In Budget 2021, the EPF taxation rules changed. Now, if an employee contributing more than Rs.2.5 lakh in a year, then such an additional amount is taxable for the employee.

Refer to this latest CBDT NOTIFICATION before reading this post – Taxation of EPF contribution above Rs.2.5 Lakh – CBDT Clarification

Refer our latest post on this topic “EPF contribution above Rs.2.5 Lakh Taxable“

There are many individuals who have the mandatory contributions to EPF. For them no option but to pay the tax. However, those who are contributing to it through VPF then felt this new taxation law as if a breach of their trust in this Government.

However, think for a while from the Government’s point of view. Generating 8.5% GUARANTEED returns is not so easy. Hence, to reduce their obligation on EPF, the Government introduced this taxation rule so that one may not use the VPF route.

EPF is the best debt instrument for your retirement goal. Who will give you the current 8.5% tax-free returns in the current scenario?

Investing more than Rs.2.5 Lakh in EPF is still the BEST strategy!!

Many are crying as if their door to wealth is ended after this new tax law. However, I still suggest EPF is the best option for your debt part of your retirement goal.

# Post Tax Returns are still higher than any other instruments

Let us assume that your EPF contribution is Rs.4,00,000 a year (inclusive of EPF+VPF). Now in this, interest earned on up to Rs.2,50,000 is tax-free. On the remaining Rs.1,50,000, the interest earned is Rs.12,750. Do remember that interest on EPF is compounded monthly but credited yearly. However, for simplicity sake, I am considering the 8.5% interest on the whole Rs.1,50,000.

Now you have to pay the tax on this Rs.12,750 as per your tax slab. If you are under the 30% tax slab, then your post-tax returns will be Rs.8925 (5.95%). If you are under a 20% tax slab, then your post-tax returns will be Rs.10,200 (6.8%). Finally, if your tax slab is 10%, then your post-tax returns will be Rs.11,475 (7.65%).

Assuming you are under the highest tax bracket of 30%, who will give you the 5.95% tax-free returns in the current scenario?? Bank FDs? Tax-Free Bonds? RBI Floating Rate Bonds or NCDs??Debt Funds (Refer to the taxation of Debt Mutual Funds at “Mutual Fund Taxation FY 2021-22 / AY 2022-23 | Capital Gain Tax Rates”? Many may argue that Gilt Funds since few years generating fantastic returns of around 10% to 12%. However, these are pre-tax returns at first and the second aspect is that they generated fantastic returns mainly because of the downtrend in the interest rate market. What if the trend reverse??

However, there may be few instruments like PPF which may be offering higher tax-free returns than the EPF post-tax returns on the amount which is taxable as per the new tax rule. Calm down….let us move to the second important point.

# Interest on this additional amount is not taxable from subsequent years

One more important point mentioned during the Budget 2021 is that “provisions of these clauses shall not apply to the interest income accrued during the previous year in the account of the person to the extent it relates to the amount or the aggregate of amounts of the contribution made by the person exceeding two lakh and fifty thousand rupees in a previous year in that fund, on or after 1 st April 2021, computed in such manner as may be prescribed.“.

It means, the EPF of what you contributed in the year (on which you are forced to pay the tax) if we take the example of above of Rs.1,50,000 and interest of Rs.12,750 in total to be considered as a principal for the next year compounding (Rs.1,62,750). Interest on this Rs.1,62750 is tax-free from subsequent years.

Hence, this new taxation is applicable only for the year where you contributed more than Rs.2.50,000. From the second year onwards, any interest you earn from this is COMPLETELY TAX-FREE.

Do you think it is wise to earn 5.9% on first year and from second year again 8.5% as usual than experimenting with some other products??

Conclusion:-Considering the current interest rate scenario, even though the Government disheartened many by imposing this tax, I think we look into the investment options available and the subsequent years tax treatment offered to us, EPF is still the best option for your debt part of retirement goal.

Refer to our latest posts:-

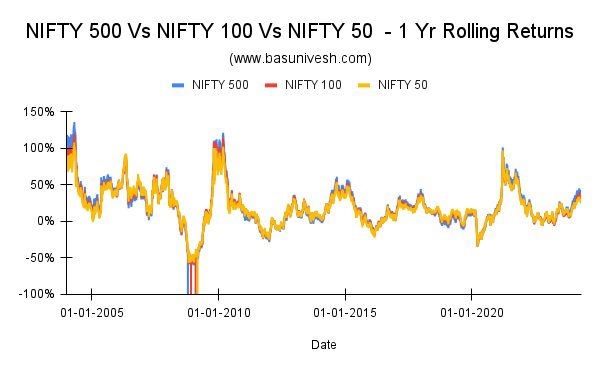

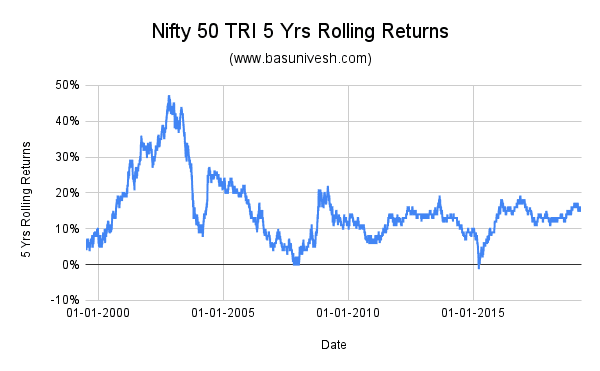

- Should we invest in Nifty 500 Index Fund?

- Opted New Tax Regime – Should I stop investing in PPF, SSY, and NPS?

- Is It Wise for Young Long-Term Investors to Put 100% in Equity?

- Can Arbitrage Funds give negative returns?

- We are now BasuNivesh Fee Only Financial Planners !!

- Is it safe to invest in Small Finance Bank Fixed Deposits?

35 Responses

Have we got the official notification on this regard (Interest taxation on subsequent years) from CBDT?

Dear Mani,

Yes, it is taxable.

Hello,

Is there now clarity in writing from government gazette notification that the VPF will be tax only once and not from second year please?

Appreciate a link to the notification.

Thank you

Dear Tarun,

As of now, no such notification.

Thank you for your article. But you sounded confident in your article that there will be no tax in subsequent years from the amount invested in previous year. Have your opinion changed ?

Dear Rohit,

As long as there is no official notification on this aspect, let us be CONFIDENT 🙂

hello, assume no word yet too?

Dear Tarun,

Yes.

As long as there is no official notification on this aspect, let us be CONFIDENT IN GOVT’s GREED FOR TAXPAYERS MONEY

Dear Nehal,

Whether it is Govt’s greed or members greed, let us wait for clarity.

Dear sir,

My EPF balance is reaching 90 Lakh this year. Due to personal issues I have to quit my job. Is it wise idea to keep the EPF as is as I heard even the in operative account will earn interest , although the interest earned will be taxable.

Can I use this fund as regular source of income by withdrawing the interest portion earned every year keeping the rest of the fund as is ?.

Even though the interest of around 7 lakhs per year will be taxed , but if you are not working and with proper plan you can avoid most of the tax on this amount ( I heard upto 5 lakhs).

How easy or difficult to withdraw from EPF every year giving some reasons.

Dear Santosh,

Withdrawing or not depends on you. Yes, it is taxable. You can’t withdraw the yearly interest ONLY.

Dear Sir,

Have we got the official notification on this regard (Interest taxation on subsequent years) from CBDT? Need to declare VPF to employer by 1st week of March for next year. The decision to park retirement savings in VPF or other avenues (NPS/MF) is based on this notification and the interest rate they declare for EPF for FY 2020-21.

Thanks

mod ets2 indonesia

Dear Mod,

As of now no.

I invest 60000 in PPF and more than 5 lacs in VPF.

Should I increase investment in PPF to 1.5 lac.

Pl advise.

Dear Sanjeev,

Hard to say BLINDLY.

Let me put my question clearly.

Is interest income from PPF taxable in any case ? If not, I can decrease contribution in VPF and invest the same amount in PPF.

Dear Sanjeev,

Interest earned from PPF is tax-free. My intention of saying is that don’t use VPF or EPF just from the taxation point of view. Look into your actual need. If the products suitable for your goals, then go ahead.

Thanks for sharing a very nice article, in depth analysis and useful information, Sir. Appreciate your efforts. Few clarifications.

a) Do you foresee the interest on PF (and so VPF) will remain around 7-8.5 percent owing to labour ministry pressure at least for next few years. This will help the conservative investors to continue with PF/VPF (as it is still better than FD) rather than risky/unpredictable MF.

b) If the interest above 2.5 lakhs deposited from Apr 2021 is not taxable in subsequent year (other than the first year), conservative middle aged (45+) investors with decent balance already in PF should continue for more years in VPF rather than freshly investing in MF/Stocks as otherwise they will be losing the compounding interest (guaranteed) benefits in PF.

c) For moderate middle aged investors, do you suggest moving a portion of this VPF to NPS Tier 2 rather than MF? Any thoughts/suggestions…

Dear Ramesh,

a) I assume it will remain more than the regular debt instruments.

b) Compounding is also in MF and Stocks. However, it is not in a linear way like EPF.

c) Better to move to NPS and this is what the Government intention also 🙂

Whether Employer’s contribution towards EPF (3.67%) also part of 2,50,000?

Dear Manjunatha,

These new rules are only related to employee’s share but not the employer’s share.

Dear Sir,

I think CBDT has confirmed that this interest is taxable every year. Just for your review and to update the article.

https://economictimes.indiatimes.com/wealth/tax/fd-model-for-tax-on-2-5l-contribution-to-employees-pf/articleshow/80676208.cms

Dear Abdus,

Let wait for official notification but not the media interviews.

Hi,

The government will mandate EPFO to account all interest above 2.5 lakh in separate section and is going to show in the statement in subsequent. So if anyone is planning to invest in VPF thinking its only for the first year need to be careful here.

Dear Sony,

Easy to say and float but hard to implement and especially if it is from EPFO. Let us wait and watch.

Dear Sir,

Have we got the official notification on this regard (Interest taxation on subsequent years) from CBDT? Need to declare VPF to employer by 1st week of March for next year. The decision to park retirement savings in VPF or other avenues (NPS/MF) is based on this notification and the interest rate they declare for EPF for FY 2020-21.

Thanks

Ramesh

Dear Ramesh,

As of now, NO.

An eye-opener with all details nicely explained especially the calculations. This is the reason I regularly check your blog.

Dear Ashok,

My pleasure.

I think the interest that is deposited is not taxable subsequent years. But the interest principal above 2.5 lakh each year would be taxable. They excluded interest as they don’t know the tax slab paid . But keeping this excess principal in separate bucket each year interest earned can be taxed. So only interest earned on interest in subsequent years not taxable. Interest earned in principal each year is taxable

Dear Mohan,

Easy to say but hard to implement. Let them first implement (especially EPFO) of what they usually say. I know, there is no clarity as of now on this part. But let us wait for their clarity. Many of such rules thought at high level but never thought of real difficulties.

Many thanks for this clarification which is extremely crucial for planning PF/VPF continuity. If the next year’s interest on this “additional/above 2.50 lakh threshold” is not going to be taxed at all, then, of course, it makes immense sense to continue with the additional contribution to PF/VPF.

Dear Kamal,

It is nowhere mentioned in Finance Bill that the subsequent years interest is also taxable.

Nice information