For 2-3 days there are certain news items mentioning how certain AMCs are doing the Inter-Scheme Transfer to manage their redemption pressure in debt funds. Due to Mutual Funds Inter-Scheme Transfer – Whether Hybrid Funds risky now?

The major concern to all of the investors is what will the fate of their Hybrid Funds.

What are Hybrid Funds?

As per the SEBI recategorizition circular, there are three varients in Hybrid Funds and they are as below.

# Conservative Hybrid-

The definition is “Investment in equity & equity related instruments-between 10% and 25% of total assets; Investment in Debt instruments-between 75% and 90% of total assets”. Also, the type of scheme is mentioned as “An open-ended hybrid scheme investing predominantly in debt instruments”.

# Balanced Hybrid Fund

Definition is “Equity & Equity related instruments-between 40% and 60% of total assets; Debt instruments-between 40% and 60% of total assets. No Arbitrage would be permitted in this scheme. Also, the type of scheme is mentioned as “An open-ended balanced scheme investing in equity and debt instruments”.

# Aggressive Hybrid Fund

Definition is “Equity & Equity related instruments-between 65% and 80% of total assets; Debt instruments-between 20% 35% of total assets”. Also, type of the scheme is mentioned as “An open-ended hybrid scheme investing predominantly in equity and equity-related instruments”.

Note:-Mutual Funds will be permitted to offer either an Aggressive Hybrid fund or Balanced fund.

Mutual Funds Inter-Scheme Transfer – Whether Hybrid Funds risky now?

There are many posts written that Mutual Fund Companies risking the portfolio of the Hybrid Fund investors by transferring their risky debt funds assets to hybrid funds. In such a situation, whether those investing in Hybrid Funds should feel risky or what they have to do?

# Whether Inter-Scheme Transfer is LEGAL?

Sadly it is LEGAL!. I am unable to find any such restrictions from SEBI. The last time SEBI talked about the inter-scheme transfer is with respect to the valuation of securities while transferring. But as per my knowledge, there are no restrictions for inter-scheme transfer.

Hence, you can’t question such move of AMCs.

# Inter-Scheme Transfer is NEW?

It is not new. It is happening for long. Now due to recent downgrade, default, or liquidity crunch, we are noticing such events in a BIG way.

If you go by this ET report, you noticed that it is rampant since almost 2010 (highest was during this period). It is increasing on a yearly basis. However, again during recent times, it increased drastically.

# Definition of Hybrid Funds

If you look at SEBI’s definition of Hybrid Funds, it is clear that it is just defining the asset allocation between Equity and Debt. However, deliberately or what, it is silent on what type of asset allocation the fund manager has to follow in an equity portfolio. Whether the portfolio should have a minimum or maximum allocation towards Large, Mid, or Small is not clear.

Same way, in generic SEBI, defined hybrid funds debt portion. However, it is clearly not suggesting what should be the quality of the securities and up to what extent the fund manager can take the risk. In fact, the definition is silent with respect to the Macaulay duration of the debt portfolio.

Hence, it is a complete freedom for fund manager to handle the portfolio as per his wish 🙂

# Do you think Mutual Fund Companies ACCEPT?

Data prove that there is a huge inter-fund transfer. Hence, in such a situation, do you think AMCs will come up and say you upfront that they are NOT doing this inter-scheme transfer to manage their badly hit debt funds redemption pressure?

They will not. Instead, they will tell you some more ROSY story and defend their such movement. But you have to look at whether their intention is right or wrong by the quality of the papers they are doing the inter transfer. If the securities inter transfer are low quality, obviously, there is a motive to bail out their debt funds.

# It is investors and Advisers FAULT

Many advisers and investors using Hyrbid Funds as if they are TAX-FREE SHORT TERM DEBT INSTRUMENTS. In fact, many are depending on such funds income to survive for their ongoing expenses.

Many of us considered that such funds holding around 35% debt (Aggressive Hybrid) mean it is safe and only 65% in equity is RISKY. They never understood the risk of the debt part.

Those who are in such wrong belief are now under the HIGHEST RISK. They have to think twice of what to do with Hybrid Funds. Hence, before that, they have to understand what is their purpose of investing.

Conclusion:-Yes, by opting for the inter-scheme transfer, AMCs are actually playing the games. However, within the ambit of legality. Hence, as investors, we can’t question them. By doing this inter-scheme transfer, AMCs are managing the liquidity issue of their debt funds. It is actually bad precedence. SEBI should restrict such an inter-scheme movement to bailout the AMC’s worst-hit funds at the cost of other fund investors. Let us see when the SEBI will again open its eyes on this front.

However, as an investor, think Hybrid Funds as 100% equity funds but not 65% equity and 35% debt funds. Because we can’t track the portfolio on a regular basis. Hence, use such aggressive hybrid funds only if your goal is more than 5 years and that also with proper asset allocation between debt and equity. Also, within the equity, it is foolish to rely on such category of a single fund.

Keep one thing in mind-NEVER TAKE IT LIGHTLY WHERE THE DEFINITIONS ARE GENERIC. This is what is the case with hybrid funds. Fund managers can invest your whole equity part either in small-cap, mid-cap, large-cap, or to specific sectors. Same way, he can take a risk of any level in the mad rush to generate certain alpha.

Read our recnet posts on Mutual Funds:-

- Top 10 Best SIP Mutual Funds to invest in India in 2020

- Mutual Fund Taxation FY 2020-21 (AY2021-22)

- Taxation on Side Pocketed or Segregated Mutual Funds

Read out latest posts:-

- Is it safe to invest in Small Finance Bank Fixed Deposits?

- Gold price touched Rs.74,000 – Should you invest?

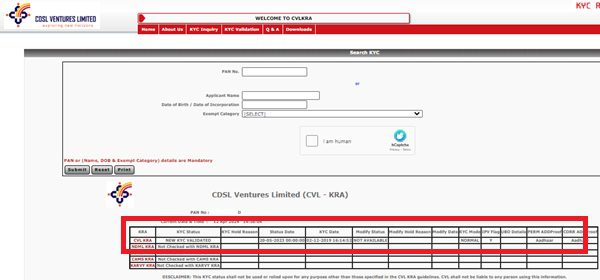

- Mutual Fund KYC Status Validation – How to check and continue investment?

- Latest changes in Health Insurance from 1st April 2024

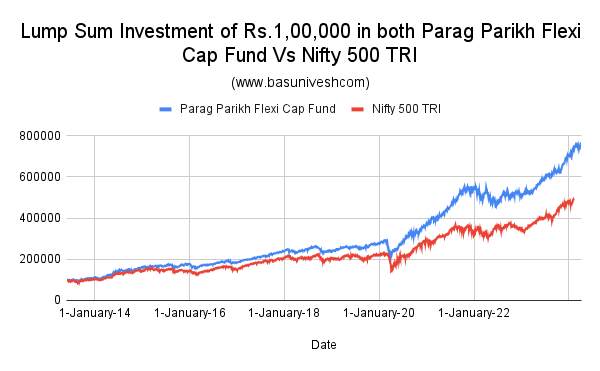

- Parag Parikh Flexi Cap Fund Review 2024 – Should you invest?

- Investing Rs.1.5 Lakh in PPF and SSY before 5th April – When you must NOT invest?

12 Responses

Hello

I am trying to get the list of the funds where these low rated debts are been transferred, but don’t see exclusive details anywhere..

Could you list out the names of the mutual funds where these things have done recently? That will help investors to to take decisions accordingly..

At least give a list of top 10 names of the mutual funds where low rated debts have ben pushed substantially..

Dear Jane,

Please search in Google, many financial news agencies wrote a detailed post.

Good article. Saw this risk coming soon. My point is why not avoid these funds altogether. Hybrid funds have not given much of downside protection, now we realise the debt portfolio portion of these funds may be risky and expense ratio is anyway high. Why not go for a multicap instead and manage the risk with overall portfolio allocation.

Dear Ashish,

There is also no guarantee of downside production. Both Hybrid and Multicap are like you are giving your freehand to fund manager.

Can you name, which AMC doing this predominantely so that we can stay away from them.

Dear Jay,

There are many like HDFC and Birla if I name a few.

Hello Jay,

To share you some info.

I have noticed that IDFC and Canara Robeco are two AMC, they usually never take credit risk in debt funds (of course except credit risk fund) or hybrid funds.

They are fully invested in AAA/A1+ rated bonds (that too major portion in PSUs or Giant like RIL, HDFC, LIC etc..) and Gov sec/SOV or in cash.

Canara Robeco Equity Hybrid fund – is quite good. In long term, it has good track record (meaning, good return) and it has reasonable AUM size (less than 3K cr).

Dear Jalpesh,

Thanks for your inputs 🙂

Sir,

Really good article.

Usually people never think much about debt part of hybrid fund seriously in terms of risk (especially credit risk).

ICICI Pru E&D fund and ICICI BAF have major holdings in AA/AA+ or lower rated bonds which make them very risky.

Specially BAF are being mis-sold by agents or distributes to Senior citizens to get them regular income for dividend options.

They will be hit very hard during this time.

After FT debt fund crisis, I saw ICICI AMC was saying that they always invest majority in highest rated bonds in debt fund (they never mentioned about Hybrid fund 🙂 ) so investors should not worry who are investing in ICICI debt funds.

Dear Jalpesh,

Thanks for airing your views and yes I accept them.

There is a perception that holding a AA rated paper makes the entire portfolio risky. If you do a thorough check of the entire portfolio of ICICI BAF and E&D there are running no risk in either of the schemes.All companies have good cash flow and liquidity. Also have a look at the exposure levels of all the papers there is hardly any concentration risk. FT debt crisis was a liquidity crisis and not credit crisis bearing aside the wrong calls they took before. This has led to a domino effect on the industry. Every AA and below paper is viewed as credit risk. Let us understand that there are companies In NBFC sector and others which still have had the AA and below rating even before the crisis and continues to have the same rating after the crisis unlike DHFL and IL&FS which were downgraded from AAA to D (everyone is quick to blame lower rated papers even for default of highly rated paper).

Dear Avid,

If everything is FINE, then why they are graded AA but why not upper grading? Everything looks fantastic when they create a rosy picture. I am not saying that all AA are bad. But as an investor, we have a right to ask such motives.