PFRDA introduced the NPS Systematic Lump Sum Withdrawal (SLW) in its cercular dated 27th Oct 2023. What is this NPS NPS Systematic Lump Sum Withdrawal (SLW), is it tax-free, and how one can avail of this facility?

National Pension System (NPS) Withdrawal Options 2023

There are currently FIVE withdrawal options available for NPS subscribers.

a) Premature Exit / Voluntary Retirement (Exit before 60 Years or Superannuation)

# Government Sector

- Complete (100%) Lump sum withdrawal is allowed if the corpus is equal to or below Rs.2.5 Lakh.

- If the corpus is higher than Rs.2.5 Lakh, at least 80% of the accumulated pension wealth has to be utilized for the purchase of an Annuity providing for monthly pension to the Subscriber, and the balance 20% is paid as a lump sum to the Subscriber.

- Subscribers can opt and are encouraged to continue in NPS under the All Citizens Model post carrying out Inter Sector Shifting (ISS).

# Non-Government Sector

- 5 Years mandatory subscription.

- Complete (100%) Lump sum withdrawal if the corpus is equal to or less than Rs.2.5 Lakh.

- If the corpus is more than Rs.2.5 Lakh, at least 80% of the accumulated pension wealth of the Subscriber has to be utilized for the purchase of an Annuity, and the balance 20% is paid as a lump sum to the Subscriber.

b) Normal exit (60 years or beyond /Superannuation )

# Government Sector

- Complete (100%) Lump sum withdrawal is allowed if the corpus is equal to or below Rs. 5 Lakh.

- If the corpus is more than Rs.5 Lakh, at least 40% of the accumulated pension wealth of the Subscriber has to be utilized for the purchase of an Annuity providing for monthly pension to the Subscriber, and the balance of 60% is paid as a lump sum to the Subscriber.

- In case of death after 60 years/superannuation) 60% lump sum will be paid to the nominees and 40% for default annuity by dependents.

# Non-Government Sector

- Complete (100%) Lump sum withdrawal is allowed if the corpus is less than or equal to Rs.5 Lakh.

- If the corpus is more than Rs.5 Lakh, at least 40% of the accumulated pension wealth of the Subscriber has to be utilized for the purchase of an Annuity, and the balance 60% is paid as a lump sum.

- In case of death after 60 years/superannuation, a lump sum is paid to the nominees. However, the nominees can opt for an annuity if they desire so.

c) Unfortunate Death before normal exit / 60 years or Superannuation

# Government Sector

- Complete (100%) withdrawal for the corpus to nominees/legal heirs if the corpus is less than or equal to ? 5 Lakh. However, the nominees can opt for an annuity if desired.

- If the corpus is higher than Rs.5 Lakh, at least 80% of the accumulated pension wealth of the Subscriber has to be utilized for the purchase of default Annuity by dependents, and the balance 20% is paid as a lump sum to the nominee/legal heir.

- If none of the dependent family members (spouse, mother & father) are alive, the Corpus i.e. 80 % has to be returned to the surviving children of the Subscriber and in the absence of children, to the legal heirs.

# Non-Government Sector

- The entire accumulated pension wealth of the Subscriber is payable to the nominee or legal heirs if the Subscriber dies before or after attaining 60 years. However, the nominees can opt for an annuity if they desire so.

In case of death of NPS Subscriber post payment of the lump sum but annuity not issued, then

– Default annuity is to be bought by the dependents in the case of Govt sector. If none of the dependent family members (spouse, mother & father) are alive, the Corpus has to be returned to the surviving children of the Subscriber and in the absence of children, to the legal heirs.

– For the Non-Govt sector, annuity as per the choice is to be availed by spouse/dependents. Complete (100%) lump sum withdrawal or annuity or lump sum withdrawal & annuity as per the choice is to be availed by spouse/dependents.

d) Exit & withdrawal due to disability and in-capacitation

# Government Sector

If the employer certifies that the Subscriber has been discharged from the services of the concerned office on account of invalidation or disability, in such case, exit shall be handled as superannuation.

# Non-Government Sector

lf Subscriber is physically incapacitated or has suffered a bodily disability leading to his incapability to continue NPS subject to the Subscriber submitting a disability certificate from a Government surgeon or Doctor (treating such disability or invalidation of Subscriber) stating the nature and extent of disability and also certifying that:

- the affected Subscriber shall not be in a position to perform his regular duties and there is a real possibility of the affected Subscriber, being not able to work for the remaining period of his life.; and

- Percentage of disability is more than 75 % in the opinion of such Government surgeon or doctor (treating such disability or invalidation of Subscriber).”

It means such cases shall be handled similarly to exit cases at the age of superannuation or at the age of 60 years.

e) Deferment/Continuation under NPS

1. Continuation of NPS

# Government Sector

- Subscribers can opt to continue in NPS till 75 years of age and also deposit contributions to avail exclusive tax benefits.

- All the facilities and options of a normal NPS account like access to the CRA system, the option to switch fund managers and assets class, etc. provided.

- Subscribers can exit from NPS and start pension anytime during the period of continuation.

# Non-Government Sector

- Subscribers can opt to continue in NPS till 75 years of age and also deposit contributions to avail exclusive tax benefits.

- All the facilities and options of a normal NPS account like access to the CRA system, an option to switch fund managers and assets class, etc. provided.

- If the Subscriber after attaining the age of 60 years/Superannuation has not initiated an exit request or has not exercised the option of continuation under NPS, then Subscriber shall be automatically continued under NPS till he/she attains the age of 75 years, as if he/she has exercised the option of Continuation. In the case of Corporate Subscribers, the Subscriber shall be automatically continued under NPS till he/she attains the age of 75 years, after 90 days of superannuation.

- Subscribers can exit from NPS and start pension anytime during the period of continuation.

2. Defferment of withdrawal NPS

For Government Subscribers and Non-Government subscribers, below are the options available for deferment withdrawal. During this phased withdrawal period, no fresh contributions are allowed (Only for Tier 1).

- Subscribers can defer their withdrawal with multiple options

- Defer only Lump sum withdrawal

- Defer only Annuity

- Defer both

- Subscribers can opt to defer the lump sum for up to 10 years.

- An annuity can be deferred for 3 years.

The individual can opt for withdrawal of a lump-sum amount in a phased manner (up to 10 installments) over the period from 60 years (or any other retirement age as stated by the employer) to 70 years. However, the subscriber will have to avail annuity before the phased withdrawal.

All about NPS Systematic Lump Sum Withdrawal (SLW)

This NPS Systematic Lump Sum Withdrawal (SLW) is applicable for deferred withdrawal post 60 years of your retirement (as per option e.Deferment/Continuation under NPS). As I mentioned above, during this withdrawal phase, you are not allowed to contribute to NPS (Only for Tier 1).

As per the existing withdrawal guidelines, the subscribers post 60 years/superannuation, can defer availing annuity & withdrawing the lump sum on any combination till 75 years. The lump sum amount can be withdrawn as a single tranche or it can be withdrawn on an annual basis. If withdrawn annually, the Subscriber has to initiate the withdrawal request each time and the request has to be authorized as the case may be.

Do remember that you still have to opt 40% annuity and the remaining 60% is eligible for Systematic Lump sum Withdrawal (SLW).

PFRDA proposes that the lump sum can be paid systematically on a periodical basis viz monthly, quarterly, half-yearly, or annually for a period until the age of 75 in an automated manner with a one-time request. This will apply to both Tier I and II. Also, Partial withdrawal won’t be allowed post-setting up of SLW.

For Tier II, the SLW can be availed at any point of time i.e. even before attaining the age of 60 years. This is mainly because of the fact that one can make withdrawals from Tier-II anytime and this facility when introduced would act as a monthly income for the subscriber or his family members.

Advantages of NPS Systematic Lump Sum Withdrawal (SLW)

# The choice of SLW at periodical intervals through automation would add flexibility, provide liquidity and hence optimize the retirement benefits.

# Enable and empower the Subscribers with periodical withdrawal to manage their needs and requirement.

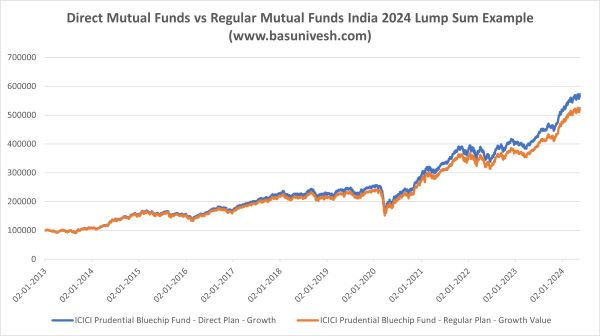

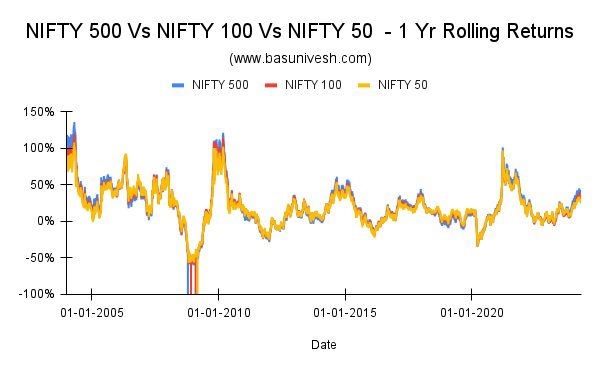

# Allows the Subscribers to participate and reap market-linked investment gains for the amount not withdrawn which continue to lie in PRAN and remain invested as per the choice of investment.

# As this Systematic Lump Sum Withdrawal (SLW) is part of that 60%, it is tax-free like a lump sum 60% withdrawal.

# Reduce the risk of reinvestment associated with a one-time lump sum withdrawal even though the option shall continue.

Disadvantages of NPS Systematic Lump Sum Withdrawal (SLW)

# You are not allowed to contribute during this SLW period (only in Tier 1).

# Partial withdrawal is not allowed during this SLW period.

# As you can choose the scheme preference during this SLW period also, you have to be cautious while choosing the asset classes (especially equity). This scheme preference is available only for 60% of the balance. The 40% balance which obviously will have to be converted into an annuity, will not have such a facility to choose from.

How to set up NPS Systematic Lump Sum Withdrawal (SLW)?

You have to opt for SLW through the intermediary. Such an intermediary will charge you for availing this SLW. As of now, the charges are not revealed. Once I get this information, then I will update.

The facility is allowed as an option during Superannuation as well as Premature Exit requests. Exit due to Death of NPS Subscriber will not have the option of SLW.

Facility to ‘Modify’ and ‘Cancel & Redeem’ SLW will be provided in the login only. In case of modification, Subscriber will be able to modify the mandate, already created.

In case of cancellation, SLW will get canceled and redemption will be processed for all available units and withdrawal proceeds will be transferred to the account.

For SLW mandate creation, Subscribers will have to select,

o Frequency – Monthly, Quarterly, Half Yearly, and Annual

o Amount/ Units

o Start Date

o End Date – will be derived based on a total corpus, amount, frequency, and start date and shown to Subscribers.

o In case Subscriber keeps the ‘End Date’ blank, SLW will be triggered at a predefined frequency till the corpus is available/ Tier is active or till 75 years of age.

o After attaining 75 years, units available will be redeemed and the balance will be transferred to the Subscribers bank account.

SLW will start at least after 30 days after the creation of the mandate in the system.

If Subscriber opts for monthly withdrawal on the 5th of every month, then the request will be considered for PayIn on the 5th of every month (provided the 5th is not a settlement holiday). If the selected date is a non-settlement day then the request will be considered for the next settlement day.

If on the scheduled SLW, sufficient balance is not available in the lump sum category then the withdrawal will be executed only for the available amount, and the lump sum category will become zero, all remaining SLW requests will be autocancelled.

If Subscriber wishes to change the bank account in which funds are getting credited, then Subscriber will update the bank details through the existing bank account updation option available in the Subscriber login where penny drop bank details verification will be applicable and there may be a cooling-off/gestation period of 30 days for any type of Withdrawal after Bank details change as per existing guidelines.

Appropriate & Regular alerts will be sent to the Subscriber on set up / modification/cancellation of SLW through email & SMS.

In case of the demise of the Subscriber during the SLW, his/her associated Nodal Office/POP/ NPST will have to initiate a Death withdrawal request wherein the entire corpus will be paid to the nominee.

Conclusion – It looks fantastic as a 60% lump sum withdrawal obviously creates a lot of reinvestment risk for the NPS subscribers. However, one has to choose the investment choice during the SLW period. The only hindrance is the blockage of partial withdrawal during this period. One more restriction is not allowing you to contribute during this SLW period for Tier 1 accounts. The rest of all looks good.

Note that this post is written based on the PFRDA proposal. I hope PFRDA will soon initiate the process of implementation with further notification. Once it is implemented and if there are any changes to it, I will update accordingly.

2 Responses

Dear Basu,

I want to exit nps at 65 defering and continue investing at 60.

I started late also did mistake of withdrawal from market. And am Looking at 20 year investment without withdrawal options hence NPS

Looking at above options I believe this is possible

Dear Govind,

Do you actually NEED the NPS?