LIC : 50 Lakh for 35 year term = Rs 11670

Right now I have LIC term plan of 50lakh 30 year term & paying almost RS. 16000. So thinking to revisit my term insurance. I want to take a cover for 1cr & wanted to split in two companies with 50lakh cover. From above options ageaon life & max life’s looks like best option, which covers most of the points in less premium compared to other. But at the same time we have to anticipate companies credibility against claim till the term period. As Aegon life is having presence from last 10 year & max life also near about 15 year. So I am in a confusion how to select out of these options. Please share your guidance.

Dear JS,

There is no point in diversifying the Term Life Insurance. If you are comfortable and affordable LIC plan, then please go ahead with LIC. However, between Max and Aegon, both are fine for me.

Thanks for the reply. I am thinking to stop term plan of LIC as it cost me 16000 for 50 lac instead of that I am planing to buy two new each of 50lac. I have three option HDFC, Max life, Aeagon life. But in a confusion which one need to select.

I will get 1 cr cover in same price as I am paying for 50lac in LIC

Dear JS,

Cancel the one when you get the new in your hand. Better not to split the term life cover. Go with one company.

how is edelweiss tokio term insurance.

Dear Piyush,

I usually not trust the new entrant.

Dear Sir,

Thank you for the elaborate explanation of term insurance plans.

I am 26 years old, unmarried, non smoker and no dependent so far. I will be joining a 13 L/annum job this month. I was planning to get a term insurance plan for 35 years (until my retirement) for a sum assured of 1 crore.

Does this plan seem feasible to you?

My major concern was about the review of policy after every 5 years. How do you suggest I go about it? Should I buy a new policy for a higher premium to cover higher sum assured or is there a provision to customise my existing term plan.

Could you please share your views on increasing term insurance plan too?

Thanks Sir!

Dear Abhimanyu,

“Does this plan seem feasible to you?”-YES. When the time comes to enhance your sum assured, you have to buy a new policy. It is not possible to enhance the cover within the same plan.

Dear Basu,

It is an amazing article on Term insurance. Thanks for that.

> When the time comes to enhance your sum

> assured, you have to buy a new policy. It is not

> possible to enhance the cover within the

> same plan.

I see Aegon, HDFC and others give an option to increase the cover on life events like marriage, 1st kid and 2nd kid. Is that not the same as enhancing the cover?

Dear Sudhakar,

It is a selling gimmick to retain the clients (which few offers you). But I suggest you to enhance separate where you have to undergo all routine procedure.

Dear Basu ji , first off all i’d like to thank you for your helpful information regarding term policy . My query is , my wife is not at all good in handling emails or online transactions. Now if i buy a policy online and in the case of my absence will she be able to get the claim without any hassle ? as u understand that i’ll not be there to help them .pls help me .

Dear Sabyasachi,

Claim process will not be ONLINE. In many cases, you have to process it offline. Hence, you no need to worry in that aspect. Also, if you buy it online, then it does not mean that the claim process MUST be ONLINE.

Dear sir

now my age is 50, can i buy term plan at this age,

online or offline which is best pls suggest

thanks

Dear Deepak,

If someone financially dependent on YOU, then you must buy. The term of the policy should be up to your retirement. Better to go for ONLINE.

Sir ..i m 30 years old..want to take 1 cr term insurance..which term insurance is best r me

Dear Manikant,

I already listed my choices in the above post.

Hi Basu,

Your blog is very useful. Thanks for sharing this information for quick awareness on term insurance plan.

I work in an industry where I get onsite assignment to work in foreign country. Does ICICI Pru cover mis-happening under term insurance plan if someone lives in other country (For Ex. USA) for longer period (1 to 2 years in single stay)?

Thanks!!

Dear kdivanshu,

Many insurers offers this option. However, better you confirm with them.

Hi,

Your blogs have been very useful.. considering that I have a question — What is your opinion on Single Premium term insurance vs. Annual? Are there any such Single Premium term policies available? Do you have a comparison?

Thank you!

Vikram

Dear Vikram,

Single premium or limited premium term life insurance plans are suitable to those who have limited years of high income. However, considering the cost of premiums, I don’t think it is such high cost for an individual. Hence, I prefer the annual premium. I don’t think anyone offers single premium term life insurance. But you can prefer a limited period term life insurance.

Hi sir,

Thank you for your valuable information.

Actually my friend wants to buy it she is 23years old and her income is 2-3 Lakhs per annum.

Which insurance we should go with please suggest. I am planning to go with aegon life insurance. Is it correct choice???

Also she wants invest around 10k to 12k per month with low risk.so please suggest some investment plan.(3yrs of locking period can be fine for her)

Please help and thank you.

Dear Vikas,

Regarding the term life insurance, I already mentioned my choices in the above post. Please refer the same. Regarding the investment, if her holding period is just 3 years, then better to use the Bank FDs rather than any fancy products.

Thank you for the wonderful explanation. I intend to buy buy a term plan for 5 crores based on my current annual income. Also I want a cover Till the age of at least 85 years.

1) which planet would be best for me ( considering above conditions and hassle free and quick claim settlement) ?

2) Can I change the nominee in future?

3) do insurance companies provide discount for early premium payment for future periods?

Dear Jignesh,

Do you need Life Insurance up to 85 years of your age?

1) They are already explained in the above post.

2) Yes.

3) Some may be. But I don’t think it is useful.

I have applied for max term insurance. After month long process of various verifications and health check-up they rejected my claim saying that my income is low. How can they reject my application on this base while they know my salary feom first day. What should I do?

Dear M,

By mere entering your salary on the first day itself does not mean the company underwriter will come to know immediately. Once underwriter get all the information, then finally they take a call. You can’t question their decision. It is up to you to accept or reject the proposal based on their risk strategies.

One thing they also mentioned that the pincode area not covered while their max employees visited my permanent address for address verification so how they can say pincode is not covered?

Even underwriter did not know the salary from fist day but they says all medicals are ok but based on salary we cannot offer cover so then how they can claim to offer such high cover on their website while mentioning low salary. On website they calims to offer cover up to 25times of salary but in the end they just want to offer cover of about 10times of salary. I think they should mention on website what they can actually provide.

Earlier I applied for ageon term insurance for 1 crore cover and after doing all the procedure and mentioning their is not any medical problem but they can only offer cover of 30lakh on salary bases .

Sir are you think this is right practice?

Dear M,

Regarding the coverage, it is upto them to decide. Regarding the underwriting rules, it purely depends on the company. They have all rights to raise the premium or cancel your proposal after they receive all the information about you.

Dear Sir,

First of all I want to take this opportunity to thank you for this vital information.

Sir, I am an Banker employed with SBI. I am 32 and have decided to take Term plane of ICIC Prud, with Limited Premium option up to 60 yrs and covewr up to the age of 85 yrs. The Policy Bazzar Execative are ringing me again and again as I have searched for plan online.

I wish to ask you few questions:

a) is my plan choice is correct ?

b) is there any extra premium if I am buying through police Bazzar.com.

c) The Premium is coming around 255000/- per yr up to 60 yrs. is this nominal in comparison to other peers ?

Regards

Kmalender Singh

Himachal Pradesh

Dear Kamlendar,

Never buy a product based on online aggregators suggestions. Take your own call while buying.

a) Now regarding is my plan choice is right or wrong, do you need life insurance up to 85 years of age?

b) NO.

c) Hard to say without knowing your personal details and again this may not remain same as it again may get increased due to health and other issues.

Thanks for the wonderful information on term plan.

I have purchase term plan from max life. Please let me know if the premium of same fall under 80cc and can show for tax saving purpose.

Thanks

Dear Vinod,

YES.

Dear Basu ji,

After reading your well researched article, I stand informed about top 5 insurance companies, but my doubt still remains “which one to choose?”

Considering Article 45, the only criteria to choose the company should be the cost of plan, but I understand that is not the case. I have apprehensions that there should be some terms and conditions specific to the company which must be read to decide. Kindly guide!!

Similarly, Is there any difference in terms and conditions of different companies for the similar products… (for eg: one LI company pays the sum assured when insured meets the accident either overspeeding or driving under the influence of substance while other company may reject the claim…pls correct me if otherwise) This is against the back ground that term plan covers suicide too!!!!

Regards

Amit Bansal

Dear Amit,

The only thing that is in your hand is to declare the facts properly. Regarding terms and conditions, it is you who has to read properly before buying the plan. However, I don’t think there are major exceptions which a particular insurance company follows to indirectly deny the claim in the future.

Regarding certain clauses like suicide, as per my knowledge, all insurance companies follow the same set of rules.

Sir, can you review this plan “Reiliance Nippon Life Fixed Money Back” , their employee told me that this plan gives guaranteed 12 % return plus cash back on subsequent year premium plus principal amount, Is it possible 12% as no bank is giving this much return?

Dear Udit,

Whether the 12% GUARANTEED return is mentioned in the policy document? Please cross check.

Hello sir,

Thanks for such detail info for buying term plans,

My current age is 29, I’m planning to buy Aegon term 1cr, but unfortunately and accordingly to there policy, I’m not eligible for 1cr, I can buy the only 50L, due to my education.

I saw a couple of reviews are little negative,

(ex: Aegon customer service, and pre-medical checkup wave due to age.)

I discussed on the call with Aegon customer care, they are asking me that medical is not required for me. But I’m forcing them to do my medical checkup.

(is that okay? can I force them to do medical checkup?)

Seriously I’m extremely confused that what should I do,

icici is very costly for me, please suggest.

Thanks 🙂

Dear Dhruv,

It is better to go with a medical examination. If the insurance company not following it, then simply choose another.

Okyy,

sir I saw irdai annual report, aegon’s CSR is very good compare to others,

ICICi is bigger then aegon then why ICICi CSR is not good? I saw that too much claims are pending from 1yr.

Is there any way to search and understand why that much claims are pending?

Sir I’m asking this because I can’t afford wrong term insurance due to my financial situation.

Dear Dhruv,

I can understand your concern. But sadly we have this much data to analyze.

Dear Basavraj,

First of all thanks for such insightful details for buying term plan. You not only done number crunching but also provided great amount of details for buying term plans.

It would be great help if you give your insights in following queries regarding term plans

1. There are plans available which provide SA on death and Monthly Income thereafter to nominee. Should these kinds of plan to go for or to go for only pure term plans? For Example Tata AIA, HDFC Life (as far as I know) provide such plan in which SA of 1 Cr. plus 1 L per month for next 10 years takes total cover to 2.20 Cr.

2. Should we keep Pay Terms 10/15 years or till 60 years as at younger age we have more financial flexibility and not to worry at later in 50s and 60s. My current age is of 29

3. Can someone planning to settle abroad later, purchase term plan currently and pay regular premium and can get claim settled if died at foreign land?

Thanks in advance!!!

Dear Niraj,

1) Go for simple one.

2) You can proceed as per your comfort.

3) It depends on the Product clause, which you have to discuss with the concerned Life Insurance company.

Hello Sir,

Thank you so much for this information. I really appreciate you.

I am 27 Male and planning for Term Insurance. I am really confused to choose one among your last 5 companies. Could you please help me out ?

Dear Pushkar,

You can choose any of your choice among those top 5.

Thank you for saving us from thousands of misleading phone call.?? Now my query – do u advice to do entire payment in 5 yrs/10 yrs and can save 9 lakhs or u suggest to pay annually till Polocy last.

Second – Hdfc life option covers till 85 and 3D life covered till 75 yrs but with 34 illness rider . Which one u suggest life or 3D life since cover period differs with same premium and will U suggest to pay in 5 or -10 yrs to save money ??? Please suggest

Dear Dhiren,

Pay annually. The term of life insurance should end with the end of your working age.

Hi Sir,

I have taken 1cr term insurance from aegon and given full details while filling in the application. They have waived medical tests saying all parameters look good and no need of tests. It is been more than a year that policy is in force. Will it be a problem since they have not done the medicals?

Dear Sagar,

Not an issue.

Sir,After ur post i enquired for aegon but they do not provide service to some pincodes that is horrible.on the other side though max bupa(7500 with WoP CI rider) is cheaper than others only HDFC 3d plus(8900) provides inbuilt WoP for CI and accident rider.Should i really bother about claim settlement ratio?Need ur advice.

Dear Maunish,

Not at all.

Thank you sir…

Hi,

I just want to know why the education is important to take the term plan either for individual or wife?

Dear Rahul,

Not at all. I am being an undergraduate (at the time of buying), have enough coverage. No insurer (at least to whom I purchased) asked me about education as the major criteria for Life Insurance.

Hi Sorry to say but you are wrong. Undergraduate is also a criteria. Becuase of which i cannot take policy of many companies. Only HDFC, PNB and some companies provide policy to undergrad. Well one more thing might be the agent/user provide false info but that is a risk.

Dear Bilal,

You are completely wrong. I purchased Rs.2 Cr policy from two different companies (which are different from HDFC and PNB), two years back (when I was undergraduate at that time) 🙂

Hi Sir,

This is regarding nominee for the Term Insurance Policy.

As I am not married, I will nominate my father or mother to the policy.

However, when i get married after few years, is if possible to replace my wife as nominee?

Dear Veer,

Yes, you can change the nominee as many times as you wish.

Hi Basu,

I have a query. what’ll happen to the term insurance policy f a holder if the insurance company closes?

Dear Chhering,

Refer my post “What if your Insurance Company goes bankrupt?“.

Dear sir,

I am a central govt.employee (Age:36 yrs). I want to have life insurance. so after some homework, I am planning insurance of Rs. 50 lakhs each from LIC-eterm, PLI-Suraksah & Max Life Online Term Plan Plus OR ICICI Pru iProtect Smart for total insurance of 1.5 Cr. so that risk & the premium amount is spread between Govt.players & private.

Am I on right decison? or i need to change. Plz suggest.

Dear Pradeep,

Why this SPREAD?

Sir, I wish to have at least one policy from government backed player and one from a private player for peace of mind and to reduce premium.LIC eterm would cost me Rs. 54118 for 30 yrs for SA1.5 Cr. where as if i spread the risk, balance amount of around 15 thousand can be invested in other instruments.

Also suggest about PLI suraksha.

Dear Pradeep,

How can you GUARANTEE that LIC will not reject your claim?

No guarantee but peace of mind to me & family.

Sir, Also suggest about PLI suraksha.

very useful and original article

Dear sir,

I have recently discovered your blogs/site and I must thank you for the wonderfully informative posts that you write.

I have a term insurance – LIC New Bima Kiran 150 – which I bought (without researching on somebody’s recommendation) in 2005. Annual premium of Rs 5608 to be paid for 25 years with SA Rs 5,00,000.

Comparing this to the options recommended by you, it looks like I have made a big mistake.

1) 5 Lakh of SA is quite meaningless

2) Almost the same premium is giving a SA of 1 Cr in your recommeded list.

Considering I have paid LIC premiums for 13 years already and my age is 43 years, I request you to please recommend whether I should

a) stop paying LIC premiums and buy a new policy from your list?

b) continue with LIC policy and buy a new policy from your list too?

Many thanks,

Dear NY,

LIC’s New Bima Kiran is not a term plan but a typical endowment plan. Hence, better to close and go for term life insurance.

Hii sir,

I want to purchase term plan. I am in service and was on sabattical for 4 months. So my annual income in current year is lesser as compared to previous and future years (I hope).

Buying term plan on the basis of last year ITR would not lead to suppression of facts to the company??

I had disc prolapse 9 months back, would it have any affect in my eligibility?

Please guidr

Dear Swati,

It will not be considered as SUPPRESSION of facts. Take, for example, you are leaving job the next day and you purchased the Term Life Insurance by filling the CURRENT data, then it is not considered as suppression. The current information you declared properly and that none can question it.

Regarding your past ailment, it is up to the insurance company to decide.

LIC e-term costs nearly 50% higher than private insurers. Is it due to Brand LIC or due to inefficiency being Government organisation or high administration expenses and high agent commissions?

Dear Ritesh,

It is hard to say why they are costly. For us, only two choices. One to accept or to move to other insurance companies.

Dear Basu,

Can you please give comment on limited pay option on premium by ICICI I protect. I can pay for 7 years and it covers till my age 85. Please let me the advantages and disadvantages. And also comment any others offering same as limited pay option of upto 7 years.

Dear Makesh,

Limit premium payment option best suitable to those who have a limited period of income. Other than that, there is no such great advantage.

Dear sir,

Thank you for updating the post.

Based on my study and your helpful post, I have choose ICICI i protect smart and Max online term plan plus. Though it is not advisable as per you suggestion, (what I understand based on above data, that small policies has less chance of rejection), I want two policies 30 lakh from each. For age up to 75 (my current age 42 years). (Please check and correct if any suggestion)

I want you to share your vast knowledge for Insurance. While taking policy, most people have fear that my claim will be accepted or not. Please release a post regarding points to be taken care while purchasing new policy. (You have already mentioned few points in above post. I want it to be in more detail.) My idea is that people should be aware of reasons for rejection of any policy. For example, if a person has accidental rider and his death is due to accident but he is drunk. (Though he might have declared that he is alcoholic). That is OK.

But few points we ignore. For example

(1) (like in our Rajkot) – Nobody wants to wear helmet. Can it be a reason for claim rejection ?

(2) If any person has no licence / expired licence and his death is due to accident while driving. Can it be a reason for claim rejection ?

(3) And few such point….. not to be so lengthy.

Please guide

Dear Paresh,

Is there any guarantee that small policy means less chance of rejection? It is all in our mind and there is no logic in that. By splitting your insurance, you are giving more work to your dependent.

1) I think it may not be intentional. Hence, claim may be accepted.

2) NO.

3) There are millions of reasons for one’s death. Same way millions of reasons for rejection. Hence, it is hard for me to sum up.

The only thing that in your hand is that to disclose the facts properly.

Thank you sir, for your point wise reply.

Sorry, but I am not able to find any click point on upper right corner for subscription of your website. Could you please help with some more detail.

Dear Paresh,

If you are reading the blog from mobile, then you will find after the end of the post. If you are reading from desktop, then it is at right side. Let me know if you still unable to find.

I received calls from ageon marketing team after i checked quotes on their website their representative says that they provide cover of death due to natural calamities under term insurance but when i checked brochure and website their they mentioned that it is not covered when i pointed out that to representative she says she also come to know that now. Same from max. So do not believe marketing representative check out facts yourself.

Basu sir, can you povide the names of term insurances which also cover terror attack and natural calamities

Dear Man,

Thanks for sharing your experience. This may be helpful for those who BLINDLY buy based on the oral confirmations of sales guys. Surely I try to provide the names of insurance products which covers the terror attack or natural calamities.

Is premium for separate critical illness policy changes with age??

Dear Man,

NO.

Good Evening Sir,

Which is the best cashless mediclaim, individual or family floater ? Also kindly advise the best company.

Dear Sanjay,

It is hard to say without knowing your actual requirement.

Good morning Sir,

In that case kindly advise the 5 best medical health insurance policy. i shall select accordingly as per my requirements.

Dear Sanjay,

Wait for my blog post.

Hello Sir, can you please let us know when we can expect blog to choose best health insurance policies ?

Dear Rohit,

Soon 🙂

Could you pls advise which is one better MAX BUPA or ROYAL Sunderam family floater in respect of CSR ?

Dear Sanjay,

Both are equally good and bad.

Hello Basu,

Wats the difference between maximum term and maximum maturity age?

Dear Vineeth,

Good question. Assume your age is 40 Yrs. The maximum term of the policy is 40 Yrs but the maximum maturity age is 75 Yrs. In this case, you are allowed to take the term of the policy up to 75 years of age only. Hence, even though the maximum term available is 40 years, you are allowed to take the term of the policy as 35 years only. Because the maximum maturity age is restricted to 75 years of your age.

Hi Basu, great research there ! I am thinking of a term plan and narrowed down to Aegon and Max life, going as per your criteria of CSR, Time in Insurance market, Average claim settlement amount etc which one would you suggest ? I am also concerned about very low ratings for others on Mouthshut but good rating for Aegon (Are they paid??)? Waiting for an early reply. Thanks!

Dear kuldeep,

For me, both are fine. Regarding other portals, I can’t say on what basis they rate.

Dear Kuldeep, according to my experience, aegon’s customer service is horrible. I don’t know whether others are any better . But aegon’s customer service is really bad. I am going to wind up their term policy and plan to take maxlife for me and my wife.

Dear Ravi,

Thanks for sharing your personal experience.

Sir, most useful article I ever read on term insurance. Thank you. Will you please comment, which is better. A joint term policy for husband and wife or separate term policies for both of them?

Dear Ravikumar,

Please refer my post “Joint Life Term Insurance Policies-Who can buy?“.

Sir, thank you for your please let me know, after medical is done, and policy is successfully issued, can any company refuse term insurance claims, after three years, saying ‘Facts not disclosed’ Also, if initial medical of company did not find any adverse reason and issues a policy but if the insured goes for additional investigation and finds some issue, should he declare it even though claim is not done for that treatment? Can insurere refuse claims for latter investigation and treatment, if required?

Dear Sanjay,

If facts are intentionally hidden by the policyholder, then YES they can reject the claim. If health issue was not present at the time of policy issuing date, then it is not considered as you hide that information.

Hello Sir,

Blog is very useful to understand choosing of Term Insurance.

Can you please also suggest if Term Insurance is also eligible for Tax exemption and in which section. I am interested if it beyond of 80C(1.5 Lakh).

Dear Girish,

You can claim the deduction under Sec.80C (The limit is Rs.1.5 lakh).

Hi Basu, thanks for this detailed and informative article. My question is regarding minimum age criteria. What is the logic, as per you, for making a kid of 5 or 10 years of age eligible for term insurance. I mean money-back policies maybe better for them, if not then in what scenarios will these term plans are better?

Dear Kris,

They set minimum age to garner more business. However, Life Insurance is not required if NO one is dependent on him or her (whether the kid is 18 Years or 80 Years).

Hi,

Can you confirm all the top 5 mentioned companies provide insurance to NRIs or not.

Dear Jatin,

That you have to check with respective Life Insurer.

Nice article,very useful

Thanks

Hi Sir!

Kindly suggest me best plan for critical Illness for 25 Lacs with maximum term.

Dear Zubin,

Refer my post “Best Critical illness policy in India – Comparison Table“.