Including me everybody’s eyes are always on insurance agent’s earning. But do you know your mutual fund agent’s earning, agent who sells you mutual funds as well as charge fee (fee based financial planners) or few online portals (where you feel so comfort to invest online 🙂 )? Let us compare this issue in detail.

Let us say that tenure of investment is 15 years and investor is ready to invest yearly Rs.1,00,000. Insurance agent as usual offering a traditional plan saying secured and no risk. Where as Mutual Fund agent created a portfolio for you and recommended few mutual fund products to invest. Now let us see what are the earnings from both the format of agents.

Insurance Agents Earnings:-

Note-The commission structure will change from 1st April, 2017. I have written a post on this. Refer this new updated post at “Life, Health and Vehicle Insurance Agents Commission in India”

Usually for traditional plans insurance commission will as high as around 35% and this is called first year commission and rest of years commission is called as renewal commission. But for 2nd and 3rd years it will be around 7.5%. From 4th year onward it will be fixed at 5%. That is the reason why insurance agents lure you by sharing commission in first year of your buy. Because they are looking for long term 5% return what they get from you.

Mutual Fund Agents Earnings:-

Mutual fund agents usually get four types of commissions which are as below

1) One time transaction charge-This is fixed as Rs.150 for new investors of mutual fund and Rs.100 for existing investors. This is the cost which will be deducted from your invested amount. We need to neglect this cost as it is not high, one time and actually agent will bear this much to close the sale. This will be deducted from your invested amount either one time if you have invested lump sum or Rs.25 per month if you invested through SIP.

2) Upfront Commission-This is the commission which will be paid by mutual fund companies to agents and it included in the total expense of mutual funds. Hence you will not feel the heat of this expenses but indirectly you are paying for it. Your mutual fund agent will receive it whenever you invest newly. This commission varies from product to product, high in ELSS funds (around 4.5% to 1%), equity schemes (around 0.5% to 2.5%) and low in debt funds (around 0.2% to 0.8%).

3) Trial Commission-One of the undisclosed commission structure which you will not come to know is this “trail commission”. This commission structure range from 0.5% to 1% based on the products and mutual companies. This will be paid to your agents even if you not invest also but if your investment stayed without withdrawal. This will be paid on your total net worth or asset under management. Suppose agent have around 100 clients and including all of them he have asset under management is around Rs.5 Crores then 0.5% of Rs.5 Cr is Rs.2,50,000 annually 🙂

If next year due to good market condition or additional investment by existing clients it grown to Rs.10 Cr then his next year commission will be Rs.5,00,000. But at the same time few clients withdrawn their money or total asset under him depreciated due to bad market condition to Rs.2.5 Cr then he will receive Rs.1,25,000 in that year.

This trial commission structure is actually created with good intention to protect investors in giving them good fund selection. If agents advice is good and and investors money grows then both agents and investor will get profit otherwise both will be looser. But more to investor than agent 🙂

4) Fee based on AUM of Client-This structure of collecting fee was emerged once the ban on entry load. It depends on agents to agents. It usually ranges from 1% to 2% based on the service and value agents provide you. I saw lot agents charge this fee saying they will not get anything from investor investment as nothing will be disclosed to client either upfront or trial (both are adjusted in NAV itself). Investors are thus fooled that the only expenses to them is the fee they are paying to their agents. But remember that mutual fund companies will not pay this fee to agent, instead he need to collect it from investors.

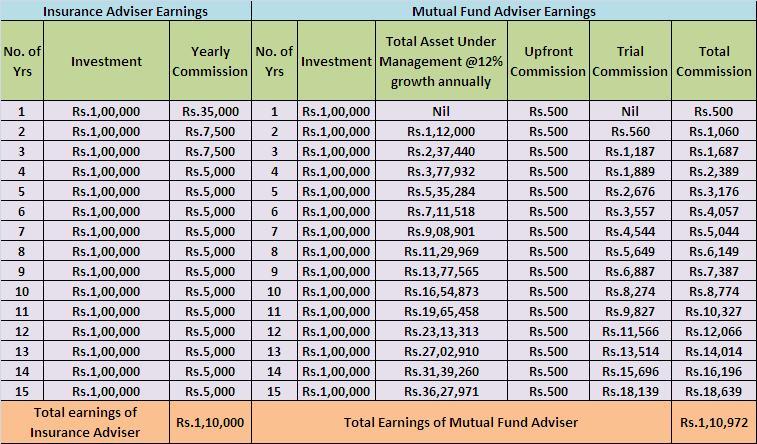

Now after understanding earning ways for both life insurance and mutual fund agents, it is now time to check who earns more. For calculation purpose I considered Life Insurance commission structure as-1st year commission 35% (including bonus commission), 2nd and 3rd yr commission 7.5% and from 4th year onward it is 5%.

For mutual fund advisers earning, I consider upfront as 0.5% and trial also 0.5%. But excluded the fee they charge as of now. Also I considered equity mutual fund investment with growth of 12%.

In both the cases yearly investment is Rs.1,00,000 and time period is 15 years. I considered 15 yrs period, because normally insurance agents will sell you the product more than 15 years as their earnings are also based on the term of the policies. Below is the calculation and result.

From above table you noticed that in the beginning period insurance agent’s earnings are high and after 4th year it is constant till end. Whereas mutual fund agent’s earnings are low at beginning but drastically improved as AUM grows. When you compare the earnings at end, both are almost equal.

From above table you noticed that in the beginning period insurance agent’s earnings are high and after 4th year it is constant till end. Whereas mutual fund agent’s earnings are low at beginning but drastically improved as AUM grows. When you compare the earnings at end, both are almost equal.

So can you buy life insurance product? No…because you are buying product to fulfill your financial dreams but not your agents. Hence what I am not pointing here is buy life insurance products as investment. Instead I am pointing is how few mutual fund agents hide their earnings and disclose the earnings of life insurance agents.

Nothing is free on this earth…including my advice 🙂 But their need to be some value addition and customer centric approach. I found few investors who are still paying entry load as their SIPs were started before entry load ban and still continues.

Whether Online investment in mutual funds is direct investment or free investment?

Recently you have option to invest directly where their will not be any expense charges and NAV of that also lesser than indirect plans. So in long run you will get benefit of this. But few online portals just wooing investors to invest in mutual funds online for free !!! Is it actually free?? No it is not free to you..they are earning commission through upfront and trial brokerages. The only advantage they providing you is online service and some customized fund selection ways. So direct investment in mutual fund means direct way of investment with mutual fund companies without any mediator and selecting the direct plans also. Hence be careful while selecting the way of investment.

Finally I am neither against life insurance agents nor mutual fund agents earnings. But disclosing the true facts and opting the customer friendly approach will be a win win situation in long run. Let me see how harsh and enjoyable comment for this post 🙂

Help up to win “Indian Blogger Awards 2013” by visiting “Help “BasuNivesh”win at The Indian Blogger Awards!” and clicking on recommend tab and posting your reviews on the same.

257 Responses

Hi Basavaraj

Presented very lucidly. Great work.

Just one query…Does the calculation still hold good in 2022? If not, can you post an update based on the latest fee structure?

Dear Sreevalsan,

It is an old post. Many things changed now. I will update the same soon.

Sir, is the topic is relevant and commission structure still same even after sebi banned the upfront commission in 2018 0r 2019. I remember some ban on upfront commissions. And if apps like paytm kuvera and all, does they get same commissions for selling direct plans… ?

Dear Adra,

They not get the commission on selling any direct funds.

Hello Sir,

If i become MF agent/distributor and I made some investments under my name/family member’s name, will i get upfront & Trail commission for those investments?

Dear Raghu,

Yes.

Hi sir,

I was wondering if I start my own MFD Pvt. Ltd. Company and then if I manage my own funds (i.e. consider it as if I sold some mutual funds to myself) then is it legal? Will I earn commission in this way also?

Dear Shashi,

Yes.

Well done.

Your comparison of Insurance Agent with MF Agent is biased towards what they earned. But, from the customer point of view who created more for them is important. As you assumed, the commission of MF agent is spinned with what he makes for his clients and not like insurance agent where his commission is based on how much he bring from his clients. I understand the issues in this way. May be i am wrong. I am neither insurance agent nor MF agent. But, ur article is wonderful and touch the central point that many layman investors wanted to know…..

Dear Muruganandan,

Glad to hear your views.

Nice article. I had a suggestion to make the comparison more accurate. Instead of just comparing the total commission received over 15 years, try to calculate the present value of the commission and than compare. LIC agent receives 35000 in 1st year while mutual fund distributor receives larger amount of commision of 18,000 in 15th year. The value of the Rs. 35000 received in 1st year is almost equal to 1 lakhs if same was received in 15th year.

Dear Amey,

Agreed. However, let me say that this is the old post and let me update as per your suggestion.

that why investor get low return in LIC

AM I GOING TO GET GOOD RETURN

Dear Devendra,

As an adviser or investor? 🙂

what about hdfc life sanchay guarenteed income plan10yr P T and12-20yrs payout.

Dear Devendra,

Check with HDFC Life.

As an investor, what is the best mode of investment such thatI inur a minimum mutual fund charges ?

Is direct mode the best one ?

Also are the broker systems such as ICICI Direct, Kite, etc … mutual fund agent ?

Dear Akansha,

If you know what is mutual funds and how to manage your money, then go ahead with DIRECT Funds. Otherwise, stick to regular funds by choosing the right adviser for you.

If I get 10 clients monthly with 1000 sip each, so at the end of year I have total investment 7,80,000

So my commission is 3900 for year which is to less. And if anybody quits then it will reduce further

Dear Rahul,

So?

Sir,

Reading this post all doubts clear and thanks for making this blog

Dear Swati,

Pleasure.

Sir, I am an govt employee and going to retire after 8 years.

I dong have pension but have cpf, and accumulated around 7 lakhs.

We are around 30/40 employees like that and our age does not permit NPS as advised.

Now an UTI person (he himself declare as employee of UTI, not agent and no commission) has convinced majority of us to invest all our accumulated cpf amount in UTI pension benefit scheme, something 60 and 40 in debt and equity respectivvely.

I am totally ignorant on this funda. So, if you kindly advise and give knowledge on these, I would be very grateful to you.

Thanks in advance.

Dear Lanu,

Stay away from a product which is named as a RETIREMENT PLAN or PENSION PLAN.

Sir,

Thanks for your kind and prompt reply.

The person has convinced 99 percent employee and file is under process. Today I am given one day time to think and opt for the same.

Sir, Please guide how do I refuse and points to argue.

Dear Lanu,

How do you refuse is left with you. But my suggestion is to stay away from such products.

Sir,

OK, but at least let me know why should do I stay away from Retirement and pension plan?

In a few words and laymen language. Thanks is advance.

Regards

Dear Lanu,

Lock-in, better option than these products and tax treatment makes to stay away.

Sir,

Thanks for your kind and prompt reply.

The person has convinced 99% of the employee. All my colleague has already opted. I am given todays time to think and opt for the same.

Sir, now how do I argue and on what points I refuse it and continue my cpf as it is kept in bank.

Please give some demerits to avoid and counter question the person.

Hi,

I have just got ARN, Kindly guide me steps to be followed and how can I manage clients portfolio, I mean is there any software provided by CAMS where I can see and manage my clients portfolio.

Dear Amarendra,

CAMS provides service related to AMCs which it serves. Instead, better to use the portals like MFU.

I have recently started investing in mutual funds and started through an agent. I have been reading about kuvera who suggest they help in migrating to direct MF. Is that advisable?

Dear Sid,

Migrating not a big issue. But are you capable of managing your portfolio on your own? If answer is YES, then go for direct.

Thanks Basu.

I am not sure if I can manage my own portfolio. But I have not received any suggestions from either my agent or the online portal (upwardly in my case) to alter my portfolio.So if I switch to Kuvera, atleast I get the benefit of going direct.

Also, do you have any post for managing portfolios?

Thanks again.

Dear Sid,

DIRECT is the solution for your portfolio management??? Refer my posts related to mutual funds. You may get some ideas on how to build a portfolio.

Hello Basavaraj,

Which is better, to become direct mutual fund advisor or through NJ wealth and why?

Satish-Initially with NJ and once you accumulated AUM and client base, then do independently.

Your above chart totally worng, in LIC only invested 1 Lac in 15 yrs but in mutual fund you have invested 1 lac each year thats why boths are same commission, LIC AGENTS GET MUCH MONEY THAT MUTUAL FUND AGENTS

Dear Shrej,

Please check the table properly. For both, I considered Rs.1 lakh investment EACH YEAR and accordingly I showed how much middlemen earn each year (Life Insurance and Mutual Fund Agent).

I apologies, yes you are right i was wrong….

Hello Mr Basavaraj,

I am investing in mutual funds for 5 years and wanted to invest directly, but in this case Is there any plateform where I can check the progress of my directly invested mutual funds under different fund managers.

2) I also become mutual fund advisor very soon, in that case is there any system to invest (one time, sip, SWp, withdrawal, stop request) in funds through online? Or advisor can do this through offline only?

Gokul-1) You can use MF Utility platform.

2) There are many platforms for advisers. You can check with respective fund houses for the same.

you can track many AMCs folios in camsonline (MyCam), without having individual account for each AMCs

Sir,

1)I am a new mutual Fund Distributor, tell me some tips to invest in lumsum investment. And give some tips about Sip investment.

2)tell me some good books for mutual fund distributor.

Or give me the best source of gaining knowledge about mf.

Samir-Refer my article “Top 10 Best SIP Mutual Funds to invest in India in 2018“.

Sir

A mutual fund advisor sale only regular plan , and after knowing about direct plan why a investor will buy regular plan , is there any solution to increase sales..?? ,

Amit-All investors are not so knowledgeable or have time to manage their money on their own. This is where an adviser can play a role.

Hello sir

So just to come to a conclusion,it is always better to invest in mutual funds directly with the company rather than going through an advisor /agent is what you suggest.As in directly go online and buy whichever funds i want to invest in and so that my profits or earnings will generally have a 1 to 1.5 % difference.Correct me if i am wrong .

Chetan-Direct is GOOD if you know what you are doing.

What if i create my mutual fund account or buy by myself(Ignore the tedious process because i might have CKYC due to old MF running etc) Since there isn’t any financial adviser, what happens to the amount which was earlier going to financial adviser?

Do i get any additional benefit for being direct investor? I would like to know the flow?

Regards,

Manoj

Manoj-When you buy the DIRECT funds, then that will be the savings to you as there will not be any middlemen. Hence, the possibility of direct funds over regualr funds returns gap start with 1% to 1.5% higher returns.

Sir,

I am I F A, and L.I.C./ General Insurance agent, I do say that customer has no knowledge about Funds /Policies which are sell online, (Direct), so they put money in wrong Funds as companies ‘s Advertisement on T.V. or sends mails to the customers, and convince them that to invest online in such funds or Policies is very easy, after some time they loose money or redeem before time, cause lack of Knowledge and vows not to invest in M. F. or any Policy.

The KIM has around 12 to 32 pages to read or understand the funds, T&C is certainly never never read by any customer, cause lack of time, and he even can not understand the wordings also.

But we I F A make customer understand to invest in right funds, and right time to exit from funds.

So it is my suggestion to all the customers who wants to invest in Mutual Fund or other Policies kindly get suggestion from right I.F.A. or L.I.C agent, not to Invest DIRECT ONLINE.

Thanks

&

Regards

Vinod-How many so called IFAs really read the KIM and able to understand it? Also, how many IFAs in true sense INDEPENDENT?

🙂 well said

Hi Sir, I would Like To Work in This Finance field Of Mutual fund advisor and Distributor

So far I m CA finalist still persuing for

final exam since 2017 just 2

attempts , I have Experiance in accounting, Auditing, Taxation and Corporates Share And Investments Portfolios How Do I Start In this

Field MF wheather is it benefinal pls advise me sir ?????? and i m already

workings as DSA for banks For all type of loans and also in Life Insurance also .. pls let me know sir

Thank u

Shaik-You must first understand that there are direct plans also which are turning to be popular. Hence, nothing is easy and short cut. You have to create a trust in your clients and also must have a knowledge.

Awesomely Explained…!!! Crisp and to the point…!!!

One question.. why the NAV of DIRECT Plans higher than NAV of regular plans?

Vinay-Because they have given higher appreciation than the regular plans.

The correct reason is that Direct Plans have lower expenses, hence their NAVs are higher. For the same asset value, when you deduct a higher expense (inclusive of brokerage), you will get a Regular NAV, which will be lower than the Direct Plan NAV (no brokerage).

Direct plan has no distribution cost that s why NAV is higher than regular plan.

Dear Amarendra,

Known fact.

i am an insurance agent, and now i would like to start as mutual fund distributor,

1. how can i start, means can i get any short term training for NISM certification course? or it will easy to get training online and go for exam?

2. after getting certification can i sell all companies product or i have to stuck with any one?

Bandewar-1) Be in touch with any of the mutual funds or AMFI.

2) You can sell all companies products. MF distribution agency is not like Life Insurance agency.

Thanks Sir..

I am currently in tybcom and had passed nism va exam……but i cant apply for job as i am not undergraduate…….so can u please guide regarding what should i do next…..are there any other exams which creates a value in my cv because i want to do job before starting selling mutual funds on my own

Ravi-Sorry I can’t guide in this regard.

Dear Basavaraj,

I hope you can advise me about my requirement,am an investor in stock market,mutual funds since 2010.

Now am planning to become

1)A mutual fund distributor of HDFC,BIRLA and ICICI

2)A General insurance agent of a good company(company not decided still under searching,if you can suggest it will be great)

3)A Life insurance agent of a good company(company not decided still under searching,if you can suggest it will be great)

4)Also become a Remiser of stock brocker(discussion in progress with one of the broker)

Except serial no 4,i need your advise all of the above.

I appriciate your advise on the subject

Am located Kochi,Kerala

Thanks

shiyas

Shiyas-What help you need?

as i mentioned above, i want to become a mutual fund distributor,life and general insurance agent.

how can i become mutual fund distributor,life and general insurance agent.

can you please advise the procedure

Hi! I am 19 yrs old from Mumbai. I am interested in selling mutual funds

But i dont know which exam should i give and which are the companies that will hire me!

Is nism v-a exam enough to go to a company for position of broker/sub-broker

Also sir I want to start working as a freelancer ahead so how should I start my business after having experience in job

Do i need to do mba in finance to be a mutual fund distributor of a company?

PLEASE HELP SIR! I am confused:(

Nikhil-Be in touch with AMFI.

Sir please in detail!

I searched for amfi-it says that i need to get the nismva exam and register with amfi

But what about the company?where do i go for job?

And also guide how do i start working as freelancer after doing job for a year or 2

Nikhil-You are looking for job in MF industry or want to be an adviser?

First i want a job, because no body will take my advice unless and until I have experience in this field!

After gaining experience in job i want to start my own firm

Nikhil-Then you approach any MF Companies for the opportunities of job in this market. I am not an expert to guide about that option.

1)Also sir please specify which companies will hire me if i just cleared nism v a and have a bcom degree

2)Also is it possible to be a mutual fund advisor with just above 2 qualifications (if yes how should i start this)

Guide me please!

Nikhil-1) Hard to say.

2) YES.

Hello sir

I want to start as a mutual fund adviser , but I am confuse Which company is best for me, NJ or JM or any other ,who give good commision and good support for client fund. Plz advise

Thank you

Ajay

Ajay-For your information, NJ is not a mutual fund company but a broker.

I know that, but who is better?

No, jm financial, prudent??

Ajay-I never rely on both.

Please recalculate the Trail commission of Mutual Fund in the Box you have given..

Trail commission calculation is actually wrong. You have applied trail commission directly on the AUM,

But actually trail Commission calculated as below:

[Balance units * Cumulative NAV of the month * Rate/100 * 1/365]

So, at the end of 15th year Actual Trail Commission will be around Rs. 1,490 and not Rs. 18,139

Kaushal-It is just for understand the purpose that who earns more. Hence, calculating balance units and NAV will not be a point here.

If Kaushal’s calculation is correct how mutual fund agent will get more than insurance agent

Prahlad-Refer my above table.

Really eye opener article.

Do the mutual funds bought under cams and karvy are really direct plans if we choose direct option, or the same loss of wealth is there as bought with an advisor.

I’m really enjoying your blog and updating myself.

Vineet-If along with fund name there is a mention of DIRECT (For example HDFC Top 200-Growth-Direct), then it is a DIRECT fund where there will not be any middlemen. Check and confirm at your end.

Ok sir thanks.

I want join sip plan. Plz suggest plan year etc

Arvind-Unable to understand your requirement. Can you elaborate more?

Hi Basavaraj,

I have decided to be a mutual fund distributor and have enrolled for NISM test, which I will be talking at the end of this month. Before visiting your site, I had made my mind to enrol myself as a sub distributor with NJ Wealth. This was on the basis of advise of my relative who also is a MF distributor is working as a sub distributor under NJ Wealth.

Now I want to understand, the pros and cons of working under a distributor viz NJ Wealth. Like for all my efforts of selling MF to my customers, NJ will make money and pass me some. So what is that they have that I need to share my fees with them. I know that approaching each MF company to enrol as their distributor will be a time consuming task, but is it so difficult to do. How difficult is this process of direct empanelment with MF companies.

Sir, if you can elaborate in details, I would be obliged.

Sourav-At beginning it is best to be with NJ. Once your business and AUM grow, then apply for direct.

Yes, this is what my relative told me too. But I was not impressed by his explanation to start with NJ Wealth first. Apart from the training material and updates I think NJ Wealth may not offer much to me. Also the training and recommendations of funds etc are now easily available on internet. I think I am capable to learn on my own and start.

So in my case would you still recommended me to start with NJ Wealth or direct with MF companies. I am willing to take effort to approach MF companies for direct empanelment, since it is a one time effort. Another deterrent is the high joining fees with NJ Wealth, it is Rs. 10,000 to become there sub distributor.

Also sir, what is the commission sharing with distributors like NJ Wealth? i.e. how much % to them and how much % to sub distributor? Is this negotiable in the long run.

Thanks

Sourav-The positive being with NJ are-One point to dumb all companies MF applications, best software, button of click to generate beautiful reports to clients. All these at no extra cost. Hence, initially such cost effective way of doing business helps you earn more. Rest you have to decide.

Such a Very Nice Advice…..

Thanks for Sharing It….

Kiran-Pleasure.

Dear Basavaraj Sir,

I am having SIP in HDFC mutual fund for last 64 months. Rs. 2000/- per month . It is Regular Plan and Growth Option. Sir with reference to the various commissions,

1. I didNOT understand how they charge various commission from my portfolio? My broker didnot tell anything about this. I request your kindselves to please explain how these charges are affecting my portfolio?

2. Shall i redeem all the units held and switch to Direct plan instead? will it benefit me?

3. Is there any way to minimize these commission losses to the mutual fund customers?

Thanks in advance

regards

Dr Rajesh Pai B

Rajesh-I don’t know which HDFC Fund you are discussing. If you are scaring of so many expenses and your adviser also not helping, then approach the HDFC Mutual Fund Company directly.

Sir,

HDFC Equity, Top 200 and Prudence (each sip 2000/month). they have option of direct plan also. Main problem is i dont know who is the advisor. The person who approached me is out of HDFC mf now. In portfolio statement it shows some other persons name. I never met my broker sir. So totally confused about charges and commissions. Will it harm my portfolio sir?

regards

RAJESH PAI B

Rajesh-Whether your concern is about who is broker or what are expenses? If they are expenses, then clarify the same with HDFC.

Sir,

My doubt is with expenses sir, Will mail once i talk to HDFC mf sir.

regards

RAJESH PAI B

Dear Sir,

I called HDFC mf helpline and had a discussion with executive. He told me that on redemption No commission will be cut (for brokers). It will be paid from the expense ratio from mf company only. Is this true sir?

regards

Rajesh pai B

Rajesh-YES.

Dear sir

i am vijay and i leaving in saurashtra veraval i am all ready Adviser of Birla Sunlife insurance and i have interesting in Mutul fund adviser but i have not proper guide so how can i join as mutul fund adviser ,

thank & regards

Vijay-You have to clear AMFI exam. Check on their website.

Hi ,

Very nice article.

My query is regarding that my family invested monthly amount in SIP and in mutual funds. We monthly invest approx. 30K in different SIP and also made one time investment in lacs in mutual funds. As per your article on our money, agents are earning commission. Is there any way that we can withdraw money from them and can invest on our own. This way we can earn commission and also gets return on our investment.

Please suggest.

Thanks:

Aditya Jain

Aditya-You can opt for DIRECT funds where no agents involved. But do understand first how to manage funds. If your adviser providing that service which is not possible for you, then go with him. Otherwise, you can move to DIRECT funds. Refer my post “Mutual Fund Direct Plans-Who can move?“.

Dear Basavaraj, i am satish panchal living at Mumbai my age is 42 running, & i want to know which is good mutual fund in sip way or lump sum for giving me good return in long term,pls. suggest me?for child education after 5 years college expense & after another 8 years marriage expense and lastly another 8 years after i retire from job i want sufficent amount fro my retirement life. so pls. guide me or send me reply on [email protected]

Thanks

Satish-Refer my latest post “Top 10 Best SIP Mutual Funds to invest in India in 2017“.

Dear sir ,

I am living in Pune , I am regular invester in MF through SIP. But now I am intrested to start business as a MF distributer or agent . So how can I start? & where I can inquire about it ? Pls guide

Sachin-You have to clear AMFI exam. Contact any mutual fund companies or AMFI directly, they guide you.

Hi,

i just want to know only A SEBI registered Investment Advisor can charge as %on AUM..is it? or any Individual or corporate Registered as MFD can charge fee as % AUM of customers invested amount.

Srinivas-Only SEBI registered advisers allowed to collect fee from clients for their advice.

LI agents earn from Upfront Commission, Renewal Commission & Internal Contests whereby % of earning is much higher than MF Agent.

MF selling is a game of Volume, Churning in Debt/Equity & Sustainability of customer however online trading accounts & awareness is snatching away probable income

On the same line in LI, those agents earn who mostly sell endowment/traditional plans which are debt oriented schemes with almost prefixed rate of return beside Life Cover.

Neeraj-So what you want to point?

Dear Basu

Thanks for this detailed article.

I wish to understand that apart from Mutual Funds and Insurance, are there any other Financial Products which Financial Advisors can sell to their clients.

Would be great if you could guide me about these products and the commissions, if any.

Karan-Nice to see your comment 🙂 Yes, nowadays apart from MF and Insurance, few sell corporate FDs, Bonds, Loans, RE Projects and many more.

Thanks for the quick revert 🙂

Karan-Pleasure 🙂

This article misses the basic principle of compounding. An insurance commission of 35000 earned in first year will yield Rs. 111000 at the end of 15 years an an annual compounded growth of 8%

DJ-Rightly pointed and so instead of investor, an agent will be richer at end.

Hi Basavaraj,

I want to know whether it is beneficial to invest after becoming an agent or it is good to invest from customer point itself.

Please help me with this doubt.

Amrinjan-Invest based on your goal requirement.

SIR,we r in a buisness of milk distribution and manufactures and marketing of no. of products like incense sticks,fruits and vegetables,cerials,flour products etc to our registered and loyal customer.we have base of 10000 customers,my question to u is cam.we collect money on monthly basis from them at fixed rate of interest say 9-10% with quaterly compounding and invest that money in equity mutual fund and whatever money that we get apart from 9-10% will be ours….is it possible and legal?we have a sum of money around 100 crore…plz suggest

Ankit-Collecting money without RBI approval is illegal. Let them do the investment on their own and you can help them.

Your comment is awaiting moderation.

Nothing is rite or nothing is wrong in financial industry,

One who is not at all aware of savings, family security, goal setting then insurance agents force them n start the savings habit (so insurance agent is not wrong)

After a period of time he wants to make more profit by taking some extra risk in his investment perspective, MF distributor will help him (so giving commission for MF agent is also not wrong)

One fine day CFP (Certified Financial Planner) will help him to plan his financial goals going with direct investment n make him aware of many things n responsibility n he charge fee for it (so CFP charging fee is also not wrong)

Then he become expert in his investment management, Insurance n goal setting n monitoring on his own, then he don’t require any advisors or agents or planners where he has to shell out hefty commissions or fees (now hi is also not wrong)

So my conclusion is welcome everything, learn from everything ultimately be responsible for your family, don’t stop savings or investment for commission perspective, life is a lesson.

Live n let live

Madan-Whether in financial world only insurance agents have such profession which make them to force people to save? There are many who does this. So what is special in this?

Dear Sir,

Appreciate your early reply, n happy to discuss with an expert person like you, I dint mean that Only Insurance Agent will make ppl to start their savings, its one view which i have told you, thats y i am telling anyone who helps in financial planning or goal setting and helping them to reach their goals has to get some benefits so that he should also survive, however we should not encourage the agents or advisors or MF distributors who run away from giving proper service when it is actually needed, then no point of giving part as commission for such intermediaries.

Madan-How can you say that only insurance agents help their clients during service need? It is half truth.

Sir even i am an Insurance Agent and a Mutual Fund Distributor and also undergoing CFP Training, I feel IRDA has to reduce Insurance Commissions so that more and more ppl will buy insurance products and secure their families (1st Priority ). fighting for rebates and miss selling will reduce and also only the person with knowledge front can give insurance advice, many ppl are spoiling the industry by miss selling. what ever efforts we put for prospecting for years and at the time of conversion some irresponsible ethicalness agent gives more discount and grab the business. in this case its very difficult to survive in this industry, now as a planner can u survive only with fee based earnings??? is Indian market welcome this??

Plz help me

(Plz forgive, this is out of topic but felt like to share with you)

Madan-Reducing commission will not happen so easily. Second thing, survival of fittest applies to each industry including CFP. Slowly people giving importance to fee based module. It takes time, but future is in this type of planning only.

very right madan

It’s indeed a fantastic blog ! Thanks for writing such helpful content on your blog.

Very nice article throwing light upon varied aspects of commission structure…I would be grateful if you can kindly help me out in analyzing the following situation:

What is general commission rate for Debt Savings Plan MF? To be more precise, for one whose family is investing in Mutual Fund – Debt – Savings Fund through “Direct Plan”, is it more profitable for such person to rather pass NISM MF exam and do such investment of his/her family member/s in his/her own ERN (considering cumulative aggregate income of a family) ? Or would it be better to go by Direct Plan? I mean, in which case the net benefit shall over-weigh (considering cumulative aggregate income of a family) ? Bcz, by investing through Direct Plan, one gets benefit of higher NAV; & by investing through own ERN, although in name of other family member/s, one gets benefit of commission retaining in the family itself; so then which does overweigh especially considering MF Debt Savings Plan ?

Thanks in advance !

Netmail-Both are one and same right? Taking agency and earning commission on that and going for direct. Instead going for agency mode on your own is cumbersome. Instead, simply go to DIRECT.

Thank you Sirji for your valuable input

Also thanks for many other useful articles on your blog

hi sir

i want sip agent work but i have no ideai

Bipin-Even I too 🙂

sir, I am a C.A Final student, I have also cleared NISM Mutual Fund Distributors Certification Exam, I am planning to become a agent and take it up as career. Is it a good line of business??

Mehul-It is good but now after the entry of direct mutual funds it became bit unviable.

dear sir,

can you please explain direct mutual ?

thanks®ards,

Atul

Atul-Refer my earlier post on the same “Mutual Fund Direct Plans-Who can move?“.

Sir My Name Is Joyjit Chakraborty , live In kolkata,Now I m Insurance Advisor, bt Now I m Interest In Mutual Agency Pls Give Proper Guide , How I will Take Mutual Fund Agency. My contact no. 9804611085

Joyjit-You can contact mutual fund companies, AMFI or the brokers like NJ India.

Dear Basavaraj Tonagatti

Thank you for most valuable information for advisors / Investors. Could you please provide your contact details like mail id and mobile no for future guidelines

Thank you

Regards

Sethu

Trichy

Sethu-You can use [email protected] to reach me.

Sir My Name Is Mahesh , live In Mumbai, Now I m Insurance Advisor, bt Now I m Interest In Mutual Agency Pls Give Proper Guide , How I will Take Mutual Fund Agency.

Mahesh-Contact any mutual fund company or AMFI.

Thanks for the info. Great article!

Dear Sir,

I want to become SIP mutual fund agent. Could you tell me what is the process?

Sumit-There is nothing called “SIP Mutual Fund Agent”. But you can become a Mutual Fund Agent. For this, you have to clear AMFI exam. Please visit AMFI portal for more details.

Respected Sir,

Very informative article.

I have recently got ARN NO.

I want to join NJ or any other company.

Please guide.

Nalin Mayer

Nalin-In my view it is better to start with NJ.

Sir,

I am thinking of investing in Mutual funds for around 10 to 12 yrs of Rs. 10ooo to 12000 per month. which one you prefer Reliance MF Gr, Birla Sullife or SBI Magnum or any other. Total Fund will be as per Nj calculation 92 Laks + if i invest 12000 per month for 13 yrs. Shall i really get this much amount or near by this. Waiting of your valuable suggestion…. Pls….

Also mention good company name, fund name, portpolios etc details…. to invest.

Thanking you,

Vinay-What expected return NJ calculation considered to arrive at Rs.92 lakh?

Hi

Reliance Mutual Fund – Equity – general purpose – Reliance growth Fund (Gr) – for 12 yrs (145 months) total fund value coming up to 57,48,535. Shall i really get this much or less than this. below are details.

Amount Invested : 17,40,000 `

Installment Amount : 12,000 `

No of Months : 145

Total Units : 7,253.093

Total Amount : 57,48,535 `

Return : 18.4 %

please suggest me some of the good mutual fund companies to invest. and i am 45 yrs old. i would like to have corpus amount in the end. therefore suggest me which fund (equity, balance, index, etf ….. etc..) is suitable for me. Monthly i can invest max 12K.

Wating for your reply

Thanking you,

Vinay-Shall I retain or continue is purely your call. Because I know don’t your goals and for what purpose you invested. You can read my earlier post regarding my mutual fund choices “Top 10 Best SIP Mutual Funds to invest in India in 2016“.

Hi Basavaraj,

I have not yet invested , i am going to invest for about 12 yrs from this month or next month. I want to have corpus amt at 57 or 58 yrs. that is why i am asking you all the above mentioned details.

In previous mail fund value – 57L approx. (past performance). is this fund will provide same good result in future (12 yrs). what is your thought on this.

also if i stop SIP in between what will happen. Shall i get the what ever paid amount or less. ?

Thanking you

Vinay-Since few years this fund is not performing well. Hence, I suggest you to switch to some other funds of same category. Yes, you get whatever you paid for even if stopped SIP in middle.

Hi Basavaraj,

Thanks for your reply.

As you said, since few years this fund is not performing well, here are you referring Reliance MF or Birla Sunlife.

Also please suggest, any mutual funds which covers Risk factor like life insurance. I heard, there are one or two which are started recently. If so please mention.

Thanking you,

Vinay-I don’t know which fund you naming from Birla. Hence, my answer is towards Reliance. Never combine insurance with investment.

Hi Basavaraj,

I would like to invest in : Birla Sun Life mutual Fund – Equity Fund – Birla Sunlife Equity Fund (Gr). do you prefer this fund. or any other funds. Pls mention

Thanks

Vinay-I prefer Birla Sunlife Frontline Equity.

Hi Basavaraj,

what i am saying is ; the past performance of Reliance Mutual fund for the 12 yrs i considered in NJ site giving return 18% and total fund value is around 57 Lakhs

Reliance MF – Equity fund – General purpose – Reliance growth Fund (Gr) for 12 yrs (145 months) total fund value coming up to 57,48,535.

If i invest now in this portopofilio for same period, same amount (12 yrs/12000) from now on till 2027 shall i get 57 Laks or lesss, that is my question. I know this depends on market fluctuation. but approximately the figure will be more or less same or not?

I took advise from one of the MF financial consultant. He is suggesting me to invest in Birla sunlife fund… is it ok to invest in Birla?

Please clarify my doubts.

Thanking you in advanced.

Hello Sir,

I have icicidirect online account where I can buy mutual funds on my own. But one of my relative is saying he is doing mutul funds and can send an application for me to fill and send back to him. Can we go in this manual way of buying mutual funds? In this way we can help our relative for getting his commission from the company (as per your article)? or buy only through icicidirect? Please advise.

Thanks

Rukmini

Rukmini-Yes, you can go ahead with your relative too. He will also earn some commission on this.

Hi – Basavaraj

I am an IT professional, and thinking for the pension plan and one of my friend suggested 814-New Endowment of LIC including LIC Nomura Mutual fund, wherein I have to Pay 1, 54K approx for four year and than at the age of 55 I will get good return. He suggested me three term plan 22/22, 27/27 and 32/32 which I will get back in three part after 55. The investement breakup is 47K approx toward this table number i.e. 814 and 105K towards Nomura Mutual fund. So, request your expert advise which will be really helpful for me.

Regards,

Ghananand

Ghanand-Do you know the return from this endowment plan? It is around 5% to 6%. Also do you know LIC MF is a worst mutual fund company in Inida. Let me know what is GOOD RETURN which your agent shared with you. A single advice is STAY AWAY FROM BOTH.

Hi can you plz suggest me how maximum number of registered sip for a long term can give more return along with compounding effect on trial commission.

Vinay-What is your doubt? Return on investment or how the trail commission affect the returns? You want to compare the DIRECT Vs Regular?

Hello Sirji,

With due respect, very beautiful and useful post. I have come across many Financial planners, and have many a times questioned them, coz they always point out LIC agents are fooling customers. They are earning more commisions and they r selling traditional plans for great commisions but customer is not benefitting n all like crap.

But first time have seen someone mentioning something good about the insurance agents. Thanks for the information and pls do share vital informations.

FYI, Am associated with LIC as a agent.. N i know personaly how hard its to convince a client to be with LIC for long years to get higher returns along with life cover…

If ECS premium is bounced of any client agent is the one who runs to client collects the amount goes to the counter and pays on his clients behalf. For surrender, again agent is the one who will run for the clients service. For Claim settlement also agent will have to assist the family of the deceased.

All this he does coz he received commision from the premium and that he is bound to giv doorstep service to his clients.

Whereas i have seen, in mutual funds or ULIP sections agents fade away during years, and what ever service is required as mentioned in above, client is the one whos back is on fire and he has to run for it to get served. (Prove me if am wrong Sir).

Coz i am a victim too. hehehe

Regards,

Shyamkumar (LIC)

7387622626

Ambarnath, Mumbai

Ambarnath-Nothing comes free. That applies to agent’s income. If they provide quality service then they earn. Hence, don’t say earning commission comes with hard work. For your information, ULIP is an insurance product and it is sold by agents but not by mutual fund advisers. In the financial field, you come to know LIC agents, mutual fund advisers fade away. Hence, this not applies to only mutual fund industry. It is rampant in all.

Mr. Basavraj,

Thanks for your reply. FYI, my name is Shyamkumar and not Ambarnath. Ambarnath is the place i live in..

What income is generated by means of selling Term plans and health plans.. its less as the premium is lower. But then too agents do give service to their client as the need may arise. LIC agents dont fade away..

Shyamkumar-Oh is it? Sorry then 🙂 LIC agents not fade away? check the drop outs of an insurance industry or IRDA report.

I AM VICTIM OF LIFE INSURANCE AGENT. 1ST YEAR HE SERVED ME BUT AFTER THAT HE DID NOT CONTACT WITH ME EVEN ON SEVERAL CALLS. I CONTACTED MY FRIEND WHO IS A FUND ADVISOR AND THROUGH HIM I AM NOW PAYING MY PREMIUM. LIC AGENTS ARE NOT LOOKING AFTER THE CLIENT AFTER EXPIRY OF ONE YEAR. THIS THE EXPERIENCE MANY OF US.

Asoke-You can opt for online payment, why you rely on an agent?

Recently i have passed out amfi exam and start work with nj as a mutial fund advisory. Kindly suggest am i in right direction and is it fruitfull work as regard earning. I want to tell you that i had worked as a insurance advisor since 2005.

Barkha-Go ahead and best of luck 🙂 I too still with NJ.

what is NJ ?

Atul-NJ India is a mutual fund broker.

Hi Basavaraj,

I went through your article which is good. I can understand the kind of research you have been doing.

As you have rightly pointed out, customers should be treated properly. Yes, one should make money for his living but not at the cost of a customer. Unfortunately, a lot of misselling happens in the insurance and mutual funds industry.

I want to know about ULIP? Is it a good product at all even in its new “avatar” ?

Wishing you great luck !!

Regards

Venkat

Venkat-Thanks for your kind words 🙂 I suggest not to touch ULIP. Reasons are-I am strictly against Insurance with Investment, your money get locked and no option to switch to other funds or other options (in case the fund is not performing well) and it is hard to find the historical data of the fund to judge whether the fund is beating the benchmark or what.

Very good article sir 🙂 Thanks for the info

Very useful information but also include how to become a mutual fund agent. This will help a lot of aspirants.

Thirumal-You can contact any mutual fund company or AMFI.

It’s rare to find such articles. Really Good.

Fortunate to come across your website.

All the best for future. 🙂

Ravi-Pleasure 🙂

Hi Basavaraj,

Very nice and informative article.

I’ve a different question which may be off topic, so I’m sending you a mail for that, hope to see your reply.

Thanks and Regards,

Yogesh Sidana.

Yogesh-Sure you can.

Hi,

I had sent you a mail and hope you must have received it by now.

I’m eagerly waiting for your reply sir.

Thanks and Regards,

Yogesh Sidana.

Yogesh-I am out of city now. I may reply to you once I am back.

Hi,

Very Nice post. Can you please tell me the detail process of buying DIRECT SIP. i.e. No Agent, No Portal.

Prashant-It is explained here at “How to switch to direct plans of Mutual Fund?“, “Mutual Fund Direct Plans-Who can move?” or “How to invest in Mutual Funds in India online?“

does it mean that whether one invests through agent or directly or on line – up front commission as well as trail commission will be payable in all cases.

Piyush-Upfront and Trail commissions will not be there if you invest in DIRECT plans. But yes if you invest through agents, directly (without opting direct plans) or online portals then you have to pay the commission.

Hi sir….

I have got fan of yours after reading your artical.As you told the mantra of success.Really it touched to my heart.

I am an insurance advisor in HDFC life but what I have seen in the traditional policies it not give a good return to customers.

As you know every insurance company launch a good policy some time for customers which gives good return and wealth creation. And as this time IRDA has became more strict on this so I consider the ULIP plan where agent commission is very less (3to4%) and all profit goes to customers and customers also can chose their fund allocation on that.

But sir I want to work for customers where I also want to earn mony but I want to give them a good profit.

So I have decided to join MF as well.

I want to work under you guide line if u deciede that I am the person who want to grow but who also want to give good return to their client.

Thank you Sir for your arrival.

Deepak

8882133820

[email protected]

Deepak-Thanks for your kind words. But I work solely and manage everything myself. So currently I don’t need any another hand. But I can defenitely help you in building your business. Always welcome for the same and better to mail me instead of posting comment at my mail [email protected].

sir, plse suggest me diffierence in nav of mutualfund purchased from amc & by mutualfund agent.

Narendra-Difference between two NAV=Agent’s Trial and upfront commission. So if you go directly then it will be less of that expenses.

Respected sir,

I want to start a business firm regarding mutual fund,life insurance,general insurance and more.already I am a irda holder &from last 8years working in life insurance co.but now I have to start my own company or firm.Pl tell me the procedure of starting a new company by appointing a sales executive and perform the work from this sales persons.tell me about ARN CODE.

Thanking you sir,

Awaiting for your fast reply.

Regards,

Sameer wadelkar.

Sameer-Sir I am not expert in this matter.

sir i am insurance agent of lic of india now i am also interested in selling mutual funds so pl give me proper guideline so that i can get proper way to start buisness as early as possible

Vishal-You can start the business. For more details visit AMFI website.

Hi Basavaraj,

I need a suggestion,I have a SIP of 5000 which my financial planner has suggested to me based on my goal,requirement and investment horizon

Now that SIP is available through direct investment and I am also planning to start one more SIP for my wife where the goals are same

Does it make sense to go with the same SIP for direct?

Regards

Praveen

Praveen-If your financial adviser not adding more value to your investment and you are confident of handling and reviewing your investments then definitely you can move to direct plans.

Hello,

Can I become financial adviser of only one mutual fund or multiple mutual funds are possible ?

Kalpit-You can associate with all mutual funds of your choice. It is not life Life Insurance.

Thanks.

One more doubt mate. Can I appear for “NISM-Series-V-C: Mutual Fund Distributors (Level 2) Certification Examination” without giving Level 1 certification ?

Kalpit-Please contact NISM.

Hi Basavaraj,

I want to go for long term investment in MF .

Can i get minimum of 15% returns anuaaly in MF.

Yogesh-How much is long term according to you?

Sir

I want to be MUTUAL FUND Adviser.

Kindly guide.

Devinder kumar

MOB:9872253630

Devinder-You can contact AMFI or any mutual fund companies. They will guide you.

Hi,

I have read all the articles of you and find it more useful. In particular, the tone used by you is superb even if there are rude comments from the people. Keep it up..

I am in need of help from you in becoming MF advisor.

I have been analysing the equity markets since June’2010 and an active investor through HDFCSEC initially and thru Sharekhan now. I have been investing in Mutual Funds through Direct Investment plan for 2.5years in SIP plan.

I am planning to become Mutual Fund Advisor and needed few suggestions in this regards.

I knew that NISM exams are to be cleared as a initial step. But the issue is that I am not sure which exam has to be cleared from the below 4exams.

1)NISM Series V A: Mutual Fund Distributors Certification Examination

2)NISM Series V-B: Mutual Fund Foundation Certification Examination

3)NISM-Series-V-C: Mutual Fund Distributors (Level 2) Certification Examination

4)NISM Series II B: Registrars and Transfer Agents (Mutual Fund) Certification Examination

If you could guide me with the correct assessment to be cleared or refer me to suitable persons for becoming a MF advisor, it would be of much help for me.

Also, please let me know the next step in the process after clearing the exams.

Contact No : 9789286692

Kumar-Contact AMFI and they will guide you.

Thanks.

I have dropped a mail to them and expecting their reply for the same.

Hi Kumar

the above series will be like this

1- MF Foundation

2- MF VA

3-MF VC

4- MF RTA

FOR ANY ASSISTANCE CALL ME 8826418871

Karan Sinha

IFA

You have mentioned about various charges that are indirectly debited from investor. Are those collectively represents expense ratio of a mf product or it is something additional to that. ?

Also I read about your blog on various mode of investing in mf. I am having a Demat account with hdfc sec. If you can tell me, if I transact through Demat account what are the possible charges that they ll detect either in sip or lump sum mode. N in future if I wish to close the Demat n tradding account, will I be able to still continue having mf or should I sell or what happens?

many thanks for your blog

Elam-Officially they included in expense ratio. But few days back I found that apart from these expenses mutual fund companies offer higher commission to agents to lure advisers (which is unofficial). Your Demat account provider may charge upfront some amount for each new investments (either lump sum or SIP) and apart from this they will earn above said regular commission. So in my view this will be costlier. If in future you tried to close the account then your investment will in non demat format only (which I think will not differentiate that much). Instead, I suggest you to go for DIRECT plans if you are very much comfortable with mutual fund investments.

Dear Sir,

I am from Bangalore.

I have recently joined with TATA AIA as an Insurance Agent for Life Insurance & TATA AIG for General Insurance. Though I am a Commerce Graduate, barring my first 8-9 years of career in Accounts, I worked nearly 20 years in non- finance domain. I had to quit my job due to an accident leading to couple of surgeries on my knee.

I am 50+ and hence getting back to a job is not very easy. So, I got into this field. I require couple of advise from your end.

1. Since, the business of Insurance is driven basically on personal contacts, how one can carry forward and extent the contacts. There are some people providing data of HN1 people charging some fee, but are they reliable ? Is there any other way/ ways to find the prospects ? Solicit your kind advise.

2. Would also like to know how one can enrol with NJ India / Funds India post qualifying the required Exam ?

Look forward to your reply.

Thanks & best regards,

Raveendran.K

+8971224505

Raveendran-First of all sorry to know about your accident. Below are my suggestions for you.

1) Instead of concentrating on selling, try to spread the awareness about insurance among your known. Never try to sell product. Once they understand the value of insurance then let them ask about product. I know it may take time but in long run this is a MANTRA of success. Also never look for short term gains like selling a product which suites to you. Instead always be client centric.

2) I already passed your contact information to Mr.Srikanth, Director of FundsIndia. Someone from his team will contact you and describe you the procedure. It is good to associate with FundsIndia as they offer online platform and this all clients of today’s generation need.

Dear Sir,

Thanks for the advise. Through out my life I have always upheld the values of Ethics and always worked in the interest of my Clients/ customers.

Post qualifying the IRDA Exam (through TATA’s), I have just forayed into this field. I have only very limited circle of Friends. Can Social Media Network like Facebook & Professional Networks like Linkedin are of any help in spreading the awareness of Insurance ? Kindly guide me on this.

FundsIndia people did contacted me … I wanted some add on beyond Insurance and planning to take MF relevent Exam very shortly.

All this I am doing for enabling me to get some Income in a decent way to keep the things going at my end.

Thanks & Regards,

Raveendran.K

Raveendran-Social media definitely will increase your business, if you use it in right perspective. Otherwise they will consume your day. Hence first acquire knowledge about your profession, be update on this and spread this among known. Success will follow slowly. Best of luck 🙂

SIR

Is becoming a mutual fund distributor, a good option?

My father is a financial advisor in a company and he wants me to open up a mutual fund distributor company

Should I go ahead?

Ayush Jain-Go ahead and work sincerely keeping clients interest first in mind.

Thank you for your advice sir.

Ayush-Pleasure 🙂

sir,

I am totally new in the field of mutal fund sector. your valuable advise would help me/direct me to invest in which mutal fund for the long term. I am now at the age 40 and for 15-20 year which mutal fund would be benifical to me @ 1000 p.m. Also sir indicate the company name for the mutal fund.

Devendra-You can select Franklin India Bluechip Fund (G).

good comparison financial planners are available in any city. to encourage the public by investments with financial planners only. they give good suggestion without selfishness.

Hari-Pleasure 🙂

I have passed the AMFI exam, how to join as mutual fund advisor. pls help me out…

Sandeep-Either you can enroll with individual mutual fund companies to do business with them or you can enroll with the big brokers like NJ India or the online platforms like Funds India. I am with NJ India since 5 years and I don’t have any problem in service or payment issues.

hey dear… can u compare NJ India Vs Carvy .. i need suggestion from u … thanx

Mukesh-Both are brokers then what you want to learn more about these brokers? Is it related to service?

Hi Sundeep,

I am planning to write the necessary exams for becoming Mutual Fund Advisor.

Could you please help me with the names of the exams from NISM?

Is the below exam is sufficient for becoming the advisor?

NISM-Series-V-B: Mutual Fund Foundation Certification Examination

You can contact me at 9789286692 if you could provide more details such that it would be very useful for me.

Kumar-Contact AMFI.

Can you consider the cost of services by any profession insurance agent provide for 15 years. if you minus the same then I think insurance agent earn quite less. I do agree many agent quit their profession but same time professional agent do manage orphanage policy of their client.

I am one of leading agent of LIC and managing almost 4000 policy out of which 2,500 policy of some other agent and providing services to client without any personal benefits.

Bankin-Can you elaborate meaning of “Service” when you are providing to your insurance clients? At the same time Mutual Fund Advisers will not bear the heat of this after sale “Service” expenses?

Hi, Basu

I agree with what you said that MF advisor earning more than an insurance agent, but in above table why you have cumulative added Rs 1,00,000 every year in MF because looking to the above table it sounds like insurance agent selling a policy of Rs 1,00,000 one time and earning Rs 1,10,000 total in 15 years but MF advisor is selling every year Rs 1,00,000 for 15 years than after completing of 15 years he would get Rs 1,10,972 which is according to your above calculation.

Please explain or post a new chart showing correct calculation, that selling of one time of Rs 1,00,000 either a insurance policy or MF scheme how much a advisor will earn ?

Anand-I showed a cumulative increase in value each for MF because MF agent’s trial commission is based on the AUM. There is no other intention than that. Instead of looking at that cumulative increase, look at investors perspective who is paying an equal amount to MF and Insurance and who is earning more.

Sure in future will do that post also where one time investment in MF and Insurance calculation. Thanks for giving me an idea 🙂

not possible as such party will not continue till the period in MF

Dipak-Then mutual fund investment especially is long term or short term? Ideal equity investment will be of long term hence investors who are looking at short sight either eager to book profit or loss. Here my intention is to show the returns to agents. Also let me say you one thing, making them stick to plan and making them to contribute for long term depends on planners take also. So plainly putting blame on investors is not prudent.

The analysis is fine. I have come across with similar comparisons earlier elsewhere. Insurance is, at least for some people , a need and they think they have satisfied it by purchasing a policy, some fear the loss of surrendering a policy, some continue it for tax benefits and finally some think that after paying instalments so many years there are vew few years left so continue, some progress in their economic life to such a level that they feel the premium is so small to care about and for all these reasons policies continue and agent continue to earn. This is not the case with mutual funds what are sold with the special benefit/feature of liquidity. People do not believe in the markets. If they happen to get positive experience initially, then they continue but always want to book profits barring exceptions. Many even equate it with shares and want to trade. It’s a difficult task for the mutual fund agent right from selling till liquidating the investments and it’s a challenge to retain the customer for long period into the investments as compared to the insurance agent. I feel mutual fund agent should rightfully earn more or at least equal to the insurance or any other agent. The above facts mentioned by me ensure stady flow of income to the insurance agent but nothing like that for mutual fund agent. Then there is a danger of switch out/change of broker/direct plan etc. The calculations assuume a period of 15 years which for various reasons given above can be true for insurance but not for mutual funds. Even average SIP continuation period is around 3 years (not sure but remember having read).

Second point which I would like to raise is why there is so much enthusiasm about disclosing the commissions whereas no other product/service is disclosing it. Nobody expects from any product seller or service provider to disclose his commissions. Any person is spending at least 8 to 10 times more money on products and services other than mutual funds and nobody is disclosing the profits then why only mutual fund distributors have to disclose it? This is not correct. If it is transperency then it should be in all products and services. Why only mutual funds are singled out?

DB Desai-Thanks for your long review 🙂 I agree your point with why investors stick with insurance. But regarding mutual funds, when you plan client with specific goal and making them understanding the importance of goal and reviewing it on periodic base will actually boost their confidence and faith. But sadly majority of mutual fund agents just eager to sell the product rather than knowledge+product. This is lacking investors in confidence about mutual funds.

Regarding your points of switch to other schemes, I think agent will not loose anything. Now changing broker or going direct plans, I think it is because of agent’s inefficiency in serving the client. So i don’t think these two are negative to any mutual fund agent who is confidence about his knowledge and quality service. Now study showing average period of investment-Is it 100% reflect the whole Indian mutual fund industry? If so can you share those data on this platform, so that others too can get knowledge about the same.

Now a great issue you raised-Disclosure 🙂 Friend when you are doing ethical business then what prompting you not to disclose. If you are so confident about knowledge and the service your are providing and in return you are getting as commission to that value addition then what is wrong in that? Here I am not saying only disclosure about mutual fund agents commission structure but also from insurance agents too. Do you know their are plenty of insurance agents who disclose their commission to clients and do 100% no commission sharing business? It is our attitude that makes us difference than brooding on other things.

I a eagerly looking at your reply 🙂

Considering time value of money insurance advisor makes more money

Narasimha-Yes you are right but what about the time value of money to insurance buyers (I mean traditional insurance products) 🙂

Partly agree with you. But the problem is Insurance investor STAYS for 15 years., but very few rare mutual fund investors stay invested even for 5 years. They take out money and very rarely come back.

Very fickle minded.

Srikanth-I agree with your point and the same points were expressed by me in your FB page. Reason for staying with insurance and liquidating early with mutual fund investment is-LIQUIDITY. So it is very big task to make investor stay invested for as long as 15 years.

Good article sir. 🙂

Sunil-Thanks.

Very nice post! Which is more difficult to get established in? I have seen life insurance agents operate out of a small office or their house. They have a small but loyal client base, I would imagine it would be tougher for a mf agent to operate in that kind of setup.

Pattu-I partially agree with your point. Just check out how many mutual fund agents actually have their own office…hardly few and the most advantage to them is the commission structure which obviously make them to say-no income so no sharing…but this is not the case with insurance agents.

I have very little idea about how mf agents operate. hence the question. Thanks

Pattu-I understand and respect your views always 🙂 you are inspiration to all financial planners fraternity. Thanks once again for your valuable comments 🙂

If you extend beyond 15 years, it seems that MF adviser is better.

Anand-Exactly it start to manifold as investor stays in 🙂