This is the fourth article in a series of articles on simplifying debt mutual funds. In this post, we will discuss about the concept of Yield To Maturity or YTM.

Read the first part “Part 1 – Debt Mutual Funds Basics“, the second part “Part 2 – Debt Mutual Funds Basics“ and the third part “Part 3 – Debt Mutual Funds Basics“.

In my last post, I explained the concept of the interest rate risk of bonds and how it will impact investors. In this post, as I mentioned in my earlier post, let us try to understand the concept of Yield To Maturity or YTM.

For a new bond investor, yield to maturity in a simple way say is the return on investment if he holds the bond till maturity. You know that when you buy a bond, then you will get interest at a certain interval (in the majority of bonds) and at maturity, you will get back the face value of the bond.

Let us assume that a 10-year bond is currently trading at Rs.105, the time horizon is 10 years and the coupon (interest rate) is 8%, then the buyer has to calculate the return on investment. The buyer will pay Rs.105 (for Rs.100 face value bond), he will receive 8% (on Rs.100 face value but not on Rs.105) every year, and at maturity after 10 years, he will receive Rs.100 (face value but not the invested amount of Rs.105).

The YTM calculation is a little bit complicated to understand for many investors. Instead, there are online readymade calculators available to understand the YTM. If we go by the above example, then the yield to maturity for a buyer or return on investment for a buyer is 7.8% IF HE HOLD THE BOND UP TO MATURITY.

Obviously, buyers by calculating the YTM compare with the current prevailing interest rate. If YTM is better then he will buy otherwise he will negotiate the price with the seller to make it more profitable for him.

Now in the above example, you noticed that rate of interest on the bond is 8% but YTM is 7.8%. It is mainly because if a buyer is buying at face value, then for him the YTM will be 8%. However, in the above example, as he is buying at a higher than the face value, his return on investment is proportionately reduced.

Hence, whenever someone buys a bond, it is YTM matters a lot more than the coupon rate. However, if someone is buying the bond at issuing price, then YTM equals to the coupon rate. To understand this concept in a better way, let us take into consideration the current YTM of the various maturing bonds.

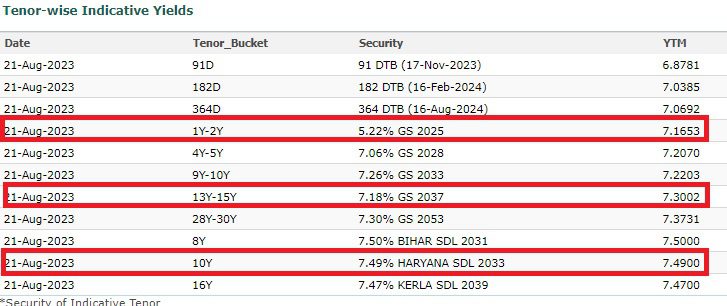

The above list includes the latest YTM of various maturing bonds. Just concentrate on the bonds which I have highlighted.

The 2025 maturing bond YTM is now at 7.16%. But the coupon rate is 5.22%. It obviously indicates that the bond is available at a lower than the face value. If we calculate the price, then the bond is available at around Rs.97 (the face value is Rs.100).

Same way, if look into the 15-year maturing bond, you noticed that the YTM is 7.3% but the interest rate is 7.18%. this again shows that the bond is available at a discounted price.

However, if you look at the 10-year Haryana state government bond (which is usually called SDL), the YTM is equal to the interest rate. It means the bond is available at face value.

Now, your debt mutual fund is holding a bunch of bonds, right? Then how the fund will arrive at the YTM of the fund? The fund manager will calculate the weighted average of bonds is calculated. It means based on the weightage of the particular bond in a fund’s portfolio, the YTM is considered proportionately to arrive at the total YTM of the fund.

Important Points about YTM

- YTM is a return a bond investor can expect IF he is holding the bond till maturity. However, if he is selling it before maturity, then his YTM will differ based on the prevailing price of the bond (do remember that bond price changes on a daily basis and hence the YTM too) at the time of selling.

- YTM will not take into consideration the taxation part.

- Also, YTM will not take into the buying and selling costs.

- Few argue that higher YTM means risky and lower YTM means non-risky. I don’t believe in this plain judgment. Instead, we have to look for the credit quality of the bond and the time horizon left to mature also. Of course, the lower YTM bond may be less volatile. However, what matters is the quality of the bond and the time horizon for maturity.

That’s it for now. So as of now, we have covered the basics of bonds, the interest rate risk concept, and the YTM concept. In the next post, I will explain to you the concept of credit risk and default risk of bonds.

Refer to earlier posts –

14 Responses

Sir….Bond Market is now set to bloom with JP Morgan includes Indian Bond in the index….

I am interested to know more on the nitty gritties of analysing the daily market changes and be a dynamic investor myself FIRST to learn…

I have your 4 part basics on Bonds…

Dear Narayanan,

To certain extent it may impact but not a big game changer.

Thanks Basu, any recommendations for target funds and can we have a sip for the targets funds.

Dear Pradep,

Yes.

Hi Basu,

Thanks for providing the details of debt fund. I need your inputs regarding investing on debt fund.

Currently I own a petrol car which is 9.5 years old and I will be forced to change my car after 5 years ( due to 15 years policy). If I need to buy a car today I will be assuming a budget of 15 lakhs (creta, seltos etc), so after 5 years I am assuming I will be needing around 20 lakhs (considering inflation)for the car.

What would you recommend, should I start a SIP in debt fund or should I invest in equity funds or should be going for RD/FD.

Please suggest how much amount SIP i need to start and also suggest the funds for achieving this goal.

Thanks,

Pradeep

Dear Pradeep,

I suggest a 5 year matching target maturity fund.

Dear Basu,

Good article. 1 doubt. Why do the debt mutual funds not declare the weighted average of the coupons of the underlying bonds they are holding? (similar to how they declare YTM). This will help us to know if we are getting the underlying bonds at a discounted price or not.

Dear Melwyn,

Mainly because the purpose of investors in bond is looking for YTM and mutual fund NAV matters than the price of individual bonds. Good point and good thinking from your side.

Dear sir, if we are investing through mutual fund route, then do we still need to analyze YTM, interest rate etc? i think this content is useful for people who wants to invest in Direct Debt (or Bond) market.

Dear Subramaniam,

Good question. YTM of the portfolio is a major indicator of the risk and return expectation. Regarding the interest rate, it is most important part to analyze the risk on the bonds which the fund manager is holding. Hence, if you are a debt fund investor, knowing about these is a MUST.

Thanks Basu sir for your reply, so what is the best time to buy debt mutual funds is it during or after the interest rates have peaked? (assume i have suitable time horizon). Also after FY23-24 budget announcement, LTCG benefits are not much attractive for Debt MF. so with not much margin difference with FD does Debt MF worth investing?

Dear Subramaniam,

NONE can predict the interest rate movements perfectly. Rather than in a prediction mode, use debt portfolio as a cushion for your equity portfolio and for short term goals. Don’t chase the returns from debt portfolio. Debt Funds still holds good for your long term goals compared to Bank FDs. However, for short term goals, you can easily use bank FDs.

Thanks Basu sir, but when is the good time to invest in debt MF- is it during high interest rate time or when interest rates are low?

Dear Subramaniam,

Obiviously when the interest rate is high and bond price fall. However, I am still insisting you not to try this timing.