I think many of us shocked when interest rates of Post Office Savings Schemes slashed on 31st March 2021. Yes, it is obviously shocking news for many. However, as a damage control mode, FM reinstated the order. It is mainly because of Elections in some parts of India. Hence, we may expect such action in coming quarters. In such a situation where to invest our debt part?

On 31st March 2021, when the Government announced the Post Office Saving Schemes interest rates for April – June 2021, many felt like life is going to end for the common man. In such a situation what action one can take or adopt the strategy?

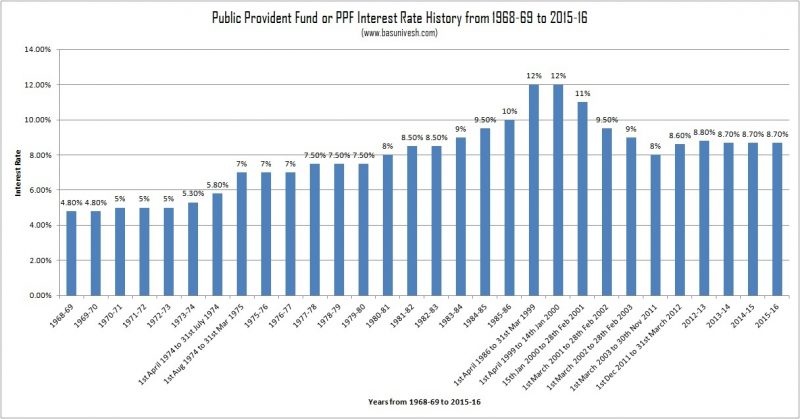

Almost 46 years back the PPF interest was below 7%. Refer to the below image of how the PPF interest rate was earlier from one of my earlier posts.

I know it is a very difficult time for many who are completely relying on such instruments. The second wave of Corona, skyrocketing fuel prices, actual inflation is shooting up but interest rates of small savings schemes are falling.

Interest Rates of Post Office Savings Schemes may be reduced – Where to invest?

In this post, I am want to share my views with respect to what strategy or mindset one can adopt for their debt part of the investment.

# Accept the REALITY

I want to share the quoe of Gerd Gigerenzer from his wonderful book “Risk Savvy: How to Make Good Decisions”.

We teach our children the mathematics of certainty—geometry and trigonometry—but not the mathematics of uncertainty, statistical thinking. And we teach our children biology but not the psychology that shapes their fears and desires. Even experts, shockingly, are not trained how to communicate risks to the public in an understandable way. And there can be positive interest in scaring people: to get an article on the front page, to persuade people to relinquish civil rights, or to sell a product.

For our inestments, we must learn the art of accepting and managing such uncertainities of life.

Many of us who are currently alive, never saw such a low-interest rate regime in our life. Hence, each passing day turning to be horrific for all of us to accept the 3% to 5% debt products returns.

Decades ago we were enjoying around 10% returns on few of such schemes. Now they are almost half. We can’t control the economic trend. It is not in our control. Accept this reality. We can control things at our level but not at the economic level. This applies to both the debt and equity markets.

If you noticed the interest rates of Post Office Savings Schemes of last one year, Government not changed it. Even though interest rates were falling, Government retained it mainly because of Covid or some political moves. However, we can’t expect the same in future.

# Think of REAL RETURNS

Whether it is the current 5% returns regime or 10 years back 10% returns regime, the truth is that we never get satisfied with our debt instruments returns. It is a fact. Start to think in terms of real returns. Real returns in the sense of actual returns minus the inflation rate. If your real returns are zero to positive from debt instruments, then feel that you are lucky.

However, we look at returns in absolute terms but not real terms. Whether it is debt or equity, change your mindset to look in terms of real returns.

I have tweeted the on the same few days back as below:-

# Be ready to take RISK in your debt part of the portfolio

Yes, you must to a certain extent be ready to take the CALCULATED RISK. By saying so, I am not pointing that you take risks for your short-term goals.

If your goals are less than 3 years, I still suggest Bank FDs and RDs are the BEST choices. At the same time, If your goals are more than 3 years but less than 10 years or so, then adopt the strategy like around 50% in Liquid, 25% in Money Market, and another 25% in Ultra Short Term Bond Funds.

But do remember to check the portfolio of Money Market and Ultra Short Term Bond Funds regularly. I know it is not easy for the common man. However, at the end of the day, it is YOUR MONEY. Hence, you have to LEARN. There are no other alternatives.

For your long-term goals, I still suggest EPF, PPF, or SSY as major debt parts of the portfolio (if they are matching your time horizon of the goals). If you still have an additional amount to deploy, then adopt the strategy of investing in Constant Maturity Gilt Funds along with Liquid and Money Market Funds.

Why I am still suggesting EPF, PPF, and SSY as major parts of debt when the interest rates of these instruments are falling? Mainly because of their tax-free nature and safety. With the remaining amount, you can take the calculated risk of investing in the Money Market and constant maturity gilt (where there is no question of default or downgrade but only interest risk).

Do remember that I am not suggesting any debt funds where these so-called fund managers take a call (as per THEIR RISK APPETITE and RESEARCH), instead of taking the calculated risk of a major portion in fixed instruments like PPF, SSY or EPF and the remaining portion can be split among Liquid Fund, Money Market Funds and Gilt (strictly for your long term goals).

I am repeating again that even though Gilt Funds are safe from credit risk or default risk, they are risky for interest rate movement. Hence, don’t assume that if you are investing in Gilt Funds means your money is SAFE. Refer to my earlier post on the same “Whether Gilt Mutual Funds are Safe?“.

Note:- TAKING RISK DOES NOT MEAN BLIND RISK BUT A CALCUALTED RISK.

# Stay away from other categories of Debt Funds, Corporate FDs or NCDs

You noticed that in my debt fund recommendations earlier I used to recommend either arbitrage or liquid. But now I am recommending Money Market and Gilt (constant maturity) along with those existing two categories.

The main reason is that I stopped believing all these AMCs, Fund Managers stories, and their expertise (especially after the Franklin fiasco). They take a call based on THEIR RISK APPETITE, which is not trustworthy at all to me.

Regarding the Corporate FDs or NCDs, do remember that credit rating is not CONSTANT and if anything goes wrong with the company, even though they claim your investments are secured, it takes years of time to get back the money.

Hence, in the case of debt, I am adopting simple, easy to understandable and clear products like Bank FDs, RDs, PPF, SSY, EPF, Liquid Funds, Arbitrage Funds, Money Market or Gilt (Constant Maturity).

Conclusion:- I know it hurts many when the interest rates fall. However, accept the reality and move on. But it does not mean to take a BLIND RISK in your debt portfolio. Take a calculated risk as per your risk appetite and the time horizon of the goals. WE ARE INVESTING IN DEBT NOT TO GENERATE HIGHER RETURNS BUT FOR OUR SHORT TERM GOALS AND DEBT PART OF OUR MEDIUM TO LONG TERM GOALS.

Congrats Sir on publishing a very good article . You have at the same time touched upon the most required behavioral change in thinking process to ease oneself from uncertainty. Even Disease has “ease” inbuilt in it, hope this article will delink Ease from disease in real life terms to all.

Considering different debt funds have varying sensitivity to change in interest rate regime, for an investment horizon of 3+ years would it be appropriate to opt for Dynamic bond funds (with high concentration in AAA & above credit rating ) as the portfolio is blend of all category of funds & hence law of averages will define the absolute returns with downside risk protection ?

Need your valuable insights as FDs , apart from low returns , are also tax inefficient thereby increasing risk of negative real returns .

Dear Chandrashekar,

How many times these fund managers were turned right in we don’t know. Also, never rely on credit ratings. They may change at any point of time. Hence, better to stay away from playing.

Sir

Do we have a Post on “Best Funds” under

Liquid, Arbitrage, Money Market and Gilt Funds

Dear Vijay,

As of now, I have not published those. But soon will publish.

Thanks, Awating Eagerly.

Have followed your advice regarding Equity Funds and have invested in UTI Nifty 50 Index (Large Cap), Parag Parikh Flexi (Multi Cap) and HDFC Hybrid Equity( Hybrid).

I needed to invest other 50% of of allocation into some good debt products that give security to my funds and a Real return better than Banks and Post office schemes.

Dear Vijay,

Expecting real return from debt?? Follow the above options which I have shared.

Real Return as you said is Returns minus inflation.

Now the rate of inflation as/govt website for 2020 comes to 6.61%.

So considering a time frame of 3 years i don’t think any debt instrument would give real returns (also considering the tax outgo on gains) unless of course if any of the liquid, money market and ultra short term funds give a return of at least 8%+

Browsing thru the money control website i see literally only 2 funds in the above category giving return of 8% over a period of 3 years.

But since i don’t have the expertise to select funds, i would be awaiting your post on some good funds in this category and take a call accordingly.

Dear Vijay,

We diversify to debt not to generate real return but to have better downside protection.

Okay.

What i additionally understand is that Debt part will also be to stop our money from devaluation. (in case portfolio is 100% debt). Correct?

For Real returns we look into Equity (Funds and Individual Stocks).

Dear Vijay,

Debt part is to protect your money but not to enhance the real returns.

Hello sir,

Thanks for suggesting alternatives in Debt category.

As Liquid and Arbitrage funds giving very low returns, we can start exploring long term investment options as suggested in the article.

Thanks,

Harsha

Dear Harsha,

Thanks for endorsing the views.

How about rbi floating rate bonds? 30 points about NSC.

Are there any problems or risk if someone wants fixed income?

Dear Partha,

Both are for different purposes. Read the features at first. If they suites, then go ahead.

Hello Sir, as per your article on PM vaya vandana yojna, you said 7.4% interest rate is fixed for 10 yrs once invested.

but Lic official saying that 7.4 is only for current year, every year rate will be decided by Goi.

Can you please confirm which is correct?

Dear Abhijit,

Yes, it is.

Hi,

Very informative article thank you..

I have a request – if you can write an article about Health Insurance for lower income group people like house maids, drivers etc. We would like to buy for our maids but if there are relatively cheaper options available which do not compromise on the service.

Plus any other requirements for such health insurance.

Dear Nilay,

Surely I will write and thanks for the idea.

Mr.Basu you have mentioned that interest rates on post office small savings were reduced w.e.f 1st April but FM cancelled the order by twitting.But Basuji till date no notification has been issued cancelling the above as Post offices and LIC are not accepting any deposits since no notification cancelling the above order has been issued.So it also seems to be a Jhumla.

Dear Prakash,

I don’t think so. Post Office is accepting it. Where comes the LIC here?

Hello Basuji, Would like to know your views on Small Finance Bank FDs. Since SFBs take DICGC Insurance & deposits upto 5Lakh are secured by same, how prudent will it be if one opts for same and spreads his Debt Portfolio in 2-3 Banks.

Dear Vaibhav,

You can but to what extent the Budget proposal of settling the amount instantly will take place is the only concern. If Government implements the Budget proposal, then you can go with SFB (after checking whether they have opted for DICGC).