In this article, I will share my Top 10 Best SIP Mutual Funds to invest in India in 2019. Yearly I will publish my Top 10 Best SIP Mutual Funds to invest in India. Continuing that trend, I will publish the list for 2019.

Two major things happened to the Mutual Fund industry during the 2018 years.

# SEBI Recategorization-SEBI came up with new set of categorization. This was a huge shock to the Mutual Fund Industry. Because many funds are forced to merge with similar funds offered in the AMC. Also, this gave the investors about the clarity on the fund types. (Refer my post “SEBI Mutual Fund Categorization and Rationalization – How it helps investors? “). However, due to this big change, Large Cap may suffer to beat the index.

# TRI (Total Return Index)- When you invest in stocks, there are two types of benefits. One is price appreciation in the stock and another is dividend income. Earlier the mutual fund companies use to benchmark the indexes which are not inclusive of dividend income. With new SEBI ruling now all mutual fund companies are forced to benchmark the respective TRI Index for their funds.

These two big moves made me also to wait for few more months. Earlier I used to publish my Top 10 funds list in the month of November or December.

Now let us move on and try to find the basics of investing. Request you all readers to read this at first and then jump into the fund selection process.

Why I have to invest?

Before a BLIND investment, it is always best that you must know the reason for your investment. Hence, before jumping into investment read what I am sharing below.

You must have a proper Financial Goal

I noticed that many of investors simply invest in mutual funds just they have some surplus money. The second reason may be someone guided that mutual funds are best in long run compared to Bank FDs, PPF, RDs, or even LIC endowment product.

If you have clarity like why you are investing, when you need money and how much you need money at that time, then you will get the better clarity in selecting the product. Hence, first identify your financial goals.

You must know the current cost of that particular goal. Along with that, you must also know the inflation rate associated with that particular goal. Remember that each financial goal to have it’s own inflation rate. For example, education or marriage cost of your kid’s is different inflation that the inflation rate of household expenses.

By identifying the current cost, time horizon and inflation rate of that particular goal, you can easily find out the future cost of that goal. This future cost of the goal is your target amount.

I have written a separate post on how to set your financial goals. Read the same at “Financial Goals – How to set before jumping into investing?”

Asset Allocation is MUST

Next step is to identify the asset allocation. Whether it is short-term goal or long-term goal, the proper asset allocation between debt and equity is a must. I personally prefer the below asset allocation. Remember that it may differ from individual to individual. However, the basic idea of asset allocation is to protect your money and smoothly sail to reach the financial goals.

If the goal is below 5 years-Don’t touch equity product. Use the debt products of your choice like FDs, RDs or Debt Funds.

If the goal is 5 years to 10 years-Allocate debt:equity in the ratio of 40:60.

If the goal is more than 10 years-Allocate debt:equity in the ratio of 30:70.

While choosing debt product, make sure that the maturity period of the product must match your financial goals. For example, PPF is best debt product. However, it must match your financial goals. If the PPF maturity period is 13 years and your goal is 10 years, then you will fall short of meeting your financial goals.

Return Expectation

Next and the biggest step is the return expectation from each asset class. For equity, you can expect around 10% to 12% return. For debt, you can expect around 7% return expectation.

When your expectations are defined, then there is less probability of deviating or taking knee-jerk reactions to the volatility.

Portfolio Return Expectation

Once you understand how much is your return expectation from each asset class, then the next step is to identify the return expectation from the portfolio.

Let us say you defined the asset allocation of debt:equity as 30:70. Return expectation from debt is 7% and equity is 10%, then the overall portfolio return expectation is as below.

(70% x 10%) + (30% x 7%)=9.1%.

How much to invest?

Once the goals are defined with target amount, asset allocations is done, return expectation from each asset class is defined, then the final step is to identify the amount to invest each month.

There are two ways to do. One is constant monthly SIP throughout the goal period. Second is increasing some fixed % each year up to the goal period. Decide which suits best to you.

Hope the above information will give you clarity before jumping into equity mutual fund products.

How many mutual funds are enough?

How many mutual funds do we have? Is it 1, 3, 5 or more than 5? The answer is simple…you don’t need more than 3-4 funds for investing in mutual funds. Whether your investment is Rs.1,000 a month or Rs.1 lakh a month. With the maximum of 3-4 funds, you can easily create a diversified equity portfolio.

Having more fund does not give you enough diversification. Instead, in many cases, it may create you portfolio overlapping and leads to underperformance.

Now let us move to the selection of mutual funds.

Taxation of Equity Mutual Funds for 2019-20

Remember that Equity Funds and Debt funds are taxed differently. Hence, you must understand the taxation part as well before jumping into investment. I tried to explain the same in below image.

The rate of taxation is as below for the current FY.

Below is the DDT Rates applicable to Mutual Funds after the Budget 2019.

Hope taxation part is clear to all of you. If you still have doubt, then refer my latest post “Mutual Fund Taxation FY 2019-20“.

How I selected Top 10 Best SIP Mutual Funds to invest in India in 2019?

I will first screen the top 15 funds in each category based on their returns to benchmark since inception. The funds who consistently beaten the benchmark are listed in that 15. Once I have the list in my hand, then I select the funds based on Risk-Return Analyzer.

Many simply select the funds based on eye-catching returns. However, at what cost the fund is giving you a better return? To what extent it protects my investment during a downturn is what differentiate from good fund to bad fund.

Again, I am not saying that these 10 funds alone be considered as “Top 10 Best SIP Mutual Funds to invest in India in 2019”. There may be fewer other funds, which are good to compete with these funds. However, I may be biased towards few Mutual Fund Companies (purely on their size and how long they are in MF business in India). Below are the metrics I used to arrive at finally selecting the funds.

If the fund cleared all these tests and given me around a minimum of 80% score since inception, will be added to my list.

- Beta-Volatility measure and tell how much the fund changes for a given change in the Index. Lower the beta, lower the volatility. Hence, your fund must have lower beta.

- Standard deviation-It tells us how for a given set of returns, how much do fund returns deviate from the average. Lower the standard deviation, lower the volatility. Hence, your fund must have lower beta.

- Alpha-It is the risk-adjusted measure. By taking risks, how much the fund manager generated the return over the benchmark. Higher the alpha, higher the outperformance of the fund.

- Sharpe Ratio-It is the risk-adjusted measure. Higher the Sharpe ratio, better is the performance.

- Sortino Ratio-It is the risk-adjusted measure. Higher the Sortino ratio, better is the performance.

- Treynor Ratio-It is also be known as reward ratio. Higher the Treynor ratio, better is the performance.

- Information Ratio-This is calculated by average excess return obtained compared to a benchmark and divides it by the standard deviation of excess returns. Higher the information ratio, higher the consistency in beating the benchmark.

- Omega Ratio- It is a risk-return performance measure of an investment asset.

- Downside deviation-This is also be called as BAD RISK.

- Upside potential-This is exactly the opposite of Downside deviation.

- R-squared- It is a measure of how correlated the fund’s NAV movement is with its index.

- SIP Returns-For how many times the fund’s returns are above the index when we invest in SIP.

- Lump Sum Returns-For how many times the fund’s returns are above the index when we invest in a lump sum.

Below are my selection in each category of funds.

Best SIP Mutual Funds to invest in India in 2019 -Large Cap

The biggest change in this category is that due to recent SEBI Recategorization and after referring to the various studies (One done my Mr.Pattu “Only Five Large Cap funds have comfortably beat Nifty 100 “), I am not selecting any active Large Cap Funds. I am sticking to Index Fund.

The advantage is that you no need to chase the BEST Fund Manager or Best Fund also. Because for such funds they replicate the Index. Also, the expense ratio is low compared to active funds.

The only disadvantage (few may point out) is that no downside protection. However, with proper asset allocation and including the hyrbid funds we can easily negate this.

Hence, in Large Cap space , I am recommending two Index Funds.

Here, you noticed that I have included on Nifty and another Sensex Fund. Keep one thing in mind that, there is no such huge difference when it comes to Nifty or Sensex Returns. Hence, you can choose anyone from the above. said funds.

What the existing investors must do with their active large cap funds? The answer is please continue for time being. But keep an eye on their respective funds with the benchmark. Slowly move to Index Funds in Large Cap Category.

Best SIP Mutual Funds to invest in India in 2019 -Multi-Cap

Here also, due to the SEBI Recategorization, I am changing my stance and completely moving to new funds rather than retaining my old funds. However, those who invested in my earlier recommended funds may continue as usual (but by keeping an eye).

The below funds may not be STAR rated funds. However, they are the consistent performers.

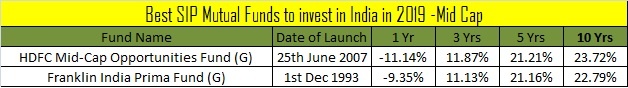

Best SIP Mutual Funds to invest in India in 2019 -Mid Cap

Last year I recommended

Best SIP Mutual Funds to invest in India in 2019 -Small Cap

In this category also, earlier I have recommended DSPBR Small Cap Fund and also Franklin India Smaller Companies Fund. I am retaining the same funds for this year too.

Best SIP Mutual Funds to invest in India in 2019 -Equity Oriented Balanced Funds or Agressive Hybrid Fund

Here, I am retaining earlier fund of HDFC (HDFC Hybrid Equity Oriented Fund) and recommending the new fund rather than the earlier ICICI Balanced Fund to Franklin India Equity Hybrid Fund.

The final list of Top 10 Best SIP Mutual Funds to invest in India in 2019 is as below.

Conclusion:-You might have surprised that I did not change my funds this year also. Yes, because equity investment does not mean changing fund frequently. However, keeping an eye on fund performance is also a must. The fund I selected are old funds and consistently performed in all market cycles.

You may see some other funds which performed well above these funds. But do remember that during a market uptrend, even the worst fund will generate you BEST returns. The real test of the fund will come into picture when the market starts to fall i.e downside protection.

If the benchmark fell to 20% and your fund has fallen 10 15%, then this is the best fund to me. Because it protected from fall. Hence, always look for consistency and other parameters rather than chasing returns.

Also, before jumping into investment try to refer my GYAAN given about investment. Because I found that many of the blog readers have no clue of why they investing and for how long they have to invest.

Refer my latest posts related to Mutual Funds:-

Hi Basu Sir,

I’m switching from ELSS to other funds as now i’m not come under Tax Slab.

ELSS Funds:

1. DSP

2. TATA Tax saver Fund

3. Nippon Retirement Fund

my fund adviser suggested the following fund companies.

1. Invesco Mutual Fund- Mid Cap-2000/-

2. Sundaram Mutual Fund-Multicap-3000/-

3. Tata Mutual Fund.- Large Cap-3000/-

please let me know your opinion on these fund companies or should i look for other funds.

Thank You.

Dear Rajesh,

Without knowing your goal details, it is hard for me to guide.

Hi Basu sir…we all are waiting for your blog for 2020 SIP funds for both Debt and Equity funds….kindly publish the same.

Dear Sat,

As I said, I am clearing pending posts related to Budget 2020. Also, as I said, I will publish the post before this month end.

sir, where can I find the link to your 2020 sip funds blog?

Dear Pravesh,

Refer it at “Top 10 Best SIP Mutual Funds to invest in India in 2020“.

Hi Basu sir,

Very good afternoon. I have done a mistake by investing in one of the wrong funds based on guidance of the friend and need your suggestion now. Along with large and mid cap I have invested in 2 small cap funds as SIP. SBI small cap and L and T emerging fund. SBI small cap is going good but L and T is always in negative from more than a year. I am not sure whether I should continue investing in this fund or stop and invest the money of this fund in another small cap. Kindly suggest so that I can correct it.

Dear Sat,

I personally avoid small cap funds.

Thank you Basu sir.

Thanks you Basu sir…

Hello Mr Basu,

I really appreciate your post regarding finical aspects, let so straight and clear. For normal people like me it really helps to understand few aspects before investing.

I have few query and need your suggestion / opinion .

1. ICICI Prudential Bluechip Fund – Growth – I have SIP of 4k from last 2 years and further added SIP of another 4k. Should I continue my SIP which is 2years old or switch to another fund. I see many other Bluechip fund performing well.

2. HDFC Mid-Cap Opportunities Fund – Growth – I have SIP of 7k from last 2 years, should I continue here too?

Sure I want to switch from Growth to regular one, initial did via banking agent without knowing difference between growth and regular.

My goal is simple to have corpus in 10 to 12 years and wish to increase my SIP per month to 30k.

Thanks in advance and please keep posting.

Dear Saumil,

1) Better to switch to Index Fund (as suggested above).

2) Continue.

Hi Basu sir I am sincere follower of your blogs and have segregated my folio accordingly. I have one small confusion in selecting one of the index funds which you had suggested. Which one would be better as of now in 2020 HDFC Index sensex fund or UTI Nifty Index fund ? I can invest only in one. Kindly suggest please.

Dear Sat,

I am still recommending the same and you can choose anyone between these two.

Hi Basu sir, Hopefully this year also you share such list of MFs which are good to invest in 2020 both in Equity and Debt it would be helpful

Dear Sat,

Obviously I will publish soon.

Hi Basu…it’s already February 7 and still no recommendation on mutual funds!!!surprising…. Seems like you are busy in other stuffs…plz post your recommendations,as we always wait for it and this time it’s very late

Dear Rajesh,

As I told you, I stuck with my planning tasks of my clients. I will write a post within this month.

I really appreciate your blogs sir…just eagerly wait for your fund recommendation always… Started to invest and planning my goals properly after reading your blogs..They are really easy to understandable to a common man like me…plz keep spreading the knowledge like always.thanks.

Dr Rajesh Gairi

Dear Dr.Rajesh,

As I promised to all, I will write a post before February.

I am regularly following your blog from last 4 years.

I am too waiting your MF list and also ELSS for 2020.

Dear Pranav,

Surely I will soon.

Dear Basu,

I have seen AXIS mutual funds have performed very well in last 3 years for example AXIS Blue Chip fund returns are much above the index. Do you suggest them or stick with Index funds? Also most of the small caps are negative for example Franklin India Smaller companies but AXIS Small cap seems to be doing well. Any suggestions?

Thanks

Chaitanya

Dear Chaitanya,

I stick to Index Funds.

Dear Basu,

Global event in Iran has impacted the stock market, Should we consider these are normal ups and downs and not do anything ? My understanding is no action but confirming

Thanks

Nandu

Dear Nandu,

NO ACTION 🙂

In the case of index funds how does the AMC matter i.e. are similar index (e.g Sensex) funds from different AMCs very different ?

Dear Koel,

AMCs or Fund Managers does not matter. However, you have to check the TRACKING ERROR, AUM and EXPENSE RATIO.

Basuji,

Is SBI focussed equity fund good for 10 + year investment via sip mode. Its noted that the performance of fund is good. Please advice.

Dear Arun,

Why you selected this fund?

Basuji,

Currently i am investing in Franklin prima plus fund via sip mode. Due to recategorisation, i am in search of a better multicap fund.I studied both parag parikh and SBI focussed equity fund. SBI AUm size, returns, ranking seems to be satisfactory.

Sir,

Kindly guide me for the right choice.

Dear Arun,

I am comfortable with Parag Parikh.

No recommendations for 2020?

Dear Nandu,

Wait.

Sir can you elaborate about total expenses ration effect on long term investments direct mf & should go with index fund,?

Dear Jai,

TER with respect to active funds Vs Index Fund is around 1%+. Hence, better to go with Index Funds.

Which best index fund for long term please suggest

Dear Jai,

Refer above post properly.

Hi Mr. Basavaraj,

When can we expect the updated list for investment to be made in (mutual fund) 2020? I’m waiting for your updated list to make new investments.

Thanks!

Abhishek

Dear Abhishek,

I will publish soon.

Hi Mr. Basavaraj,

Any plans to publish top 10 best sip mutual funds list for 2020?

Kindly advise.

Regards,

Abhishek

Dear Abhishek,

Yes, I will. Just wait.

Sir ! What should be the percentage allocation for mutual fund investment among large cap, mid cap and small cap for a goal period of more than 05 years but less than 20 years?

Dear Sudeep,

There is a BIG DIFFERENCE of 15 years between 5 years to 20 years. If you are not clear of when you need, then how can I guide you?

Dear Sir, I am an aggressive investor and want to do SIP of 40K per month for next 20 years. I have identified the following funds-

1) Large Cap- Mirae Asset Large Cap/Axis Blue Chip 2) Large and Mid Cap- Mirae Asset Emerging Blue Chip 3) Multicap- Kotak Standard 4) Focused- Axis Focused 25 5) Midcap- Axis Midcap 6) Small Cap- SBI Small Cap/Axis Small Cap 7) Contra- Invesco India Contra 8) International- Franklin India Feeder Franklin US Opportunities.

However the number of funds is more and there is lot of overlapping amongst different categories. Can you please prepare a good PF with minimum required funds having very less overlapping which can generate aggressive returns over next 20 years. Please suggest amount as well for each fund based on SIP of 40K. If you think there is any better fund, please do let me know. Thanks and Regards

Dear Mohit,

What do you mean by AGRESSIVE INVESTOR?

Sir, By Aggressive Investor I mean I can take a bit more risk as I have time period of 20 Years atleast. I can take a small exposure to Small/Mid Caps. If you can please advise MF Portfolio construction for a bit risky investor. Thanks and Regards

Dear Mohit,

Are you ready for loss of around 40% to 50% of your assets? Define your aggressive nature. It looks wise to say I AM AGRESSIVE INVESTOR. But hard to digest the loss. Hence, I am trying to dig deep to question you.

Dear Sir, I agree with you but I think that having one MF with small exposure to small Caps should be there. This provides alpha to overall PF returns. For e.g. CAGR of SBI Small Cap Fund over past 10 years. I also understand the importance of Multicap funds after seeing the heavy correction in Mid/Small Caps and jump in certain Blue Chips. I am unable to figure out right structure i.e. Large, Mid cap and Large & Mid cap MF have lot of overlapping. I am of the view that 1 or 2 Multi Cap MF will do. There is lot of info available on Blue Chips. Therefore lot of overlapping. However Small Cap Fund Managers have to dig in deep to take out info. Therefore there is very less overlapping between Multicap and Small Cap Funds. May be if I can add one small cap fund with Multi Cap Funds. I am also confused that currently overlapping is due to the fact market is tilted towards select few blue chips. Therefore currently most of Large Cap Funds, Large & Midcap Funds or Multi Cap Funds have these stocks. But what will happen when there will be recovery in Midcaps/Small Caps. Then extent of Overlapping will change. I have also read that Multi Cap fund Managers have the advantage of moving from one cap to another without any restriction. However Fund manager can’t do this where AUM is huge i.e. Kotak Standard Multicap. In, Large and Midcap Funds, Manager has to invest minimum 35% in each Large and Midcap. He has to move the remaining 30%. In this way L&M Cap funds have slight advantage. I have also read that we should go with experienced Fund managers who have expertise in their respective caps i.e. 1 Large Cap Fund, 1 Midcap etc instead of Multicap or L&M Cap Funds. This all has confused me. I need your help to define a structure i.e. How many funds from which category. Thanks

Dear Mohit,

Small Cap Fund Managers dig deep to find stocks? That is why they are superior to BLUECHIP? Remember risk always not return also. Higher RISK many times may be HIGHER LOSS also. If you trust your FUND MANAGER, then I rest my case and you can choose as per your choice. Check Multi Cap Fund definition as per SEBI but not as per FUND. I least bother about fund managers and avoid fund managers risk by indexing. Rest is your choice.

Sir, Then please help me in constructing a good MF PF for next 20 Years i.e. which fund from which category. Thanks

Dear Mohit,

For equity, One Large Cap Index Fund, one Mid Cap and one Hybrid Equity Fund enough.

Hello Basuji,

Pls review my investments. All investments are in direct-Growth funds for 20 years. I started in 2015 with Axis LTE..

Equity to debt ration is 60:40.

Debt investments are in PPF, FD only.

MF: (25k using SIP)

Axis Long term – 6K/m

Mirae asset Bluechip – 5K/m

LnT Midcap – 4K/m

HDFC Hybrid Equity 5K/m

Mirae asset Large Cap – Total investment 2L (no SIP)

Under equity:: Large:Mid:Small ratio is 55:35:05 (approx)

Questions:

My investments are 7% up. All of them are in green.

1. Is my portfolio is okey.

Dear Mukul,

Avoid small cap and move to index funds in large cap.

Hi Basu,

Question on your Mid-Cap fund selection of HDFC Mid Cap Opp Fund. This fund from the past three 3 years is showing negative returns, can you please explain how this has downside protection??

Dear Suresh,

Down with respect to? Check this tool to identify the RISK and Return and you notice that it is well ahead of Benchmark index.

https://www.morningstar.in/mutualfunds/f000000i3z/hdfc-mid-cap-opportunities-fund-growth/risk-ratings.aspx

Dear Basuji, I am doing monthly SIP of 4000 Rs. in franklin India smaller companies since last 3 years. But the fund is giving poor return. It is not giving average return. Peers are well ahead of this fund. My horizon is above 8 yrs. Should I stop this SIP after waiting some more months or remain in this fund? Please advice..

Hi, I am 24 years old, my financial goal is to create Rs.1 Cr corpus for next 10 years. please guide me to reach my goal. How much should I invest (SIP)every month ? what kind of Mutual funds should I start or maintain in my portfolio? Also please tell me, is it good time to invest ? as we are keep hearing about Market recession in future. Please suggest me good Mutual funds and my risk appetite is high.

Thanks,

Akhil Kumar K.

Dear Akhil,

Please read above post once again. I have answered to all your questions already. Regarding the timing, the BEST time to invest is NOW.

Thank you Basavaraj

Basu,

Please advise, running into 25% loss on Mutual fund invested for 2 years is it time to pull out ?( Stopped SIP while back)

All SIPS are showing negative margin those invested since 2 years .,around 10% my understanding is hold on to these for a longer term ( Canara Rubeco emerging equity, L&T India Value fund , Mirea Asset emerging blue chip)

Please Suggest.

Thanks

Raghavendra

Dear Raghavendra,

If your goal is long term (5+ Yrs) and you did the proper asset allocation, then why to worry?

Hi Basu,

I am confused between SBI NIFTY Index fund and UTI Nifty Index fund. As per my understanding, UTI has a better expense ratio while SBI has a better tracking error.

Please suggest

Dear Sarthak,

Go with the fund which has higher AUM.

Hi Basu,

I’m planning to invest in mutual fund for more than 10 years for financial growth. My portfolio is 60:40 ratio of equity and debt. Below funds are in my mind.

Large: 40% UTI Nifty Index Fund-Direct Plan Growth Option

Multi: 20% Axis Focused 25 Fund (or) Kotak standard multicap fund

Hybrid:40% ICICI Prudential Equity & Debt Growth Direct

Can you suggest me which one is to choose from multicap fund between Axis Focused 25 Fund or Kotak standard Multicap fund?

Thanks

Dear Sivaganesh,

I suggest Parag Parikh Long Term Equity Fund or Quantum Fund.

Thanks Basu Sir.

I’m 40 years old, I started my investments 5 years ago and can wait for 12 more years.

Below are my holdings:

Mirae emerging bluechip fund – 8.2 lakhs and ongoing 50K 4x SIP per month.

Reliance Small cap – 8.1 lakhs and ongoing 15K 2x SIP per month. Currently showing negative returns, should i keep this or redeem it?

Axis Midcap -2.1 Lakhs, no SIP, but buying manually minimum for 3K or 4K monthly

HDFC mid-cap opportunities – 5.6 Lakhs, no SIP, no manual purchase, thinking to redeem as i want to invest more into Axis midcap

ABSL pure value -1.05 lakhs – no SIP – currently showing negative return. When i don’t see loss, planning to redeem this considering other midcap holdings

Franklin smaller companies – 9.27 Lakhs – no SIP – currently showing negative returns, should i keep this or redeem it?

Please advise on my holdings and your view on redeeming HDFC midcap, Franklin smaller companies, ABSL pure value, Reliance small cap fund. Which funds i can hold and which funds i can redeem?

If you suggest redeeming those, please suggest alternate funds to transfer. I just want to move the money to better funds, i don’t need money now. Thanks.

Dear Kalai,

What is your asset allocation between debt and equity?

i’m a NRI. I don’t want to invest anything which has 3 yr lock in although i have long term view. I’m an aggressive investor and my risk is high. if these small and mid caps are not going to perform in the long term, i want to move them to better fund or better catergory like multi cap or large cap. Please advise.

Dear Kali,

First define yourself time horizon, the meaning of LONG TERM and HIGH RISK. Then take your call. Every time, high risk does not mean high return.

ok. thanks.

My age is 23. Equity investments are for 15 years horizon and debt investments for 4-5 years.

Following is my Equity portfolio:

Large Cap: (2000)

Axis Bluechip Fund – 2000

Mid Cap: (4000)

L&T Midcap – 4000

MultiCap (4500)

Kotak Standard Multicap – 3000

SBI Magnum Multicap – 1500

ELSS (4500)

Aditya Birla SL Tax Relief 96 – 2500

Axis Long Term Equity Fund – 2000

Total – 15000

Debt Investments include FDs, PPF, NSC. (No debt mutual funds yet.)

Equity to Debt ratio is 65:35

Please suggest any improvements that can be made to my portfolio.

Dear Omkar,

The debt to equity ratio is for 15 years goal or for 4-5 years goal?

Hi,

Will maintain the same equity:debt ratio of 65:35 for 15 years.

Will pull out some investments in debt after 5 years. And may compensate later.

But won’t touch equity investments in the short-term.

Dear Omkar,

Refer my comments. You just need one large cap, ond mid cap and one hyrbid from above list. For debt, if the goal is 15 years away, then why not use PPF?

Hi Basu,

Thanks for these regular posts of yours, they are very informative. I personally do not like index funds but I agree with you that they look good in current scenario.

I have a request for you to give your detailed opinion on DSP small cap fund please.

The AMC has gone through a change, they went wrong in the market timings, the fund manager is managing the whole AMC now and the fund hardly has shown any recovery in comparison to other funds. I have been investing in this fund for the last 4 years and from the best performing fund it’s become the worst in my portfolio.

I really need your opinion, I am not concerned about the performance of Small cap as an Index but rather performance of this fund against it peers.

Also, in the large cap fund, if we want to continue with the large cap itself then what would be your one recommendation? I had SBI Bluechip fund and I was thinking of replacing that with Axis Bluechip fund.

As always, thank you for your guidance.

Dear Sandip,

You already mentioned the reasons to come out from DSP. Hence, better to come out. But one suggestion, don’t compare the funds with their peers. Rather compare that with the benchmark it is following. Yes, even if you compare the benchmark, this fund underperforming the benchmark. Hence, better to exit. Regarding large cap, SBI Bluechip is also one among other funds which is struggling to beat the index. However, I suggest you to continue this fund (if you are not a fan of an index fund).

Thanks Basu, one last thing. When funds go bad like in the case of DSP Small cap, should we exit or stop the SIP and wait for it to get even?

When the markets are down it could be a good idea to exit and put all this money in a better fund.

I have SBI Bluechip fund and ABSL Frontline equity fund in my Large cap

Mirae Asset emerging bluechip in Small & Mid cap

HDFC Mid cap opportunities in Mid cap

Kotak Multi cap fund in Diversified Funds

DSP Small cap was in the Small cap funds which i am planning to exit but what should be my alternative if i exit?

Should i put it in another or existing diversified fund?

I do follow your advise on equity debt and allocation, these are my for my retirement goals in about another 15-20 years.

Dear Sandip,

“When funds go bad like in the case of DSP Small cap, should we exit or stop the SIP and wait for it to get even?”-NO-POINT IN RETAINING. Never look for the MARKET but the overall equity portfolio of your investment. Follow the above funds (especially in case of Large Cap and Mid Cap). Avoid small cap and use hyrbid funds instead. For goals 15 years away, debt part can be wisely managed by investing around 75% in PPF and rest 25% in combination of liquid and arbitrage fund.

Thank you very much Basu.

I’m investing in 60:40 ratio.

following is my portfolio

Equity Funds –

1. Franklin India Prime Fund

2. Icici Prudential bluechip

3. icici Prudential small cap

4. sbi small cap

5. Tata Equity P/E Fund

Debt Funds –

1. Franklin India Low Duration

2. icici Prudential savings fund

3. sbi small saving

4. Tata treasury fund

My goals are

1. retirement – 25 years

2. Kids education – 10-15 years

3. Kids marriage – 20-25 years

Kindly let me know if my portfolio is right.

Dear Shreyas,

In large cap, use Index Funds. Why two small cap funds? Regarding debt, stick to Liquid or to the extent Ultra Short Term Debt Funds.

Dear sir,

I am investing throw SIP in following funds from jan 2018 for 5 years

Franklin India focused equity fund amt 5500

Aditya birla sl frontline equity fund amt 7500,

Hdfc midcap opportunities fund amt 6400,

L&t emerging business fund amt 1700.

Please suggest as my fund value is in negative.. shall i continue these funds or switch in other funds. Please

Advice

Dear Rupali,

If your time horizon is 5 years away, then better to come out of equity immediately.

Dear sir,

If i am planning to continue for 10 yrs for children education so shall i continue all these sip or do you suggest any other best funds for sip

Dear Rupali,

If your goal is to retain for next 10 years, then first do the asset allocation between debt and equity. The debt should be around 40% and equity should be around 60%. For debt, use Liquid Fund and Arbitrage Funds. For equity, one large cap, one mid cap and one hybrid fund in the ratio of 50:30:20 enough for you. Don’t exposure more towards Mid, Small or Thematic Funds.

Dear sir

Your suggestions and advice is important .pls throw some light on below mentioned funds as I m investing since last 5 years . Now valuation is not good and in huge loss.pls suggest what to do, should I continue my SIP OR change or stop

1) Reliance Small cap – 4000 / month

2) SBI small – mid cap – 4000/ month

3) HDFC small cap –

2000 / month

4) UTI transportation & logistics- 1500/ month

5) DSP small cap- 2000/ month

6) DSP NRE – 2500/ month

7) Reliance banking-

2500/ month

8) Canrobecco emerging- 2000/ month

9) DSP taxsaver –

1500/ month

Dear Monu,

Who suggested such a huge exposure to small and sector-specific funds? What is the asset allocation you are following between debt and equity? What is your holding period?

Sir, I did mistake. But now I want to rectify it. My holding period is still 12 years from now . Pls suggest what to do with this funds

Dear Monu,

First read the above post properly (not about funds but the theory). Then if you still have doubts, then we discuss.

Thanks for prompt reply sir

Yes sir I understand the mistake I did mistake in allocation,. But sir pls help me to as I m in dilema.

Dear Monu,

No option but to correct the mistakes. Hence, first identify your goal time horizon, accordingly first do the asset allocation and then we discuss further.

Brother,

I want to invest in debt mutual funds (equity portfolio already running). As of now, I have extra 5 lacs which I dont need for 2-3 years. With your old debt mutual funds post (hope u will write new one shortly 🙂 ) and my own research, I have sorted 5 debt mutual funds. Returns are almost similar but I want to diversify little bit so that is why selected 5 funds, just in case, something goes wrong.

https://www.valueresearchonline.com/funds/h2_fund_compare.asp?pg=compare&schemecode=15677%2C16854%2C16339%2C17470%2C16503&isTabChng=1

Please click on above mentioned link – I have done Fund comparison on valueresearch.

My priority is – safety, better return that FD/NSE & lastly most imp LIQUIDITY which we dont have in NSE and FD (early redemption charge + TDS).

So, I wanted to ask, if u were in my situation, how would u have spitted 5 L LUMP sum amt in above funds? Which one to avoid? Which new one I can add ? (if u have any suggestion)? I mean, returns are almost similar so which funds are safest to go with. 🙂

Your suggestions will be highly appreciated.

Thanks in advance for your reply.

Rahul

Dear Rahul,

Stay away from all and use Liquid and Arbitrage Funds like Quantum Liquid Fund and ICICI Arbitrage Fund.

Hi Basu

Taking into current situation can we choose ICICI Prudential Equity & Debt Fund over HDFC Hybrid Equity fund

Dear Ahmad,

Why there is a doubt about HDFC?

Hi,

I have been investing in MF for past 2 years for a time horizon of 15 years.After making due allocations into equity/debt etc i have started sips in the following funds

1. ABSL focussed equity

2. kotak standard multicap

3. motilal oswal most 35

4 mirae asset emerging blue chip

5 canara robeco emerging equities

6 franklin india small co.

Now when i am reviewing the performance after 2 years things are not that great. I understand the markets witnessed a lot of volatility and i am also not imaptient considering my goals are still far off. But one thing i noticed is that my plans are regular ones and now we have better and easy platforms selling direct plans. I am planning to migrate to direct plans by stopping sips in existing plans( and stay invested, not withdraw from existing plans) and start fresh sips in direct plans

I want to use this opportunity to tweak my funds as follows

1. hdfc top 100

2 uti nifty index

3kotak std multicap

4. mirae asset emerging equities.

I am confused whether to continue with FT small co.?or replace it with a midcap fund?

Your advice please

Thanks

Dear Murthy,

Where is your debt part and what asset allocation you are following?

debt is in the form of ppf, rd nps. Ratio of 70:30.

Dear Murthy,

Make it to 60:40. At the same time, follow the strategy like 50:30:20 in Large Cap:Mid Cap:Hybrid.

hi,

thanks for your suggestion and i have tweaked my asset allocation accordingly(60/40). now the question is with regards to equity funds. After microanalysing the allocation of the above funds in various categories i am more or less getting 60-65:25-30:20-25 in large:mid:small cap funds.

The question now is to continue with above funds only or change a few (only because i am switching to direct funds, i want to use this opportunity).IF so, what changes you suggest?

Dear Murthy,

If you are anyhow moving from regular to direct funds, then select the above listed funds in each category.

Sir,

Am a beginner to mutual fund,wanted to invest like 4k each month,please suggest SIP to start with

Thanks in Advance

Shabeeb

Dear Shabeeb,

Time horizon?

I do not understand by the idea of Mutual fund growth option. Are they going to re invest the gains every year or we need to observe the fund movement and invest the cumulative amount when ever profits are booked.

Dear Sarin,

They reinvest the gains continuously not on every yearly basis.

According to me, investing in the mutual funds is the best way to invest your hard earned money, just make sure you invest in the right funds like Kotak mutual funds that will give you good returns over a long term. Make sure you choose the best mutual funds for SIP.

I am currently investing 3000/month in ABSL ELSS 96 from last year. I want to invest upto 10000 per month. My goal is 10 years and above. Please suggest me good investment options

Dear Pradnya,

Please continue.

Dear Basunivesh,

I have been investing in Franklin’s India smaller company from past 2 years but in Regular SIP mode. Last month I stopped it to invest in Direct mode. Now please suggest me should I go with the same fund or should I look at HDFC SmallCap or SBI SmallCap for direct mode SIP. Consider my sip amount is not changed and I will continue my investment for next 15+ years. I have maintained equity to debt ratio . Am 28 years aged.

Dear Sravan,

Please continue.

Hi I have invested 1.75 lakh in L&T INFRA fund and L&T value fund..it has beenn 1.8 years . Funds are making loss (10 %, 4%) should I switch/continue please advise

Dear Raghunandan,

Hard to suggest anything without knowing your reason behind investing. I usually avoid thematic funds.

Thanks for response, I had invested this for a period of 10 years in 2017 for my Kids education in a period of 1 year. This would be 2 years in Sep

Dear Ragu,

That is fine but what asset allocation you are following between debt and equity? What other funds did you include? What made you to go for these sector funds?

50% in debt and 50% in equity is the allocation , with Target of 30 lakhs in debt primarily its in VPF and some in PPF( which is completed) choose this as VPF has higher interest rate.

am trying to build up same amount( 30 lakhs) in Equity; 2017 made investment of 7.5 lakhs 1.5 each in in L&T infra, L&T value fund , Canara Rubeco emerging equity, Mirea Asset emerging blue chip, Icici banking fund as STP for one year.( This investment has not grown it is more ore less same since then)

am doing SIP( 45,000) into Reliance Large cap, PARAG PARIKH LONG TERM EQUITY FUND – GROWTH, ICICI PRUDENTIAL BLUECHIP FUND – GROWTH is roughly 5 lakhs

I realized SIP is best way and have to do steadily than pumping in all at once

Please advise if i should keep L&T infra fund, ( This is at 14% loss) though overall not making a loss / should i wait for one more year. Let me know on overall planning if this is in right direction

Dear Ragu,

Try to avoid the thematic funds.

Dear Sir,

I have made my own research and invested in the following funds last year as lump-sum ( Planning for long term investment)

1. HDFC Small Cap Fund – Direct Plan (G)

2. L&T Emerging Businesses Fund – Direct Plan

3. L&T Infrastructure Fund – Direct Plan (G)

4. Reliance Small Cap Fund – Direct Plan (G)

5. Tata Digital India Fund – Direct Plan (G)

6. Tata India Consumer Fund – Direct Plan (G)

But due to market condition i noticed 20% surge in fund value overall. hence i am planning to switch over to the below listed funds in order to diversify in different sectors and avoid loss , please suggest whether the below listed funds are good to go or do i have to rethink about the selection, need your valuable advice before i proceed.

1. Axis Bluechip Fund – Direct Plan (G)

2. Axis Mid Cap Fund – Direct Plan (G)

3. HDFC Small Cap Fund – Direct Plan (G)

4. ICICI Prudential US Bluechip Equity Fund – Direct Plan (G)

5. Tata Digital India Fund – Direct Plan (G)

6. Tata India Consumer Fund – Direct Plan (G)

Dear Saravanan,

What do you mean by LONG TERM? Why there is no asset allocation between debt and equity?

Hi Sir, I am 30 years old now, I opted to stay invested for at least min 10 Years, that’s the reason I mentioned it as long term, also I maintain some amount in bank FD and I considered it as stable investment equivalent to debt funds, hence I didn’t choose separate debt fund and to diversify my investment I selected the funds which I mentioned above and I really don’t have accurate knowledge to analyze the fund which I choose for diversification is good to go or my idea of asset allocation is wrong, hence I am in need of your help, kindly guide me.

Dear Saravanan,

In that case, what is the ratio between debt and equity? I am not saying you choose debt funds ONLY for your debt part, it is completely as per your comfort.

Dear Sir,

Noted,As of now I have 40(debt):60(Equity), in-order to diversify my investment, These 60% funds I have selected on my own,

1. Axis Bluechip Fund – Direct Plan (G)

2. Axis Mid Cap Fund – Direct Plan (G)

3. HDFC Small Cap Fund – Direct Plan (G)

4. ICICI Prudential US Bluechip Equity Fund – Direct Plan (G)

5. Tata Digital India Fund – Direct Plan (G)

6. Tata India Consumer Fund – Direct Plan (G)

can you please review these selected funds and suggest that selected funds are correct choice to go for long term (10 +) investment or do I have to make any different choice, kindly advise.

Dear Saravanan,

Avoid thematic funds and also, you no need to have two funds within a category. Also, the small-cap exposure should be less or NIL.

Noted Sir, Thank you, I will alter as per your recommendation.

Hi,

i am NRI , planing my rental income India 2 lakhs per month for SIP minimum of 5years.

Please advise which one will better

Thanks

Murugaraj

Dear Murugaraj,

Considering your time horizon, I suggest you to go for Debt Funds rather than equity.

Dear Basavaraj,

I am investing in the below funds via SIP from last 2 Months.

My Investment horizon is around 10 years

I have taken these SIP’s..

Aditry Birla Sun Life tax relief 96 DG– 3000/Month

Mirae Asset Emerging Bluechip Fund DG-5000

ICICI Pru Equity & DEbt Fund DG – 1000/Month

Mirae Asset Hybrid Equity Fund DG – 1000/Month

Mirae Asset Tax Saver Fund DG – 15000 L/S

HDFC Hybrid Rquity Fund DG – 1000/Month

REliance Small Cap Fund DG- 1000/Month

L&T midcap find DG-1500/Month

Kindly advise if they are ok to invest & where should I invest more

Please give your suggestions.

Dear Amit,

If your time horizon is 10 years away, then the asset allocation between debt and euqity should be around 60:40. For debt, use Ultra Short Term Debt Funds and for equity one large cap and one mid cap is sufficient for you.

Dear Sir,

My plan now is to invest 20k/month as SIP for 15 years.

After reading your article above and other articles I have chosen the following funds.

1.UTI Nifty Index Fund

2.Franklin India Prima Fund

3.DSP Small Cap Fund

4.ICICI Pru Long Term Fund

I am allocating 6000 on No.4 to maintain the 70:30 ratio.

Kindly advise whether I can proceed with the above. It will be really appreciated if you could advise how to distribute the remaining 14000 among the first 3 funds.

Dear Praveen,

70:30 between? What about debt to equity ratio?

30% (6,000Rs) of the the 20,000 i am investing is in ICICI Pru Long Term Fund, which is a debt fund from your list. Rest 70%(14,000Rs) I am planning to distribute in the first 3 funds mentioned above, which are equity funds from your list.

Dear Praveen,

Increase your debt portion and also stay away from DYNAMIC Bond Funds.

Dear Sir,

My final portfolio is below.

1.UTI Nifty Index Fund

2.Franklin India Prima Fund

3.DSP Small Cap Fund

4.Birla Sunlife Short Term Fund.

60-40 Equity to debt; Among equity 50,30,20 in Index, Mid & Small Cap.

Kindly advice whether I am good to go.

Dear Praveen,

Yes.

Hi sir, iam investing in franklin india blue chip fiund SIP since 1 year, what to do now. Can i change to another largecap fund or to continue in this fund.

Dear Sukumar,

Please continue.

Dear Sir

I want ‘ to say that in all 10 Funds sir you have suggested all Growth plan categories why you have not suggested Direct growth plan in which long term investment investor save the commission and other expenses, please explain. Thanks

Dear Sir,

For your reference, I just mentioned regular funds. However, I am a staunch believer in DIRECT Funds.

Dear Basavaraj,

My current SIP investment is mentioned below, which I am planning for 15 years.

1) SBI Focused Equity Fund Growth – 3000

2) ICICI Prudential Bluechip Fund Growth – 3000

3) Reliance Small Cap Fund – Growth – 3000

4) L&T Midcap Fund Growth – 3000

5) Kotak Standard Multicap Growth – 3000

Do you think the above folios are good as monthly SIP for a long period or should I remove and add other funds? Appreciate your valuable suggestions.

Regards,

Arun

Dear Arun,

What is your asset allocation between debt and equity?

Dear Basavaraj,

To be honest with you, I am quite a rookie when it comes to MF and equities. To answer your question, I do not have the allocation of assets between equity and debts; all MF SIP’s are equity based.

Presume that I have answered the question correctly, if not excuse my ignorance on the assumption that ignorants are not ingnored and appreciate the right guidance and insight.

Dear Arun,

It’s alright and nothing to worry. In that case, first try to read the post once again and let me know if you still have doubts.

Dear Basavaraj,

Thanks for the answer.

I do understand the significance of allocation of funds between equity and debts, either by 60:40 or 70:30 ratio.

My concern regarding posting the comment is mentioned below

Do the folios which I am investing each month are good to continue or should I remove underperforming ones and add new to replace the removed? An interim check about the folios.

Regards

Arun

Dear Arun,

I think you need readymade answers. But I can’t give the answers without knowing the reasons behind each of your investments.

Hi, sir I am new to mutual fund and started investing 1 month back.

I have moderate to high risk appetite and want to invest for at least 15 years and expecting high return possible.

below are the funds I am investing..

1) Axis Blu chip direct g – 1000

2) Mirare Asset Emerging bluchip – 1000

3) Hdfc small cap -1000

4) sbi small cap -1000

5) L&T mid cap -1000

6) Mirae asset India equity -1000

Sir please check my portfolio …

Dear Snehasis,

Why did you doubt your one-month-old decision now? Whether you read the above post properly (especially regarding the goal setting and asset allocation)? If no, then read first.

AS usual very good presentation and to the point information

my query is why not hdfc sensex etf instead of hdfc index fund . you can easily start sip with brokers nowadays .

here is comparison

https://www.valueresearchonline.com/funds/fundSelector/returns.asp?pg=compare&schemecode=31377%2C16071&isTabChng=1

Dear Rajeev,

What about LIQUIDITY? Are they tradable often and have choice to sell as and when I wish?

Sir, I am seeking to build very large long term corpus for my children and maybe even their children. I want to maximise the power of compounding (1). Which funds for lump sum investment of 60 plus years? (2). Will mutual funds and their respective investments even last that long? (3). I seek 12% cagr. (4). Trade-off between STP over 2 years (to average pricing) vs one time investment ( more time for compounding) thank you. P.s fantastic blog

Dear Srini,

1) There is no fund on this earth which I say that you must HOLD for 60 years.

2) Yes if you have behavior and emotions under control.

3) Good but what asset allocation you are following between debt and equity?

4) Why STP when you have a view of 60 YEARS?

Hello sir, I want to invest 30000 per month, kindly suggest me some funds name or asset allocation (Large cap, mid, small or Bluechip etc.). My age 28 years. My goals are Dream home after 10 year (price- 40 lakh now), child education (20yrs), and retirement (32 yrs later). I am waiting your response. Thank you.

Dear Prokash,

Your all questions are already answered in above post. Read the post carefully once again.

Hello Sir ,

I have done my asset allocation as 70:30 for my goal of 15 years . I am doing my SIP from 2 years . I have three funds total SIP of 25k .

My multicap fund in Motilal oswal 35 is performing poor in comparison to its peer .As a part of review do you suggest me to continue with this fund ?

Thanks.

Dear Tanuj,

Don’t compare the fund with PEERS. Compare with benchmark.

It is lagging with its benchmark ,if 2 year return is considered .

Dear Tanuj,

Then you can take a call.

Hi Sir

I want to start investing in mutual funds and wanted to check what are the best available online platforms, whether web based fund managers such as Upwardly or Goalwise are a proper platform for SIP investments.

Dear Suraj,

Whether you are looking for REGULAR funds or DIRECT funds?

Hi Sir

I think Direct funds have more advantages than a regular fund, so that would be the first preference but even if it is a regular fund for small amount SIP investments would it make a major difference between the two when we look at a long term period of 10 to 15 years. My main intention is to save a good amount for my daughters education in 15 years time as she is currenly 4 years.

Dear Suraj,

A penny saved is a penny earned.

So the best way is to deal directly with AMC’s ?

Dear Suraj,

The best option.

I am NRI, I want to invest in mutual fund . which best option for nri..

and how to invest

I am waiting your best debt fund 2019. which debt fund best for less than 1 year of investment

Dear Patel,

OPTIONS of choosing the funds will NOT change just because you are NRI (Yes, if you are resident of USA or Cananda as only few AMCs allow to such NRIs). If your time horizon is just one yar for debt part search, then use a Liquid Fund or even your NRE FD is enough.

Is “Zerodha” best brokerage firm in India for investment in Share market? or anything else? I’m new in share market so give your valuable suggeston. Thanks in advance.

Dear Raj,

Zerodha is a discount broker. If you are an INVESTOR, then you no need to bother about the cost. However, if you are a TRADER, then you can look at such a discount broker.

Hi Basu,

Do I need to have INTERNATIONALL FUNDS for portfolio diversification?

Goal- Retirement 18 yrs later. I have made a portfolio Debt: Equity of 80:20. Thanks in advance.

Dear Pappu,

As per me NO. But you are optimistic, then you can include around 5% to 10%.

Hi Basu sir,

What are your debt fund recommendations for a investment horizon of less than a year?

Dear Raj,

Use Liquid Funds.

Hello Basavaraj Ji,

I am a follower of your posts. Thanks in spreading the financial literacy in the Nation. This is the first time I am commenting here.

I am 28 years old. Time horizon more than 10 years (Goals- House, Child education, child marriage). My investing target is 15.5 k per month. I’m thinking to invest (SIP) in the following:

Aditya Birla Sun Life Tax Relief 96- 3000

Kotak Standard Multicap Fund- 2500

Mirae Asset India Equity Fund- 1500

SBI Magnum Ultra Short Duration Fund – 1500

Mirae Asset Emerging Bluechip Fund- 4000

SBI Small Cap Fund (20%)- 3000

I already have EPF+ PPF+LICI=70K/YEAR

Do I need any changes in my folio? Please give your valuable suggestions.

Regards.

Dear Saidur,

What is your asset allocation for this 10 years goal? Whether EPF, LIC and PPF will match your 10 years goal? Why so many multi cap funds?

Actually, I want to buy a house after 10-12 years. After Child education 22 years later, child marriage 28 years later. Asset allocation: Equity- 70%, Liquid Funds-5-10%, PPF+EPF+ LICI=20-25% (Except Emergency funds as in Bank account).

Dear Saidur,

If your all goals are more than 10 years, then follow the asset allocation of 40:60. For debt, how can EPF help you when it is linked for your retirement? Also, do you think LIC policies are the RIGHT debt products? Regarding equity, one large cap index, one mid cap and one small cap in the ratio of 50:30:20 enough for you.

Hello sir,

I invested in sbi blue chip fund reg plan and sbi magnum midcap regular fund , are both good for future or i should go for another fund ??

Please suggest

Dear Sourav,

May I know the meaning of FUTURE?

Dear sir

My current SIP’s are

1. Kotak standard multicap fund regular growth- 2000/-

2. MOTILAL oswal multicap 35 fund regular growth – 2000/-

3. Aditya Birla sunlife focused equity fund- 2000/-

Above sips I have started on oct 2017 for 3 years

And in Feb 2019, I have started sip in below fund again for 3 years

4. ICICI PRUDENTIAL blueChip fund regular growth -2000/-

Now I want to start a long term sip for my child education and marriage please suggest me a fund in which I can invest with sip amount 2k-3k for 15yrs period.

And is it good to start one more sip for long term?

Thank you

Best regards

Amit

Dear Amit,

Why you have doubts on your existing funds?

Dear Sir

Thank you for your response.

Actually, I don’t have any doubts on my existing funds. I just want to know which fund will be a good to invest as long term investment.

Will you suggest me please.

Bcoz I have not done any long term investment or I didn’t bought any children plan for my childs future.

Thank you

Amit

Dear Amit,

Then the current investments are for how many years goals?

Dear sir

My current investment are for 3 years only.

Dear Amit,

In that case, don’t touch equity and use debt products.

Dear sir

Well noted.

Is there any option to increase the duration of the investment from 3 years to 5 years

Thank you

Amit

Dear Amit,

Invest based on your financial goals. If your goal is 3 years away, then whether you can postpone the goal up to 5th year?

Dear Basu,

First of all thanks to you for your continuous review/Comments/Suggestion. It helps us a lot 🙂

I have one Query

I am investing on ICICI Discovery Fund via Agent. Now I want to stop it.

1. I called up Customer Care and came to know that a Mutual Fund taken Offline , cannot be stopped online and we have to visit the ICICI Mutual Fund Branch and submit the closure Form. This I followed up for last 2 months but some how its not getting stopped and getting rejected due to some or other reason [Wrong IFSC Code , etc :]

2. Is it possible to switch this Offline ICICI Discovery Fund to any other Online ICICI Mutual fund via https://www.icicipruamc.com/ .

Regards,

Rishi

Dear Rishi,

1) Someone misguiding you. If you have folio number, then create a login in ICICI Pru AMC portal and invest either in direct or regular funds with ease.

2) Switching to another fund means redeeming and investing freshly. So take your call based on the requirement.

Thanks Basu.

I do have a login with https://www.icicipruamc.com/ and have a folio Number for Discovery Fund. But seems I am not able to Cancel the SIP Online however I was able to Redeem all the Units to my Bank Account.

When I contacted Customer care for the same then they conveyed that since I have taken this Mutual Fund Offline I need to submit SIP Cancellation form to nearest ICICI Pru Branch.

I want to avoid this Approach as its very much time taking

:(.

So I am thinking to maintain low balance in Bank so avoid any Auto Debit.I heard after unsuccessful Debit , AMC automatically stop the SIP.

Regards,

Rishi

Dear Rishi,

Rather than lowering your balance to default, better to do it by visiting the branch or CAMS Office.

Hello Basavaraj,

I am a regular follower of your posts. Thanks in spreading the financial literacy in the country. This is the first time I am commenting here. I am not sure if we should take the current Nifty return in comparison with a Large cap fund at this point. As you must be well aware currently the rise in Nifty can be attributed to hardly 5-10 stocks. That does not mean other stocks bad. As a contrarian, one should rather look at some of the good fundamental stock who have not participated in the last 12-18 months rally. Just a thought.

Dear Rohit,

Your points may be valid. However, Mutual Fund investors can’t pick the stocks based on which stocks rallied and which are not.

Thanks for response. I was only mentioning the same while comparing the return of Large Cap MF with Index. Given the gain in Index is skewed by few stocks, good large cap MFs in generalon average should be able to deliver better return than index(for ex on average 1/3 of large cap MF should able to beat index.). Current return showing only 5 out of 36 having better return is seems out of trend

Dear Rohit,

Only 5 out of 36 are able to beat mainly because of TRI. If their call of picking the stock as per their expertize, then they might have beaten the Index easily.

Thanks Basavaraj. Make sense. Given the current index level. Do you think one should wait for investing in an Index fund? I have a lumpsum amount to invest.

Dear Rohit,

If your goal is more than 5+ years and you did proper asset allocation, then no need to bother about LEVELS.

Hello Basavaraj sir,

My age is 30 years. Investment horizon 10-15 years. My investing target is 12 k per month. I have sip in the following

ICICI focused bluechip – 2k

SBI bluechip -2k

HDFC Midcap opp. -2k

DSP midcap fund-2k

ABSL small cap -2k

Reliance multicap-2k

Which fund do you stop or new suggest? Any change in above you feel?

pls.advised

Dear Braz,

First do the asset allocation like 40:60 between debt and equity. For debt part, use either PPF or Ultra Short Term Debt Fund. For equity, one large cap, one mid cap and one small cap in the ratio of 50:30:20 is fine. Don’t invest two funds within the same category. It just increases your number rather than creating a true diversification.

Sir,

My investments

1. Kotak select Focus Equity Fund (Large Cap) amount 3K per month.

2. Amount1000 in Reliance small & Mid cap Equity Fund(D)

Is it good investment or requires some other investments

Dear KB,

Hard to say without knowing your time horizon of the goal and the asset allocation you are following.

Hi

I am 30 years age, NRI , Married. I heard that ICICI launched a new NFO called ICICI Prudential Retirement Funds (Equity and Debt Plans) – As of now, I havent started any investment for my retirement which is almost 20 years far itself..What do u think about this ICICI NFO(Equity plan)? Should I choose this? Please share ur thoughts..

Also Do u have any article regarding NFO investment?

Dear Albin,

Stay away from NFOs and products labeled as RETIREMENT.

thank you

Dear Basu,

I have a home loan of 25lakhs which i want to end in next 5 years. For that as per my calculations with 9% return per month sip comes to aroumd 32k which i can cover. I am planning to alloat 70% of this to Debt (PPF + Franklin india ultrashort fund) and 30% in HDFC index fund sensex.

Does it look ok?

Dear Raghu,

If your goal is 5 years, then stay away from equity.

Sir,

I plan to invest 40K in SIP for 20 years.

Can you help me design a portfolio in which funds I should invest.

It would be great if you could advise

Dear Suresh,

Refer the above post once again. If you still have doubts, then we will discuss.

Hello Basavarajji,

My age is 47 age years. Investment horizon 8-9 years. My investing target is 13-14k per month. I have sip in the following

Mirae asset India equity – 2k

Mirae asset emerging bluechip-2k

HDFC small cap -2k

ICICI LTEF-2k

Around 5K more would like to invest. Which fund do you suggest? Any change in above you feel?

Dear Ravi,

First do the asset allocation like 60:40 between debt and equity. For equity, use one Large Cap and one Mid Cap. Stay away from Small Cap.

Thanks so much Basavaraj Ji. For debt investment, which fund I should invest other than PPF? Any ultra short term, low duration or short duration fund do you recommend? As far as I have seen, the return in most of these are hardly 8 to 9%. For large cap can I go for index fund. Mid cap I will chose franklin prima fund. Thanks

Dear Ravi,

You are looking for debt part to diversify and I assume 7% returns. I think from debt portfolio also you are expecting something equal like equity. Please set your expectations and basics right.

Thanks. I have understood. Please suggest me the some large cap fund. Is Index fund better or can I choose ICICI pru bluechip/ HDFC top 100?

Dear Ravi,

Index Funds better.

Thank you so much

Hello Sir,

I really like your blog and valuable inputs, really appreciate & thanks.

This is Vikas, NRI based in Japan.

My age is 35 and I would like to invest in mutual funds for 15-20 years at least. (funds required for retirement approx. 3+ Cr.)

Since I have an investment in PPF (on my wife and mother name), NRE FD etc, its time for me to look for mutual funds and please advise if the following funds are acceptable. If you have an alternative, please recommend so.

I have mentioned below funds based on my own study and also referred your blog as well.

Total five funds and SIP of each shall be 8000/month

?if minimum return is 12% year, I can easily get approx.3Cr. after 20years as per my calculation.

1. Index – UTI Nifty (8000/month)

2. Large & Mid Cap – Mirae Emerging Bluechip (8000/month)

3. Multi – Parag Parik (8000/month)

4. Value – Invesco Contra (8000/month)

5. Mid Cap- Axis Midcap (8000/month)

Dear Vikas,

One Large Cap Index, one Mid Cap and if possible Parag Parikh Fund enough for you.

Many thanks Sir,

Does it mean, below funds are good and enough for an investment of SIP amount 40,000/month

1. Index – UTI Nifty (15,000/month)

2. Multi – Parag Parik (15,000/month)

3. Mid Cap- Axis Midcap (10,000/month)

Thanks again for your support & kind inputs

Dear Vikas,

Yes, but with proper debt to equity ratio.

Thanks Sir,

I have done debt & equity raito as per your advise in well manners.

Dear Vikas,

Great to know this 🙂

Hello Sir,

I have a doubt possibly most of them are investing more than one fund in the same category (large/mid/small) for safe side. For example, if one fund is not doing good in Large cap category other may do well in the same category by chance. So in this case we may escape from down fall. Please correct, if i’m wrong sir.

Thanks again for your valuable suggestions.

Dear Ganesh,

Choosing two funds within a category may not create a diversified investment. However, definitely avoid the AMC specified or fund manager specified concentrated risk.

Thank you sir for clarification.

I’m planning to invest in MF for more than 7 and 20+ years for children’s Education, their marriage, retirement and Growth. Here is my portfolio and diversified Fund(Hope so). Can you please correct me, if i need any change in it.

Portfolio: 50:50

Equity: 50% (Rs 32500)

Large: 30% —UTI Nifty Index Fund-Direct Plan Growth Option(Rs 9750)—Home loan repayment

Mid: 20% —-Franklin India midcap (Rs 6500)—-Children’s marriage

Multi: 30% —Rarag Parik (Rs 9750) —————–Retirement

Hybrid: 20% — HDFC Hybrid (Rs 6500) —-Children’s education

Debt: 35% (Rs 22750)

Short term: 30% Franklin India Savings Fund-Direct Plan Growth (Rs 6825)

Ultra short term : 20% Franklin India Ultra-Short Bond Fund – Super Institutional Plan (Rs 4550)

Liquid: 40% Quantum Liquid fund Direct Plan Growth Option (Rs 9100)

Long term : 10% —PPF (Rs 2275)

Cash: 15% —HDFC Saving Max account (Rs 9750) —Emergency

Do you want me to replace UTI Nifty next 50 direct plan instead of Franklin India midcap fund for satellite part?

Please suggest me. Thanks and Regards.

Dear Ganesh,

As your all goals are more than 7+ years, consider the whole portfolio you are building towards those goals (instead of aligning each single fund towards goals). I suggest you to stick to Mid Cap than Index.

Thank you Sir.

As per your suggestions, I will follow the whole portfolio towards those goals instead of separating them towards goals. That’s a good idea.

1)PPF vs NPS. Which one is the best for long term goals? or

2)Do we have any other long term MF debt funds (7+ years) to replace PPF because 80C is already covered by Home loan principal repayment.

Thanks & regards

Dear Ganesh,

1) Stay way from NPS. Use PPF as debt part of your goals which are in long term.

2) Don’t invest in PPF just because it provides you the tax benefits. Which debt product is safe and tax-free at maturity like PPF? Hence, better you consider this.

Thank you so much Sir for your support and advise. You made my day :-).

Dear Basuji, I am 52 yrs. old. My SIP is as follows

Axis Long Term : Rs. 4,000

Hdfc Hybrid : Rs. 4,000

Franklin Smaller Companies : Rs. 4,000

PPF : Rs. 10,000

I think I miss on large and mid cap category. Is it necessary to add another fund from this category or should I increase SIP in same funds?

Dear Pratap,

Without knowing your goal time horizon, it is hard for me to say anything.

Sir, My horizon is minimum 8 yrs.

Dear Pratap,

Then first do the asset allocation as I prescribed above. Then chose the funds as I suggested.

Hi Sir,

I have following SIP’s from the last one year,

LNT mid cap – 3K

Kotak Emerging equity fund – 3K

ELSS – Axis – 4K

ELSS – ABSL – 4K

All these funds are for long term 5-10 years

Please share your suggestion on my folio.

Dear Rajin,

There is a huge gap of 5-10 years. When you invest, then you must be specific and also must do the proper asset allocation between debt and equity.

Dear Basu Sir,

I am 40 years old and investing in Mutual funds from Jan 2019 to generate corpus for my retirement and goals like kids education and marriage.

Time horizon Max: 20 yrs. (retirement)

10-15 yrs.(kids education & marriage)

Debt: PPF, MIS and FD’s

Equity:

ICICI Pru Bluechip-Growth (Direct) – 2000/-

HDFC Mid-cap Opp-Growth (Direct) – 2000/-

Franklin India Smaller Companies-Growth (Direct) – 1000/-

I would like to have the feedback on my current portfolio to know if I am doing right.

Pls. suggest if any changes are required, If I need to add or change any fund . Should I invest separately for each goal or club it in single portfolio.

Just started with small amount and will increase it in coming months.

Regards

Saini

Dear Saini,

But you have not mentioned what asset allocation you are following between debt and equity.

Dear Basu Sir,

Currently it is 50:50 but in few months I try to follow 30:70 debt:equity or as you suggest according to my age and goals.

Dear Saini,

Asset allocation should be as per time horizon of the goals but not as per age.

Dear sir

I am new to mutual fund investing, and trying to invest by reading your blogs only. So pls. suggest whatever you think is right according to my portfolio given above.

Regards

Saini

Dear Saini,

If your goal is more than 10 Years, then make sure the asset allocation should be 40:60 between debt and equity. For equity, in large-cap try to shift to Index Funds (mentioned above). Rest looks fine for me in equity.

Dear Sir

Is it okay if I invest partial amount of large cap in Index, means investing in both ICICI and index simultaneously or I totally shift to Index funds. In both the cases one fund from index funds(as suggested above) is okay.

And overall what %age should I expect from these funds ?

Thank you very much for reviewing my portfolio and suggestions. By reading your blogs and replies to the queries of beginners like me I got confidence to invest in Mutual Funds.

Regards

Ravinder Singh

Dear Saini,

“Is it okay if I invest partial amount of large cap in Index, means investing in both ICICI and index simultaneously or I totally shift to Index funds. In both the cases one fund from index funds(as suggested above) is okay.”-YOU CAN DO SO.

For equity for long term goals you can expect around 10% to 12%.

Hi Sir,

I am new into mutual fund investing. I have read your entire article above. I have chosen the 40:60(debt:equity) asset allocation bracket. I have chosen the below funds to invest in, please provide your suggestions on them.

1. Birla sun life tax relief(elss as I’m currently working). I have gone through your article on elss as well.

2. Franklin India prima fund

or

HDFC hybrid equity fund(does aggressive allocation means high risk, ultimately is this beneficial?)

3. Franklin India(ultra short term debt fund)

I am planning to invest 2000/month SIPs in each of these.

Can you please suggest which fund to allocate more or less?

Thank you in Advance,

Sajith

Dear Sajith,

Why not LARGE CAP?

Hi Basavaraj,

last month SEBI gave a circular that to bring down concentrated risks for Index as well as ETF funds which follows indices, and

told minimum 18stocks should be there and need to be tracked and capped top three holdings to max 65% in a index fund and 25%max for a single stock or sector in a portfolio..

so will be be no downside risk.. So entire largecap can be invested in HDFC sensex index fund instead currently you suggested 50% each in hybrid and index fund of larges portion..

please explain..

link here

https://www.livemint.com/money/personal-finance/are-new-sebi-rules-for-etfs-index-funds-good-for-you/amp-1549299612274.html

sorry it’s minimum 10stocks..please explain basavaraj

Dear Krishna,

Even though it avoids concentrated risk, but it fails to protect the downside protection. Hence, I advised a hybrid fund.

What is difference between concentrated risk and downside risk…

1)Can you differentiate?

2)Is SEBI aware of downside risk in index funds?

3)Also, then why SEBI is not bothering about downside risk in index funds..which is very very important

Please conclude.

Dear Krishna,

1) The concentrated risk is that your portfolio highly tilted towards a particular sector or stock. Whereas downside risk is that your fund will fall exactly like how the index falls. But in case of active funds, the fund manager may protect it by taking a call within a limit of fund mandate.

2) The downside risk is in relation to equity, which YOU the investor has to manage but not the regulator.

3) I already pointed. Managing the downside risk is left with investor not with market or regulator.

Hello Basavaraj,

First of all, thanks for sharing such useful information with us. In the past, I had FD but I don’t know it is good only for upto 5 years.

I am interested to invest in the equity market but not able to understand your 40:60 ratio.

Can you explain in details what is 40:60 ratio?

Thanks

Pradeep Kumar

Dear Pradeep,

I hope with the link you used, it seems to be you are from a finance background and I hope you did ratios calculation when you are a kid. Please google it for ratios. You will find simple examples.

Is ABSL small cap fund good to continue or I should quit. SIP Rs 4000 PM.

Dear Anuranjan,

It is hard for me to say anything with your limited sharing.

Hi Basavaraj,

Is there a way to scout mutual funds based on stocks of interest. Lets say for example i have shortlisted 10 stocks(HDFC,infosys, reliance etc) and would want a mutual fund which has portfolio consisting of all these 10 stocks.

Is there any portal which can help me with that?

Thanks in advance

Dear Anubhav,

Sadly NO. Reason is that your shortlisted stocks are not MUTUAL to other investors. Hence, how can you find such a MUTUAL fund?

In that case it would be a manual job to find out which mutual fund portfolio has stocks of interest.

Another issue is overlapping in stocks in different mutual fund portfolios.

I did find a website which compares portfolios in terms of common and uncommon stocks.

Dear Anubhav,

If you find your chosen stock replicating fund, then let me know. As per me, it is not possible.

Hi Basu,

I have worked out my portfolio as Debt:Equity = 60:40 (moderate risk)

I want to select 4 funds and am planning to invest Rs.5k in each for 5 years. I selected the below 2. can you suggest a few more to diversify my portfolio?

1. HDFC Hybrid equity funds

2. ICICI Pru Regular savings fund

Thanks

Dear Divya,

If you already did the asset allocation of 60:40, then why again hybrid funds? Why you have arrived at the numbers like four funds? Can you elaborate more?

Hi, the fund you have suggested in multicap segment belongs to value oriented equity fund, other than ppfa there is no real multicap fund to compete

Dear Sravan,

Then why not go for PPFA?

Very educative article. Can you please describe the criteria you follow in selecting mutual funds. Recently in a TV show one institutional advisor said how they put a target price for every stock in the MF portfolio and then fix a target NAV for the fund. Also they claimed that they see the track record of the individual fund managers. Please enlighten us about your methodology whether it is historical performance based or projected basis.

Dear Dinesh,

The so-called INSTITUTIONAL adviser is not a follower of a goal based investment advisery, but a typical SELLER with churning your portfolio regularly. The more they show their activeness about your portfolio, the more you (customers) feel adviser is CARING for their money. But sadly investment is lazy process with once in a year review enough.

Really great and nice article and very useful that every year we get such information

Hello Sir,

I have the following requirement

Elder Son: Currently Grade 4. After 7 years Need 20 Lakhs – Education

Younger Son: Currently in Nursery. After 13 years Need 35 Lakhs – Education

Retirement: 1 CR

I can invest 40K per month. Please suggest.

Thanks,

Ricky

Dear Ricky,