What are the Latest Income Tax Slab Rates for FY 2022-23 / AY 2023-24 after Budget 2022? Are there any changes to applicable tax rates for individuals? Let us see the details.

Note – Refer our latest posts based on the Budget 2023 announcement.

- Revised Latest Income Tax Slab Rates FY 2023-24

- Budget 2023 – 12 Key highlights impacting personal finance

In this post, my concentration is to share with you the Latest Income Tax Slab Rates for FY 2022-23 / AY 2023-24 and applicable Security Transaction Tax (STT).

Budget 2022 Key Highlights

Considering the current updates available after the Finance Minister’s speech. However, I will update this section once the documents of the budget speech and Finance Bill are available.

# No change in tax slabs

There is no change in tax slabs.

# Digital Currency Introduced

RBI will launch the Indian version of Digital Currency.

# Revised Tax Filing if you missed some information

If you missed sharing certain tax information while filing ITR, then you can do the same by revising within 2 years from the end of the relevant assessment year. Rest details will be updated soon.

# Tax Relief for persons with disabilities

The parents or guardians can take insurance from their children with disabilities. The payment of the annuity or lump sum for the disabled dependent will be exempted during the lifetime.

# Digital Assets are taxed at 30%

The government will tax income from digital asset transfers at 30%. No deduction is allowed while computing income except cost of acquisition.

Loss cannot be set off from any other income. Also, even the Gift of digital assets are taxed at the receiver’s end. I have written a detailed post on Crypto taxation and you can refer the same at “Cryptocurrency Taxation in India – Budget 2022“.

The difference between Gross Income and Total Income or Taxable Income?

Before jumping into what are the Latest Income Tax Slab Rates for FY 2022-23 / AY 2023-24 after Budget 2022? Are there any changes to applicable tax rates for individuals? Let us see the details., first, understand the difference between Gross Income and Total Income.

Many of us have the confusion of understanding what is Gross Income and what is Total Income or Taxable Income. Also, we calculate the income tax on Gross Income. This is completely wrong. The income tax will be chargeable on Total Income. Hence, it is very much important to understand the difference.

Gross Total Income means total income under the heads of Salaries, Income from house property, Profits and gains of business or profession, Capital Gains or income from other sources before making any deductions under Sections.80C to 80U.

Total Income or Taxable Income means Gross Total Income reduced by the amount of permissible as deductions under Sec.80C to 80U.

Therefore your Total Income or Taxable Income will always be less than the Gross Total Income.

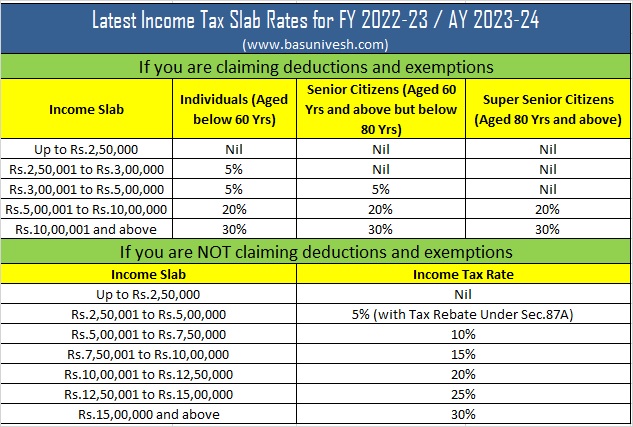

Latest Income Tax Slab Rates for FY 2022-23 / AY 2023-24

There were no changes proposed in this Budget 2022 with respect to income tax slab rates. Hence, the old rates will continue for FY 2022-23 / AY 2023-24.

There will be two types of tax slabs.

- For those who wish to claim IT Deductions and Exemptions.

- For those who DO NOT wish to claim IT Deductions and Exemptions.

Let me explain both the slabs as below.

Now, if you wish to choose the new tax regime, then you have to forget the below deductions or exemptions.

(i) Leave travel concession as contained in clause (5) of section 10;

(ii) House rent allowance as contained in clause (13A) of section 10;

(iii) Some of the allowance as contained in clause (14) of section 10;

(iv) Allowances to MPs/MLAs as contained in clause (17) of section 10;

(v) Allowance for income of minor as contained in clause (32) of section 10;

(vi) Exemption for SEZ unit contained in section 10AA;

(vii) Standard deduction, deduction for entertainment allowance and employment/professional tax as contained in

section 16;

(viii) Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23.

(Loss under the head income from house property for rented house shall not be allowed to be set off under any

other head and would be allowed to be carried forward as per extant law);

(ix) Additional deprecation under clause (iia) of sub-section (1) of section 32;

(x) Deductions under section 32AD, 33AB, 33ABA;

(xi) Various deduction for donation for or expenditure on scientific research contained in sub-clause (ii) or sub-clause

(iia) or sub-clause (iii) of sub-section (1) or sub-section (2AA) of section 35;

(xii) Deduction under section 35AD or section 35CCC;

(xiii) Deduction from family pension under clause (iia) of section 57;

(xiv) Any deduction under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA,

80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc). However, deduction under

sub-section (2) of section 80CCD (employer contribution on account of the employee in notified pension scheme) and

section 80JJAA (for new employment) can be claimed.

However, there are certain deductions you can still claim using the new tax regime and they are as below.

- Retirement benefits, gratuity etc.

- commutation of pension

- leave encashment on retirement

- retrenchment compensation

- VRS benefits

- EPFO: Employer contribution

- NPS withdrawal benefits

- Education scholarships

- Payments of awards instituted in public interest

Which one to use for the highest tax benefits?

It is not yet clear and hence it is hard for me to say anything BLINDLY. However, going by changes, I assume it changes from individual to individual. Hence, you have to calculate on your own and adopt the one which is more beneficial for you.

CONFUSING RIGHT? YES, as per me, this new tax slab regime is the most complicated tax slab rate any government introduced. Now many individuals will be in a dilemma of which one to use, the ADDITIONAL one along with the existing headache for taxpayers of HOW TO SAVE MORE TAX.

Note: – Along with the applicable taxes, you have to additional surcharges at below rates.

- Surcharge:

- 10% surcharge on income tax if the total income exceeds Rs.50 Lakhs but below Rs.1 Cr.

- 15% surcharge on income tax if the total income exceeds Rs.1 Cr.

- Health and Education cess : 4% cess on income tax including surcharge. This Health and Education Cess replaced the earlier 2% Education Cess and 1% Secondary and Higher Education Cess from Budget 2018.

Whether the interest earned from PPF, EPF, or SSY (Sukanya Samridhi Yojana) is taxable?

There is one more confusion among many of us if one adopted the new tax regime, then whether the PPF, EPF or SSY will remain tax-free? The answer is YES.

Once you adopt the new tax slab by not using any deductions or exemptions, you are just forgoing the tax-saving part of these schemes. However, the interest earned and maturity amount will remain tax-free for you as it was earlier.

Earlier these products used to be classified as EEE (Exempt-Exempt-Exempt) but now they turned into TEE (Taxable-Exempt-Exempt).

Security Tranction Tax (STT) Rates for FY 2022-23

Below is the STT Rates applicable for FY 2022-23.

Conclusion- As usual there are no big changes when it comes to personal finance in this Budget 2022.