EPF changed certain rules in relation to EPF withdrawal for house, flat or construction of property. These rules will come into effect from 12th April 2017. These changes are called as Provident Funds (Fourth Amendment) Scheme, 2017.

I already wrote a detailed post on EPF partial withdrawal rules. Now the new paragraph is inserted along with those changes as 68BD. This paragraph will now supersede of whatever written in earlier rules.

Let us see these new rules related to EPF withdrawal for house, flat or construction of property. If you are planning to acquire or construct a house or flat or a site, then you can apply for EPF withdrawal for house, flat or construction of property. The two conditions are as below.

# If you are interested in purchasing or constructing the house or flat or a site.

# Otherwise, you must be a member of a co-cooperative society or a society registered for housing purpose under any law for the time being in force and such society has at least 10 members of the EPF.

Who can apply for EPF withdrawal for house, flat or construction of property?

# If you are the member of EPF for more than 3 years (earlier it was 5 years).

# EPF withdrawal for house, flat or construction of property is allowed only once. Hence, if you already availed this facility, then you are not allowed to withdraw again. Earlier also the rule was same.

# Your accumulated EPF balance must be more than Rs.20,000. If your spouse is also the EPF member, then the combined balance will be considered for the eligibility.

EPF withdrawal for house, flat or construction of property – How much you can withdraw?

You can withdraw up to 90% of EPF Balance (Employee share and interest on that+Employer share and interest on that) or the cost of the construction of property whichever is less.

For calculation of the EPF balance eligibility for EPF withdrawal for house, flat or construction of property, employee’s contribution and interest on that along with employer contribution and interest on that is considered.

EPFO will not transfer the money to you, instead to the Cooperative society, Central Government, a State Government, or any Housing Agency under any Housing Scheme or any promoter or builders as the case may be, in one or more than one installments as employee authorize the EPFO.

If the amount of such withdrawal is more than the actual cost or expenses of acquiring the property, then you have to refund such excess amount to EPFO in lump sum within 30 days from the date of finalization of the purchase, completion of the property, or necessary additions or alterations to a house or flat.

If you have failed to utilize the withdrawal for acquiring the property, then you must refund the whole amount to EPFO within 15 days from the date of such non-allotment.

Which form to use for EPF withdrawal for house, flat or construction of property?

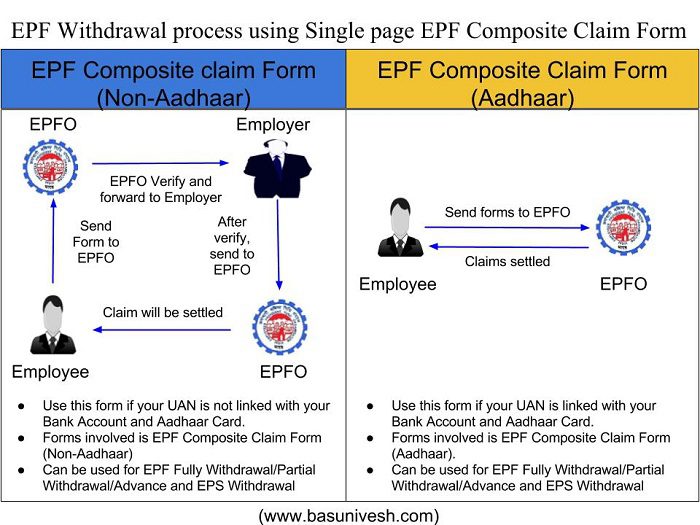

You can use the C0mposite Claim Form for EPF withdrawal for house, flat or construction of property. There are two types of forms. One is Aadhaar complied and another Non-Aadhaar complied. Use the forms as the case may be. The process is explained in below image.

You noticed from above image that for EPF withdrawal for house, flat or construction of property, you can submit the form through your employer or can directly submit the same to regional EPFO.

Download EPF Composite Claim Form (Aadhaar)

Download EPF Composite Claim Form (Non-Aadhaar)

Along with the EPF Composite Claim Form, you have to request EPFO Commissioner to issue the certificate in relation to the last 3 months EPF contribution and also the balance as of today. The form for the same can be downloaded from “Download Application to obtain a certificate of EPF withdrawal for the house, flat or construction of property“.

How to use EPF to repay your home loan EMI?

Do you know that you can use your EPF Balance to repay your monthly home loan EMI? Yes, you can use it to repay the home loan EMI for the accumulated EPF corpus.

You can use EPF balance to repay your home loan EMI either fully or partly as per your wish. For that, you have to instruct the EPFO. EPFO will transfer the money to your bank monthly as long as there is sufficient EPF balance in your account. This transfer will be active as long as you are the member of EPF. Once your membership of EPF ceases, then EPFO will stop to repay the loan.

Download the form to authorize EPF for repayment of Home Loan EMI.

Hope this much information suffices for you to avail these two new facilities of EPF.

571 Responses

Hi Sir I have applied for pf got the PF of one of the company on 20 March 2024 then I have applied for other company on 21 March 2024 filled the form number 31 the claim is rejected due to insufficient service for 68b form number 31 please assist me what should I do now

Dear Basanti,

Hard for me to predict of what went wrong. Better you approach EPFO through Grievance Cell.

I applied for PF withdrawl under this cateogory “Purchase of House / Flat / Construction including acquisition if site from agency”

But my claim got rejected with below reason.

1) UNDER PARA 68B(1)A PAYMENT SHALL NOT BE MADE TO MEMBER BUT TO AGENCY 2) PHOTOCOPY OF BANK PASSBOOK NOT ATTESTED BY THE AUTHORIZED SIGNATORY/BANK MANAGER

How should i proceed, I need the PF withdrawal in my bank account.

I have claimed PF amount for purchasing property, claim got rejected due to “FURNISH AGENCY DETAILS TO PROCESS CLAIM”, but while I submit in online nowhere it asked for any documents to submit. How to correct this and re-apply.

Dear Ayyappan,

Raise an issue with EPFO Grievance Cell Online.

Hello sir.

please need your help. My claim is rejected with the below message. what other option should i be selecting to withdraw PF for purchase of flat. Please help on priority.

Claim Rejected CONSTRN OF HOUSE UNDER AGENCY SHALL NOT BE PAYABLE TO MEMBERS ACCOUNT

Dear Nadeem,

It seems you have not provided the builder details.

I want to withdraw my EPF to make payment to DDA for newly constructed Flat (my own funds+ loan+EPF).How much % amount of my EPF i can withdraw? Will EPFO make payment to DDA directly or to me (the member) ? As flat amount is more compared to my EPF, will DDA accept such payment method ?

Dear Sid,

Your all questions are already answered in the above post.

Hi Nivesh,

I applied for construction of house but it get rejected and the rejection reason is: ‘ OK 2) NOT ELIGIBLE-INSUFFICIENT SERVICE’

However My total service tenure is 5 year 6 mnth

Total NCP days is 5

All previous employer transferred to current one

Can you please help me what could be the reason

Dear Mohammad,

In that case, better to raise an issue with EPFO Grievance Cell Online.

Hello BasuNivesh,

i had appled for PF advance but it was rejected as below reason . Even EPF bank details and cheque details are same.

SAME BANK ADDRESS NOT MENTIONED ON BANK STATEMENT/CANCELLED CHEQUE AND PF FORM.

Kindly suggest me how do i proceed further on the issue.

—

Thanks & Regards.

G Venu Gopala Rao

Dear Venu,

May be some clearical error at EPFO side. Better to raise an issue using EPFO Grievance Cell Online.

Can i withdraw under para 68B(1)(b) for purchase of site for constructing dwelling house if para 68B(7) alteration of house is already availed?

Dear Kumar,

NO.

I got hospitalised a week back and total bill was of around 2 lakhs. Can i claim from epfo against illness clause?

Dear Kumar,

Check the conditions before proceeding.

what condition , can you please explain in some context? can i claim or no??

Dear Kumar,

Please refer the relevant notification of EPFO.

Hi, I’ve completed 4 years 10 months of service can I withdraw pf for construction of house property

Dear Kranthi,

Please re-read the above post.

Claim Rejected PROMOTER AGENCY BANK DETAILS NOT AVAILABLE IN KYC APPLY FOR PAYMENT IN SELF ACCOUNT

Dear Nilesh,

What is your doubt?

Hi,

Good Evening!!

My wife is Japanese national but living and working in Indian since last ten years.

She has adhar, pan and OCI.

Shes trying to withdraw PF for purchasing house.

She working in this company since last 6 years.

Her claim got rejected twice.

Reason –

1st -Claim Rejected PLEASE FURNISH BANK DETAILS OF THE AGENCY FOR RELEASING PAYMENT

2nd – Claim Rejected BANK OF DETAILS OF THE AGENCY TO RELASE PAYMENT IS REQUIRED

Can you advice.

Dear Sidhant,

She has to update the seller bank details.

Where should we submit and is there no way we can get this money in our account?

Dear Kiran,

To EPFO.

Hello Sir, i have recently bought a resale flat and would like to withdraw money by para 68B (1) B could you please help how to apply and what documents will require to submit, claim submission page there is only one option to submit cancelled cheque photo.

Appreciate your help on this regards.

Thanks,

Faiz

Dear Mohammed,

It is hard for me to explain the whole process here in comment section. If you are finding it difficult, then approach the EPFO directly.

Hi sir we have planned to maintain our house and requested for pf amount under construction of house ,its been 7 days its still under process. Can we get that amount or it will be rejected. Can we cancel it . Currently we dropped the plan due to personal reasons

Dear Vishnu,

Please contact the regional EPFO.

Hi Nivesh

My pf withdraw got rejected while claiming for purchase of flat saying agency bank acct to be provided. Where should i provide the agency bank acct number while claiming. Will the amount to the agency will be in installments?

Dear Hari,

Raise this issue with EPFO.

my previous company pf money got transferred to current company. Annexure K is also available for the same. previous company had private trust handling epf and current company has epfo handling. I want that money as I have purchased a new flat. I have completed 5 years in previous company. When I select online claim status form, previous company name comes in red. cant raise any claim against that.

How do i claim that money. I tried once claiming, it got regetted with reason PARA 68B(1)A IS PAYABLE TO AGENCY NOT TO MEMBER.

Dear Djarni,

The error showing that you are requesting a money to be transferred to your account rather than the seller’s account. It is not possible in EPF.

Hi Nivesh, My claim got rejected as ALREADY AVAILED 68B 1 C when I applied with the construction of house para and yes I did. I am in urgent need of money. Is there any other way to withdraw the employer share? Please advise.

Dear Madan,

Sadly NO.

PF Form 31 there are multiple PARA 68B example: 68B(1)(a), 68B(1)(b), 68B(1)(bb), 68B (1)(c), 68B(7) and 68B(7b). All these PARA’s have different condition to claim PF amount. if any one of these PARA is already claimed then can we claim again under different PARA 68B?

Dear Kuldeep,

It again depends on which case you have opted. Hard to say generically.

i had claimed PARA 68 (7B) for renovation of house in May 2021 and now in Jan 2023 i claimed PARA 68 (1) (c) for Construction of house and it got rejected with reason ALREADY AVAILED THE ADVANCE FOR 68B IN MAY-2021. Since both the PARA’s are different and to claim also the conditions are different then why it got rejected? i have completed more than 11 years in company.

Dear Kuldeep,

I have already explained the reasons in the above post. Please read it again.

Hi Sir,

Can i avail EPF to produce a downpayment for a resale property 10 years old and if yes will the EPF dept.transfer the amount directly to the owner(individuals)bank account?

Dear Subhransu,

I am not sure how the EPF without transfer can be considered downpayment by the opposite party.

Hello! My claim was rejected for the reason Claim Rejected 68B(7) ALREADY ABVAILED IN 2021. Is there a way out?

Dear Balaji,

It is clear from the reasons that you already availed. Hence, no second chance.

were you able to withdraw again?

I have the same problem – Claim Rejected 5 YEARS OF SERVICE NOT COMPLETED AFTER TAKEN ADVANCE UNDER 68B WHICH IS NECESSARY FOR REQUIRED ADVANCE. I withdrew an amount in 2021 and now when I want to withdraw it got rejected.. Any help, I am in urgent need!

Dear sir,

Please advise to solve below mentioned error,

Claim Rejected PAYMENT MADE ONLY IN FAVOUR OF MEMBER NOT AGENCY SO PLEASE APPLY UNDER ANOTHER PARA

Thanks n rgrds,

Upen

Dear Upendra,

I think it is an issue of your form filling.

I am employed in the same company since 2004. I applied plot loan repayment of ?200,000 in 2014 under Section 68BB and received the money directly into the loan account. This property is not mine anymore. I sold this property in 2016.

Now in 2022 October I applied for site purchase loan and got rejected saying already availed under Section 68

I made some changes to my home and I paid it all myself so I am applying for advance so that I can meet the site purchase shortage. Will I get it sanctioned. I am afraid because that is also under Section 68

Dear Viswasaraj,

Sadly NO.

Epfo will pay money to whom, to me or constructor? If I select for house construction to withdraw advanced.

Dear Venu,

It is for the builder.

Hi, i have applied for pf advance online form 31 for buying flat from promotor , but i didnt find any details to fill about promoter , and it got rejected by saying there is no provision to pay advance flat from promotor , what is this, which form should i apply for this

Dear Tilak,

Raise an issue with EPFO Grievance Cell Online.

I had applied for home construction advance but got rejected with the reason – has been rejected due to : 1) AS PER SYSTEM REMARK- INSUFFICIENT BALANCE. 2) NOT ELIGIBLE- INSUFFICIENT BALANCE

But i have sufficient balance (Employer contribution) more than what I applied for. Employee contribution is less.

What could be the reason?

Dear Rajesh,

Raise an issue with EPFO Grievance Cell Online.

I applied through the online portal. It got rejected with the following comment.

“Claim Rejected ADVANCE CANNOT BE SANCTIONED TO PROMOTER”

What’s the reason?

Dear Subbu,

May be the person whom to be payable is wrongly mentioned by you. Check with EPFO for clarity.

Hi Sir, I have raised claim for partial withdrawal of PF ( for house construction) on Sept 7, 2022. This is still showing as Under Process. Please suggest.

Dear Satyandra,

Wait for few more days or raise an issue with EPFO.

If I apply for epfo advance for construction of house Will the amount be credited to my account or to the bank I need to pay loan or to the builder as I didn’t find an option to share these details in the form 31. Also I had applied a claim for alterations of house thinking the construction of second floor will come under addition but it got rejected stating I need to have 5 years of service after construction of house so I thought I applied in wrong category and reapplied again under construction of house category within 2 days of previous rejection I have Total 11 years of exp with the same company. Could u pls guide me

Dear Mary,

It will be payable to the seller.

Hi Sir, I’ve applied for online claim for purchase of house. Claim got rejected stating “NOT ELIGIBLE FOR 68B(1)(A)”

I’ve completed 6.5 years of years. I’ve withdrawn PF amount for illness 4 months back, is there any time gap needed to withdraw cash? I’ve no idea why my claim got rejected for purchase of house. Please advice.

Dear Ajmeer,

That illness advance is for a different purpose. You can raise an issue with EPFO Grievance Cell Online.

Hi Sir,

I applied Pf For construction of house which I took a land in my hometown they rejected as my cheque was given to them to credit the funds. It got rejected, but they are saying if I can give them in writing that I will be responsible if any money withdrawn under my name. They will credit it. What does that mean?

Dear Shailendra,

I am not sure about whom you are sharing. Please check the same with regional EPFO.

Hello Mr. Basu,

I am trying to apply for pf withdrawal online. My total continues service is 13 years and not withdrawn any amount till now. I am not able to find composite aadhar form on the epfo website or mobile app. When I use form 31 I do not see any drop down to select para 68B for 90% withdrawal. Please let me know how can I apply for online pf advance. My establishment is based in bangalore. Do I need to physically submit the form in epfo bangalore office?

Dear Anupam,

Why not apply through employer?

Hello sir,

Can I apply for pf for the construction of a house on a plot/land owned by mother?

Dear Smit,

Try your luck.

I have applied to get PF amount under the head of purchase flat options

But my claim rejected, below is the reason

“Claim Rejected, provide promoter/Agency bank account details for advance payment”

Please advise what I can do in this case and please confirm whether I will get PF amount in my account or epfo will transfer my pf account into seller account directly

Should I reapply

Dear Ankit,

I think you have not filled the form properly. Please re-do again.

I have applied for pF withdraw under construction of house: it got rejected saying NOT eligible for this para though my total experience is 7 years.

Can you please suggest what is the reason for same?

Dear Ruchita,

Hard to predict. Better you raise an issue with EPFO Grievance Cell Online.

My claim was rejected stating this reason. kindly help

I had choose purchase of house/flat

Claim Rejected IT IS NOT ADMISSIBLE TO SANCTION ADVANCE UNDER THIS PURPOSE.

Dear Roahn,

Either you are not eligible for withdrawal or the service period is less. Raise an issue with EPFO Grievance Cell Online.

Hello Basu,

I had withdraw from PF for home loan in 2020, now i am trying to withdraw for house construction but claim has rejected twice.

Can I withdraw

from PF for house?

is there any time limit post i can submit my claim?

Dear Vipin,

Sadly you are not allowed to withdraw twice.

Dear Sir,

I have already withdrawn PF Advance in November’2018 for construction of House.

Now can I withdrawal PF Advance for Purchase of Flat?

Dear Kiran,

Sadly NO.

My service with first company is 3 years and service with present company is 4 years. I have transfered the PF balance from first company to current company successfully. I want to withdraw PF advance for House construction. So, for this minimum 5 Five years service is required. Am I eligible to apply PF advance in this case. Kindly confirm

Dear Krishna,

Yes.

I have taken a new villa and i have applied for EPF withdrawal for 5L but my cliam reject with below comment.. can you please help?

Claim Rejected WHETHER PERMISSION IS TAKEN FOR PAYMENT OF VPF, IF TAKEN PLEASE SUBMIT THE PERMISSION LETTER

Dear Manohar,

I am not sure how come the VPF issue arrived here for the withdrawal. Better to raise an issue with EPFO.

Hi,

I applied for purchase of dwelling house/flat from a promoter on 7th Jan 2022.

Request is still under process how much time usually take for request approval.

Regards

Pankaj Makkar

Dear Pankaj,

Hard to say the timeline.

I applied the claim online to purchase under construction flat. The claim got rejected due to name mismatch on cheque leaf and office. Now I corrected my name on bank account and trying to reapply online,but now all options of reason field are disabled except illness and I am not able to proceed further. What can I do now?

Also is it mandatory to have same name on my linked PAN card? The change in my name happened after my marriage,which is reflected in office record, but i have not changed it in bank account and PAN.

Dear Swati,

No option but to raise an issue with EPFO Grievance Cell Online.

Hello sir,

If I have let’s say 9 lacs (combined employee + employer + pension) in my current PF account and 1 lac (combined) in previous employer’s PF account both linked to same UAN and I have been with my current employer for 5.5 years, can I withdraw money to pay for down payment + stamp duty and registration of a flat in an under construction building.. If yes, how much can I withdraw? Thank you.

Dear Vijay,

Refer the post again.

My EPF claim has been rejected three times with the error “Claim Rejected PROMOTER DETAILS ARE NOT FURNISHED, CHOOSE ANOTHER RELATED PARA OR SUBMIT THE SAME DETAILS.” I chose “Purchase of Dwelling House / Flat from a Promoter” Not sure where to enter the promoter details in the claim form.

Dear Varsha,

Try with any different pop up related to this.

I have applied twice for “construction of house” and both times its been rejected. I have been with same company for 8 years and 9 months. I applied through the UAn portal and the amount was 435000 which is less than 90% of my and my employer share. I attested the cancelled cheque with all details on it .. even signed the cheque but it got rejected. Below is the reject reason

Your claim id BGBNG210750150611 ahs been rejected due to 1) Kindly upload bank copy with bearing IFSC, BANK, BRANCH NAME, SB ACCOUNT NUMBER AND PRINTED NAME ON IT. 2)SAME BANK ADDRESS NOT MENTIONED ON BANK STATEMENT CANCELLED CHEQUE AND PF FORM.

Can you please help me with what has to be done to get this claim setteled?

Dear Kapil,

Raise an issue with EPFO Grievance Cell or visit the concerned EPFO.

Hi Basavaraj

Am planning to clear my home loan taken from the bank by Withdrawing PF

Which option should one chose

Purchase of Dwelling

Purchase of House / Flat

Dear Magesh,

You can choose the second option. But personally, I feel, better to avoid doing this.

Hi All,

I have applied for house Renovation/additions of house using the Claim 3 1 form , but it was rejected with reason 1) Claim Rejected CAN BE AVAILED ONLY AFTER COMPLETION OF 5 YRS FROM CONSTRUCTION OF HOUSE 2) Not Eligible – Insufficient Service Can someone help me with why this has come as even though i am working from Year 2012. Do i need to submit any other documents supporting the selected option , there is only chance to submit the Seeded bank a/c Cheque but nothing else. Can someone help me with this ???

Dear Sravanthi,

Whether you are using the same EPF account since 2012?

Hi Basavaraj, I had purchased a flat last year and due to lockdown, I could not complete my flat renovation. Hence can you suggest to me under which reason I have to select so that I can withdraw a certain amount from the PF amount to complete my interiors?

Dear Wasim,

It is only for construction not for renovation.

Dear Sir,

I would like to buy a flat from a builder which is under construction:

Which option shall I choose on the withdrawal form

1. Purchase of Dwelling House / Flat from a Promoter

2. Purchase of House / Flat / Construction including acquisition if site from agency

Will the amount be credited to the builder’s account directly?

Dear Vivek,

Choose the first one.

Dear Sir,

Thank you so much for your response!

Will the amount be credited to the builder’s account?

Dear Vivek,

Yes.

Hello Sir,

I am purchasing a new flat and was planning to partly withdraw money from my epf account for down payment. I have a few questions

Can I apply only after property registration is done ?

I have been working with my company for 6 months now, however my total years of service with this same UAN is 9.5 years, am I eligible for this withdrawal ?

Will this money be credited to my account or to the seller ?

My employer says for online claim submission if kyc is complete, employer’s approval is not required, is this true as in various articles I see employer’s approval is needed.

Thanks for your patience.

Dear Bidisha,

First check whether you are eligible to withdraw or not.

Hello sir,

I have applied for renovation of house.

I thought for renovation of house we do get both employee and employer. But it got settled for employee amount which is less.

And again i hav applied for construction of house it got rejected saying am not eligible since I took already on renovation of house..

Now i have applied for purchasinh a property. It is still under process am waiting for that money which is very much needed at home. Is that valid will that be approved further both employee and employer amount. Please do reply.

Dear Niharika,

I don’t think it will be approved.

Same condition is with me, I have availed pf advance for renovation and when applied for construction it’s rejected with reason not sufficient service whereas I have completed 5 years in current job

Dear Ajay,

It is happening mainly they consider EPF accounts separately (even though within same UAN). Sad but true.

Sir, I availed advance for renovation of Home recently, now Can I take advance for construction of house? And what documents will be required

Dear Ajay,

I think it is not possible.

Sir,

I have availed advance for renovation as I thought I will get both Employer and Employee share but that was very less and I am in very much need of the amount, please suggest if its possible to claim both shares while in job ..

Dear Ajay,

Yes, both the shares but not EPS. Hence, you received less than your expected.

Now how can I withdraw both shares as I have already taken advance for renovation, I have completed 5 years in my current service. My claim for construction is rejected giving reason that not sufficient service. As told earlier I have availed advance for renovation

Dear Ajay,

If you are currently working, then you can’t withdraw without valid reasons.

Sir

My share is only Rs.87/- and employer share is 3 lac. Can i withdraw PF from employer share for addition/alteration of House.

Dear Indranil,

No.

Hi Basavaraj,

First of all, I would like to appreciate you for helping people from 2017 with your replies.

My issue is I’ve changes 6 companies in total and ended up with 3 UAN numbers; I’ve managed to transfer money from all pf accounts(even the PF’s associated with my different UAN numbers) to my current PF account through UAN portal.

I would like to do partial withdrawal for purchasing a property. Now my issue is my service history associated with previous UAN’s are not showing in my current UAN, because of this my service is showing as less than 60 months; hence I’m not able to withdraw money.

Could you please guide me to merge my previous service history in my current UAN.

Thanks in advance.

Regards,

Mahesh

Dear Mahesh,

Better to merge all EPF under one UAN and then apply.

I am constructing home, planning to withdraw some portion of PF. I have raised request online & its under process. Do i need to submit any document for the same ? Please advice

Dear Nagaraj,

As of now, NO.

Hi, I am planning for down payment of resale house through EPF. First query js whether it would be credited to my account or to seller’s account? Secondly my query is broker states we need to show that seller has received the payment perhaps giving through PDC and cannot show anything payable. Whereas in EPF form I see column which says payable as per agreement. How. Should I proceed here so that my application doesn’t gets rejected.

Dear Harsh,

It will be credited to seller. It is obviously mentioned as payable.

Dear Basavaraj, my broker said you cannot show anything as outstanding in registered agreement, he asked me to give cheque which will be shown as received. So my query is will I still be able to withdraw as cheque won’t be realised until I withdraw

Dear Harsh,

I am not sure why your broker saying so. But whatever I have written and replied is as per the rule.

Hello

Thanks for the article. I am planning to buy a resale flat from an individual. I would be taking a home loan for the same. I was thinking of using some portion of EPF for down payment for the loan? Can it be done? If Yes, which advance para I need to select? Will the money come to my bank a/c?

Dear Nishant,

Yes. Approach your employer.

Hi Sir,

The house is not a approved one and is on agreement papers. which is on my mothers name , however i can get the terrace transferred to my name on agreement will for further construction.

can I apply for PF withdrawn, also can i get that amount in my account as I myself will be bringing materials and labor to build the house.

Dear Singh,

As per me, NO.

Thanks for taking time out to reply to all.

I have a query regarding tax implication of partial PF withdrawal from my current company. I have worked in company A for 4 years, then a company B for 2 years and then current company C for 1 year. Company A and C have PF accounts but company B was a small company with employees count less than 20 and hence no PF account. Now I have transferred PF from company A to C (my current company). So I have a total service (where active PF contribution was made) of (4+1 = ) 5 years. It is not continuous though. There was a 2 year gap in company B. My questions are –

1. Am I eligible for partial withdrawal for house purchase ? Is the total service taken into account or period of continuous service ?

2. If yes, then would the withdrawn amount be taxed ? The reason for my doubt is that the PF contribution is not made for 5 continuous years, there was a 2 year gap in company B when no PF contribution was made. I have read at many places in internet that if any PF withdrawal is made before 5 continuous years of service (where active PF contribution is made) then it is taxed.

Please help.

Dear Narendra,

1) Yes.

2) No Tax.

Dear Narendar,

Your questions are already answered in the above post. Please read it again.

Hi, I am planning to buy a flat which I want to withdraw money from my pf and I am planning online claim just want to know will I get my claim money in my account and is any document required to claim flat purchase online

Dear Mohammad,

How can you buy a flat ONLINE?

Greetings of the day, sir

My service period is above 10 years, I want to withdraw advance money around 2.5 lakh for construction of house,

everything is linked like pan Adhar etc

Will department deduct TDS??

KIndly reply, Thanks in advance.

Dear Sahil,

Why TDS?

Because sir i had already claimed EPF under 80 C in pervious years,

So i want to confirm from you is there any chance of TDS deduction in my case.

Dear Sahil,

NO.

Hello,

I had applied PF advance for purchasing a new house, My claim was rejected with reason “Claim Rejected ALREADY AVAILED ADVANCE FOR PERMISSIBLE TIMES”. Where as I have never applied or withdrawn PF till now. Please guide me how to solve this issue. Thanks.

Dear Ritz,

Raise an issue with EPFO Grievance Cell Online.

Thanks Basavaraj,

PF Advance for House purchase and PF advance for home loan repayment, are they same category or I can claim both individually? Please confirm. thanks

Dear Ritz,

Theoretically same.

Sir,

If I take construction of house advance payment from my pf account can I repayment to epfo with interest

Please suggest sir

Dear Sagar,

Yes, you can.

Sir, my total service ex is 8+ years, i recently switched company 8 months ago and tfd prior companies all pf amount and my service record also. I applied for Home loan withdraw category for 90% but it came as claim rejected- insufficient service. If i raise a grievance will they resolve and then approve the amount or how it will work? i am tensed as the amounts are becoming due.

Dear Ashwin,

Rather than being in doubt of whether they resolve or not, better to raise the issue immediately.

I have purchased a plot and as the builder wanted immediate money, i have taken personal loans and got site registered. Now to clear my PL as the interest rate is very high, I am planning to take PF amount, can you suggest to take out money from my PF account!

Dear Mruthyunjaya,

What reason do you say? As you already paid to the seller how can you justify it? Instant gratification played a big role in this. Think twice the cost of a personal loan to the returns you get it from that plot.

Recently i have booked a flat and also done with Agreement Payment. My Home loan also approved and it will disburse once Registration done. Now as next procees is flat registration. it will cost around 342000. For that i am planning to withdraw my PF. So Can i withdraw PF for flat registration? Also if yes then will it be part of Flat purchase type in PF withdrawal process.

Dear Jayesh,

You cant withdraw for the registration cost.

I have claimed EPF advance form 31 under reason ” construction of house” . now once the claim is approved where the money will get credit??

Will the money get credit in my bank account which i mentioned in EPF portal?

Please clarify in detail

Dear Sivakumar,

Yes, to your account.

Hello already i have purchased a flat by withdrawn some amount from my pf account.

What are the post withdrawal documents i need to submitted?

Is that required to get back the interest amount which has been deducted post withdrawal?

Dear Neel,

Submit the photocopy of the property deed.

Sir,

I have applied for pf advance under repair/ alteration of house on 23 Jan 2018, now I want to repay my home loan, I need 90 % of pf amount, I have completed 12years of service…what should I do to avail pf advance.can I apply for purchase of house option

Dear Sudesh,

Check your email.

Hello sir.

I also have a similar query.

I already have a homeloan from past 5 years. Now i wish to withdraw money from pf and reduce principal of homloan.

If this is possible, which Para should i select while raising the claim online.

I was searching many places but couldnt find which Para to select.

Dear Chaitanya,

May I know what are your doubts in selecting the option?

Hi,I had already availaed PF advance for construction of house in 2018.Please let me know if I can claim PF advance for purchase of land/plot?

Dear Santhosh,

NO.

Hi Basu, can i withdraw from EPF post purchase of the flat to adjust against the down payments i have made ? Will need immediate liquidity to carry out some works in the flat and would prefer to maximize withdrawal.

Dear Nishant,

If you have already purchased, then how can it be possible?

i have applied advance from epfo purchase of dwelling house/flat from promoter and same rejected for following reason,

1. it is not admissible to sanction advance under- this purpose

2.photocopy of bank passbook not attested by the authorised signatory ( i have submitted cheque copy and passbook having bank seal)

what head i have to apply for advance and is it compulsory to get attestation for bank passbook kindly inform section under which i have to apply for advance

Dear Vaidyanathan,

I think they rejected may be due to the promoter option. Check with regional EPFO.

Hello Sir, so is withdrawal for Purchase from Promoter not eligible

Dear Rohit,

The promoter in the sense? Can you elaborate more?

I processed the EPF claim online but there is no provision to put the builder name. I requested claim for the 90% which is about the 20% upfront payment I need to pay the builder for the new flat and rest I am processing a loan amount. But I am also confused that EPF will not post the money in my account but will settle the payment to the builder but how to then provide the builder details to EPFO? builder is processing in flats and will be ready Dec 2021

Dear Sachin,

Visit the concerned EPFO and discuss this issue.

Hi, I have also bought a property with father as joint owner and I am paying the EMI. I am also eligible for withdrawal under this catagory. But my requests are getting rejected by my company citing the reason that I cannot have a joint ownership with father. Can you please let me know the steps for withdrawing

Dear Radha,

I think they are right.

What are the documents required to withdrawal pf for construction even if epfo account comes under trust because they have rejected my claim stating that insufficient document

Dear Satish,

How can I say for what reason or what documents made them to reject? Better you approach through your employer.

What to select if i want a pf advance for renovation of my house

Dear Himani,

It is only for construction but not for renovation.

Claim Rejected MEMERS SHARE IS RS 21/-AND ADV U/P 68L IS GETTING FROM EE SHARE ONLY HENCE NOT ELIGIBLE

Respected Sir,

I am trying for PF advance withdrawal online for purpose of house property. The claim is being rejected due to “insufficient service” I have now been in continuous service for more than 5 years (including all employers). However, when I submit the form on the online portal, the date of joining which is considered is the current employer’s only. How can I change that?

Thanks in advance

Dear Anisha,

You can’t change the date of joining. However, if all your past EPF accounts are merged with the latest one, then better you raise an issue with EPFO Grievance Cell Online.

Sir, I have the same issue – my UAN number is same from last 6 years but i was told insufficient service criteria. But my association with my existing Employer service is 13 Months old and on my grievance they are saying UAN number doesn’t matter service needs to be filled as per requirement.

Regards,

Dear Mahima,

Yes, obviously service details should show the details right?

Hi Sir, Can you tell if there are any documents required to take an advance for down payment of flat? I am planning to tale 90% of the fund for the same. Also i am planning to use future credits to fund EMI partly. Please if you can confirm the process and documentation that will be very helpful.

Dear Prashant,

90% of EPF?

Hi Sir,

I am working in one organization from last 7 years and i have completed 6 years for VPF (Voluntary Provident Fund) and have applied form 31 in construction of house, and the amount is created to account, now i came to know i required some more amount.

can i apply again for construction of house by form 31?

Dear Shaik,

Yes.

Are you got PF amount for contruction of house 2nd time?

Dear Sir,

Bit confused with few questions, answers will be great help

1. I am buying a ready to move flat on mother name from builder. Can I use my epf balance to make some payment

2. Form 31 ask in whose favour check needed, can’t I mentioned builder name even if property not on my name

3. Do I need to give any supporting document to employer/epfo with form 31 as per rule

Dear Vipin,

1) No.

I have applied PF claim for construction of House through online portal on 05.08.2020. The portal shows the status is under process still. How many days required to complete the process and kindly share the details.

Dear sir,

I have applied PF claim for construction of House through online portal on 05.05.2020. The portal shows the status is under process still. How many days required to complete the process and kindly share the details.

Hi Sir,

I applied the form 31 online. Here i donot see the option for withdrawer for site/land purchase, i can see only for the purpose of construction of house. Please help me as i want to apply PF for site purchase.

Dear Mohammad,

Use the same option.

Hi Sir,

Thanks for your quick reply. As I see my claim status is “under process”, so I want to know whether in the next step it will ask for the required set of the doc? If yes what docs are required to purchase a site?. It already 2 days over, so total how much time it will take to finally process the PF and get the amount.

Thanks

-Asif

Dear Asif,

Wait for their process to complete.

Hi,

I have applied withdrawal option Renovation of house that is my ancestral house but my employer asked me to provide registered document although I have given all the necessary document how is it possible to give registry paper if my house is ancestral house. So is it will not be consider without registry?

Thanks – H Khan

Dear Khan,

It should be owned by you and new one.

Hi Sir,

I have booked a flat in November 2019 and Registration was done in February 2020 but It is still under construction and i havent occupied the flat yet.

Is it possible to apply for EPF Claim under House Construction category. If Yes, what all documents are needed for the same

Dear Chanti,

If the registration is already done, then how can it be possible?

I had applied for the construction of house for epfo withdrawal.

It’s shows under process is the fund is approved.

Dear Rudra,

Hard to say.

hi sir im vishwa

when will update the option i had complted 5 years but not updated the epfo has 5 years options home construction of house option

i have joined 20-july2015 its now 6-7-2020

by last month its complted 5 years but option is not upated in my epfo

who will update this option employer or epfo office

Dear Vishwa,

Hard to predict. However, if you have urgency, then approach the regional EPFO.

Message received from pf office that NOT ELIGIBLE INSUFFICIENT BALANCE and my claim 19 has been rejected although Iam without job last 5 months. Why my claim rejected

Dear Naveen,

Hard to predict. Better you raise an issue with EPFO Grievance Cell Online.

Dear Sir,

My claim was rejected with the following reason.

1) REJ NOT ELIGIBLE DUE TO INSUFFICIENT SVC OF FIVE YRS INCL EPF TFR IN. 2) NOT ELIGIBLE-INSUFFICIENT SERVICE

I have 12 years of epf contribution, although I have changed organizations, I have transferred them. I am able to see last 7 years in the service history.

Can you please help, how should I proceed with the claim?

Dear Bageerathan,

Hard to predict of what went wrong. Better you raise an issue with EPFO Grievance Cell Online.

Sir I applied for partial claims using 31 form via umaang app. I claimed under covid19 scheme

It’s showing pending at DA accounts

How many days still it takes?

Or I have to apply it again?

Dear Hemanth,

It may take a week’s time.

Dear Sir,

Can I withdraw 90% of the EPF amount for renovation of my house ?

If yes, kindly suggest the process to raise request and also, the documentation required. Thank you.

Dear Venu,

Refer above post properly.

Construction of house how many time epf withdrawal

Dear Srikanta,

Refer above post.

I have raised a claim online. After 12 days it is saying status as Pending with DA accounts. Not sure what is it … Can you guide me on this please.

Dear Subramanian,

You have to wait for the process to be complete.

Sir I already done pf process online withdraw before 20 ago but still status showing pending at DA account so means what reply

Dear shaimh,

Raise an issue with EPFO Grievance Cell Online.

Dear Sir, i ad applied for pf advance form 31 it been 20 days status showing that pending at Da accounts whats does it mean i m nt understanding the same

Dear Aditya,

It is under the process.

sir reply dena jarur

8 yers pf me hogy hy pan updated nahi aadar update hy or advnce pf niklna he amount 1 lakh upar he to ky tds lag sakta hy?

advnce pf layny ke baad . kitny time baad total pf kitny dino baad kar sakty hy?

Dear Faiyazuddin,

There is no TDS for advance.

Hello sir , sir I recently claimed advance pf of 5 lakhs for the purpose I mentioned is construction of house . My total balance is 11 lakhs (8+3).but amount approved by EPFO I only. 2.5 lakhs and they mentioned that “amount is settled for 2.5 lakhs as a first installment”. Now the thing I did not understand is what is mean by first installment and if they make payment in two installments then when will they pay remaining amount? After how much time ?

Dear Nitin,

I am not sure about what you mentioned while applying. Hence, better to raise an issue.

Hi Basavraj, I want to withdraw of for construction. Since bank is funding 80% of the estimate. Now, my question is can I withdraw the pf for construction of house for paying remaining 20%. Can I withdraw after the loan is sanctioned and also after 80% of what bank will be funding has exhausted means after 80% construction of house. This is because more money may be accumulated at that time.

Dear Vijay,

When to withdraw depends on you. Regarding your withdrawal, check the above post for your eligibility.

hi in my PF account i have nearly 2L of fund ( EE+ER ) (UAN is nearly 7 active years ) are but when i filed a claim of 140000 Rs they have opproved only 40,000 rs ( EE share ) Any idea why they have reduced the requested amount

Dear Jagan,

Raise an issue with EPFO Grievance Cell Online.

Hi Basavaraj,

I have total 9 years of working experience, where initial 2.5 years had PF Trust account (It was PF Trust with my 1st company). Now, for the past 6+ years I’m having EPFO account. I tried submitting online claim for PF Advance (Form 31) via online EPFO portal, and recently got rejected with below reason:

Claim-Form-31 (EPF Advance)(Construction of House) Claim id-xxxx Member id-xxxx has been rejected due to :- 1) INSUFFICIENT SERVICE FOR ADVANCE UNDER PARA 68B 2) NOT ELIGIBLE-INSUFFICIENT SERVICE

PS: I have joined my current company 7 months back. But having EPFO account for all the last 6+ years.

Are they calculating only my last company experience for PF Advance? If not, how could I resolve this?

Please help!

Thanks,

Shihad

Dear Shahid,

In my view, they are calculating the last service only. Better you raise an issue with EPFO Grievance Cell Online.

Dear Shinde,

yes your correct, your not transfer your previous PF amount to current employer, hence request will send to your current employer only its shows insufficient service because urs 9 month only, kinldy check if your transferred

or not

I applied for home construction pf withdrawal. But my request is rejected. I have in my account 1.20 lack empyee fund and 38 thousands employer fund. How much can I withdrawal.

Dear Yash,

First try to understand the reasons behind the rejection by raising an issue with EPFO Grievance Cell Online.

Hi Basavaraj

I and my father are joint owner of property but the emi is paid by me.Can I withdraw from FP to pay housing loan presuming i have completed the no of years service and have accumulated PF balance

Dear Poornima,

Yes, you can do so.

My PF withdrawal for house construction got rejected due to INSUFFICIENT MEMBER SERVICE .I have been working since 8.8 years and i dont no the reason for rejection .

Dear Shiva,

Raise an issue with EPFO Grievance Cell Online.

Hello ,

i am applying for a house purchasing advance , can i use the funds of my Pension or only epf share which i pay to pf and my company share , because when i opened a Pass book it has 3 coloumns , one mine and company share and 3rd was a Pension share , Please suggest , because my share and company share is totaling 6 lacks and if i include pension share its showing as one more lack totaling 7 lacks , can i draw 90 % of 7 lack or 90 % of 6 lacks

Dear Praveen,

As per my knowledge, it is only EPF.

Hi, I have started construction on my own site. Can you please let me know documents needs to be submitted required for pf withdrawl. Form-31 did not mention requirement for such documents

Dear Urvesh,

Better you be in touch with regional EPFO.

Hi,

I am planning to buy a flat, would like to withdraw my pf for making Down payment. When I raised the request online for construction of house it got rejected without giving any reason. I have raised a grievance for the same but haven’t received any response till now. Any idea about

the defined timeline for grievances?

Also my wife is trying to apply online for the same reason but we are not getting the option for construction of house both of us have same years of service. Any alternative option to apply?

Thanks in advance.

Dear Ashish,

It is hard to say the reasons. Hence, I suggest you to visit the regional EPFO.

Hi Basavaraj,

Thank you for the blog.

My flat is almost ready and I have to pay my contribution to builder now and the registration may be after a month or two. If I receive my of advance now through online application, can I use it for paying the builder now and keep remaining amount till registration which may be happening after one or two months?

Dear Thomas,

Sadly you are not allowed to do so.

Thank you for the reply. Within how many days I should use the money for registration?

Dear Thomas,

As far as I know, there is no such restriction.

Sir I have purchased a Bda flat by karnataka government. Flat is in the name of my dad but Emi is payed by me. Loan is joint loan between me and my dad. I have completed 5 years of service to be eligible for pf withdrawl. Can I withdraw the amount if flat is in the name of my dad.

Dear Subasis,

Sadly NO.

Hello , I have bought an constructed flat from an builder in April 2017 by home loan. I have also closed all the dues to the builder in June 2018 . But currently in 2019, I am planning take my PF amount 90% under the construction/purchase of flat through my employer So in this case how should I proceed it ? What are the documents do I need to submit ?. Please help me on this regard .

Dear Ranjith,

If you already purchased the house, then how can you withdraw now?

Yes that is what my doubt . Is it possible to do it still under the construction of flat ??

Hi,

I have plot land and planning to start the house construction. Can i withdraw PF under construction of house option? if so, what are the documents i have to provide?

Dear Dhamo,

Yes. Regarding documents, either approach EPFO or your employer.

I have the eligiblity for PF withdrawl. I am planning to construct a house on the land which is in my name. I am planning to give a labour contract and all material will be purchased by me. As such I want to withdraw some amount from PF. ( I have been member for 20 years). I want the DD/Cheque to be in Contractor’s name and the rest of the withdrawl amount in my account. Or I can have all the amount in my account and I can make the payment to Contractor as per our agreement (which I can share while applying). Is this mode of withdrawl possible?

Dear Taps,

There is no clarity in this regard. Hence, better to raise an issue with EPFO Grievance Cell Online.

One followup question.. If I withdraw PF money for House Construction, Will it be taxable at any point in next 1 year.. I have 20 years of services, so I think there won’t be any TDS but since I had claimed rebate under Section 80C during all years of IT returns, will the amount I withdraw becomes taxable?

Dear Taps,

NO…It is not taxable.

I am completed 3.8 years (2years one company and 1.8 years another company) am I eligible to with draw my pf for house construction

Dear Nadamuni,

Please read the above post once again. I have explained this in above post.

Hello Sir,

Thanks for writing such an helpful blog.

I booked an under construction flat recently (paid token amount) and I need EPF advance to pay down payment. I completed 6years of service.

In online form, I don’t see an option to pay the money directly to the builder rather I see “Construction of House”. Is it ok to use “Construction of House ” option in online form and pay the down payment to the builder after receiving the EPF advance in my account linked to UAN (i.e. EPF -> to my bank account -> to builder)

Thanks,

Shiva

Dear Shiva,

Yes.

Hi Sir, I have applied for PF loan advance ( house construction). Current status shows as under process.

1. Did i need to submit any form. If yes, what form and how to send in online?

2. Did i need to show the proof of landbuilding documents.

Dear SKP,

As you already applied, wait for the response from EPFO.

Thanks for your quick response Basa..

Yes, i have already applied in online. But didnt submit any (composite claim) form. I have claimed for PF advance. I have completed 6yrs in one organization and joined in another company recently.

how long they will take time to processreply?

Will thy transfer amount or else they will ask for any document?

Will thy provide 90% of PF amount or thy will reduce the loan amount?

Dear SKP,

It may usually takes around 10-15 days of time (maximum). Whether they ask the documents or not depends on future. Hence, let us wait.

Hi Basa,

Now the claim shows its rejected..

So what to do next…

Dear SKP,

Hard to say what went wrong. Better to raise an issue with EPFO Grievance Cell Online or visit the concerned EPFO.

Hi Basu,

I got this suggestion from a blog “Suggest you to transfer the funds from your previous EPF account to current one and then can apply for partial withdrawal.”

Share your comments on it. Is it rite or any suggestion

Dear SKP,

It is the right process as per me.

They didnt mention anything in the remarks.

“has been rejected due to :- left blank” What i have to do next

Sir I like to withdraw epf amount through online for purchase a plot but while submitting online claim there is no option for purchase of plot there is only one option related to this is construction of home can I use this option for online withdrawal

Dear Abhishek,

In my view, they not provide such facility for the purchase of land.

Sir can I whose online epf withdrawal claim 31 option construction of house for purchase of plot

Dear Abhishek,

I am unable to understand your doubt. Can you elaborate more?

Hello Basavraj

I am buying a new flat straightaway from the builder. Option I am seeing in for 31 is ‘Contruction of House’. Should I use this for option for ‘Buying of Flat’.

Also it is asking me to enter the amount. I want to withdraw whole of the eligible amount, which I understand is 90 % of total fund. Is it possible to withdraw more than 90 %. What if I enter more than 90% in the Amount. Will it be rounded off to max eligible or claim will be rejected.

Best Regards

Dear Zameer,

Yes, you can use this option to fund your purchase. You are eligible for 90% only.

Hello Basavaraj,

Online PF claim is applicable for purchasing a flat?

Because there were no option to provide supporting documents and builder details to get the cheque in favour of.

Previously I have applied through online pf claim form 31 for para construction of house . After few days claim got rejected without rejection reason. I have raised the concern in grievance portal.

Please assist how to proceed further.

Dear Premkumar,

Yes, for flat also you can withdraw. If the option is not visible, then raise an issue with EPFO Grievance Cell Online.

Thanks for your reply Basavaraj,

My pan not verified in Uan portal is it lead to online claim rejection?

Dear Premkumar,

May not be but they deduct the TDS as your PAN is not verified.

I have withdrawn PF in 2015 for renovation of house, can i withdraw pf again for purchasing new flat as registration for the same flat has been complated.

Dear Anil,

You are not allowed to withdraw again.

I have a service of 4.5 years and I am buying a flat on my mother’s name but home loan will be on my name.

Can I withdraw pf from my account?

I have given some amount to the builder but I am a little short on the full payment.

How much time it takes to complete the process?

Dear Rupinderjit,

The property should be in your name.

Hi Bhuvanesh,

My PF account is being managed by DKM trust. And i need to withdraw some amount to purchase a site in my wife’s name. Will they allow that? In the form 31, this is what the condition is “? Grant of withdrawal for purchase of site/house / flat in the name of the spouse is not permissible.” Dont they follow the EPFO rules ?

Thanks in advance.

Dear Amit,

Yes, they follow the EPFO rules.

Hi Basavaraj,

Is it possible to withdrawn the PF amount for the flat registration purpose?

If yes, then how much % max I can withdraw ?

Regards,

Abhishek

Dear Abhishek,

Sadly NO.

Hi Bhuvanesh,

I need to withdraw the PF amount around 2L for Kitchen, bedroom woodworks.

Can i withdraw for the same.

Dear Vijay,

NO.

Actually house registration done recently.

i want to give it for rent so i need money atleast kitchen woodwork, is there way to withdraw it?

under house construction, as my existing homeloan is exhausted.

Dear Vijay,

You might have planned it in advance.

Hi Basavaraj,

I have applied for PF claim under house or flat construction. I have some doubts, Please clarify:

1) I have worked in 2 company. First company work experience was 5 years & 4 months. & I have joined another organisation in Feb-2018. So I have 6 month of experience in present organisation. I have transfer my PF amount from previous employer to current employer & PF amount was credited to my present organisation’s PF account. So am I eligible to withdraw my PF amount under house or flat construction using Form 31?(as my present company exp is 6 month & total experience is near about 6 years) . Please conform.

2) I have online PF claim under house or flat construction & status is showing “Under process”.

3) As I have claim under house or flat construction, then I am eligible for 90% PF amount. Will 90% of PF amount will be a part of both Previous PF amount + Present PF amount (will the claim amount consider from my Previous PF amount + Present PF amount?)

eg:- My previous organisation PF is 160000 & present organisation PF is 40000 then the 90% of claim amount would be from 160000 or 200000?

Dear Sharadchandra,

1) Yes.

2) Then coordinate with employer and regional EPFO for the same.

3) You are eligible for 90% of the amount.

As you say I am eligible for 90% of the amount but that 90% of amount consider from my Previous PF amount + Present PF amount? or It may consider only my previous PF amont?

Dear Sharadchandra,

It is inclusive of all your past and current balance.

Thank you very much.

I have applied for PF claim under house or flat construction. & I have raised a concern on GRIEVANCE so got a reply as pending at DA level. Its already 20 days before I have applied for claim. What is the meaning of “pending at DA level”? How much day it will take to settle from this status?

Dear Sharadchandra,

It is some procedural steps. Hence, you have to wait.

Hi Basavraj,

Thanks for your valuable suggestions. Here is my situation is similar above like Sharadchandra, but in my case as below.

Name: Prasad Vasadi

I joined a company A – 24-Jan-2011, this company created a UAN and I transferred all my past companies PF to Company A account.

In 2016 Company name A changed to B and management and staff remaining same.

After changing the name to B, B created new UAN and new PF account number and they transferred, company A PF money to company B and CompanyB DOJ as 01-04-2016.

Here I have an issue to withdraw money for House construction. i.e new UAN DOJ less than 60 months to full fill the PF rule.

I am not sure, how to deal this, when I contact Company B i.e current company, simply said to deal with PF office and have been chasing them for last 2 yrs, no update yet.

I raised PMO as well, but no luck.

Please, could you suggest your thoughts on this?

Is this case PF withdrawal possible for house construction?

Dear Prasad,

Whether you raised the issue with EPFO Grievance Cell Online?

Thanks for your reply. I haven’t raised yet. I will raise now.

Please, could you confirm, is this my case, PF can be withdrawn for the house construction?

Dear Prasad,

Yes.

Thanks for your response.

I have been trying to raise a complaint to EPFO Grievance Cell, I filled all the necessary information, but not showing an error or success after clicking submit button, simply back to same screen. I have tried more than 10 times. No Luck.

http://epfigms.gov.in/grievanceRegnFrm.aspx tried this URL

Dear Prasad,

It may be due to some browser issue or an issue with website. Try after sometime or try with different browser.

Hi Basavaraj,

I am EPF member since 2007 (i.e more than 11 Years now , 1 company 1 PF account, with UAN number & Aadhaar Verified)

Now my questions are,

1. If i withdraw my PF amount to repay my already existing home loan , Can i still go ahead and use the choice “You can use EPF balance to repay your home loan EMI either fully or partly as per your wish”.

And Set my part of PF as EMI ?

2. What would be the tax treatment for amount withdrawn for repaying the loan , will there be any TDS on the amount which is transferred to Loan account ?

Thanks,

Vaibhav

Dear Vaibhav,

1) You are not eligible to repay the existing home loan. They provide this option only when you are buying a new property.

2) It is an advance and hence no TDS.

i want money for my personal use. Which option should i take for advance pf?

Dear Ashutosh,

For your personal use, you can’t withdraw EPF.

Should i fill the option of constrution/renovation of house?

House is on my father name.

Dear Ashutosh,

If it is in your father’s name, then how can they give it to you?

What is the disadvantages of withdrawal for construction before 5 years

Dear Mahindrakar,

There are no such disadvantages. But do remember that EPF is meant for your retirement.

Thanks Sir

little bit confusion about percentage of pf withdrawal for construction. Different site shows different percentage ;e 30%,48% or 90%

Dear Mahindrakar,

The above post is written based on the latest rule.

DEAR SIR , I HAVE TAKEN PARTIAL WITHDRAWAL FROM EPF AROUND 1 YEAR BACK FOR HOUSE CONSTRUCTION (1 ST FLOOR ADDITION / CONSTRUCTION) . NOW AGAIN I AM IN REQUIREMENT OF AMOUNT FOR HOUSE RENOVATION AND ADDITION OF SOME CONSTRUCTION.

AM I ELIGIBLE.

I AM HAVING SUFFICIENT BALANCE WITH EPF .

Dear Rajendra,

As you already availed the loan, you are not eligible for the same again.

Hi Basavaraj,

I have overall 7.5 years of service with EPFO under a single UAN number (4.5 years in 1st Company + 2.5 years in 2nd Company + 7 Months in present Organization) with three different EPFO offices.

I have also transferred all my PF accumulations to my current EPFO account.

But when I raised PF withdrawal claim for house construction, it was rejected by EPFO saying the below reason.

LESSTHEN 5 YEARS SERVICE NOT ELIGIBLE FOR WITHDRAL/LESSTHEN 5 YEARS SERVICE

Please let me know if I have to update certain details under my UAN and how am I supposed to raise this claim.

Dear Ganesh,

As per me, you are eligible for this withdrawal. Hence, raise an issue with EPFO Grievance Cell Online.

Hi Basavaraj,

First of all, thank you so much for your prompt response.

Besides, my current organizations EPF/EPS DOJ is Dec 2017, wherein my actual DOJ of EPF through my first organization (which is a EPF Trust) is Nov 2010.

Do I need to request my current organization to make changes to DOJ of my current EPF account.

Please let me know if any of these above factors are affecting my eligibility to withdraw PF amount.

I have also raised grievance to my EPFO related to this.

Dear Ganesh,

Yes, you have to correct this date as it is one of the vital information.

Plz mujhe btaye ki kyese pf ke acourding book karwa sakte hai or minimum pf kitne ka kata hona chahiye kya process hai

Dear Divya,

You have to book the property on your own. But you can use EPF fund to purchase that.

Hi Basavaraj,

I have total 5 yrs of exp (3yrs in 1st company and 2 yrs in present company). I have following doubts regarding the PF withdrawal for House Construction

1. My PF transfer process is completed and i could see the amount got credited in to the present company’s PF account. But my DOJ still remains my 2nd companys’ joining date. When i checked with my present employer, they said “DoJ will not be change in Portal, only your services will be added to your account “. Is it correct?

2. Withdrawal limit for House construction is minimum 24 months basic salary or total cost of the property, is it 90% of total PF amount?

3. If it is 90%, then should i calculate the 90% of the amount or they will calculate 90% incase i enter full amount in the “Amount Required in the Applciation Form”. Bcoz it should not happen that my application gets rejected by entering full amount.

3. Will the PF withdrawal amount is directly credited to my bank account linked with the portal? While applying online, there is no provision entering the builders’ account details right?

Thanks,

Lithin

Dear Nitin,

1) It should be your current DOJ. Please rectify the same with them

2) Refer my post “EPF withdrawal for house, flat or construction of property“.

3) YES.

1. It should be your current DOJ. Please rectify the same with them –> It should be present employer DOJ or Previous Employer DOJ?

Dear Nithin,

It should be current employer DOJ.

Dear Sir,

I did withdraw my PF online 10 days back, but still could see status as “under process” ..when I check with my friends they say usually it gets credited in 3days…Kindly advise

Dear Fayas,

You have to wait for the process to complete.

Sir,

May please advise. Is it admissible to withdraw loan from PF for second home as the first acquired thru PF loan has already been sold. Any EPF rule for getting loan second time .

waiting for your kind advise

Dear Deepa,

You can avail this facility only once (irrespective of you are holding the property or sold it). Hence, you can’t avail this facility again.

Dear Sir,

Today i tried to withdraw PF amount. But, I am facing the error message as below after submitted all details.

—————————

Error: Invalid key info in digital signature (this means that certificate used for signing the authentication request is not valid – it is either expired, or does not belong to the AUA or is not created by a well-known Certification Authority).

————-

Can you explain me, how to sort out this issue?

Thanks,

K RAJESHKANNAN

Dear Rajeshkannan,

I am not sure what went wrong as many are getting such message. Better to raise an issue with EPFO Grievance Cell Online.

Dear Sir,

I am buying a plot of land to construct a house. When I go to the UAN PORTAL for online application, it is only showing me “CONSTRUCTION OF HOUSE” as the option in PURPOSE field and not “PURCHASE OF SITE” , request your suggestion on what to do.

Also they have not yet updated the interest accrued for FY 2017-18 which they normally do by end of march every year and now with this 90% limitation should I just enter the entire PF balance I have in the “AMOUNT REQUIRED” field and let them handle all the calculations?

I will really appreciate if you can help me out.

Thanks & Regards,

Nishant Pundhir

Dear Nishant,

You update the value as it is present there.

Thank You sir, I shall just enter the entire pf balance I have and let them handle all the calculations.

And what should I do about the PURPOSE field as it is not showing me the option of PURCHASING OF SITE ?

Dear Nishant,

They not provide you advance just to purchase but to build also.

Hello Sir,

If I opt for PF withdrawal for housing loan will it include EPS amount as well even after 10 years?

Will i able to withdraw employee+employer+pension in total amount?

Thanks & Regards

Pankaj

Dear Pankaj,

Refer above post properly. I already mentioned that. Your EPS balance will not be part of this withdrawal.

I am the member of the PF for more than 3 years and i want to remove my 90% PF amount for home construction but when i am applying it is still showing as 60 months which means 5 years.

Could you please confirm whether it is 3 years or 5 years.

Dear Maaz,

As per this new notification, it is 3 years but not 5 years.

HI,

am also facing the same problem, when am trying to process the claim online…. is the EPFO rule amended or not?

Dear JCK,

As far as I know, there is no change in rules.

Hi Sir,

I need to withdraw EPF for house construction purpose. I have UAN and adhar and mobile bith are linked to UAN.

I wanted to know, what evidence for house construction I would need to submit and at what stage?

I mean i need to provide any evidence initially while initiating the claim? or at some later stage?

Thanks in advance.

Dear Surendra,

You have to just fill the form and submit with your employer. Regarding the proof, better to interact with regional EPFO.

Hi Sir,

I purchased a site in 2016, Now i’m planning to construct the house. So I need to withdrawn PF amount. I have completed 6 years employment in one organization. Please let me know the documents which i need to submit and how many days it will take to credit many into my account?

Dear Sivakumar,

It is the procedural matter, which I can’t say. Better you interact with your employer or the concerned regional EPFO.

I have 2 UAN for 2 PF account of different employer

2-3 month back have transferred my old epf account to current epf account ,but problem is that old UAN is also live till now and old pension amount showing their,

now need to withdraw advance PF for house construction but portal not allowing me due to below 60 month current PF account, while my old PF service was 7.5 yrs and new PF service is 2.3 yrs

what should i do

Dear Amit,

You have to first transfer both accounts into one and also request EPFO through your current employer for the merging of both UAN.

I’m planning to buy a flat under construction. I’m Member of epfo since 6yrs. Don’t have enough money to make the down payment. Possession is in April 2018. I want to withdraw pf for making down payment. What are the things I need to provide to epfo? And to whom the amount will be credited?

Thanks in advance!

Dear Amol,

Refer above post for the same. Regarding procedure, be in touch with your employer or the concerned regional EPFO.

Hi

If PF advance amount withdrawn and used for buying flat and this amount needed to be repay?

Thanks

HPB

Dear Hanumantappa, Not required to repay.

Hi,

I am PF member since last 6 Years. Now I am going to by Plot from a farmer in Authority sectors. Plot will sell by Farmer and all the payment need to go farmer directly via chaque or online transfer. Property on his name currently.

Can I withdraw PF for Down payment or for Registry in this regard. Construction will be done after 2 years. as per authority norms.

EPFO will sent money to farmer account or they will send it to my account and after that i can transfer the amount to farmer.

How many days it will take to complete the claim to settle after submitting online request.

Thanks in advance

Regards,

Anoop Yadav

Anoop-In my view, the advance will be only for house, flat or construction of property but for just purchasing the land.

My PF funds are managed by a trust (per my company policy). I have completed more than 23 years in service now and need a small amount to pay as booking amount to a builder in Bangalore. Is it possible for me to get the amount in my account and then I write a cheque to the builder for advance? What does the rule say?

Biju-You can take the advance for the reason as buying property. Rules are same as explained above.

Hi,

I have 1 query. I am able to withdraw my PF amount, I was requested for 90% of amount including employee and employer. But now I can check the status via track my claim its showing me exact half amount. They did neft yesterday so probably I will get money on Monday. Can you explain my I can see exact half amount on track my portal?

Shreyas-Yes you can see. But before that wait for amount to credit. If it is less than what you expected, then raise an issue with EPFO Grievance Cell Online.

Hi,

As discussed earlier i have transfered my old company PF to new company. I can see the entire amount got transferred to new account except pension fund. Now I am facing new issue, the DOJ EPF is my new company joining date it should reflect my old company joining date. Due to this I am unable to withdraw my PF amount.

Shreyas-Your employer has to edit it.

Hi Sir,

I am working in Public limited company, and completed 4 Yrs and 10 months of service, Now i urgently required Loan from PF for construction of House. But they denying for accept application for not completed 5 years. Company HR has told me still 5 years time limit is maintained in PF for withdrawl limit.

Can you please advice, is it possible for apply now ( 4 yrs + 10 months completed )

Saravankumar-As per me NO.

Thanks Basavaraj

Claim-Form-31 (EPF Advance)(Purchase of Dwelling House/ Flat from a Promoter) is approved for payment via cheque. Payment under process.

I have applied for this partial withdrawal through my employer. for Purchase of Dwelling House/ Flat from a Promoter. My employer told me fund will be credited into member account only than as per this status it is showing payment via Cheque. Please clarify.

Mantu-Your employer is correct. Please wait if that not happen, then approach EPFO.

I have spent 4 years with my previous company and with the present company I have spent 1year 4 months.I am using the same UAN no as I used in my previous company as I have not withdrawl money and transferred the pf balance to the new company which I joined.Can I now withdraw money for my house which I have booked as per the new policy of withdrawl.

Bashab-Yes, if you are eligible as per above post.

Dear Basavaraj,

I am looking your assistance in 2 topics:

1. I want to do partial withdraw of my PF account as I have attained eligibility criteria of minimum five years in my organization, I am looking for 20% initial down payment of my new flat though this. You mentioned above that if your aaadhar & bank account details are seeded correctly in UAN (which is in my case) withdrawal can be made directly to employee so do we still required to fill the physical form and send cross cheque bank leaf to EPFO?

Could you please clarify because as per my understanding everything is just need to be online.

As per your block “EPFO will not transfer the money to you, instead to the Cooperative society, Central Government, a State Government, or any Housing Agency under any Housing Scheme or any promoter or builders as the case may be, in one or more than one installments as employee authorize the EPFO.”

2. Claim website of EPFO UAN is down since last 2-3 days, I assume interest calculation will be going on these days but any assumption when it can be available again for the people ?

Vikas-1) Physical form submission not required.

2) Not sure when.

Thanks Basavaraj , appreciate your quick response !!

Checked with PF office today. Looks like it will be back in 5 days. But, no guarantee. I am also waiting for applying PF withdrawal for the past one week.

I need to apply PF withdrawal for a re-sale home. Can you please tell me the documents required to submit in this case (sale agreement) for applying

I assume you are buying a resale house.No documents other than the Aadhar card copy and PAN card copy ,Form31 and a Form 31 decln,a cancelled cheque

Archana-Please be in touch with regional EPFO.

I dont think once can withdraw from the epf corpus for resale property

Dear Anand,

I am not getting your reply. Can you elaborate more?

Sir please guide me

(1) which challan to be filled by a tenant to deposit/remit TDS in bank on rent paid to NRI landlord?

(2) Is it necessary for a tenant to obtain TAN no. or PAN no.will do?

Rajesh- Please raise issue separately in our Blog Forum if your doubt is not relevant to above post.

My PF is settled for house purchase and amount credited to my bank account directly. However I have already registered last month through borrowed amount from friends (As My PF was earlier rejected for missing documents and we provided it) . Can I just use my PF money to repay or should I use some process so that I dont violate any terms.

Ranga- Yes you have to repay.

Hello Mr. Basu,

I am having an ongoing home loan from HDFC Ltd. I want to pre-pay it (fully/ or partly) with some of my savings and an amount maximum from PF withdrawal. I fulfill all conditions for the same.

My questions:1) Is HDFC Ltd comes under the set of institutions which are eligible for payment from EPFO.

2) If yes, what is the mode of payment, a DD or money goes to HDFC account directly.