After the Budget 2023, what are the NPS Tax Benefits 2023 under the new tax and old tax regimes? This confusion started mainly because the government stressed promoting the new tax regime rather than the old one. Hence, let us understand the NPS tax benefits in both regimes in detail.

Note – I have updated the latest taxation of NPS Tier 2 at “NPS Tier 2 Tax Benefits 2023 – Under New Tax and Old Tax Regimes“.

All of you know that during the Budget 2020, the Government introduced a new tax regime. Also, the Government gave you the option to choose either the old tax regime or the new tax regime.

However, if you try to choose the new tax regime, then you have to forget certain deductions and exemptions. I have written a detailed post on this. You can refer to the same “New Tax Regime – Complete list of exemptions and deductions not allowed“.

Because of these changes, many of us have been confused about what will be the NPS Tax Benefits 2023.

NPS Tax Benefits 2023 – Under New Tax and Old Tax Regimes

Now let us understand the various taxation issues with respect to NPS.

1. NPS Tax Benefits while investing

First, let us understand the NPS Tax benefits you will get at the time of investing. Due to Budget 2020, here the big changes happened and hence let us understand what are the tax benefits if you opted for an old tax regime and what if you opted for the new tax regime.

# NPS Tax Benefits 2023 under the old tax regime – Tier 1

If you wish to retain the old tax regime for your IT return filing, then the old taxation rules with respect to NPS will continue as usual.

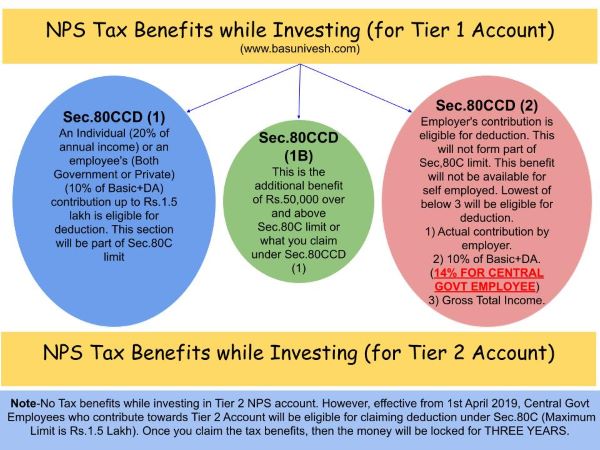

I tried to explain the same from the below image. Remember that tax benefits under Tier 1 and Tier 2 are not available for all investors. Tier 2 tax benefits are available only for Government Employees.

Let us discuss one by one as below.

NPS Tax Benefits under Sec.80CCD (1)

- The maximum benefit available is Rs.1.5 lakh (including the Sec.80C limit).

- An individual’s maximum 20% of annual income (Earlier it was 10% but after Budget 2017, it increased to 20%) or an employee’s (10% of Basic+DA) contribution will be eligible for deduction.

- As I said above, this section will form the part of Sec.80C limit.

NPS Tax Benefits under Sec.80CCD (2)

- There is a misconception among many that there is no upper limit for this section. However, the limit is the least of the 3 conditions. 1) Amount contributed by an employer, 2) 10% of Basic+DA (For Central Government Employees it is now 14% of Basic+DA effective from 1st April 2019), and 3) Gross Total Income.

- This is an additional deduction that will not form the part of Sec.80C limit.

- The deduction under this section will not be eligible for self-employed.

Also, if your employer contribution under Sec.80CCD(2) is more than Rs.7,50,000 a year (along with EPF and Superannuation), then such exceeded contribution will be taxable income in the hands of the employee.

In fact, even the returns on the such exceeding amount of Rs.7,50,000 (from NPS, EPF, and Superannuation) will be taxable each year.

NPS Tax Benefits under Sec.80CCD (1B)

- This is the additional tax benefit of up to Rs.50,000 eligible for an income tax deduction and was introduced in the Budger 2015

- Introduced in Budget 2015. One can avail of the benefit of this Sect.80CCD (1B) from FY 2015-16.

- Both self-employed and employees are eligible for availing of this deduction.

- This is over and above Sec.80CCD (1).

# NPS Tax Benefits 2023 under the old tax regime – Tier 2

Earlier there was no income tax benefit if you invest in a Tier 2 Account. However, the Government of India changed the rules recently. According to this, if Central Government Employee contributes towards a Tier 2 Account, then he can claim the tax benefits under Sec.80C (The combined maximum limit under Sec.80C will be Rs.1.5 lakh ONLY). Also, if someone availed of such tax benefits, then the invested money will be locked for 3 years (exactly like ELSS Mutual Funds).

# NPS Tax Benefits 2023 under the new tax regime – Tier 1

If you adopted the new tax regime, then as I mentioned in my older post ” New Tax Regime – Complete list of exemptions and deductions not allowed“, you have to forget the tax benefits which you are availing under Sec.80C.

Hence, obviously, the NPS Tax Benefits 2023 under Sec.80C, Sec.80CCD(1), and Sec.80CCD(1B) will not be available for you. Because Sec.80CCD(1) and Sec.80CCD(1B) are part of the Sec.80C limit.

However, whatever the employer contribution under Sec.80CCD(2) is eligible for deduction under the new tax regime also.

# NPS Tax Benefits 2023 under the new tax regime – Tier 2

Earlier there was no income tax benefit if you invest in a Tier 2 Account. However, due to the Government of India changed rules, if Central Government Employee contributes to a Tier 2 Account, then he can claim the tax benefits under Sec.80C (The combined maximum limit under Sec.80C will be Rs.1.5 lakh ONLY). Also, if someone availed of such tax benefits, then the invested money will be locked for 3 years (exactly like ELSS Mutual Funds).

However, under the new tax regime, you are not eligible for tax deduction under Sec.80C, there is no tax benefit if you invest in NPS Tier 2 Account.

2. NPS Tax Benefits while withdrawing

Once attaining the age of 60 or superannuation under section 80CCD(5), lumpsum withdrawal of 60% of accumulated pension wealth is tax-free. However, you have to buy an annuity from the remaining 40%. This will be taxed as per your tax slab.

Assume that you accumulated Rs.100. In this, you have to buy an annuity for Rs.40 from Life Insurance Companies. They will pay you the pension as per the option you have chosen. This pension is taxable as per your income tax slab.

Now the remaining Rs.60 is completely Tax-Free.

Note-As per Budget 2017, the subscriber whose NPS account is at least 10 years old will be eligible for withdrawing 25% of his/her contributions (without accrued income earned thereon). This 25% withdrawal will be part of a total 60% withdrawal (which is tax-free).

3. NPS Tax Benefits on Pre-mature withdrawal

In this case, you are allowed to buy an annuity product from 80% of the accumulated corpus. So there is no confusion here as the annuity will be taxable income for you year on year.

The confusion is about 20% lump sum withdrawal. IT Department needs to come out with clarity. The rules just say 40% of lump sum withdrawal from NPS is tax-free. However, in this particular case, the lump sum investment is 20%.

Hence, whether the whole 20% is tax-free (as it is less than 40% tax-free limit) or 40% of 20% is only tax-free (i.e. 8% from 20%). As of now, there is no clarity on this aspect.

4. NPS Tax Benefits on Pre-mature withdrawal

Partial withdrawal from NPS is allowed on certain conditions. I explained the same in my post “Latest NPS Withdrawal Rules 2018“.

There is no clarity about the tax treatment relating to this partial withdrawal. However, I feel such partial withdrawal will be taxed in the year of withdrawal as per the subscriber’s income tax slab.

5. NPS Tax Benefits on Pre-mature withdrawal

Government Employees-Nominee will be allowed to withdraw only 20% of a lump sum. The nominee must purchase the annuity from the remaining 80%. However, in case the accumulated corpus is less than or equal to Rs.2,00,000 then his spouse (or nominee) can withdraw all the amount at once without any mandatory.

For others-Nominee will be allowed to withdraw 100% accumulated corpus. However, the nominee has a choice to buy an annuity too.

The lump-sum withdrawal by the nominee will be exempt from Income Tax. If the nominee opted for buying an annuity, then annuity income will be taxed as per the nominee’s income tax slab in the year of receipt.

6. NPS Tax Benefits from Tier 2 Accounts withdrawal

Sadly there is no clarity on this aspect. Few argue that as the structure of Tier 2 is like Mutual Funds, we can pay the tax like mutual funds (debt and equity) based on our holding proportion (either equity or debt).

However, few argue that as in the case of the NPS Tier 2 Account, we are not paying any STT (Security Transaction Tax), we must not consider the taxation of Tier 2 account as like Mutual funds and should be taxed under the head of “Income From Other Sources”. Also, as of now, the NPS Tier 2 account is not qualified as Capital Asset under Section 2.

Personally, I feel the second opinion of considering this as income from other sources looks like a valid reason. However, it must not be considered a rule. I am just airing my views. I know that my view may be harsh. However, as long as there is no clarity from IT Department, it is hard to judge.

Note – I have updated the latest taxation of NPS Tier 2 at “NPS Tier 2 Tax Benefits 2023 – Under New Tax and Old Tax Regimes“.

There is a caveat on withdrawal the way I understand it. Upto 5L of corpus (at the time of withdrawal) it is not mandatory to go for the 60-40 lumpsum-annuity split. You can choose to take the entire 5L as withdrawal. Only over and above 5L is where this rule applies. So if you have 6L in your NPS at the time of withdrawal, you get 5.6L and remaining 40k going to annuity.

Dear Karan,

You are wrong. It is clearly mentioned as “If the total accumulated pension corpus is less than or equal to Rs. 5 lakh, Subscriber can optfor 100% lumpsum withdrawal.”. Hence, if your corpus is more than Rs.5 lakh, then no option but to convert into annuity+partial withdrawal rule than what you assumed.

There is still confusion. Under 80 CCD(1B) Rs.50,000/contribution is eligible for deduction which is in addition to contribution under 80 CCD(1), which is within the overall limit of Rs.1.50 Lac. When contribution under 80CCD(1B) is in addition to contribution under 80CCD(1)then how both these sections are within the limit of 80C, Rs.1.50 Lac.Under the new tax regime contribution under 80CCD(1B) 50,000/is eligible for deduction.

Dear Dhami,

The list of deductions available for new tax regime is very much clear. Hence, you no need to consider Sec.80 CCD(1B) under new tax regime.